Credit

Spreads Down Across Credit Indices, With IG Cash Spreads Down 1 And HY Down 4

Primary market totals this week as reported by the IFR: US$ 22bn priced in investment grade (2021 YTD volume US$ 821 bn vs 2020 YTD US$1,182 bn), and US$ 9bn priced in high yield (2021 YTD volume US$ 282 bn vs. 2020 YTD US$ 212 bn)

Published ET

Beazer Homes USD 5Y CDS Spread | Source: Refinitiv

QUICK SUMMARY

- S&P 500 Bond Index was down -0.05% today, with investment grade down -0.08% and high yield up 0.21% (YTD total return: -1.50%)

- The iBoxx USD Liquid Investment Grade Total Return Index was down -0.31% today (Month-to-date: 1.50%; Year-to-date: -2.07%)

- The iBoxx USD Liquid High Yield Total Return Index was up 0.08% today (Month-to-date: 0.76%; Year-to-date: 2.68%)

- ICE BofA US Corporate Index (Investment Grade) spread to worst down -1.0 bp, now at 82.0 bp (YTD change: -16.0 bp)

- ICE BofA US High Yield Index spread to worst down -4.0 bp, now at 318.0 bp (YTD change: -72.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index down -0.01% today (YTD total return: +2.1%)

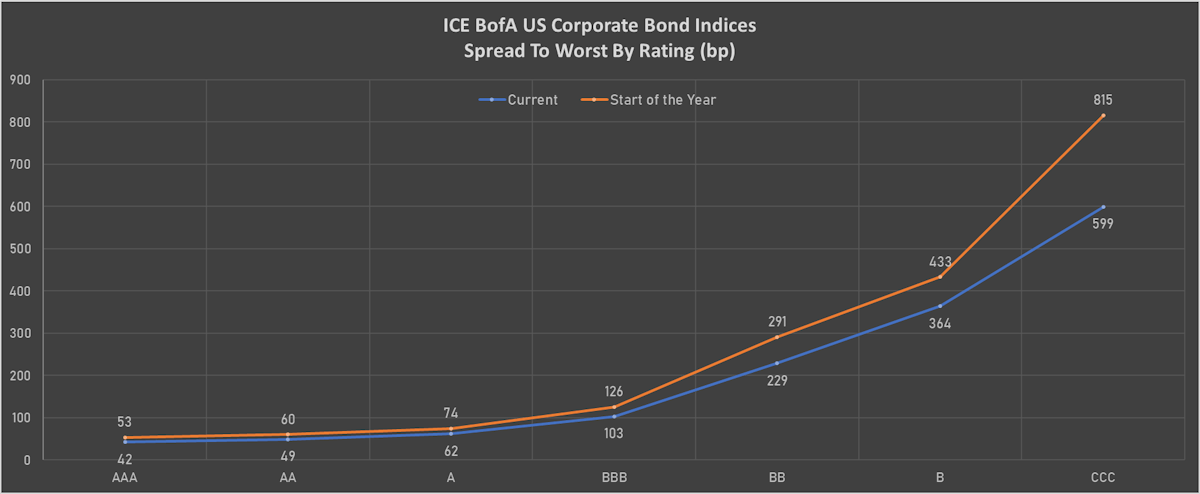

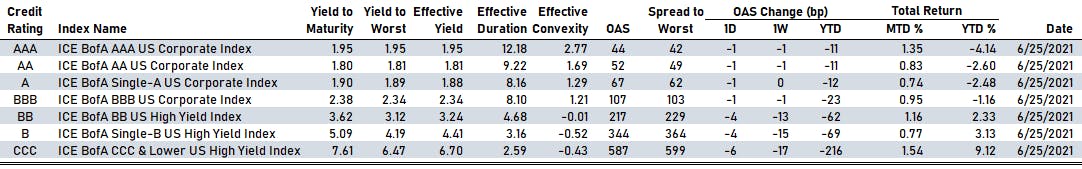

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

- AAA down by -1 bp at 44 bp

- AA down by -1 bp at 52 bp

- A down by -1 bp at 67 bp

- BBB down by -1 bp at 107 bp

- BB down by -4 bp at 217 bp

- B down by -4 bp at 344 bp

- CCC down by -6 bp at 587 bp

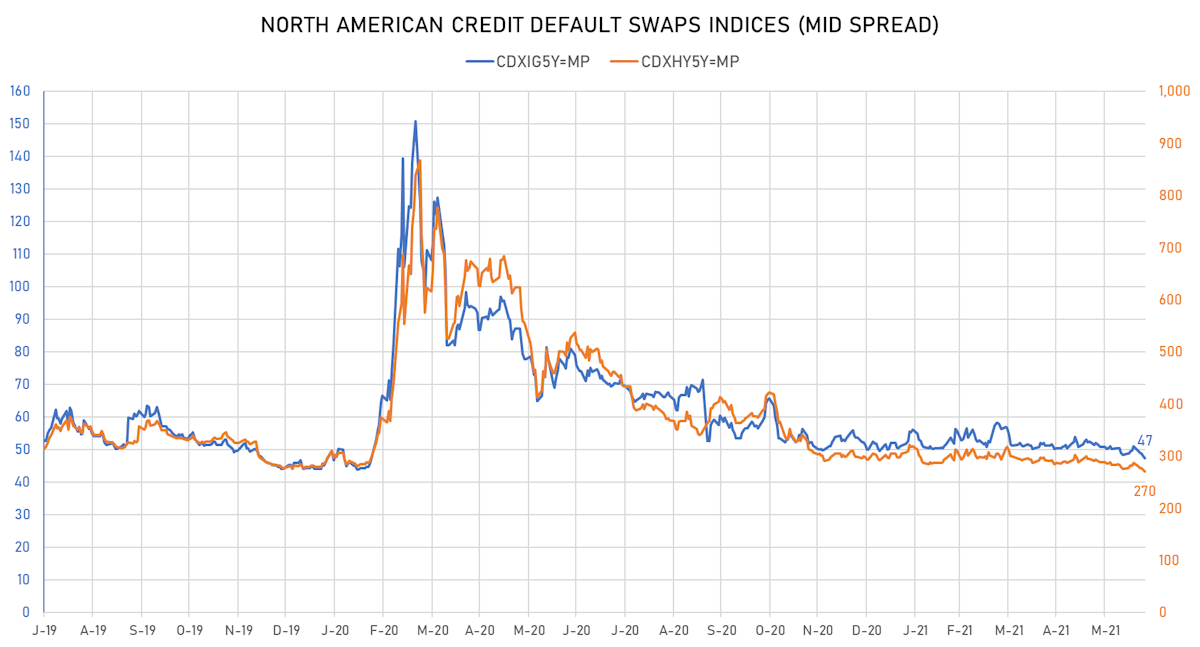

CDS INDICES (mid-spreads)

- Markit CDX.NA.IG 5Y down 0.8 bp, now at 47bp (YTD change: -2.8bp)

- Markit CDX.NA.HY 5Y down 3.3 bp, now at 270bp (YTD change: -23.2bp)

