Credit

A Good Day For US Corporate Bonds, With IG Cash Spreads Down 1 And HY Down 5

Some credit trading desks are reporting that investment grade accounts are crossing over into high-quality HY to boost performance

Published ET

Z-Spreads By Maturity for USD IG & HY Bonds | Sources: ϕpost, Refinitiv data

QUICK SUMMARY

- The iBoxx USD Liquid Investment Grade Total Return Index was up 0.10% today (Month-to-date: 1.50%; Year-to-date: -2.07%)

- The iBoxx USD Liquid High Yield Total Return Index was up 0.08% today (Month-to-date: 0.76%; Year-to-date: 2.68%)

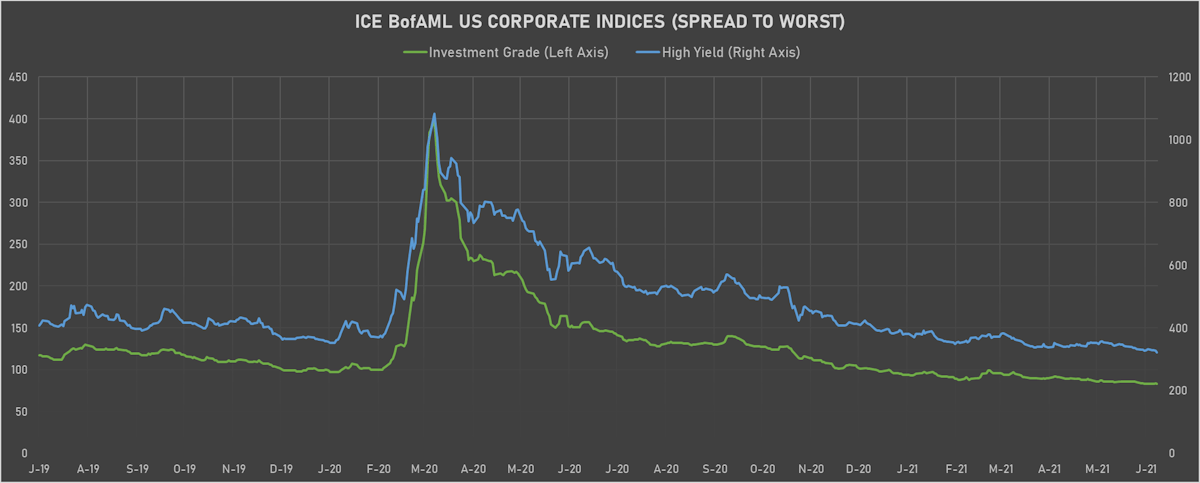

- ICE BofA US Corporate Index (Investment Grade) spread to worst down -1.0 bp, now at 83.0 bp (YTD change: -15.0 bp)

- ICE BofA US High Yield Index spread to worst down -5.0 bp, now at 322.0 bp (YTD change: -68.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index up 0.05% today (YTD total return: +2.2%)

