Credit

Cash Spreads Widen, But US Corporate Bonds Rise On Lower Rates

The US Dollar primary corporate bond market was dominated by foreign financial issuers on Tuesday, with Mizuho Financial Group and Nomura Holdings each printing over US$ 1bn

Published ET

Performance of the iBOXX USD Liquid IG & HY Total Return Indices | Sources: ϕpost, Refinitiv data

QUICK SUMMARY

- The iBoxx USD Liquid Investment Grade Total Return Index was up 0.51% today (Month-to-date: 0.67%; Year-to-date: -0.93%)

- The iBoxx USD Liquid High Yield Total Return Index was up 0.049% today (Month-to-date: 0.26%; Year-to-date: 3.31%)

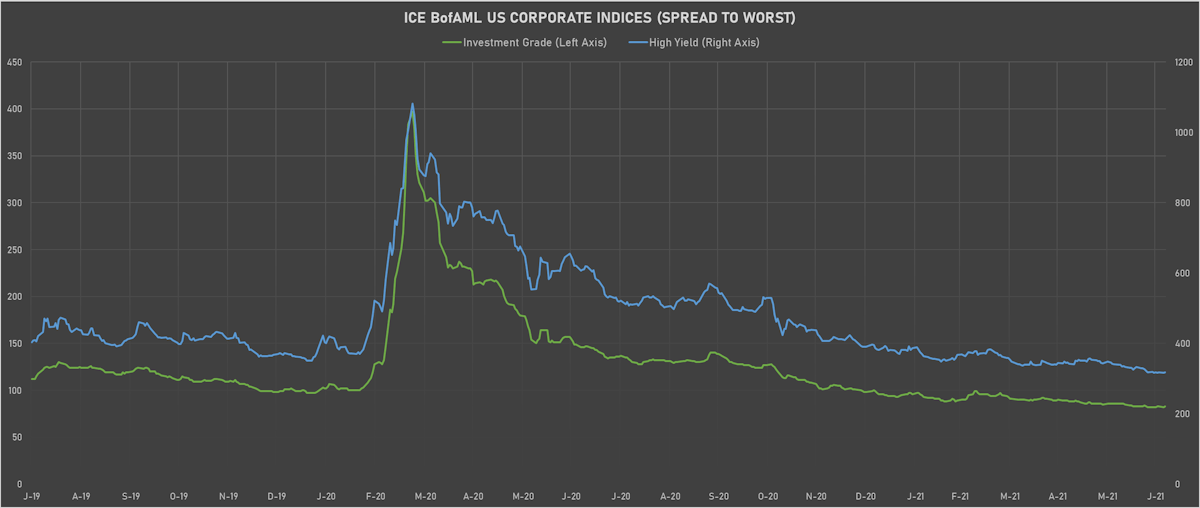

- ICE BofA US Corporate Index (Investment Grade) spread to worst up 1.0 bp, now at 83.0 bp (YTD change: -15.0 bp)

- ICE BofA US High Yield Index spread to worst up 1.0 bp, now at 318.0 bp (YTD change: -72.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index up 0.07% today (YTD total return: +2.2%)

