Credit

High Yield Cash Rises With Tighter Spreads, IG Tripped Up By Higher Rates

A good day for investment grade bond issuance, with Apple printing US$ 6.5bn in 4 tranches and Humana $3bn in 3 tranches

Published ET

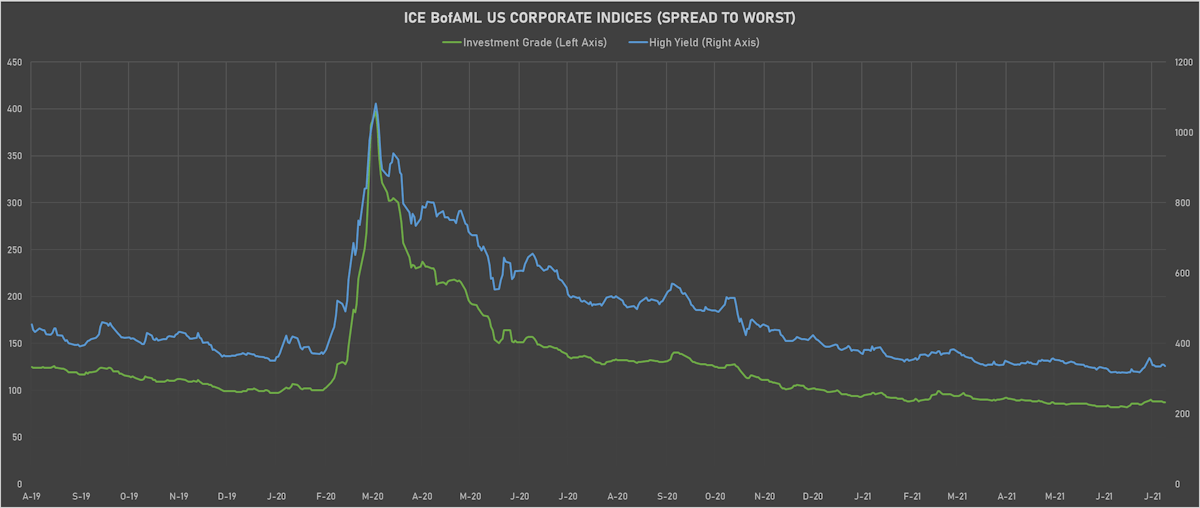

ICE BofAML US Corporate Spreads To Worst By Rating | Sources: ϕpost, Refinitiv data

