Credit

US Credit Spreads Widen, But Corporate Bonds Rise On Lower Rates

A good summer day for corporate bond issuance, with Honeywell raising US$ 2.5bn in 2 tranches and Credit Suisse US$ 3.75bn in 3 tranches

Published ET

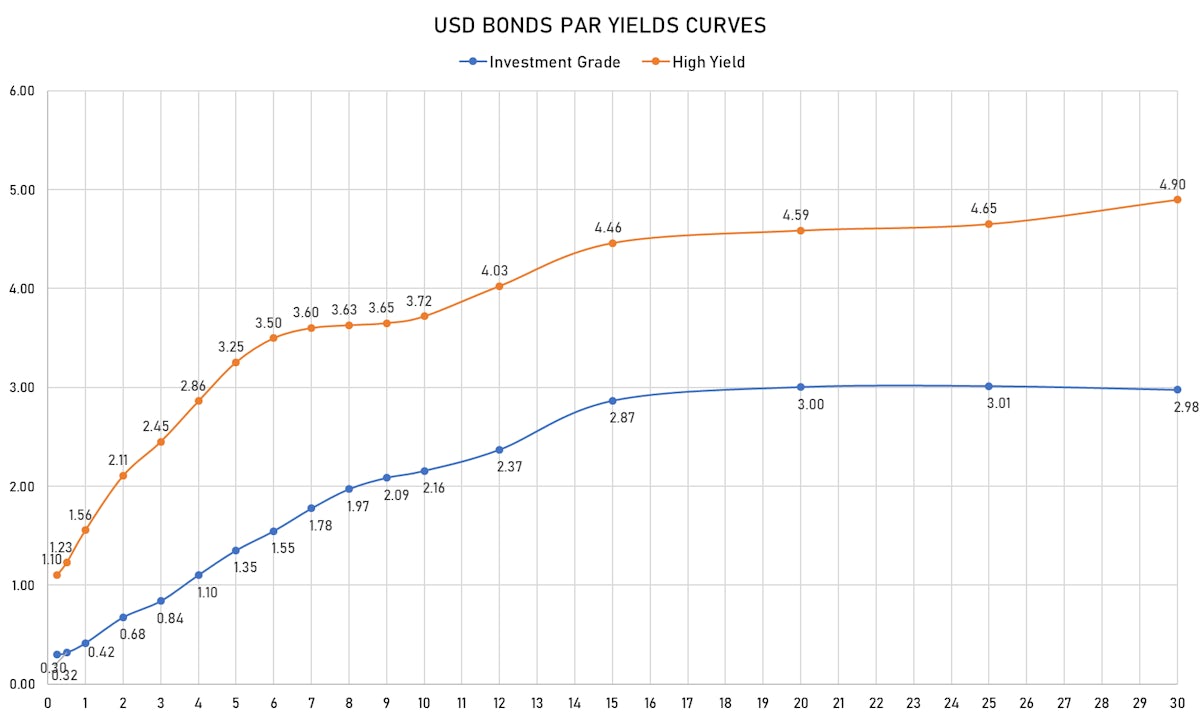

USD Bonds Par Yield Curves IG & HY | Sources: ϕpost, Refinitiv data

QUICK SUMMARY

- S&P 500 Bond Index was up 0.53% today, with investment grade up 0.57% and high yield up 0.18% (YTD total return: +0.65%)

- The iBoxx USD Liquid Investment Grade Total Return Index was up 0.32% today (Month-to-date: 0.32%; Year-to-date: 0.18%)

- The iBoxx USD Liquid High Yield Total Return Index was up 0.03% today (Month-to-date: 0.03%; Year-to-date: 3.27%)

