Credit

High Yield Spreads Widen But Corporate Bonds Rise With Flatter Rates Curve

Very little activity in the primary bond market today; according to the IFR, weekly total IG issuance was $23.5bn (2021 YTD US$798.6bn vs 2020 YTD US$1.159trn) and $9.75bn in HY (2021 YTD US$273.063bn vs 2020 YTD US$195.064bn)

Published ET

IBOXX Liquid High Yield USD | Source: FactSet

QUICK SUMMARY

- S&P 500 Bond Index was up 0.59% today, with investment grade up 0.65% and high yield up 0.12% (YTD total return: -1.02%)

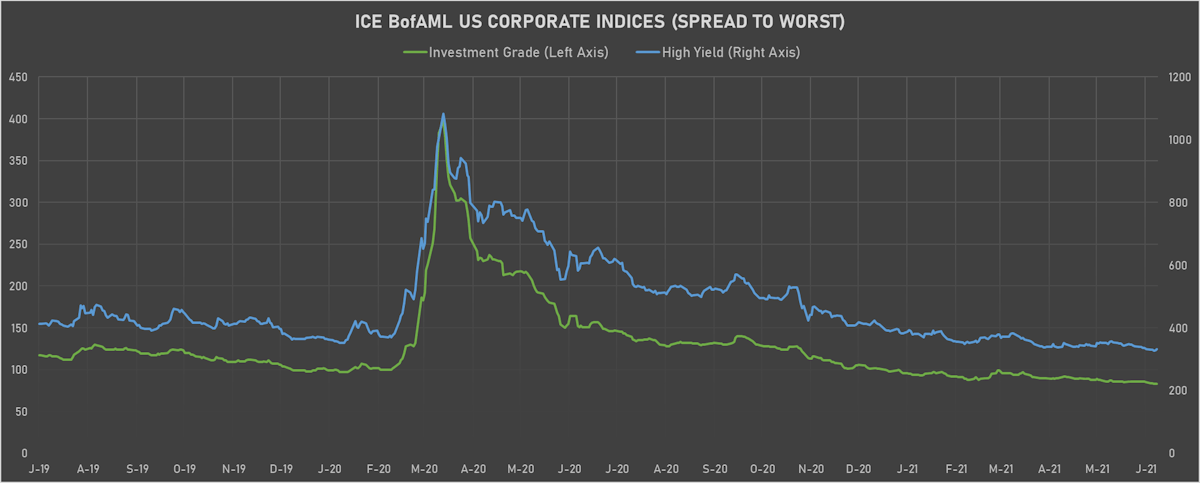

- ICE BofA US Corporate Index (Investment Grade) spread to worst unchanged at 83.0 bp (YTD change: -15.0 bp)

- ICE BofA US High Yield Index spread to worst up 4.0 bp, now at 333.0 bp (YTD change: -57.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index down -0.04% today (YTD total return: +2.2%)

