Credit

Spreads And Prices On Credit Indices Pretty Much Unchanged Today

A busy day for USD issuance with financials leading the way: Canadian Imperial Bank of Commerce printed US$ 2.5 bn, Macquarie Group US$2.25 bn and Toyota Motor Credit $1.8 billion

Published ET

Transocean 5Y USD CDS Mid Spreads | Source: Refinitiv

QUICK SUMMARY

- S&P 500 Bond Index unchanged today (YTD total return: -1.79%)

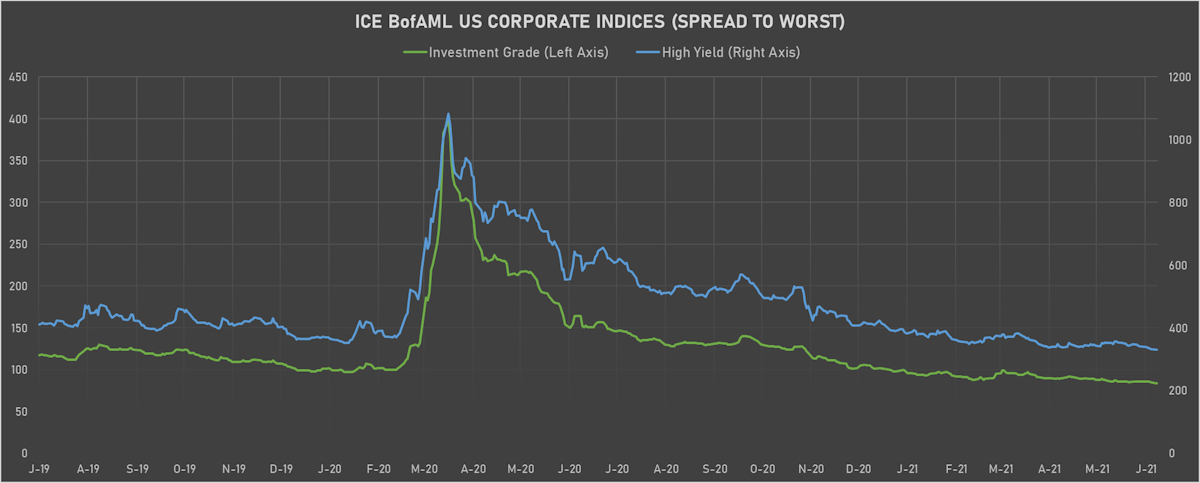

- ICE BofA US Corporate Index (Investment Grade) spread to worst unchanged at 84.0 bp (YTD change: -14.0 bp)

- ICE BofA US High Yield Index spread to worst down -1.0 bp, now at 330.0 bp (YTD change: -60.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index down -0.03% today (YTD total return: +2.3%)