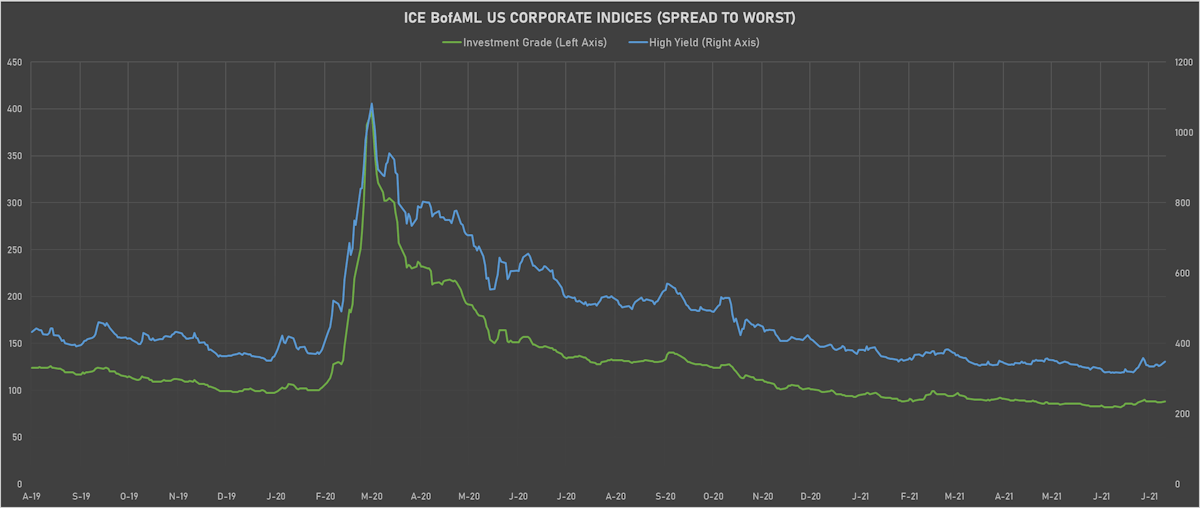

- ICE BofAML US Corporate Index (Investment Grade) spread to worst up 1.0 bp, now at 88.0 bp (YTD change: -10.0 bp)

- ICE BofAML US High Yield Index spread to worst up 10.0 bp, now at 348.0 bp (YTD change: -42.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index up 0.02% today (YTD total return: +1.9%)

