Credit

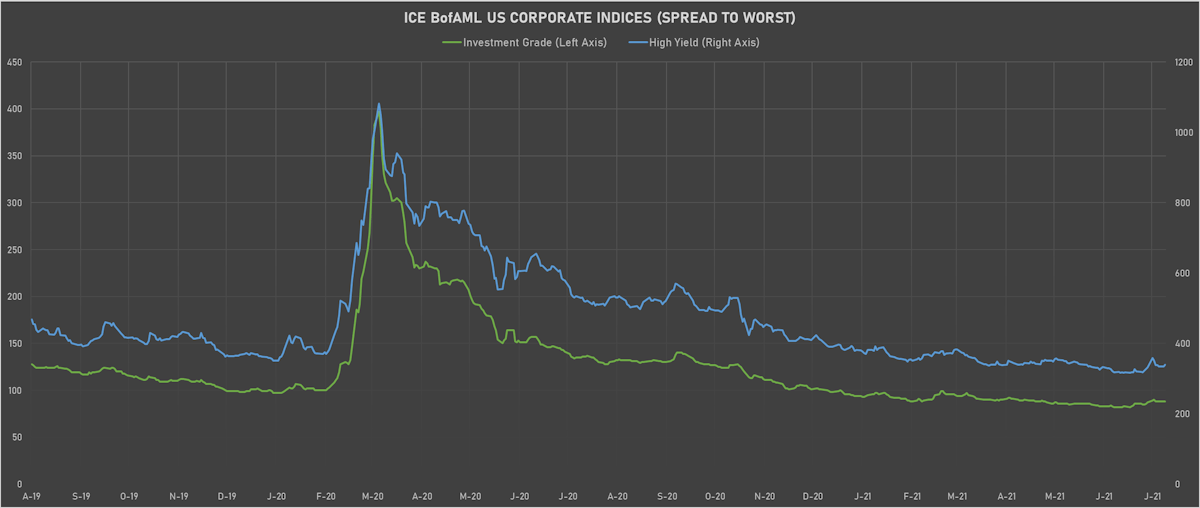

Equity Weakness Brings Wider High Yield Spreads, IG Overperforms On Lower Rates

Looking at forward issuance, August should see a pick-up in IG supply with US$ 90bn expected (potential headwind for spreads), while HY should see its slowest month of the year at US$ 25bn

Published ET

iTRAXX Credit Indices Default Probabilities | Sources: ϕpost, Refinitiv data

QUICK SUMMARY

- S&P 500 Bond Index was up 0.34% today, with investment grade up 0.37% and high yield up 0.03% (YTD total return: +0.21%)

- The iBoxx USD Liquid Investment Grade Total Return Index was up 0.36% today (Month-to-date: 1.35%; Year-to-date: -0.26%)

- The iBoxx USD Liquid High Yield Total Return Index was down -0.12% today (Month-to-date: 0.10%; Year-to-date: 3.14%)

- ICE BofA US Corporate Index (Investment Grade) spread to worst unchanged, now at 88.0 bp (YTD change: -10.0 bp)

- ICE BofA US High Yield Index spread to worst up 6.0 bp, now at 340.0 bp (YTD change: -50.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index down -0.04% today (YTD total return: +2.0%)