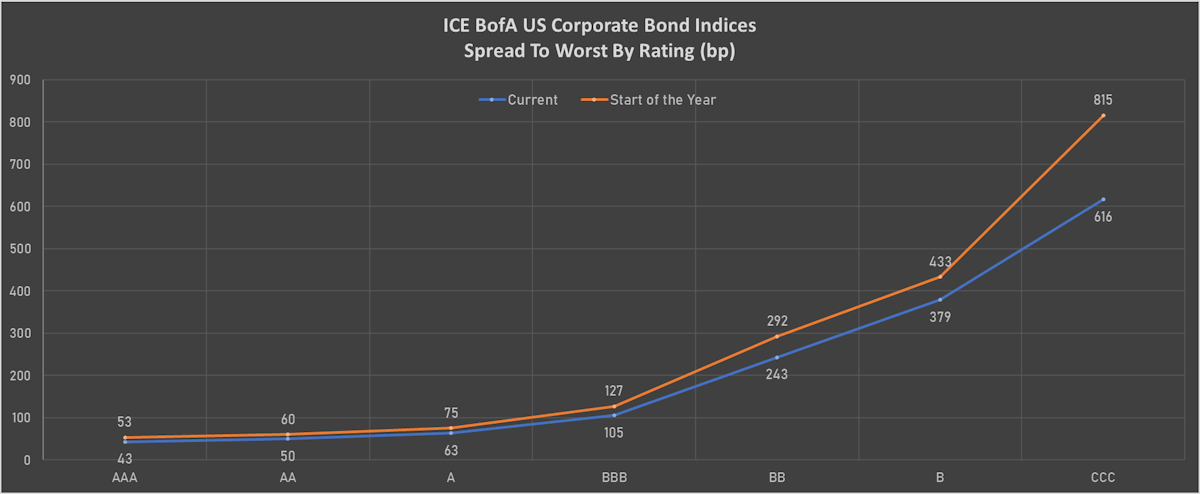

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

- AAA up by 1 bp at 45 bp

- AA unchanged at 53 bp

- A unchanged at 67 bp

- BBB unchanged at 108 bp

- BB up by 3 bp at 230 bp

- B up by 3 bp at 359 bp

- CCC up by 3 bp at 604 bp

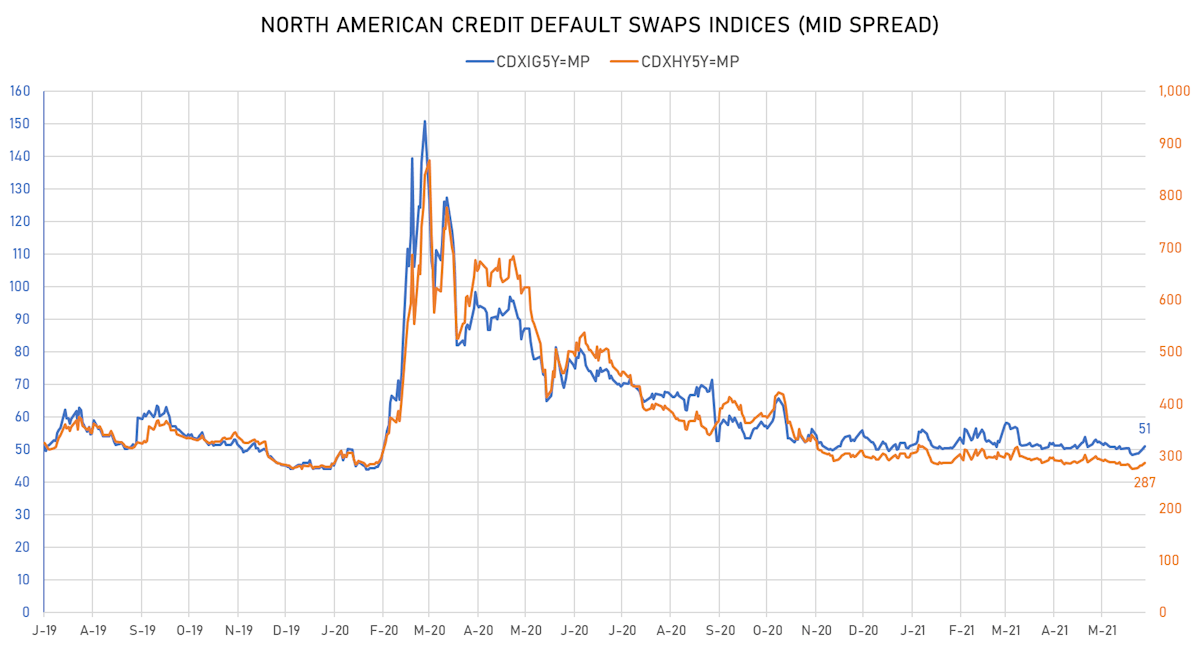

CDS INDICES (mid-spreads)

- Markit CDX.NA.IG 5Y up 1.3 bp, now at 51bp (YTD change: +0.9bp)

- Markit CDX.NA.HY 5Y up 5.3 bp, now at 287bp (YTD change: -6.6bp)

