Credit

Spreads Fairly Stable Across The Credit Complex

A few corporate bonds priced in the primary market, with Novelis and RBC the largest issuers today at US$ 1.5 bn each

Published ET

ICE BofAML US Corporate IG & HY Spreads To Worst | Sources: ϕpost, Refinitiv data

QUICK SUMMARY

- S&P 500 Bond Index was down -0.04% today, with investment grade down -0.05% and high yield up 0.04% (YTD total return: -0.13%)

- The iBoxx USD Liquid Investment Grade Total Return Index was down -0.117% today (Month-to-date: 0.98%; Year-to-date: -0.62%)

- The iBoxx USD Liquid High Yield Total Return Index was up 0.034% today (Month-to-date: 0.22%; Year-to-date: 3.27%)

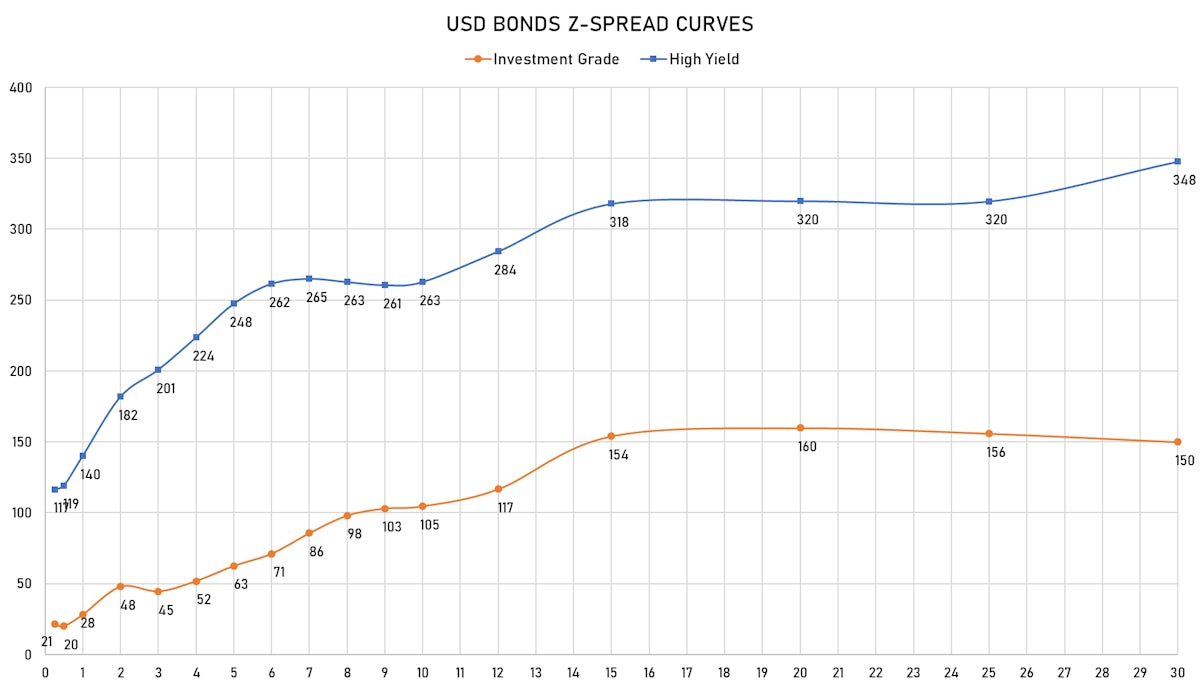

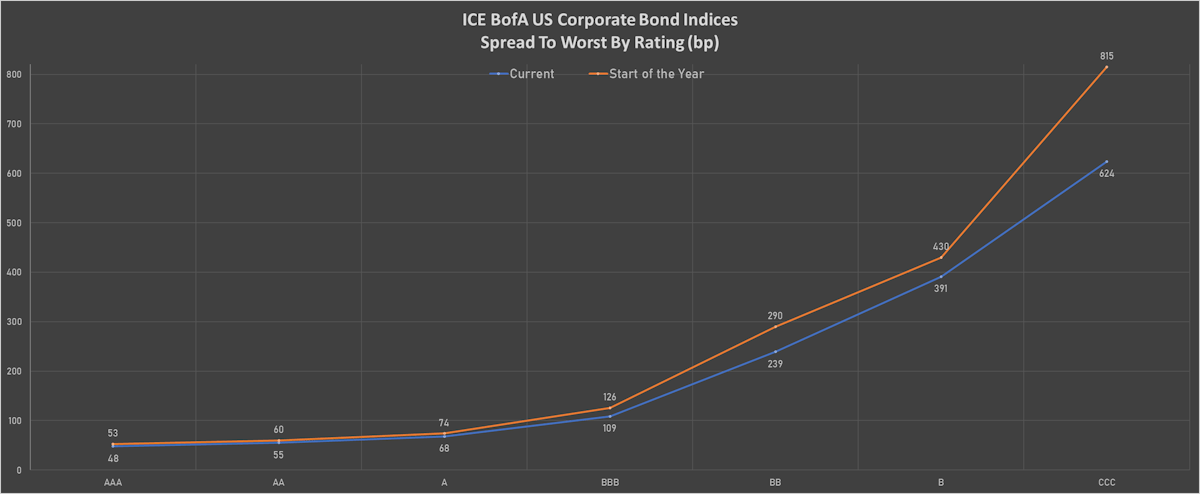

