Credit

US Corporate IG Bonds Fell Today, While High Yield Rose On Tighter Cash Spreads

Not a huge amount of activity in the primary market but here some notable ones issued by global financials: Nomura printed $4.5bn, Santander US$ 1.5bn and BNP Paribas US$ 1bn

Published ET

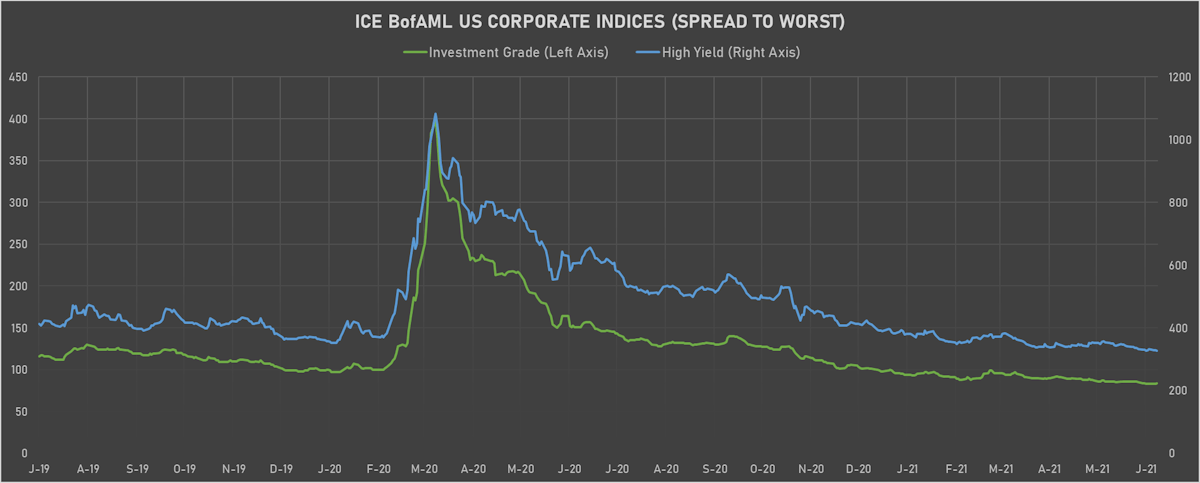

HY cash (bonds) have more room to tighten with CDS spreads than IG | Source: Credit Suisse

QUICK SUMMARY

- S&P 500 Bond Index was down -0.03% today, with investment grade down -0.05% and high yield up 0.10% (YTD total return: -1.45%)

- The iBoxx USD Liquid Investment Grade Total Return Index was down -0.135% today (Month-to-date: 1.40%; Year-to-date: -2.17%)

- The iBoxx USD Liquid High Yield Total Return Index was up 0.069% today (Month-to-date: 0.68%; Year-to-date: 2.59%)

- ICE BofA US Corporate Index (Investment Grade) spread to worst up 1.0 bp, now at 84.0 bp (YTD change: -14.0 bp)

- ICE BofA US High Yield Index spread to worst down -2.0 bp, now at 327.0 bp (YTD change: -63.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index unchanged today (YTD total return: +2.1%)

