Credit

Little Movement In US Corporate Cash Spreads: IG Unchanged, HY Down 1

Only a few USD bond issues on Monday, led by Mitsubishi's 3-tranche US$6bn offering (4NC3, 6NC5, 11NC10)

Published ET

iBOXX USD Liquid Bond Indices | Sources: ϕpost, Refinitiv data

QUICK SUMMARY

- S&P 500 Bond Index was down -0.03% today, with investment grade down -0.03% and high yield up 0.04% (YTD total return: -0.55%)

- The iBoxx USD Liquid Investment Grade Total Return Index was down -0.036% today (Month-to-date: 0.40%; Year-to-date: -1.19%)

- The iBoxx USD Liquid High Yield Total Return Index was up 0.049% today (Month-to-date: 0.32%; Year-to-date: 3.37%)

- ICE BofA US Corporate Index (Investment Grade) spread to worst unchanged, now at 86.0 bp (YTD change: -12.0 bp)

- ICE BofA US High Yield Index spread to worst down -1.0 bp, now at 319.0 bp (YTD change: -71.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index up 0.05% today (YTD total return: +2.2%)

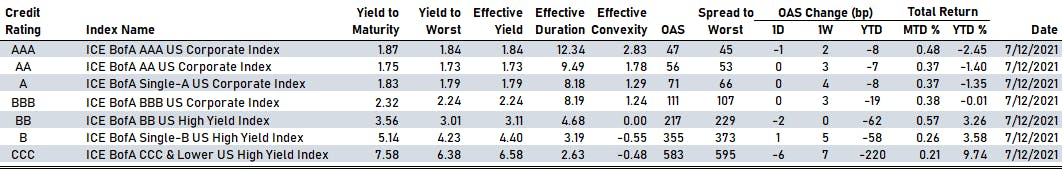

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

- AAA down by -1 bp at 47 bp

- AA unchanged at 56 bp

- A unchanged at 71 bp

- BBB unchanged at 111 bp

- BB down by -2 bp at 217 bp

