Credit

IG Spreads Modestly Higher, HY Unchanged As iBOXX USD Liquid Bond Indices Rise

A decent summer day in the primary bond market, with foreign corporates ENEL and Xiaomi raising US$ 4bn and US$ 1.2bn respectively

Published ET

Sabre Holdings 5Y USD CDS Spread | Source: Refinitiv

QUICK SUMMARY

- S&P 500 Bond Index was up 0.39% today, with investment grade up 0.41% and high yield up 0.22%

- The iBoxx USD Liquid Investment Grade Total Return Index was up 0.25% today (Month-to-date: 0.92%; Year-to-date: -0.68%)

- The iBoxx USD Liquid High Yield Total Return Index was up 0.10% today (Month-to-date: 0.36%; Year-to-date: 3.42%)

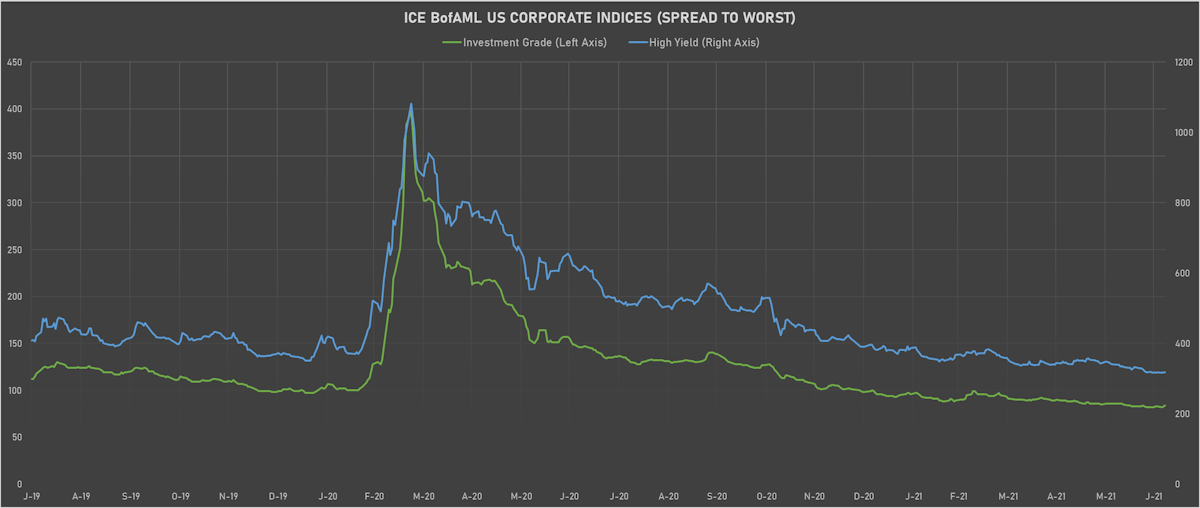

- ICE BofA US Corporate Index (Investment Grade) spread to worst up 1.0 bp, now at 84.0 bp (YTD change: -14.0 bp)

- ICE BofA US High Yield Index spread to worst unchanged, now at 318.0 bp (YTD change: -72.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index down -0.01% today (YTD total return: +2.2%)

