Credit

Spreads Wider Across The US Credit Complex

Very little activity in the US corporate primary bond market, with financials dominating the scene

Published ET

Durations Still Rising In US Corporate Investment Grade | Sources: ϕpost, Refinitiv data

QUICK SUMMARY

- The iBoxx USD Liquid Investment Grade Total Return Index was up 0.04% today (Month-to-date: 0.96%; Year-to-date: -0.64%)

- The iBoxx USD Liquid High Yield Total Return Index was down -0.15% today (Month-to-date: 0.22%; Year-to-date: 3.26%)

- ICE BofA US Corporate Index (Investment Grade) spread to worst up 2.0 bp, now at 86.0 bp (YTD change: -12.0 bp)

- ICE BofA US High Yield Index spread to worst up 9.0 bp, now at 327.0 bp (YTD change: -63.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index down -0.06% today (YTD total return: +2.2%)

- New issues: US$ 3.5bn in dollars and € 7.1bn in euros

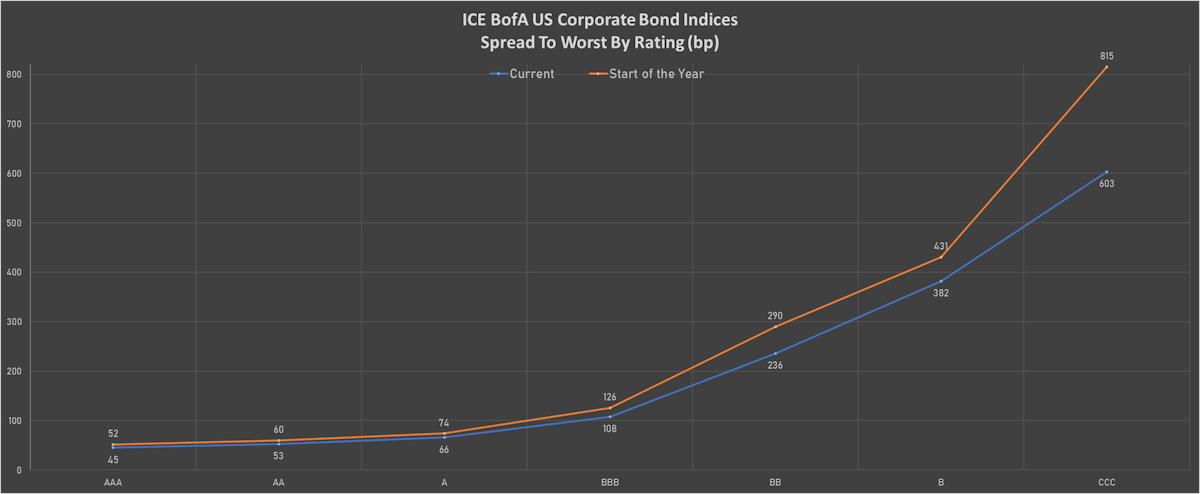

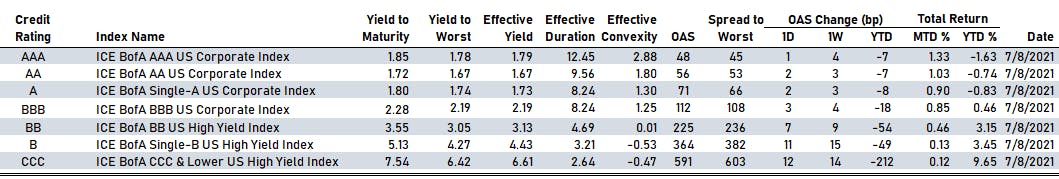

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

- AAA up by 1 bp at 48 bp

- AA up by 2 bp at 56 bp

- A up by 2 bp at 71 bp

- BBB up by 3 bp at 112 bp

- BB up by 7 bp at 225 bp

- B up by 11 bp at 364 bp

- CCC up by 12 bp at 591 bp

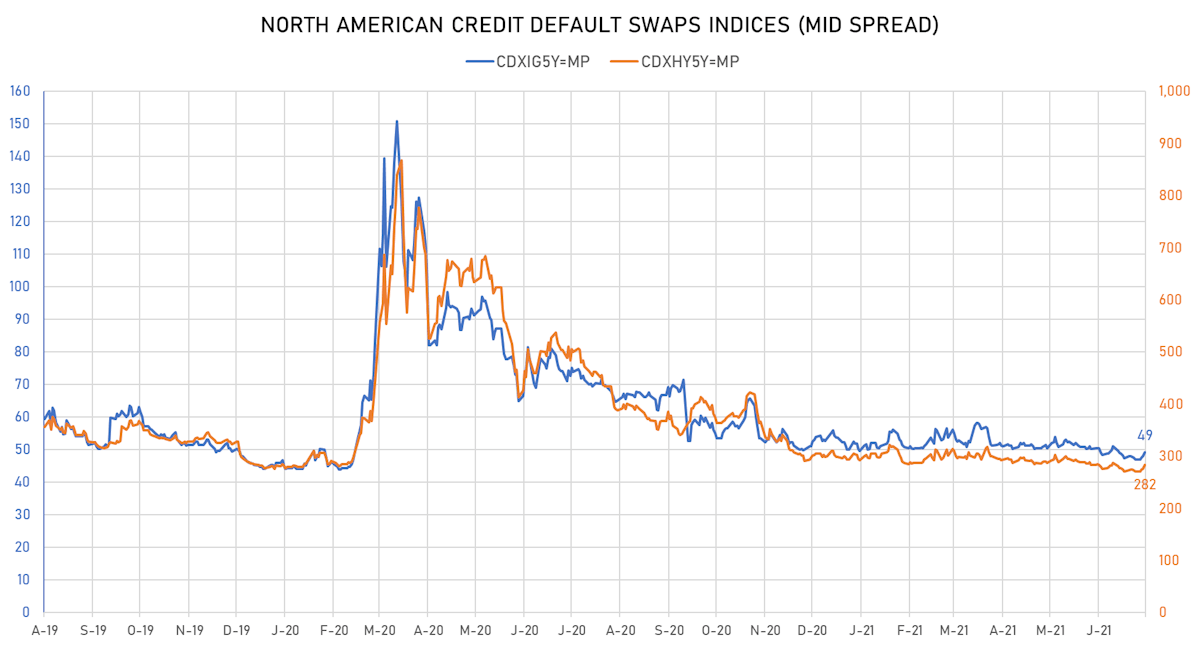

CDS INDICES (mid-spreads)

- Markit CDX.NA.IG 5Y up 1.1 bp, now at 49bp (YTD change: -0.9bp)

- Markit CDX.NA.HY 5Y up 7.1 bp, now at 282bp (YTD change: -10.8bp)