- New issues: US$ 20.8bn in dollars and € 22.9bn in euros

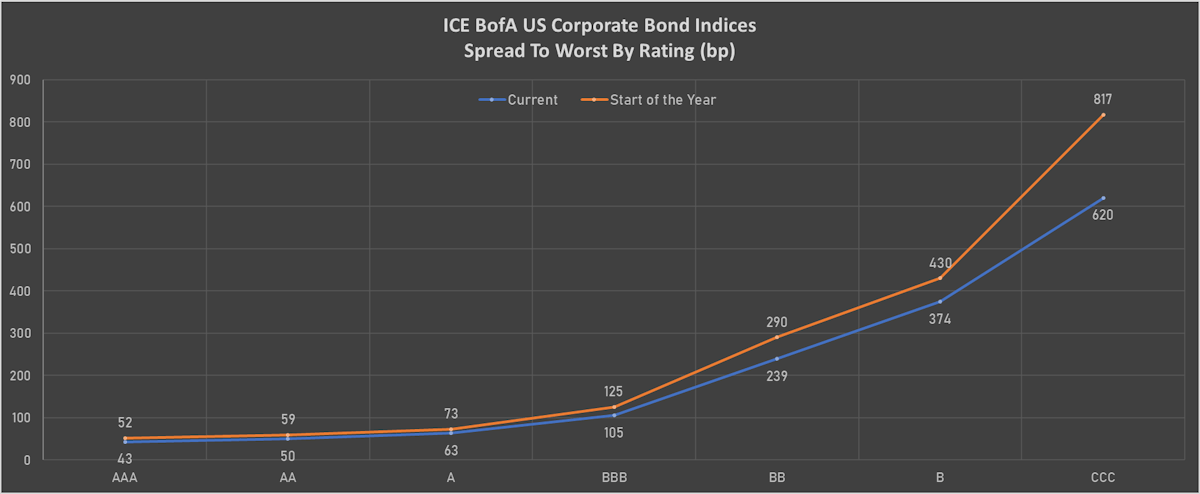

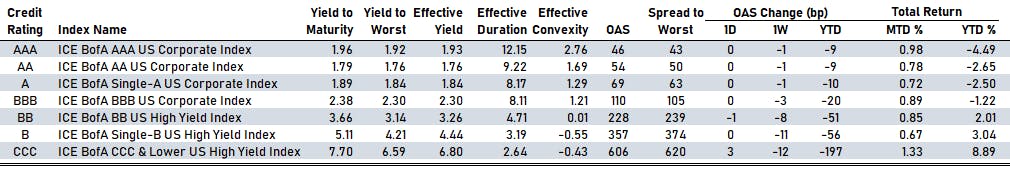

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

- AAA unchanged at 46 bp

- AA unchanged at 54 bp

- A unchanged at 69 bp

- BBB unchanged at 110 bp

- BB down by -1 bp at 228 bp

- B unchanged at 357 bp

- CCC up by 3 bp at 606 bp

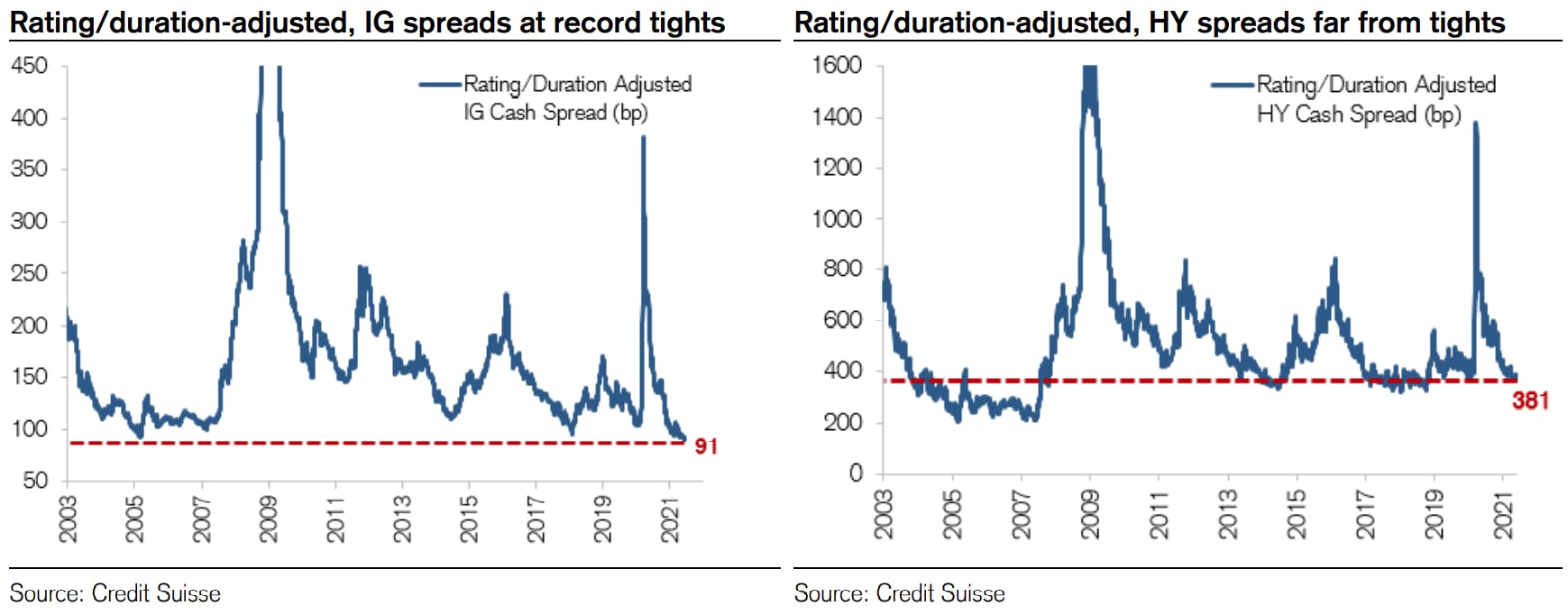

ADJUSTED CASH SPREADS

- Credit Suisse notes in a credit report today that the credit quality and duration of the IG and HY buckets have changed