- New issues: US$ 8.0bn in dollars and € 9.6bn in euros

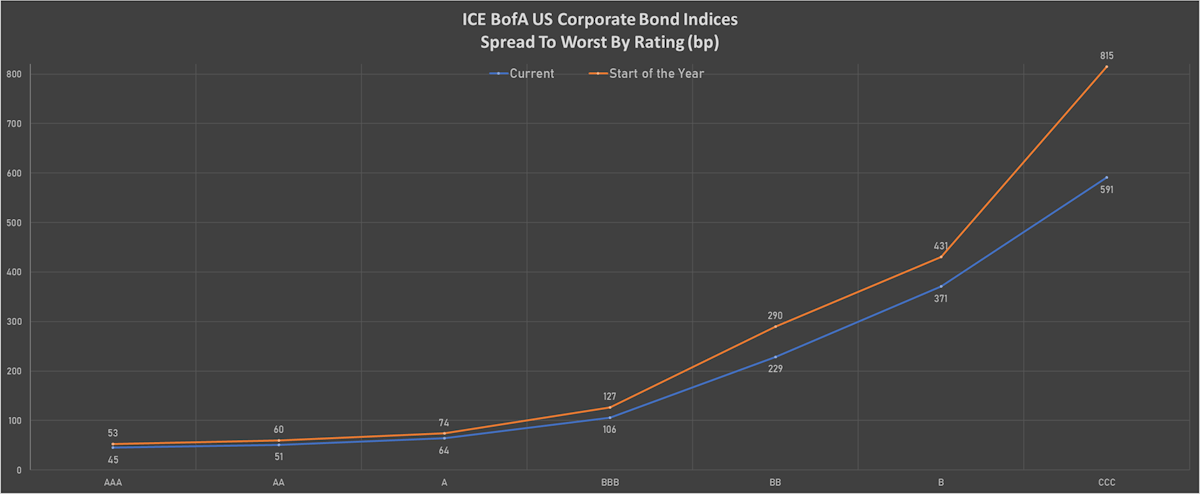

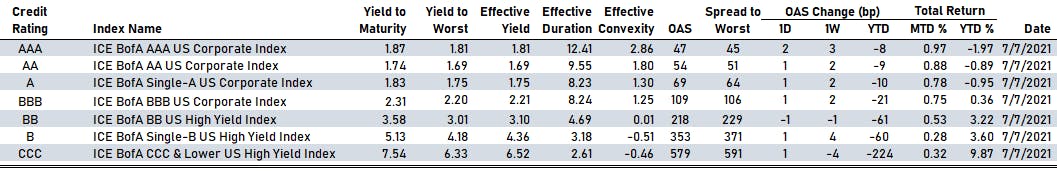

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

- AAA up by 2 bp at 47 bp

- AA up by 1 bp at 54 bp

- A up by 1 bp at 69 bp

- BBB up by 1 bp at 109 bp

- BB down by -1 bp at 218 bp

- B up by 1 bp at 353 bp

- CCC up by 1 bp at 579 bp

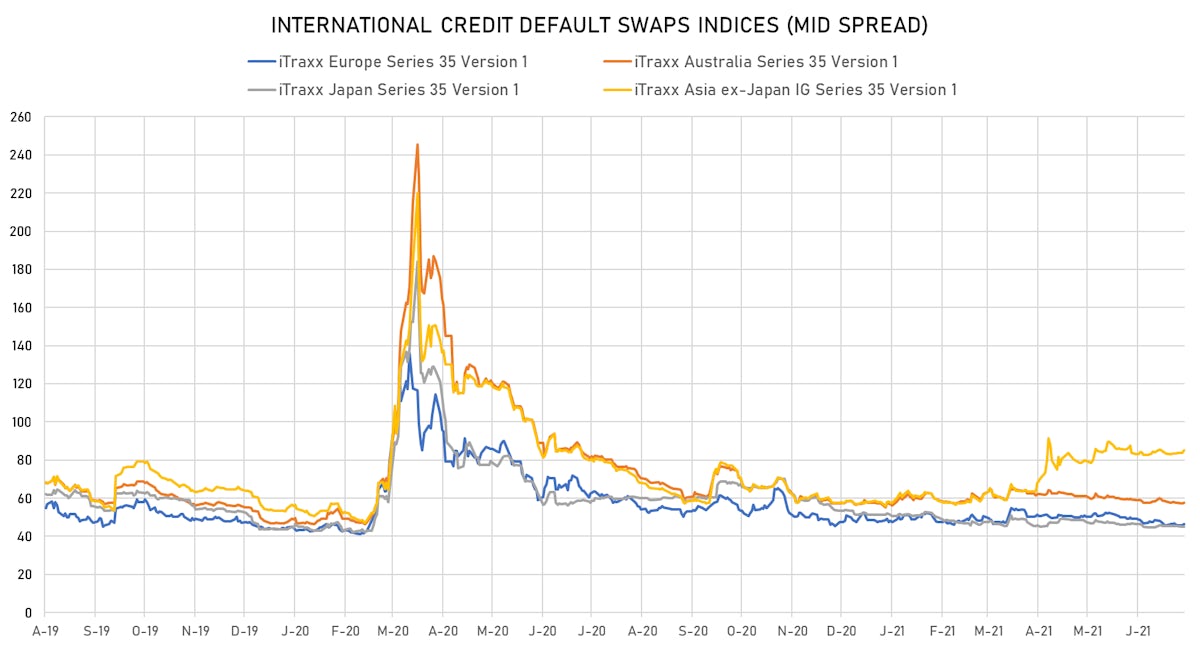

CDS INDICES (mid-spreads)