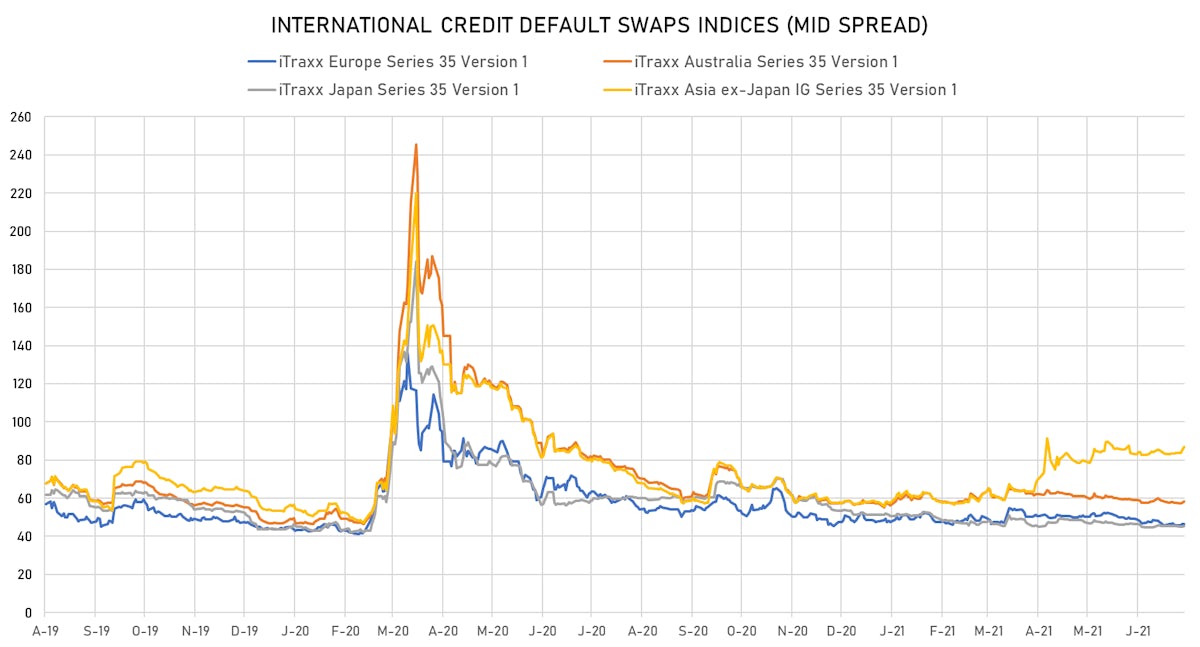

- Markit iTRAXX Europe up 1.4 bp, now at 48bp (YTD change: -0.3bp)

- Markit iTRAXX Japan up 0.1 bp, now at 45bp (YTD change: -5.9bp)

- Markit iTRAXX Asia Ex-Japan up 2.1 bp, now at 89bp (YTD change: +31.0bp)

TOP BONDS MOVES IN THE PAST WEEK - USD HY

- Issuer: Guacolda Energia SA (LAS CONDES, Chile) | Coupon: 4.56% | Maturity: 30/4/2025 | Rating: B+ | ISIN: USP3711HAF66 | Z-spread up by 187.9 bp to 1,746.4 bp, with the yield to worst at 17.6% and the bond now trading down to 63.9 cents on the dollar (1Y price range: 64.0-92.1).

- Issuer: Vedanta Resources Finance II PLC (London, United Kingdom) | Coupon: 8.95% | Maturity: 11/3/2025 | Rating: B- | ISIN: USG9T27HAD62 | Z-spread up by 59.3 bp to 952.6 bp, with the yield to worst at 9.8% and the bond now trading down to 96.5 cents on the dollar (1Y price range: 94.3-99.8).

- Issuer: American Airlines Group Inc (Fort Worth, Texas (US)) | Coupon: 3.75% | Maturity: 1/3/2025 | Rating: CCC | ISIN: USU0242AAD47 | Z-spread up by 54.3 bp to 621.0 bp (CDS basis: -26.7bp), with the yield to worst at 6.5% and the bond now trading down to 90.6 cents on the dollar (1Y price range: 71.0-93.1).

- Issuer: WeWork Companies Inc (New York City, New York (US)) | Coupon: 7.88% | Maturity: 1/5/2025 | Rating: CC | ISIN: USU96217AA99 | Z-spread up by 33.4 bp to 624.1 bp, with the yield to worst at 6.4% and the bond now trading down to 103.8 cents on the dollar (1Y price range: 67.5-104.8).

- Issuer: NCL Corporation Ltd (Miami, Bermuda) | Coupon: 5.88% | Maturity: 15/3/2026 | Rating: CCC+ | ISIN: USG6436QAL08 | Z-spread up by 32.3 bp to 418.3 bp, with the yield to worst at 4.8% and the bond now trading down to 103.8 cents on the dollar (1Y price range: 98.5-105.3).

- Issuer: SoftBank Group Corp (Minato-ku, Japan) | Coupon: 6.00% | Maturity: 30/7/2025 | Rating: BB- | ISIN: XS1266660122 | Z-spread up by 30.9 bp to 290.2 bp, with the yield to worst at 3.4% and the bond now trading down to 108.8 cents on the dollar (1Y price range: 108.6-112.5).

- Issuer: Royal Caribbean Cruises Ltd (Miami, Liberia) | Coupon: 5.50% | Maturity: 1/4/2028 | Rating: B | ISIN: USV7780TAE39 | Z-spread up by 30.6 bp to 375.9 bp (CDS basis: 6.6bp), with the yield to worst at 4.6% and the bond now trading down to 104.0 cents on the dollar (1Y price range: 100.1-105.9).

- Issuer: Bank Muscat SAOG (Muscat, Oman) | Coupon: 4.75% | Maturity: 17/3/2026 | Rating: BB- | ISIN: XS2310799809 | Z-spread up by 26.0 bp to 326.7 bp, with the yield to worst at 3.8% and the bond now trading down to 103.3 cents on the dollar (1Y price range: 101.7-105.1).

- Issuer: Seazen Group Ltd (Shanghai, Cayman Islands) | Coupon: 6.00% | Maturity: 12/8/2024 | Rating: BB+ | ISIN: XS2215175634 | Z-spread up by 25.1 bp to 437.7 bp, with the yield to worst at 4.5% and the bond now trading down to 103.4 cents on the dollar (1Y price range: 102.3-105.8).

