Credit

US Bonds Fall, With The Rise In Rates Outpacing The Drop In Spreads

In the primary market, bond issuance is slowing down in IG, but less so in HY: though today was fairly quiet, more deals were priced in HY than IG

Published ET

US IG primary market | Source: Credit Suisse

QUICK SUMMARY

- S&P 500 Bond Index was down -0.20% today, with investment grade down -0.22% and high yield down -0.07% (YTD total return: -1.99%)

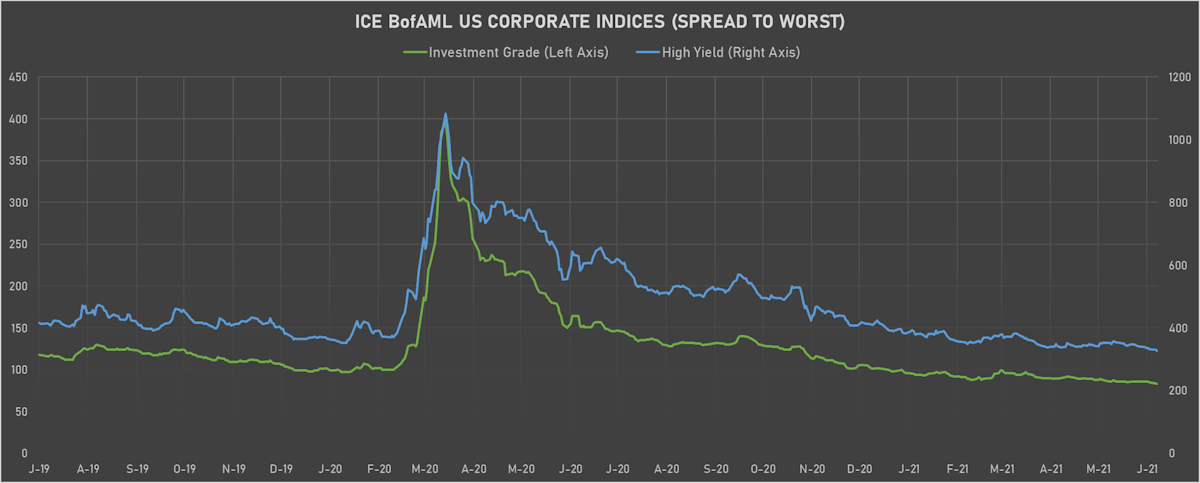

- ICE BofA US Corporate Index (Investment Grade) spread to worst down -1.0 bp, now at 83.0 bp (YTD change: -15.0 bp)

- ICE BofA US High Yield Index spread to worst down -4.0 bp, now at 326.0 bp (YTD change: -64.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index down -0.06% today (YTD total return: +2.2%)