- New issues: US$ 8.8bn in dollars and € 10.5bn in euros

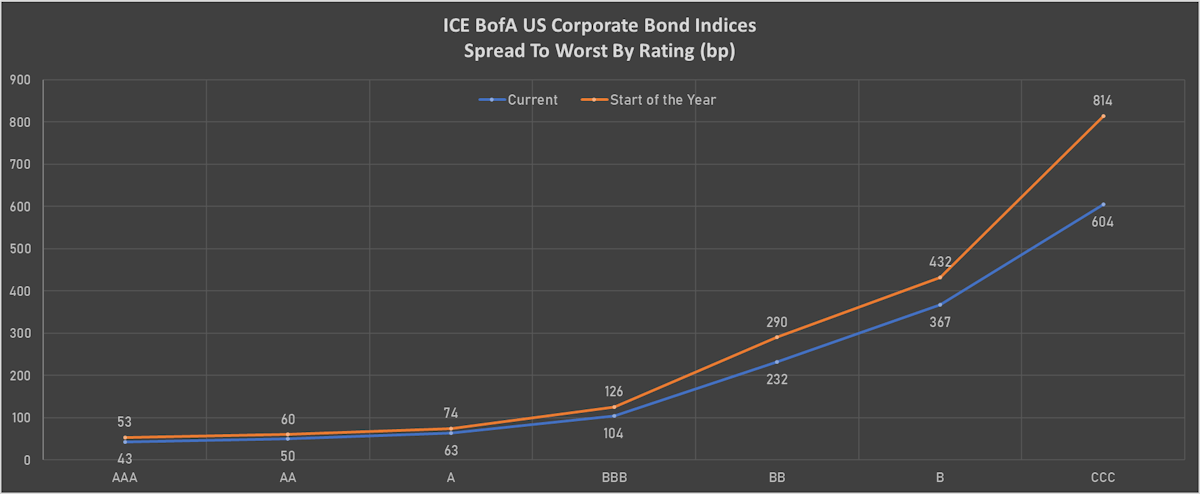

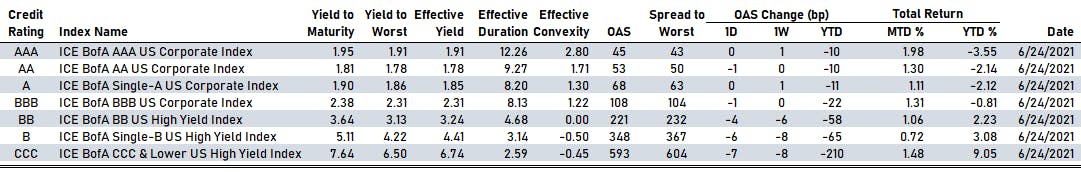

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

- AAA unchanged at 45 bp

- AA down by -1 bp at 53 bp

- A unchanged at 68 bp

- BBB down by -1 bp at 108 bp

- BB down by -4 bp at 221 bp

- B down by -6 bp at 348 bp

- CCC down by -7 bp at 593 bp

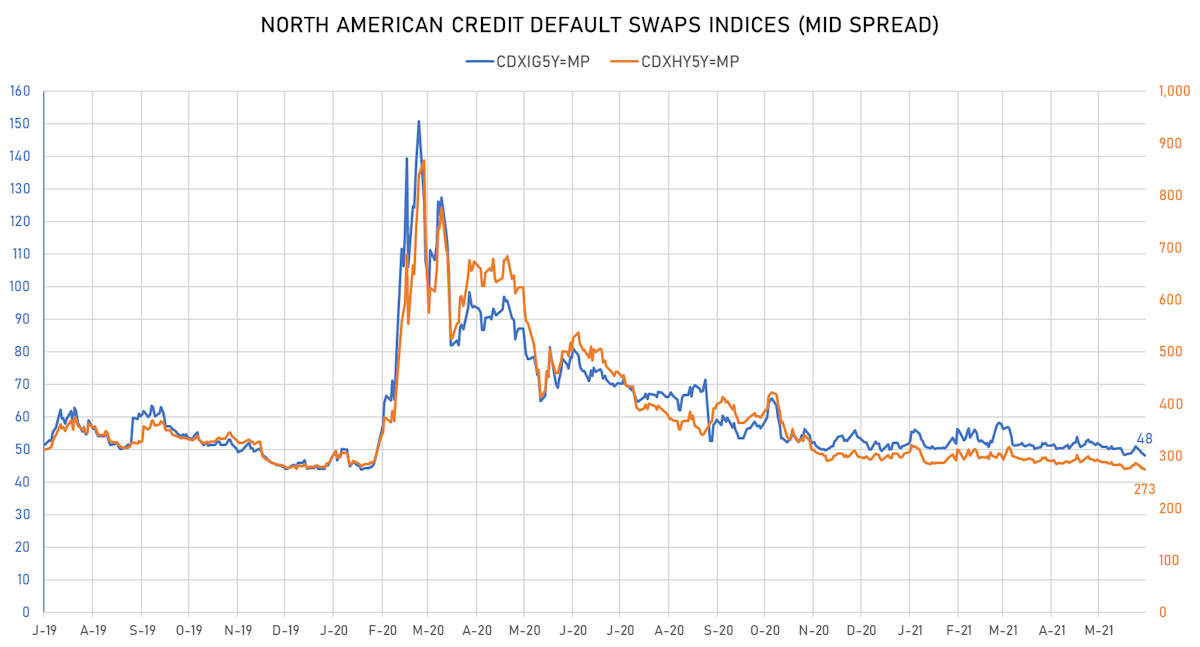

CDS INDICES (mid-spreads)

- Markit CDX.NA.IG 5Y down 0.8 bp, now at 48bp (YTD change: -2.0bp)

- Markit CDX.NA.HY 5Y down 3.1 bp, now at 273bp (YTD change: -19.9bp)