- B up by 1 bp at 355 bp

- CCC down by -6 bp at 583 bp

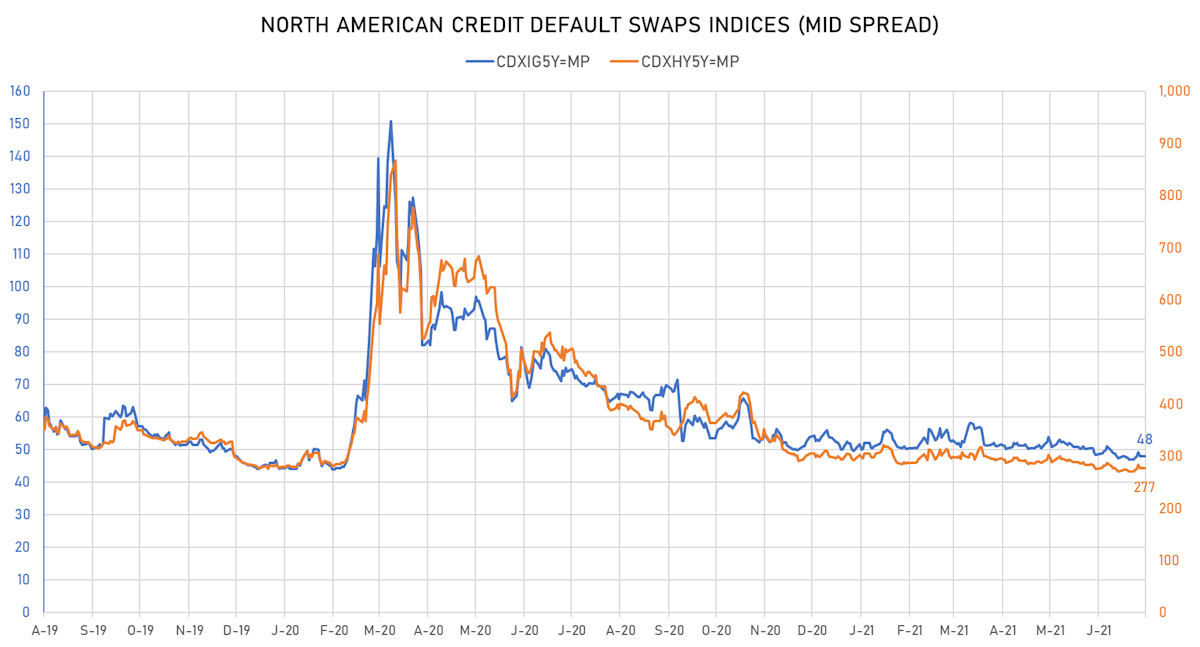

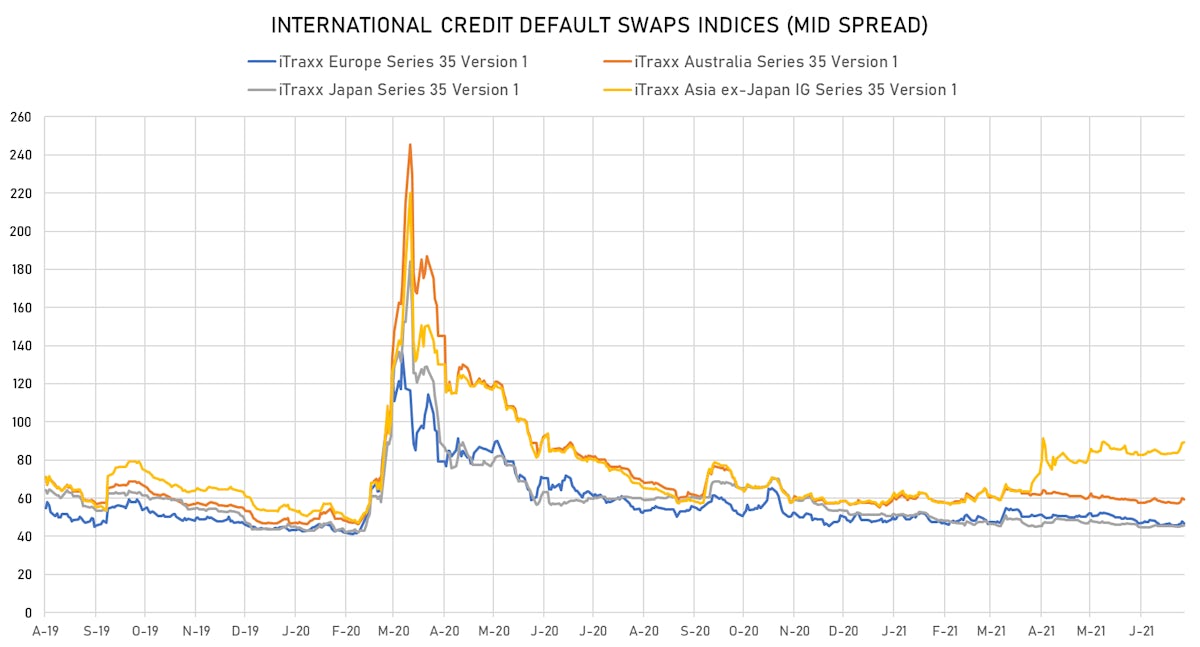

CDS INDICES (mid-spreads)

- Markit CDX.NA.IG 5Y down 0.2 bp, now at 48bp (YTD change: -2.2bp)

- Markit CDX.NA.HY 5Y up 0.5 bp, now at 277bp (YTD change: -16.6bp)

- Markit iTRAXX Europe down 0.1 bp, now at 47bp (YTD change: -1.4bp)

- Markit iTRAXX Japan down 0.2 bp, now at 46bp (YTD change: -5.7bp)

- Markit iTRAXX Asia Ex-Japan down 0.3 bp, now at 89bp (YTD change: +30.8bp)

TOP BONDS MOVES IN THE PAST WEEK - USD HY

- Issuer: Vedanta Resources Finance II PLC (London, United Kingdom) | Coupon: 8.95% | Maturity: 11/3/2025 | Rating: B- | ISIN: USG9T27HAD62 | Z-spread up by 45.6 bp to 966.0 bp, with the yield to worst at 9.9% and the bond now trading down to 96.0 cents on the dollar (1Y price range: 94.3-99.8).

- Issuer: Banco Votorantim SA (Sao Paulo, Brazil) | Coupon: 4.50% | Maturity: 24/9/2024 | Rating: BB- | ISIN: XS2055749720 | Z-spread up by 39.7 bp to 232.0 bp (CDS basis: -108.6bp), with the yield to worst at 2.5% and the bond now trading down to 105.0 cents on the dollar (1Y price range: 103.1-106.8).

