Credit

US Corporate Bonds Rise On Stable Spreads, Lower Rates

Slow start to the week for bond issuance, but a couple of notable sovereign deals in Asia with Mongolia printing US$ 1bn in 2 tranches, and the Philippines US$ 3bn in 2 tranches

Published ET

Prices of Mongolian Government Bonds (US60937FAB40) have rebounded Strongly In the past year | Source: Refinitiv

QUICK SUMMARY

- The iBoxx USD Liquid Investment Grade Total Return Index was up 0.545% today (Month-to-date: 1.75%; Year-to-date: -1.84%)

- The iBoxx USD Liquid High Yield Total Return Index was up 0.097% today (Month-to-date: 0.94%; Year-to-date: 2.86%)

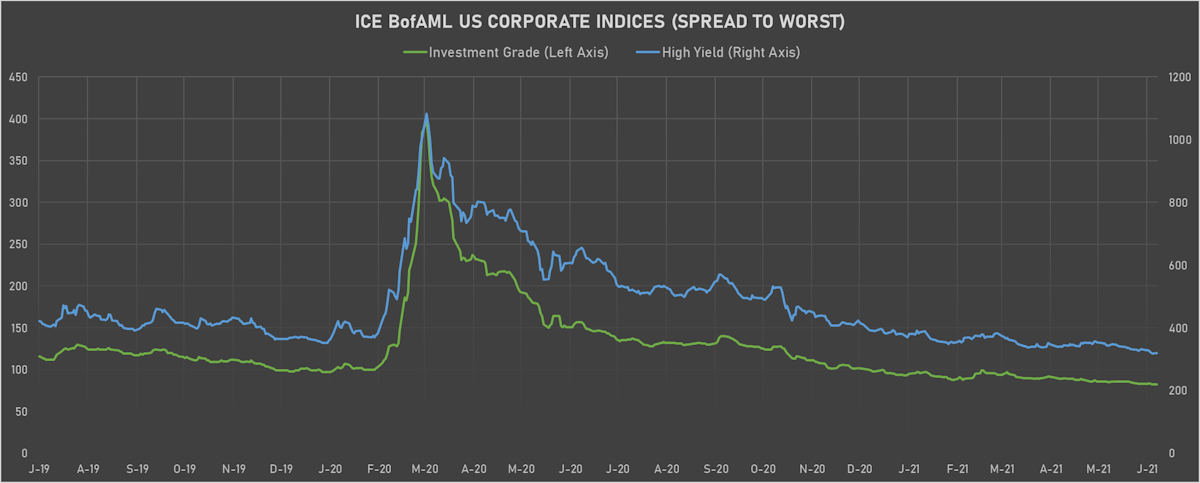

- ICE BofA US Corporate Index (Investment Grade) spread to worst unchanged, now at 82.0 bp (YTD change: -16.0 bp)

- ICE BofA US High Yield Index spread to worst up 1.0 bp, now at 319.0 bp (YTD change: -71.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index up 0.04% today (YTD total return: +2.2%)