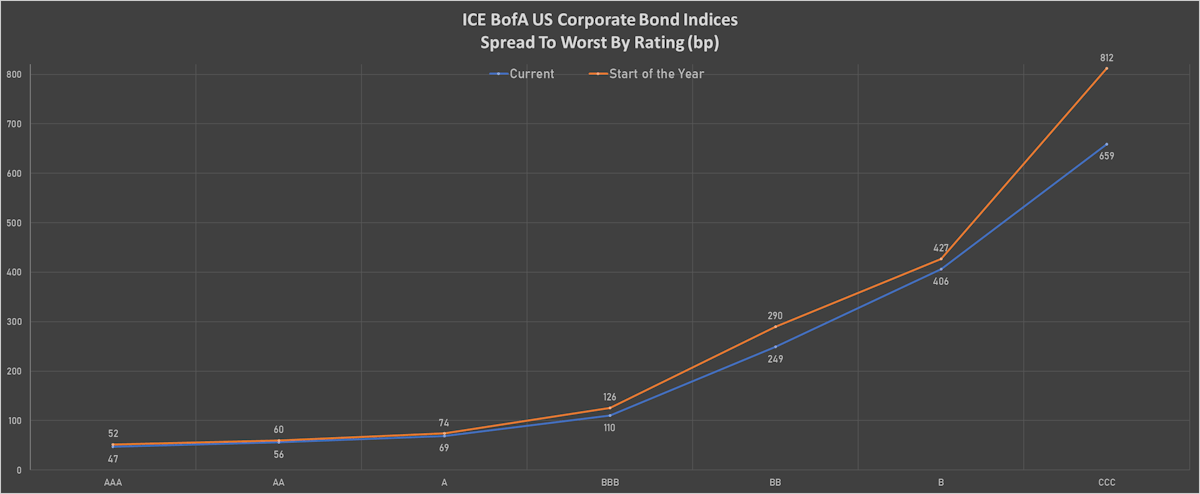

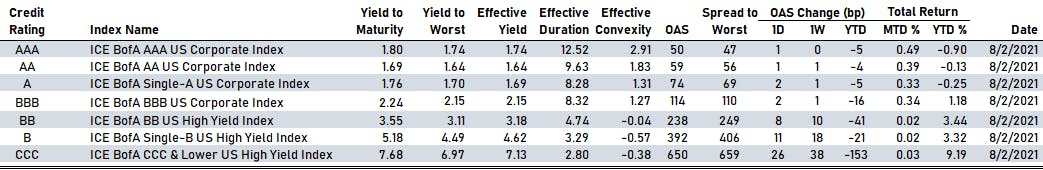

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

- AAA up by 1 bp at 50 bp

- AA up by 1 bp at 59 bp

- A up by 2 bp at 74 bp

- BBB up by 2 bp at 114 bp

- BB up by 8 bp at 238 bp

- B up by 11 bp at 392 bp

- CCC up by 26 bp at 650 bp

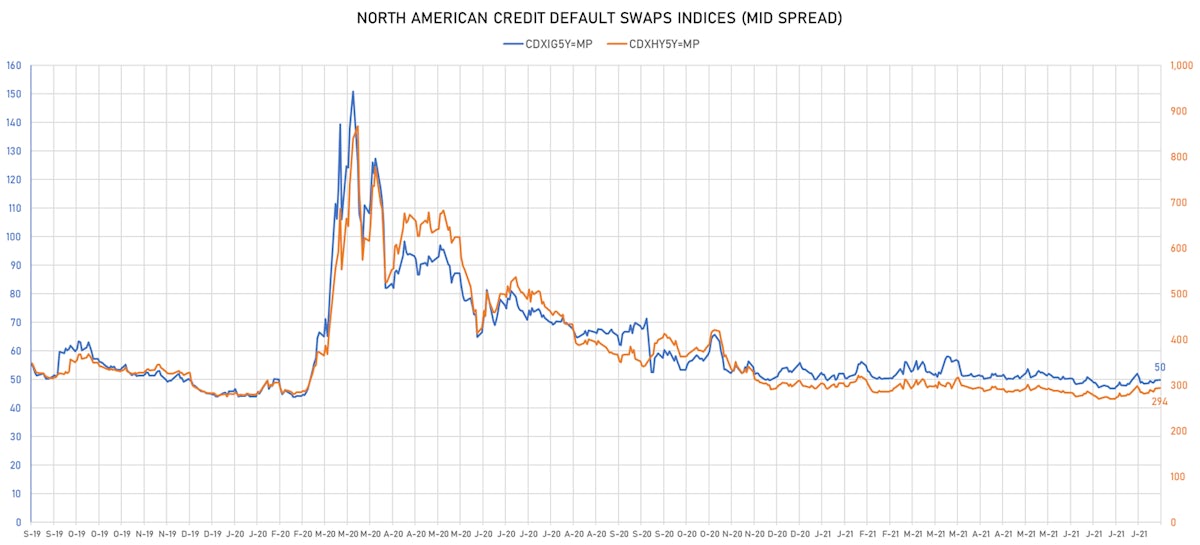

CDS INDICES (mid-spreads)

- Markit CDX.NA.IG 5Y up 0.1 bp, now at 50bp (YTD change: -0.1bp)

- Markit CDX.NA.HY 5Y up 2.0 bp, now at 294bp (YTD change: +1.1bp)