- Issuer: Pennsylvania Electric Co (Akron, Ohio (US)) | Coupon: 4.15% | Maturity: 15/4/2025 | Rating: BB+ | ISIN: USU70842AB21 | Z-spread up by 33.9 bp to 145.5 bp (CDS basis: -84.6bp), with the yield to worst at 2.0% and the bond now trading down to 107.0 cents on the dollar (1Y price range: 106.4-109.8).

- Issuer: American Airlines Group Inc (Fort Worth, Texas (US)) | Coupon: 3.75% | Maturity: 1/3/2025 | Rating: CCC | ISIN: USU0242AAD47 | Z-spread up by 31.4 bp to 596.0 bp (CDS basis: 3.2bp), with the yield to worst at 6.3% and the bond now trading down to 91.3 cents on the dollar (1Y price range: 71.0-93.1).

- Issuer: Syngenta Finance NV (Enkhuizen, Netherlands) | Coupon: 4.89% | Maturity: 24/4/2025 | Rating: BB | ISIN: USN84413CL06 | Z-spread up by 30.2 bp to 147.8 bp, with the yield to worst at 2.0% and the bond now trading down to 109.6 cents on the dollar (1Y price range: 100.0-110.9).

- Issuer: Jaguar Land Rover Automotive PLC (COVENTRY, United Kingdom) | Coupon: 4.50% | Maturity: 1/10/2027 | Rating: B | ISIN: USG5002FAM89 | Z-spread up by 28.8 bp to 401.1 bp (CDS basis: -15.8bp), with the yield to worst at 4.8% and the bond now trading down to 97.3 cents on the dollar (1Y price range: 93.4-99.0).

- Issuer: Rolls-Royce PLC (BIRMINGHAM, United Kingdom) | Coupon: 3.63% | Maturity: 14/10/2025 | Rating: BB- | ISIN: USG76237AB53 | Z-spread up by 27.2 bp to 244.6 bp (CDS basis: -45.3bp), with the yield to worst at 2.9% and the bond now trading down to 101.6 cents on the dollar (1Y price range: 98.4-102.6).

- Issuer: Turkiye Petrol Rafinerileri AS (#N/A, Turkey) | Coupon: 4.50% | Maturity: 18/10/2024 | Rating: B | ISIN: XS1686704948 | Z-spread up by 23.0 bp to 396.0 bp, with the yield to worst at 4.2% and the bond now trading down to 99.9 cents on the dollar (1Y price range: 95.5-101.3).

- Issuer: Wynn Las Vegas LLC (Las Vegas, Nevada (US)) | Coupon: 5.50% | Maturity: 1/3/2025 | Rating: B+ | ISIN: USU98347AK05 | Z-spread up by 22.4 bp to 270.4 bp, with the yield to worst at 3.0% and the bond now trading down to 107.0 cents on the dollar (1Y price range: 102.5-108.3).

- Issuer: Videotron Ltd (Pre-Merger) (MONTREAL, Canada) | Coupon: 5.38% | Maturity: 15/6/2024 | Rating: BB+ | ISIN: USC96225AA22 | Z-spread down by 24.8 bp to 114.6 bp, with the yield to worst at 1.5% and the bond now trading up to 109.9 cents on the dollar (1Y price range: 108.8-110.4).

- Issuer: SoftBank Group Corp (Minato-ku, Japan) | Coupon: 5.25% | Maturity: 6/7/2031 | Rating: BB+ | ISIN: XS2361253607 | Z-spread down by 25.5 bp to 369.1 bp, with the yield to worst at 4.9% and the bond now trading up to 101.9 cents on the dollar (1Y price range: 99.9-102.1).

- Issuer: FBN Finance Company BV (Amsterdam, Netherlands) | Coupon: 8.63% | Maturity: 27/10/2025 | Rating: B- | ISIN: XS2243733685 | Z-spread down by 27.0 bp to 583.7 bp, with the yield to worst at 6.2% and the bond now trading up to 108.0 cents on the dollar (1Y price range: 104.5-110.5).

- Issuer: Banco BTG Pactual SA (Luxembourg Branch) (Luxembourg, Luxembourg) | Coupon: 5.50% | Maturity: 31/1/2023 | Rating: BB- | ISIN: US05971BAD10 | Z-spread down by 28.5 bp to 175.9 bp, with the yield to worst at 1.8% and the bond now trading up to 105.3 cents on the dollar (1Y price range: 104.9-107.3).