- New issues: US$ 9.9bn in dollars and € 8.6bn in euros

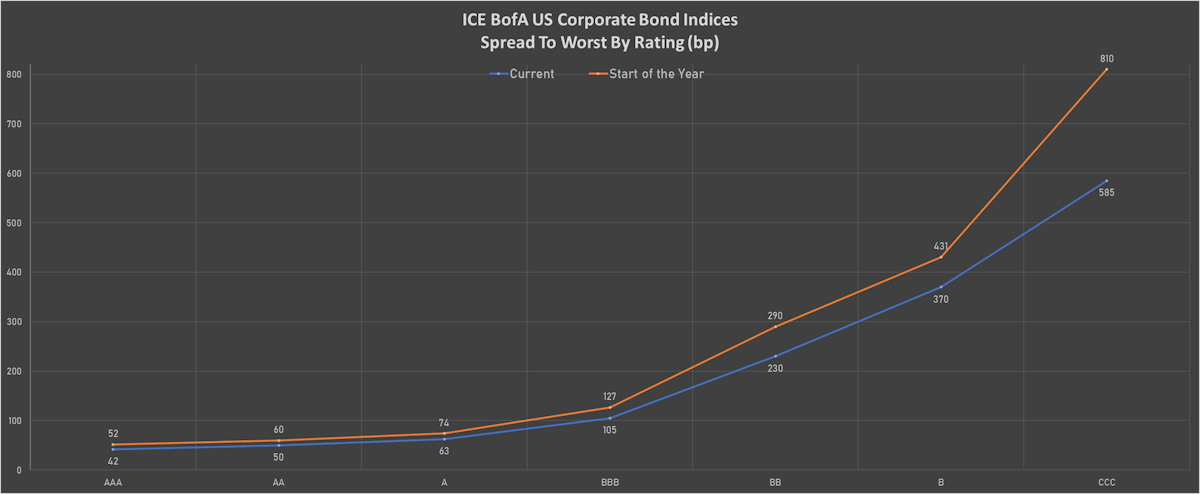

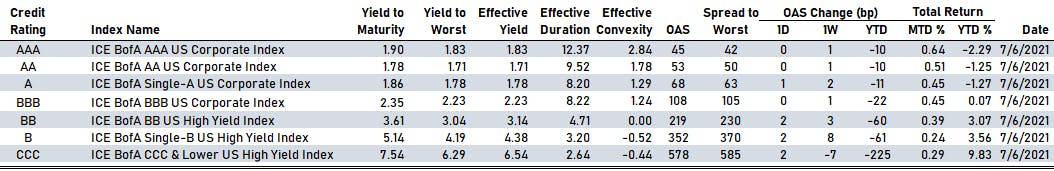

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

- AAA unchanged at 45 bp

- AA unchanged at 53 bp

- A up by 1 bp at 68 bp

- BBB unchanged at 108 bp

- BB up by 2 bp at 219 bp

- B up by 2 bp at 352 bp

- CCC up by 2 bp at 578 bp

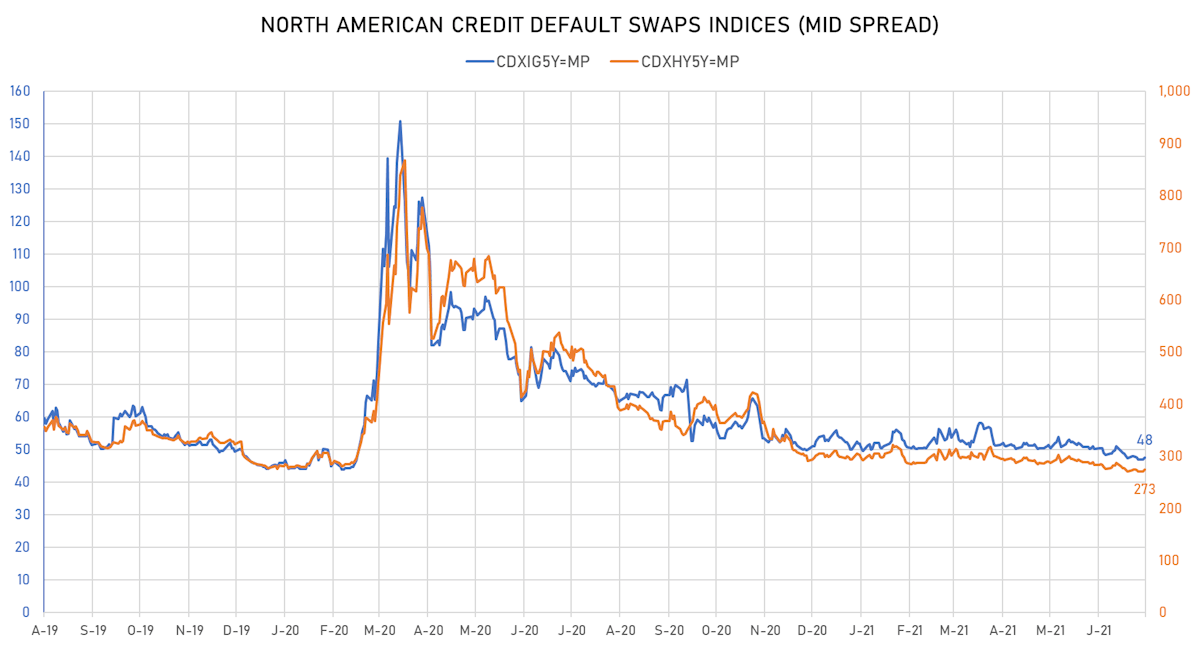

CDS INDICES (mid-spreads)