- New issues: US$ 4.7bn in dollars and € 2.3bn in euros

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

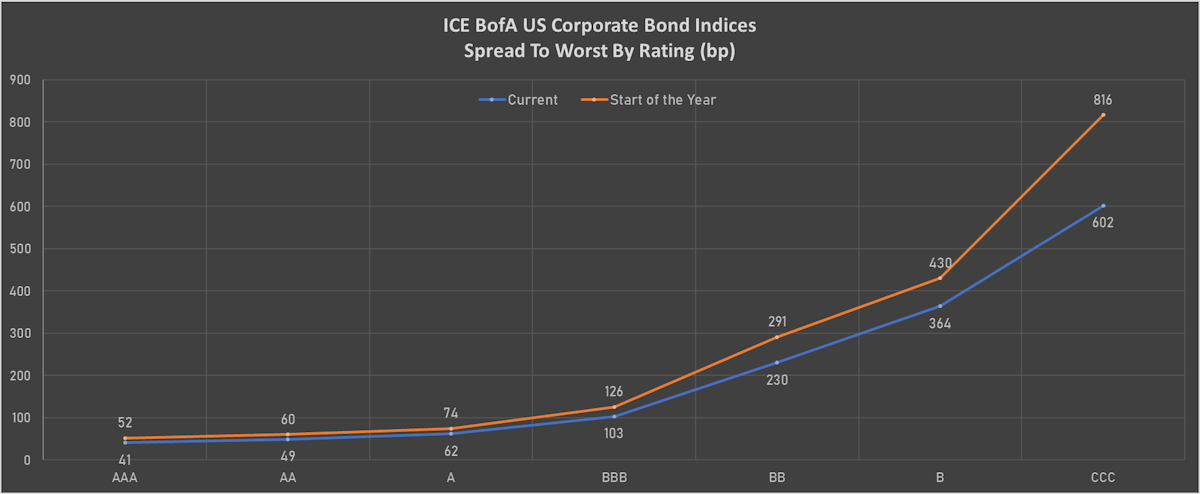

- AAA unchanged at 44 bp

- AA unchanged at 52 bp

- A unchanged at 67 bp

- BBB unchanged at 107 bp

- BB up by 1 bp at 218 bp

- B up by 3 bp at 347 bp

- CCC up by 2 bp at 589 bp

CDS INDICES (mid-spreads)

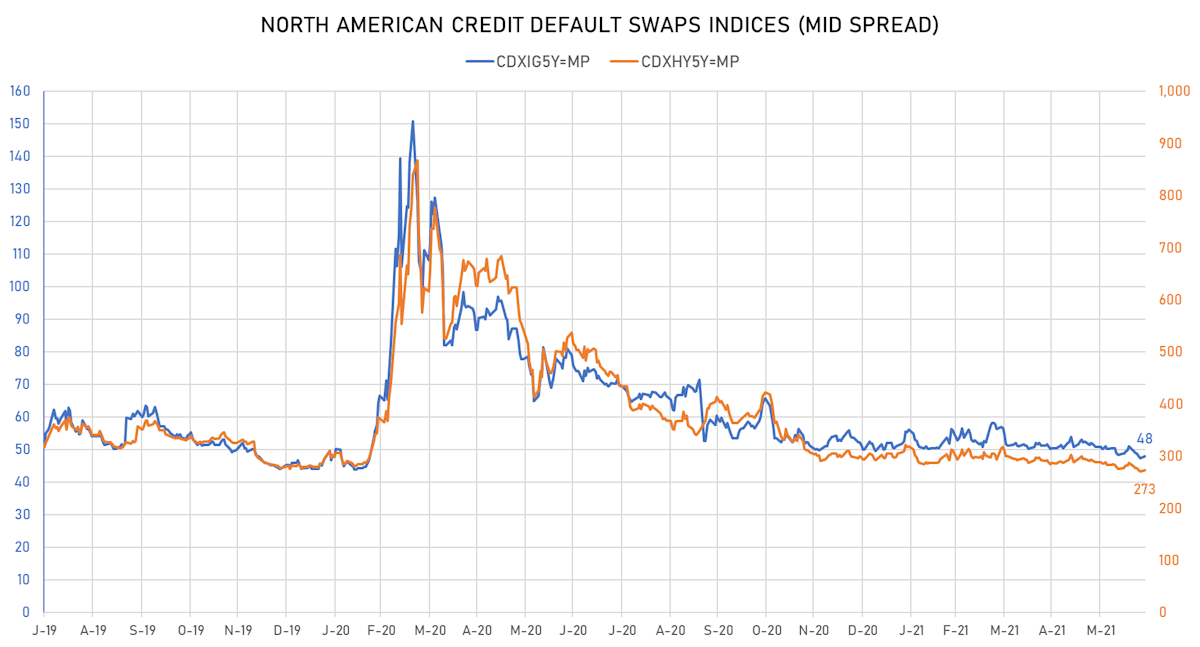

- Markit CDX.NA.IG 5Y up 0.7 bp, now at 48bp (YTD change: -2.1bp)

- Markit CDX.NA.HY 5Y up 3.1 bp, now at 273bp (YTD change: -20.2bp)

