Credit

iBOXX USD Liquid Credit HY Up 3.04% In 1H 2021, IG Down -1.59%

According to IFR data, the first half of 2021 saw an all-time record volume for high-yield bond issuance at US$283bn, with investment-grade volume at US$ 842.47bn (trailing behind last year)

Published ET

IBOXX USD LIQUID INDICES | Sources: ϕpost, Refinitiv data

QUICK SUMMARY

- The iBoxx USD Liquid Investment Grade Total Return Index was up 0.155% today (Month-to-date: 2.00%; Year-to-date: -1.59%)

- The iBoxx USD Liquid High Yield Total Return Index was up 0.111% today (Month-to-date: 1.12%; Year-to-date: 3.04%)

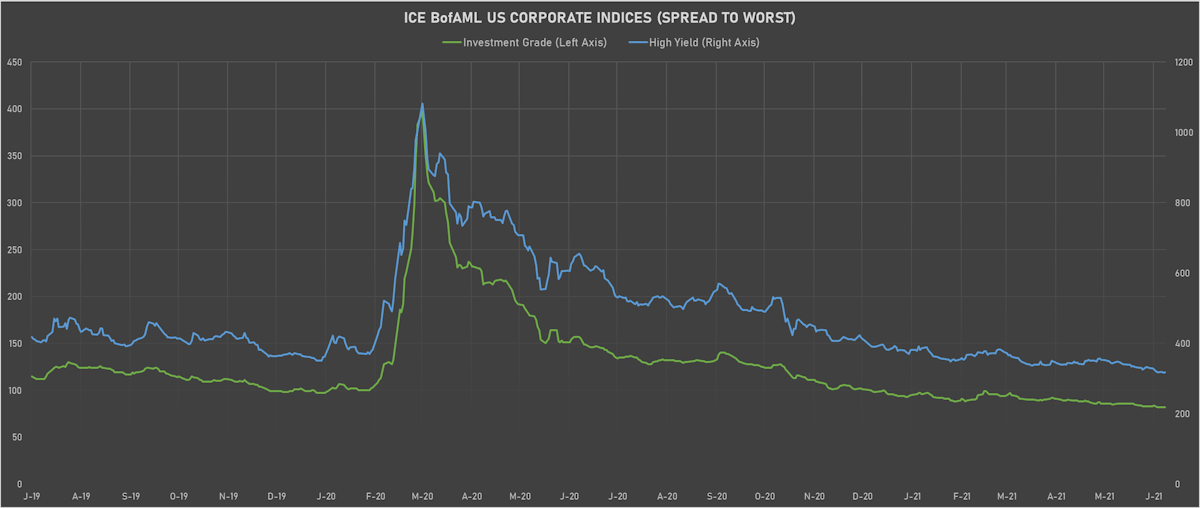

- ICE BofA US Corporate Index (Investment Grade) spread to worst unchanged, now at 82.0 bp (YTD change: -16.0 bp)

- ICE BofA US High Yield Index spread to worst up 1.0 bp, now at 318.0 bp (YTD change: -72.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index down -0.02% today (YTD total return: +2.2%)