- ICE BofA US Corporate Index (Investment Grade) spread to worst unchanged at 88.0 bp (YTD change: -10.0 bp)

- ICE BofA US High Yield Index spread to worst down -1.0 bp, now at 334.0 bp (YTD change: -56.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index down -0.02% today (YTD total return: +2.0%)

- New issues: US$ 3.3bn in dollars and € 3.5bn in euros

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

- AAA unchanged at 50 bp

- AA unchanged at 58 bp

- A unchanged at 73 bp

- BBB unchanged at 113 bp

- BB unchanged at 228 bp

- B down by -1 bp at 374 bp

- CCC down by -4 bp at 612 bp

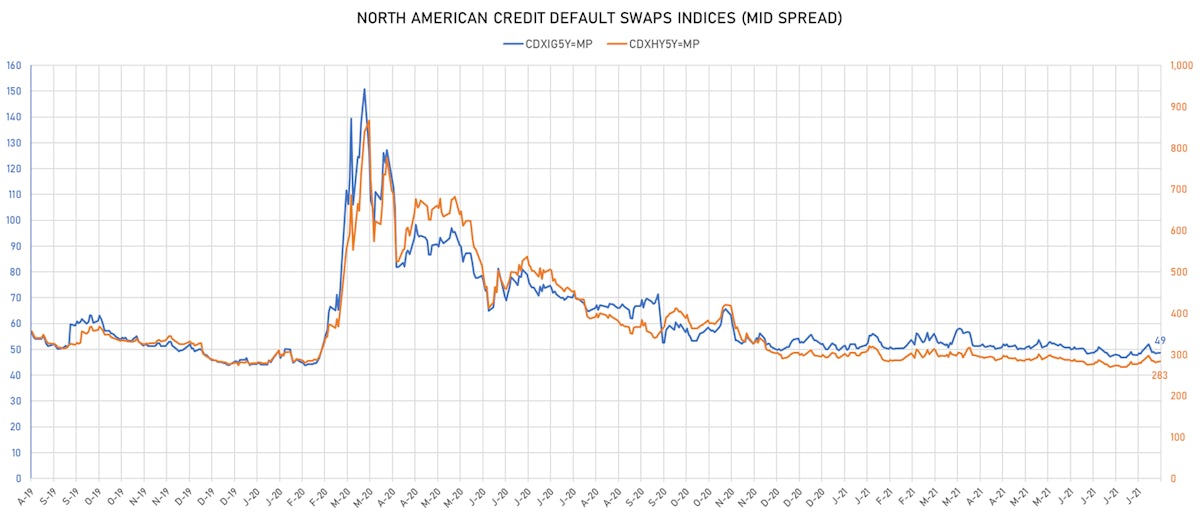

CDS INDICES (mid-spreads)

- Markit CDX.NA.IG 5Y up 0.2 bp, now at 49bp (YTD change: -1.3bp)

- Markit CDX.NA.HY 5Y up 2.0 bp, now at 283bp (YTD change: -10.0bp)

