Credit

US Corporate Investment Grade Bonds Down On Higher Rates, While High Yield Bonds Inched Up On Tighter Spreads

Very quiet Friday in the primary market, but Jaguar Land Rover printed €500m and US$500m with a two-part cross-border bond offering; totals this week from IFR data: US$18.3bn in IG (US$20bn-$25bn forecast for next week) and US$1.625bn in HY

Published ET

Talen Energy Supply LLC 5-Year USD CDS Spread | Source: Refinitiv

QUICK SUMMARY

- S&P 500 Bond Index was down -0.41% today, with investment grade down -0.45% and high yield down -0.10% (YTD total return: -0.53%)

- The iBoxx USD Liquid Investment Grade Total Return Index was down -0.52% today (Month-to-date: 0.44%; Year-to-date: -1.16%)

- The iBoxx USD Liquid High Yield Total Return Index was up 0.05% today (Month-to-date: 0.27%; Year-to-date: 3.32%)

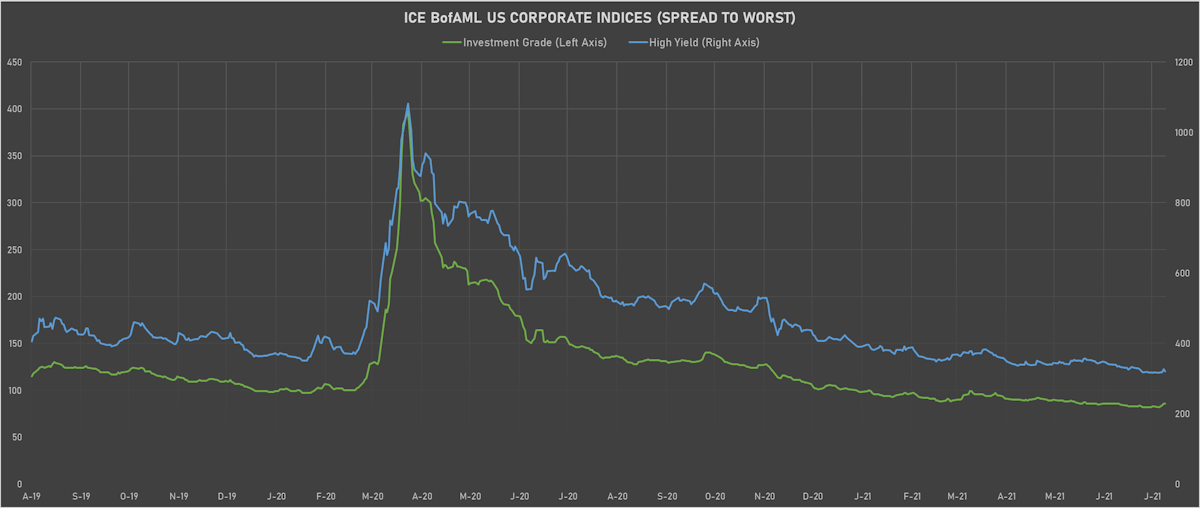

- ICE BofA US Corporate Index (Investment Grade) spread to worst unchanged, now at 86.0 bp (YTD change: -12.0 bp)

- ICE BofA US High Yield Index spread to worst down -7.0 bp, now at 320.0 bp (YTD change: -70.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index down -0.07% today (YTD total return: +2.1%)