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

- AAA unchanged at 45 bp

- AA up by 1 bp at 54 bp

- A unchanged at 68 bp

- BBB up by 1 bp at 109 bp

- BB down by -1 bp at 225 bp

- B down by -3 bp at 354 bp

- CCC down by -3 bp at 600 bp

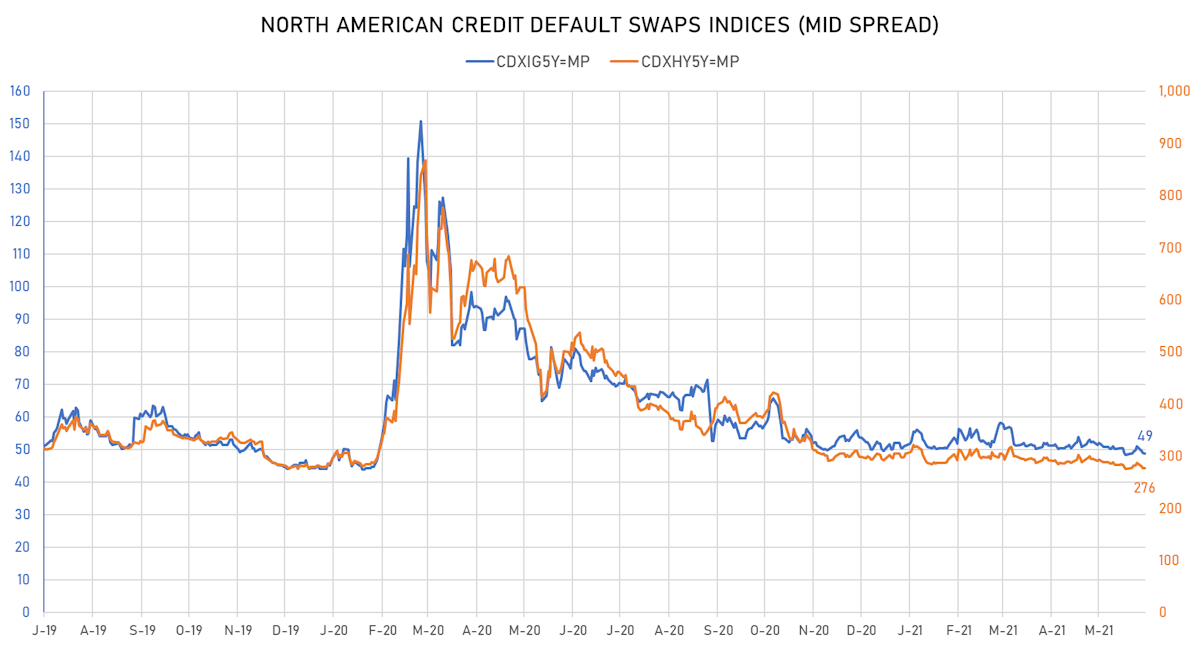

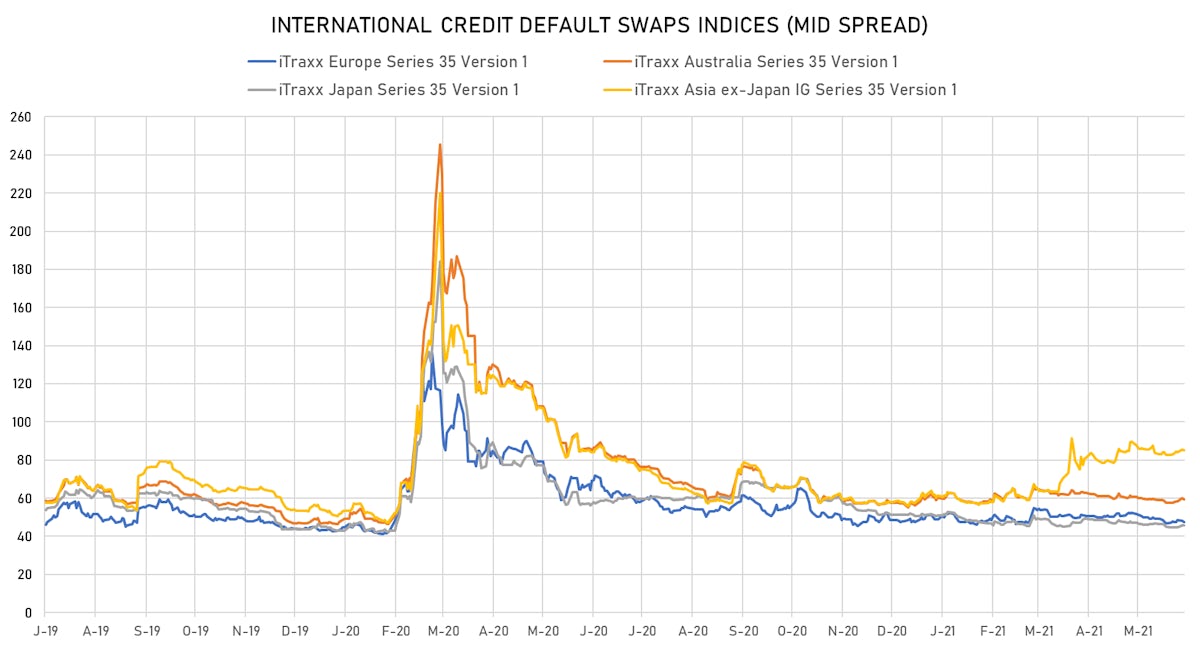

CDS INDICES (mid-spreads)

