Credit

Spreads Widen Across The Credit Complex

US investment grade bonds did well today despite wider cash spreads, with their higher average duration and a fall in long rates; US financials issued large offerings after releasing their earnings, with BofA printing US$7.75bn and MS US$8.5bn

Published ET

Rite Aid 5-Year USD CDS Spreads Have Widened Markedly Since February | Source: Refinitiv

QUICK SUMMARY

- S&P 500 Bond Index was up 0.70% today, with investment grade up 0.77% and high yield up 0.05% (YTD total return: -0.12%)

- The iBoxx USD Liquid Investment Grade Total Return Index was up 0.272% today (Month-to-date: 0.90%; Year-to-date: -0.71%)

- The iBoxx USD Liquid High Yield Total Return Index was down -0.113% today (Month-to-date: 0.12%; Year-to-date: 3.16%)

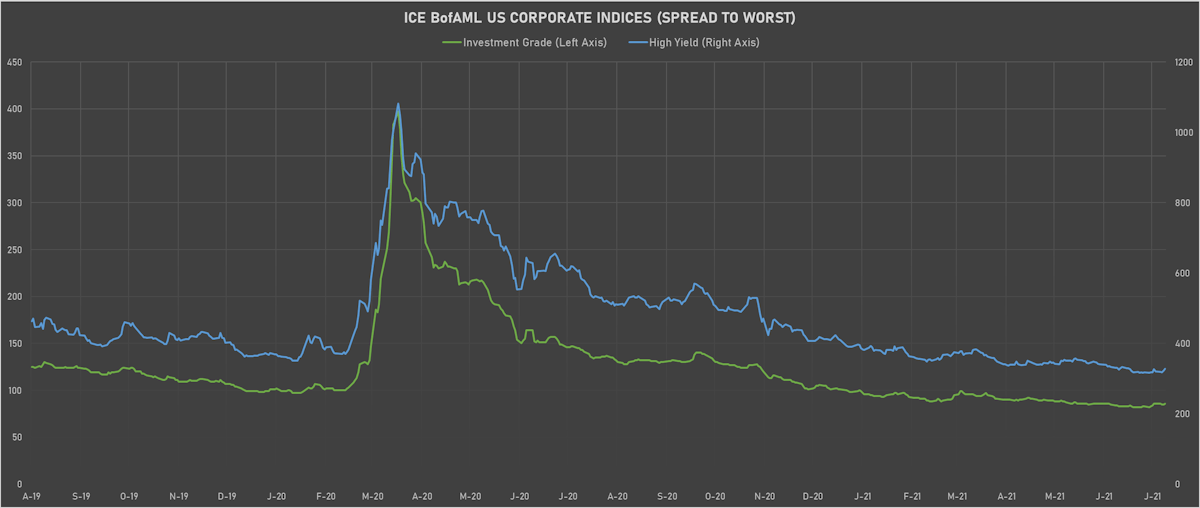

- ICE BofA US Corporate Index (Investment Grade) spread to worst up 1.0 bp, now at 86.0 bp (YTD change: -12.0 bp)

- ICE BofA US High Yield Index spread to worst up 5.0 bp, now at 328.0 bp (YTD change: -62.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index down -0.03% today (YTD total return: +2.2%)