- Markit iTRAXX Europe down 0.6 bp, now at 46bp (YTD change: -1.8bp)

- Markit iTRAXX Japan down 0.2 bp, now at 45bp (YTD change: -6.1bp)

- Markit iTRAXX Asia Ex-Japan down 0.4 bp, now at 84bp (YTD change: +26.1bp)

TOP BONDS MOVERS - USD HY

- Issuer: Guacolda Energia SA (LAS CONDES, Chile) | Coupon: 4.56% | Maturity: 30/4/2025 | Rating: B+ | ISIN: USP3711HAF66 | Z-spread up by 48.3 bp to 1,378.2 bp, with the yield to worst at 14.1% and the bond now trading down to 71.5 cents on the dollar (1Y price range: 71.5-92.1).

- Issuer: Petroleos Mexicanos (MIGUEL HIDALGO, Mexico) | Coupon: 4.88% | Maturity: 18/1/2024 | Rating: BB- | ISIN: US71656MAQ24 | Z-spread up by 43.6 bp to 276.9 bp (CDS basis: 2.9bp), with the yield to worst at 2.8% and the bond now trading down to 104.1 cents on the dollar (1Y price range: 102.2-105.6).

- Issuer: Starwood Property Trust Inc (Greenwich, Connecticut (US)) | Coupon: 5.50% | Maturity: 1/11/2023 | Rating: B+ | ISIN: USU85656AE39 | Z-spread up by 27.4 bp to 278.9 bp, with the yield to worst at 3.0% and the bond now trading down to 104.7 cents on the dollar (1Y price range: 103.4-105.5).

- Issuer: Minsur SA (San Borja, Peru) | Coupon: 6.25% | Maturity: 7/2/2024 | Rating: BB- | ISIN: USP6811TAA36 | Z-spread up by 24.4 bp to 337.5 bp, with the yield to worst at 3.7% and the bond now trading down to 106.0 cents on the dollar (1Y price range: 100.6-111.4).

- Issuer: FMG Resources (August 2006) Pty Ltd (Australia) | Coupon: 5.13% | Maturity: 15/5/2024 | Rating: BB+ | ISIN: USQ3919KAK71 | Z-spread up by 23.3 bp to 132.9 bp, with the yield to worst at 1.4% and the bond now trading down to 108.5 cents on the dollar (1Y price range: 106.5-109.6).

- Issuer: Periama Holdings LLC (Baytown, Texas (US)) | Coupon: 5.95% | Maturity: 19/4/2026 | Rating: BB- | ISIN: XS2224065289 | Z-spread up by 23.1 bp to 323.5 bp, with the yield to worst at 3.9% and the bond now trading down to 108.0 cents on the dollar (1Y price range: 104.1-109.3).

- Issuer: Taylor Morrison Communities Inc (Scottsdale, Arizona (US)) | Coupon: 5.75% | Maturity: 15/1/2028 | Rating: BB- | ISIN: USU8760NAB56 | Z-spread down by 22.8 bp to 244.3 bp, with the yield to worst at 3.4% and the bond now trading up to 112.3 cents on the dollar (1Y price range: 108.5-113.5).

- Issuer: Uzauto motors AO (Tashkent, Uzbekistan) | Coupon: 4.85% | Maturity: 4/5/2026 | Rating: B+ | ISIN: XS2330272944 | Z-spread down by 23.2 bp to 419.9 bp, with the yield to worst at 4.8% and the bond now trading up to 99.1 cents on the dollar (1Y price range: 98.3-100.5).

- Issuer: Brinker International Inc (Coppell, Texas (US)) | Coupon: 5.00% | Maturity: 1/10/2024 | Rating: B | ISIN: USU6223WAB01 | Z-spread down by 25.3 bp to 246.0 bp, with the yield to worst at 3.0% and the bond now trading up to 105.6 cents on the dollar (1Y price range: 103.5-105.6).

- Issuer: Jaguar Land Rover Automotive PLC (COVENTRY, United Kingdom) | Coupon: 4.50% | Maturity: 1/10/2027 | Rating: B | ISIN: USG5002FAM89 | Z-spread down by 27.0 bp to 370.3 bp (CDS basis: -18.2bp), with the yield to worst at 4.6% and the bond now trading up to 98.3 cents on the dollar (1Y price range: 93.4-98.3).