QUICK SUMMARY

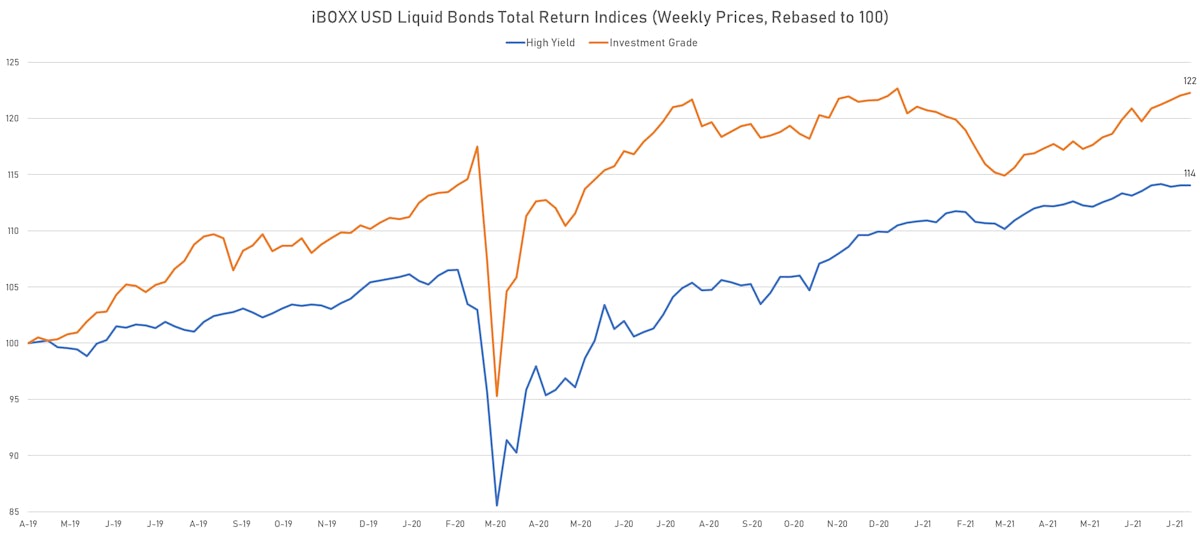

- The iBoxx USD Liquid Investment Grade Total Return Index was down -0.197% today (Month-to-date: 1.30%; Year-to-date: -0.31%)

- The iBoxx USD Liquid High Yield Total Return Index was up 0.076% today (Month-to-date: 0.18%; Year-to-date: 3.23%)

- ICE BofA US Corporate Index (Investment Grade) spread to worst unchanged, now at 87.0 bp (YTD change: -11.0 bp)

- ICE BofA US High Yield Index spread to worst down -4.0 bp, now at 336.0 bp (YTD change: -54.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index down -0.02% today (YTD total return: +1.9%)

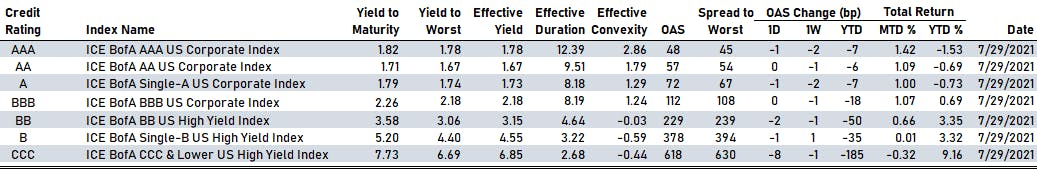

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

- AAA down by -1 bp at 48 bp

- AA unchanged at 57 bp

- A down by -1 bp at 72 bp

- BBB unchanged at 112 bp

- BB down by -2 bp at 229 bp

- B down by -1 bp at 378 bp

- CCC down by -8 bp at 618 bp

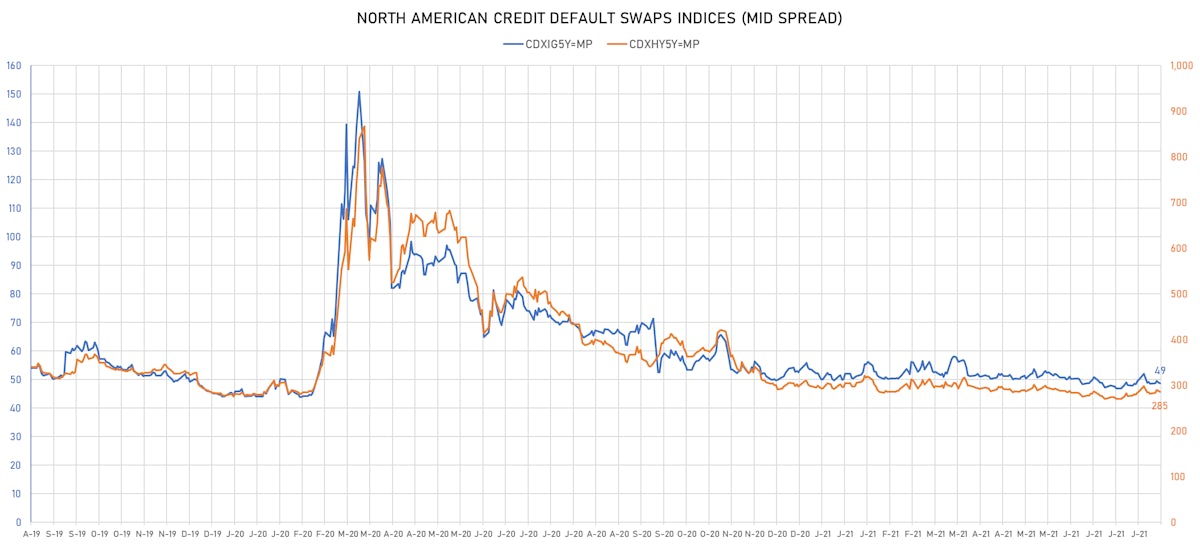

CDS INDICES (mid-spreads)