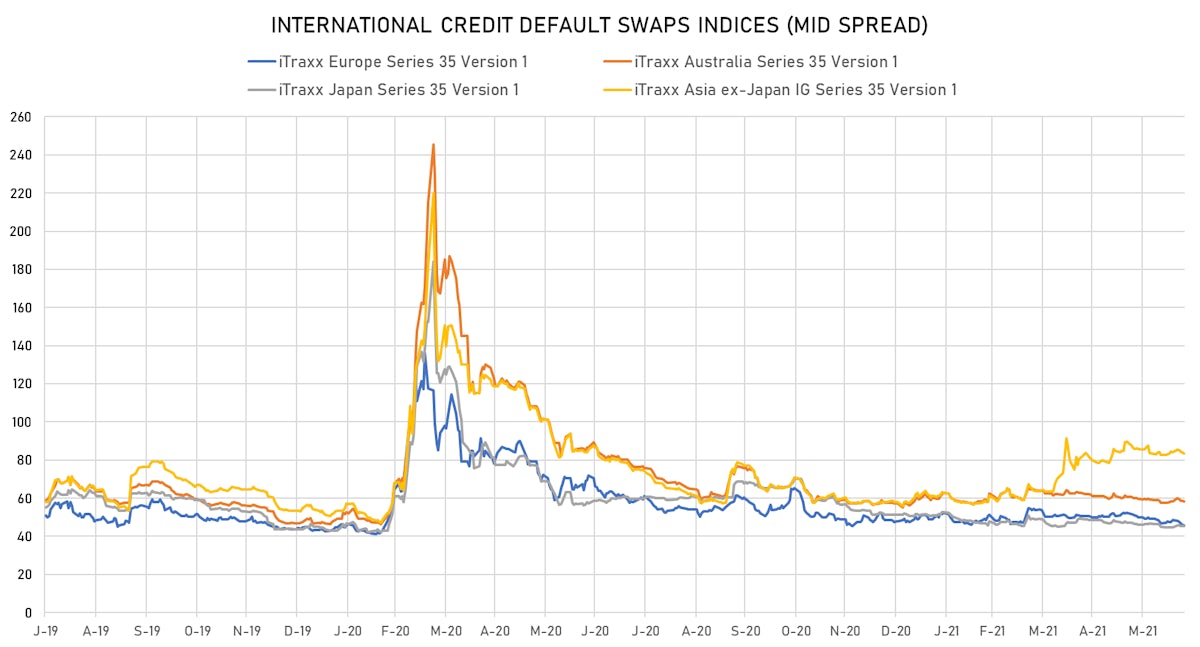

- Markit iTRAXX Europe up 0.7 bp, now at 46bp (YTD change: -1.6bp)

- Markit iTRAXX Japan unchanged at 45bp (YTD change: -6.1bp)

- Markit iTRAXX Asia Ex-Japan down 0.5 bp, now at 83bp (YTD change: +24.9bp)

TOP BONDS MOVES IN THE PAST WEEK - USD HY

- Issuer: Bank Muscat SAOG (Muscat, Oman) | Coupon: 4.88% | Maturity: 14/3/2023 | Rating: BB- | ISIN: XS1789474274 | Z-spread up by 29.5 bp to 246.5 bp, with the yield to worst at 2.5% and the bond now trading down to 103.6 cents on the dollar (1Y price range: 101.3-104.5).

- Issuer: MTN (Mauritius) Investments Ltd (Port Louis, Mauritius) | Coupon: 4.76% | Maturity: 11/11/2024 | Rating: BB- | ISIN: XS1128996425 | Z-spread up by 21.6 bp to 201.9 bp, with the yield to worst at 2.5% and the bond now trading down to 106.8 cents on the dollar (1Y price range: 104.5-107.6).

- Issuer: Starwood Property Trust Inc (Greenwich, Connecticut (US)) | Coupon: 5.50% | Maturity: 1/11/2023 | Rating: B+ | ISIN: USU85656AE39 | Z-spread up by 21.3 bp to 278.0 bp, with the yield to worst at 3.0% and the bond now trading down to 104.7 cents on the dollar (1Y price range: 103.4-105.5).

- Issuer: Grupo de Inversiones Suramericana SA (Medellin, Colombia) | Coupon: 5.50% | Maturity: 29/4/2026 | Rating: BB+ | ISIN: USG42036AB25 | Z-spread down by 22.2 bp to 261.6 bp, with the yield to worst at 3.3% and the bond now trading up to 108.4 cents on the dollar (1Y price range: 107.0-114.6).

