Credit

IG Cash Spreads To Worst Unchanged, HY Down 3bp

Here are the totals for this slow week in US corporate issuance (IFR data): US$ 14.4bn for IG (in 20 tranches), US$ 8.9bn for HY (in 8 tranches)

Published ET

iBOXX USD Liquid Bonds Indices | Sources: ϕpost, Refinitiv data

QUICK DAILY SUMMARY

- S&P 500 Bond Index was down -0.14% today, with investment grade down -0.16% and high yield up 0.03% (YTD total return: -0.09%)

- The iBoxx USD Liquid Investment Grade Total Return Index was down -0.09% today (Month-to-date: 1.10%; Year-to-date: -0.51%)

- The iBoxx USD Liquid High Yield Total Return Index was up 0.06% today (Month-to-date: 0.18%; Year-to-date: 3.23%)

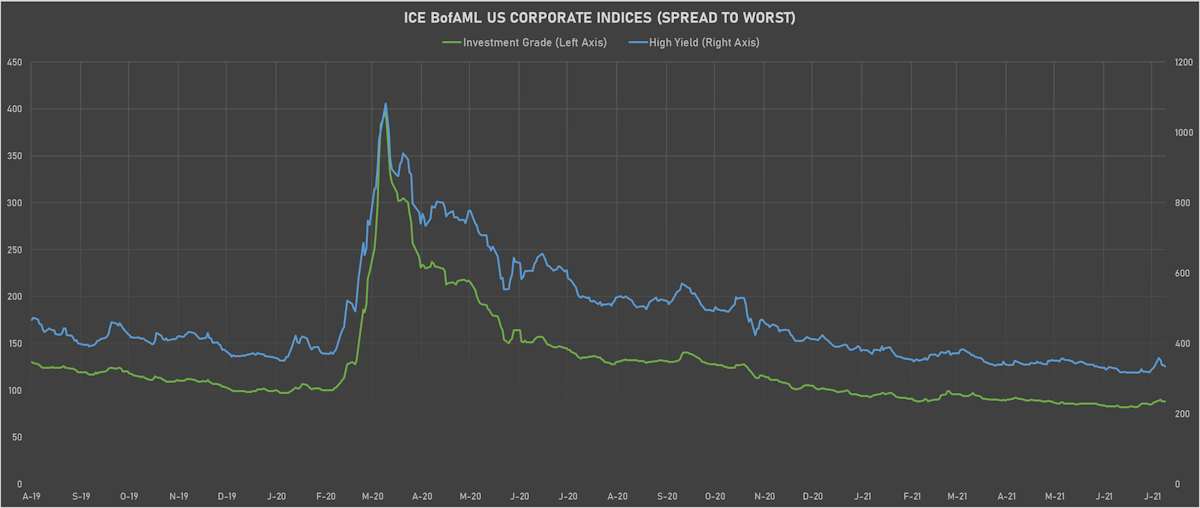

- ICE BofA US Corporate Index (Investment Grade) spread to worst unchanged, now at 88.0 bp (YTD change: -10.0 bp)

- ICE BofA US High Yield Index spread to worst down -3.0 bp, now at 335.0 bp (YTD change: -55.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index down -0.01% today (YTD total return: +2.1%)