- New issues: US$ 17.4bn in dollars and € 2.9bn in euros

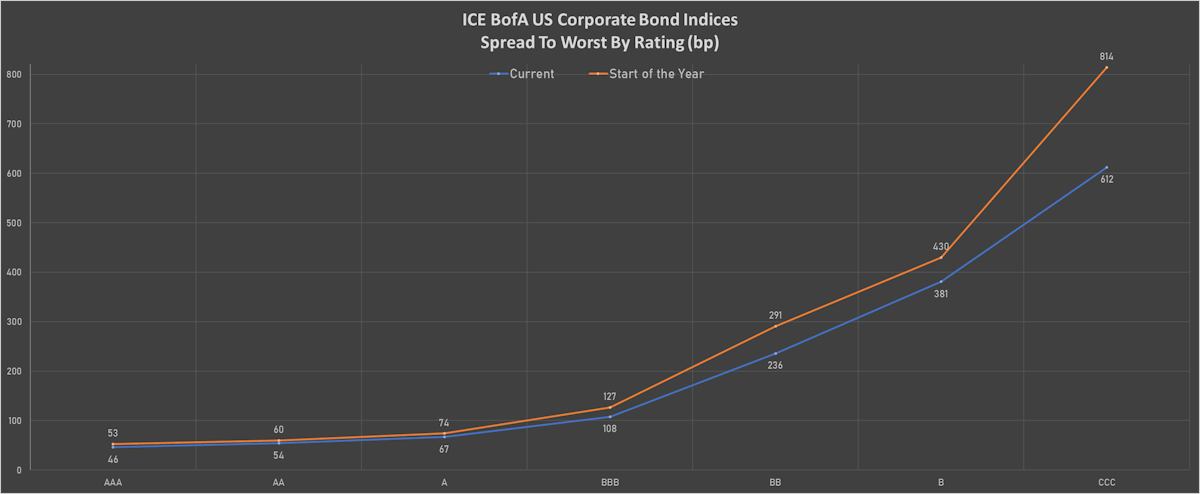

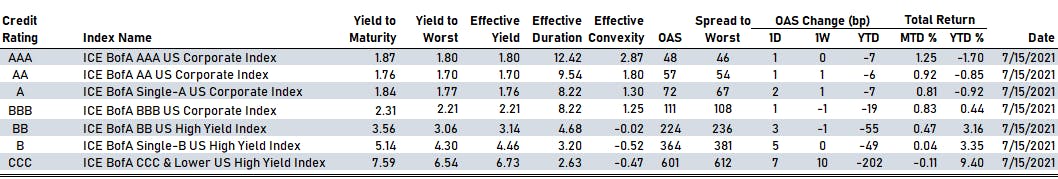

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

- AAA up by 1 bp at 48 bp

- AA up by 1 bp at 57 bp

- A up by 2 bp at 72 bp

- BBB up by 1 bp at 111 bp

- BB up by 3 bp at 224 bp

- B up by 5 bp at 364 bp

- CCC up by 7 bp at 601 bp

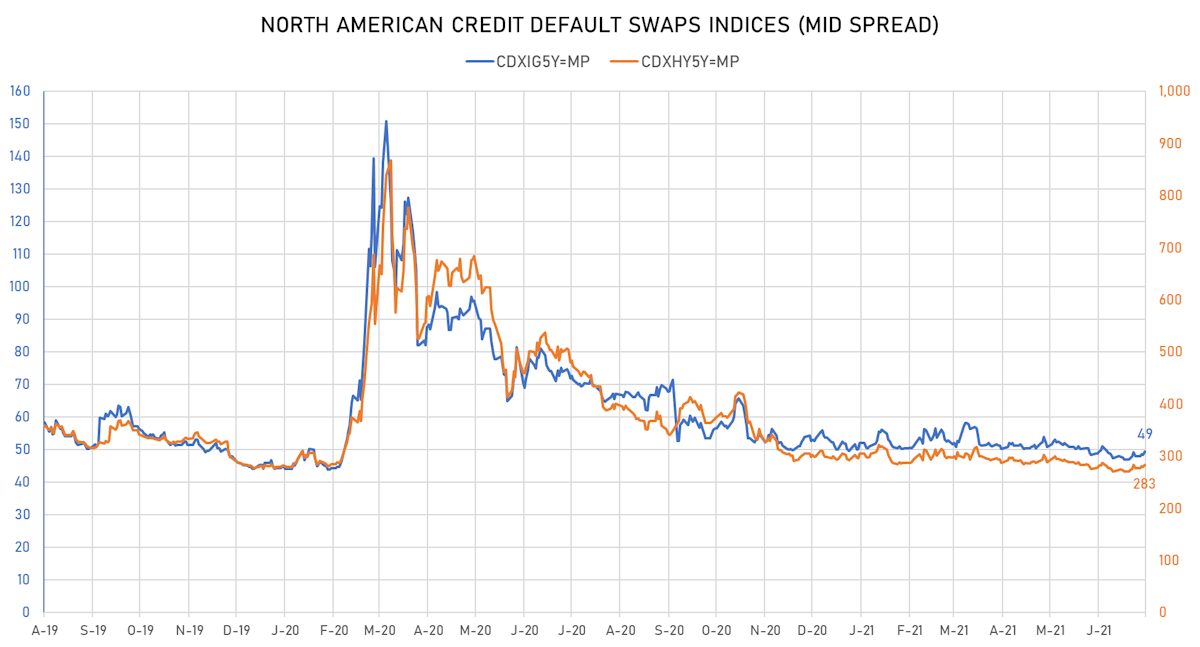