TOP BONDS MOVES IN THE PAST WEEK - EUR HY

- Issuer: Saipem Finance International BV (Amsterdam, Netherlands) | Coupon: 3.38% | Maturity: 15/7/2026 | Rating: BB | ISIN: XS2202907510 | Z-spread up by 33.0 bp to 307.4 bp (CDS basis: 32.1bp), with the yield to worst at 2.6% and the bond now trading down to 102.7 cents on the dollar (1Y price range: 101.4-106.3).

- Issuer: Deutsche Lufthansa AG (Cologne, Germany) | Coupon: 3.00% | Maturity: 29/5/2026 | Rating: BB- | ISIN: XS2265369657 | Z-spread up by 29.4 bp to 327.4 bp (CDS basis: -69.0bp), with the yield to worst at 2.8% and the bond now trading down to 100.1 cents on the dollar (1Y price range: 95.7-102.3).

- Issuer: International Consolidated Airlines Group SA (London, Spain) | Coupon: 1.50% | Maturity: 4/7/2027 | Rating: B+ | ISIN: XS2020581752 | Z-spread up by 11.1 bp to 350.1 bp, with the yield to worst at 3.1% and the bond now trading down to 90.6 cents on the dollar (1Y price range: 84.0-92.1).

- Issuer: Petroleos Mexicanos (Miguel Hidalgo, Mexico) | Coupon: 2.75% | Maturity: 21/4/2027 | Rating: BB- | ISIN: XS1172951508 | Z-spread up by 9.4 bp to 447.8 bp (CDS basis: -56.6bp), with the yield to worst at 4.1% and the bond now trading down to 92.6 cents on the dollar (1Y price range: 89.3-94.8).

- Issuer: Titan Global Finance PLC (Hull, United Kingdom) | Coupon: 2.75% | Maturity: 9/7/2027 | Rating: BB | ISIN: XS2199268470 | Z-spread up by 7.2 bp to 202.2 bp, with the yield to worst at 1.6% and the bond now trading down to 105.2 cents on the dollar (1Y price range: 102.6-105.9).

- Issuer: Carnival PLC (Southampton, United Kingdom) | Coupon: 1.00% | Maturity: 28/10/2029 | Rating: B- | ISIN: XS2066744231 | Z-spread up by 4.7 bp to 367.6 bp (CDS basis: -22.5bp), with the yield to worst at 3.2% and the bond now trading down to 81.7 cents on the dollar (1Y price range: 71.0-83.7).

- Issuer: Ford Motor Credit Company LLC (Dearborn, Michigan (US)) | Coupon: 3.25% | Maturity: 15/9/2025 | Rating: BB | ISIN: XS2229875989 | Z-spread down by 5.2 bp to 181.7 bp (CDS basis: -36.8bp), with the yield to worst at 1.3% and the bond now trading up to 107.2 cents on the dollar (1Y price range: 104.3-108.0).

- Issuer: MPT Operating Partnership LP (Birmingham, Alabama (US)) | Coupon: 3.33% | Maturity: 24/3/2025 | Rating: BB+ | ISIN: XS1523028436 | Z-spread down by 5.4 bp to 134.7 bp, with the yield to worst at 0.9% and the bond now trading up to 108.0 cents on the dollar (1Y price range: 106.3-108.8).

- Issuer: Teollisuuden Voima Oyj (Eurajoki, Finland) | Coupon: 1.13% | Maturity: 9/3/2026 | Rating: BB | ISIN: XS2049419398 | Z-spread down by 6.2 bp to 124.9 bp, with the yield to worst at 0.8% and the bond now trading up to 100.8 cents on the dollar (1Y price range: 92.8-101.0).

- Issuer: Renault SA (Boulogne-Billancourt, France) | Coupon: 1.00% | Maturity: 28/11/2025 | Rating: BB | ISIN: FR0013299435 | Z-spread down by 7.2 bp to 154.7 bp (CDS basis: 19.8bp), with the yield to worst at 1.1% and the bond now trading up to 99.1 cents on the dollar (1Y price range: 96.6-99.4).

- Issuer: Teva Pharmaceutical Finance Netherlands II BV (Amsterdam, Netherlands) | Coupon: 1.63% | Maturity: 15/10/2028 | Rating: BB- | ISIN: XS1439749364 | Z-spread down by 12.1 bp to 347.3 bp, with the yield to worst at 3.2% and the bond now trading up to 89.3 cents on the dollar (1Y price range: 87.1-92.6).

