Credit

US Corporate Cash Spreads Widen on Friday: IG up 1bp, HY Up 4bp

Weekly bond issuance volumes (from IFR data): US$30.55bn in 16 Tranches for IG, US$7.895bn in 12 Tranches for HY

Published ET

ICE BofAML US Corporate Single-Bs & CCCs OAS | Sources: ϕpost, Refinitiv data

QUICK SUMMARY

- The iBoxx USD Liquid Investment Grade Total Return Index was down -0.137% today (Month-to-date: 0.76%; Year-to-date: -0.84%)

- The iBoxx USD Liquid High Yield Total Return Index was down -0.040% today (Month-to-date: 0.08%; Year-to-date: 3.12%)

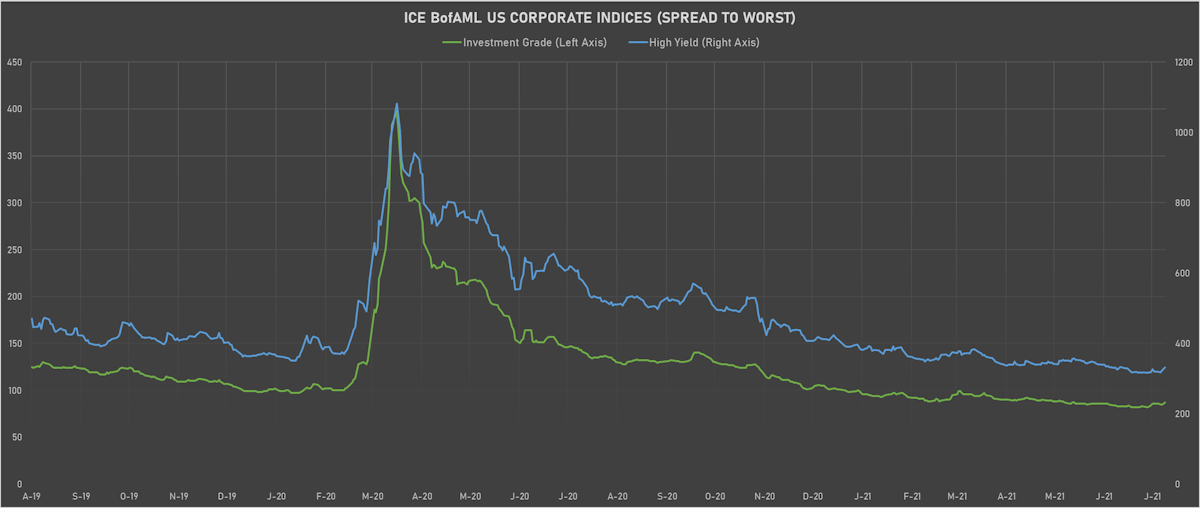

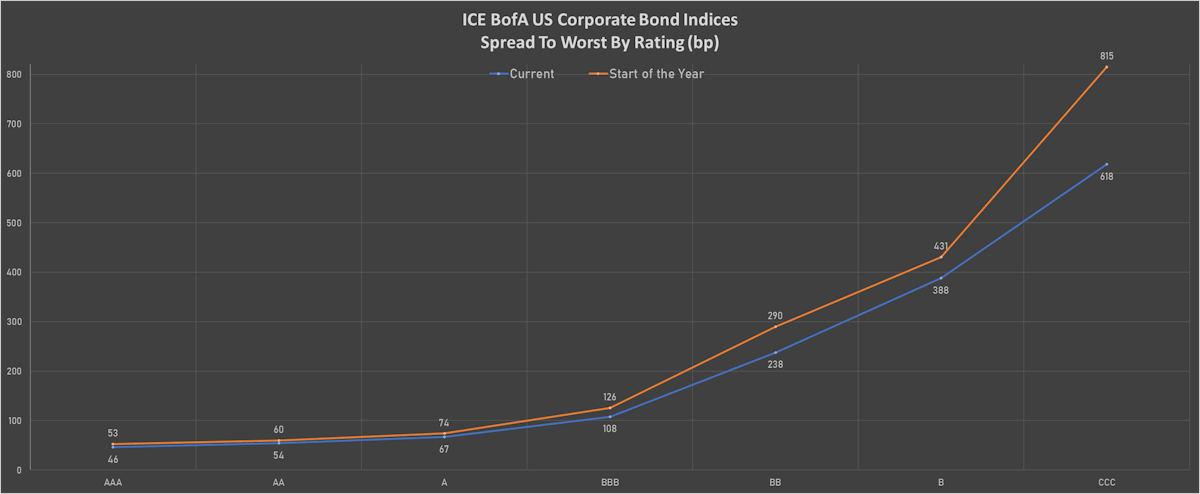

- ICE BofA US Corporate Index (Investment Grade) spread to worst up 1.0 bp, now at 87.0 bp (YTD change: -11.0 bp)