- Markit CDX.NA.IG 5Y down 0.3 bp, now at 49bp (YTD change: -1.3bp)

- Markit CDX.NA.HY 5Y down 1.9 bp, now at 285bp (YTD change: -7.9bp)

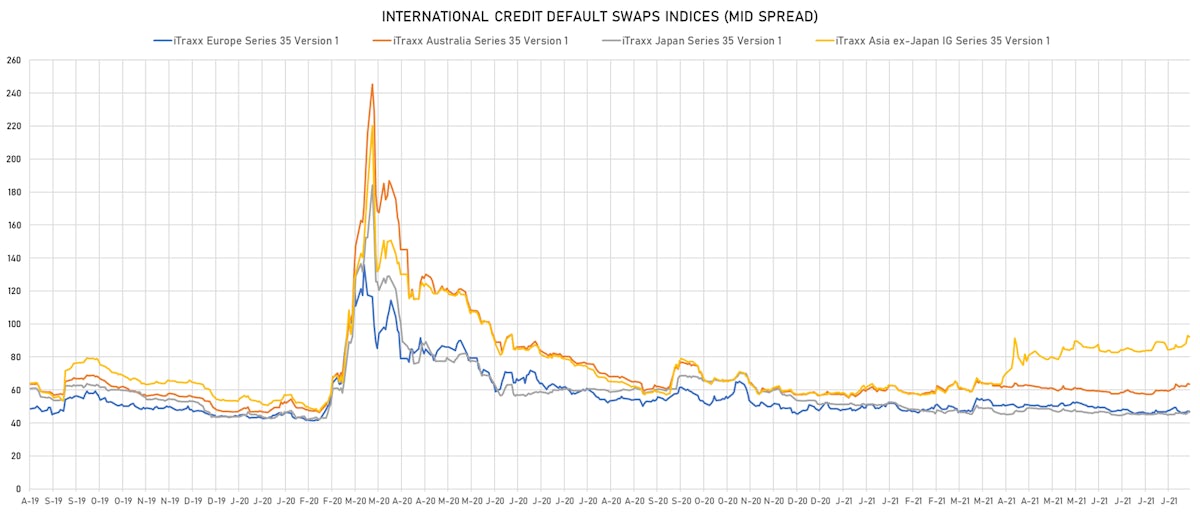

- Markit iTRAXX Europe down 0.4 bp, now at 46bp (YTD change: -1.8bp)

- Markit iTRAXX Japan down 0.5 bp, now at 47bp (YTD change: -4.5bp)

- Markit iTRAXX Asia Ex-Japan down 2.3 bp, now at 90bp (YTD change: +31.8bp)

TOP BONDS MOVES IN THE PAST WEEK - USD HY

- Issuer: China Hongqiao Group Ltd (Binzhou, Cayman Islands) | Coupon: 6.25% | Maturity: 8/6/2024 | Rating: B+ | ISIN: XS2348238259 | Z-spread up by 128.4 bp to 615.9 bp, with the yield to worst at 6.2% and the bond now trading down to 99.4 cents on the dollar (1Y price range: 99.4-102.9).

- Issuer: Guacolda Energia SA (LAS CONDES, Chile) | Coupon: 4.56% | Maturity: 30/4/2025 | Rating: B+ | ISIN: USP3711HAF66 | Z-spread up by 96.9 bp to 2,211.6 bp, with the yield to worst at 22.1% and the bond now trading down to 55.8 cents on the dollar (1Y price range: 53.5-92.1).