- Markit CDX.NA.IG 5Y down 0.1 bp, now at 49bp (YTD change: -1.2bp)

- Markit CDX.NA.HY 5Y down 0.3 bp, now at 276bp (YTD change: -16.8bp)

- Markit iTRAXX Europe down 0.6 bp, now at 47bp (YTD change: -1.2bp)

- Markit iTRAXX Japan down 0.1 bp, now at 45bp (YTD change: -5.9bp)

- Markit iTRAXX Asia Ex-Japan down 0.4 bp, now at 85bp (YTD change: +26.5bp)

TOP BONDS MOVES - USD HY

- Issuer: Bonitron DAC (DUBLIN, Ireland) | Coupon: 9.00% | Maturity: 22/10/2025 | Rating: B- | ISIN: XS2243344434 | Z-spread up by 98.6 bp to 739.3 bp, with the yield to worst at 7.8% and the bond now trading down to 103.5 cents on the dollar (1Y price range: 104.8-109.9).

- Issuer: Bank razvitiya Respubliki Belarus' OAO (MINSK, Belarus) | Coupon: 6.75% | Maturity: 2/5/2024 | Rating: B | ISIN: XS1904731129 | Z-spread up by 56.2 bp to 964.7 bp, with the yield to worst at 9.8% and the bond now trading down to 92.3 cents on the dollar (1Y price range: 93.5-102.5).

- Issuer: YPF SA (Buenos Aires, Argentina) | Coupon: 6.95% | Maturity: 21/7/2027 | Rating: CCC | ISIN: USP989MJBL47 | Z-spread up by 42.7 bp to 1,375.4 bp, with the yield to worst at 14.1% and the bond now trading down to 70.9 cents on the dollar (1Y price range: 56.6-72.0).

- Issuer: Vedanta Resources Finance II PLC (London, United Kingdom) | Coupon: 8.95% | Maturity: 11/3/2025 | Rating: B- | ISIN: USG9T27HAD62 | Z-spread up by 40.2 bp to 890.3 bp, with the yield to worst at 9.3% and the bond now trading down to 98.0 cents on the dollar (1Y price range: 94.3-99.8).

- Issuer: Dilijan Finance BV (Amsterdam, Netherlands) | Coupon: 6.50% | Maturity: 28/1/2025 | Rating: B+ | ISIN: XS2080321198 | Z-spread up by 38.6 bp to 651.5 bp, with the yield to worst at 6.7% and the bond now trading down to 98.3 cents on the dollar (1Y price range: 93.6-100.4).

- Issuer: Periama Holdings LLC (Baytown, Texas (US)) | Coupon: 5.95% | Maturity: 19/4/2026 | Rating: BB- | ISIN: XS2224065289 | Z-spread up by 28.0 bp to 325.5 bp, with the yield to worst at 3.9% and the bond now trading down to 108.0 cents on the dollar (1Y price range: 104.1-109.3).

- Issuer: Kondor Finance PLC (London, United Kingdom) | Coupon: 7.63% | Maturity: 8/11/2026 | Rating: B | ISIN: XS2077601610 | Z-spread up by 27.2 bp to 599.3 bp, with the yield to worst at 6.6% and the bond now trading down to 103.5 cents on the dollar (1Y price range: 98.9-104.8).

