Credit

High Yield Cash Spreads Rise, IG Currently Overperforming This Month

Very slow summer week in the US corporate primary market; notable today was a US$ 5.5bn, two-tranche issue from Goldman Sachs

Published ET

L Brands Inc 2025 Bond Price Rose Further, Now Yields Just 1.53% (Coupon: 9.38% | Maturity: 1/7/2025 | Rating: BB- | ISIN: USU51407AD34)

QUICK SUMMARY

- The iBoxx USD Liquid Investment Grade Total Return Index was up 0.592% today (Month-to-date: 0.62%; Year-to-date: -0.98%)

- The iBoxx USD Liquid High Yield Total Return Index was down -0.043% today (Month-to-date: 0.23%; Year-to-date: 3.28%)

- ICE BofA US Corporate Index (Investment Grade) spread to worst unchanged, now at 85.0 bp (YTD change: -13.0 bp)

- ICE BofA US High Yield Index spread to worst up 5.0 bp, now at 323.0 bp (YTD change: -67.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index up 0.00% today (YTD total return: +2.2%)

- New issues: US$ 2.4bn in dollars and € 4.3bn in euros

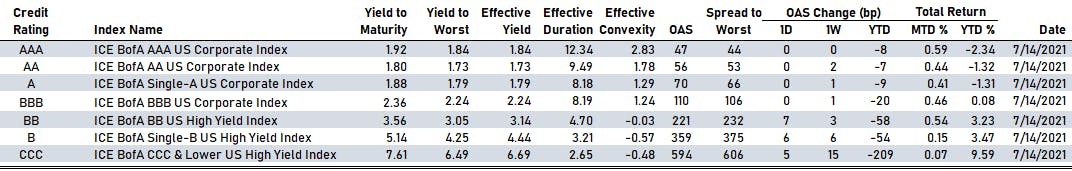

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

- AAA unchanged at 47 bp

- AA unchanged at 56 bp

- A unchanged at 70 bp

- BBB unchanged at 110 bp

- BB up by 7 bp at 221 bp

- B up by 6 bp at 359 bp

- CCC up by 5 bp at 594 bp

CDS INDICES (mid-spreads)

- Markit CDX.NA.IG 5Y down 0.1 bp, now at 48bp (YTD change: -1.6bp)

- Markit CDX.NA.HY 5Y down 1.2 bp, now at 279bp (YTD change: -14.0bp)

- Markit iTRAXX Europe up 0.1 bp, now at 47bp (YTD change: -1.2bp)

- Markit iTRAXX Japan down 0.1 bp, now at 45bp (YTD change: -6.1bp)

- Markit iTRAXX Asia Ex-Japan down 1.4 bp, now at 87bp (YTD change: +29.1bp)

TOP BONDS MOVES IN THE PAST WEEK - USD HY

- Issuer: Guacolda Energia SA (LAS CONDES, Chile) | Coupon: 4.56% | Maturity: 30/4/2025 | Rating: B+ | ISIN: USP3711HAF66 | Z-spread up by 565.0 bp to 2,254.2 bp, with the yield to worst at 22.6% and the bond now trading down to 54.6 cents on the dollar (1Y price range: 53.5-92.1).

- Issuer: Banco Safra SA (Cayman Islands Branch) (George Town, Cayman Islands) | Coupon: 4.13% | Maturity: 8/2/2023 | Rating: BB- | ISIN: US05964TAQ22 | Z-spread up by 42.0 bp to 163.4 bp, with the yield to worst at 1.7% and the bond now trading down to 103.5 cents on the dollar (1Y price range: 102.3-104.8).

- Issuer: Dilijan Finance BV (Amsterdam, Netherlands) | Coupon: 6.50% | Maturity: 28/1/2025 | Rating: B+ | ISIN: XS2080321198 | Z-spread up by 40.0 bp to 610.8 bp, with the yield to worst at 6.3% and the bond now trading down to 99.6 cents on the dollar (1Y price range: 93.6-101.0).

- Issuer: Pennsylvania Electric Co (Akron, Ohio (US)) | Coupon: 4.15% | Maturity: 15/4/2025 | Rating: BB+ | ISIN: USU70842AB21 | Z-spread up by 34.7 bp to 144.6 bp (CDS basis: -84.7bp), with the yield to worst at 2.0% and the bond now trading down to 106.9 cents on the dollar (1Y price range: 106.4-109.8).

- Issuer: Grupo de Inversiones Suramericana SA (Medellin, Colombia) | Coupon: 5.50% | Maturity: 29/4/2026 | Rating: BB+ | ISIN: USG42036AB25 | Z-spread up by 25.8 bp to 276.7 bp, with the yield to worst at 3.4% and the bond now trading down to 108.0 cents on the dollar (1Y price range: 107.0-114.6).