CDS INDICES (mid-spreads)

- Markit CDX.NA.IG 5Y up 0.9 bp, now at 49bp (YTD change: -0.7bp)

- Markit CDX.NA.HY 5Y up 3.8 bp, now at 283bp (YTD change: -10.2bp)

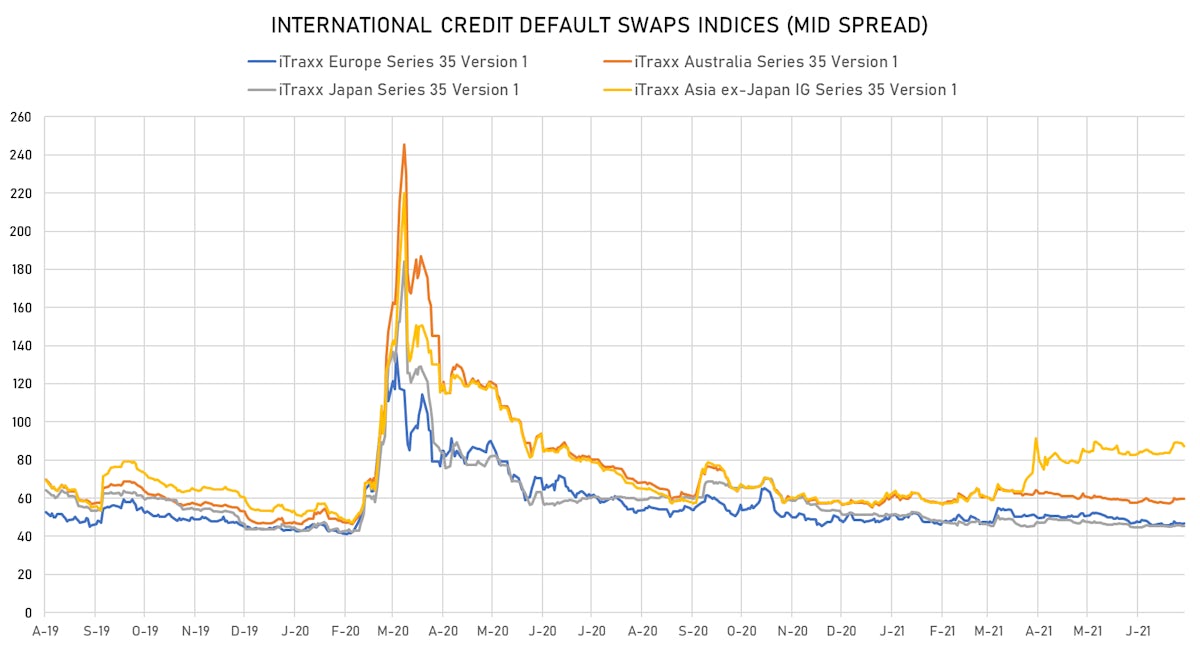

- Markit iTRAXX Europe up 0.8 bp, now at 47bp (YTD change: -0.5bp)

- Markit iTRAXX Japan down 0.3 bp, now at 45bp (YTD change: -6.4bp)

- Markit iTRAXX Asia Ex-Japan down 2.7 bp, now at 84bp (YTD change: +26.4bp)