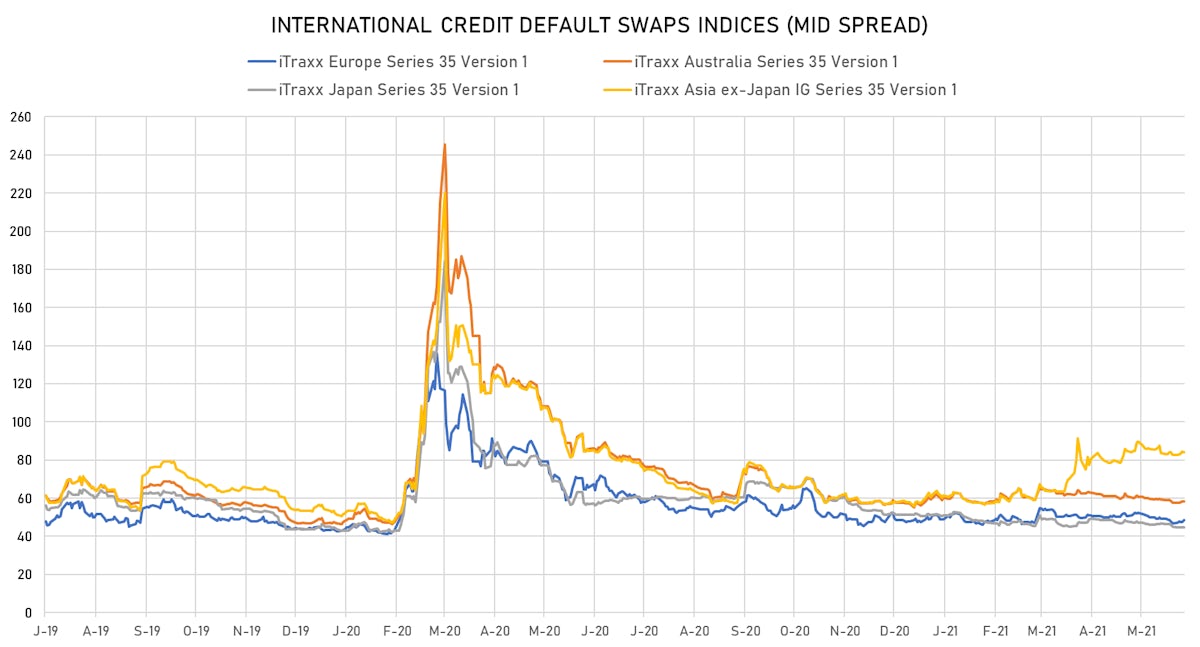

- Markit iTRAXX Europe up 1.0 bp, now at 48bp (YTD change: +0.5bp)

- Markit iTRAXX Japan up 0.1 bp, now at 45bp (YTD change: -6.5bp)

- Markit iTRAXX Asia Ex-Japan down 0.4 bp, now at 84bp (YTD change: +26.0bp)

LARGEST USD CDS MOVES IN THE PAST WEEK

- Transocean Inc (Country: KY; rated: Caa3): down 206.5 bp to 1,399.0bp (1Y range: 1,061-7,695bp)

- Nabors Industries Inc (Country: US; rated: B+): down 110.6 bp to 786.6bp (1Y range: 662-4,514bp)

- MBIA Inc (Country: US; rated: Ba3): down 47.1 bp to 440.1bp (1Y range: 378-757bp)

- Rite Aid Corp (Country: US; rated: Caa1): down 46.7 bp to 712.8bp (1Y range: 497-888bp)

- American Airlines Group Inc (Country: US; rated: B2): down 35.2 bp to 613.3bp (1Y range: 596-3,660bp)

- Laboratory Corporation of America Holdings (Country: US; rated: Baa2): down 34.3 bp to 76.0bp (1Y range: 76-110bp)

- Turkey, Republic of (Government) (Country: TR; rated: BB): down 33.5 bp to 390.4bp (1Y range: 283-595bp)

- Bombardier Inc (Country: CA; rated: Caa2): down 32.8 bp to 517.9bp (1Y range: 512-2,310bp)

- Staples Inc (Country: US; rated: B2): down 29.6 bp to 873.6bp (1Y range: 652-2,081bp)

- Genworth Holdings Inc (Country: US; rated: Caa1): down 21.5 bp to 472.7bp (1Y range: 469-906bp)

- Apache Corp (Country: US; rated: WD): down 16.3 bp to 217.8bp (1Y range: 168-453bp)

- Navient Corp (Country: US; rated: Ba3): down 15.5 bp to 303.2bp (1Y range: -303bp)

- Levi Strauss & Co (Country: US; rated: BB): down 11.5 bp to 135.0bp (1Y range: 135-166bp)

- Colombia, Republic of (Government) (Country: CO; rated: BBB-): down 11.1 bp to 136.7bp (1Y range: 85-165bp)

- Domtar Corp (Country: US; rated: Baa3): up 17.2 bp to 255.6bp (1Y range: 53-256bp)

LARGEST EURO CDS MOVES IN THE PAST WEEK

- CMA CGM SA (Country: FR; rated: B1): down 49.5 bp to 333.5bp (1Y range: 326-1,110bp)

- Air France KLM SA (Country: FR; rated: B-): down 40.5 bp to 404.5bp (1Y range: 401-1,211bp)

- Koninklijke KPN NV (Country: NL; rated: BB+): down 37.7 bp to 75.5bp (1Y range: 55-123bp)