- Issuer: L Brands Inc (Columbus, Ohio (US)) | Coupon: 9.38% | Maturity: 1/7/2025 | Rating: BB- | ISIN: USU51407AD34 | Z-spread down by 23.6 bp to 108.5 bp (CDS basis: -16.2bp), with the yield to worst at 1.7% and the bond now trading up to 129.0 cents on the dollar (1Y price range: 122.8-129.0).

- Issuer: Uzpromstroybank AKB (Tashkent, Uzbekistan) | Coupon: 5.75% | Maturity: 2/12/2024 | Rating: BB- | ISIN: XS2083131859 | Z-spread down by 24.5 bp to 310.5 bp, with the yield to worst at 3.6% and the bond now trading up to 106.5 cents on the dollar (1Y price range: 102.4-106.8).

- Issuer: MHP Lux SA (Luxembourg, Luxembourg) | Coupon: 6.25% | Maturity: 19/9/2029 | Rating: B | ISIN: XS2010044894 | Z-spread down by 26.4 bp to 491.8 bp, with the yield to worst at 6.0% and the bond now trading up to 100.3 cents on the dollar (1Y price range: 93.0-103.3).

- Issuer: Sensata Technologies BV (Almelo, Netherlands) | Coupon: 4.88% | Maturity: 15/10/2023 | Rating: BB- | ISIN: USN78840AH33 | Z-spread down by 26.4 bp to 119.8 bp, with the yield to worst at 1.4% and the bond now trading up to 107.4 cents on the dollar (1Y price range: 105.9-108.1).

- Issuer: Firstenergy Transmission LLC (Fairmont, West Virginia (US)) | Coupon: 4.35% | Maturity: 15/1/2025 | Rating: BB | ISIN: USU3200VAB63 | Z-spread down by 35.6 bp to 66.8 bp (CDS basis: -3.5bp), with the yield to worst at 1.2% and the bond now trading up to 109.8 cents on the dollar (1Y price range: 107.4-110.0).

- Issuer: Dilijan Finance BV (Amsterdam, Netherlands) | Coupon: 6.50% | Maturity: 28/1/2025 | Rating: B+ | ISIN: XS2080321198 | Z-spread down by 36.9 bp to 609.0 bp, with the yield to worst at 6.3% and the bond now trading up to 99.5 cents on the dollar (1Y price range: 93.6-100.4).

- Issuer: Banco Safra SA (Cayman Islands Branch) (George Town, Cayman Islands) | Coupon: 4.13% | Maturity: 8/2/2023 | Rating: BB- | ISIN: US05964TAQ22 | Z-spread down by 38.4 bp to 168.2 bp, with the yield to worst at 1.7% and the bond now trading up to 103.4 cents on the dollar (1Y price range: 102.3-104.8).

- Issuer: Uzauto motors AO (Tashkent, Uzbekistan) | Coupon: 4.85% | Maturity: 4/5/2026 | Rating: B+ | ISIN: XS2330272944 | Z-spread down by 43.8 bp to 402.3 bp, with the yield to worst at 4.6% and the bond now trading up to 99.9 cents on the dollar (1Y price range: 98.3-100.5).

TOP BONDS MOVES IN THE PAST WEEK - EUR HY

- Issuer: Adler Group SA (Senningerberg, Luxembourg) | Coupon: 3.25% | Maturity: 5/8/2025 | Rating: BB+ | ISIN: XS2010029663 | Z-spread up by 58.1 bp to 299.9 bp, with the yield to worst at 2.5% and the bond now trading down to 102.0 cents on the dollar (1Y price range: 99.5-105.4).

- Issuer: Teva Pharmaceutical Finance Netherlands II BV (Amsterdam, Netherlands) | Coupon: 1.63% | Maturity: 15/10/2028 | Rating: BB- | ISIN: XS1439749364 | Z-spread up by 15.5 bp to 358.9 bp, with the yield to worst at 3.4% and the bond now trading down to 88.1 cents on the dollar (1Y price range: 87.1-92.6).

- Issuer: SoftBank Group Corp (Minato-Ku, Japan) | Coupon: 5.00% | Maturity: 15/4/2028 | Rating: BB- | ISIN: XS1793255941 | Z-spread up by 12.6 bp to 298.6 bp, with the yield to worst at 2.5% and the bond now trading down to 112.9 cents on the dollar (1Y price range: 110.1-116.4).