- Markit CDX.NA.IG 5Y up 0.7 bp, now at 48bp (YTD change: -2.4bp)

- Markit CDX.NA.HY 5Y up 3.9 bp, now at 273bp (YTD change: -20.0bp)

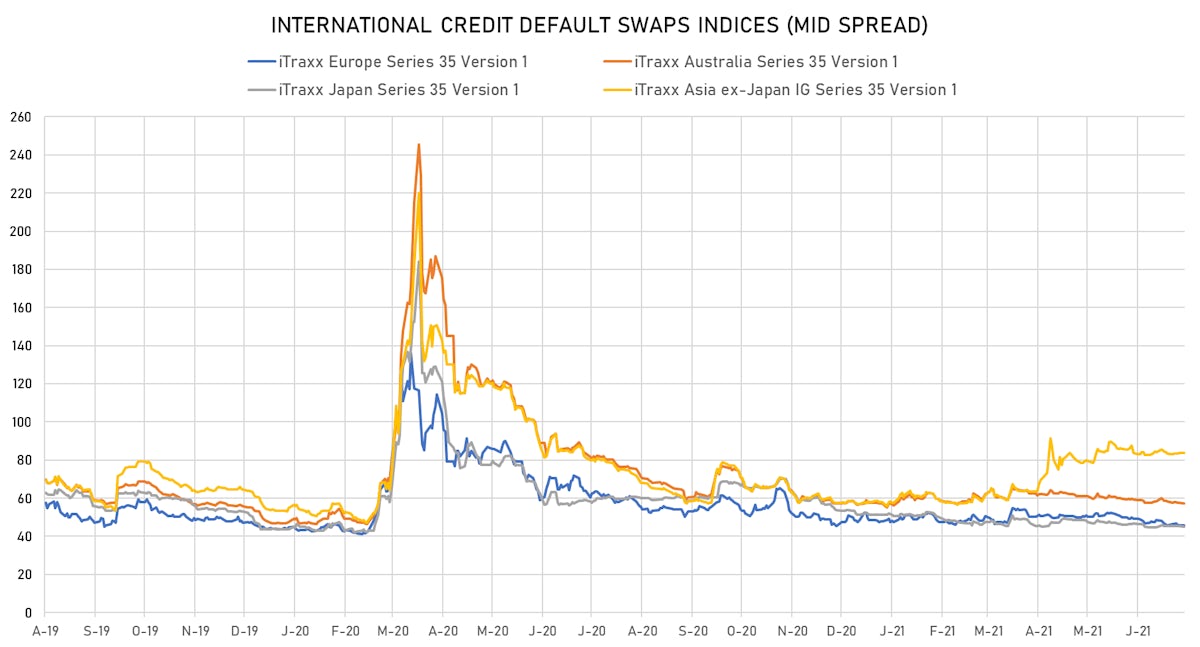

- Markit iTRAXX Europe up 0.9 bp, now at 47bp (YTD change: -1.4bp)

- Markit iTRAXX Japan down 0.1 bp, now at 45bp (YTD change: -6.3bp)

- Markit iTRAXX Asia Ex-Japan up 1.4 bp, now at 85bp (YTD change: +27.1bp)

TOP BONDS MOVES IN THE PAST WEEK - USD HY

- Issuer: Guacolda Energia SA (LAS CONDES, Chile) | Coupon: 4.56% | Maturity: 30/4/2025 | Rating: B+ | ISIN: USP3711HAF66 | Z-spread up by 244.0 bp to 1,613.9 bp, with the yield to worst at 16.3% and the bond now trading down to 66.5 cents on the dollar (1Y price range: 66.5-92.1).

- Issuer: SoftBank Group Corp (Minato-ku, Japan) | Coupon: 4.75% | Maturity: 19/9/2024 | Rating: BB- | ISIN: XS1684384511 | Z-spread up by 43.4 bp to 254.0 bp, with the yield to worst at 3.0% and the bond now trading down to 104.8 cents on the dollar (1Y price range: 104.4-108.0).