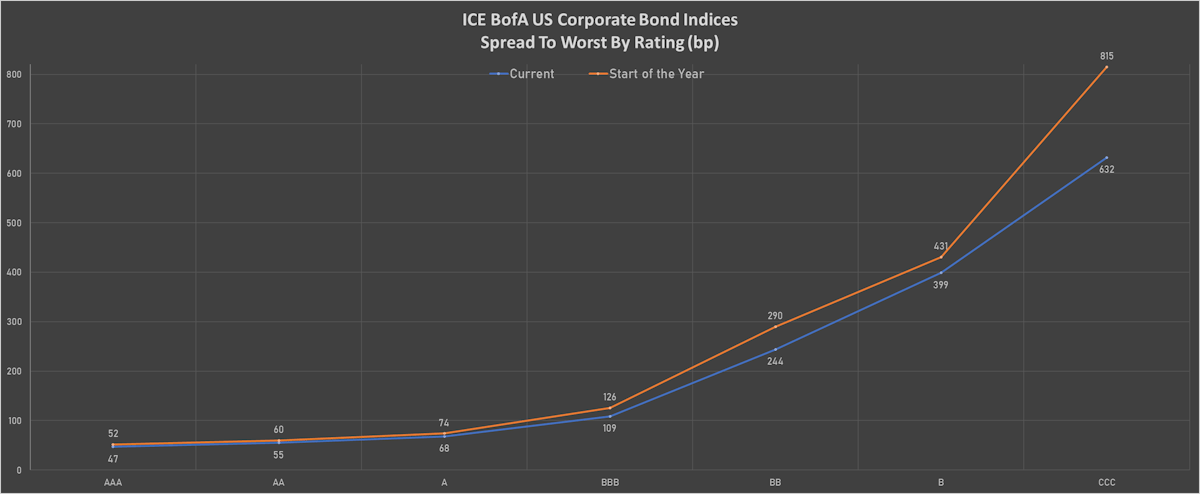

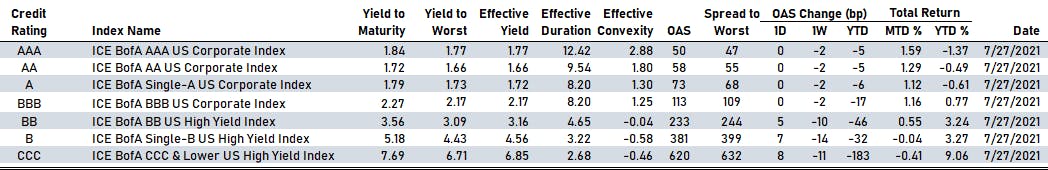

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

- AAA unchanged at 50 bp

- AA unchanged at 58 bp

- A unchanged at 73 bp

- BBB unchanged at 113 bp

- BB up by 5 bp at 233 bp

- B up by 7 bp at 381 bp

- CCC up by 8 bp at 620 bp

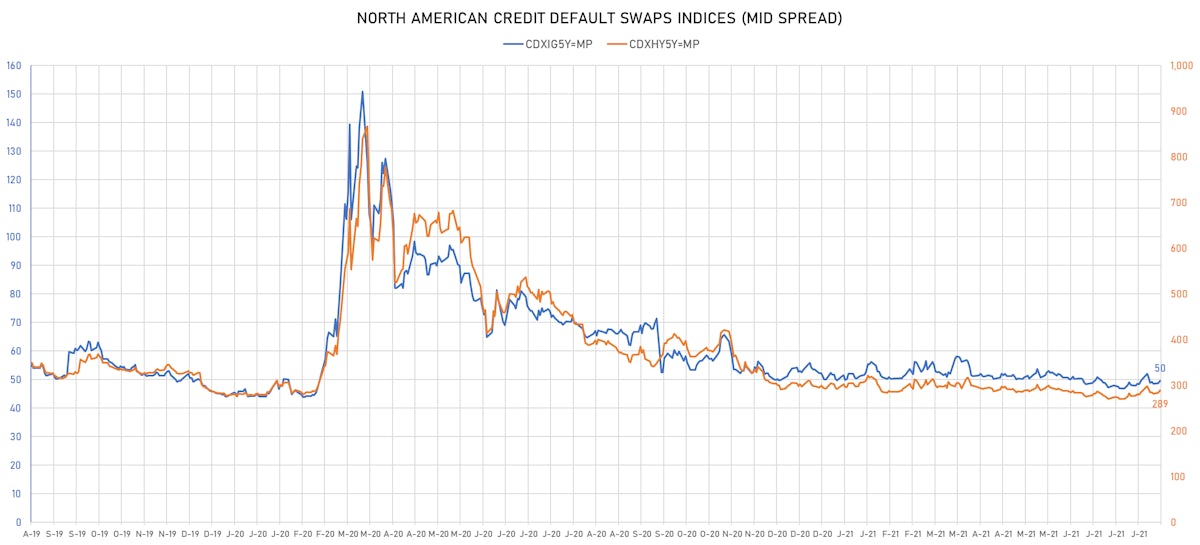

CDS INDICES (mid-spreads)

- Markit CDX.NA.IG 5Y up 0.9 bp, now at 50bp (YTD change: -0.4bp)

- Markit CDX.NA.HY 5Y up 5.8 bp, now at 289bp (YTD change: -4.2bp)

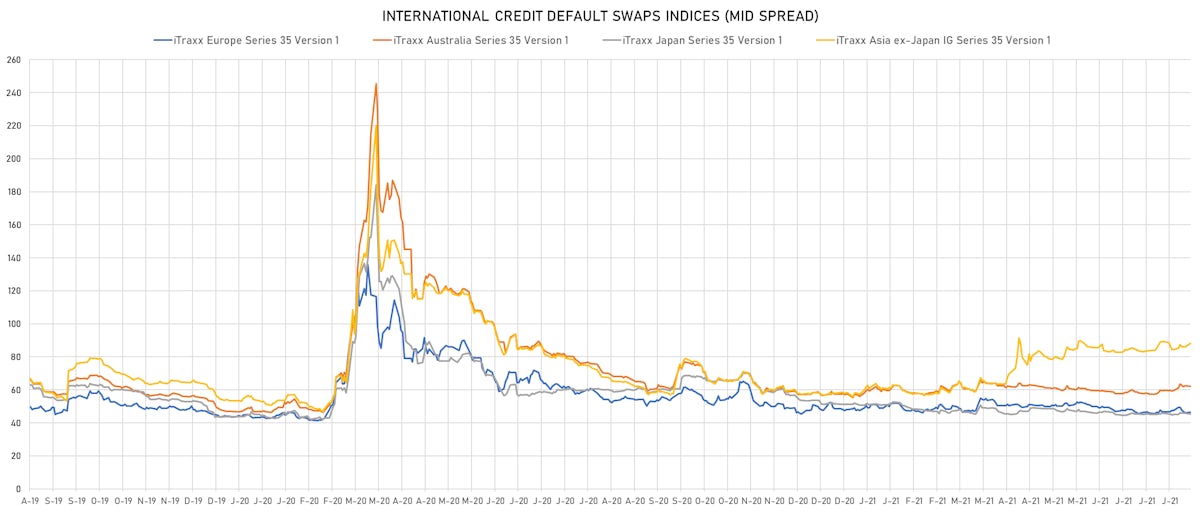

- Markit iTRAXX Europe up 0.7 bp, now at 47bp (YTD change: -0.7bp)

- Markit iTRAXX Japan up 0.8 bp, now at 46bp (YTD change: -5.2bp)

- Markit iTRAXX Asia Ex-Japan up 4.8 bp, now at 93bp (YTD change: +34.8bp)

LARGEST USD CORPORATE CDS MOVES IN THE PAST WEEK

- FirstEnergy Corp (Country: US; rated: Ba1): down 20.3 bp to 60.3bp (1Y range: 49-139bp)

- iStar Inc (Country: US; rated: BBB-): down 15.6 bp to 212.3bp (1Y range: 199-324bp)

- MBIA Inc (Country: US; rated: Ba3): down 15.3 bp to 358.3bp (1Y range: 359-757bp)

- Banco do Brasil SA (Country: BR; rated: WR): down 14.1 bp to 195.5bp (1Y range: 192-304bp)