- Issuer: Seazen Group Ltd (Shanghai, Cayman Islands) | Coupon: 6.00% | Maturity: 12/8/2024 | Rating: BB+ | ISIN: XS2215175634 | Z-spread up by 72.6 bp to 519.0 bp, with the yield to worst at 5.2% and the bond now trading down to 101.1 cents on the dollar (1Y price range: 101.1-105.8).

- Issuer: Vedanta Resources Finance II PLC (London, United Kingdom) | Coupon: 8.95% | Maturity: 11/3/2025 | Rating: B- | ISIN: USG9T27HAD62 | Z-spread up by 58.4 bp to 1,034.6 bp, with the yield to worst at 10.6% and the bond now trading down to 94.3 cents on the dollar (1Y price range: 93.5-99.8).

- Issuer: Periama Holdings LLC (Baytown, Texas (US)) | Coupon: 5.95% | Maturity: 19/4/2026 | Rating: BB- | ISIN: XS2224065289 | Z-spread up by 53.5 bp to 388.4 bp, with the yield to worst at 4.3% and the bond now trading down to 105.8 cents on the dollar (1Y price range: 104.1-109.3).

- Issuer: Wynn Las Vegas LLC (Las Vegas, Nevada (US)) | Coupon: 5.50% | Maturity: 1/3/2025 | Rating: B+ | ISIN: USU98347AK05 | Z-spread up by 37.6 bp to 302.5 bp, with the yield to worst at 3.3% and the bond now trading down to 106.0 cents on the dollar (1Y price range: 102.5-108.3).

- Issuer: American Airlines Group Inc (Fort Worth, Texas (US)) | Coupon: 3.75% | Maturity: 1/3/2025 | Rating: CCC | ISIN: USU0242AAD47 | Z-spread up by 35.7 bp to 657.3 bp (CDS basis: -19.0bp), with the yield to worst at 6.9% and the bond now trading down to 89.8 cents on the dollar (1Y price range: 71.0-93.1).

- Issuer: SoftBank Group Corp (Minato-ku, Japan) | Coupon: 3.13% | Maturity: 6/1/2025 | Rating: BB+ | ISIN: XS2362416294 | Z-spread up by 27.1 bp to 289.9 bp, with the yield to worst at 3.2% and the bond now trading down to 98.9 cents on the dollar (1Y price range: 98.4-100.1).

- Issuer: Carnival Corp (Miami, Panama) | Coupon: 5.75% | Maturity: 1/3/2027 | Rating: B | ISIN: USP2121VAL82 | Z-spread up by 26.1 bp to 456.2 bp (CDS basis: -40.3bp), with the yield to worst at 5.2% and the bond now trading down to 101.5 cents on the dollar (1Y price range: 99.1-106.5).

- Issuer: Bank razvitiya Respubliki Belarus' OAO (MINSK, Belarus) | Coupon: 6.75% | Maturity: 2/5/2024 | Rating: B | ISIN: XS1904731129 | Z-spread down by 36.1 bp to 962.4 bp, with the yield to worst at 9.7% and the bond now trading up to 92.8 cents on the dollar (1Y price range: 91.3-102.5).

- Issuer: Pennsylvania Electric Co (Akron, Ohio (US)) | Coupon: 3.25% | Maturity: 15/3/2028 | Rating: BB+ | ISIN: USU70842AC04 | Z-spread down by 38.4 bp to 92.5 bp (CDS basis: -23.3bp), with the yield to worst at 1.8% and the bond now trading up to 108.0 cents on the dollar (1Y price range: 102.0-108.0).

- Issuer: Turkiye Garanti Bankasi AS (#N/A, Turkey) | Coupon: 5.88% | Maturity: 16/3/2023 | Rating: B | ISIN: XS1576037284 | Z-spread down by 41.5 bp to 234.7 bp, with the yield to worst at 2.3% and the bond now trading up to 105.3 cents on the dollar (1Y price range: 100.0-105.4).