- IG has seen a deterioration in credit quality (average rating of the IG pool), while HY quality has improved

- Duration of IG has risen, while HY duration has fallen

- Adjusting past IG and HY spreads to the current profile of the pools, they find that IG spreads are currently at the all-time lows, while high-yield spreads still have room to fall

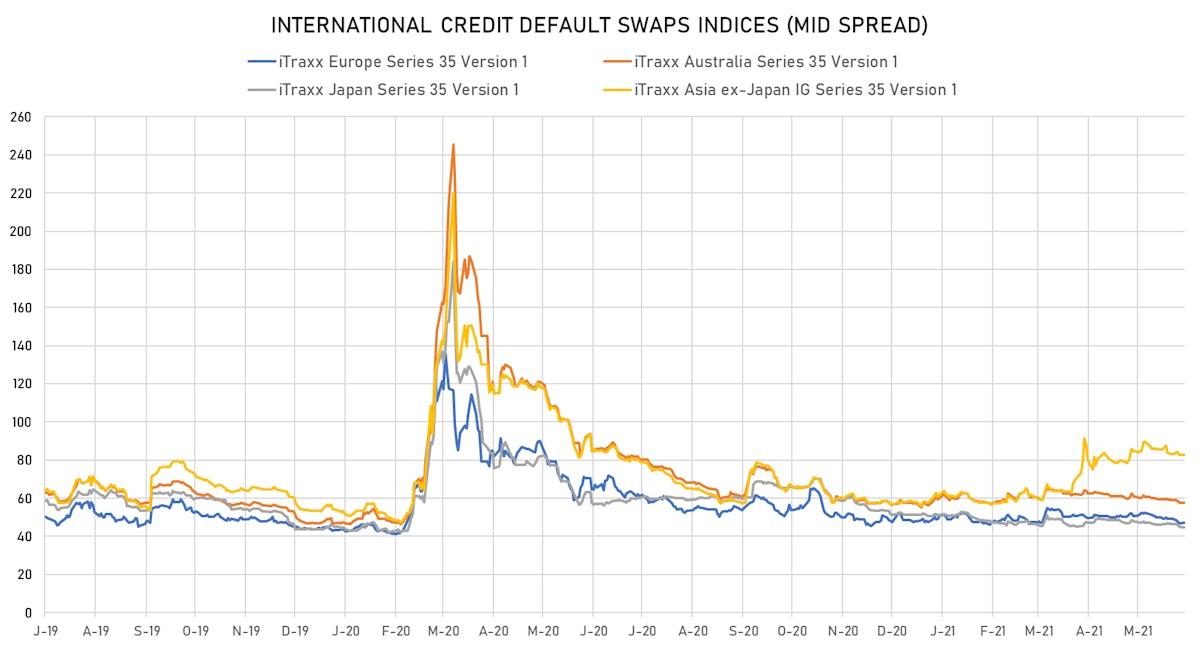

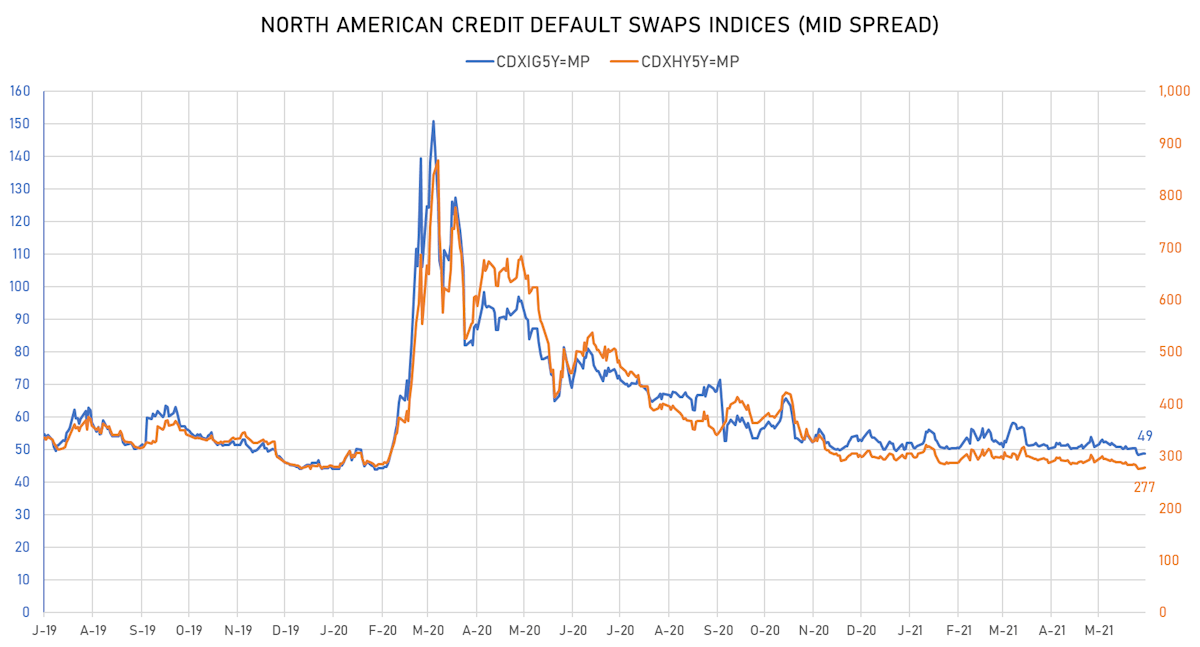

CDS INDICES (mid-spreads)

- Markit CDX.NA.IG 5Y up 0.1 bp, now at 49bp (YTD change: -1.3bp)

- Markit CDX.NA.HY 5Y up 0.4 bp, now at 277bp (YTD change: -16.2bp)

- Markit iTRAXX Europe up 0.5 bp, now at 48bp (YTD change: -0.3bp)

- Markit iTRAXX Japan down 0.1 bp, now at 45bp (YTD change: -6.7bp)

- Markit iTRAXX Asia Ex-Japan up 0.1 bp, now at 83bp (YTD change: +24.9bp)

LARGEST USD CORPORATE CDS MOVERS IN THE PAST WEEK

- Transocean Inc (Country: KY; rated: Caa3): down 206.5 bp to 1,348.6bp (1Y range: 1,183-7,695bp)