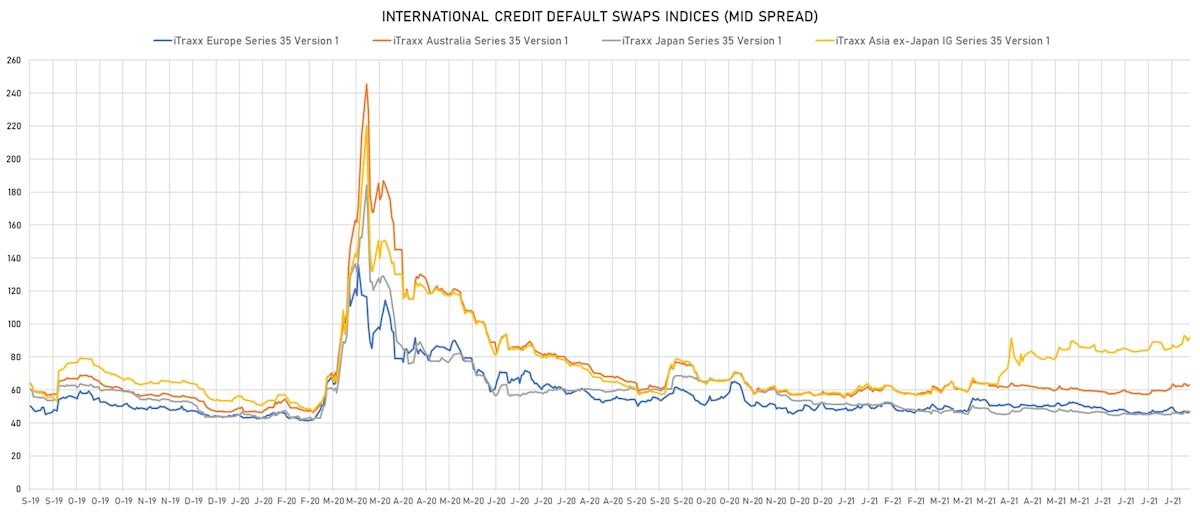

- Markit iTRAXX Europe down 0.2 bp, now at 46bp (YTD change: -1.5bp)

- Markit iTRAXX Japan down 0.2 bp, now at 47bp (YTD change: -4.7bp)

- Markit iTRAXX Asia Ex-Japan down 0.6 bp, now at 91bp (YTD change: +32.9bp)

TOP BONDS MOVES IN THE PAST WEEK - USD HY

- Issuer: American Airlines Group Inc (Fort Worth, Texas (US)) | Coupon: 3.75% | Maturity: 1/3/2025 | Rating: CCC | ISIN: USU0242AAD47 | Z-spread up by 55.2 bp to 726.3 bp (CDS basis: -62.2bp), with the yield to worst at 7.5% and the bond now trading down to 88.0 cents on the dollar (1Y price range: 71.0-93.1).

- Issuer: Nexa Resources SA (Luxembourg, Luxembourg) | Coupon: 5.38% | Maturity: 4/5/2027 | Rating: BB | ISIN: USP98118AA38 | Z-spread up by 47.1 bp to 347.2 bp, with the yield to worst at 4.1% and the bond now trading down to 105.4 cents on the dollar (1Y price range: 103.1-111.4).

- Issuer: Wynn Las Vegas LLC (Las Vegas, Nevada (US)) | Coupon: 5.25% | Maturity: 15/5/2027 | Rating: B+ | ISIN: USU98347AL87 | Z-spread up by 44.8 bp to 352.1 bp, with the yield to worst at 4.1% and the bond now trading down to 104.5 cents on the dollar (1Y price range: 101.5-108.1).

- Issuer: Starwood Property Trust Inc (Greenwich, Connecticut (US)) | Coupon: 5.50% | Maturity: 1/11/2023 | Rating: B+ | ISIN: USU85656AE39 | Z-spread up by 39.4 bp to 278.1 bp, with the yield to worst at 2.9% and the bond now trading down to 104.7 cents on the dollar (1Y price range: 103.4-105.5).

- Issuer: Periama Holdings LLC (Baytown, Texas (US)) | Coupon: 5.95% | Maturity: 19/4/2026 | Rating: BB- | ISIN: XS2224065289 | Z-spread up by 39.1 bp to 386.3 bp, with the yield to worst at 4.3% and the bond now trading down to 106.1 cents on the dollar (1Y price range: 104.1-109.3).

- Issuer: Southeast Supply Header LLC (Houston, Texas (US)) | Coupon: 4.25% | Maturity: 15/6/2024 | Rating: BB- | ISIN: USU83854AB29 | Z-spread up by 39.0 bp to 380.9 bp, with the yield to worst at 3.8% and the bond now trading down to 100.0 cents on the dollar (1Y price range: 99.0-101.2).

- Issuer: Vedanta Resources Finance II PLC (London, United Kingdom) | Coupon: 8.95% | Maturity: 11/3/2025 | Rating: B- | ISIN: USG9T27HAD62 | Z-spread up by 38.8 bp to 1,031.7 bp, with the yield to worst at 10.5% and the bond now trading down to 94.5 cents on the dollar (1Y price range: 93.5-99.8).