LARGEST USD CORPORATE CDS MOVES IN THE PAST WEEK

- Hasbro Inc (Country: US; rated: A2): down 26.0 bp to 79.2bp (1Y range: 76-137bp)

- Bombardier Inc (Country: CA; rated: Caa2): down 24.0 bp to 436.0bp (1Y range: 437-1,912bp)

- Banco do Brasil SA (Country: BR; rated: WR): down 14.2 bp to 202.8bp (1Y range: 192-304bp)

- Pitney Bowes Inc (Country: US; rated: LGD2 - 16%): down 13.8 bp to 402.2bp (1Y range: 363-1,458bp)

- Royal Caribbean Cruises Ltd (Country: US; rated: LGD4 - 59%): up 14.5 bp to 336.7bp (1Y range: 318-1,425bp)

- Apache Corp (Country: US; rated: WD): up 16.6 bp to 186.3bp (1Y range: 168-453bp)

- RR Donnelley & Sons Co (Country: US; rated: B2): up 17.0 bp to 503.5bp (1Y range: 447-1,113bp)

- Beazer Homes USA Inc (Country: US; rated: B3): up 19.1 bp to 337.8bp (1Y range: 231-397bp)

- Carnival Corp (Country: US; rated: LGD5 - 71%): up 20.9 bp to 360.2bp (1Y range: 291-1,214bp)

- Macy's Inc (Country: US; rated: Ba3): up 22.7 bp to 299.9bp (1Y range: 273-1,253bp)

- Rite Aid Corp (Country: US; rated: Caa1): up 43.3 bp to 921.7bp (1Y range: 497-933bp)

- Nabors Industries Inc (Country: US; rated: B+): up 76.4 bp to 810.3bp (1Y range: 662-4,514bp)

- Transocean Inc (Country: KY; rated: Caa3): up 77.2 bp to 1,176.9bp (1Y range: 941-7,695bp)

- Talen Energy Supply LLC (Country: US; rated: B2): up 865.7 bp to 3,027.5bp (1Y range: 875-2,983bp)

LARGEST EURO CORPORATE CDS MOVES IN THE PAST WEEK

- Stonegate Pub Company Financing PLC (Country: GB; rated: WR): down 11.4 bp to 497.6bp (1Y range: 486-984bp)

- Ardagh Packaging Finance PLC (Country: IE; rated: B1): up 5.9 bp to 223.7bp (1Y range: 188-272bp)

- Virgin Media Finance PLC (Country: GB; rated: WR): up 6.0 bp to 242.0bp (1Y range: 208-325bp)

- Renault SA (Country: FR; rated: A-): up 6.1 bp to 195.8bp (1Y range: 168-277bp)

- Marks and Spencer PLC (Country: GB; rated: Ba1): up 7.6 bp to 193.6bp (1Y range: 174-349bp)

- Iceland Bondco PLC (Country: GB; rated: LGD3 - 46%): up 7.9 bp to 441.0bp (1Y range: 358-764bp)

- UPC Holding BV (Country: NL; rated: LGD6 - 93%): up 9.7 bp to 231.7bp (1Y range: 211-315bp)

- Alstom SA (Country: FR; rated: P-2): up 10.5 bp to 54.4bp (1Y range: 37-57bp)

- Stena AB (Country: SE; rated: B2-PD): up 10.8 bp to 529.3bp (1Y range: 523-750bp)

- Tui AG (Country: DE; rated: LGD4 - 50%): up 11.3 bp to 721.5bp (1Y range: 590-1,799bp)

- J Sainsbury PLC (Country: GB; rated: WR): up 12.6 bp to 82.3bp (1Y range: 52-84bp)

- CMA CGM SA (Country: FR; rated: B1): up 14.7 bp to 342.0bp (1Y range: 326-975bp)

- Deutsche Lufthansa AG (Country: DE; rated: Ba2): up 16.0 bp to 267.5bp (1Y range: 236-421bp)

- Novafives SAS (Country: FR; rated: Caa1): up 28.6 bp to 771.7bp (1Y range: 716-1,205bp)