- ICE BofA US High Yield Index spread to worst up 4.0 bp, now at 332.0 bp (YTD change: -58.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index down -0.02% today (YTD total return: +2.2%)

CDS INDICES (mid-spreads)

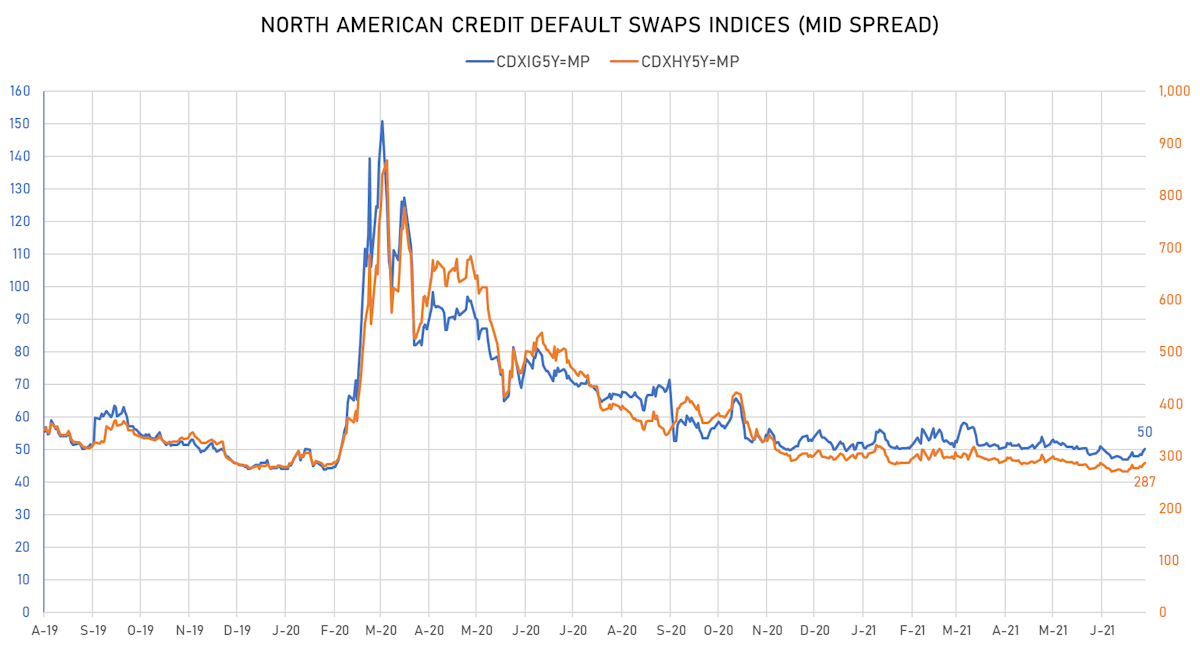

- Markit CDX.NA.IG 5Y up 0.7 bp, now at 50bp (YTD change: +0.1bp)

- Markit CDX.NA.HY 5Y up 3.6 bp, now at 287bp (YTD change: -6.5bp)

