Credit

US Corporate Bonds Up On Lower Rates

Cash spreads were stable to slightly higher today while spreads on CDX indices fell, widening the CDS basis

Published ET

Historical Default Rates For US and European High Yield And Leveraged Loans | Source: Credit Suisse

QUICK SUMMARY

- S&P 500 Bond Index was up 0.20% today, with investment grade up 0.22% and high yield up 0.12% (YTD total return: -0.81%)

- The iBoxx USD Liquid Investment Grade Total Return Index was up 0.291% today (Month-to-date: -0.15%; Year-to-date: -1.74%)

- The iBoxx USD Liquid High Yield Total Return Index was up 0.068% today (Month-to-date: 0.10%; Year-to-date: 3.14%)

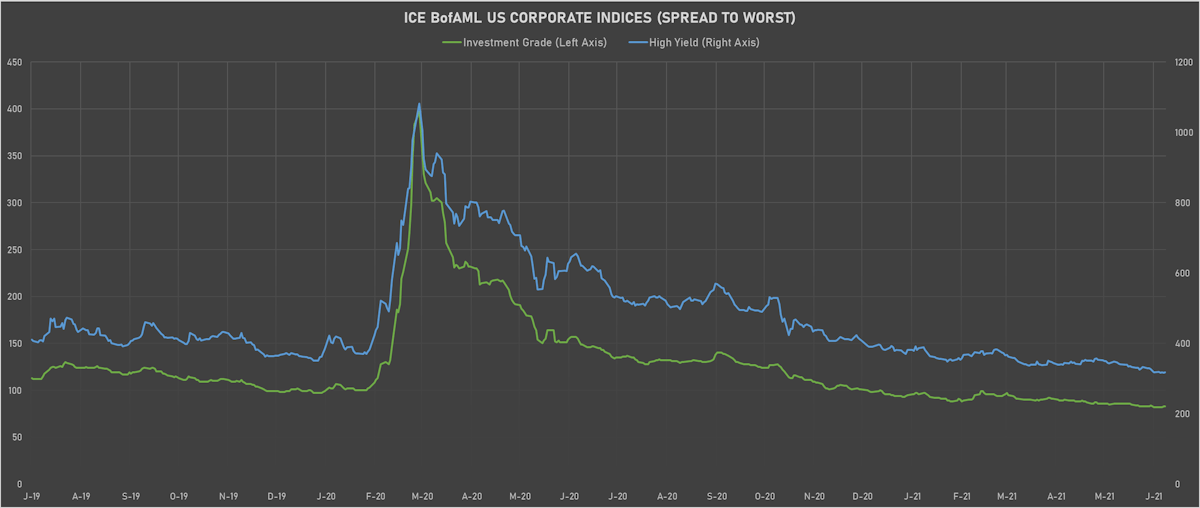

- ICE BofA US Corporate Index (Investment Grade) spread to worst unchanged 0.0 bp, now at 83.0 bp (YTD change: -15.0 bp)

- ICE BofA US High Yield Index spread to worst up 2.0 bp, now at 318.0 bp (YTD change: -72.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index up 0.01% today (YTD total return: +2.2%)