- New issues: US$ 15.1bn in dollars and € 4.9bn in euros

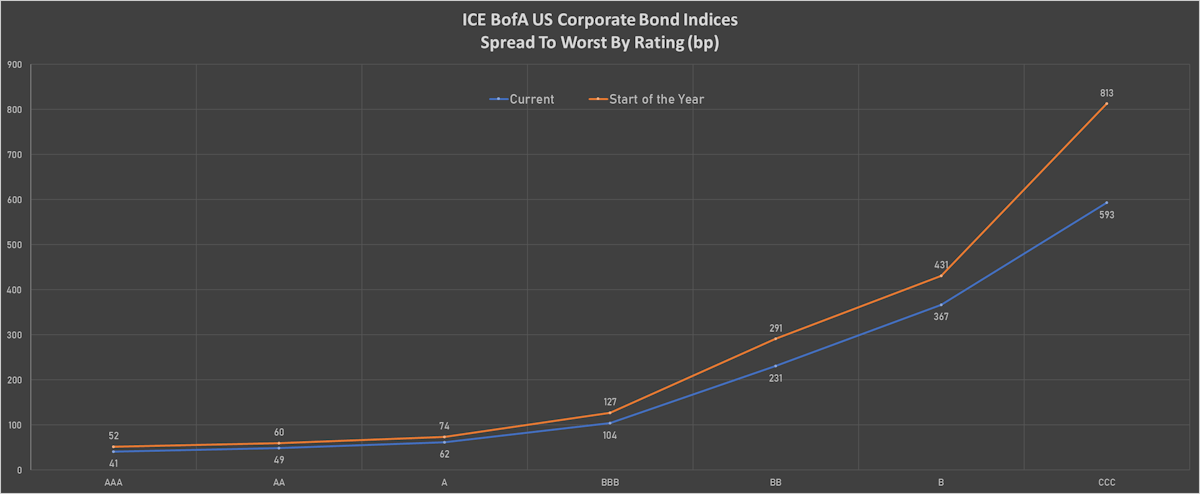

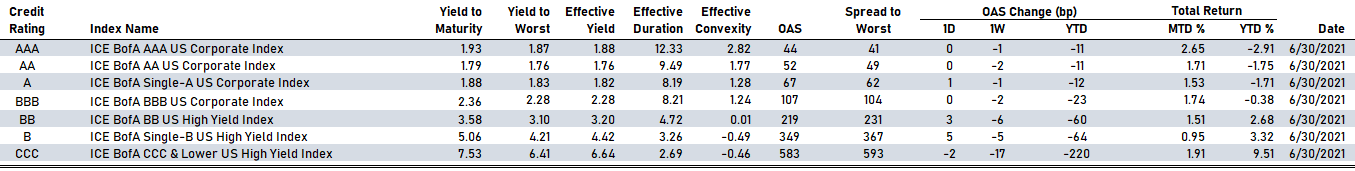

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

- AAA unchanged at 44 bp

- AA unchanged at 52 bp

- A up by 1 bp at 67 bp

- BBB unchanged at 107 bp

- BB up by 3 bp at 219 bp

- B up by 5 bp at 349 bp