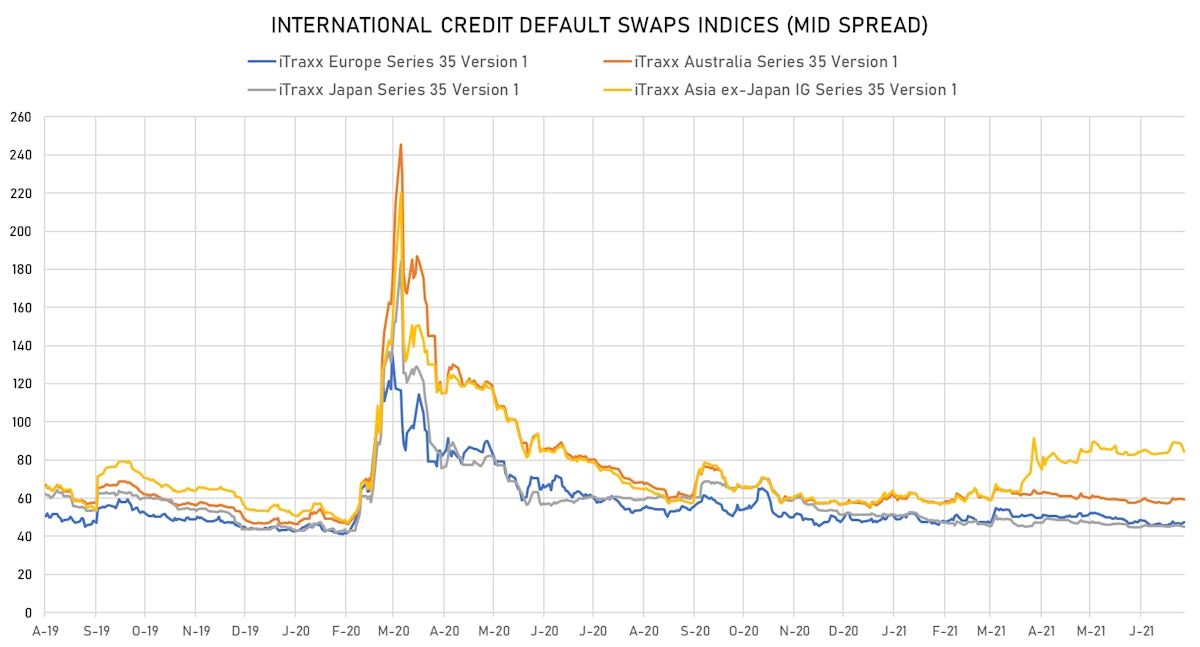

- Markit iTRAXX Europe up 0.1 bp, now at 48bp (YTD change: -0.3bp)

- Markit iTRAXX Japan up 0.1 bp, now at 45bp (YTD change: -6.3bp)

- Markit iTRAXX Asia Ex-Japan down 0.1 bp, now at 84bp (YTD change: +26.3bp)

LARGEST USD CORPORATE CDS MOVES IN THE PAST WEEK

- Hasbro Inc (Country: US; rated: A2): down 26.0 bp to 79.2bp (1Y range: 75-137bp)

- Bombardier Inc (Country: CA; rated: Caa2): down 24.0 bp to 436.0bp (1Y range: 445-1,912bp)

- Banco do Brasil SA (Country: BR; rated: WR): down 14.2 bp to 202.8bp (1Y range: 192-304bp)

- Pitney Bowes Inc (Country: US; rated: LGD2 - 16%): down 13.8 bp to 402.2bp (1Y range: 363-1,411bp)

- Mattel Inc (Country: US; rated: Ba2): down 12.1 bp to 195.3bp (1Y range: 190-397bp)

- American Airlines Group Inc (Country: US; rated: B2): up 12.5 bp to 645.6bp (1Y range: 596-3,463bp)

- Royal Caribbean Cruises Ltd (Country: US; rated: LGD4 - 59%): up 14.5 bp to 336.7bp (1Y range: 318-1,412bp)

- Apache Corp (Country: US; rated: WD): up 16.6 bp to 186.3bp (1Y range: 168-453bp)

- RR Donnelley & Sons Co (Country: US; rated: B2): up 17.0 bp to 503.5bp (1Y range: 447-1,113bp)

- Beazer Homes USA Inc (Country: US; rated: B3): up 19.1 bp to 337.8bp (1Y range: 231-396bp)

- Carnival Corp (Country: US; rated: LGD5 - 71%): up 20.9 bp to 360.2bp (1Y range: 291-1,214bp)

- Macy's Inc (Country: US; rated: Ba3): up 22.7 bp to 299.9bp (1Y range: 273-1,253bp)

- Transocean Inc (Country: KY; rated: Caa3): up 77.2 bp to 1,176.9bp (1Y range: 941-7,695bp)

- Talen Energy Supply LLC (Country: US; rated: B2): up 865.7 bp to 3,027.5bp (1Y range: 875-2,855bp)

LARGEST EURO CORPORATE CDS MOVES IN THE PAST WEEK - Valeo SE (Country: FR; rated: BB): up 5.8 bp to 135.3bp (1Y range: 115-189bp)