- Issuer: Dilijan Finance BV (Amsterdam, Netherlands) | Coupon: 6.50% | Maturity: 28/1/2025 | Rating: B+ | ISIN: XS2080321198 | Z-spread up by 34.1 bp to 656.9 bp, with the yield to worst at 6.6% and the bond now trading down to 98.6 cents on the dollar (1Y price range: 93.6-101.0).

- Issuer: HPCL-Mittal Energy Ltd (Noida, India) | Coupon: 5.25% | Maturity: 28/4/2027 | Rating: BB- | ISIN: XS1599758940 | Z-spread up by 24.8 bp to 405.1 bp, with the yield to worst at 4.6% and the bond now trading down to 102.3 cents on the dollar (1Y price range: 100.1-104.3).

- Issuer: NCL Corporation Ltd (Miami, Bermuda) | Coupon: 5.88% | Maturity: 15/3/2026 | Rating: CCC+ | ISIN: USG6436QAL08 | Z-spread up by 21.4 bp to 509.7 bp, with the yield to worst at 5.6% and the bond now trading down to 100.4 cents on the dollar (1Y price range: 98.5-105.3).

- Issuer: Ecobank Nigeria Ltd (#N/A, Nigeria) | Coupon: 7.13% | Maturity: 16/2/2026 | Rating: B- | ISIN: XS2297197266 | Z-spread up by 21.4 bp to 680.3 bp, with the yield to worst at 7.0% and the bond now trading down to 99.3 cents on the dollar (1Y price range: 99.1-101.9).

- Issuer: Bombardier Inc (MONTREAL, Canada) | Coupon: 7.45% | Maturity: 1/5/2034 | Rating: CCC | ISIN: USC10602AJ68 | Z-spread down by 29.4 bp to 482.8 bp (CDS basis: 31.6bp), with the yield to worst at 5.9% and the bond now trading up to 113.0 cents on the dollar (1Y price range: 86.5-113.3).

- Issuer: Bank razvitiya Respubliki Belarus' OAO (MINSK, Belarus) | Coupon: 6.75% | Maturity: 2/5/2024 | Rating: B | ISIN: XS1904731129 | Z-spread down by 31.1 bp to 928.7 bp, with the yield to worst at 9.3% and the bond now trading up to 93.6 cents on the dollar (1Y price range: 91.3-102.5).

- Issuer: Pennsylvania Electric Co (Akron, Ohio (US)) | Coupon: 4.15% | Maturity: 15/4/2025 | Rating: BB+ | ISIN: USU70842AB21 | Z-spread down by 36.6 bp to 71.0 bp (CDS basis: -26.9bp), with the yield to worst at 1.1% and the bond now trading up to 109.9 cents on the dollar (1Y price range: 106.4-109.9).

TOP BONDS MOVES IN THE PAST WEEK - EUR HY

- Issuer: CyrusOne LP (Dallas, Texas (US)) | Coupon: 1.45% | Maturity: 22/1/2027 | Rating: BB+ | ISIN: XS2089972629 | Z-spread up by 529.5 bp to 123.4 bp, with the yield to worst at 0.8% and the bond now trading down to 102.9 cents on the dollar (1Y price range: 100.4-102.9).

- Issuer: Adler Group SA (Senningerberg, Luxembourg) | Coupon: 2.25% | Maturity: 14/1/2029 | Rating: BB+ | ISIN: XS2283225477 | Z-spread up by 25.0 bp to 339.2 bp, with the yield to worst at 3.0% and the bond now trading down to 94.2 cents on the dollar (1Y price range: 93.2-98.9).

- Issuer: Saipem Finance International BV (Amsterdam, Netherlands) | Coupon: 3.13% | Maturity: 31/3/2028 | Rating: BB | ISIN: XS2325696628 | Z-spread up by 15.3 bp to 332.5 bp (CDS basis: 85.1bp), with the yield to worst at 2.8% and the bond now trading down to 100.5 cents on the dollar (1Y price range: 98.5-102.9).

- Issuer: Syngenta Finance NV (Enkhuizen, Netherlands) | Coupon: 1.25% | Maturity: 10/9/2027 | Rating: BB | ISIN: XS1199954691 | Z-spread up by 10.8 bp to 104.1 bp, with the yield to worst at 0.6% and the bond now trading down to 103.0 cents on the dollar (1Y price range: 93.2-103.7).