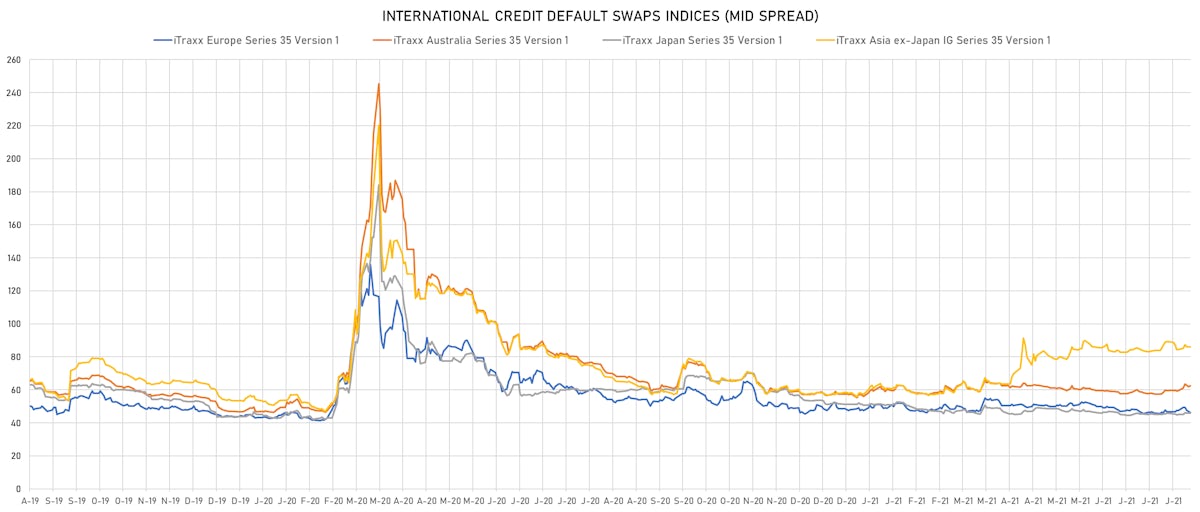

- Markit iTRAXX Europe up 0.5 bp, now at 47bp (YTD change: -1.4bp)

- Markit iTRAXX Japan down 0.6 bp, now at 45bp (YTD change: -6.0bp)

- Markit iTRAXX Asia Ex-Japan up 2.1 bp, now at 88bp (YTD change: +30.0bp)

TOP BONDS MOVES IN THE PAST WEEK - USD HY

- Issuer: Oi SA em Recuperacao Judicial (Rio de Janeiro, Brazil) | Coupon: 10.00% | Maturity: 27/7/2025 | Rating: CCC+ | ISIN: USP7354PAA23 | Z-spread up by 101.9 bp to 1,019.8 bp, with the yield to worst at 10.2% and the bond now trading down to 98.3 cents on the dollar (1Y price range: 98.3-107.0).

- Issuer: Syngenta Finance NV (Enkhuizen, Netherlands) | Coupon: 4.44% | Maturity: 24/4/2023 | Rating: BB | ISIN: USN84413CM88 | Z-spread up by 34.6 bp to 144.4 bp, with the yield to worst at 1.5% and the bond now trading down to 104.5 cents on the dollar (1Y price range: 101.5-106.4).

- Issuer: Seazen Group Ltd (Shanghai, Cayman Islands) | Coupon: 6.00% | Maturity: 12/8/2024 | Rating: BB+ | ISIN: XS2215175634 | Z-spread up by 33.1 bp to 468.0 bp, with the yield to worst at 4.7% and the bond now trading down to 102.5 cents on the dollar (1Y price range: 102.3-105.8).

- Issuer: Banco Votorantim SA (Sao Paulo, Brazil) | Coupon: 4.38% | Maturity: 29/7/2025 | Rating: BB- | ISIN: XS2210789934 | Z-spread up by 32.1 bp to 284.3 bp (CDS basis: -112.1bp), with the yield to worst at 3.2% and the bond now trading down to 103.4 cents on the dollar (1Y price range: 102.8-107.6).

- Issuer: Turkiye Vakiflar Bankasi TAO (Turkey) | Coupon: 5.25% | Maturity: 5/2/2025 | Rating: B | ISIN: XS2112797290 | Z-spread up by 29.7 bp to 529.8 bp, with the yield to worst at 5.5% and the bond now trading down to 98.3 cents on the dollar (1Y price range: 94.0-101.0).

- Issuer: Firstenergy Transmission LLC (Fairmont, West Virginia (US)) | Coupon: 5.45% | Maturity: 15/7/2044 | Rating: BB | ISIN: USU3200VAA80 | Z-spread down by 27.1 bp to 195.4 bp (CDS basis: -95.9bp), with the yield to worst at 3.5% and the bond now trading up to 129.0 cents on the dollar (1Y price range: 114.9-129.0).