- Markit CDX.NA.IG 5Y up 0.4 bp, now at 48bp (YTD change: -2.0bp)

- Markit CDX.NA.HY 5Y up 2.1 bp, now at 275bp (YTD change: -17.9bp)

- Markit iTRAXX Europe down 0.3 bp, now at 46bp (YTD change: -1.7bp)

- Markit iTRAXX Japan up 0.3 bp, now at 45bp (YTD change: -6.0bp)

- Markit iTRAXX Asia Ex-Japan up 1.8 bp, now at 87bp (YTD change: +28.9bp)

LARGEST USD CORPORATE CDS MOVES IN THE PAST WEEK

- Transocean Inc (Country: KY; rated: Caa3): down 157.6 bp to 1,099.6bp (1Y range: 941-7,695bp)

- Bombardier Inc (Country: CA; rated: Caa2): down 46.7 bp to 460.1bp (1Y range: 432-1,912bp)

- Pitney Bowes Inc (Country: US; rated: LGD2 - 16%): down 21.1 bp to 416.0bp (1Y range: 366-1,458bp)

- Staples Inc (Country: US; rated: B2): down 18.9 bp to 838.4bp (1Y range: 652-2,081bp)

- Calpine Corp (Country: US; rated: LGD5 - 88%): down 18.1 bp to 300.4bp (1Y range: 173-349bp)

- Sabre Holdings Corp (Country: US; rated: Ba3): down 14.8 bp to 355.0bp (1Y range: 337-611bp)

- iStar Inc (Country: US; rated: BBB-): down 14.2 bp to 257.2bp (1Y range: 199-324bp)

- Radian Group Inc (Country: US; rated: BBB-): down 12.8 bp to 168.5bp (1Y range: 170-385bp)

- Gap Inc (Country: US; rated: Ba2): down 12.5 bp to 146.3bp (1Y range: 144-308bp)

- Liberty Interactive LLC (Country: US; rated: Ba3): down 12.0 bp to 277.5bp (1Y range: 249-404bp)

- Mattel Inc (Country: US; rated: Ba2): down 11.0 bp to 207.4bp (1Y range: 193-397bp)

- Avis Budget Car Rental LLC (Country: US; rated: WR): up 11.7 bp to 267.2bp (1Y range: 137-2,386bp)

- American Airlines Group Inc (Country: US; rated: B2): up 22.0 bp to 633.1bp (1Y range: 596-3,660bp)

- Rite Aid Corp (Country: US; rated: Caa1): up 41.7 bp to 878.4bp (1Y range: 497-910bp)

- Talen Energy Supply LLC (Country: US; rated: B2): up 648.6 bp to 2,161.8bp (1Y range: 875-2,561bp)

LARGEST EURO CORPORATE CDS MOVES IN THE PAST WEEK

- Casino Guichard Perrachon SA (Country: FR; rated: WR): down 13.0 bp to 494.7bp (1Y range: 494-1,210bp)

- Hammerson PLC (Country: GB; rated: Baa3): down 11.5 bp to 188.5bp (1Y range: 188-604bp)

- Banca Monte dei Paschi di Siena SpA (Country: IT; rated: NP): down 11.2 bp to 216.8bp (1Y range: 188-272bp)

- Monitchem Holdco 3 SA (Country: LU; rated: B2): down 9.6 bp to 239.5bp (1Y range: 238-393bp)

- Thyssenkrupp AG (Country: DE; rated: B1): down 9.3 bp to 296.2bp (1Y range: 206-479bp)

- Stena AB (Country: SE; rated: B2-PD): down 6.2 bp to 518.4bp (1Y range: 518-750bp)

- Ineos Group Holdings SA (Country: LU; rated: LGD5 - 88%): down 5.2 bp to 220.9bp (1Y range: 219-447bp)

- Louis Dreyfus Co BV (Country: NL; rated: ): down 3.7 bp to 117.0bp (1Y range: -116bp)

- J Sainsbury PLC (Country: GB; rated: WR): up 3.6 bp to 69.7bp (1Y range: 52-80bp)

- Air France KLM SA (Country: FR; rated: B-): up 6.7 bp to 400.5bp (1Y range: 392-1,211bp)