- Issuer: Rolls-Royce PLC (BIRMINGHAM, United Kingdom) | Coupon: 3.63% | Maturity: 14/10/2025 | Rating: BB- | ISIN: USG76237AB53 | Z-spread up by 24.5 bp to 246.6 bp (CDS basis: -46.5bp), with the yield to worst at 3.0% and the bond now trading down to 101.5 cents on the dollar (1Y price range: 98.4-102.6).

- Issuer: Enact Holdings Inc (Raleigh, North Carolina (US)) | Coupon: 6.50% | Maturity: 15/8/2025 | Rating: BB- | ISIN: USU3230LAA45 | Z-spread up by 23.0 bp to 332.4 bp (CDS basis: 69.9bp), with the yield to worst at 3.8% and the bond now trading down to 108.4 cents on the dollar (1Y price range: 106.5-110.0).

- Issuer: Colombia Telecomunicaciones SA ESP (Bogota, Colombia) | Coupon: 4.95% | Maturity: 17/7/2030 | Rating: BB | ISIN: USP28768AC69 | Z-spread up by 21.5 bp to 318.0 bp, with the yield to worst at 4.3% and the bond now trading down to 103.9 cents on the dollar (1Y price range: 102.3-111.1).

- Issuer: AKIB Ipoteka-Bank (Tashkent, Uzbekistan) | Coupon: 5.50% | Maturity: 19/11/2025 | Rating: BB- | ISIN: XS2260457754 | Z-spread up by 20.4 bp to 362.1 bp, with the yield to worst at 4.2% and the bond now trading down to 104.6 cents on the dollar (1Y price range: 101.1-105.6).

- Issuer: L Brands Inc (Columbus, Ohio (US)) | Coupon: 9.38% | Maturity: 1/7/2025 | Rating: BB- | ISIN: USU51407AD34 | Z-spread down by 26.9 bp to 85.6 bp (CDS basis: 3.8bp), with the yield to worst at 1.4% and the bond now trading up to 130.0 cents on the dollar (1Y price range: 122.8-130.3).

- Issuer: Taylor Morrison Communities Inc (Scottsdale, Arizona (US)) | Coupon: 5.88% | Maturity: 15/4/2023 | Rating: BB- | ISIN: USU8759MAA28 | Z-spread down by 28.1 bp to 108.8 bp, with the yield to worst at 1.1% and the bond now trading up to 106.8 cents on the dollar (1Y price range: 105.3-112.0).

- Issuer: FBN Finance Company BV (Amsterdam, Netherlands) | Coupon: 8.63% | Maturity: 27/10/2025 | Rating: B- | ISIN: XS2243733685 | Z-spread down by 35.9 bp to 565.7 bp, with the yield to worst at 6.0% and the bond now trading up to 108.6 cents on the dollar (1Y price range: 104.5-110.5).

- Issuer: China Hongqiao Group Ltd (Binzhou, Cayman Islands) | Coupon: 6.25% | Maturity: 8/6/2024 | Rating: B+ | ISIN: XS2348238259 | Z-spread down by 38.5 bp to 492.4 bp, with the yield to worst at 5.0% and the bond now trading up to 102.4 cents on the dollar (1Y price range: 101.0-102.9).

- Issuer: Vedanta Resources Finance II PLC (London, United Kingdom) | Coupon: 8.95% | Maturity: 11/3/2025 | Rating: B- | ISIN: USG9T27HAD62 | Z-spread down by 49.4 bp to 904.7 bp, with the yield to worst at 9.4% and the bond now trading up to 97.8 cents on the dollar (1Y price range: 94.3-99.8).

- Issuer: TBC bank'i SS (Tbilisi, Georgia) | Coupon: 5.75% | Maturity: 19/6/2024 | Rating: BB- | ISIN: XS1843434363 | Z-spread down by 91.7 bp to 170.8 bp, with the yield to worst at 1.9% and the bond now trading up to 110.0 cents on the dollar (1Y price range: 104.0-108.3).

TOP BONDS MOVES IN THE PAST WEEK - EUR HY

- Issuer: International Consolidated Airlines Group SA (London, Spain) | Coupon: 1.50% | Maturity: 4/7/2027 | Rating: B+ | ISIN: XS2020581752 | Z-spread up by 10.0 bp to 349.6 bp, with the yield to worst at 3.1% and the bond now trading down to 90.6 cents on the dollar (1Y price range: 84.0-92.1).

- Issuer: CBOM Finance PLC (Dublin, Ireland) | Coupon: 1.63% | Maturity: 9/5/2028 | Rating: BB- | ISIN: XS1819574929 | Z-spread up by 7.7 bp to 296.5 bp (CDS basis: -19.9bp), with the yield to worst at 2.6% and the bond now trading down to 92.9 cents on the dollar (1Y price range: 90.4-94.1).