- Issuer: Eurochem Finance DAC (DUBLIN, Ireland) | Coupon: 5.50% | Maturity: 13/3/2024 | Rating: BB- | ISIN: XS1961080501 | Z-spread down by 28.4 bp to 117.5 bp, with the yield to worst at 1.4% and the bond now trading up to 109.3 cents on the dollar (1Y price range: 108.2-110.6).

- Issuer: BRF SA (ITAJAI, Brazil) | Coupon: 3.95% | Maturity: 22/5/2023 | Rating: BB- | ISIN: USP1905CAD22 | Z-spread down by 36.7 bp to 156.3 bp, with the yield to worst at 1.6% and the bond now trading up to 103.9 cents on the dollar (1Y price range: 103.0-104.6).

- Issuer: QNB Finansbank AS (Istanbul, Turkey) | Coupon: 6.88% | Maturity: 7/9/2024 | Rating: B | ISIN: XS1959391019 | Z-spread down by 45.7 bp to 366.1 bp (CDS basis: -321.9bp), with the yield to worst at 4.1% and the bond now trading up to 107.8 cents on the dollar (1Y price range: 103.3-110.5).

TOP BONDS MOVERS - EUR HY

- Issuer: Adler Group SA (Senningerberg, Luxembourg) | Coupon: 3.25% | Maturity: 5/8/2025 | Rating: BB+ | ISIN: XS2010029663 | Z-spread up by 54.8 bp to 293.6 bp, with the yield to worst at 2.5% and the bond now trading down to 102.3 cents on the dollar (1Y price range: 99.5-105.4).

- Issuer: Akropolis Group UAB (Vilnius, Lithuania) | Coupon: 2.88% | Maturity: 2/6/2026 | Rating: BB+ | ISIN: XS2346869097 | Z-spread up by 17.6 bp to 337.1 bp, with the yield to worst at 3.0% and the bond now trading down to 98.9 cents on the dollar (1Y price range: 98.5-99.4).

- Issuer: Teva Pharmaceutical Finance Netherlands II BV (Amsterdam, Netherlands) | Coupon: 1.63% | Maturity: 15/10/2028 | Rating: BB- | ISIN: XS1439749364 | Z-spread up by 15.9 bp to 361.3 bp, with the yield to worst at 3.4% and the bond now trading down to 88.0 cents on the dollar (1Y price range: 87.1-92.6).

- Issuer: Mahle GmbH (Stuttgart, Germany) | Coupon: 2.38% | Maturity: 14/5/2028 | Rating: BB+ | ISIN: XS2341724172 | Z-spread up by 9.8 bp to 258.1 bp, with the yield to worst at 2.3% and the bond now trading down to 99.4 cents on the dollar (1Y price range: 99.1-100.9).

- Issuer: Petroleos Mexicanos (Miguel Hidalgo, Mexico) | Coupon: 4.75% | Maturity: 26/2/2029 | Rating: BB- | ISIN: XS1824424706 | Z-spread up by 9.3 bp to 497.3 bp (CDS basis: -70.8bp), with the yield to worst at 4.8% and the bond now trading down to 99.1 cents on the dollar (1Y price range: 95.6-102.0).

- Issuer: Thyssenkrupp AG (Essen, Germany) | Coupon: 2.50% | Maturity: 25/2/2025 | Rating: B+ | ISIN: DE000A14J587 | Z-spread up by 8.7 bp to 233.0 bp (CDS basis: 29.5bp), with the yield to worst at 1.8% and the bond now trading down to 101.8 cents on the dollar (1Y price range: 100.1-102.9).

- Issuer: International Consolidated Airlines Group SA (London, Spain) | Coupon: 3.75% | Maturity: 25/3/2029 | Rating: B+ | ISIN: XS2322423539 | Z-spread down by 24.9 bp to 349.5 bp, with the yield to worst at 3.3% and the bond now trading up to 102.1 cents on the dollar (1Y price range: 97.5-102.0).

- Issuer: Banca Monte dei Paschi di Siena SpA (Siena, Italy) | Coupon: 2.63% | Maturity: 28/4/2025 | Rating: CCC+ | ISIN: XS2110110686 | Z-spread down by 25.6 bp to 284.4 bp, with the yield to worst at 2.4% and the bond now trading up to 100.4 cents on the dollar (1Y price range: 99.2-105.8).