- Accor SA (Country: FR; rated: B): up 7.1 bp to 143.6bp (1Y range: 136-255bp)

- Deutsche Lufthansa AG (Country: DE; rated: Ba2): up 12.4 bp to 251.5bp (1Y range: 236-421bp)

- Stonegate Pub Company Financing PLC (Country: GB; rated: WR): up 21.6 bp to 509.0bp (1Y range: 486-984bp)

- Boparan Finance PLC (Country: GB; rated: B3): up 27.1 bp to 915.8bp (1Y range: 478-911bp)

- TUI AG (Country: DE; rated: LGD4 - 50%): up 67.7 bp to 710.3bp (1Y range: 590-1,799bp)

USD BOND ISSUES

- Equitable Financial Life Global Funding (Financial - Other | Wilmington, United States | Rating: NR): US$500m Note (US29449W7M32), fixed rate (1.30% coupon) maturing on 12 July 2026, priced at 99.81 (original spread of 55 bp), non callable

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$200m Bond (US3133EMQ962), floating rate (AB3DM + 2.5 bp) maturing on 13 July 2023, priced at 100.00, non callable

- China Modern Dairy Holdings Ltd (Industrials - Other | Ma'Anshan, Hong Kong | Rating: BBB): US$500m Senior Note (XS2355517728), fixed rate (2.13% coupon) maturing on 14 July 2026, priced at 99.72 (original spread of 140 bp), callable (5nc5)

- ENEL Finance International NV (Financial - Other | Amsterdam, Italy | Rating: NR): US$1,000m Senior Note (US29278GAN88), fixed rate (1.88% coupon) maturing on 12 July 2028, priced at 99.60 (original spread of 85 bp), callable (7nc7)

- ENEL Finance International NV (Financial - Other | Amsterdam, Italy | Rating: NR): US$750m Senior Note (US29278GAQ10), fixed rate (2.88% coupon) maturing on 12 July 2041, priced at 98.77 (original spread of 110 bp), callable (20nc20)

- ENEL Finance International NV (Financial - Other | Amsterdam, Italy | Rating: NR): US$1,000m Senior Note (US29278GAP37), fixed rate (2.25% coupon) maturing on 12 July 2031, priced at 99.38 (original spread of 103 bp), callable (10nc10)

- ENEL Finance International NV (Financial - Other | Amsterdam, Italy | Rating: NR): US$1,250m Senior Note (US29278GAM06), fixed rate (1.38% coupon) maturing on 12 July 2026, priced at 99.51 (original spread of 70 bp), callable (5nc5)

- Hyundai-Assan Otomotiv Sanayi ve Ticaret AS (Industrials - Other | Istanbul, South Korea | Rating: BBB+): US$300m Senior Note (XS2362559481), fixed rate (1.63% coupon) maturing on 12 July 2026, priced at 99.60 (original spread of 85 bp), non callable

- Nestle Holdings Inc (Consumer Products | Arlington, Switzerland | Rating: AA-): US$300m Senior Note (XS2363914933), fixed rate (1.13% coupon) maturing on 13 July 2026, priced at 99.92 (original spread of 33 bp), callable (5nc5)

- No Va Land Investment Group Corp (Building Products | Ho Chi Minh, Ho Chi Minh, Vietnam | Rating: NR): US$300m Bond (XS2364281175), fixed rate (5.00% coupon) maturing on 16 July 2026, priced at 100.00, non callable, convertible

- Shenwan Hongyuan International Finance Ltd (Financial - Other | Rating: NR): US$500m Senior Note (XS2334569774), fixed rate (1.80% coupon) maturing on 14 July 2026, priced at 99.82 (original spread of 105 bp), non callable

- Xiaomi Best Time International Ltd (Financial - Other | China (Mainland) | Rating: BBB-): US$400m Bond (US98422HAD89), fixed rate (4.10% coupon) maturing on 14 July 2051, priced at 98.99 (original spread of 220 bp), callable (30nc30)

- Xiaomi Best Time International Ltd (Financial - Other | China (Mainland) | Rating: BBB-): US$800m Bond (US98422HAC07), fixed rate (2.88% coupon) maturing on 14 July 2031, priced at 99.14 (original spread of 165 bp), callable (10nc10)