- CCC down by -2 bp at 583 bp

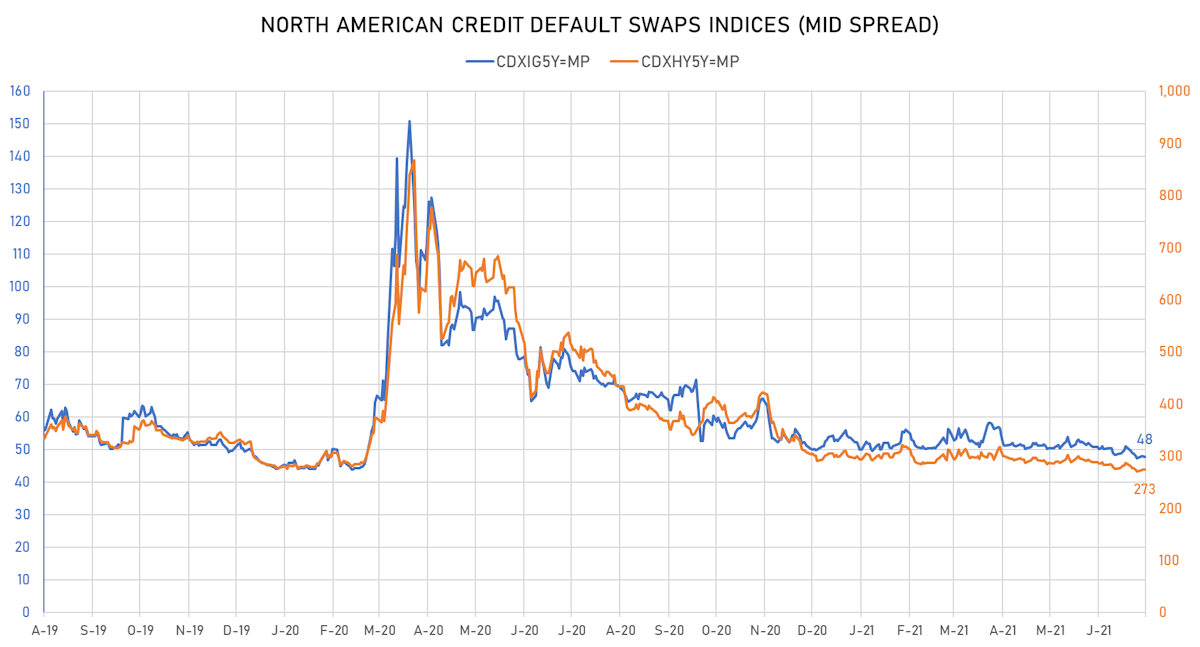

CDS INDICES (mid-spreads)

- Markit CDX.NA.IG 5Y down 0.1 bp, now at 48bp (YTD change: -2.2bp)

- Markit CDX.NA.HY 5Y down 0.2 bp, now at 273bp (YTD change: -19.8bp)

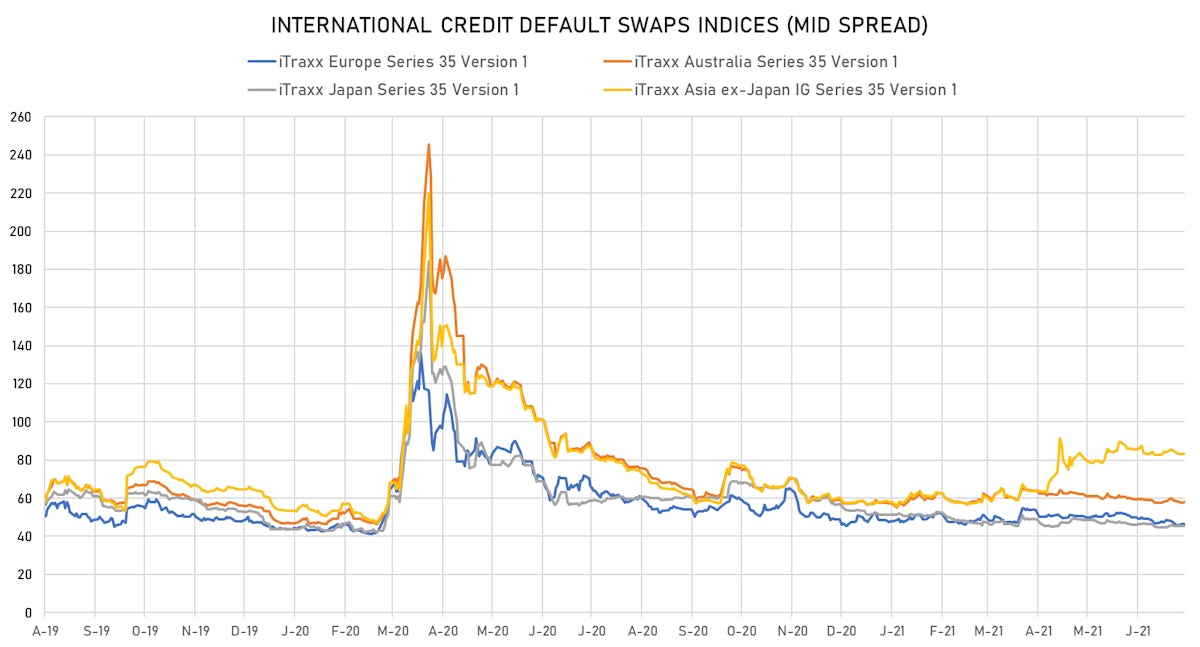

- Markit iTRAXX Europe up 0.4 bp, now at 47bp (YTD change: -1.2bp)