- New issues: US$ 1.8bn in dollars and € 5.0bn in euros

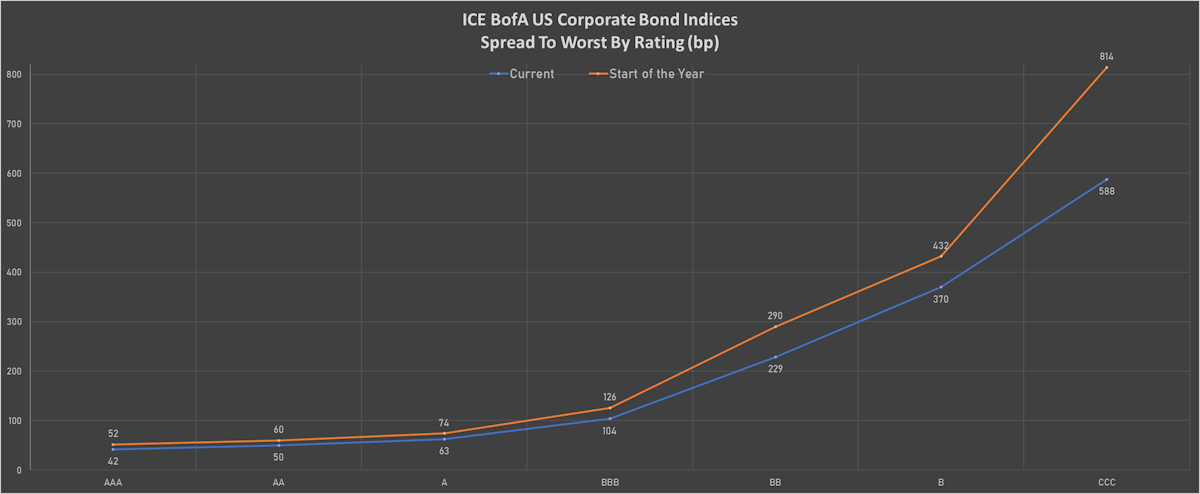

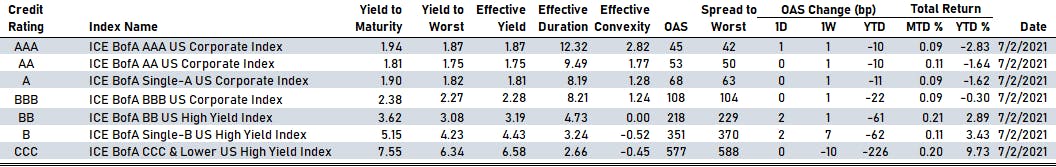

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

- AAA up by 1 bp at 45 bp

- AA unchanged at 53 bp

- A unchanged at 68 bp

- BBB unchanged at 108 bp

- BB up by 2 bp at 218 bp

- B up by 2 bp at 351 bp

- CCC unchanged at 577 bp

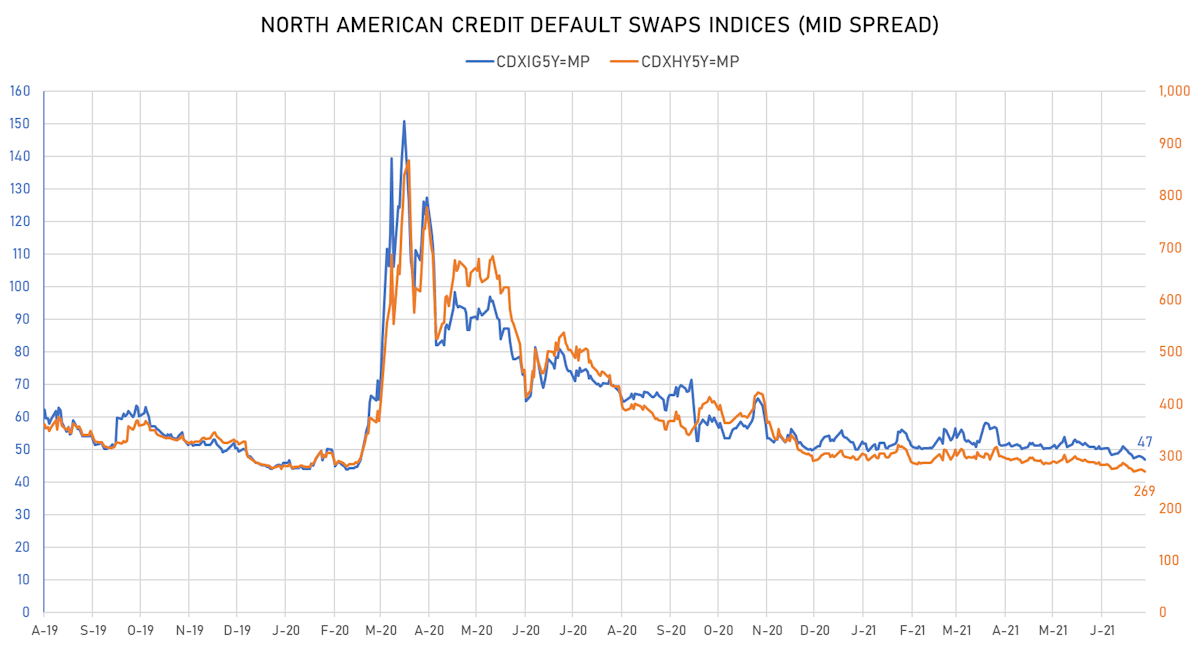

CDS INDICES (mid-spreads)