- New issues: US$ 2.0bn in dollars and € 1.0bn in euros

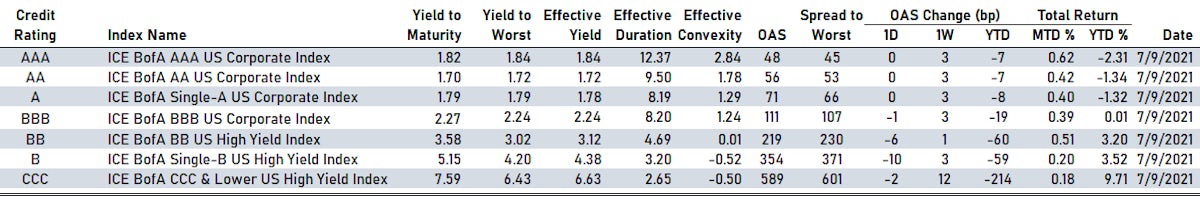

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

- AAA unchanged at 48 bp

- AA unchanged at 56 bp

- A unchanged at 71 bp

- BBB down by -1 bp at 111 bp

- BB down by -6 bp at 219 bp

- B down by -10 bp at 354 bp

- CCC down by -2 bp at 589 bp

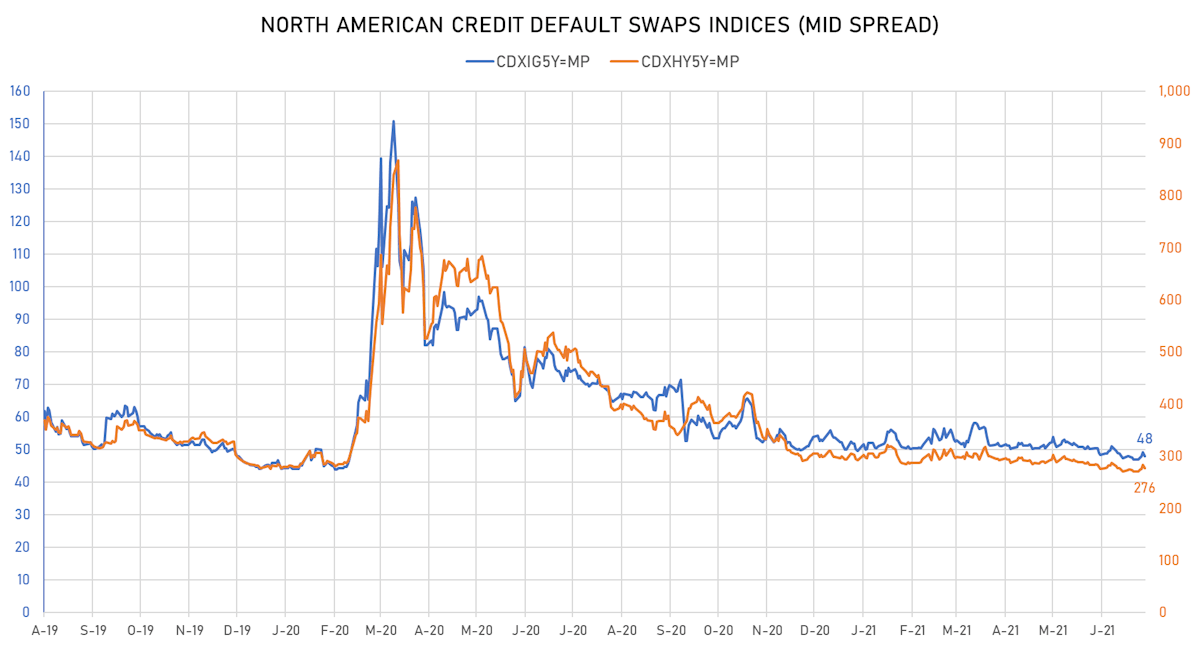

CDS INDICES (mid-spreads)

- Markit CDX.NA.IG 5Y down 1.1 bp, now at 48bp (YTD change: -2.0bp)

- Markit CDX.NA.HY 5Y down 6.2 bp, now at 276bp (YTD change: -17.1bp)