- Stonegate Pub Company Financing PLC (Country: GB; rated: WR): down 28.8 bp to 502.6bp (1Y range: 486-984bp)

- Novafives SAS (Country: FR; rated: Caa1): down 23.3 bp to 748.4bp (1Y range: 716-1,362bp)

- TUI AG (Country: DE; rated: LGD4 - 50%): down 18.0 bp to 668.3bp (1Y range: 590-1,799bp)

- Syngenta AG (Country: CH; rated: Ba2): down 17.1 bp to 101.6bp (1Y range: 100-288bp)

- Casino Guichard Perrachon SA (Country: FR; rated: WR): down 16.5 bp to 530.8bp (1Y range: 516-1,210bp)

- Jaguar Land Rover Automotive PLC (Country: GB; rated: WD): down 14.2 bp to 340.9bp (1Y range: 340-975bp)

- Renault SA (Country: FR; rated: A-): down 13.1 bp to 189.5bp (1Y range: 168-277bp)

- Virgin Media Finance PLC (Country: GB; rated: WR): down 12.8 bp to 249.8bp (1Y range: 208-325bp)

- UPC Holding BV (Country: NL; rated: LGD6 - 93%): down 12.7 bp to 230.2bp (1Y range: 211-315bp)

- Iceland Bondco PLC (Country: GB; rated: LGD3 - 46%): down 12.4 bp to 428.5bp (1Y range: 358-918bp)

- Telecom Italia SpA (Country: IT; rated: Ba2): down 11.3 bp to 164.0bp (1Y range: 142-219bp)

- Banca Monte dei Paschi di Siena SpA (Country: IT; rated: PNP): up 25.0 bp to 248.0bp (1Y range: 188-272bp)

NEW LOANS

- Horace Mann Educators Corp (BBB), signed a US$ 225m Term Loan, to be used for acquisition financing.

- ABM Industries Inc, signed a US$ 650m Term Loan A and a US$ 1,300m Revolving Credit Facility, to be used for general corporate purposes. It matures on 06/25/26 and initial pricing is set at LIBOR +225bps

- ECN Capital, signed a US$ 1,000m Revolving Credit Facility, to be used for general corporate purposes. It matures on 06/21/25.

- Acadia Realty Trust, signed a US$ 400m Term Loan A and a US$ 300m Revolving Credit Facility, to be used for general corporate purposes. It matures on 06/28/26 and initial pricing is set at LIBOR +150bps

- EastGroup Properties Inc, signed a US$ 425m Revolving Credit Facility, to be used for general corporate purposes. It matures on 06/30/25 and initial pricing is set at LIBOR +100.000bps

- Associated Asphalt Inc, signed a US$ 250m Term Loan, to be used for general corporate purposes. It matures on 01/00/00.

- VRC Companies LLC, signed a US$ 595m Term Loan B, to be used for leveraged buyout. It matures on 06/25/27 and initial pricing is set at LIBOR +550.000bps

- Charter NEX Films Inc, signed a US$ 1,596m Term Loan B, to be used for general corporate purposes. It matures on 12/23/27.

- Franco-Nevada Corp, signed a US$ 1,000m Revolving Credit Facility, to be used for general corporate purposes. It matures on 06/30/25.

- US Concrete Inc (B), signed a US$ 300m Revolving Credit Facility, to be used for general corporate purposes and working capital. It matures on 06/25/26 and initial pricing is set at LIBOR +150bps

- Salesforce.com Inc (A), signed a US$ 4,000m Bridge Loan, to be used for acquisition financing. It matures on 06/29/22 and initial pricing is set at LIBOR +75.000bps

- Chubb Corp (A+), signed a US$ 925m 364d Revolver, to be used for general corporate purposes. It matures on 06/28/22 and initial pricing is set at LIBOR +100.000bps

- Sherwin-Williams Co (BBB), signed a US$ 2,000m Revolving Credit Facility, to be used for general corporate purposes and working capital. It matures on 06/29/26 and initial pricing is set at LIBOR +125bps

- Tornator Oy, signed a € 150m Term Loan, to be used for general corporate purposes. It matures on 06/18/28.

NEW ISSUES IN SECURITIZED CREDIT

- BBCMS 2021-AGW Mortgage Trust issued a floating-rate CMBS in 8 tranches, for a total of US$ 349 m. Highest-rated tranche offering a spread over the floating rate of 125bp, and the lowest-rated tranche a spread of 400bp. Bookrunners: Barclays Capital Group and Citigroup Global Markets Inc