- Markit CDX.NA.IG 5Y down 0.7 bp, now at 47bp (YTD change: -3.1bp)

- Markit CDX.NA.HY 5Y down 3.3 bp, now at 269bp (YTD change: -23.9bp)

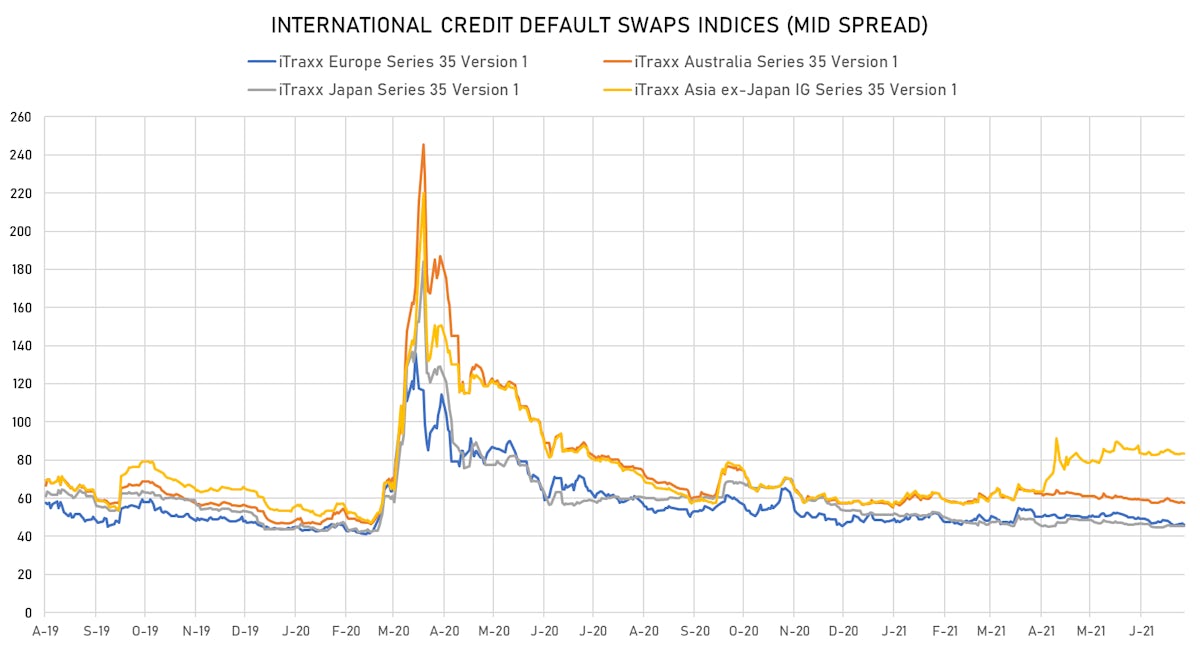

- Markit iTRAXX Europe down 0.5 bp, now at 46bp (YTD change: -2.2bp)

- Markit iTRAXX Japan down 0.1 bp, now at 45bp (YTD change: -6.1bp)

- Markit iTRAXX Asia Ex-Japan up 0.3 bp, now at 84bp (YTD change: +25.8bp)

LARGEST USD CORPORATE CDS MOVES IN THE PAST WEEK

- Transocean Inc (Country: KY; rated: Caa3): down 141.8 bp to 1,257.2bp (1Y range: 989-7,695bp)

- Nabors Industries Inc (Country: US; rated: B+): down 60.9 bp to 725.7bp (1Y range: 662-4,514bp)

- Macy's Inc (Country: US; rated: Ba3): down 49.7 bp to 286.6bp (1Y range: 277-1,253bp)

- Apache Corp (Country: US; rated: WD): down 43.5 bp to 174.3bp (1Y range: 168-453bp)

- L Brands Inc (Country: US; rated: Ba3): down 30.0 bp to 131.6bp (1Y range: 127-679bp)

- Genworth Holdings Inc (Country: US; rated: Caa1): down 27.4 bp to 445.3bp (1Y range: 447-876bp)

- HCA Inc (Country: US; rated: Baa3): down 25.1 bp to 77.8bp (1Y range: 80-218bp)