- Issuer: Pakistan Water and Power Development Authority (Lahore, Pakistan) | Coupon: 7.50% | Maturity: 4/6/2031 | Rating: B- | ISIN: XS2348591707 | Z-spread up by 26.7 bp to 628.8 bp, with the yield to worst at 7.4% and the bond now trading down to 100.0 cents on the dollar (1Y price range: 100.0-101.9).

- Issuer: Bank Muscat SAOG (Muscat, Oman) | Coupon: 4.75% | Maturity: 17/3/2026 | Rating: BB- | ISIN: XS2310799809 | Z-spread up by 26.4 bp to 311.6 bp, with the yield to worst at 3.7% and the bond now trading down to 103.4 cents on the dollar (1Y price range: 101.7-105.1).

- Issuer: bijeo jgupi ss (Tbilisi, Georgia) | Coupon: 6.00% | Maturity: 26/7/2023 | Rating: BB- | ISIN: XS1405775880 | Z-spread down by 29.5 bp to 259.9 bp, with the yield to worst at 2.8% and the bond now trading up to 106.2 cents on the dollar (1Y price range: 104.5-106.2).

- Issuer: L Brands Inc (Columbus, Ohio (US)) | Coupon: 9.38% | Maturity: 1/7/2025 | Rating: BB- | ISIN: USU51407AD34 | Z-spread down by 30.1 bp to 114.7 bp (CDS basis: -1.0bp), with the yield to worst at 1.7% and the bond now trading up to 128.9 cents on the dollar (1Y price range: 122.8-128.6).

- Issuer: Multibank Inc (PANAMA CITY, Panama) | Coupon: 4.38% | Maturity: 9/11/2022 | Rating: BB+ | ISIN: USP69895AA12 | Z-spread down by 34.7 bp to 236.6 bp, with the yield to worst at 2.4% and the bond now trading up to 102.4 cents on the dollar (1Y price range: 102.0-103.5).

- Issuer: WeWork Companies Inc (New York City, New York (US)) | Coupon: 7.88% | Maturity: 1/5/2025 | Rating: CC | ISIN: USU96217AA99 | Z-spread down by 40.5 bp to 585.0 bp, with the yield to worst at 6.2% and the bond now trading up to 104.8 cents on the dollar (1Y price range: 67.5-104.8).

- Issuer: QNB Finansbank AS (Istanbul, Turkey) | Coupon: 6.88% | Maturity: 7/9/2024 | Rating: B | ISIN: XS1959391019 | Z-spread down by 43.6 bp to 365.2 bp (CDS basis: -321.0bp), with the yield to worst at 4.0% and the bond now trading up to 107.9 cents on the dollar (1Y price range: 103.3-110.5).

- Issuer: BRF SA (ITAJAI, Brazil) | Coupon: 4.75% | Maturity: 22/5/2024 | Rating: BB- | ISIN: USP1905CAE05 | Z-spread down by 45.3 bp to 169.4 bp, with the yield to worst at 1.9% and the bond now trading up to 107.1 cents on the dollar (1Y price range: 104.9-107.8).

TOP BONDS MOVES - EUR HY

- Issuer: Banca Monte dei Paschi di Siena SpA (Siena, Italy) | Coupon: 2.63% | Maturity: 28/4/2025 | Rating: CCC+ | ISIN: XS2110110686 | Z-spread up by 13.7 bp to 295.4 bp, with the yield to worst at 2.5% and the bond now trading down to 100.0 cents on the dollar (1Y price range: 99.2-105.8).

- Issuer: ZF Europe Finance BV (Amsterdam, Netherlands) | Coupon: 2.00% | Maturity: 23/2/2026 | Rating: BB+ | ISIN: XS2010039381 | Z-spread up by 13.6 bp to 206.8 bp, with the yield to worst at 1.6% and the bond now trading down to 100.9 cents on the dollar (1Y price range: 97.9-101.9).

- Issuer: Mahle GmbH (Stuttgart, Germany) | Coupon: 2.38% | Maturity: 14/5/2028 | Rating: BB+ | ISIN: XS2341724172 | Z-spread up by 11.9 bp to 256.3 bp, with the yield to worst at 2.3% and the bond now trading down to 99.5 cents on the dollar (1Y price range: 99.1-100.9).

