Credit

Spreads Fall Across The Credit Complex, And So Do Investment Grade Bonds With Higher Rates

Transportation and travel companies have seen weaker bond prices in the past week, with the spreads on Carnival and Royal Caribbean Cruises widening in high double digits

Published ET

ICE BofAML US Corporate IG & HY Spreads To Worst | Sources: ϕpost, Refinitiv data

QUICK SUMMARY

- S&P 500 Bond Index was down -0.28% today, with investment grade down -0.34% and high yield up 0.16% (YTD total return: -0.28%)

- The iBoxx USD Liquid Investment Grade Total Return Index was down -0.36% today (Month-to-date: 0.79%; Year-to-date: -0.81%)

- The iBoxx USD Liquid High Yield Total Return Index was up 0.25% today (Month-to-date: 0.05%; Year-to-date: 3.09%)

- ICE BofA US Corporate Index (Investment Grade) spread to worst down -2.0 bp, now at 88.0 bp (YTD change: -10.0 bp)

- ICE BofA US High Yield Index spread to worst down -14.0 bp, now at 338.0 bp (YTD change: -52.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index up 0.01% today (YTD total return: +2.0%)

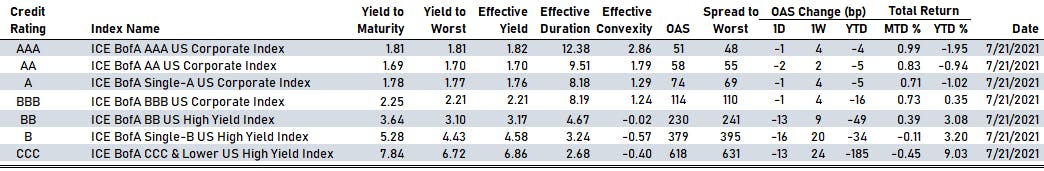

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

- AAA down by -1 bp at 51 bp

- AA down by -2 bp at 58 bp

- A down by -1 bp at 74 bp

- BBB down by -1 bp at 114 bp

- BB down by -13 bp at 230 bp

- B down by -16 bp at 379 bp

- CCC down by -13 bp at 618 bp

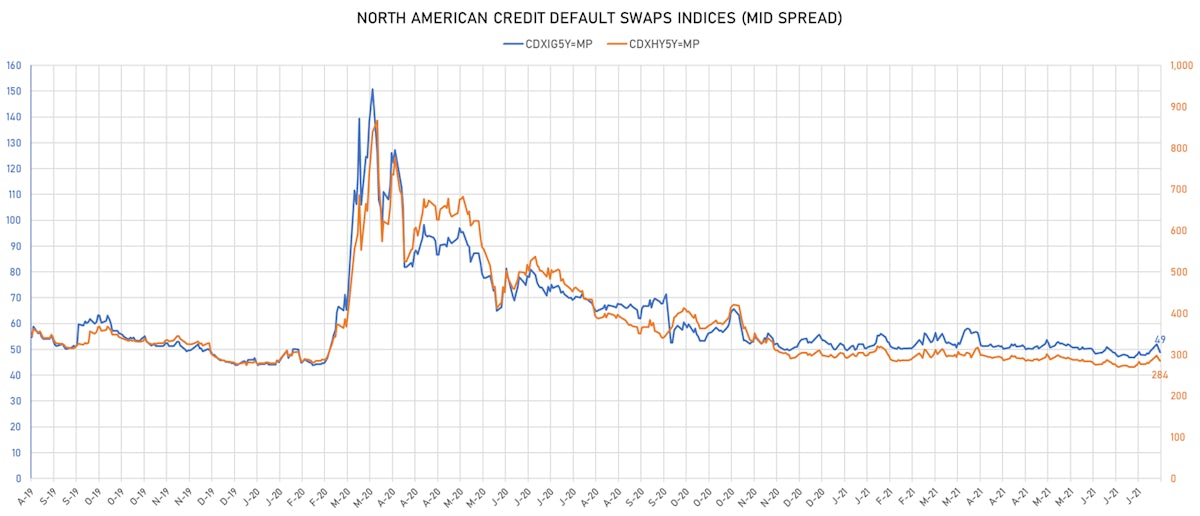

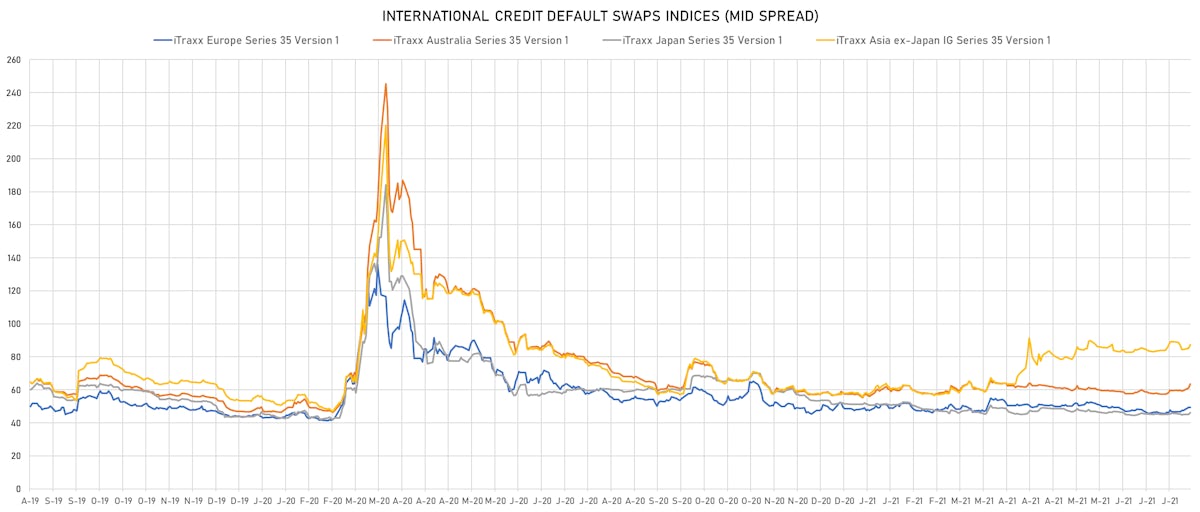

CDS INDICES (mid-spreads)

- Markit CDX.NA.IG 5Y down 1.9 bp, now at 49bp (YTD change: -1.1bp)

- Markit CDX.NA.HY 5Y down 7.5 bp, now at 284bp (YTD change: -8.9bp)

- Markit iTRAXX Europe down 1.7 bp, now at 48bp (YTD change: -0.4bp)