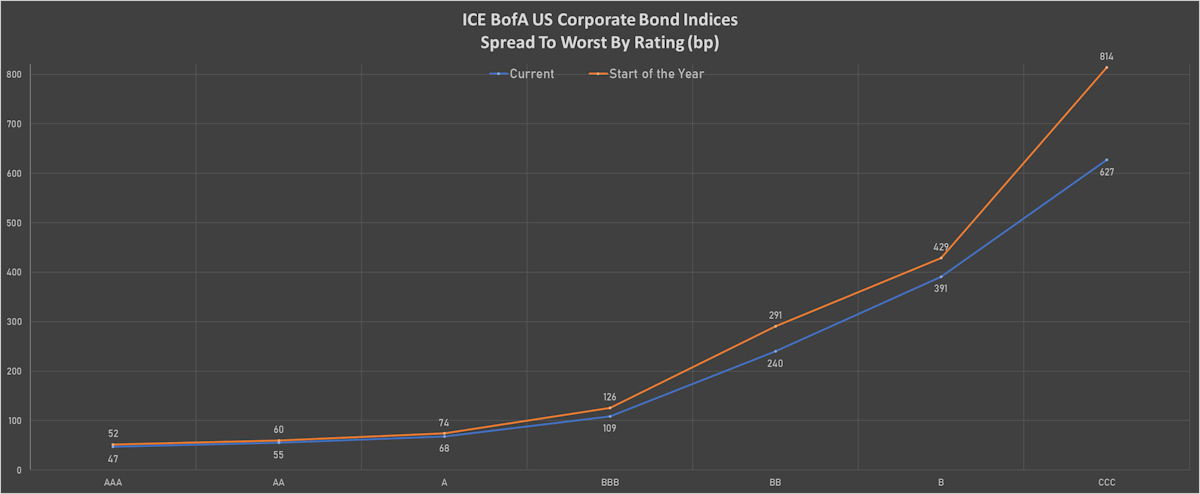

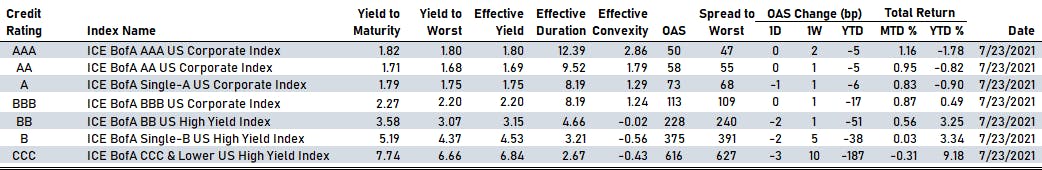

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

- AAA unchanged at 50 bp

- AA unchanged at 58 bp

- A down by -1 bp at 73 bp

- BBB unchanged at 113 bp

- BB down by -2 bp at 228 bp

- B down by -2 bp at 375 bp

- CCC down by -3 bp at 616 bp

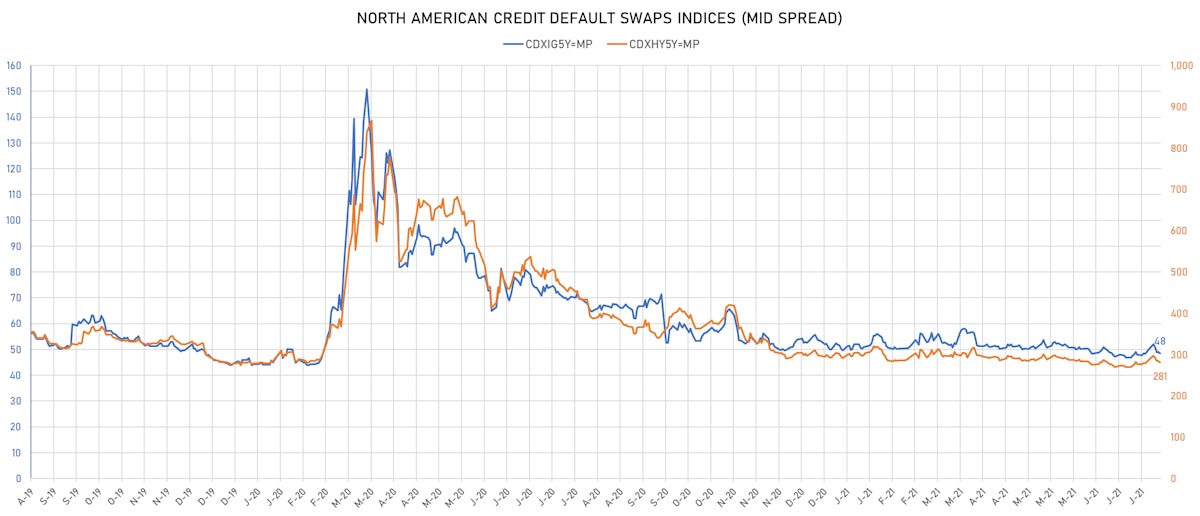

CDS INDICES (mid-spreads)

- Markit CDX.NA.IG 5Y down 0.7 bp, now at 48bp (YTD change: -1.5bp)

- Markit CDX.NA.HY 5Y down 3.3 bp, now at 281bp (YTD change: -12.0bp)