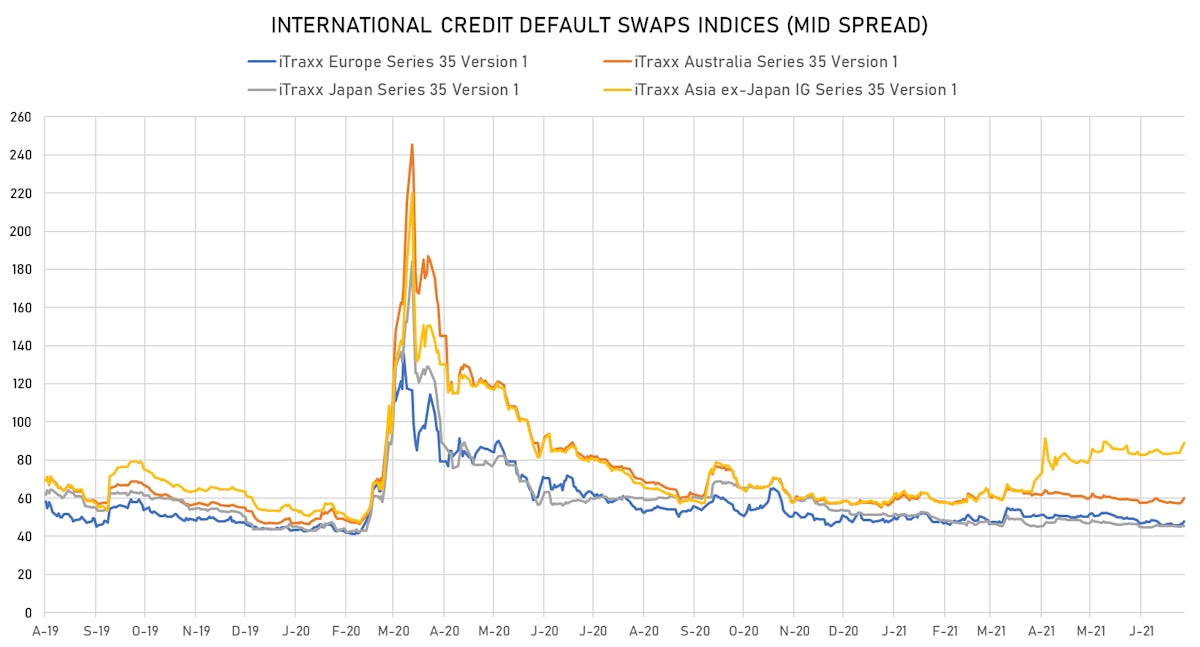

- Markit iTRAXX Europe down 1.0 bp, now at 47bp (YTD change: -1.3bp)

- Markit iTRAXX Japan up 0.4 bp, now at 46bp (YTD change: -5.5bp)

- Markit iTRAXX Asia Ex-Japan up 0.1 bp, now at 89bp (YTD change: +31.1bp)

LARGEST USD CORPORATE CDS MOVES IN THE PAST WEEK

- Transocean Inc (Country: KY; rated: Caa3): down 157.6 bp to 1,099.6bp (1Y range: 941-7,695bp)

- Bombardier Inc (Country: CA; rated: Caa2): down 46.7 bp to 460.1bp (1Y range: 437-1,912bp)

- Pitney Bowes Inc (Country: US; rated: LGD2 - 16%): down 21.1 bp to 416.0bp (1Y range: 366-1,458bp)

- Staples Inc (Country: US; rated: B2): down 18.9 bp to 838.4bp (1Y range: 652-2,081bp)

- Calpine Corp (Country: US; rated: LGD5 - 88%): down 18.1 bp to 300.4bp (1Y range: 173-349bp)

- Sabre Holdings Corp (Country: US; rated: Ba3): down 14.8 bp to 355.0bp (1Y range: 337-611bp)

- iStar Inc (Country: US; rated: BBB-): down 14.2 bp to 257.2bp (1Y range: 199-324bp)

- Radian Group Inc (Country: US; rated: BBB-): down 12.8 bp to 168.5bp (1Y range: 171-385bp)

- Gap Inc (Country: US; rated: Ba2): down 12.5 bp to 146.3bp (1Y range: 144-308bp)

- Liberty Interactive LLC (Country: US; rated: Ba3): down 12.0 bp to 277.5bp (1Y range: 249-404bp)

- Mattel Inc (Country: US; rated: Ba2): down 11.0 bp to 207.4bp (1Y range: 193-397bp)

- Avis Budget Car Rental LLC (Country: US; rated: WR): up 11.7 bp to 267.2bp (1Y range: 137-2,386bp)

- American Airlines Group Inc (Country: US; rated: B2): up 22.0 bp to 633.1bp (1Y range: 596-3,660bp)

- Rite Aid Corp (Country: US; rated: Caa1): up 41.7 bp to 878.4bp (1Y range: 497-922bp)

- Talen Energy Supply LLC (Country: US; rated: B2): up 648.6 bp to 2,161.8bp (1Y range: 875-3,027bp)