- Issuer: Deutsche Lufthansa AG (Cologne, Germany) | Coupon: 2.50% | Maturity: 25/2/2025 | Rating: B+ | ISIN: DE000A14J587 | Z-spread up by 5.8 bp to 236.1 bp (CDS basis: 9.8bp), with the yield to worst at 1.9% and the bond now trading down to 101.8 cents on the dollar (1Y price range: 100.1-102.9).

- Issuer: Saipem Finance International BV (Amsterdam, Netherlands) | Coupon: 2.75% | Maturity: 21/4/2027 | Rating: BB- | ISIN: XS1172951508 | Z-spread up by 5.4 bp to 449.4 bp (CDS basis: -53.7bp), with the yield to worst at 4.1% and the bond now trading down to 92.6 cents on the dollar (1Y price range: 89.3-94.8).

- Issuer: Mytilineos SA (Athina, Greece) | Coupon: 3.63% | Maturity: 19/1/2024 | Rating: BB | ISIN: XS1347748607 | Z-spread down by 5.4 bp to 111.9 bp (CDS basis: -6.3bp), with the yield to worst at 0.6% and the bond now trading up to 107.3 cents on the dollar (1Y price range: 106.8-107.8).

- Issuer: Petroleos Mexicanos (Miguel Hidalgo, Mexico) | Coupon: 1.50% | Maturity: 18/6/2025 | Rating: BB+ | ISIN: FR0013342334 | Z-spread down by 5.5 bp to 96.8 bp (CDS basis: 6.1bp), with the yield to worst at 0.5% and the bond now trading up to 103.3 cents on the dollar (1Y price range: 102.0-103.6).

- Issuer: Adler Group SA (Senningerberg, Luxembourg) | Coupon: 3.13% | Maturity: 15/5/2028 | Rating: BB | ISIN: XS2171872570 | Z-spread down by 6.1 bp to 146.1 bp (CDS basis: -28.7bp), with the yield to worst at 1.1% and the bond now trading up to 111.8 cents on the dollar (1Y price range: 108.4-112.0).

- Issuer: SoftBank Group Corp (Minato-Ku, Japan) | Coupon: 2.39% | Maturity: 17/2/2026 | Rating: BB | ISIN: XS2013574384 | Z-spread down by 6.2 bp to 187.8 bp (CDS basis: -32.8bp), with the yield to worst at 1.4% and the bond now trading up to 103.7 cents on the dollar (1Y price range: 100.3-104.5).

- Issuer: Renault SA (Boulogne-Billancourt, France) | Coupon: 1.13% | Maturity: 9/3/2026 | Rating: BB | ISIN: XS2049419398 | Z-spread down by 6.3 bp to 122.3 bp, with the yield to worst at 0.8% and the bond now trading up to 100.9 cents on the dollar (1Y price range: 92.8-101.0).

- Issuer: MPT Operating Partnership LP (Birmingham, Alabama (US)) | Coupon: 3.63% | Maturity: 15/6/2030 | Rating: BB+ | ISIN: XS2072829794 | Z-spread down by 7.1 bp to 129.4 bp, with the yield to worst at 1.1% and the bond now trading up to 119.9 cents on the dollar (1Y price range: 112.9-121.8).

- Issuer: Teollisuuden Voima Oyj (Eurajoki, Finland) | Coupon: 1.63% | Maturity: 15/10/2028 | Rating: BB- | ISIN: XS1439749364 | Z-spread down by 9.9 bp to 348.4 bp, with the yield to worst at 3.2% and the bond now trading up to 89.3 cents on the dollar (1Y price range: 87.1-92.6).

- Issuer: Titan Global Finance PLC (Hull, United Kingdom) | Coupon: 2.88% | Maturity: 2/6/2026 | Rating: BB+ | ISIN: XS2346869097 | Z-spread down by 11.7 bp to 350.4 bp, with the yield to worst at 3.0% and the bond now trading up to 98.6 cents on the dollar (1Y price range: 97.8-99.4).

- Issuer: Akropolis Group UAB (Vilnius, Lithuania) | Coupon: 2.75% | Maturity: 9/7/2027 | Rating: BB | ISIN: XS2199268470 | Z-spread down by 12.9 bp to 201.0 bp, with the yield to worst at 1.6% and the bond now trading up to 105.2 cents on the dollar (1Y price range: 102.6-105.9).

USD BOND ISSUES

- AmWINS Group Inc (Property and Casualty Insurance | Charlotte, North Carolina, United States | Rating: B-): US$790m Senior Note (US031921AB57), fixed rate (4.88% coupon) maturing on 30 June 2029, priced at 100.00 (original spread of 379 bp), callable (8nc3)

- Federal Home Loan Banks (Agency | Washington, Washington Dc, United States | Rating: NR): US$500m Bond (US3130ANCD01), fixed rate (1.11% coupon) maturing on 27 July 2026, priced at 100.00 (original spread of 102 bp), callable (5nc1m)

- Goldman Sachs Group Inc (Bank | NYC, United States) | $5.5 billion offering in 2 parts: 2.383% 11-year (non-call 10) notes priced at T+103, and 2.908% 21-year (non-call 20) notes priced at T+100.