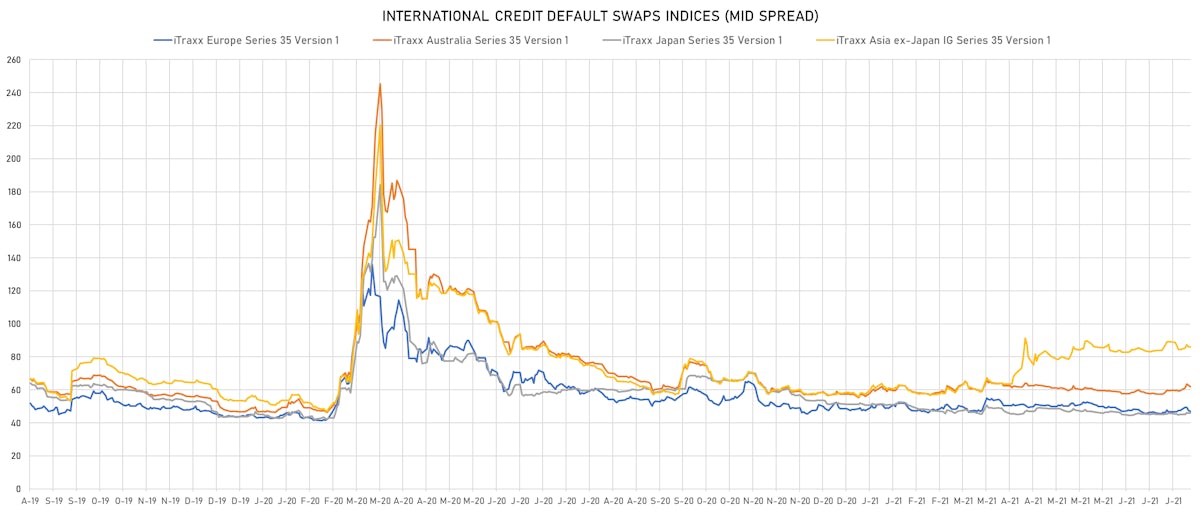

- Markit iTRAXX Europe down 0.9 bp, now at 46bp (YTD change: -1.9bp)

- Markit iTRAXX Japan unchanged at 46bp (YTD change: -5.5bp)

- Markit iTRAXX Asia Ex-Japan unchanged at 86bp (YTD change: +27.9bp)

TOP BONDS MOVES IN THE PAST WEEK - USD HY

- Issuer: Oi SA em Recuperacao Judicial (Rio de Janeiro, Brazil) | Coupon: 10.00% | Maturity: 27/7/2025 | Rating: CCC+ | ISIN: USP7354PAA23 | Z-spread up by 123.7 bp to 1,012.6 bp, with the yield to worst at 10.2% and the bond now trading down to 98.5 cents on the dollar (1Y price range: 98.7-107.0).

- Issuer: Kuwait Projects Company SPC Ltd (Dubai, United Arab Emirates) | Coupon: 5.00% | Maturity: 15/3/2023 | Rating: BB- | ISIN: XS1379107219 | Z-spread up by 47.3 bp to 320.8 bp, with the yield to worst at 3.2% and the bond now trading down to 102.5 cents on the dollar (1Y price range: 100.8-104.4).

- Issuer: TBC bank'i SS (Tbilisi, Georgia) | Coupon: 5.75% | Maturity: 19/6/2024 | Rating: BB- | ISIN: XS1843434363 | Z-spread up by 41.9 bp to 259.9 bp, with the yield to worst at 2.7% and the bond now trading down to 107.5 cents on the dollar (1Y price range: 104.0-110.0).

- Issuer: Banistmo SA (PANAMA CITY, Panama) | Coupon: 3.65% | Maturity: 19/9/2022 | Rating: BB+ | ISIN: USP15383AC95 | Z-spread up by 41.5 bp to 225.7 bp, with the yield to worst at 2.3% and the bond now trading down to 101.4 cents on the dollar (1Y price range: 101.2-103.5).

- Issuer: Vedanta Resources Finance II PLC (London, United Kingdom) | Coupon: 8.95% | Maturity: 11/3/2025 | Rating: B- | ISIN: USG9T27HAD62 | Z-spread up by 38.7 bp to 979.0 bp, with the yield to worst at 10.0% and the bond now trading down to 95.8 cents on the dollar (1Y price range: 94.3-99.8).

- Issuer: Banco Votorantim SA (Sao Paulo, Brazil) | Coupon: 4.38% | Maturity: 29/7/2025 | Rating: BB- | ISIN: XS2210789934 | Z-spread up by 34.7 bp to 285.6 bp (CDS basis: -112.9bp), with the yield to worst at 3.2% and the bond now trading down to 103.4 cents on the dollar (1Y price range: 102.8-107.6).

- Issuer: Terraform Power Operating LLC (New York City, New York (US)) | Coupon: 5.00% | Maturity: 31/1/2028 | Rating: BB- | ISIN: USU8812LAE12 | Z-spread down by 32.5 bp to 262.9 bp, with the yield to worst at 3.4% and the bond now trading up to 107.8 cents on the dollar (1Y price range: 104.0-113.3).