- Issuer: International Consolidated Airlines Group SA (London, Spain) | Coupon: 2.75% | Maturity: 25/3/2025 | Rating: B+ | ISIN: XS2322423455 | Z-spread up by 11.2 bp to 293.0 bp, with the yield to worst at 2.4% and the bond now trading down to 100.5 cents on the dollar (1Y price range: 97.9-101.3).

- Issuer: Standard Industries Inc (Parsippany, New Jersey (US)) | Coupon: 2.25% | Maturity: 21/11/2026 | Rating: BB | ISIN: XS2080766475 | Z-spread up by 7.7 bp to 246.9 bp, with the yield to worst at 2.2% and the bond now trading down to 99.9 cents on the dollar (1Y price range: 97.4-102.9).

- Issuer: Arcelik AS (Istanbul, Turkey) | Coupon: 3.00% | Maturity: 27/5/2026 | Rating: BB+ | ISIN: XS2346972263 | Z-spread up by 5.9 bp to 297.4 bp, with the yield to worst at 2.6% and the bond now trading down to 101.2 cents on the dollar (1Y price range: 100.4-101.4).

- Issuer: Titan Global Finance PLC (Hull, United Kingdom) | Coupon: 2.75% | Maturity: 9/7/2027 | Rating: BB | ISIN: XS2199268470 | Z-spread down by 6.3 bp to 206.7 bp, with the yield to worst at 1.7% and the bond now trading up to 104.6 cents on the dollar (1Y price range: 102.6-105.9).

- Issuer: ACS Actividades de Construccion y Servicios SA (Madrid, Spain) | Coupon: 1.38% | Maturity: 17/6/2025 | Rating: BB+ | ISIN: XS2189592616 | Z-spread down by 6.8 bp to 137.6 bp, with the yield to worst at 1.0% and the bond now trading up to 101.1 cents on the dollar (1Y price range: 100.9-103.4).

- Issuer: Webuild SpA (Milan, Italy) | Coupon: 5.88% | Maturity: 15/12/2025 | Rating: BB- | ISIN: XS2271356201 | Z-spread down by 8.3 bp to 331.9 bp, with the yield to worst at 2.8% and the bond now trading up to 110.6 cents on the dollar (1Y price range: 99.6-111.3).

- Issuer: Nexi SpA (Milan, Italy) | Coupon: 1.75% | Maturity: 31/10/2024 | Rating: BB- | ISIN: XS2066703989 | Z-spread down by 8.5 bp to 146.7 bp, with the yield to worst at 1.0% and the bond now trading up to 102.0 cents on the dollar (1Y price range: 100.7-102.9).

- Issuer: Autostrade per l'Italia SpA (Rome, Italy) | Coupon: 1.88% | Maturity: 4/11/2025 | Rating: BB- | ISIN: XS1316569638 | Z-spread down by 12.2 bp to 127.1 bp (CDS basis: -21.6bp), with the yield to worst at 0.8% and the bond now trading up to 103.8 cents on the dollar (1Y price range: 99.8-104.4).

USD BOND ISSUES

- Logan Group Co Ltd (Home Builders | Shenzhen, Guangdong, Guernsey | Rating: BB-): US$300m Senior Note (XS2342970402), fixed rate (4.70% coupon) maturing on 6 July 2026, priced at 100.00, callable (5nc3)

- Mongolia (Government) (Sovereign | Mongolia | Rating: B): US$500m Senior Note (US60937LAE56), fixed rate (4.45% coupon) maturing on 7 July 2031, priced at 98.02, non callable

- Mongolia (Government) (Sovereign | Mongolia | Rating: B-): US$500m Senior Note (USY6142NAF51), fixed rate (3.50% coupon) maturing on 7 July 2027, priced at 98.67, non callable

- Philippines, Republic of the (Government) (Sovereign | Manila, Philippines | Rating: BBB): US$750m Senior Note (US718286CN52), fixed rate (1.95% coupon) maturing on 6 January 2032, priced at 98.78 (original spread of 60 bp), non callable