- Nabors Industries Inc (Country: US; rated: B+): down 110.6 bp to 771.0bp (1Y range: 700-4,514bp)

- MBIA Inc (Country: US; rated: Ba3): down 47.1 bp to 446.3bp (1Y range: 378-757bp)

- Rite Aid Corp (Country: US; rated: Caa1): down 46.7 bp to 699.5bp (1Y range: 497-888bp)

- American Airlines Group Inc (Country: US; rated: B2): down 35.2 bp to 605.1bp (1Y range: 605-3,660bp)

- Laboratory Corporation of America Holdings (Country: US; rated: Baa2): down 34.3 bp to 78.7bp (1Y range: 79-110bp)

- Turkey, Republic of (Government) (Country: TR; rated: BB): down 33.5 bp to 386.1bp (1Y range: 283-595bp)

- Bombardier Inc (Country: CA; rated: Caa2): down 32.8 bp to 507.6bp (1Y range: 508-2,310bp)

- Staples Inc (Country: US; rated: B2): down 29.6 bp to 826.2bp (1Y range: 652-2,081bp)

- Genworth Holdings Inc (Country: US; rated: Caa1): down 21.5 bp to 497.6bp (1Y range: 469-906bp)

- Apache Corp (Country: US; rated: WD): down 16.3 bp to 166.4bp (1Y range: 166-453bp)

- Navient Corp (Country: US; rated: Ba3): down 15.5 bp to 301.3bp (1Y range: -301bp)