- Issuer: Vedanta Resources Finance II PLC (London, United Kingdom) | Coupon: 8.95% | Maturity: 11/3/2025 | Rating: B- | ISIN: USG9T27HAD62 | Z-spread up by 37.4 bp to 921.9 bp, with the yield to worst at 9.5% and the bond now trading down to 97.3 cents on the dollar (1Y price range: 94.3-99.8).

- Issuer: Grupo de Inversiones Suramericana SA (Medellin, Colombia) | Coupon: 5.50% | Maturity: 29/4/2026 | Rating: BB+ | ISIN: USG42036AB25 | Z-spread up by 34.3 bp to 273.8 bp, with the yield to worst at 3.4% and the bond now trading down to 108.2 cents on the dollar (1Y price range: 107.0-114.6).

- Issuer: Seazen Group Ltd (Shanghai, Cayman Islands) | Coupon: 6.00% | Maturity: 12/8/2024 | Rating: BB+ | ISIN: XS2215175634 | Z-spread up by 26.6 bp to 434.0 bp, with the yield to worst at 4.5% and the bond now trading down to 103.4 cents on the dollar (1Y price range: 102.3-105.8).

- Issuer: Rolls-Royce PLC (BIRMINGHAM, United Kingdom) | Coupon: 3.63% | Maturity: 14/10/2025 | Rating: BB- | ISIN: USG76237AB53 | Z-spread down by 22.7 bp to 218.5 bp (CDS basis: -23.6bp), with the yield to worst at 2.7% and the bond now trading up to 102.6 cents on the dollar (1Y price range: 98.4-102.6).

- Issuer: Southeast Supply Header LLC (Houston, Texas (US)) | Coupon: 4.25% | Maturity: 15/6/2024 | Rating: BB- | ISIN: USU83854AB29 | Z-spread down by 23.0 bp to 351.1 bp, with the yield to worst at 3.6% and the bond now trading up to 100.6 cents on the dollar (1Y price range: 99.0-100.9).

- Issuer: Pennsylvania Electric Co (Akron, Ohio (US)) | Coupon: 4.15% | Maturity: 15/4/2025 | Rating: BB+ | ISIN: USU70842AB21 | Z-spread down by 23.3 bp to 112.6 bp (CDS basis: -47.5bp), with the yield to worst at 1.6% and the bond now trading up to 108.2 cents on the dollar (1Y price range: 106.4-109.8).

- Issuer: Empresa Nacional del Petroleo (LAS CONDES, Chile) | Coupon: 3.75% | Maturity: 5/8/2026 | Rating: BB+ | ISIN: USP37110AK24 | Z-spread down by 23.5 bp to 178.6 bp (CDS basis: -126.8bp), with the yield to worst at 2.6% and the bond now trading up to 105.0 cents on the dollar (1Y price range: 103.4-109.9).

- Issuer: EnerSys (Reading, Pennsylvania (US)) | Coupon: 5.00% | Maturity: 30/4/2023 | Rating: BB- | ISIN: USU2928LAA36 | Z-spread down by 24.7 bp to 182.9 bp, with the yield to worst at 1.9% and the bond now trading up to 104.5 cents on the dollar (1Y price range: 103.8-105.8).

- Issuer: Firstenergy Transmission LLC (Fairmont, West Virginia (US)) | Coupon: 4.35% | Maturity: 15/1/2025 | Rating: BB | ISIN: USU3200VAB63 | Z-spread down by 31.9 bp to 53.8 bp (CDS basis: 9.6bp), with the yield to worst at 1.0% and the bond now trading up to 110.4 cents on the dollar (1Y price range: 107.4-110.6).

TOP BONDS MOVES IN THE PAST WEEK - EUR HY

- Issuer: SoftBank Group Corp (Minato-Ku, Japan) | Coupon: 4.00% | Maturity: 19/9/2029 | Rating: BB- | ISIN: XS1684385591 | Z-spread up by 24.7 bp to 354.1 bp, with the yield to worst at 3.2% and the bond now trading down to 104.0 cents on the dollar (1Y price range: 103.7-111.3).