- Markit iTRAXX Japan down 0.2 bp, now at 46bp (YTD change: -5.5bp)

- Markit iTRAXX Asia Ex-Japan down 1.1 bp, now at 86bp (YTD change: +28.1bp)

TOP BONDS MOVES IN THE PAST WEEK - USD HY

- Issuer: Royal Caribbean Cruises Ltd (Miami, Liberia) | Coupon: 4.25% | Maturity: 1/7/2026 | Rating: B | ISIN: USV7780TAF04 | Z-spread up by 65.4 bp to 410.9 bp (CDS basis: -15.5bp), with the yield to worst at 4.7% and the bond now trading down to 97.1 cents on the dollar (1Y price range: 94.6-100.9).

- Issuer: Carnival Corp (Miami, Panama) | Coupon: 5.75% | Maturity: 1/3/2027 | Rating: B | ISIN: USP2121VAL82 | Z-spread up by 61.1 bp to 462.4 bp (CDS basis: -39.7bp), with the yield to worst at 5.3% and the bond now trading down to 101.2 cents on the dollar (1Y price range: 99.1-106.5).

- Issuer: Vedanta Resources Finance II PLC (London, United Kingdom) | Coupon: 8.95% | Maturity: 11/3/2025 | Rating: B- | ISIN: USG9T27HAD62 | Z-spread up by 60.7 bp to 963.5 bp, with the yield to worst at 9.9% and the bond now trading down to 96.2 cents on the dollar (1Y price range: 94.3-99.8).

- Issuer: NCL Finance Ltd (#N/A, United Kingdom) | Coupon: 6.13% | Maturity: 15/3/2028 | Rating: CCC+ | ISIN: USG6437FAA78 | Z-spread up by 55.0 bp to 486.3 bp, with the yield to worst at 5.7% and the bond now trading down to 101.5 cents on the dollar (1Y price range: 101.5-105.9).

- Issuer: WeWork Companies Inc (New York City, New York (US)) | Coupon: 7.88% | Maturity: 1/5/2025 | Rating: CC | ISIN: USU96217AA99 | Z-spread up by 43.3 bp to 685.5 bp, with the yield to worst at 7.0% and the bond now trading down to 101.8 cents on the dollar (1Y price range: 67.5-104.8).