- Ardagh Packaging Finance PLC (Country: IE; rated: B1): up 5.9 bp to 223.7bp (1Y range: 188-272bp)

- Virgin Media Finance PLC (Country: GB; rated: WR): up 6.0 bp to 242.0bp (1Y range: 208-325bp)

- Banca Monte dei Paschi di Siena SpA (Country: IT; rated: NP): up 6.1 bp to 222.9bp (1Y range: 188-272bp)

- Renault SA (Country: FR; rated: A-): up 6.1 bp to 195.8bp (1Y range: 168-277bp)

- Marks and Spencer PLC (Country: GB; rated: Ba1): up 7.6 bp to 193.6bp (1Y range: 174-349bp)

- Iceland Bondco PLC (Country: GB; rated: LGD3 - 46%): up 7.9 bp to 441.0bp (1Y range: 358-764bp)

- UPC Holding BV (Country: NL; rated: LGD6 - 93%): up 9.7 bp to 231.7bp (1Y range: 211-315bp)

- Alstom SA (Country: FR; rated: P-2): up 10.5 bp to 54.4bp (1Y range: 37-57bp)

- Tui AG (Country: DE; rated: LGD4 - 50%): up 11.3 bp to 721.5bp (1Y range: 590-1,799bp)

- J Sainsbury PLC (Country: GB; rated: WR): up 12.6 bp to 82.3bp (1Y range: 52-86bp)

- CMA CGM SA (Country: FR; rated: B1): up 14.7 bp to 342.0bp (1Y range: 326-975bp)

- Deutsche Lufthansa AG (Country: DE; rated: Ba2): up 16.0 bp to 267.5bp (1Y range: 236-421bp)

- Novafives SAS (Country: FR; rated: Caa1): up 28.6 bp to 771.7bp (1Y range: 716-1,205bp)

- Jaguar Land Rover Automotive PLC (Country: GB; rated: WD): up 45.1 bp to 381.1bp (1Y range: 339-918bp)

USD BOND ISSUES

- CURO Group Holdings Corp (Financial - Other | Wichita, United States | Rating: B-): US$750m Note (US23131LAC19), fixed rate (7.50% coupon) maturing on 1 August 2028, priced at 100.00, callable (7nc3)

- Citigroup Global Markets Holdings Inc (Securities | New York City, United States | Rating: BBB+): US$345m Unsecured Note (XS2307409255), fixed rate (4.00% coupon) maturing on 28 July 2026, priced at 100.00, non callable

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$140m Bond (US3133EMV418), floating rate (SOFR + 6.0 bp) maturing on 22 July 2024, priced at 100.00, non callable

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$365m Bond (US3133EMV251), fixed rate (0.45% coupon) maturing on 23 July 2024, priced at 100.00 (original spread of 0 bp), non callable

- Federal Home Loan Banks (Agency | Washington, United States | Rating: NR): US$110m Bond (US3130ANDB36), fixed rate (1.11% coupon) maturing on 13 August 2026, priced at 100.00 (original spread of 103 bp), callable (5nc1m)

EUR BOND ISSUES

- Luminis Investments PLC (Financial - Other | Dublin, Ireland | Rating: NR): €125m Unsecured Note (XS2360496041) zero coupon maturing on 21 January 2026, non callable

- SIGNA Development Finance SCS (Financial - Other | Senningerberg, Austria | Rating: NR): €300m Senior Note (DE000A3KS5R1), fixed rate (5.50% coupon) maturing on 23 July 2026, priced at 98.93 (original spread of 642 bp), callable (5nc2)

NEW LOANS

- Mumbai Intl Airport Pvt Ltd, signed a US$ 1,100m Revolving Credit / Term Loan, to be used for project finance and refinancing bank debt

- Dominion Energy Inc (BBB), signed a US$ 1,265m Term Loan, to be used for general corporate purposes. It matures on 12/31/21 and initial pricing is set at LIBOR +60bps

NEW ISSUES IN SECURITIZED CREDIT

- Capital One Multi-Asset Execution Trust Series 2021-A2 issued a fixed-rate ABS backed by receivables in 1 tranche, for a total of US$ 1,399 m. Highest-rated tranche offering a yield to maturity of 1.40%, and the lowest-rated tranche a yield to maturity of 1.40%. Bookrunners: JP Morgan & Co Inc, RBC Capital Markets, Wells Fargo Securities LLC