- Issuer: Taylor Morrison Communities Inc (Scottsdale, Arizona (US)) | Coupon: 5.88% | Maturity: 15/6/2027 | Rating: BB- | ISIN: USU8760NAA73 | Z-spread up by 25.0 bp to 257.4 bp, with the yield to worst at 3.3% and the bond now trading down to 112.4 cents on the dollar (1Y price range: 108.5-113.6).

- Issuer: Tata Motors Ltd (Mumbai, India) | Coupon: 5.88% | Maturity: 20/5/2025 | Rating: B+ | ISIN: XS2079668609 | Z-spread up by 24.7 bp to 345.3 bp (CDS basis: -101.5bp), with the yield to worst at 3.8% and the bond now trading down to 106.5 cents on the dollar (1Y price range: 103.4-107.1).

- Issuer: Icahn Enterprises LP (Sunny Isles Beach, Florida (US)) | Coupon: 4.38% | Maturity: 1/2/2029 | Rating: BB- | ISIN: USU44927AZ18 | Z-spread up by 23.9 bp to 329.2 bp, with the yield to worst at 4.3% and the bond now trading down to 99.9 cents on the dollar (1Y price range: 96.3-101.5).

- Issuer: Syngenta Finance NV (Enkhuizen, Netherlands) | Coupon: 4.44% | Maturity: 24/4/2023 | Rating: BB | ISIN: USN84413CM88 | Z-spread down by 28.9 bp to 93.1 bp, with the yield to worst at 1.0% and the bond now trading up to 105.5 cents on the dollar (1Y price range: 101.5-106.4).

- Issuer: Dilijan Finance BV (Amsterdam, Netherlands) | Coupon: 6.50% | Maturity: 28/1/2025 | Rating: B+ | ISIN: XS2080321198 | Z-spread down by 30.9 bp to 570.8 bp, with the yield to worst at 5.9% and the bond now trading up to 101.0 cents on the dollar (1Y price range: 93.6-101.0).

- Issuer: Banco Safra SA (Cayman Islands Branch) (George Town, Cayman Islands) | Coupon: 4.13% | Maturity: 8/2/2023 | Rating: BB- | ISIN: US05964TAQ22 | Z-spread down by 36.5 bp to 122.2 bp, with the yield to worst at 1.2% and the bond now trading up to 104.2 cents on the dollar (1Y price range: 102.3-104.8).

TOP BONDS MOVES IN THE PAST WEEK - EUR HY

- Issuer: Deutsche Lufthansa AG (Cologne, Germany) | Coupon: 3.75% | Maturity: 11/2/2028 | Rating: BB- | ISIN: XS2296203123 | Z-spread up by 33.6 bp to 364.8 bp (CDS basis: -80.4bp), with the yield to worst at 3.3% and the bond now trading down to 101.9 cents on the dollar (1Y price range: 97.6-105.3).

- Issuer: Saipem Finance International BV (Amsterdam, Netherlands) | Coupon: 3.13% | Maturity: 31/3/2028 | Rating: BB | ISIN: XS2325696628 | Z-spread up by 29.0 bp to 328.2 bp (CDS basis: 50.5bp), with the yield to worst at 2.9% and the bond now trading down to 100.3 cents on the dollar (1Y price range: 98.5-102.9).

- Issuer: Petroleos Mexicanos (Miguel Hidalgo, Mexico) | Coupon: 4.88% | Maturity: 21/2/2028 | Rating: BB- | ISIN: XS1568888777 | Z-spread up by 15.2 bp to 495.0 bp (CDS basis: -83.0bp), with the yield to worst at 4.6% and the bond now trading down to 100.8 cents on the dollar (1Y price range: 97.7-103.3).

- Issuer: International Consolidated Airlines Group SA (London, Spain) | Coupon: 3.75% | Maturity: 25/3/2029 | Rating: B+ | ISIN: XS2322423539 | Z-spread up by 14.0 bp to 389.7 bp, with the yield to worst at 3.6% and the bond now trading down to 100.1 cents on the dollar (1Y price range: 97.5-102.0).