- Issuer: EnLink Midstream LLC (Dallas, Texas (US)) | Coupon: 5.63% | Maturity: 15/1/2028 | Rating: BB | ISIN: USU26790AB82 | Z-spread up by 41.1 bp to 372.9 bp, with the yield to worst at 4.5% and the bond now trading down to 104.9 cents on the dollar (1Y price range: 96.8-107.4).

- Issuer: Kuwait Projects Company SPC Ltd (Dubai, United Arab Emirates) | Coupon: 4.23% | Maturity: 29/10/2026 | Rating: BB- | ISIN: XS2071383397 | Z-spread up by 40.9 bp to 390.3 bp, with the yield to worst at 4.5% and the bond now trading down to 98.0 cents on the dollar (1Y price range: 96.6-104.7).

- Issuer: NCL Corporation Ltd (Miami, Bermuda) | Coupon: 5.88% | Maturity: 15/3/2026 | Rating: CCC+ | ISIN: USG6436QAL08 | Z-spread up by 40.5 bp to 489.7 bp, with the yield to worst at 5.5% and the bond now trading down to 100.9 cents on the dollar (1Y price range: 98.5-105.3).

- Issuer: Banco BTG Pactual SA (Cayman Islands Branch) (#N/A, Cayman Islands) | Coupon: 4.50% | Maturity: 10/1/2025 | Rating: BB- | ISIN: US05971BAE92 | Z-spread up by 37.6 bp to 287.4 bp, with the yield to worst at 3.3% and the bond now trading down to 103.4 cents on the dollar (1Y price range: 102.4-107.7).

- Issuer: bijeo jgupi ss (Tbilisi, Georgia) | Coupon: 6.00% | Maturity: 26/7/2023 | Rating: BB- | ISIN: XS1405775880 | Z-spread up by 31.2 bp to 282.7 bp, with the yield to worst at 2.9% and the bond now trading down to 105.6 cents on the dollar (1Y price range: 104.5-106.5).

- Issuer: EnerSys (Reading, Pennsylvania (US)) | Coupon: 5.00% | Maturity: 30/4/2023 | Rating: BB- | ISIN: USU2928LAA36 | Z-spread up by 30.5 bp to 207.9 bp, with the yield to worst at 2.1% and the bond now trading down to 104.0 cents on the dollar (1Y price range: 103.8-105.8).

- Issuer: Banco Safra SA (Cayman Islands Branch) (George Town, Cayman Islands) | Coupon: 4.13% | Maturity: 8/2/2023 | Rating: BB- | ISIN: US05964TAQ22 | Z-spread down by 28.9 bp to 159.5 bp, with the yield to worst at 1.6% and the bond now trading up to 103.5 cents on the dollar (1Y price range: 102.3-104.8).

TOP BONDS MOVES IN THE PAST WEEK - EUR HY

- Issuer: Adler Group SA (Senningerberg, Luxembourg) | Coupon: 2.25% | Maturity: 27/4/2027 | Rating: BB+ | ISIN: XS2336188029 | Z-spread up by 33.0 bp to 319.1 bp, with the yield to worst at 2.7% and the bond now trading down to 96.6 cents on the dollar (1Y price range: 94.4-100.2).

- Issuer: International Consolidated Airlines Group SA (London, Spain) | Coupon: 3.75% | Maturity: 25/3/2029 | Rating: B+ | ISIN: XS2322423539 | Z-spread up by 21.7 bp to 413.4 bp, with the yield to worst at 3.8% and the bond now trading down to 98.7 cents on the dollar (1Y price range: 97.5-102.0).

- Issuer: SoftBank Group Corp (Minato-Ku, Japan) | Coupon: 3.38% | Maturity: 6/7/2029 | Rating: BB+ | ISIN: XS2361255057 | Z-spread up by 14.0 bp to 375.2 bp, with the yield to worst at 3.4% and the bond now trading down to 98.8 cents on the dollar (1Y price range: 97.7-99.9).

- Issuer: Teva Pharmaceutical Finance Netherlands II BV (Amsterdam, Netherlands) | Coupon: 1.88% | Maturity: 31/3/2027 | Rating: BB- | ISIN: XS1211044075 | Z-spread up by 13.2 bp to 380.9 bp, with the yield to worst at 3.3% and the bond now trading down to 91.7 cents on the dollar (1Y price range: 90.5-95.4).

- Issuer: Rolls-Royce PLC (Birmingham, United Kingdom) | Coupon: 1.63% | Maturity: 9/5/2028 | Rating: BB- | ISIN: XS1819574929 | Z-spread up by 12.1 bp to 312.6 bp (CDS basis: -22.1bp), with the yield to worst at 2.7% and the bond now trading down to 92.3 cents on the dollar (1Y price range: 90.4-94.1).