- Issuer: EQM Midstream Partners LP (Canonsburg, Pennsylvania (US)) | Coupon: 6.00% | Maturity: 1/7/2025 | Rating: BB- | ISIN: USU26886AA62 | Z-spread down by 37.5 bp to 286.0 bp, with the yield to worst at 3.2% and the bond now trading up to 108.8 cents on the dollar (1Y price range: 103.0-109.5).

- Issuer: Carnival Corp (Miami, Panama) | Coupon: 5.75% | Maturity: 1/3/2027 | Rating: B | ISIN: USP2121VAL82 | Z-spread down by 40.9 bp to 431.2 bp (CDS basis: -21.9bp), with the yield to worst at 4.9% and the bond now trading up to 102.8 cents on the dollar (1Y price range: 99.1-106.5).

- Issuer: Continental Resources Inc (Oklahoma City, Oklahoma (US)) | Coupon: 5.75% | Maturity: 15/1/2031 | Rating: BB+ | ISIN: USU21180AG60 | Z-spread down by 44.9 bp to 189.4 bp, with the yield to worst at 3.0% and the bond now trading up to 121.0 cents on the dollar (1Y price range: 107.8-121.0).

- Issuer: Royal Caribbean Cruises Ltd (Miami, Liberia) | Coupon: 5.50% | Maturity: 1/4/2028 | Rating: B | ISIN: USV7780TAE39 | Z-spread down by 46.6 bp to 413.2 bp (CDS basis: 11.2bp), with the yield to worst at 4.9% and the bond now trading up to 102.0 cents on the dollar (1Y price range: 99.7-105.9).

- Issuer: Syngenta Finance NV (Enkhuizen, Netherlands) | Coupon: 4.44% | Maturity: 24/4/2023 | Rating: BB | ISIN: USN84413CM88 | Z-spread down by 54.3 bp to 100.5 bp, with the yield to worst at 1.1% and the bond now trading up to 105.3 cents on the dollar (1Y price range: 101.5-106.4).

- Issuer: Guacolda Energia SA (LAS CONDES, Chile) | Coupon: 4.56% | Maturity: 30/4/2025 | Rating: B+ | ISIN: USP3711HAF66 | Z-spread down by 77.4 bp to 2,124.3 bp, with the yield to worst at 21.3% and the bond now trading up to 57.1 cents on the dollar (1Y price range: 53.5-92.1).

- Issuer: American Airlines Group Inc (Fort Worth, Texas (US)) | Coupon: 3.75% | Maturity: 1/3/2025 | Rating: CCC | ISIN: USU0242AAD47 | Z-spread down by 142.2 bp to 621.6 bp (CDS basis: 21.8bp), with the yield to worst at 6.5% and the bond now trading up to 90.8 cents on the dollar (1Y price range: 71.0-93.1).

TOP BONDS MOVES IN THE PAST WEEK - EUR HY

- Issuer: Adler Group SA (Senningerberg, Luxembourg) | Coupon: 2.25% | Maturity: 27/4/2027 | Rating: BB+ | ISIN: XS2336188029 | Z-spread up by 20.2 bp to 318.4 bp, with the yield to worst at 2.7% and the bond now trading down to 96.7 cents on the dollar (1Y price range: 94.4-100.2).

- Issuer: Titan Global Finance PLC (Hull, United Kingdom) | Coupon: 2.75% | Maturity: 9/7/2027 | Rating: BB | ISIN: XS2199268470 | Z-spread up by 16.2 bp to 205.7 bp, with the yield to worst at 1.6% and the bond now trading down to 105.2 cents on the dollar (1Y price range: 102.6-105.9).

- Issuer: Bulgarian Energy Holding EAD (Sofia, Bulgaria) | Coupon: 2.45% | Maturity: 22/7/2028 | Rating: BB | ISIN: XS2367164576 | Z-spread up by 10.4 bp to 283.6 bp (CDS basis: -213.6bp), with the yield to worst at 2.5% and the bond now trading down to 99.0 cents on the dollar (1Y price range: 98.9-100.0).

- Issuer: SoftBank Group Corp (Minato-Ku, Japan) | Coupon: 3.88% | Maturity: 6/7/2032 | Rating: BB+ | ISIN: XS2362416617 | Z-spread up by 8.6 bp to 404.1 bp, with the yield to worst at 3.9% and the bond now trading down to 98.8 cents on the dollar (1Y price range: 98.1-100.1).

- Issuer: Petroleos Mexicanos (Miguel Hidalgo, Mexico) | Coupon: 4.75% | Maturity: 26/2/2029 | Rating: BB- | ISIN: XS1824424706 | Z-spread up by 8.0 bp to 533.7 bp (CDS basis: -102.0bp), with the yield to worst at 5.0% and the bond now trading down to 97.7 cents on the dollar (1Y price range: 95.6-102.0).