- Issuer: Jaguar Land Rover Automotive PLC (Coventry, United Kingdom) | Coupon: 6.88% | Maturity: 15/11/2026 | Rating: B | ISIN: XS2010037682 | Z-spread up by 16.5 bp to 387.4 bp (CDS basis: -46.4bp), with the yield to worst at 3.4% and the bond now trading down to 115.4 cents on the dollar (1Y price range: 102.3-116.4).

- Issuer: Fortune Star (BVI) Ltd (British Virgin Islands) | Coupon: 3.95% | Maturity: 2/10/2026 | Rating: BB- | ISIN: XS2357132849 | Z-spread up by 12.5 bp to 441.4 bp, with the yield to worst at 4.1% and the bond now trading down to 99.4 cents on the dollar (1Y price range: 99.2-99.8).

- Issuer: Adler Group SA (Senningerberg, Luxembourg) | Coupon: 2.75% | Maturity: 13/11/2026 | Rating: BB+ | ISIN: XS2248826294 | Z-spread up by 9.8 bp to 282.2 bp, with the yield to worst at 2.4% and the bond now trading down to 100.9 cents on the dollar (1Y price range: 99.7-103.2).

- Issuer: Saipem Finance International BV (Amsterdam, Netherlands) | Coupon: 3.13% | Maturity: 31/3/2028 | Rating: BB | ISIN: XS2325696628 | Z-spread up by 9.6 bp to 302.9 bp (CDS basis: 73.2bp), with the yield to worst at 2.7% and the bond now trading down to 101.6 cents on the dollar (1Y price range: 98.5-102.9).

- Issuer: Petroleos Mexicanos (Miguel Hidalgo, Mexico) | Coupon: 4.88% | Maturity: 21/2/2028 | Rating: BB- | ISIN: XS1568888777 | Z-spread up by 8.3 bp to 488.1 bp (CDS basis: -80.6bp), with the yield to worst at 4.6% and the bond now trading down to 101.1 cents on the dollar (1Y price range: 97.7-103.3).

- Issuer: Akropolis Group UAB (Vilnius, Lithuania) | Coupon: 2.88% | Maturity: 2/6/2026 | Rating: BB+ | ISIN: XS2346869097 | Z-spread up by 8.2 bp to 355.2 bp, with the yield to worst at 3.1% and the bond now trading down to 98.3 cents on the dollar (1Y price range: 97.8-99.4).

- Issuer: Renault SA (Boulogne-Billancourt, France) | Coupon: 1.13% | Maturity: 4/10/2027 | Rating: BB | ISIN: FR0013451416 | Z-spread up by 8.1 bp to 250.9 bp (CDS basis: -46.7bp), with the yield to worst at 2.2% and the bond now trading down to 93.2 cents on the dollar (1Y price range: 91.1-95.8).

- Issuer: Standard Industries Inc (Parsippany, New Jersey (US)) | Coupon: 2.25% | Maturity: 21/11/2026 | Rating: BB | ISIN: XS2080766475 | Z-spread up by 7.8 bp to 267.6 bp, with the yield to worst at 2.3% and the bond now trading down to 99.2 cents on the dollar (1Y price range: 97.4-102.9).

- Issuer: Mahle GmbH (Stuttgart, Germany) | Coupon: 2.38% | Maturity: 14/5/2028 | Rating: BB+ | ISIN: XS2341724172 | Z-spread up by 7.3 bp to 263.3 bp, with the yield to worst at 2.3% and the bond now trading down to 99.4 cents on the dollar (1Y price range: 99.1-100.9).

- Issuer: International Consolidated Airlines Group SA (London, Spain) | Coupon: 3.75% | Maturity: 25/3/2029 | Rating: B+ | ISIN: XS2322423539 | Z-spread down by 7.3 bp to 371.2 bp, with the yield to worst at 3.5% and the bond now trading up to 101.0 cents on the dollar (1Y price range: 97.5-102.0).

- Issuer: ACS Actividades de Construccion y Servicios SA (Madrid, Spain) | Coupon: 1.38% | Maturity: 17/6/2025 | Rating: BB+ | ISIN: XS2189592616 | Z-spread down by 8.1 bp to 134.7 bp, with the yield to worst at 0.9% and the bond now trading up to 101.4 cents on the dollar (1Y price range: 100.9-103.4).