- Issuer: Akropolis Group UAB (Vilnius, Lithuania) | Coupon: 2.88% | Maturity: 2/6/2026 | Rating: BB+ | ISIN: XS2346869097 | Z-spread down by 25.3 bp to 352.6 bp, with the yield to worst at 3.1% and the bond now trading up to 98.5 cents on the dollar (1Y price range: 97.8-99.4).

USD BOND ISSUES

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$180m Bond (US3133EMT693), fixed rate (1.94% coupon) maturing on 19 April 2032, priced at 100.00, callable (11nc3m)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$135m Bond (US3133EMT776), fixed rate (1.79% coupon) maturing on 21 July 2031, priced at 100.00, callable (10nc1)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$220m Bond (US3133EMT511), fixed rate (0.42% coupon) maturing on 19 July 2024, priced at 100.00 (original spread of 5 bp), callable (3nc3m)

- Performance Food Group Inc (Restaurants | Richmond, Virginia, United States | Rating: B+): US$1,000m Senior Note (US71376LAE02), fixed rate (4.25% coupon) maturing on 1 August 2029, priced at 100.00 (original spread of 302 bp), callable (8nc3)

- CLP Power Hong Kong Financing Ltd (Financial - Other | Tortola, Hong Kong | Rating: NR): US$500m Unsecured Note (XS2366184120), fixed rate (3.00% coupon) maturing on 21 July 2036, priced at 100.00, non callable

- Korea Investment & Securities Co Ltd (Securities | Seoul, Seoul, South Korea | Rating: BBB): US$300m Senior Note (XS2363709762), fixed rate (1.38% coupon) maturing on 19 July 2024, priced at 99.66 (original spread of 110 bp), non callable

- Korea Investment & Securities Co Ltd (Securities | Seoul, Seoul, South Korea | Rating: BBB): US$300m Senior Note (XS2363709929), fixed rate (2.13% coupon) maturing on 19 July 2026, priced at 99.98 (original spread of 135 bp), non callable

- Lani Finance Ltd (Financial - Other | George Town, Cayman Islands | Rating: NR): US$138m Unsecured Note (XS2366416860) zero coupon maturing on 29 June 2026, non callable

- Mitsubishi UFJ Financial Group Inc (Banking | Chiyoda-Ku, Tokyo-To, Japan | Rating: A-): US$2,100m Senior Note (US606822BY90), fixed rate (1.54% coupon) maturing on 20 July 2027, priced at 100.00 (original spread of 75 bp), callable (6nc5)

- Vmed O2 Uk Financing I PLC (Financial - Other | London, United Kingdom | Rating: NR): US$550m Note (USG9444PAE28), fixed rate (4.75% coupon) maturing on 15 July 2031, priced at 100.75 (original spread of 329 bp), callable (10nc5)

EUR BOND ISSUES

- Credit Industriel et Commercial SA (Banking | Paris, Ile-De-France, France | Rating: A): €150m Unsecured Note (XS2365074249), fixed rate (3.90% coupon) maturing on 20 December 2029, priced at 100.00, non callable

- Hessen, State of (Official and Muni | Wiesbaden, Hessen, Germany | Rating: AA+): €500m Jumbo Landesschatzanweisung (DE000A1RQD50) zero coupon maturing on 19 July 2028, priced at 101.70 (original spread of 25 bp), non callable

NEW LOANS

- Schibsted ASA, signed a € 300m Revolving Credit Facility, to be used for general corporate purposes. It matures on 07/09/26.

- Turkiye Sinai Kalkinma Bankasi, signed a € 116m Term Loan, to be used for general corporate purposes. It matures on 07/11/22.

- Whataburger Restaurants LP, signed a US$ 200m Revolving Credit Facility, to be used for general corporate purposes.

- Whataburger Restaurants LP, signed a US$ 2,300m Term Loan B, to be used for general corporate purposes.

- JELD-WEN Inc (BB-), signed a US$ 550m Term Loan B, to be used for general corporate purposes. It matures on 07/16/28 and initial pricing is set at LIBOR +225.000bps

NEW ISSUES IN SECURITIZED CREDIT

- BRSP 2021-Fl1 Ltd issued a floating-rate CLO in 6 tranches, for a total of US$ 670 m. Highest-rated tranche offering a spread over the floating rate of 115bp, and the lowest-rated tranche a spread of 345bp. Bookrunners: Goldman Sachs & Co, Morgan Stanley International Ltd, Barclays Capital Group, Citigroup Global Markets Inc, Wells Fargo Securities LLC