- Issuer: Netflix Inc (Los Gatos, California (US)) | Coupon: 4.63% | Maturity: 15/5/2029 | Rating: BB+ | ISIN: XS2076099865 | Z-spread up by 8.3 bp to 128.5 bp, with the yield to worst at 0.9% and the bond now trading down to 126.8 cents on the dollar (1Y price range: 120.0-128.0).

- Issuer: Elis SA (Saint-Cloud, France) | Coupon: 1.63% | Maturity: 3/4/2028 | Rating: BB | ISIN: FR0013449998 | Z-spread down by 10.0 bp to 186.8 bp, with the yield to worst at 1.4% and the bond now trading up to 100.2 cents on the dollar (1Y price range: 95.8-100.3).

- Issuer: ZF Finance GmbH (Friedrichshafen, Germany) | Coupon: 3.75% | Maturity: 21/9/2028 | Rating: BB+ | ISIN: XS2231331260 | Z-spread down by 10.0 bp to 234.0 bp, with the yield to worst at 1.9% and the bond now trading up to 110.8 cents on the dollar (1Y price range: 105.4-110.6).

- Issuer: International Consolidated Airlines Group SA (London, Spain) | Coupon: 3.75% | Maturity: 25/3/2029 | Rating: B+ | ISIN: XS2322423539 | Z-spread down by 10.4 bp to 397.6 bp, with the yield to worst at 3.6% and the bond now trading up to 100.1 cents on the dollar (1Y price range: 97.5-102.0).

- Issuer: ZF Europe Finance BV (Amsterdam, Netherlands) | Coupon: 2.50% | Maturity: 23/10/2027 | Rating: BB+ | ISIN: XS2010039977 | Z-spread down by 12.6 bp to 213.0 bp, with the yield to worst at 1.7% and the bond now trading up to 103.9 cents on the dollar (1Y price range: 99.0-104.0).

- Issuer: Deutsche Lufthansa AG (Cologne, Germany) | Coupon: 3.50% | Maturity: 14/7/2029 | Rating: BB- | ISIN: XS2363235107 | Z-spread down by 13.4 bp to 350.7 bp (CDS basis: -48.0bp), with the yield to worst at 3.1% and the bond now trading up to 101.5 cents on the dollar (1Y price range: 97.7-101.6).

- Issuer: SoftBank Group Corp (Minato-Ku, Japan) | Coupon: 3.38% | Maturity: 6/7/2029 | Rating: BB+ | ISIN: XS2361255057 | Z-spread down by 13.9 bp to 393.1 bp, with the yield to worst at 3.6% and the bond now trading up to 98.0 cents on the dollar (1Y price range: 95.7-99.9).

- Issuer: Renault SA (Boulogne-Billancourt, France) | Coupon: 2.50% | Maturity: 1/4/2028 | Rating: BB | ISIN: FR0014002OL8 | Z-spread down by 19.6 bp to 262.9 bp (CDS basis: -49.5bp), with the yield to worst at 2.2% and the bond now trading up to 100.9 cents on the dollar (1Y price range: 98.4-101.3).

- Issuer: Teva Pharmaceutical Finance Netherlands II BV (Amsterdam, Netherlands) | Coupon: 1.63% | Maturity: 15/10/2028 | Rating: BB- | ISIN: XS1439749364 | Z-spread down by 21.6 bp to 330.9 bp, with the yield to worst at 2.9% and the bond now trading up to 91.0 cents on the dollar (1Y price range: 87.1-92.6).