- New issues: US$ 7.5bn in dollars and € 8.7bn in euros

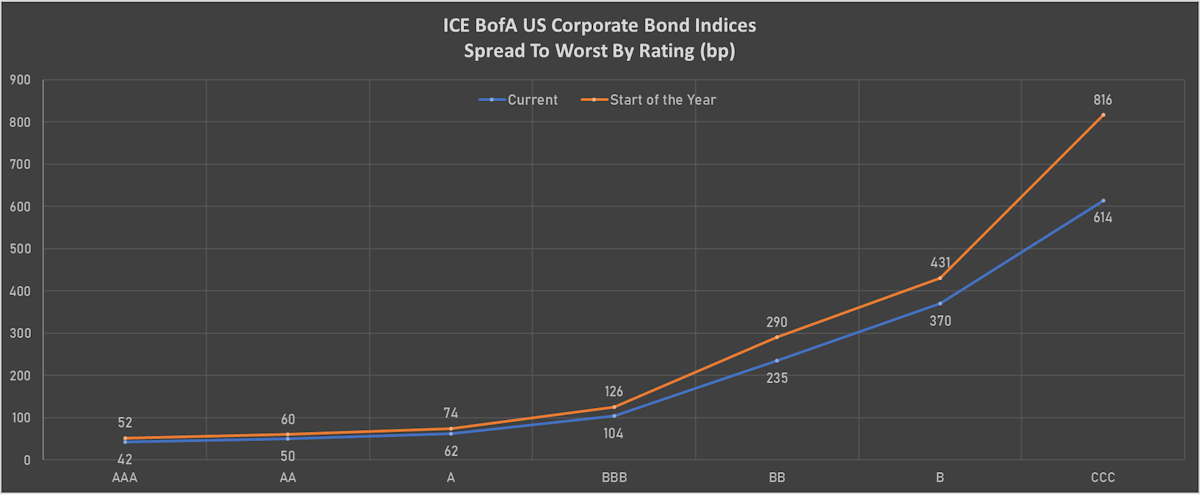

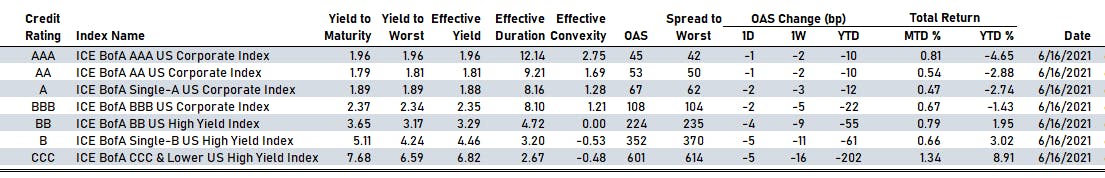

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

- AAA down by -1 bp at 45 bp

- AA down by -1 bp at 53 bp

- A down by -2 bp at 67 bp

- BBB down by -2 bp at 108 bp

- BB down by -4 bp at 224 bp

- B down by -5 bp at 352 bp

- CCC down by -5 bp at 601 bp

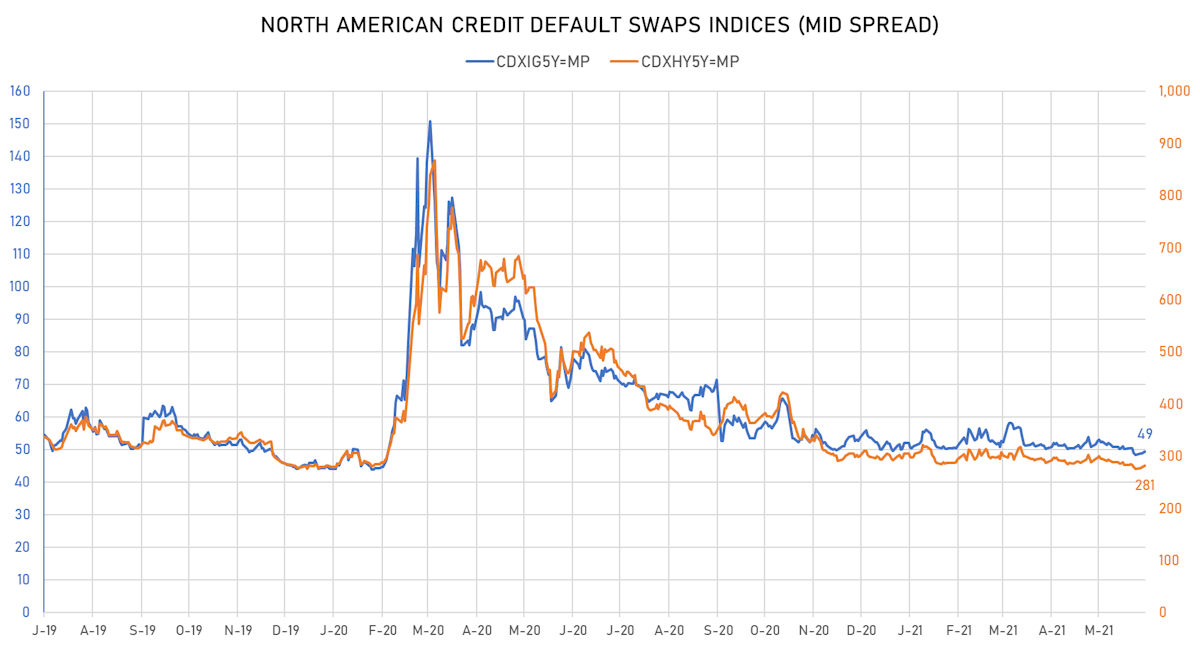

CDS INDICES (mid-spreads)

- Markit CDX.NA.IG 5Y up 0.6 bp, now at 49bp (YTD change: -0.7bp)

- Markit CDX.NA.HY 5Y up 4.3 bp, now at 281bp (YTD change: -11.9bp)