- Jaguar Land Rover Automotive PLC (Country: GB; rated: WD): up 45.1 bp to 381.1bp (1Y range: 339-918bp)

USD BOND ISSUES

- ADT Security Corp (Electronics | Boca Raton, Florida, United States | Rating: BB-): US$1,000m Note (US00109LAA17), fixed rate (4.13% coupon) maturing on 1 August 2029, priced at 100.00 (original spread of 298 bp), callable (8nc7)

- Bank of America hit the market with 3 tranches for a total of US$7.75bn: US$2bn 7/22/2027 coupon 1.734% priced at 100.907 to yield 1.545%, US$3.75bn 11nc10 priced at 2.2990% (US06051GKA66) and $2bn 31nc30 at 2.9720% (US06051GKB40)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$145m Bond (US3133EMU592), fixed rate (1.22% coupon) maturing on 21 July 2028, priced at 100.00 (original spread of 99 bp), callable (7nc2)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$165m Bond (US3133EMU758), floating rate (FFQ + -1.0 bp) maturing on 21 July 2023, priced at 100.00, non callable

- HCRX Investments HoldCo LP (Financial - Other | Delaware, United States | Rating: NR): US$650m Senior Note (US40390FAA84), fixed rate (4.50% coupon) maturing on 1 August 2029, priced at 100.00 (original spread of 331 bp), callable (8nc3)

- Morgan Stanley (Financial - Other | New York City, United States | Rating: BBB+): US$3,500m Senior Note (US61747YED31), floating rate maturing on 21 July 2032, priced at 100.00 (original spread of 98 bp), callable (11nc10)

- Morgan Stanley (Financial - Other | New York City, United States | Rating: BBB+): US$3,000m Senior Note (US61747YEC57), floating rate maturing on 20 July 2027, priced at 100.00 (original spread of 66 bp), callable (6nc5)

- Morgan Stanley (Financial - Other | New York City, United States | Rating: BBB+): US$2,000m Senior Note (US61747YEB74), floating rate maturing on 22 January 2025, priced at 100.00 (original spread of 37 bp), callable (4nc3)

- Royalty Pharma PLC (Pharmaceuticals | New York City, United States | Rating: BBB-): US$600m Senior Note (US78081BAN38), fixed rate (2.15% coupon) maturing on 2 September 2031, priced at 98.26 (original spread of 109 bp), callable (10nc10)

- Royalty Pharma PLC (Pharmaceuticals | New York City, United States | Rating: BBB-): US$700m Senior Note (US78081BAP85), fixed rate (3.35% coupon) maturing on 2 September 2051, priced at 97.57 (original spread of 193 bp), callable (30nc30)

- Adani Electricity Mumbai Ltd (Utility - Other | Ahmedabad, India | Rating: BBB-): US$300m Note (US00654GAB95), fixed rate (3.87% coupon) maturing on 22 July 2031, priced at 100.00 (original spread of 262 bp), callable (10nc10)

- African Development Bank (Supranational | Abidjan, Ivory Coast | Rating: AAA): US$2,750m Senior Note (US00828EEF25), fixed rate (0.88% coupon) maturing on 22 July 2026, priced at 99.94 (original spread of 9 bp), non callable

- Banco Fibra SA (Banking | Sao Paulo, Brazil | Rating: B-): US$600m Senior Note (US171653AA64), fixed rate (4.38% coupon) maturing on 22 July 2031, priced at 99.61 (original spread of 317 bp), with a make whole call

- CCBL (Cayman) 1 Corporation Ltd (Financial - Other | Beijing, Beijing, China (Mainland) | Rating: A): US$600m Senior Note (XS2333669518), fixed rate (1.80% coupon) maturing on 22 July 2026, priced at 99.83 (original spread of 105 bp), non callable

- Estate Sky Ltd (Financial - Other | Tortola | Rating: NR): US$300m Senior Note (XS2360202829), fixed rate (5.45% coupon) maturing on 21 July 2025, priced at 100.00, callable (4nc3)