TOP BONDS MOVES IN THE PAST WEEK - EUR HY

- Issuer: SoftBank Group Corp (Minato-Ku, Japan) | Coupon: 2.88% | Maturity: 6/1/2027 | Rating: BB+ | ISIN: XS2361254597 | Z-spread up by 27.1 bp to 363.3 bp, with the yield to worst at 3.2% and the bond now trading down to 98.0 cents on the dollar (1Y price range: 97.8-100.0).

- Issuer: Syngenta Finance NV (Enkhuizen, Netherlands) | Coupon: 1.25% | Maturity: 10/9/2027 | Rating: BB | ISIN: XS1199954691 | Z-spread up by 16.2 bp to 106.1 bp, with the yield to worst at 0.7% and the bond now trading down to 102.7 cents on the dollar (1Y price range: 93.2-103.7).

- Issuer: Adler Group SA (Senningerberg, Luxembourg) | Coupon: 2.25% | Maturity: 27/4/2027 | Rating: BB+ | ISIN: XS2336188029 | Z-spread up by 12.3 bp to 333.5 bp, with the yield to worst at 2.9% and the bond now trading down to 96.0 cents on the dollar (1Y price range: 94.4-100.2).

- Issuer: Standard Industries Inc (Parsippany, New Jersey (US)) | Coupon: 2.25% | Maturity: 21/11/2026 | Rating: BB- | ISIN: XS2080766475 | Z-spread up by 11.2 bp to 285.7 bp, with the yield to worst at 2.4% and the bond now trading down to 98.6 cents on the dollar (1Y price range: 96.7-102.9).

- Issuer: Renault SA (Boulogne-Billancourt, France) | Coupon: 1.13% | Maturity: 4/10/2027 | Rating: BB | ISIN: FR0013451416 | Z-spread down by 7.8 bp to 255.2 bp (CDS basis: -40.7bp), with the yield to worst at 2.1% and the bond now trading up to 93.5 cents on the dollar (1Y price range: 91.1-95.8).

- Issuer: ZF Finance GmbH (Friedrichshafen, Germany) | Coupon: 2.00% | Maturity: 6/5/2027 | Rating: BB+ | ISIN: XS2338564870 | Z-spread down by 9.3 bp to 206.7 bp, with the yield to worst at 1.6% and the bond now trading up to 101.3 cents on the dollar (1Y price range: 99.8-101.6).

- Issuer: Esselunga SpA (Pioltello, Italy) | Coupon: 1.88% | Maturity: 25/10/2027 | Rating: BB+ | ISIN: XS1706922256 | Z-spread down by 10.4 bp to 106.5 bp, with the yield to worst at 0.6% and the bond now trading up to 106.4 cents on the dollar (1Y price range: 103.6-106.7).

- Issuer: Teva Pharmaceutical Finance Netherlands II BV (Amsterdam, Netherlands) | Coupon: 1.63% | Maturity: 15/10/2028 | Rating: BB- | ISIN: XS1439749364 | Z-spread down by 13.2 bp to 340.2 bp, with the yield to worst at 3.0% and the bond now trading up to 90.2 cents on the dollar (1Y price range: 87.1-92.6).

- Issuer: Deutsche Lufthansa AG (Cologne, Germany) | Coupon: 3.50% | Maturity: 14/7/2029 | Rating: BB- | ISIN: XS2363235107 | Z-spread down by 15.9 bp to 349.1 bp (CDS basis: -50.5bp), with the yield to worst at 3.1% and the bond now trading up to 101.3 cents on the dollar (1Y price range: 97.7-101.4).

- Issuer: International Consolidated Airlines Group SA (London, Spain) | Coupon: 1.50% | Maturity: 4/7/2027 | Rating: B+ | ISIN: XS2020581752 | Z-spread down by 17.9 bp to 363.2 bp, with the yield to worst at 3.2% and the bond now trading up to 90.3 cents on the dollar (1Y price range: 84.0-92.1).