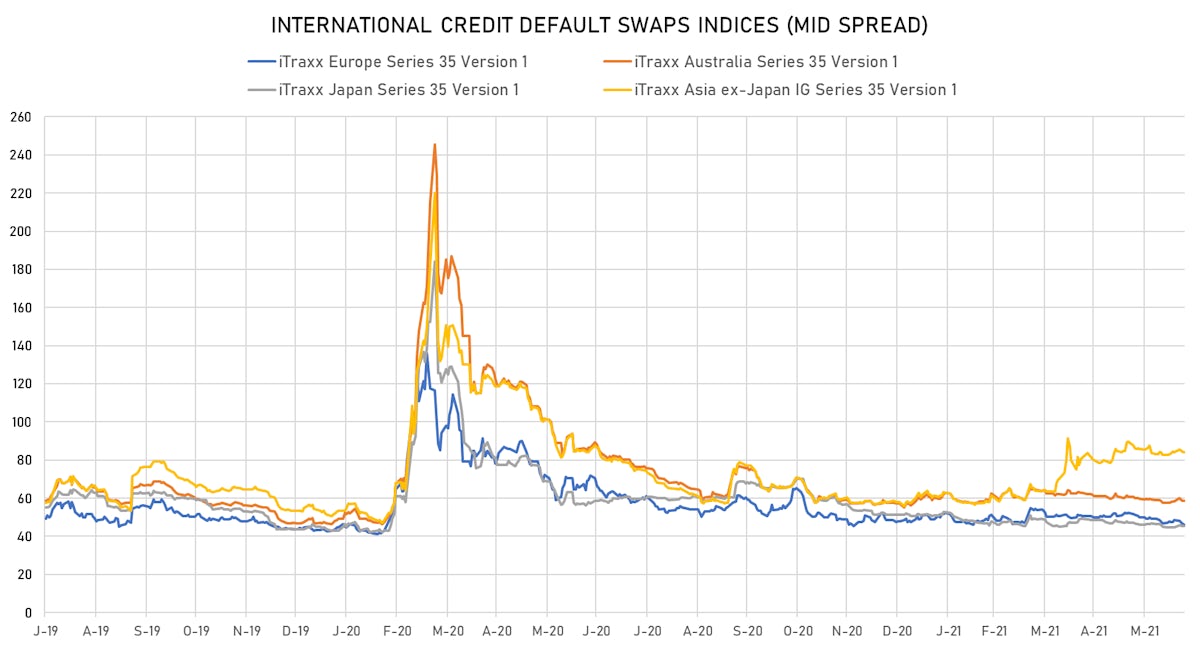

- Markit iTRAXX Europe down 0.5 bp, now at 46bp (YTD change: -2.3bp)

- Markit iTRAXX Japan unchanged at 45bp (YTD change: -6.1bp)

- Markit iTRAXX Asia Ex-Japan down 0.7 bp, now at 83bp (YTD change: +25.4bp)

LARGEST USD CORPORATE CDS MOVES IN THE PAST WEEK

- Transocean Inc (Country: KY; rated: Caa3): down 167.8 bp to 1,399.0bp (1Y range: 1,061-7,695bp)

- Nabors Industries Inc (Country: US; rated: B+): down 85.6 bp to 786.6bp (1Y range: 662-4,514bp)

- Genworth Holdings Inc (Country: US; rated: Caa1): down 29.8 bp to 472.7bp (1Y range: 450-906bp)

- NRG Energy Inc (Country: US; rated: Ba1): down 20.2 bp to 183.5bp (1Y range: 108-231bp)

- MBIA Inc (Country: US; rated: Ba3): down 18.8 bp to 440.1bp (1Y range: 378-757bp)

- Rite Aid Corp (Country: US; rated: Caa1): down 14.3 bp to 712.8bp (1Y range: 497-888bp)

- Petroleo Brasileiro SA Petrobras (Country: BR; rated: B): up 12.6 bp to 206.7bp (1Y range: 175-354bp)

- Royal Caribbean Cruises Ltd (Country: US; rated: LGD4 - 59%): up 13.9 bp to 331.5bp (1Y range: 316-1,979bp)

- Macy's Inc (Country: US; rated: Ba3): up 15.9 bp to 336.3bp (1Y range: 286-1,253bp)

- Avis Budget Group Inc (Country: US; rated: CCC): up 17.4 bp to 251.1bp (1Y range: 236-1,021bp)

- Beazer Homes USA Inc (Country: US; rated: B3): up 24.3 bp to 307.0bp (1Y range: 231-446bp)

- Carnival Corp (Country: US; rated: LGD5 - 71%): up 41.9 bp to 348.2bp (1Y range: 291-1,408bp)

- Apache Corp (Country: US; rated: WD): up 43.6 bp to 217.8bp (1Y range: 168-453bp)

- Staples Inc (Country: US; rated: B2): up 74.1 bp to 873.6bp (1Y range: 652-2,081bp)

LARGEST EURO CORPORATE CDS MOVES IN THE PAST WEEK

- TUI AG (Country: DE; rated: LGD4 - 50%): down 25.5 bp to 668.3bp (1Y range: 590-1,799bp)

- Air France KLM SA (Country: FR; rated: B-): down 23.4 bp to 404.5bp (1Y range: 392-1,211bp)

- Casino Guichard Perrachon SA (Country: FR; rated: WR): down 11.6 bp to 530.8bp (1Y range: 508-1,210bp)

- Novafives SAS (Country: FR; rated: Caa1): down 10.7 bp to 748.4bp (1Y range: 716-1,362bp)

- Stellantis NV (Country: NL; rated: BBB): down 6.2 bp to 103.9bp (1Y range: 99-569bp)