- Nordstrom Inc (Country: US; rated: WR): down 22.9 bp to 220.6bp (1Y range: 211-684bp)

- Kohls Corp (Country: US; rated: BBB): down 21.8 bp to 124.8bp (1Y range: 118-332bp)

- Mattel Inc (Country: US; rated: Ba2): down 21.7 bp to 218.3bp (1Y range: 207-397bp)

- Interval Acquisition Corp (Country: US; rated: WR): down 19.7 bp to 314.5bp (1Y range: 296-362bp)

- Calpine Corp (Country: US; rated: LGD5 - 88%): down 19.3 bp to 318.5bp (1Y range: 173-349bp)

- Staples Inc (Country: US; rated: B2): down 16.3 bp to 857.3bp (1Y range: 652-2,081bp)

- KB Home (Country: US; rated: Ba2): up 15.9 bp to 195.9bp (1Y range: 125-236bp)

- Rite Aid Corp (Country: US; rated: Caa1): up 123.9 bp to 836.7bp (1Y range: 497-888bp)

LARGEST EURO CORPORATE CDS MOVES IN THE PAST WEEK

- TUI AG (Country: DE; rated: LGD4 - 50%): down 25.7 bp to 642.6bp (1Y range: 590-1,799bp)

- Banca Monte dei Paschi di Siena SpA (Country: IT; rated: NP): down 20.0 bp to 228.0bp (1Y range: 188-272bp)

- Hammerson PLC (Country: GB; rated: Baa3): down 15.5 bp to 200.0bp (1Y range: 189-604bp)

- Stonegate Pub Company Financing PLC (Country: GB; rated: WR): down 15.3 bp to 487.3bp (1Y range: 486-984bp)

- Stena AB (Country: SE; rated: B2-PD): down 12.1 bp to 524.6bp (1Y range: 518-750bp)

- Virgin Media Finance PLC (Country: GB; rated: WR): down 11.8 bp to 238.0bp (1Y range: 208-325bp)

- Air France KLM SA (Country: FR; rated: B-): down 10.7 bp to 393.8bp (1Y range: 392-1,211bp)

- UPC Holding BV (Country: NL; rated: LGD6 - 93%): down 7.0 bp to 223.2bp (1Y range: 211-315bp)

- Altice Finco SA (Country: LU; rated: Caa1): down 6.6 bp to 338.3bp (1Y range: 317-477bp)

- Jaguar Land Rover Automotive PLC (Country: GB; rated: WD): down 6.5 bp to 334.4bp (1Y range: 336-932bp)

- Rolls-Royce PLC (Country: GB; rated: BB-): down 6.4 bp to 233.5bp (1Y range: 227-516bp)

- Boparan Finance PLC (Country: GB; rated: B3): down 5.8 bp to 888.6bp (1Y range: 478-916bp)

- Stellantis NV (Country: NL; rated: BBB): down 5.2 bp to 98.7bp (1Y range: 97-569bp)

- Iceland Bondco PLC (Country: GB; rated: LGD3 - 46%): up 5.0 bp to 433.5bp (1Y range: 358-765bp)

- J Sainsbury PLC (Country: GB; rated: WR): up 8.1 bp to 66.1bp (1Y range: 52-70bp)

EUR BOND ISSUES

- Bank Gospodarstwa Krajowego (Agency | Warsaw, Woj. Mazowieckie, Poland | Rating: A-): €500m Senior Note (XS2361047538), fixed rate (0.50% coupon) maturing on 8 July 2031, priced at 98.97 (original spread of 85 bp), non callable

- Coventry Building Society (Mortgage Banking | Coventry, West Midlands, United Kingdom | Rating: A-): €750m Covered Bond (Other) (XS2360599281), fixed rate (0.01% coupon) maturing on 7 July 2028, priced at 99.86 (original spread of 51 bp), non callable

- Credit Agricole Home Loan SFH SA (Financial - Other | Montrouge, Ile-De-France, France | Rating: NR): €1,000m Obligation de Financement de l'Habitat (Covered Bond) (FR0014004EJ9), fixed rate (0.01% coupon) maturing on 12 April 2028, priced at 100.79 (original spread of 38 bp), non callable