- Issuer: Standard Industries Inc (Parsippany, New Jersey (US)) | Coupon: 2.25% | Maturity: 21/11/2026 | Rating: BB | ISIN: XS2080766475 | Z-spread up by 9.9 bp to 272.0 bp, with the yield to worst at 2.4% and the bond now trading down to 99.1 cents on the dollar (1Y price range: 97.4-102.9).

- Issuer: Mahle GmbH (Stuttgart, Germany) | Coupon: 2.38% | Maturity: 14/5/2028 | Rating: BB+ | ISIN: XS2341724172 | Z-spread up by 8.4 bp to 268.9 bp, with the yield to worst at 2.4% and the bond now trading down to 99.3 cents on the dollar (1Y price range: 99.1-100.9).

- Issuer: Renault SA (Boulogne-Billancourt, France) | Coupon: 2.50% | Maturity: 1/4/2028 | Rating: BB | ISIN: FR0014002OL8 | Z-spread up by 7.9 bp to 268.2 bp (CDS basis: -62.0bp), with the yield to worst at 2.3% and the bond now trading down to 100.2 cents on the dollar (1Y price range: 98.4-101.3).

- Issuer: Adler Group SA (Senningerberg, Luxembourg) | Coupon: 1.88% | Maturity: 14/1/2026 | Rating: BB+ | ISIN: XS2283224231 | Z-spread up by 7.8 bp to 276.4 bp, with the yield to worst at 2.3% and the bond now trading down to 97.7 cents on the dollar (1Y price range: 96.4-99.6).

- Issuer: Telecom Italia SpA (Rome, Italy) | Coupon: 1.63% | Maturity: 18/1/2029 | Rating: BB | ISIN: XS2288109676 | Z-spread up by 6.8 bp to 206.4 bp (CDS basis: 1.6bp), with the yield to worst at 1.9% and the bond now trading down to 98.1 cents on the dollar (1Y price range: 96.8-100.1).

- Issuer: ACS Actividades de Construccion y Servicios SA (Madrid, Spain) | Coupon: 1.38% | Maturity: 17/6/2025 | Rating: BB+ | ISIN: XS2189592616 | Z-spread up by 6.6 bp to 134.7 bp, with the yield to worst at 0.9% and the bond now trading down to 101.5 cents on the dollar (1Y price range: 100.9-103.4).

- Issuer: Syngenta Finance NV (Enkhuizen, Netherlands) | Coupon: 1.25% | Maturity: 10/9/2027 | Rating: BB | ISIN: XS1199954691 | Z-spread down by 12.5 bp to 97.4 bp, with the yield to worst at 0.7% and the bond now trading up to 103.0 cents on the dollar (1Y price range: 93.2-103.0).

- Issuer: Akropolis Group UAB (Vilnius, Lithuania) | Coupon: 2.88% | Maturity: 2/6/2026 | Rating: BB+ | ISIN: XS2346869097 | Z-spread down by 13.7 bp to 354.4 bp, with the yield to worst at 3.1% and the bond now trading up to 98.5 cents on the dollar (1Y price range: 97.8-99.4).

USD BOND ISSUES

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$180m Bond (US3133EMS786), fixed rate (2.00% coupon) maturing on 14 April 2033, priced at 100.00 (original spread of 72 bp), callable (12nc3m)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$210m Bond (US3133EMR952), fixed rate (2.31% coupon) maturing on 14 July 2036, priced at 100.00 (original spread of 85 bp), callable (15nc1)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$140m Bond (US3133EMS869), fixed rate (2.00% coupon) maturing on 14 July 2033, priced at 100.00, callable (12nc1)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$350m Bond (US3133EMS372), fixed rate (0.13% coupon) maturing on 14 July 2023, priced at 100.00, non callable

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$150m Bond (US3133EMS521), floating rate (PRQ + -310.0 bp) maturing on 15 July 2024, priced at 100.00, non callable

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$170m Bond (US3133EMQ707), fixed rate (1.15% coupon) maturing on 14 October 2027, priced at 100.00 (original spread of 114 bp), callable (6nc3m)

- Bright Galaxy International Ltd (Financial - Other | Hong Kong | Rating: NR): US$517m Bond (XS2314498333), fixed rate (3.25% coupon) maturing on 15 July 2026, priced at 99.11 (original spread of 270 bp), non callable

- Deutsche Bank AG (Banking | Frankfurt, Hessen, Germany | Rating: BBB): US$500m Note (XS0459855390), fixed rate (1.35% coupon) maturing on 5 August 2027, priced at 100.00, non callable