- Leonardo SpA (Country: IT; rated: Ba1): up 4.3 bp to 155.2bp (1Y range: 152-298bp)

- British Telecommunications PLC (Country: GB; rated: Baa2): up 5.8 bp to 72.3bp (1Y range: 63-113bp)

- Iceland Bondco PLC (Country: GB; rated: LGD3 - 46%): up 7.6 bp to 428.5bp (1Y range: 358-822bp)

- Ardagh Packaging Finance PLC (Country: IE; rated: B1): up 8.0 bp to 217.5bp (1Y range: 188-276bp)

- Boparan Finance PLC (Country: GB; rated: B3): up 10.4 bp to 894.5bp (1Y range: 478-889bp)

- CMA CGM SA (Country: FR; rated: B1): up 13.0 bp to 333.5bp (1Y range: 326-1,110bp)

- Thyssenkrupp AG (Country: DE; rated: B1): up 16.2 bp to 303.0bp (1Y range: 206-479bp)

- Ceconomy AG (Country: DE; rated: Ba1): up 17.4 bp to 156.0bp (1Y range: 94-188bp)

- Stonegate Pub Company Financing PLC (Country: GB; rated: WR): up 17.9 bp to 502.6bp (1Y range: 486-984bp)

- Banca Monte dei Paschi di Siena SpA (Country: IT; rated: NP): up 50.5 bp to 248.0bp (1Y range: 188-272bp)

USD BOND ISSUES

- Synchronoss Technologies Inc (Service - Other | Bridgewater, United States | Rating: NR): US$120m Senior Note (US87157B3015), fixed rate (8.38% coupon) maturing on 30 June 2026, priced at 100.00, callable (5nc1)

- Summer (BC) Bidco B LLC (Financial - Other | Rating: B-): US$425m Note (US865632AA18), fixed rate (5.50% coupon) maturing on 31 October 2026, priced at 100.00 (original spread of 454 bp), callable (5nc2)

EUR BOND ISSUES

- Aries Capital DAC (Financial - Other | Dublin, Dublin, Ireland | Rating: NR): €468m Unsecured Note (XS2360267368), floating rate maturing on 14 July 2026, priced at 100.00, non callable

- Aries Capital DAC (Financial - Other | Dublin, Dublin, Ireland | Rating: NR): €330m Unsecured Note (XS2360267442), floating rate maturing on 14 July 2026, priced at 100.00, non callable

- Intesa Sanpaolo SpA (Banking | Torino, Italy | Rating: BBB-): €1,000m Senior Note (XS2358227762), floating rate (EU03MLIB + 87.5 bp) maturing on 25 June 2028, priced at 100.00 (original spread of 100,000 bp), non callable

- Premium Green PLC (Financial - Other | Dublin, Dublin, Ireland | Rating: NR): €150m Unsecured Note (XS2357747554), floating rate maturing on 25 June 2026, priced at 100.00, non callable

- SG Issuer SA (Financial - Other | Luxembourg, France | Rating: NR): €900m Unsecured Note (XS1957227223) zero coupon maturing on 29 June 2099, priced at 100.00, non callable

NEW LOANS

- Dentsply Sirona Inc (BBB), signed a US$ 300m Term Loan, to be used for general corporate purposes.

- Oncor Electric Delivery Co LLC (A), signed a US$ 540m Delayed Draw Term Loan, to be used for general corporate purposes. It matures on 06/29/22 and initial pricing is set at LIBOR +60.000bps

NEW ISSUES IN SECURITIZED CREDIT

- Starwood Residential Mortgage Trust 2021-3 issued a fixed-rate RMBS in 6 tranches, for a total of US$ 307 m. Highest-rated tranche offering a yield to maturity of 1.13%, and the lowest-rated tranche a yield to maturity of 4.10%. Bookrunners: Credit Suisse, Morgan Stanley International Ltd, Deutsche Bank Securities Inc

- Progress Residential Sfr Abs 2021-Sfr6 issued a fixed-rate ABS backed by rental income in 8 tranches, for a total of US$ 513 m. Highest-rated tranche offering a yield to maturity of 1.52%, and the lowest-rated tranche a yield to maturity of 4.00%. Bookrunners: Credit Suisse, Goldman Sachs & Co, Morgan Stanley International Ltd, Deutsche Bank Securities Inc, RBC Capital Markets