- Markit iTRAXX Japan down 0.1 bp, now at 45bp (YTD change: -6.1bp)

- Markit iTRAXX Asia Ex-Japan up 0.1 bp, now at 84bp (YTD change: +25.4bp)

TOP BONDS MOVES IN THE PAST WEEK - USD HY

- Issuer: BRF SA (ITAJAI, Brazil) | Coupon: 3.95% | Maturity: 22/5/2023 | Rating: BB- | ISIN: USP1905CAD22 | Z-spread up by 46.7 bp to 203.0 bp, with the yield to worst at 2.1% and the bond now trading down to 103.0 cents on the dollar (1Y price range: 100.9-104.6).

- Issuer: Bank razvitiya Respubliki Belarus' OAO (MINSK, Belarus) | Coupon: 6.75% | Maturity: 2/5/2024 | Rating: B | ISIN: XS1904731129 | Z-spread up by 44.4 bp to 1,008.8 bp, with the yield to worst at 10.2% and the bond now trading down to 91.4 cents on the dollar (1Y price range: 91.3-102.5).

- Issuer: Syngenta Finance NV (Enkhuizen, Netherlands) | Coupon: 4.44% | Maturity: 24/4/2023 | Rating: BB | ISIN: USN84413CM88 | Z-spread up by 41.1 bp to 94.5 bp, with the yield to worst at 1.1% and the bond now trading down to 105.5 cents on the dollar (1Y price range: 101.5-106.4).

- Issuer: Southeast Supply Header LLC (Houston, Texas (US)) | Coupon: 4.25% | Maturity: 15/6/2024 | Rating: BB- | ISIN: USU83854AB29 | Z-spread up by 39.6 bp to 371.5 bp, with the yield to worst at 3.9% and the bond now trading down to 99.9 cents on the dollar (1Y price range: 99.0-100.9).

- Issuer: Eurochem Finance DAC (DUBLIN, Ireland) | Coupon: 5.50% | Maturity: 13/3/2024 | Rating: BB- | ISIN: XS1961080501 | Z-spread up by 34.8 bp to 151.5 bp, with the yield to worst at 1.8% and the bond now trading down to 108.5 cents on the dollar (1Y price range: 108.2-110.6).

- Issuer: SoftBank Group Corp (Minato-ku, Japan) | Coupon: 4.75% | Maturity: 19/9/2024 | Rating: BB- | ISIN: XS1684384511 | Z-spread up by 25.7 bp to 211.8 bp, with the yield to worst at 2.6% and the bond now trading down to 105.9 cents on the dollar (1Y price range: 104.4-108.0).

- Issuer: EnerSys (Reading, Pennsylvania (US)) | Coupon: 5.00% | Maturity: 30/4/2023 | Rating: BB- | ISIN: USU2928LAA36 | Z-spread up by 22.7 bp to 207.3 bp, with the yield to worst at 2.1% and the bond now trading down to 104.1 cents on the dollar (1Y price range: 103.8-105.8).

- Issuer: EQM Midstream Partners LP (Canonsburg, Pennsylvania (US)) | Coupon: 6.00% | Maturity: 1/7/2025 | Rating: BB- | ISIN: USU26886AA62 | Z-spread down by 21.1 bp to 276.9 bp, with the yield to worst at 3.2% and the bond now trading up to 108.8 cents on the dollar (1Y price range: 103.0-109.4).

- Issuer: Turkiye Petrol Rafinerileri AS (KOCAELI, Turkey) | Coupon: 4.50% | Maturity: 18/10/2024 | Rating: B | ISIN: XS1686704948 | Z-spread down by 22.3 bp to 373.1 bp, with the yield to worst at 4.0% and the bond now trading up to 100.4 cents on the dollar (1Y price range: 95.5-101.3).

- Issuer: Jersey Central Power & Light Co (Akron, Ohio (US)) | Coupon: 4.70% | Maturity: 1/4/2024 | Rating: BB+ | ISIN: USU04536AC95 | Z-spread down by 24.8 bp to 70.2 bp (CDS basis: -13.3bp), with the yield to worst at 1.1% and the bond now trading up to 108.7 cents on the dollar (1Y price range: 107.9-109.8).