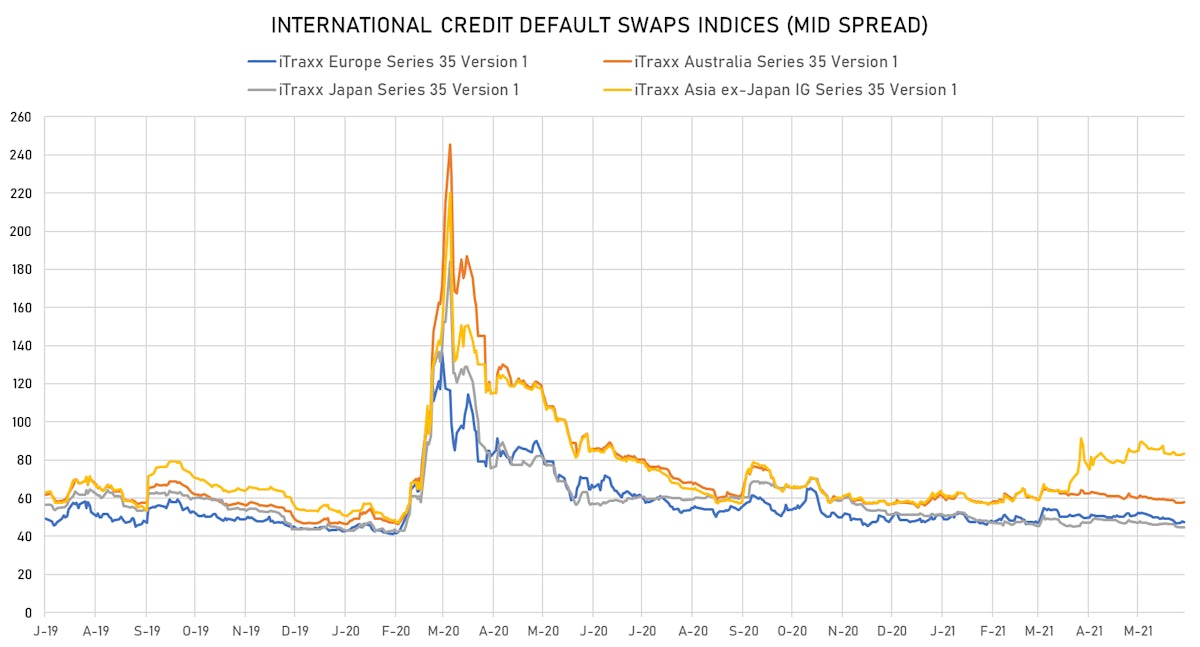

- Markit iTRAXX Europe down 0.2 bp, now at 47bp (YTD change: -0.5bp)

- Markit iTRAXX Japan unchanged, now at 45bp (YTD change: -6.7bp)

- Markit iTRAXX Asia Ex-Japan up 0.4 bp, now at 83bp (YTD change: +25.3bp)

USD BOND ISSUES

- Colgate Energy Partners III LLC (Oil and Gas | Midland, Texas, United States | Rating: B): US$500m Senior Note (US19416MAB54), fixed rate (5.88% coupon) maturing on 1 July 2029, priced at 100.00 (original spread of 484 bp), callable (8nc3)

- Caisse des Depots et Consignations (Agency | Paris, Ile-De-France, France | Rating: AA): US$150m Senior Note (FR00140046O5), fixed rate (0.34% coupon) maturing on 23 June 2023, non callable

- Gajah Tunggal Tbk PT (Vehicle Parts | Jakarta Pusat, Indonesia | Rating: CCC+): US$175m Note (XS2344284893), fixed rate (8.95% coupon) maturing on 23 June 2026, priced at 98.53, callable (5nc2)

- Great Canadian Gaming Corp (Gaming | North York, Ontario, Canada | Rating: NR): US$350m Note (US75383KAA25), fixed rate (4.88% coupon) maturing on 1 November 2026, priced at 100.00 (original spread of 399 bp), callable (5nc1)

- Indigo Merger Sub Inc (Financial - Other | Rating: BB+): US$500m Note (US45569KAA16), fixed rate (2.88% coupon) maturing on 15 July 2026, priced at 100.00 (original spread of 210 bp), callable (5nc2)