- Issuer: Pennsylvania Electric Co (Akron, Ohio (US)) | Coupon: 3.25% | Maturity: 15/3/2028 | Rating: BB+ | ISIN: USU70842AC04 | Z-spread down by 29.2 bp to 102.7 bp (CDS basis: -30.4bp), with the yield to worst at 1.9% and the bond now trading up to 107.4 cents on the dollar (1Y price range: 102.0-107.4).

- Issuer: Empresa Nacional del Petroleo (LAS CONDES, Chile) | Coupon: 4.50% | Maturity: 14/9/2047 | Rating: BB+ | ISIN: USP37110AM89 | Z-spread down by 30.5 bp to 259.4 bp (CDS basis: -127.1bp), with the yield to worst at 4.1% and the bond now trading up to 104.0 cents on the dollar (1Y price range: 96.3-111.4).

- Issuer: Sensata Technologies BV (Almelo, Netherlands) | Coupon: 4.88% | Maturity: 15/10/2023 | Rating: BB- | ISIN: USN78840AH33 | Z-spread down by 30.8 bp to 127.5 bp, with the yield to worst at 1.4% and the bond now trading up to 107.1 cents on the dollar (1Y price range: 105.9-108.1).

- Issuer: NCL Corporation Ltd (Miami, Bermuda) | Coupon: 5.88% | Maturity: 15/3/2026 | Rating: CCC+ | ISIN: USG6436QAL08 | Z-spread down by 31.3 bp to 480.8 bp, with the yield to worst at 5.4% and the bond now trading up to 101.3 cents on the dollar (1Y price range: 98.5-105.3).

- Issuer: Continental Resources Inc (Oklahoma City, Oklahoma (US)) | Coupon: 5.75% | Maturity: 15/1/2031 | Rating: BB+ | ISIN: USU21180AG60 | Z-spread down by 33.1 bp to 190.5 bp, with the yield to worst at 3.0% and the bond now trading up to 120.8 cents on the dollar (1Y price range: 107.8-121.0).

- Issuer: Southeast Supply Header LLC (Houston, Texas (US)) | Coupon: 4.25% | Maturity: 15/6/2024 | Rating: BB- | ISIN: USU83854AB29 | Z-spread down by 56.5 bp to 345.3 bp, with the yield to worst at 3.5% and the bond now trading up to 100.8 cents on the dollar (1Y price range: 99.0-101.1).

- Issuer: Royal Caribbean Cruises Ltd (Miami, Liberia) | Coupon: 4.25% | Maturity: 1/7/2026 | Rating: B | ISIN: USV7780TAF04 | Z-spread down by 70.1 bp to 387.8 bp (CDS basis: -16.1bp), with the yield to worst at 4.4% and the bond now trading up to 98.1 cents on the dollar (1Y price range: 94.6-100.9).

- Issuer: American Airlines Group Inc (Fort Worth, Texas (US)) | Coupon: 3.75% | Maturity: 1/3/2025 | Rating: CCC | ISIN: USU0242AAD47 | Z-spread down by 113.2 bp to 629.4 bp (CDS basis: 18.4bp), with the yield to worst at 6.6% and the bond now trading up to 90.5 cents on the dollar (1Y price range: 71.0-93.1).

TOP BONDS MOVES IN THE PAST WEEK - EUR HY

- Issuer: Telecom Italia SpA (Rome, Italy) | Coupon: 3.63% | Maturity: 19/1/2024 | Rating: BB | ISIN: XS1347748607 | Z-spread up by 20.4 bp to 112.9 bp (CDS basis: -6.0bp), with the yield to worst at 0.6% and the bond now trading down to 107.2 cents on the dollar (1Y price range: 106.8-107.8).

- Issuer: SoftBank Group Corp (Minato-Ku, Japan) | Coupon: 4.00% | Maturity: 19/9/2029 | Rating: BB- | ISIN: XS1684385591 | Z-spread up by 11.1 bp to 367.0 bp, with the yield to worst at 3.2% and the bond now trading down to 103.7 cents on the dollar (1Y price range: 103.4-111.3).

- Issuer: Syngenta Finance NV (Enkhuizen, Netherlands) | Coupon: 1.25% | Maturity: 10/9/2027 | Rating: BB | ISIN: XS1199954691 | Z-spread up by 9.7 bp to 99.2 bp, with the yield to worst at 0.6% and the bond now trading down to 103.1 cents on the dollar (1Y price range: 93.2-103.7).