- Issuer: Nexa Resources SA (Luxembourg, Luxembourg) | Coupon: 6.50% | Maturity: 18/1/2028 | Rating: BB | ISIN: USL67359AA48 | Z-spread down by 27.3 bp to 312.4 bp, with the yield to worst at 4.0% and the bond now trading up to 112.5 cents on the dollar (1Y price range: 107.5-118.3).

- Issuer: Chengdu Airport Xingcheng Investment Group Co Ltd (Chengdu, China (Mainland)) | Coupon: 6.50% | Maturity: 18/7/2022 | Rating: BB+ | ISIN: XS2025664306 | Z-spread down by 27.9 bp to 363.9 bp, with the yield to worst at 3.7% and the bond now trading up to 102.7 cents on the dollar (1Y price range: 102.0-103.0).

- Issuer: Uzauto motors AO (Tashkent, Uzbekistan) | Coupon: 4.85% | Maturity: 4/5/2026 | Rating: B+ | ISIN: XS2330272944 | Z-spread down by 35.2 bp to 384.7 bp, with the yield to worst at 4.5% and the bond now trading up to 100.6 cents on the dollar (1Y price range: 98.3-100.6).

TOP BONDS MOVES IN THE PAST WEEK - EUR HY

- Issuer: CyrusOne LP (Dallas, Texas (US)) | Coupon: 1.45% | Maturity: 22/1/2027 | Rating: BB+ | ISIN: XS2089972629 | Z-spread up by 206.2 bp to 130.5 bp, with the yield to worst at 1.0% and the bond now trading down to 101.9 cents on the dollar (1Y price range: 100.4-102.2).

- Issuer: Deutsche Lufthansa AG (Cologne, Germany) | Coupon: 3.75% | Maturity: 11/2/2028 | Rating: BB- | ISIN: XS2296203123 | Z-spread up by 37.6 bp to 337.9 bp (CDS basis: -73.7bp), with the yield to worst at 3.1% and the bond now trading down to 103.0 cents on the dollar (1Y price range: 97.6-105.3).

- Issuer: International Consolidated Airlines Group SA (London, Spain) | Coupon: 2.75% | Maturity: 25/3/2025 | Rating: B+ | ISIN: XS2322423455 | Z-spread up by 36.2 bp to 310.8 bp, with the yield to worst at 2.6% and the bond now trading down to 99.9 cents on the dollar (1Y price range: 97.9-101.3).

- Issuer: SoftBank Group Corp (Minato-Ku, Japan) | Coupon: 5.00% | Maturity: 15/4/2028 | Rating: BB- | ISIN: XS1793255941 | Z-spread up by 30.3 bp to 320.0 bp, with the yield to worst at 2.7% and the bond now trading down to 111.7 cents on the dollar (1Y price range: 110.1-116.4).

- Issuer: Akropolis Group UAB (Vilnius, Lithuania) | Coupon: 2.88% | Maturity: 2/6/2026 | Rating: BB+ | ISIN: XS2346869097 | Z-spread up by 22.8 bp to 350.4 bp, with the yield to worst at 3.1% and the bond now trading down to 98.4 cents on the dollar (1Y price range: 98.2-99.4).

- Issuer: Standard Industries Inc (Parsippany, New Jersey (US)) | Coupon: 2.25% | Maturity: 21/11/2026 | Rating: BB | ISIN: XS2080766475 | Z-spread up by 14.8 bp to 259.4 bp, with the yield to worst at 2.3% and the bond now trading down to 99.4 cents on the dollar (1Y price range: 97.4-102.9).

- Issuer: CBOM Finance PLC (Dublin, Ireland) | Coupon: 3.10% | Maturity: 21/1/2026 | Rating: BB- | ISIN: XS2281299763 | Z-spread up by 10.4 bp to 354.8 bp, with the yield to worst at 3.1% and the bond now trading down to 99.3 cents on the dollar (1Y price range: 96.0-100.0).