- Levi Strauss & Co (Country: US; rated: BB): down 11.5 bp to 135.0bp (1Y range: 135-166bp)

- Domtar Corp (Country: US; rated: Baa3): up 17.2 bp to 251.2bp (1Y range: 51-251bp)

- Talen Energy Supply LLC (Country: US; rated: BB): up 376.5 bp to 2,186.6bp (1Y range: 875-2,187bp)

LARGEST EURO CORPORATE CDS MOVERS IN THE PAST WEEK

- CMA CGM SA (Country: FR; rated: B1): down 49.5 bp to 323.0bp (1Y range: 323-1,197bp)

- Air France KLM SA (Country: FR; rated: B-): down 40.5 bp to 410.7bp (1Y range: 411-1,211bp)

- Koninklijke KPN NV (Country: NL; rated: BB+): down 37.7 bp to 76.3bp (1Y range: 55-123bp)

- Stonegate Pub Company Financing PLC (Country: GB; rated: WR): down 28.8 bp to 502.1bp (1Y range: 486-984bp)

- Novafives SAS (Country: FR; rated: Caa1): down 23.3 bp to 756.8bp (1Y range: 716-1,409bp)

- Tui AG (Country: DE; rated: LGD4 - 50%): down 18.0 bp to 699.3bp (1Y range: 590-1,799bp)

- Syngenta AG (Country: CH; rated: Ba2): down 17.1 bp to 100.3bp (1Y range: 100-288bp)

- Casino Guichard Perrachon SA (Country: FR; rated: WR): down 16.5 bp to 533.0bp (1Y range: 516-1,210bp)

- Jaguar Land Rover Automotive PLC (Country: GB; rated: WD): down 14.2 bp to 337.7bp (1Y range: 338-1,071bp)

- Renault SA (Country: FR; rated: A-): down 13.1 bp to 186.0bp (1Y range: 168-277bp)

- Virgin Media Finance PLC (Country: GB; rated: WR): down 12.8 bp to 244.9bp (1Y range: 208-325bp)

- UPC Holding BV (Country: NL; rated: LGD6 - 93%): down 12.7 bp to 226.1bp (1Y range: 211-315bp)

- Iceland Bondco PLC (Country: GB; rated: LGD3 - 46%): down 12.4 bp to 417.7bp (1Y range: 358-993bp)

- Telecom Italia SpA (Country: IT; rated: Ba2): down 11.3 bp to 158.7bp (1Y range: 142-219bp)

- Banca Monte dei Paschi di Siena SpA (Country: IT; rated: PNP): up 25.0 bp to 241.7bp (1Y range: 188-242bp)

USD BOND ISSUES

- API Group DE Inc (Financial - Other | New Brighton, Minnesota, United States | Rating: B): US$350m Senior Note (US001877AA71), fixed rate (4.13% coupon) maturing on 15 July 2029, priced at 100.00 (original spread of 293 bp), callable (8nc3)

- Apollo Commercial Real Estate Finance Inc (Real Estate Investment Trust | New York City, New York, United States | Rating: B+): US$500m Note (US03762UAD72), fixed rate (4.63% coupon) maturing on 15 June 2029, priced at 100.00 (original spread of 392 bp), callable (8nc3)

- Crown Castle International Corp (Real Estate Investment Trust | Houston, Texas, United States | Rating: BBB-): US$750m Senior Note (US22822VAY74), fixed rate (2.50% coupon) maturing on 15 July 2031, priced at 99.74 (original spread of 103 bp), callable (10nc10)

- Gartner Inc (Service - Other | Stamford, Connecticut, United States | Rating: BB+): US$600m Senior Note (US366651AG25), fixed rate (3.63% coupon) maturing on 15 June 2029, priced at 100.00 (original spread of 231 bp), callable (8nc3)

- Onemain Finance Corp (Financial - Other | Evansville, Indiana, United States | Rating: BB-): US$750m Senior Note (US682691AB63), fixed rate (3.50% coupon) maturing on 15 January 2027, priced at 100.00 (original spread of 272 bp), callable (6nc3)

- Royal Caribbean Cruises Ltd (Leisure | Miami, Florida, United States | Rating: B): US$650m Senior Note (US780153BH44), fixed rate (4.25% coupon) maturing on 1 July 2026, priced at 100.00 (original spread of 346 bp), callable (5nc5)