- Lani Finance Ltd (Financial - Other | George Town, Cayman Islands | Rating: NR): US$138m Unsecured Note (XS2366416860) zero coupon maturing on 29 June 2026, non callable

- Mitsubishi UFJ Investor Services & Banking Luxembourg SA (Banking | Luxembourg, Japan | Rating: A): US$560m Bond (XS2359373284) zero coupon maturing on 15 July 2026, priced at 100.00, non callable

EUR BOND ISSUES

- APCOA Parking Holdings GmbH (Service - Other | Stuttgart, Baden-Wuerttemberg, Luxembourg | Rating: B): €365m Note (XS2366277056), floating rate (US3MLIB + 500.0 bp) maturing on 15 January 2027, priced at 100.00, callable (5nc1)

- APCOA Parking Holdings GmbH (Service - Other | Stuttgart, Baden-Wuerttemberg, Luxembourg | Rating: B): €320m Note (XS2366276835), fixed rate (4.63% coupon) maturing on 15 January 2027, priced at 100.00 (original spread of 523 bp), callable (5nc2)

- Aries Capital DAC (Financial - Other | Dublin, Dublin, Ireland | Rating: NR): €468m Unsecured Note (XS2360267368), floating rate maturing on 14 July 2026, priced at 100.00, non callable

- Aries Capital DAC (Financial - Other | Dublin, Dublin, Ireland | Rating: NR): €330m Unsecured Note (XS2360267442), floating rate maturing on 14 July 2026, priced at 100.00, non callable

- Castilla y Leon, Autonomous Community of (Official and Muni | Valladolid, Valladolid, Spain | Rating: BBB+): €253m Bond (ES0001351594) zero coupon maturing on 31 October 2023, priced at 100.74, non callable

- DekaBank Deutsche Girozentrale (Financial - Other | Frankfurt, Hessen, Germany | Rating: A): €250m Oeffenlicher Pfandbrief (Covered Bond) (XS2366703259), fixed rate (0.01% coupon) maturing on 22 July 2026, priced at 101.52 (original spread of 35 bp), non callable

- doValue SpA (Banking | Verona, Verona, Italy | Rating: BB): €300m Note (XS2367104838), fixed rate (3.38% coupon) maturing on 31 July 2026, priced at 100.00 (original spread of 401 bp), callable (5nc2)

- EOF-ZMG US Residential Holdco LLC (Financial - Other | Wilmington, Delaware, United States | Rating: NR): €260m Bond (XS2312742864), fixed rate (4.50% coupon) maturing on 31 December 2027, priced at 100.00, non callable

- NRW Bank (Agency | Dusseldorf, Nordrhein-Westfalen, Germany | Rating: AA): €250m Inhaberschuldverschreibung (DE000NWB1VK7) zero coupon maturing on 20 December 2024, priced at 101.65 (original spread of 22 bp), non callable

- Public Power Corporation SA (Utility - Other | Athina, Attiki, Greece | Rating: B+): €500m Senior Note (XS2359929812), fixed rate (3.38% coupon) maturing on 31 July 2028, priced at 100.00 (original spread of 390 bp), callable (7nc3)

- State of Rhineland Palatinate (Official and Muni | Mainz, Rheinland-Pfalz, Germany | Rating: AAA): €500m Jumbo Landesschatzanweisung (DE000RLP1320), fixed rate (0.01% coupon) maturing on 15 July 2024, priced at 101.51 (original spread of 22 bp), non callable

- UniCredit Bank AG (Banking | Muenchen, Bayern | Rating: BBB+): €500m Inhaberschuldverschreibung (DE000HV2AYL8), floating rate (EU03MLIB + 94.5 bp) maturing on 21 July 2028, priced at 100.00, callable (7nc6)

NEW LOANS

- Eagle Bidco Ltd (B-), signed a € 275m Term Loan B, to be used for general corporate purposes. It matures on 03/21/28 and initial pricing is set at EURIBOR +375.000bps

- Labeyrie Fine Foods SAS, signed a € 455m Term Loan B, to be used for general corporate purposes. It matures on 07/28/26 and initial pricing is set at EURIBOR +450.000bps

NEW ISSUES IN SECURITIZED CREDIT

- Santander Drive Auto Receivables Trust 2021-3 issued a floating-rate ABS backed by auto receivables in 6 tranches, for a total of US$ 2,500 m. Bookrunners: Barclays Capital Group, Deutsche Bank Securities Inc, Wells Fargo Securities LLC