- Issuer: Titan Global Finance PLC (Hull, United Kingdom) | Coupon: 2.75% | Maturity: 9/7/2027 | Rating: BB | ISIN: XS2199268470 | Z-spread down by 8.5 bp to 207.8 bp, with the yield to worst at 1.7% and the bond now trading up to 104.6 cents on the dollar (1Y price range: 102.6-105.9).

- Issuer: Esselunga SpA (Pioltello, Italy) | Coupon: 1.88% | Maturity: 25/10/2027 | Rating: BB+ | ISIN: XS1706922256 | Z-spread down by 9.3 bp to 115.5 bp, with the yield to worst at 0.8% and the bond now trading up to 105.2 cents on the dollar (1Y price range: 103.6-105.6).

- Issuer: Dometic Group AB (publ) (Solna, Sweden) | Coupon: 3.00% | Maturity: 8/5/2026 | Rating: BB- | ISIN: XS1991114858 | Z-spread down by 11.2 bp to 193.5 bp, with the yield to worst at 1.5% and the bond now trading up to 106.1 cents on the dollar (1Y price range: 102.7-106.4).

- Issuer: Louis Dreyfus Co BV (Rotterdam, Netherlands) | Coupon: 2.38% | Maturity: 27/11/2025 | Rating: BB+ | ISIN: XS2264074647 | Z-spread down by 11.9 bp to 122.5 bp (CDS basis: -18.4bp), with the yield to worst at 0.8% and the bond now trading up to 106.0 cents on the dollar (1Y price range: 102.8-106.1).

- Issuer: Adler Group SA (Senningerberg, Luxembourg) | Coupon: 2.25% | Maturity: 27/4/2027 | Rating: BB+ | ISIN: XS2336188029 | Z-spread down by 21.0 bp to 277.8 bp, with the yield to worst at 2.4% and the bond now trading up to 98.2 cents on the dollar (1Y price range: 94.4-100.2).

USD BOND ISSUES

- Everi Holdings Inc (Service - Other | Las Vegas, Nevada, United States | Rating: B): US$400m Senior Note (US30034TAA16), fixed rate (5.00% coupon) maturing on 15 July 2029, priced at 100.00 (original spread of 355 bp), callable (8nc3)

- Healthpeak Properties Inc (Real Estate Investment Trust | Denver, United States | Rating: BBB+): US$450m Senior Note (US42250PAC77), fixed rate (1.35% coupon) maturing on 1 February 2027, priced at 99.88 (original spread of 50 bp), callable (6nc5)

- ABQ Finance Ltd (Financial - Other | George Town, Qatar | Rating: A): US$500m Senior Note (XS2361052884), fixed rate (2.00% coupon) maturing on 6 July 2026, priced at 98.99 (original spread of 132 bp), non callable

- Elastic NV (Information/Data Technology | Amsterdam, Netherlands | Rating: B+): US$575m Senior Note (US28415LAA17), fixed rate (4.13% coupon) maturing on 15 July 2029, priced at 100.00 (original spread of 316 bp), callable (8nc3)

- Qatar Petroleum (Agency | Doha, Qatar | Rating: AA-): US$3,500m Senior Note (XS2357494322), fixed rate (2.25% coupon) maturing on 12 July 2031, priced at 98.94 (original spread of 90 bp), callable (10nc10)

- Qatar Petroleum (Agency | Doha, Qatar | Rating: AA-): US$3,500m Senior Note (US74730DAE31), fixed rate (3.13% coupon) maturing on 12 July 2041, priced at 99.63 (original spread of 113 bp), callable (20nc20)

- Qatar Petroleum (Agency | Doha, Qatar | Rating: AA-): US$1,500m Senior Note (US74730DAB91), fixed rate (1.38% coupon) maturing on 12 September 2026, priced at 99.91 (original spread of 50 bp), callable (5nc5)