- Issuer: CyrusOne LP (Dallas, Texas (US)) | Coupon: 1.45% | Maturity: 22/1/2027 | Rating: BB+ | ISIN: XS2089972629 | Z-spread down by 206.3 bp to 131.3 bp, with the yield to worst at 1.0% and the bond now trading up to 101.8 cents on the dollar (1Y price range: 100.4-102.2).

USD BOND ISSUES

- At Home Group Inc (Retail Stores - Other | Plano, Texas, United States | Rating: B): US$300m Note (US04650YAA82), fixed rate (4.88% coupon) maturing on 15 July 2028, priced at 100.00 (original spread of 362 bp), callable (7nc2)

- Athene Global Funding (Financial - Other | Wilmington, Delaware, United States | Rating: NR): US$500m Note (US04685A2Z36), fixed rate (1.61% coupon) maturing on 29 June 2026, priced at 100.00 (original spread of 72 bp), non callable

- Carrols Restaurant Group Inc (Restaurants | Syracuse, New York, United States | Rating: CCC): US$300m Senior Note (USU14539AD90), fixed rate (5.88% coupon) maturing on 1 July 2029, priced at 100.00 (original spread of 491 bp), callable (8nc3)

- Centene Corp (Life Insurance | St. Louis, Missouri, United States | Rating: BB+): US$1,800m Senior Note (US15135BAY74), fixed rate (2.45% coupon) maturing on 15 July 2028, priced at 100.00 (original spread of 121 bp), callable (7nc7)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$110m Bond (US3133EMN654), fixed rate (1.61% coupon) maturing on 6 July 2029, priced at 100.00 (original spread of 153 bp), callable (8nc1)

- Federal Home Loan Banks (Agency | Washington, Washington Dc, United States | Rating: AA+): US$130m Bond (US3133EMP485), fixed rate (0.90% coupon) maturing on 1 July 2026, priced at 100.00 (original spread of 0 bp), non callable

- Indiana University Health Inc (Health Care Facilities | Indianapolis, United States | Rating: NR): US$300m Bond (US455170AB64), fixed rate (2.85% coupon) maturing on 1 November 2051, priced at 100.00 (original spread of 75 bp), callable (30nc30)

- LBM Acquisition LLC (Financial - Other | Buffalo Grove, Illinois, United States | Rating: B-): US$270m Senior Note (USU5140LAA80), fixed rate (6.25% coupon) maturing on 15 January 2029, priced at 100.00 (original spread of 492 bp), callable (8nc3)

- Mississippi Power Co (Utility - Other | Gulfport, Mississippi, United States | Rating: BBB+): US$325m Senior Note (US605417CD48), fixed rate (3.10% coupon) maturing on 30 July 2051, priced at 98.93 (original spread of 105 bp), callable (30nc30)

- Penn National Gaming Inc (Leisure | Reading, Pennsylvania, United States | Rating: B): US$400m Senior Note (US707569AV14), fixed rate (4.13% coupon) maturing on 1 July 2029, priced at 100.00 (original spread of 316 bp), callable (8nc3)

- Ambience Merger Sub Inc (Financial - Other | Rating: CCC+): US$500m Senior Note (US04650YAB65), fixed rate (7.13% coupon) maturing on 15 July 2029, priced at 100.00 (original spread of 577 bp), callable (8nc3)

- Ares Finance Co III LLC (Financial - Other | Rating: BBB-): US$450m Senior Note (US04018VAA17), fixed rate (4.13% coupon) maturing on 30 June 2051, priced at 100.00 (original spread of 324 bp), callable (30nc5)

- Deutsche Bank AG (Banking | Frankfurt, Hessen, Germany | Rating: BBB): US$500m Note (XS0459853858), fixed rate (1.40% coupon) maturing on 15 July 2027, priced at 100.00, non callable

- Enbridge Inc (Gas Utility - Pipelines | Calgary, Alberta, Canada | Rating: BBB+): US$500m Senior Note (US29250NBE40), fixed rate (3.40% coupon) maturing on 1 August 2051, priced at 99.75 (original spread of 169 bp), callable (30nc30)

- Enbridge Inc (Gas Utility - Pipelines | Calgary, Alberta, Canada | Rating: BBB+): US$1,000m Senior Note (US29250NBF15), fixed rate (2.50% coupon) maturing on 1 August 2033, priced at 99.58 (original spread of 105 bp), callable (12nc12)