- 1011778 BC Unlimited Liability Co (Restaurants | Canada | Rating: BB): US$800m Note (USC6900PAM17), fixed rate (3.88% coupon) maturing on 15 January 2028, priced at 100.25 (original spread of 264 bp), callable (7nc1)

- ANZ New Zealand Intl Ltd (London Branch) (Securities | London, Australia | Rating: NR): US$1,000m Senior Note (), fixed rate (1.25% coupon) maturing on 22 June 2026, priced at 99.85 (original spread of 50 bp), non callable

- Barclays Bank PLC (Banking | London, United Kingdom | Rating: A): US$110m Unsecured Note (XS2354254166), fixed rate (10.75% coupon) maturing on 30 June 2029, priced at 100.00, non callable

- Canadian Imperial Bank of Commerce (Banking | Toronto, Ontario, Canada | Rating: A+): US$750m Senior Note (US13607HVE97), fixed rate (1.25% coupon) maturing on 22 June 2026, priced at 99.86 (original spread of 50 bp), with a make whole call

- Canadian Imperial Bank of Commerce (Banking | Toronto, Ontario, Canada | Rating: A+): US$1,250m Senior Note (US13607HVC32), fixed rate (0.45% coupon) maturing on 22 June 2023, priced at 99.98 (original spread of 30 bp), with a make whole call

- Canadian Imperial Bank of Commerce (Banking | Toronto, Ontario, Canada | Rating: A+): US$500m Senior Note (US13607HVD15), floating rate (SOFR + 34.0 bp) maturing on 22 June 2023, priced at 100.00, non callable

- China Aoyuan Group Ltd (Service - Other | Guangzhou, Guangdong, Switzerland | Rating: B+): US$200m Note (XS2351242461), fixed rate (7.95% coupon) maturing on 21 June 2024, priced at 99.22 (original spread of 837 bp), callable (3nc2)

- DAE Funding LLC (Financial - Other | Dubai, United Arab Emirates | Rating: NR): US$1,000m Senior Note (XS2356380373), fixed rate (1.55% coupon) maturing on 1 August 2024, priced at 99.43 (original spread of 140 bp), callable (3nc3)

- DIB Sukuk Ltd (Financial - Other | George Town, Grand Cayman, United Arab Emirates | Rating: NR): US$1,000m Senior Note (XS2307478227), fixed rate (1.95% coupon) maturing on 22 June 2026, priced at 110.00, non callable

- Dubai Aerospace Enterprise (DAE) Ltd (Aerospace | Dubai, Dubai, United Arab Emirates | Rating: BBB-): US$1,000m Senior Note (US23371DAJ37), fixed rate (1.55% coupon) maturing on 1 August 2024, priced at 99.43 (original spread of 140 bp), callable (3nc3)

- Hana Financial Investment Co Ltd (Securities | Seoul, Seoul, South Korea | Rating: A-): US$4,970m Index Linked Security (KR6HN00014X1) zero coupon maturing on 14 June 2024, priced at 100.00, non callable

- Light Servicos de Eletricidade S A (Utility - Other | Rio De Janeiro, Rio De Janeiro, Brazil | Rating: BB-): US$600m Senior Note (USP62763AB64), fixed rate (4.38% coupon) maturing on 18 June 2026, priced at 100.00, callable (5nc3)

- Macquarie Group Ltd (Financial - Other | Sydney, New South Wales, Australia | Rating: A-): US$950m Senior Note (USQ57085HJ68), floating rate maturing on 23 September 2027, priced at 100.00, callable (6nc5)

- Macquarie Group Ltd (Financial - Other | Sydney, New South Wales, Australia | Rating: A-): US$1,000m Senior Note (USQ57085HK32), floating rate maturing on 23 June 2032, priced at 100.00, callable (11nc10)

- Macquarie Group Ltd (Financial - Other | Sydney, New South Wales, Australia | Rating: A-): US$300m Senior Note (US55607PAE51), floating rate (SOFR + 92.0 bp) maturing on 23 September 2027, priced at 100.00, callable (6nc5)