- Lundin Energy Finance BV (Financial - Other | Rating: NR): US$1,000m Senior Note (US55037AAB44), fixed rate (3.10% coupon) maturing on 15 July 2031, priced at 99.81 (original spread of 160 bp), callable (10nc10)

- Lundin Energy Finance BV (Financial - Other | Rating: NR): US$1,000m Senior Note (US55037AAA60), fixed rate (2.00% coupon) maturing on 15 July 2026, priced at 99.83 (original spread of 115 bp), callable (5nc5)

- Madison Iaq LLC (Financial - Other | Rating: B): US$700m Note (US55760LAA52), fixed rate (4.13% coupon) maturing on 30 June 2028, priced at 100.00 (original spread of 322 bp), callable (7nc3)

- Madison Iaq LLC (Financial - Other | Rating: CCC+): US$1,035m Senior Note (US55760LAB36), fixed rate (5.88% coupon) maturing on 30 June 2029, priced at 100.00 (original spread of 482 bp), callable (8nc3)

- Nomura International Funding Pte Ltd (Financial - Other | Singapore | Rating: NR): US$350m Unsecured Note (XS2218456338), fixed rate (3.10% coupon) maturing on 20 June 2031, priced at 100.00, non callable

- Nomura International Funding Pte Ltd (Financial - Other | Singapore | Rating: NR): US$200m Unsecured Note (XS2218455280), floating rate maturing on 22 June 2033, priced at 100.00, non callable

- Wipro It Services LLC (Financial - Other | India | Rating: A-): US$750m Senior Note (US97654MAA45), fixed rate (1.50% coupon) maturing on 23 June 2026, priced at 99.64 (original spread of 80 bp), callable (5nc5)

- Wipro It Services LLC (Financial - Other | India | Rating: NR): US$750m Senior Note (USU9841MAA00), fixed rate (1.50% coupon) maturing on 23 June 2026, priced at 99.64 (original spread of 80 bp), callable (5nc5)

EUR BOND ISSUES

- Eurofima European Company for the Financing of Railroad Rolling Stock (Supranational | Basel, Basel-Stadt, Switzerland | Rating: AA): €250m Bond (XS2356409966), fixed rate (0.01% coupon) maturing on 23 June 2028, priced at 100.48 (original spread of 44 bp), non callable

- GTC Aurora Luxembourg SA (Financial - Other | Luxembourg, Hungary | Rating: NR): €500m Senior Note (XS2356039268), fixed rate (2.25% coupon) maturing on 23 June 2026, priced at 99.42 (original spread of 299 bp), callable (5nc5)

- HYPO NOE Landesbank fuer Niederoesterreich und Wien AG (Banking | Sankt Poelten, Niederoesterreich, Austria | Rating: A): €500m Oeffenlicher Pfandbrief (Covered Bond) (AT0000A2RY95), fixed rate (0.13% coupon) maturing on 23 June 2031, priced at 99.81 (original spread of 39 bp), non callable

- La Banque Postale SA (Banking | Paris, Ile-De-France, France | Rating: A): €750m Bond (FR00140044X1), fixed rate (0.75% coupon) maturing on 23 June 2031, priced at 99.60 (original spread of 104 bp), with a regulatory call

- NH Hotel Group SA (Lodging | Madrid, Madrid, Thailand | Rating: NR): €400m Note (XS2357281257), fixed rate (4.00% coupon) maturing on 2 July 2026, priced at 100.00 (original spread of 462 bp), callable (5nc2)

- Nomad Foods Bondco PLC (Financial - Other | Feltham, Middlesex, United Kingdom | Rating: NR): €750m Note (XS2355604708), fixed rate (2.50% coupon) maturing on 24 June 2028, priced at 100.00 (original spread of 300 bp), callable (7nc3)

- PHM Group Holding Oy (Financial - Other | Rating: B): €300m Bond (FI4000507876), fixed rate (4.75% coupon) maturing on 18 June 2026 (original spread of 498 bp), callable (5nc1m)

- Teollisuuden Voima Oyj (Utility - Other | Eurajoki, Lansi-Suomen, Finland | Rating: BB): €600m Senior Note (XS2355632741), fixed rate (1.38% coupon) maturing on 23 June 2028, priced at 99.70 (original spread of 219 bp), callable (7nc7)