- Dexia Credit Local SA (Banking | Courbevoie, Ile-De-France, Belgium | Rating: BBB-): US$1,000m Senior Note (US25214BBB99), fixed rate (0.50% coupon) maturing on 16 July 2024, priced at 99.79 (original spread of 20 bp), non callable

- Rail Capital Markets PLC (Financial - Other | London, United Kingdom | Rating: NR): US$300m Loan Participation Note (XS2365120885), fixed rate (7.88% coupon) maturing on 15 July 2026, priced at 100.00, callable (5nc5)

EUR BOND ISSUES

- Action Logement Services SASU (Service - Other | Paris, Ile-De-France, France | Rating: AA): €1,000m Senior Note (FR0014004JA7), fixed rate (0.75% coupon) maturing on 19 July 2041, priced at 98.75 (original spread of 92 bp), non callable

- Baden Wuerttemberg, State of (Official and Muni | Stuttgart, Baden-Wuerttemberg, Germany | Rating: AA+): €750m Jumbo Landesschatzanweisung (DE000A14JZT4), floating rate (EU06MLIB + 100.0 bp) maturing on 20 July 2026, priced at 105.47, non callable

- Banco BPM SpA (Banking | Verona, Verona, Italy | Rating: BB): €500m Note (XS2365097455), fixed rate (0.88% coupon) maturing on 15 July 2026, priced at 99.49 (original spread of 164 bp), non callable

- Credit Industriel et Commercial SA (Banking | Paris, France | Rating: A): €150m Unsecured Note (XS2365074249), fixed rate (3.90% coupon) maturing on 20 December 2029, priced at 100.00, non callable

- Credit Mutuel Home Loan SFH SA (Financial - Other | Paris, Ile-De-France, France | Rating: NR): €1,000m Obligation de Financement de l'Habitat (Covered Bond) (FR0014004KP3), fixed rate (0.01% coupon) maturing on 20 July 2028, priced at 101.20 (original spread of 37 bp), non callable

- Deutsche Bank AG (Banking | Frankfurt, Hessen, Germany | Rating: BBB): €500m Inhaberschuldverschreibung (DE000DB9U4M0), floating rate maturing on 9 August 2028, priced at 100.00, non callable

- DZ Hyp AG (Mortgage Banking | Hamburg, Hamburg, Germany | Rating: A+): €750m Hypothekenpfandbrief (Covered Bond) (DE000A3E5UU2), fixed rate (0.01% coupon) maturing on 15 November 2030, priced at 100.43 (original spread of 38 bp), non callable

- International Development Association (Supranational | Washington, Washington Dc, United States | Rating: AAA): €2,000m Senior Note (XS2364756036) zero coupon maturing on 15 July 2031, priced at 99.77 (original spread of 39 bp), non callable

- Motor Oil Hellas Corinth Refineries SA (Oil and Gas | Athina, Attiki, Greece | Rating: NR): €400m Senior Note (XS2364001151), fixed rate (2.13% coupon) maturing on 19 July 2026, priced at 99.47 (original spread of 290 bp), non callable

NEW LOANS

- DirecTV Holdings LLC (BBB), signed a US$ 3,100m Term Loan B, to be used for leveraged buyout. It matures on 07/22/27 and initial pricing is set at LIBOR +525.000bps

- DirecTV Holdings LLC (BBB), signed a US$ 500m Revolving Credit Facility, to be used for leveraged buyout.

- Asurion Corp (B), signed a US$ 2,800m Term Loan. It matures on 02/03/28 and initial pricing is set at LIBOR +550.000bps

- Asurion Corp (B), signed a US$ 500m Term Loan B. It matures on 07/31/27 and initial pricing is set at LIBOR +325.000bps

- American Trailer World Corp (B), signed a US$ 475m Term Loan B. It matures on 03/05/28 and initial pricing is set at LIBOR +375.000bps

- Infinitas Learning Holding BV, signed a € 489m Term Loan B, to be used for acquisition financing. It matures on 07/31/28.

NEW ISSUES IN SECURITIZED CREDIT

- Freddie Mac Spc 2021-Kf115 issued a floating-rate Agency CMBS in 1 tranche, for a total of US$ 900 m. Highest-rated tranche offering a spread over the floating rate of 21bp, and the lowest-rated tranche a spread of 21bp. Bookrunners: JP Morgan & Co Inc, Citigroup Global Markets Inc