- Shenzhen Expressway Co Ltd (Railroads | Shenzhen, Guangdong, China (Mainland) | Rating: BBB): US$300m Senior Note (XS2357032460), fixed rate (1.75% coupon) maturing on 8 July 2026, priced at 99.61, callable (5nc5)

- Shui On Development (Holding) Ltd (Financial - Other | George Town, Hong Kong | Rating: NR): US$400m Bond (XS2358225477), fixed rate (5.50% coupon) maturing on 29 June 2026, priced at 100.00, callable (5nc4)

- XP Inc (Securities | Vila Olimpia, Sao Paulo, Brazil | Rating: NR): US$750m Bond (USG98239AA72), fixed rate (3.25% coupon) maturing on 1 July 2026, priced at 98.86 (original spread of 257 bp), non callable

EUR BOND ISSUES

- Air France KLM SA (Airline | Paris, Ile-De-France, France | Rating: NR): €500m Bond (FR0014004AF5), fixed rate (3.88% coupon) maturing on 1 July 2026, priced at 99.44 (original spread of 457 bp), callable (5nc5)

- Air France KLM SA (Airline | Paris, Ile-De-France, France | Rating: NR): €300m Bond (FR0014004AE8), fixed rate (3.00% coupon) maturing on 1 July 2024, priced at 99.65 (original spread of 379 bp), callable (3nc3)

- Assicurazioni Generali SpA (Life Insurance | Trieste, Trieste, Italy | Rating: NR): €500m Senior Subordinated Note (XS2357754097), fixed rate (1.71% coupon) maturing on 30 June 2032, priced at 100.00 (original spread of 191 bp), callable (11nc11)

- Brandenburg, State of (Official and Muni | Potsdam, Brandenburg, Germany | Rating: AAA): €500m Jumbo Landesschatzanweisung (DE000A289NQ8), fixed rate (0.05% coupon) maturing on 1 July 2031, priced at 99.72 (original spread of 30 bp), non callable

- Deutsche Bank AG (Banking | Frankfurt, Hessen, Germany | Rating: BBB+): €500m Inhaberschuldverschreibung (DE000DB9U4L2), floating rate maturing on 19 July 2028, priced at 100.00, non callable

- Italy, Republic of (Government) (Sovereign | Rome, Roma, Italy | Rating: BBB-): €6,000m Bond (IT0005451361), floating rate (EU06MLIB + 65.0 bp) maturing on 15 April 2029, priced at 99.69, non callable

- Nobian Finance BV (Financial - Other | Amsterdam, Noord-Holland, Netherlands | Rating: B): €525m Note (XS2358383466), fixed rate (3.63% coupon) maturing on 15 July 2026, priced at 100.00 (original spread of 419 bp), callable (5nc2)

- Oberbank AG (Banking | Linz, Oberoesterreich, Austria | Rating: A): €250m Fundierte Schuldverschreibungen (Covered Bond) (AT0000A2RZH2), fixed rate (0.13% coupon) maturing on 2 July 2031, priced at 99.52 (original spread of 40 bp), non callable

- SG Issuer SA (Financial - Other | Luxembourg, France | Rating: NR): €900m Unsecured Note (XS1957227223) zero coupon maturing on 29 June 2099, priced at 100.00, non callable

- Snam SpA (Gas Utility - Local Distrib | San Donato Milanese, Milano, Italy | Rating: BBB): €500m Senior Note (XS2358231798), fixed rate (0.63% coupon) maturing on 30 June 2031, priced at 98.72 (original spread of 98 bp), callable (10nc10)

NEW LOANS

- Southworth-Milton Inc, signed a US$ 375m Revolving Credit Facility, to be used for general corporate purposes. It matures on 06/30/26 and initial pricing is set at LIBOR +175.000bps

NEW ISSUES IN SECURITIZED CREDIT

- SG Residential Mortgage Trust 2021-1 issued a fixed-rate RMBS in 6 tranches, for a total of US$ 187 m. Highest-rated tranche offering a yield to maturity of 1.16%, and the lowest-rated tranche a yield to maturity of 4.32%. Bookrunners: Credit Suisse, Morgan Stanley International Ltd

- CSWF 2021-Sop2 issued a floating-rate CMBS in 6 tranches, for a total of US$ 269 m. Highest-rated tranche offering a spread over the floating rate of 110bp, and the lowest-rated tranche a spread of 435bp. Bookrunners: Credit Suisse, Wells Fargo Securities LLC