- Terna Rete Elettrica Nazionale SpA (Utility - Other | Rome, Roma, Italy | Rating: BBB+): €600m Senior Note (XS2357205587), fixed rate (0.38% coupon) maturing on 23 June 2029, priced at 99.82 (original spread of 81 bp), callable (8nc8)

- Unedic (Service - Other | Paris, Ile-De-France, France | Rating: AA): €2,000m Bond (FR00140045Z3), fixed rate (0.50% coupon) maturing on 25 May 2036, priced at 99.66 (original spread of 10 bp), non callable

- Vallourec SA (Industrials - Other | Boulogne-Billancourt, Ile-De-France, France | Rating: DEF): €1,023m Bond (XS2352739184), fixed rate (8.50% coupon) maturing on 31 December 2200, priced at 100.00, non callable

- Vallourec SA (Industrials - Other | Boulogne-Billancourt, Ile-De-France, France | Rating: DEF): €1,023m Unsecured Note (XS2352740604), fixed rate (8.50% coupon) maturing on 31 December 2200, priced at 100.00, non callable

NEW LOANS

- Rockcliff Energy II LLC, signed a US$ 900m Revolving Credit Facility, to be used for general corporate purposes. It matures on 12/30/24 and initial pricing is set at LIBOR +275.000bps

- Unified Women's Healthcare LLC (B-), signed a US$ 235m Term Loan B, to be used for acquisition financing. It matures on 12/18/27.

- Penn Engr & Mnfr Corp (BB), signed a US$ 200m Revolving Credit Facility, to be used for general corporate purposes. It matures on 06/30/26 and initial pricing is set at LIBOR +275.000bps

- Tauber Oil Co, signed a US$ 400m Revolving Credit Facility, to be used for general corporate purposes. It matures on 06/22/22.

- Peninsula Petroleum, signed a US$ 210m Term Loan, to be used for general corporate purposes. It matures on 06/16/23.

- Prosol Gestion SASU, signed a € 1,382m Term Loan B and a €250m Revolving Credit Facility, to be used for general corporate purposes.

- Meyer Burger Technology AG, signed a € 125m Term Loan, to be used for general corporate purposes. It matures on 06/16/27.

NEW ISSUES IN SECURITIZED CREDIT

- Nissan Auto Receivables 2021-A Owner Trust issued a floating-rate ABS backed by auto receivables in 4 tranches, for a total of US$ 1,000 m. Bookrunners: Citigroup Global Markets Inc, Bank of America Merrill Lynch, BNP Paribas Securities Corp, MUFG Securities Americas Inc

- Freddie Mac Spc Series K-F114 issued a floating-rate Agency CMBS in 1 tranche, for a total of US$ 886 m. Bookrunners: Goldman Sachs & Co, Barclays Capital Group

- SLG 2021-OVA issued a fixed-rate CMBS in 7 tranches, for a total of US$ 2,816 m. Highest-rated tranche offering a yield to maturity of 2.44%, and the lowest-rated tranche a yield to maturity of 2.71%. Bookrunners: Goldman Sachs & Co, JP Morgan & Co Inc, Barclays Capital Group, Deutsche Bank Securities Inc, Citigroup Global Markets Inc, Wells Fargo Securities LLC, BMO Capital Markets, Bank of America Merrill Lynch

- American Car Center Subprime Auto Lease 2021-1 issued a fixed-rate ABS backed by auto receivables in 4 tranches, for a total of US$ 240 m. Highest-rated tranche offering a yield to maturity of 0.74%, and the lowest-rated tranche a yield to maturity of 5.25%. Bookrunners: Credit Suisse

- Wendys Funding 2021-1 LLC issued a fixed-rate ABS backed by business cashflow in 2 tranches, for a total of US$ 1,100 m. Highest-rated tranche offering a yield to maturity of 2.37%, and the lowest-rated tranche a yield to maturity of 2.78%. Bookrunners: Jefferies & Co Inc, Guggenheim Securities LLC

- Mosaic Solar Loan Trust 2021-2 issued a fixed-rate ABS backed by certificates in 4 tranches, for a total of US$ 181 m. Highest-rated tranche offering a yield to maturity of 1.66%, and the lowest-rated tranche a yield to maturity of 3.70%. Bookrunners: Deutsche Bank Securities Inc, RBC Capital Markets, BNP Paribas Securities Corp