USD BOND ISSUES

- Akumin Inc (Service - Other | Plantation, Florida, United States | Rating: B-): US$375m Note (US01021FAB58), fixed rate (7.50% coupon) maturing on 1 August 2028, priced at 100.00 (original spread of 648 bp), callable (7nc3)

- Allen Media LLC (Service - Other | Richmond, Kentucky, United States | Rating: B): US$350m Senior Note (USU0R77QAB49), fixed rate (10.50% coupon) maturing on 15 February 2028, priced at 98.50, callable (7nc2)

- Apple Inc (Electronics | Cupertino, California, United States | Rating: AA+): US$1,800m Unsecured Note (US037833EK23), fixed rate (2.70% coupon) maturing on 5 August 2051, priced at 99.90 (original spread of 77 bp), callable (30nc30)

- Apple Inc (Electronics | Cupertino, California, United States | Rating: AA+): US$2,300m Senior Note (US037833EH93), fixed rate (1.40% coupon) maturing on 5 August 2028, priced at 99.77 (original spread of 40 bp), callable (7nc7)

- Apple Inc (Electronics | Cupertino, California, United States | Rating: AA+): US$1,000m Unsecured Note (US037833EJ59), fixed rate (1.70% coupon) maturing on 5 August 2031, priced at 99.58 (original spread of 47 bp), callable (10nc10)

- Apple Inc (Electronics | Cupertino, California, United States | Rating: AA+): US$1,400m Senior Note (US037833EL06), fixed rate (2.85% coupon) maturing on 5 August 2061, priced at 99.88 (original spread of 92 bp), callable (40nc40)

- Celanese US Holdings LLC (Chemicals | Irving, Texas, United States | Rating: BBB): US$400m Senior Note (US15089QAK04), fixed rate (1.40% coupon) maturing on 5 August 2026, priced at 99.90 (original spread of 70 bp), callable (5nc5)

- Centene Corp (Health Care Facilities | St. Louis, Missouri, United States | Rating: BB+): US$1,300m Senior Note (US15135BAZ40), fixed rate (2.63% coupon) maturing on 1 August 2031, priced at 100.00 (original spread of 136 bp), with a make whole call

- Citigroup Global Markets Holdings Inc (Securities | New York City, New York, United States | Rating: BBB+): US$125m Unsecured Note (XS2307417860) zero coupon maturing on 9 August 2056, priced at 100.00, non callable

- D R Horton Inc (Home Builders | Arlington, Texas, United States | Rating: BBB): US$600m Senior Note (US23331ABQ13), fixed rate (1.30% coupon) maturing on 15 October 2026, priced at 99.92 (original spread of 60 bp), callable (5nc5)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$140m Bond (US3133EMZ393), fixed rate (1.77% coupon) maturing on 4 February 2031, priced at 100.00 (original spread of 168 bp), callable (10nc3m)

- Goldman Sachs Finance Corp International Ltd (Financial - Other | Saint Helier, United States | Rating: NR): US$1,130m Unsecured Note (XS2094023434), fixed rate (8.50% coupon) maturing on 5 August 2024, priced at 100.00, non callable

- Humana Inc (Health Care Facilities | Louisville, Kentucky, United States | Rating: BBB): US$750m Senior Note (US444859BQ43), fixed rate (1.35% coupon) maturing on 1 February 2027, priced at 99.91 (original spread of 65 bp), with a special call

- Humana Inc (Health Care Facilities | Louisville, Kentucky, United States | Rating: BBB): US$1,500m Senior Note (US444859BP69), fixed rate (0.65% coupon) maturing on 3 August 2023, priced at 99.93 (original spread of 50 bp), callable (2nc6m)

- Humana Inc (Health Care Facilities | Louisville, Kentucky, United States | Rating: BBB): US$750m Senior Note (US444859BR26), fixed rate (2.15% coupon) maturing on 3 February 2032, priced at 99.80 (original spread of 90 bp), non callable