EUR BOND ISSUES

- A2A SpA (Utility - Other | Milan, Italy | Rating: BBB): €500m Senior Note (XS2364001078), fixed rate (0.63% coupon) maturing on 15 July 2031, priced at 99.55 (original spread of 101 bp), callable (10nc10)

- Andalucia, Autonomous Community of (Official and Muni | Sevilla, Spain | Rating: BBB-): €500m Bond (ES0000090888), fixed rate (0.70% coupon) maturing on 30 July 2033, priced at 99.66 (original spread of 60 bp), non callable

- Banco Santander SA (Banking | Boadilla Del Monte, Spain | Rating: AA+): €220m Cedula Hipotecaria (Covered Bond) (ES0413900756), fixed rate (0.18% coupon) maturing on 8 July 2031, non callable

- Deutsche Lufthansa AG (Airline | Cologne, Germany | Rating: BB-): €500m Senior Note (XS2363244513), fixed rate (2.00% coupon) maturing on 14 July 2024, priced at 99.28 (original spread of 297 bp), callable (3nc3)

- Deutsche Lufthansa AG (Airline | Cologne, Germany | Rating: BB-): €500m Senior Note (XS2363235107), fixed rate (3.50% coupon) maturing on 14 July 2029, priced at 98.30 (original spread of 424 bp), callable (8nc8)

- JAB Holdings BV (Financial - Other | Amsterdam, Luxembourg | Rating: NR): €500m Senior Note (DE000A3KPTG6), fixed rate (1.00% coupon) maturing on 14 July 2031, priced at 99.70, non callable

- Nemak SAB de CV (Industrials - Other | San Pedro Garza Garcia, Mexico | Rating: BB+): €500m Senior Note (XS2362996519), fixed rate (2.25% coupon) maturing on 20 July 2028, priced at 100.00, callable (7nc7)

- Parts Europe SA (Vehicle Parts | Arcueil | Rating: NR): €380m Note (XS2363232930), floating rate (EU03MLIB + 400.0 bp) maturing on 20 July 2027, priced at 100.00, callable (6nc1)

- Prosus NV (Financial - Other | Amsterdam, South Africa | Rating: BBB-): €1,000m Senior Note (XS2360853332), fixed rate (1.29% coupon) maturing on 13 July 2029, priced at 100.00 (original spread of 177 bp), callable (8nc8)

- Prosus NV (Financial - Other | Amsterdam, South Africa | Rating: BBB-): €850m Senior Note (XS2363203675), fixed rate (1.99% coupon) maturing on 13 July 2033, priced at 100.00 (original spread of 231 bp), callable (12nc12)

- Romania (Government) (Sovereign | Bucuresti, Romania | Rating: BBB-): €2,000m Senior Note (XS2364199757), fixed rate (1.75% coupon) maturing on 13 July 2030, priced at 99.95 (original spread of 218 bp), non callable

- Romania (Government) (Sovereign | Bucuresti, Romania | Rating: BBB-): €1,500m Senior Note (XS2364200357), fixed rate (2.88% coupon) maturing on 13 April 2042, priced at 98.22 (original spread of 307 bp), non callable

- Royal Bank of Canada (Banking | Toronto, Canada | Rating: A): €160m Senior Note (XS2364424544), fixed rate (0.51% coupon) maturing on 15 July 2041, non callable

- Sparebank 1 SR Bank ASA (Banking | Stavanger, Norway | Rating: A-): €500m Note (XS2363982344), floating rate maturing on 15 July 2027, priced at 99.70 (original spread of 108 bp), callable (6nc5)

NEW LOANS

- Sabre Holdings Corp, signed a US$ 645m Term Loan B, to be used for general corporate purposes. It matures on 12/17/27 and initial pricing is set at LIBOR +350.000bps

- AmWINS Group Inc (B-), signed a US$ 890m Term Loan, to be used for refinancing

- AmWINS Group Inc (B-), signed a US$ 500m Term Loan B, to be used for refinancing

- Navitas Midstream Midland (B), signed a US$ 685m Term Loan B, to be used for general corporate purposes. It matures on 12/13/24.

- Verizon Communications Inc (BBB+), signed a US$ 1,500m Term Loan B, to be used for leveraged buyout.

- ATI Physical Therapy LLC, signed a US$ 570m Term Loan B, to be used for general corporate purposes. It matures on 07/22/28.