- Qatar Petroleum (Agency | Doha, Qatar | Rating: AA-): US$4,000m Bond (US74730DAD57), fixed rate (3.30% coupon) maturing on 12 July 2051, priced at 100.00 (original spread of 155 bp), callable (30nc30)

- Rudong County Jinxin Traffic Engineering Construction Investment Co Ltd (Financial - Other | Nantong, Jiangsu, China (Mainland) | Rating: NR): US$120m Bond (XS2358245822), fixed rate (2.30% coupon) maturing on 6 July 2024, priced at 100.00, non callable

- Victoria's Secret & Co (Financial - Other | Rating: BB-): US$600m Senior Note (US926400AA00), fixed rate (4.63% coupon) maturing on 15 July 2029, priced at 100.00 (original spread of 332 bp), callable (8nc3)

EUR BOND ISSUES

- Caisse Nationale De Reassurance Mutuelle Agricole Groupama (Property and Casualty Insurance | Paris, Ile-De-France, France | Rating: NR): €500m Bond (FR0014004EF7), fixed rate (0.75% coupon) maturing on 7 July 2028, priced at 99.51 (original spread of 130 bp), callable (7nc7)

- EOF-ZMG US Residential Holdco LLC (Financial - Other | Wilmington, Delaware, United States | Rating: NR): €260m Bond (XS2312742864), fixed rate (4.50% coupon) maturing on 31 December 2027, priced at 100.00, non callable

- illimity Bank SpA (Banking | Milan, Milano, Italy | Rating: NR): €200m Subordinated Note (XS2361258317), fixed rate (4.38% coupon) maturing on 7 October 2031, priced at 100.00, callable (10nc5)

- Latvia, Republic of (Government) (Sovereign | Riga, Latvia | Rating: A-): €500m Senior Note (XS2361416915) zero coupon maturing on 24 January 2029, priced at 99.98 (original spread of 39 bp), non callable

- Lion Polaris Lux 4 SA (Financial - Other | Luxembourg | Rating: NR): €650m Note (XS2361343697), floating rate (EU03MLIB + 400.0 bp) maturing on 1 July 2026, priced at 100.00, callable (5nc1)

- Picard Bondco SA (Retail Stores - Other | Findel, Luxembourg | Rating: NR): €310m Senior Note (XS2361345478), fixed rate (5.38% coupon) maturing on 1 July 2027, priced at 100.00 (original spread of 588 bp), callable (6nc2)

- Picard Groupe SAS (Financial - Other | Fontainebleau, Ile-De-France, Luxembourg | Rating: NR): €750m Note (XS2361343267), fixed rate (3.88% coupon) maturing on 1 July 2026, priced at 100.00 (original spread of 444 bp), callable (5nc2)

- Vinci SA (Building Products | Rueil-Malmaison, Ile-De-France, France | Rating: A-): €750m Bond (FR0014004FR9), fixed rate (0.50% coupon) maturing on 9 January 2032, priced at 99.12 (original spread of 83 bp), callable (11nc10)

- Wallonie, State of (Official and Muni | Namur, Namur, Belgium | Rating: A): €1,000m Bond (BE0002816974), fixed rate (0.38% coupon) maturing on 22 October 2031, priced at 99.70 (original spread of 29 bp), non callable

NEW ISSUES IN SECURITIZED CREDIT

- Firstkey Homes 2021-Sfr1 issued a fixed-rate RMBS in 7 tranches, for a total of US$ 1,690 m. Highest-rated tranche offering a yield to maturity of 1.54%, and the lowest-rated tranche a yield to maturity of 3.24%. Bookrunners: Morgan Stanley International Ltd

- Fat Brands Wbs Fgfg 2021-1 issued a fixed-rate ABS backed by business cashflow in 1 tranche, for a total of US$ 209 m. Highest-rated tranche offering a yield to maturity of 6.00%, and the lowest-rated tranche a yield to maturity of 6.00%. Bookrunners: Jefferies & Co Inc