- Venture Global Calcasieu Pass LLC (Oil and Gas | Washington Dc, Washington Dc, United States | Rating: NR): US$1,250m Note (US92328MAA18), fixed rate (3.88% coupon) maturing on 15 August 2029, priced at 100.00 (original spread of 276 bp), callable (8nc8)

- Venture Global Calcasieu Pass LLC (Oil and Gas | Washington Dc, Washington Dc, United States | Rating: BB): US$1,250m Senior Note (US92328MAB90), fixed rate (4.13% coupon) maturing on 15 August 2031, priced at 100.00 (original spread of 287 bp), callable (10nc10)

- Banco Nacional de Comercio Exterior SNC (Agency | Tlalpan, Mexico, D.F., Mexico | Rating: BBB-): US$500m Subordinated Note (US05973JAA88), fixed rate (2.72% coupon) maturing on 11 August 2031, priced at 100.00 (original spread of 200 bp), callable (10nc5)

- Bank of Nova Scotia (Banking | Toronto, Ontario, Canada | Rating: A): US$650m Senior Note (US0641596F85), floating rate (SOFR + 38.0 bp) maturing on 31 July 2024, priced at 100.00, non callable

- Chengdu Xingjin Construction Development Investment Group Co Ltd (Service - Other | Chengdu, Sichuan, China (Mainland) | Rating: NR): US$300m Senior Note (XS2357798110), fixed rate (3.70% coupon) maturing on 5 August 2024, priced at 100.00, non callable

- Deutsche Bank AG (Banking | Frankfurt, Hessen, Germany | Rating: BBB): US$500m Note (XS0459856877), fixed rate (1.30% coupon) maturing on 19 August 2027, priced at 100.00, non callable

EUR BOND ISSUES

- Deutsche Bank AG (Banking | Frankfurt, Hessen, Germany | Rating: BBB+): €500m Inhaberschuldverschreibung (DE000DB9U4R9), floating rate maturing on 23 August 2028, priced at 100.00, non callable

- Peoplecert Wisdom Issuer PLC (Financial - Other | London, Cyprus | Rating: NR): €300m Note (XS2370814043), fixed rate (5.75% coupon) maturing on 15 September 2026, priced at 100.00 (original spread of 647 bp), callable (5nc2)

NEW LOANS

- Prudential Financial Inc (A), signed a US$ 4,000m Revolving Credit Facility, to be used for general corporate purposes & working capital. It matures on 07/29/26.

- Janus International Group LLC (B+), signed a US$ 175m Term Loan B, to be used for acquisition financing.

NEW ISSUES IN SECURITIZED CREDIT

- Barings Euro CLO 2021-2 Designated Activity Co issued a floating-rate CLO in 7 tranches, for a total of € 368 m. Highest-rated tranche offering a spread over the floating rate of 98bp, and the lowest-rated tranche a spread of 899bp. Bookrunners: Morgan Stanley & Co

- Freedom Mortgage 2021-Gt1 issued a fixed-rate RMBS in 2 tranches, for a total of US$ 500 m. Highest-rated tranche offering a yield to maturity of 3.62%, and the lowest-rated tranche a yield to maturity of 4.36%. Bookrunners: Credit Suisse Securities (USA) LLC

- Bank 2021-Bnk35 issued a fixed-rate CMBS in 9 tranches, for a total of US$ 1,210 m. Highest-rated tranche offering a yield to maturity of 0.60%, and the lowest-rated tranche a yield to maturity of 2.76%. Bookrunners: Morgan Stanley International Ltd, Wells Fargo Securities LLC, Bank of America Merrill Lynch

- Vista Credit Partners Rrl 2021-1 issued a fixed-rate ABS backed by corporate loans in 3 tranches, for a total of US$ 361 m. Highest-rated tranche offering a yield to maturity of 2.15%, and the lowest-rated tranche a yield to maturity of 5.43%. Bookrunners: MUFG, Securities Americas Inc