- Issuer: Petroleos Mexicanos (Miguel Hidalgo, Mexico) | Coupon: 4.88% | Maturity: 21/2/2028 | Rating: BB- | ISIN: XS1568888777 | Z-spread up by 11.6 bp to 513.1 bp (CDS basis: -97.2bp), with the yield to worst at 4.8% and the bond now trading down to 100.0 cents on the dollar (1Y price range: 97.7-103.3).

- Issuer: Renault SA (Boulogne-Billancourt, France) | Coupon: 1.13% | Maturity: 4/10/2027 | Rating: BB | ISIN: FR0013451416 | Z-spread up by 10.1 bp to 258.0 bp (CDS basis: -36.1bp), with the yield to worst at 2.2% and the bond now trading down to 93.2 cents on the dollar (1Y price range: 91.1-95.8).

- Issuer: Mytilineos SA (Athina, Greece) | Coupon: 2.25% | Maturity: 30/10/2026 | Rating: BB- | ISIN: XS2337604479 | Z-spread up by 9.9 bp to 240.0 bp, with the yield to worst at 1.9% and the bond now trading down to 100.9 cents on the dollar (1Y price range: 99.6-102.2).

- Issuer: Dometic Group AB (publ) (Solna, Sweden) | Coupon: 3.00% | Maturity: 8/5/2026 | Rating: BB- | ISIN: XS1991114858 | Z-spread up by 7.4 bp to 196.3 bp, with the yield to worst at 1.5% and the bond now trading down to 106.3 cents on the dollar (1Y price range: 102.7-106.7).

- Issuer: Ford Motor Credit Company LLC (Dearborn, Michigan (US)) | Coupon: 2.33% | Maturity: 25/11/2025 | Rating: BB | ISIN: XS2052337503 | Z-spread down by 10.0 bp to 177.0 bp (CDS basis: -18.9bp), with the yield to worst at 1.3% and the bond now trading up to 103.9 cents on the dollar (1Y price range: 100.4-104.3).

USD BOND ISSUES

- Builders FirstSource Inc (Building Products | Dallas, Texas, United States | Rating: BB): US$1,000m Senior Note (US12008RAP29), fixed rate (4.25% coupon) maturing on 1 February 2032, priced at 100.00 (original spread of 298 bp), callable (11nc5)

- Carnival Corp (Leisure | Miami, Florida, United States | Rating: BB-): US$2,406m Note (US143658BQ44), fixed rate (4.00% coupon) maturing on 1 August 2028, priced at 100.00 (original spread of 297 bp), callable (7nc7)

- Constellation Brands Inc (Beverage/Bottling | Victor, New York, United States | Rating: BBB): US$1,000m Senior Note (US21036PBH01), fixed rate (2.25% coupon) maturing on 1 August 2031, priced at 99.56 (original spread of 100 bp), callable (10nc10)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$150m Bond (US3133EMW655), fixed rate (2.50% coupon) maturing on 29 July 2041, priced at 100.00 (original spread of 243 bp), callable (20nc1)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$150m Bond (US3133EMW812), floating rate (AB3DM + 2.5 bp) maturing on 27 July 2023, priced at 100.00, non callable

- Federal Home Loan Banks (Agency | Washington, Washington Dc, United States | Rating: NR): US$350m Bond (US3130ANF397), fixed rate (0.50% coupon) maturing on 2 August 2024, priced at 100.00 (original spread of 44 bp), callable (3nc3m)

- McGraw-Hill Education Inc (Financial - Other | New York City, New York, United States | Rating: NR): US$900m Note (US57767XAA81), fixed rate (5.75% coupon) maturing on 1 August 2028, priced at 100.00, callable (7nc3)

- Antares Holdings LP (Financial - Other | Toronto, Ontario, Canada | Rating: NR): US$500m Senior Note (US03666HAD35), fixed rate (2.75% coupon) maturing on 15 January 2027, priced at 99.31 (original spread of 215 bp), callable (5nc5)

- BNP Paribas Issuance BV (Financial - Other | Amsterdam, Noord-Holland, France | Rating: A+): US$3,097m Unsecured Note (XS2297334786) zero coupon maturing on 26 July 2023, priced at 60.00, non callable

- BNP Paribas Issuance BV (Financial - Other | Amsterdam, Noord-Holland, France | Rating: A+): US$205m Unsecured Note (XS2297341484), floating rate maturing on 10 August 2023, priced at 99.65, non callable