- Issuer: Deutsche Lufthansa AG (Cologne, Germany) | Coupon: 3.75% | Maturity: 11/2/2028 | Rating: BB- | ISIN: XS2296203123 | Z-spread down by 9.5 bp to 330.1 bp (CDS basis: -61.6bp), with the yield to worst at 2.9% and the bond now trading up to 103.7 cents on the dollar (1Y price range: 97.6-105.3).

USD BOND ISSUES

- Bank of Montreal (Banking | Montreal, Quebec, Canada | Rating: A+): US$550m Senior Note (US06368ERW48), floating rate (SOFR + 32.0 bp) maturing on 9 July 2024, priced at 100.00, non callable

- Hongkong Land Finance (Cayman Islands) Company Ltd (Financial - Other | Hong Kong | Rating: A): US$500m Senior Note (XS2357744619), fixed rate (2.25% coupon) maturing on 15 July 2031, priced at 99.43 (original spread of 90 bp), callable (10nc10)

- Korea Gas Corp (Oil and Gas | Daegu, Daegu, South Korea | Rating: AA-): US$450m Senior Note (US50066AAQ67), fixed rate (1.13% coupon) maturing on 13 July 2026, priced at 99.70 (original spread of 38 bp), non callable

- Korea Gas Corp (Oil and Gas | Daegu, Daegu, South Korea | Rating: AA-): US$350m Senior Note (US50066AAR41), fixed rate (2.00% coupon) maturing on 13 July 2031, priced at 99.82 (original spread of 65 bp), non callable

- Minerva Luxembourg SA (Financial - Other | Munsbach, Brazil | Rating: NR): US$400m Bond (USL6401PAK95), fixed rate (4.38% coupon) maturing on 18 March 2031, priced at 97.11, callable (10nc1m)

- Mizuho Financial Group Inc (Banking | Chiyoda-Ku, Tokyo-To, Japan | Rating: A-): US$1,100m Senior Note (US60687YBS72), fixed rate (1.55% coupon) maturing on 9 July 2027, priced at 100.00 (original spread of 75 bp), callable (6nc5)

- Mizuho Financial Group Inc (Banking | Chiyoda-Ku, Tokyo-To, Japan | Rating: A-): US$650m Senior Note (US60687YBT55), fixed rate (2.26% coupon) maturing on 9 July 2032, priced at 100.00 (original spread of 90 bp), callable (11nc10)

- Nomura Holdings Inc (Securities | Chiyoda-Ku, Tokyo-To, Japan | Rating: BBB+): US$1,000m Senior Note (US65535HAX70), fixed rate (2.61% coupon) maturing on 14 July 2031, priced at 100.00 (original spread of 125 bp), non callable

- Nomura Holdings Inc (Securities | Chiyoda-Ku, Tokyo-To, Japan | Rating: BBB+): US$1,250m Senior Note (US65535HAW97), fixed rate (1.65% coupon) maturing on 14 July 2026, priced at 100.00 (original spread of 85 bp), non callable

- Nomura Holdings Inc (Securities | Chiyoda-Ku, Tokyo-To, Japan | Rating: BBB+): US$1,000m Senior Note (US65535HAY53), fixed rate (2.17% coupon) maturing on 14 July 2028, priced at 100.00 (original spread of 105 bp), non callable

- Shanghai Pudong Development Bank Co Ltd (Hong Kong Branch) (Banking | China (Mainland) | Rating: NR): US$700m Senior Note (XS2359947715), fixed rate (0.88% coupon) maturing on 13 July 2024, priced at 99.91 (original spread of 47 bp), non callable

- Sino-Ocean Land Treasure Iv Ltd (Financial - Other | China (Mainland) | Rating: NR): US$320m Senior Note (XS2354271251), fixed rate (2.70% coupon) maturing on 13 January 2025, priced at 99.37 (original spread of 245 bp), callable (4nc3)

EUR BOND ISSUES

- American Honda Finance Corp (Leasing | Torrance, California, Japan | Rating: A-): €1,150m Senior Note (XS2363117321), fixed rate (0.30% coupon) maturing on 7 July 2028, priced at 99.67 (original spread of 87 bp), with a make whole call