- Single Platform Investment Repackaging Entity SA (Financial - Other | Luxembourg, Netherlands | Rating: NR): US$209m Unsecured Note (XS2353477503) zero coupon maturing on 20 March 2051, priced at 47.94, non callable

- Toyota Motor Credit Corp (Financial - Other | Plano, Texas, Japan | Rating: A+): US$600m Senior Note (US89236TJK25), fixed rate (1.13% coupon) maturing on 18 June 2026, priced at 99.96 (original spread of 35 bp), with a make whole call

- Toyota Motor Credit Corp (Financial - Other | Plano, Texas, Japan | Rating: A+): US$850m Senior Note (US89236TJH95), fixed rate (0.50% coupon) maturing on 18 June 2024, priced at 99.88 (original spread of 20 bp), non callable

- Toyota Motor Credit Corp (Financial - Other | Plano, Texas, Japan | Rating: A+): US$350m Senior Note (US89236TJJ51), floating rate (SOFR + 26.0 bp) maturing on 18 June 2024, priced at 100.00, non callable

- Turkey, Republic of (Government) (Sovereign | Ankara, Turkey | Rating: B): US$2,500m Islamic Sukuk (Hybrid) (XS2351109116), fixed rate (5.13% coupon) maturing on 22 June 2026, priced at 100.00 (original spread of 437 bp), non callable

EUR BOND ISSUES

- de Volksbank NV (Banking | Utrecht, Netherlands | Rating: A-): €500m Note (XS2356091269), fixed rate (0.25% coupon) maturing on 22 June 2026, priced at 99.42 (original spread of 98 bp), callable (5nc5)

- European Union (Supranational | Brussels, Belgium | Rating: AAA): €20,000m Senior Note (EU000A3KSXE1) zero coupon maturing on 4 July 2031, priced at 99.14 (original spread of 32 bp), non callable

- Grupo Antolin Irausa SA (Automotive Manufacturer | Burgos, Burgos, Spain | Rating: B): €390m Note (XS2355632584), fixed rate (3.50% coupon) maturing on 30 April 2028, priced at 100.00 (original spread of 399 bp), callable (7nc3)

- Inmobiliaria Colonial SOCIMI SA (Home Builders | Barcelona, Barcelona, Spain | Rating: BBB): €500m Senior Note (ES0239140025), fixed rate (0.75% coupon) maturing on 22 June 2029, priced at 98.97 (original spread of 129 bp), callable (8nc8)

- Macif SAM (Property and Casualty Insurance | Niort, France | Rating: NR): €500m Senior Subordinated Note (FR0014003Y09), fixed rate (0.63% coupon) maturing on 21 June 2027, priced at 99.35 (original spread of 130 bp), callable (6nc6)

- Sirius Real Estate Ltd (Home Builders | Saint Peter Port, Guernsey | Rating: BBB): €350m Senior Note (XS2356076625), fixed rate (1.13% coupon) maturing on 22 June 2026, priced at 99.56 (original spread of 182 bp), callable (5nc5)

- Teollisuuden Voima Oyj (Utility - Other | Eurajoki, Lansi-Suomen, Finland | Rating: BB): €500m Unsecured Note (XS2355632741), fixed rate (2.00% coupon) maturing on 23 June 2028, priced at 100.00, non callable

NEW LOANS

- Cengage Learning Inc, signed a US$ 1,250m Term Loan B, to be used for general corporate purposes. It matures on and initial pricing is set at

- Herman Miller Inc (BBB-), signed a US$ 625m Term Loan B, to be used for acquisition financing. It matures on 01/00/00.

- Cano Health LLC (B-), signed a US$ 295m Term Loan B, to be used for acquisition financing. It matures on 12/21/27 and initial pricing is set at LIBOR +450.000bps

- Remax LLC, signed a US$ 460m Term Loan B, to be used for general corporate purposes. It matures on 06/24/28 and initial pricing is set at LIBOR +275.000bps

NEW ISSUES IN SECURITIZED CREDIT

- Mf1 2021-Fl6 issued a floating-rate CMBS in 6 tranches, for a total of US$ 1,110 m. Highest-rated tranche offering a spread over the floating rate of 110bp, and the lowest-rated tranche a spread of 295bp. Bookrunners: Credit Suisse, JP Morgan & Co Inc