- Philippines, Republic of the (Government) (Sovereign | Manila, Philippines | Rating: BBB): US$2,250m Senior Note (US718286CP01), fixed rate (3.20% coupon) maturing on 6 July 2046, priced at 99.15 (original spread of 114 bp), non callable

- Yisheng International Co Ltd (Financial - Other | Rating: NR): US$300m Senior Note (XS2356930383), fixed rate (2.60% coupon) maturing on 6 June 2024, priced at 100.00, non callable

EUR BOND ISSUES

- Amundi Real Assets Company SA (Financial - Other | Luxembourg | Rating: NR): €500m Bond (XS2358919053), floating rate maturing on 20 July 2028, priced at 100.00, non callable

- Aries Capital DAC (Financial - Other | Dublin, Dublin, Ireland | Rating: NR): €468m Unsecured Note (XS2360267368), floating rate maturing on 14 July 2026, priced at 100.00, non callable

- Aries Capital DAC (Financial - Other | Dublin, Dublin, Ireland | Rating: NR): €330m Unsecured Note (XS2360267442), floating rate maturing on 14 July 2026, priced at 100.00, non callable

- UniCredit SpA (Banking | Milan, Milano, Italy | Rating: BBB): €1,000m Note (XS2360310044), floating rate maturing on 5 July 2029, priced at 99.95 (original spread of 123 bp), callable (8nc7)

NEW LOANS

- AQ Sunshine Inc, signed a US$ 117m Delayed Draw Term Loan, to be used for acquisition financing. It matures on 04/15/25 and initial pricing is set at LIBOR +600.000bps

- AZZ Inc, signed a US$ 400m Revolving Credit Facility, to be used for general corporate purposes. It matures on 06/30/26 and initial pricing is set at LIBOR +112.500bps

NEW ISSUES IN SECURITIZED CREDIT

- BBCMS Mortgage Trust 2021-C10 issued a fixed-rate CMBS in 7 tranches, for a total of US$ 733 m. Highest-rated tranche offering a yield to maturity of 0.77%, and the lowest-rated tranche a yield to maturity of 2.84%. Bookrunners: UBS Securities Inc

- Barclays Capital Group, SG Americas Securities LLC, KeyBanc Capital Markets Inc

- Nelnet Student Loan Trust 2021-1 F issued a floating-rate ABS backed by student loans in 2 tranches, for a total of US$ 797 m. Highest-rated tranche offering a spread over the floating rate of 50bp, and the lowest-rated tranche a spread of 125bp. Bookrunners: Goldman Sachs & Co, RBC Capital Markets, Citigroup Global Markets Inc, BMO Capital Markets, Bank of America Merrill Lynch

- Nelnet Student Loan Trust 2021-B issued a floating-rate ABS backed by student loans in 5 tranches, for a total of US$ 2,001 m. Highest-rated tranche offering a spread over the floating rate of 78bp, and the lowest-rated tranche a spread of 78bp. Bookrunners: Goldman Sachs & Co, RBC Capital Markets, Citigroup Global Markets Inc, Wells Fargo Securities LLC, Bank of America Merrill Lynch, Mizuho Securities USA Inc

- Sabey Data Center Issuer 2021-1 LLC issued a fixed-rate ABS backed by certificates in 1 tranche, for a total of US$ 175 m. Highest-rated tranche offering a yield to maturity of 1.88%, and the lowest-rated tranche a yield to maturity of 1.88%. Bookrunners: Guggenheim Securities LLC

- Starwood Residential Mortgage Trust 2021-3 issued a fixed-rate RMBS in 6 tranches, for a total of US$ 307 m. Highest-rated tranche offering a yield to maturity of 1.13%, and the lowest-rated tranche a yield to maturity of 4.10%. Bookrunners: Credit Suisse, Morgan Stanley International Ltd, Deutsche Bank Securities Inc

- Progress Residential SFR ABS 2021-SFR 6 issued a fixed-rate ABS backed by rental income in 8 tranches, for a total of US$ 513 m. Highest-rated tranche offering a yield to maturity of 1.52%, and the lowest-rated tranche a yield to maturity of 4.00%. Bookrunners: Credit Suisse, Goldman Sachs & Co, Morgan Stanley International Ltd, Deutsche Bank Securities Inc, RBC Capital Markets