- Issuer: Renault SA (Boulogne-Billancourt, France) | Coupon: 1.13% | Maturity: 4/10/2027 | Rating: BB | ISIN: FR0013451416 | Z-spread up by 7.0 bp to 261.0 bp (CDS basis: -44.1bp), with the yield to worst at 2.1% and the bond now trading down to 93.1 cents on the dollar (1Y price range: 91.1-95.8).

- Issuer: Fortune Star (BVI) Ltd (British Virgin Islands) | Coupon: 3.95% | Maturity: 2/10/2026 | Rating: BB- | ISIN: XS2357132849 | Z-spread up by 5.1 bp to 460.9 bp, with the yield to worst at 4.2% and the bond now trading down to 98.8 cents on the dollar (1Y price range: 98.1-102.1).

- Issuer: Netflix Inc (Los Gatos, California (US)) | Coupon: 4.63% | Maturity: 15/5/2029 | Rating: BB+ | ISIN: XS2076099865 | Z-spread down by 7.5 bp to 123.6 bp, with the yield to worst at 0.9% and the bond now trading up to 126.9 cents on the dollar (1Y price range: 120.0-128.0).

- Issuer: Teva Pharmaceutical Finance Netherlands II BV (Amsterdam, Netherlands) | Coupon: 1.88% | Maturity: 31/3/2027 | Rating: BB- | ISIN: XS1211044075 | Z-spread down by 14.9 bp to 368.5 bp, with the yield to worst at 3.2% and the bond now trading up to 92.4 cents on the dollar (1Y price range: 90.5-95.4).

- Issuer: Deutsche Lufthansa AG (Cologne, Germany) | Coupon: 3.50% | Maturity: 14/7/2029 | Rating: BB- | ISIN: XS2363235107 | Z-spread down by 30.6 bp to 367.7 bp (CDS basis: -54.3bp), with the yield to worst at 3.3% and the bond now trading up to 100.0 cents on the dollar (1Y price range: 97.7-100.2).

USD BOND ISSUES

- Harp Issuer PLC (Financial - Other | Dublin, Dublin, Ireland | Rating: NR): US$750m Unsecured Note (XS2369294348), fixed rate (4.54% coupon) maturing on 1 August 2026, priced at 100.00, non callable

- Ithaca Energy (North Sea) PLC (Oil and Gas | Aberdeen, Aberdeenshire, UK| Rating: NR): US$625m Senior Note (US46567TAB08), fixed rate (9.00% coupon) maturing on 15 July 2026, priced at 100.00 (original spread of 827 bp), callable (5nc2)

- Lani Finance Ltd (Financial - Other | George Town, Cayman Islands | Rating: NR): US$138m Unsecured Note (XS2366416860) zero coupon maturing on 29 June 2026, non callable

- Shandong Iron and Steel Xinheng International Company Ltd (Financial - Other | China (Mainland) | Rating: NR): US$500m Senior Note (XS2314627089), fixed rate (4.80% coupon) maturing on 28 July 2024, priced at 100.00, non callable

EUR BOND ISSUES

- Ideal Standard International SA (Financial - Other | Luxembourg, United States | Rating: B-): €325m Note (XS2369020644), fixed rate (6.38% coupon) maturing on 30 July 2026, priced at 98.95 (original spread of 732 bp), callable (5nc3)

NEW LOANS

- Hudson River Trading Llc (BB-), signed a US$ 225m Term Loan B, to be used for general corporate purposes & working capital. It matures on 03/08/28 and initial pricing is set at LIBOR +300bps

- Eyemart Express (B-), signed a US$ 455m Term Loan B maturing on 08/05/27, to be used for general corporate purposes.

- CH Werfen SA, signed a € 250m Revolving Credit Facility maturing on 07/23/24, to be used for working capital

NEW ISSUES IN SECURITIZED CREDIT

- ACC Auto Trust 2021-A issued a fixed-rate ABS backed by auto receivables in 4 tranches, for a total of US$ 281 m. Highest-rated tranche offering a yield to maturity of 1.09%, and the lowest-rated tranche a yield to maturity of 6.19%. Bookrunners: KeyBanc Capital Markets Inc

- CIM Retail Portfolio Trust 2021-Retl issued a floating-rate RMBS in 8 tranches, for a total of US$ 650 m. Highest-rated tranche offering a spread over the floating rate of 140bp, and the lowest-rated tranche a spread of 900bp. Bookrunners: JP Morgan & Co Inc, Deutsche Bank Securities Inc