- Issuer: Petroleos Mexicanos (Miguel Hidalgo, Mexico) | Coupon: 4.75% | Maturity: 26/2/2029 | Rating: BB- | ISIN: XS1824424706 | Z-spread up by 11.4 bp to 493.5 bp (CDS basis: -64.7bp), with the yield to worst at 4.7% and the bond now trading down to 99.3 cents on the dollar (1Y price range: 95.6-102.0).

- Issuer: Teva Pharmaceutical Finance Netherlands II BV (Amsterdam, Netherlands) | Coupon: 1.88% | Maturity: 31/3/2027 | Rating: BB- | ISIN: XS1211044075 | Z-spread up by 11.4 bp to 372.3 bp, with the yield to worst at 3.4% and the bond now trading down to 91.5 cents on the dollar (1Y price range: 90.5-95.4).

- Issuer: Autostrade per l'Italia SpA (Rome, Italy) | Coupon: 1.75% | Maturity: 1/2/2027 | Rating: BB- | ISIN: XS1528093799 | Z-spread up by 11.1 bp to 143.4 bp (CDS basis: -19.4bp), with the yield to worst at 1.1% and the bond now trading down to 102.8 cents on the dollar (1Y price range: 99.1-103.8).

- Issuer: ZF Finance GmbH (Friedrichshafen, Germany) | Coupon: 2.75% | Maturity: 25/5/2027 | Rating: BB+ | ISIN: XS2262961076 | Z-spread up by 11.0 bp to 224.6 bp, with the yield to worst at 1.9% and the bond now trading down to 103.7 cents on the dollar (1Y price range: 99.7-105.0).

- Issuer: Adler Group SA (Senningerberg, Luxembourg) | Coupon: 2.25% | Maturity: 14/1/2029 | Rating: BB+ | ISIN: XS2283225477 | Z-spread up by 10.4 bp to 270.3 bp, with the yield to worst at 2.5% and the bond now trading down to 97.4 cents on the dollar (1Y price range: 94.1-98.9).

- Issuer: Deutsche Lufthansa AG (Cologne, Germany) | Coupon: 3.75% | Maturity: 11/2/2028 | Rating: BB- | ISIN: XS2296203123 | Z-spread down by 12.1 bp to 303.7 bp (CDS basis: -42.1bp), with the yield to worst at 2.7% and the bond now trading up to 105.0 cents on the dollar (1Y price range: 97.6-105.3).

- Issuer: ArcelorMittal SA (Luxembourg, Luxembourg) | Coupon: 1.75% | Maturity: 19/11/2025 | Rating: BB+ | ISIN: XS2082324018 | Z-spread down by 16.1 bp to 71.7 bp (CDS basis: 36.6bp), with the yield to worst at 0.3% and the bond now trading up to 105.5 cents on the dollar (1Y price range: 102.8-105.7).

- Issuer: International Consolidated Airlines Group SA (London, Spain) | Coupon: 2.75% | Maturity: 25/3/2025 | Rating: B+ | ISIN: XS2322423455 | Z-spread down by 27.0 bp to 280.1 bp, with the yield to worst at 2.3% and the bond now trading up to 101.0 cents on the dollar (1Y price range: 97.9-101.1).

USD BOND ISSUES

- Nomura International Funding Pte Ltd (Financial - Other | Singapore | Rating: NR): US$2,500m Unsecured Note (XS2218450562), floating rate maturing on 15 July 2031, priced at 100.00, non callable

- Nomura International Funding Pte Ltd (Financial - Other | Singapore | Rating: NR): US$2,000m Unsecured Note (XS2218450307), floating rate maturing on 20 June 2026, priced at 100.00, non callable

- CK Property Finance (MTN) Ltd (Financial - Other | Hong Kong | Rating: A): US$250m Senior Note (XS2357430789), fixed rate (0.75% coupon) maturing on 30 June 2024, priced at 99.73 (original spread of 40 bp), non callable