- Expand Lead Ltd (Financial - Other | China (Mainland) | Rating: NR): US$300m Senior Note (XS2359944704), fixed rate (4.95% coupon) maturing on 22 July 2026, priced at 100.00, non callable

- Millennium Escrow Corp (Financial - Other | Downey, California | Rating: NR): US$785m Note (US60041CAA62), fixed rate (6.63% coupon) maturing on 1 August 2026, priced at 100.00 (original spread of 582 bp), callable (5nc2)

EUR BOND ISSUES

- Benin, Republic of (Government) (Sovereign | Cotonou, Benin | Rating: B): €500m Senior Note (XS2366833205), fixed rate (4.95% coupon) maturing on 22 January 2035, priced at 97.33 (original spread of 556 bp), non callable

- Bulgarian Energy Holding EAD (Utility - Other | Sofia, Sofia, Bulgaria | Rating: BB): €600m Senior Note (XS2367164576), fixed rate (2.45% coupon) maturing on 22 July 2028, priced at 100.00 (original spread of 305 bp), callable (7nc7)

- Leasys SpA (Service - Other | Fiumicino, Roma, Italy | Rating: NR): €500m Bond (XS2366741770) zero coupon maturing on 22 July 2024, priced at 99.83 (original spread of 79 bp), callable (3nc3)

- NRW Bank (Agency | Dusseldorf, Nordrhein-Westfalen, Germany | Rating: AA): €250m Inhaberschuldverschreibung (DE000NWB18T2) zero coupon maturing on 20 December 2024, priced at 101.65 (original spread of 0 bp), non callable

- Sani/Ikos Financial Holdings 1 SARL (Financial - Other | Windhof, Luxembourg | Rating: NR): €300m Note (XS2367108151), fixed rate (5.63% coupon) maturing on 15 December 2026, priced at 100.00 (original spread of 626 bp), callable (5nc2)

- State of Rhineland Palatinate (Official and Muni | Mainz, Rheinland-Pfalz, Germany | Rating: AAA): €130m Landesschatzanweisung (DE000RLP1312), floating rate (EU06MLIB + 150.0 bp) maturing on 15 July 2024, non callable

- UniCredit Bank Austria AG (Banking | Wien, Wien, Italy | Rating: BBB+): €600m Pfandbrief Anleihe (Covered Bond) (AT000B049879), floating rate (EU03MLIB) maturing on 22 July 2026, priced at 100.00, non callable

NEW LOANS

- Ford Otomotiv Sanayi AS, signed a € 325m Term Loan, to be used for general corporate purposes. It matures on 07/14/28 and initial pricing is set at EURIBOR +245bps

NEW ISSUES IN SECURITIZED CREDIT

- Lendingpoint 2021-A Asset Securitization Trust issued a fixed-rate ABS backed by consumer loan in 3 tranches, for a total of US$ 460 m. Highest-rated tranche offering a yield to maturity of 1.00%, and the lowest-rated tranche a yield to maturity of 5.73%. Bookrunners: Credit Suisse, Guggenheim Securities LLC

- GM Financial Consumer Automobile Receivables Trust 2021-3 issued a fixed-rate ABS backed by auto receivables in 5 tranches, for a total of US$ 1,215 m. Highest-rated tranche offering a yield to maturity of 0.21%, and the lowest-rated tranche a yield to maturity of 1.09%. Bookrunners: Wells Fargo Securities LLC, BMO Capital Markets, Lloyds Securities Inc, MUFG Securities Americas Inc

- Pret 2021-Npl3 issued a fixed-rate RMBS in 2 tranches, for a total of US$ 314 m. Highest-rated tranche offering a yield to maturity of 1.87%, and the lowest-rated tranche a yield to maturity of 3.72%. Bookrunners: Goldman Sachs & Co

- Regional Management Issuance Trust 2021-2 issued a fixed-rate ABS backed by consumer loan in 4 tranches, for a total of US$ 200 m. Highest-rated tranche offering a yield to maturity of 1.90%, and the lowest-rated tranche a yield to maturity of 4.94%. Bookrunners: Credit Suisse, JP Morgan & Co Inc, Wells Fargo Securities LLC