LARGEST EURO CORPORATE CDS MOVES IN THE PAST WEEK

- Casino Guichard Perrachon SA (Country: FR; rated: WR): down 13.0 bp to 494.7bp (1Y range: 494-1,210bp)

- Hammerson PLC (Country: GB; rated: Baa3): down 11.5 bp to 188.5bp (1Y range: 187-604bp)

- Banca Monte dei Paschi di Siena SpA (Country: IT; rated: NP): down 11.2 bp to 216.8bp (1Y range: 188-272bp)

- Monitchem Holdco 3 SA (Country: LU; rated: B2): down 9.6 bp to 239.5bp (1Y range: 240-393bp)

- Thyssenkrupp AG (Country: DE; rated: B1): down 9.3 bp to 296.2bp (1Y range: 206-479bp)

- Stena AB (Country: SE; rated: B2-PD): down 6.2 bp to 518.4bp (1Y range: 523-750bp)

- Ineos Group Holdings SA (Country: LU; rated: LGD5 - 88%): down 5.2 bp to 220.9bp (1Y range: 223-447bp)

- Louis Dreyfus Co BV (Country: NL; rated: ): down 3.7 bp to 117.0bp (1Y range: -117bp)

- J Sainsbury PLC (Country: GB; rated: WR): up 3.6 bp to 69.7bp (1Y range: 52-82bp)

- Air France KLM SA (Country: FR; rated: B-): up 6.7 bp to 400.5bp (1Y range: 392-1,211bp)

- Accor SA (Country: FR; rated: B): up 7.1 bp to 143.6bp (1Y range: 136-255bp)

- Deutsche Lufthansa AG (Country: DE; rated: Ba2): up 12.4 bp to 251.5bp (1Y range: 236-421bp)

- Stonegate Pub Company Financing PLC (Country: GB; rated: WR): up 21.6 bp to 509.0bp (1Y range: 486-984bp)

- Boparan Finance PLC (Country: GB; rated: B3): up 27.1 bp to 915.8bp (1Y range: 478-915bp)

- TUI AG (Country: DE; rated: LGD4 - 50%): up 67.7 bp to 710.3bp (1Y range: 590-1,799bp)

USD BOND ISSUES

- Apollo Investment Corp (Financial - Other | New York City, New York, United States | Rating: NR): US$125m Senior Note (US03761UAH95), fixed rate (4.50% coupon) maturing on 16 July 2026, priced at 99.87 (original spread of 375 bp), callable (5nc5)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$200m Bond (US3133EMT446), fixed rate (2.13% coupon) maturing on 19 April 2034, priced at 100.00 (original spread of 78 bp), callable (13nc3m)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$200m Bond (US3133EMT362), fixed rate (0.87% coupon) maturing on 15 April 2026, priced at 100.00 (original spread of 87 bp), callable (5nc3m)

- Federal Home Loan Banks (Agency | Washington, Washington Dc, United States | Rating: NR): US$250m Bond (US3130ANAN01), fixed rate (0.58% coupon) maturing on 29 January 2025, priced at 100.00 (original spread of 51 bp), callable (4nc1)

- Jaguar Land Rover Automotive PLC (Automotive Manufacturer | Coventry, West Midlands, India | Rating: B): US$500m Senior Note (US47010BAM63), fixed rate (5.50% coupon) maturing on 15 July 2029, priced at 100.00 (original spread of 428 bp), callable (8nc3)

- Seaspan Corp (Transportation - Other | Canada | Rating: BB-): US$750m Senior Note (US81254UAK25), fixed rate (5.50% coupon) maturing on 1 August 2029, priced at 100.00 (original spread of 448 bp), callable (8nc3)

EUR BOND ISSUES

- AXA Bank Europe SCF SA (Banking | Fontenay-Sous-Bois, Ile-De-France, France | Rating: AAA): €500m Obligation Fonciere (Covered Bond) (FR0014004J07), floating rate (EU03MLIB + 23.0 bp) maturing on 13 July 2028, priced at 100.00, callable (7nc1m)

- Jaguar Land Rover Automotive PLC (Automotive Manufacturer | Coventry, West Midlands, India | Rating: B): €500m Senior Note (XS2364593579), fixed rate (4.50% coupon) maturing on 15 July 2028, priced at 100.00 (original spread of 498 bp), callable (7nc3)