- Issuer: Fortune Star (BVI) Ltd (British Virgin Islands) | Coupon: 3.95% | Maturity: 2/10/2026 | Rating: BB- | ISIN: XS2357132849 | Z-spread up by 9.4 bp to 460.0 bp, with the yield to worst at 4.2% and the bond now trading down to 98.8 cents on the dollar (1Y price range: 98.1-102.1).

- Issuer: Elis SA (Saint-Cloud, France) | Coupon: 1.63% | Maturity: 3/4/2028 | Rating: BB | ISIN: FR0013449998 | Z-spread down by 8.3 bp to 198.5 bp, with the yield to worst at 1.6% and the bond now trading up to 99.2 cents on the dollar (1Y price range: 95.8-99.4).

- Issuer: Renault SA (Boulogne-Billancourt, France) | Coupon: 2.00% | Maturity: 28/9/2026 | Rating: BB | ISIN: FR0013368206 | Z-spread down by 9.7 bp to 240.3 bp (CDS basis: -41.7bp), with the yield to worst at 1.9% and the bond now trading up to 99.6 cents on the dollar (1Y price range: 97.6-101.2).

- Issuer: Netflix Inc (Los Gatos, California (US)) | Coupon: 4.63% | Maturity: 15/5/2029 | Rating: BB+ | ISIN: XS2076099865 | Z-spread down by 11.1 bp to 121.2 bp, with the yield to worst at 0.9% and the bond now trading up to 127.1 cents on the dollar (1Y price range: 120.0-128.0).

- Issuer: Teva Pharmaceutical Finance Netherlands II BV (Amsterdam, Netherlands) | Coupon: 1.88% | Maturity: 31/3/2027 | Rating: BB- | ISIN: XS1211044075 | Z-spread down by 16.2 bp to 366.3 bp, with the yield to worst at 3.2% and the bond now trading up to 92.5 cents on the dollar (1Y price range: 90.5-95.4).

- Issuer: International Consolidated Airlines Group SA (London, Spain) | Coupon: 1.50% | Maturity: 4/7/2027 | Rating: B+ | ISIN: XS2020581752 | Z-spread down by 17.2 bp to 376.9 bp, with the yield to worst at 3.3% and the bond now trading up to 89.6 cents on the dollar (1Y price range: 84.0-92.1).

- Issuer: Deutsche Lufthansa AG (Cologne, Germany) | Coupon: 3.50% | Maturity: 14/7/2029 | Rating: BB- | ISIN: XS2363235107 | Z-spread down by 34.8 bp to 362.6 bp (CDS basis: -56.0bp), with the yield to worst at 3.3% and the bond now trading up to 100.3 cents on the dollar (1Y price range: 97.7-100.4).

USD BOND ISSUES

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$120m Bond (US3133EMX802), fixed rate (1.23% coupon) maturing on 2 August 2028, priced at 100.00 (original spread of 21 bp), callable (7nc1)

- Adani Ports and Special Economic Zone Ltd (Service - Other | Ahmedabad, Gujarat, India | Rating: BBB-): US$300m Senior Note (US00652MAK80), fixed rate (3.83% coupon) maturing on 2 February 2032, priced at 100.00 (original spread of 255 bp), callable (11nc10)

- Adani Ports and Special Economic Zone Ltd (Service - Other | Ahmedabad, Gujarat, India | Rating: BBB-): US$450m Senior Note (US00652MAJ18), fixed rate (5.00% coupon) maturing on 2 August 2041, priced at 100.00 (original spread of 315 bp), callable (20nc20)

- Aydem Yenilenebilir Enerji AS (Utility - Other | Denizli, Turkey | Rating: NR): US$750m Note (XS2368781477), fixed rate (7.75% coupon) maturing on 2 February 2027, priced at 99.19, callable (6nc3)

- ICBCIL Finance Co Ltd (Financial - Other | China (Mainland) | Rating: A): US$250m Senior Note (XS2320543445), fixed rate (2.65% coupon) maturing on 2 August 2031, priced at 99.11 (original spread of 150 bp), non callable

- ICBCIL Finance Co Ltd (Financial - Other | China (Mainland) | Rating: A): US$450m Senior Note (XS2319959354), fixed rate (1.25% coupon) maturing on 2 August 2024, priced at 99.96 (original spread of 90 bp), non callable