- Brookfield Finance I (Uk) PLC (Financial - Other | London, United Kingdom | Rating: A-): US$600m Senior Note (US11272BAA17), fixed rate (2.34% coupon) maturing on 30 January 2032, priced at 100.00 (original spread of 105 bp), callable (11nc10)

- CSSC Capital 2015 Ltd (Financial - Other | Tortola, China (Mainland) | Rating: NR): US$500m Bond (XS2358216211), fixed rate (2.10% coupon) maturing on 27 July 2026, priced at 99.67 (original spread of 145 bp), non callable

- Chalco Hong Kong Investment Co Ltd (Financial - Other | China (Mainland) | Rating: NR): US$500m Bond (XS2366272412), fixed rate (2.10% coupon) maturing on 28 July 2026, priced at 99.74 (original spread of 145 bp), callable (5nc5)

- Chalco Hong Kong Investment Co Ltd (Financial - Other | China (Mainland) | Rating: NR): US$500m Bond (XS2366272339), fixed rate (1.55% coupon) maturing on 28 July 2024, priced at 99.80 (original spread of 125 bp), callable (3nc3)

- Harp Issuer PLC (Financial - Other | Dublin, Dublin, Ireland | Rating: NR): US$750m Unsecured Note (XS2369294348), fixed rate (4.54% coupon) maturing on 1 August 2026, priced at 100.00, non callable

- Indonesia, Republic of (Government) (Sovereign | Jakarta Pusat, Dki Jakarta, Indonesia | Rating: BBB): US$600m Bond (US455780CY00), fixed rate (2.15% coupon) maturing on 28 July 2031, priced at 99.55, non callable

- Lai Sun MTN Ltd (Financial - Other | Rating: NR): US$250m Senior Note (XS2368038050), fixed rate (5.00% coupon) maturing on 28 July 2026, priced at 100.00, non callable

- Mav Acquisition Corp (Financial - Other | Rating: NR): US$725m Senior Note (US57767XAB64), fixed rate (8.00% coupon) maturing on 1 August 2029, priced at 100.00, callable (8nc3)

- NongHyup Bank (Banking | Seoul, Seoul, South Korea | Rating: A+): US$300m Senior Note (US65540KAG04), fixed rate (1.25% coupon) maturing on 28 July 2026, priced at 99.64 (original spread of 60 bp), non callable

- NongHyup Bank (Banking | Seoul, Seoul, South Korea | Rating: A+): US$300m Senior Note (US65540KAF21), fixed rate (0.88% coupon) maturing on 28 July 2024, priced at 99.85 (original spread of 55 bp), non callable

- ShaMaran Petroleum Corp (Oil and Gas | Vancouver, British Columbia, Canada | Rating: NR): US$300m Bond (NO0011057622), fixed rate (12.00% coupon) maturing on 30 July 2025, priced at 98.50, non callable

EUR BOND ISSUES

- BNP Paribas Issuance BV (Financial - Other | Amsterdam, Noord-Holland, France | Rating: A+): €125m Unsecured Note (XS2297334430), floating rate maturing on 27 July 2023, priced at 100.00, non callable

- NRW Bank (Agency | Dusseldorf, Nordrhein-Westfalen, Germany | Rating: AA): €500m Inhaberschuldverschreibung (DE000NWB0AN7) zero coupon maturing on 28 July 2031, priced at 100.52 (original spread of 36 bp), non callable

- Single Platform Investment Repackaging Entity SA (Financial - Other | Luxembourg, Netherlands | Rating: NR): €150m Unsecured Note (XS2366672512), fixed rate (1.25% coupon) maturing on 15 August 2051, priced at 100.00, non callable

NEW LOANS

- Sovos Compliance LLC, signed a US$ 215m Delayed Draw Term Loan, to be used for general corporate purposes, acquisition financing, proceeds to shareholders. It matures on 07/29/28 and initial pricing is set at LIBOR +475bps

- Sovos Compliance LLC, signed a US$ 1,245m Term Loan B, to be used for general corporate purposes, acquisition financing, proceeds to shareholders. It matures on 07/29/28 and initial pricing is set at LIBOR +475bps

NEW ISSUES IN SECURITIZED CREDIT

- NZES 2021-FHT1 issued a fixed-rate RMBS in 1 tranche, for a total of US$ 418 m. Bookrunners: Nomura Securities Co Ltd, Amherst Securities Corp, Goldman Sachs & Co, Citigroup Global Markets Inc