- HCA Inc (Country: US; rated: Baa3): down 12.1 bp to 76.0bp (1Y range: 78-182bp)

- Avis Budget Car Rental LLC (Country: US; rated: WR): up 12.7 bp to 296.5bp (1Y range: 137-2,386bp)

- Royal Caribbean Cruises Ltd (Country: US; rated: LGD4 - 59%): up 14.0 bp to 383.5bp (1Y range: 318-1,291bp)

- Murphy Oil Corp (Country: US; rated: Ba3): up 17.8 bp to 356.6bp (1Y range: 280-763bp)

- MGM Resorts International (Country: US; rated: WD): up 17.8 bp to 208.7bp (1Y range: 173-457bp)

- Carnival Corp (Country: US; rated: LGD5 - 72%): up 19.0 bp to 432.8bp (1Y range: 291-1,214bp)

- RR Donnelley & Sons Co (Country: US; rated: B2): up 20.7 bp to 517.0bp (1Y range: 447-1,017bp)

- Genworth Holdings Inc (Country: US; rated: Caa1): up 23.7 bp to 475.7bp (1Y range: 447-850bp)

- Staples Inc (Country: US; rated: B2): up 59.4 bp to 905.0bp (1Y range: 652-1,965bp)

- Transocean Inc (Country: KY; rated: Caa3): up 119.4 bp to 1,690.2bp (1Y range: 941-7,695bp)

- Talen Energy Supply LLC (Country: US; rated: BB-): up 326.2 bp to 3,181.3bp (1Y range: 875-3,295bp)

LARGEST EURO CORPORATE CDS MOVES IN THE PAST WEEK

- Hammerson PLC (Country: GB; rated: Baa3): down 9.3 bp to 174.0bp (1Y range: 170-604bp)

- Ineos Group Holdings SA (Country: LU; rated: LGD5 - 88%): down 8.4 bp to 213.5bp (1Y range: 211-447bp)

- UPC Holding BV (Country: NL; rated: LGD6 - 93%): down 8.3 bp to 225.6bp (1Y range: 211-315bp)

- Thyssenkrupp AG (Country: DE; rated: B1): down 8.3 bp to 281.0bp (1Y range: 206-479bp)

- Lagardere SA (Country: FR; rated: B): down 6.6 bp to 235.3bp (1Y range: 220-350bp)

- Premier Foods Finance PLC (Country: ; rated: B1): down 6.3 bp to 204.0bp (1Y range: 141-273bp)

- Monitchem Holdco 3 SA (Country: LU; rated: B2): down 5.7 bp to 232.1bp (1Y range: 230-393bp)

- Ardagh Packaging Finance PLC (Country: IE; rated: B1): down 5.1 bp to 220.6bp (1Y range: 188-272bp)

- Iceland Bondco PLC (Country: GB; rated: LGD3 - 46%): down 5.1 bp to 442.4bp (1Y range: 358-730bp)

- Altice Finco SA (Country: LU; rated: Caa1): up 5.2 bp to 343.3bp (1Y range: 317-477bp)

- Air France KLM SA (Country: FR; rated: B-): up 6.0 bp to 417.4bp (1Y range: 392-1,211bp)

- Boparan Finance PLC (Country: GB; rated: WR): up 7.2 bp to 942.7bp (1Y range: 478-972bp)

- Tui AG (Country: DE; rated: LGD4 - 50%): up 7.3 bp to 808.5bp (1Y range: 590-1,799bp)

- Casino Guichard Perrachon SA (Country: FR; rated: WR): up 23.5 bp to 556.5bp (1Y range: 494-1,210bp)

- Novafives SAS (Country: FR; rated: Caa1): up 35.3 bp to 845.8bp (1Y range: 716-1,205bp)

USD BOND ISSUES

- Acrisure LLC (Service - Other | Caledonia, Michigan, United States | Rating: CCC+): US$500m Senior Note (US00489LAH69), fixed rate (6.00% coupon) maturing on 1 August 2029, priced at 100.00 (original spread of 530 bp), callable (8nc3)