- Elior Group SA (Restaurants | Paris, Ile-De-France, France | Rating: BB-): €550m Senior Note (XS2360381730), fixed rate (3.75% coupon) maturing on 15 July 2026, priced at 100.00 (original spread of 403 bp), callable (5nc2)

- Inmobiliaria Colonial SOCIMI SA (Home Builders | Barcelona, Barcelona, Spain | Rating: BBB): €125m Senior Note (ES0239140033), fixed rate (0.75% coupon) maturing on 22 June 2029, priced at 98.73 (original spread of 132 bp), callable (8nc8)

- Schleswig-Holstein, State of (Official and Muni | Kiel, Schleswig-Holstein, Germany | Rating: AAA): €650m Jumbo Landesschatzanweisung (DE000SHFM808), fixed rate (0.05% coupon) maturing on 8 July 2031, priced at 99.69 (original spread of 31 bp), non callable

- Societe Generale SA (Banking | Paris, Ile-De-France, France | Rating: A): €1,000m Bond (FR0014004GE5), fixed rate (0.25% coupon) maturing on 8 July 2027, priced at 99.91 (original spread of 76 bp), non callable

- Titan Holdings II BV (Financial - Other | Amsterdam, Noord-Holland, Netherlands | Rating: CCC+): €375m Senior Note (XS2359953283), fixed rate (5.13% coupon) maturing on 15 July 2029, priced at 100.00 (original spread of 558 bp), callable (8nc3)

NEW LOANS

- Atlantic Aviation Corp (BB), signed a US$ 350m Term Loan, to be used for 126. It matures on 07/20/29.

- Atlantic Aviation Corp (BB), signed a US$ 1,300m Term Loan B, to be used for 126. It matures on 07/20/28.

- Atlantic Aviation Corp (BB), signed a US$ 225m Revolving Credit Facility, to be used for 126. It matures on 07/20/26.

- A2A SpA (BBB), signed a € 500m Revolving Credit Facility, to be used for general corporate purposes. It matures on 07/02/26.

- Biogroup SCM, signed a € 300m Term Loan B, to be used for general corporate purposes. It matures on 02/09/28.

- Fresenius Medical Care AG & Co (BBB), signed a € 2,000m Revolving Credit Facility, to be used for general corporate purposes. It matures on 07/02/26.

- Vivalto Sante SAS, signed a € 890m Term Loan B, to be used for general corporate purposes. It matures on 07/20/28.

- Vivalto Sante SAS, signed a € 200m Revolving Credit Facility, to be used for general corporate purposes. It matures on 01/20/28.

NEW ISSUES IN SECURITIZED CREDIT

- Rate Mortgage Trust 2021-J1 issued a fixed-rate RMBS in 4 tranches, for a total of US$ 358 m. Highest-rated tranche offering a yield to maturity of 2.45%, and the lowest-rated tranche a yield to maturity of 2.45%. Bookrunners: JP Morgan & Co Inc, Bank of America Merrill Lynch

- Ladder Capital Commercial Mortgage Securities LLC 2021-Fl2 Trust issued a floating-rate CLO in 6 tranches, for a total of US$ 498 m. Highest-rated tranche offering a spread over the floating rate of 120bp, and the lowest-rated tranche a spread of 365bp. Bookrunners: JP Morgan & Co Inc, Wells Fargo Securities LLC

- Mello Mortgage Capital Acceptance 2021-Mtg3 issued a floating-rate RMBS in 5 tranches, for a total of US$ 309 m. Highest-rated tranche offering a spread over the floating rate of 85bp, and the lowest-rated tranche a spread of 85bp. Bookrunners: Amherst Securities Corp, Bank of America Merrill Lynch

- NewDay Funding Master Issuer PLC 2021-2 issued a floating-rate ABS backed by receivables in 1 tranche, for a total of US$ 104 m. Highest-rated tranche offering a spread over the floating rate of 95bp, and the lowest-rated tranche a spread of 95bp. Bookrunners: HSBC Bank PLC, Citi, SMBC Nikko Securities Inc, Bofa Securities Inc

- Angel Oak Mortgage Trust 2021-3 issued a fixed-rate RMBS in 5 tranches, for a total of US$ 292 m. Highest-rated tranche offering a yield to maturity of 1.07%, and the lowest-rated tranche a yield to maturity of 3.29%. Bookrunners: Barclays Capital Group, Deutsche Bank Securities Inc