- CK Property Finance (MTN) Ltd (Financial - Other | Hong Kong | Rating: A): US$350m Senior Note (XS2357431084), fixed rate (1.38% coupon) maturing on 30 June 2026, priced at 99.86 (original spread of 55 bp), non callable

EUR BOND ISSUES

- Banco BPM SpA (Banking | Verona, Verona, Italy | Rating: BB): €300m Subordinated Note (XS2358835036), fixed rate (2.88% coupon) maturing on 29 June 2031, priced at 99.78 (original spread of 348 bp), callable (10nc5)

- Deutsche Bahn Finance GmbH (Financial - Other | Berlin, Berlin, Germany | Rating: NR): €1,000m Unsecured Note (XS2357951164), fixed rate (0.10% coupon) maturing on 29 May 2051, priced at 100.00, non callable

- European Bank for Reconstruction and Development (Supranational | London, United Kingdom | Rating: AAA): €200m Unsecured Note (XS2357956981) zero coupon maturing on 15 July 2030, priced at 100.00, non callable

- Gecina SA (Real Estate Investment Trust | Paris, Ile-De-France, France | Rating: A-): €500m Bond (FR00140049A8), fixed rate (0.88% coupon) maturing on 30 June 2036, priced at 98.35 (original spread of 96 bp), callable (15nc15)

- KBC Groep NV (Banking | Brussels, Bruxelles-Capitale, Belgium | Rating: BBB+): €450m Bond (BE0002805860), floating rate (EU03MLIB + 65.0 bp) maturing on 23 June 2024, priced at 100.45 (original spread of 100,000 bp), non callable

- Premium Green PLC (Financial - Other | Dublin, Dublin, Ireland | Rating: NR): €150m Unsecured Note (XS2357747554), floating rate maturing on 25 June 2026, priced at 100.00, non callable

- SASA Polyester Sanayi AS (Industrials - Other | Adana, Turkey | Rating: NR): €200m Bond (XS2357838601), fixed rate (3.25% coupon) maturing on 30 June 2026, priced at 100.00, non callable, convertible

- SES SA (Service - Other | Betzdorf, Luxembourg | Rating: BBB-): €150m Senior Note (XS2358724123), fixed rate (1.63% coupon) maturing on 22 March 2026, priced at 106.67 (original spread of 72 bp), callable (5nc4)

- Societe Generale SFH SA (Financial - Other | Puteaux, Ile-De-France, France | Rating: AAA): €500m Obligation de Financement de l'Habitat (Covered Bond) (FR00140045Q2), fixed rate (0.65% coupon) maturing on 23 June 2035, non callable

- Spain, Kingdom of (Government) (Sovereign | Madrid, Madrid, Spain | Rating: BBB+): €8,000m Obligacion del Estado (ES0000012I32), fixed rate (0.50% coupon) maturing on 31 October 2031, priced at 99.58 (original spread of 39 bp), non callable

- UBS AG (London Branch) (Banking | London, Switzerland | Rating: A+): €500m Senior Note (XS2358287238), fixed rate (0.01% coupon) maturing on 29 June 2026, priced at 99.80 (original spread of 103 bp), non callable

- Yorkshire Building Society (Banking | Bradford, West Yorkshire, United Kingdom | Rating: A-): €600m Note (XS2358471246), fixed rate (0.50% coupon) maturing on 1 July 2028, priced at 99.84 (original spread of 96 bp), non callable

NEW LOANS

- Tanger Properties LP (BBB-), signed a US$ 450m Revolving Credit Facility, to be used for general corporate purposes and working capital. It matures on 06/30/25 and initial pricing is set at LIBOR +120.000bps

- Southworth-Milton Inc, signed a US$ 375m Revolving Credit Facility, to be used for general corporate purposes. It matures on 06/30/26 and initial pricing is set at LIBOR +175.000bps

NEW ISSUES IN SECURITIZED CREDIT

- College Ave Student Loans 2021-B LLC issued a floating-rate ABS backed by student loans in 5 tranches, for a total of US$ 266 m. Bookrunners: Morgan Stanley International Ltd, Barclays Capital Group