- France, Republic of (Government) (Sovereign | Paris, Ile-De-France, France | Rating: AA): €5,000m Obligation Assimilable du Tresor (FR0014004J31), fixed rate (0.75% coupon) maturing on 25 May 2053, priced at 95.38 (original spread of 3 bp), non callable

- Gruenenthal GmbH (Pharmaceuticals | Stolberg, Nordrhein-Westfalen, Germany | Rating: B+): €300m Note (XS2363605044), fixed rate (4.13% coupon) maturing on 15 May 2028, priced at 102.00 (original spread of 431 bp), callable (7nc3)

- Mexico (United Mexican States) (Government) (Sovereign | Mexico City, Mexico, D.F., Mexico | Rating: BBB-): €1,250m Senior Note (XS2363910436) zero coupon maturing on 12 August 2036, callable (15nc15)

- Renewi PLC (Service - Other | Milton Keynes, Buckinghamshire, United Kingdom | Rating: NR): €125m Senior Note (XS2353474401), fixed rate (3.00% coupon) maturing on 23 July 2027, priced at 101.88, non callable

- Westpac Securities NZ Limited(LondonBranch) (Financial - Other | Rating: NR): €750m Senior Note (XS2362968906), fixed rate (0.10% coupon) maturing on 13 July 2027, priced at 99.43 (original spread of 78 bp), non callable

NEW LOANS

- Atlantic Aviation Corp (BB), signed a US$ 350m Term Loan, maturing on 07/20/29.

- Atlantic Aviation Corp (BB), signed a US$ 1,300m Term Loan B maturing on 07/20/28.

- Atlantic Aviation Corp (BB), signed a US$ 225m Revolving Credit Facility maturing on 07/20/26.

- A2A SpA (BBB), signed a € 500m Revolving Credit Facility, to be used for general corporate purposes. It matures on 07/02/26.

- Biogroup SCM, signed a € 300m Term Loan B, to be used for general corporate purposes. It matures on 02/09/28.

- Fresenius Medical Care AG & Co (BBB), signed a € 2,000m Revolving Credit Facility, to be used for general corporate purposes. It matures on 07/02/26.

- Vivalto Sante SAS, signed a € 890m Term Loan B, to be used for general corporate purposes. It matures on 07/20/28.

- Vivalto Sante SAS, signed a € 200m Revolving Credit Facility, to be used for general corporate purposes. It matures on 01/20/28.

NEW ISSUES IN SECURITIZED CREDIT

- Rate Mortgage Trust 2021-J1 issued a fixed-rate RMBS in 4 tranches, for a total of US$ 358 m. Highest-rated tranche offering a yield to maturity of 2.45%, and the lowest-rated tranche a yield to maturity of 2.45%. Bookrunners: JP Morgan & Co Inc, Bank of America Merrill Lynch

- Ladder Capital Commercial Mortgage Securities LLC 2021-Fl2 Trust issued a floating-rate CLO in 6 tranches, for a total of US$ 498 m. Highest-rated tranche offering a spread over the floating rate of 120bp, and the lowest-rated tranche a spread of 365bp. Bookrunners: JP Morgan & Co Inc, Wells Fargo Securities LLC

- Mello Mortgage Capital Acceptance 2021-Mtg3 issued a floating-rate RMBS in 5 tranches, for a total of US$ 309 m. Highest-rated tranche offering a spread over the floating rate of 85bp, and the lowest-rated tranche a spread of 85bp. Bookrunners: Amherst Securities Corp., Bank of America Merrill Lynch

- NewDay Funding Master Issuer PLC 2021-2 issued a floating-rate ABS backed by receivables in 1 tranche, for a total of US$ 104 m. Highest-rated tranche offering a spread over the floating rate of 95bp, and the lowest-rated tranche a spread of 95bp. Bookrunners: HSBC Bank PLC, Citi, SMBC Nikko Securities Inc, BofA Securities Inc

- Angel Oak Mortgage Trust 2021-3 issued a fixed-rate RMBS in 5 tranches, for a total of US$ 292 m. Highest-rated tranche offering a yield to maturity of 1.07%, and the lowest-rated tranche a yield to maturity of 3.29%. Bookrunners: Barclays Capital Group, Deutsche Bank Securities Inc