- ICBCIL Finance Co Ltd (Financial - Other | China (Mainland) | Rating: A): US$550m Senior Note (XS2320544419), fixed rate (1.75% coupon) maturing on 2 August 2026, priced at 99.74 (original spread of 110 bp), non callable

- Novelis Corp (Financial - Other | Atlanta, Georgia | Rating: BB): US$750m Senior Note (US670001AG19), fixed rate (3.25% coupon) maturing on 15 November 2026, priced at 100.00, callable (5nc2)

- Royal Bank of Canada (Banking | Toronto, Ontario, Canada | Rating: A): US$850m Senior Note (US78016EZU45), fixed rate (0.65% coupon) maturing on 29 July 2024, priced at 99.94 (original spread of 30 bp), non callable

- Royal Bank of Canada (Banking | Toronto, Ontario, Canada | Rating: A): US$650m Senior Note (US78016EZV28), floating rate (SOFR + 36.0 bp) maturing on 29 July 2024, priced at 100.00, non callable

- San Miguel Industrias PET SA (Containers | Lima, Lima, Peru | Rating: NR): US$380m Senior Note (US79911QAA22), fixed rate (3.50% coupon) maturing on 2 August 2028, priced at 100.00 (original spread of 251 bp), callable (7nc3)

- Temasek Financial (I) Ltd (Financial - Other | Singapore | Rating: AAA): US$1,000m Senior Note (US87973PBC77), fixed rate (2.75% coupon) maturing on 2 August 2061, priced at 98.83 (original spread of 85 bp), callable (40nc40)

- Temasek Financial (I) Ltd (Financial - Other | Singapore | Rating: AAA): US$750m Senior Note (US87973PBB94), fixed rate (2.38% coupon) maturing on 2 August 2041, priced at 97.95 (original spread of 65 bp), callable (20nc20)

- Temasek Financial (I) Ltd (Financial - Other | Singapore | Rating: AAA): US$750m Senior Note (US87973PBA12), fixed rate (1.63% coupon) maturing on 2 August 2031, priced at 99.42 (original spread of 40 bp), callable (10nc10)

EUR BOND ISSUES

- NRW Bank (Agency | Dusseldorf, Nordrhein-Westfalen, Germany | Rating: AA): €500m Inhaberschuldverschreibung (DE000NWB0AN7) zero coupon maturing on 28 July 2031, priced at 100.52 (original spread of 36 bp), non callable

- Societe Generale Scf SA (Financial - Other | Puteaux, Ile-De-France, France | Rating: AAA): €500m Bond (FR0014004RA0), floating rate (EU03MLIB + 70.0 bp) maturing on 27 July 2025, priced at 102.21, non callable

- Societe Generale SFH SA (Financial - Other | Puteaux, Ile-De-France, France | Rating: AAA): €1,250m Bond (FR0014004R98), floating rate (EU03MLIB + 70.0 bp) maturing on 27 July 2024, priced at 101.75, non callable

- Societe Generale SFH SA (Financial - Other | Puteaux, Ile-De-France, France | Rating: AAA): €750m Bond (FR0014004RB8), floating rate (EU03MLIB + 70.0 bp) maturing on 27 July 2028, priced at 103.38, non callable

- Societe Generale SFH SA (Financial - Other | Puteaux, Ile-De-France, France | Rating: AAA): €500m Bond (FR0014004R80), floating rate (EU01MLIB + 70.0 bp) maturing on 27 July 2023, priced at 101.41, non callable

NEW LOANS

- Bally's Corp (CCC+), signed a US$ 1,445m Term Loan B, to be used for general corporate purposes acquisition financing.

- AVS Group GmbH (B), signed a € 120m Term Loan B, to be used for general corporate purposes. It matures on 09/17/26 and initial pricing is set at EURIBOR +375bps

- Ardent Health Services LLC, signed a US$ 900m Term Loan B, to be used for general corporate purposes. It matures on 08/04/28.

- Waterlogic Ltd, signed a € 339m Term Loan B, to be used for general corporate purposes. It matures on 08/14/28 and initial pricing is set at EURIBOR +400bps

- Waterlogic Ltd, signed a US$ 400m Term Loan B, to be used for general corporate purposes. It matures on 08/14/28 and initial pricing is set at LIBOR +425bps

- Vidrala SA, signed a € 180m Revolving Credit Facility, to be used for general corporate purposes. It matures on 09/26/25 and initial pricing is set at EURIBOR +33.5bps

- Panzani SAS, signed a € 550m Term Loan, to be used for leveraged buyout