- Capital One Financial Corp (Financial - Other | Mc Lean, Virginia, United States | Rating: BBB): US$1,000m Subordinated Note (US14040HCG83), floating rate maturing on 29 July 2032, priced at 100.00 (original spread of 108 bp), callable (11nc10)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$135m Bond (US3133EMY305), fixed rate (1.94% coupon) maturing on 2 August 2033, priced at 100.00, callable (12nc1)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$145m Bond (US3133EMY222), fixed rate (1.72% coupon) maturing on 4 August 2031, priced at 100.00 (original spread of 165 bp), callable (10nc1)

- Federal Home Loan Banks (Agency | Washington, Washington Dc, United States | Rating: NR): US$600m Bond (US3130ANGM63), fixed rate (1.05% coupon) maturing on 13 August 2026, priced at 100.00, callable (5nc1m)

- Penn Virginia Escrow LLC (Financial - Other | United States | Rating: NR): US$400m Senior Note (US70789PAA21), fixed rate (9.25% coupon) maturing on 15 August 2026, priced at 99.02 (original spread of 879 bp), callable (5nc2)

- Abu Dhabi Commercial Bank PJSC (Banking | Abu Dhabi, Abu Dhabi, United Arab Emirates | Rating: A): US$150m Unsecured Note (XS2371040218), fixed rate (1.63% coupon) maturing on 3 August 2026, priced at 100.00, non callable

- Air Canada (Airline | Saint-Laurent, Quebec, Canada | Rating: BB-): US$1,200m Note (US008911BK48), fixed rate (3.88% coupon) maturing on 15 August 2026, priced at 100.00 (original spread of 318 bp), callable (5nc5)

- Deutsche Bank AG (Banking | Frankfurt, Hessen, Germany | Rating: BBB): US$200m Note (XS2371228870) zero coupon maturing on 17 August 2055, priced at 100.00, callable (34nc5)

- Oi Movel SA (Financial - Other | Brasilia, Distrito Federal, Brazil | Rating: NR): US$880m Note (XS2370808318), fixed rate (8.75% coupon) maturing on 30 July 2026, priced at 100.00, callable (5nc3)

EUR BOND ISSUES

- Credit Agricole SA (Banking | Montrouge, France | Rating: A+): €213m Bond (FR0014003RK1), fixed rate (1.40% coupon) maturing on 28 July 2031, priced at 100.00 (original spread of 15,000 bp), non callable

- Nasdaq Inc (Securities | New York City, United States | Rating: BBB): €615m Senior Note (XS2369906644), fixed rate (0.90% coupon) maturing on 30 July 2033, priced at 99.99 (original spread of 138 bp), callable (12nc12)

- Valeo SE (Vehicle Parts | Paris, Ile-De-France, France | Rating: BB+): €700m Bond (FR0014004UE6), fixed rate (1.00% coupon) maturing on 3 August 2028, priced at 99.94 (original spread of 171 bp), callable (7nc7)

NEW LOANS

- Ontic Engineering & Mnfg Inc, signed a US$ 140m Term Loan B, to be used for general corporate purposes. It matures on 10/23/26 and initial pricing is set at LIBOR +400bps

- PAREXEL International Corp (CCC), signed a US$ 2,700m Term Loan B

- PAREXEL International Corp (CCC), signed a US$ 500m Revolving Credit Facility

- ICG PLC (BBB-), signed a € 1,450m Term Loan, to be used for general corporate purposes

- Iberdrola SA (BBB), signed a € 550m Term Loan, to be used for general corporate purposes.

NEW ISSUES IN SECURITIZED CREDIT

- Government National Mortgage Association issued a fixed-rate Agency CMBS in 8 tranches, for a total of US$ 10,605 m. Bookrunners: Wells Fargo Securities LLC