USD BOND ISSUES

- AEP Transmission Company LLC (Utility - Other | Columbus, Ohio, United States | Rating: A-): US$450m Senior Note (US00115AAN90), fixed rate (2.75% coupon) maturing on 15 August 2051, priced at 99.61 (original spread of 90 bp), callable (30nc30)

- CCO Holdings LLC (Cable/Media | St. Louis, Missouri, United States | Rating: BB): US$2,000m Senior Note (USU12501BN87), fixed rate (4.25% coupon) maturing on 15 January 2034, priced at 100.00 (original spread of 307 bp), callable (12nc6)

- Consumers Energy Co (Utility - Other | Jackson, Michigan, United States | Rating: A-): US$300m First Mortgage Bond (US210518DN34), fixed rate (2.65% coupon) maturing on 15 August 2052, priced at 99.92 (original spread of 108 bp), callable (31nc31)

- Corporate Office Properties LP (Real Estate Investment Trust | Columbia, Maryland, United States | Rating: BBB-): US$400m Senior Note (US22003BAN64), fixed rate (2.00% coupon) maturing on 15 January 2029, priced at 99.97 (original spread of 105 bp), callable (7nc7)

- Hess Midstream Operations LP (Oil and Gas | Houston, Texas, United States | Rating: BB+): US$750m Senior Note (US428102AE79), fixed rate (4.25% coupon) maturing on 15 February 2030, priced at 100.00 (original spread of 316 bp), callable (9nc4)

- Sirius XM Radio Inc (Cable/Media | New York City, New York, United States | Rating: BB): US$1,000m Senior Note (US82967NBL10), fixed rate (3.13% coupon) maturing on 1 September 2026, priced at 100.00 (original spread of 248 bp), callable (5nc2)

- Sirius XM Radio Inc (Cable/Media | New York City, New York, United States | Rating: BB): US$1,500m Senior Note (US82967NBM92), fixed rate (3.88% coupon) maturing on 1 September 2031, priced at 100.00 (original spread of 271 bp), callable (10nc5)

- Abu Dhabi Commercial Bank PJSC (Banking | Abu Dhabi, Abu Dhabi, United Arab Emirates | Rating: A): US$150m Senior Note (XS2371040218), fixed rate (1.63% coupon) maturing on 3 August 2026, priced at 100.00, non callable

- BNG Bank NV (Agency | S-Gravenhage, Zuid-Holland, Netherlands | Rating: AAA): US$500m Unsecured Note (XS2373155295), floating rate maturing on 5 August 2026, priced at 103.93 (original spread of 3 bp), non callable

- Credit Suisse AG (New York Branch) (Banking | New York City, New York, Switzerland | Rating: A+): US$1,400m Senior Note (US22550L2F72), fixed rate (0.52% coupon) maturing on 9 August 2023, priced at 100.00 (original spread of 35 bp), non callable

- Credit Suisse AG (New York Branch) (Banking | New York City, New York, Switzerland | Rating: A+): US$1,750m Senior Note (US22550L2G55), fixed rate (1.25% coupon) maturing on 7 August 2026, priced at 99.77 (original spread of 65 bp), non callable

- Korea Midland Power Co Ltd (Utility - Other | Boryeong, Chungcheongnam-Do, South Korea | Rating: AA): US$300m Senior Note (XS2367816076), fixed rate (1.25% coupon) maturing on 9 August 2026, priced at 99.73 (original spread of 63 bp), non callable

- Rwanda, Republic of (Government) (Sovereign | Kigali, Kigali City, Rwanda | Rating: B): US$620m Senior Note (XS2373051320), fixed rate (5.50% coupon) maturing on 9 August 2031, priced at 100.00 (original spread of 432 bp), non callable

- YCIC International HK Co Ltd (Financial - Other | Rating: NR): US$200m Senior Note (XS2344282335), fixed rate (3.10% coupon) maturing on 9 August 2024, priced at 100.00, non callable

EUR BOND ISSUES

- Barclays PLC (Banking | London, United Kingdom | Rating: BBB): €1,500m Senior Note (XS2373642102), fixed rate (0.58% coupon) maturing on 9 August 2029, priced at 100.00 (original spread of 126 bp), callable (8nc7)

NEW LOANS

- Waste Connections Inc, signed a US$ 650m Term Loan A, to be used for general corporate purposes. It matures on 07/30/26 and initial pricing is set at LIBOR +75bps

- Waste Connections Inc, signed a US$ 1,850m Revolving Credit Facility, to be used for general corporate purposes. It matures on 07/30/26 and initial pricing is set at LIBOR +75bps

- Cambium Learning Group Inc (B-), signed a US$ 2,150m Term Loan

- LifeMiles, signed a US$ 400m Term Loan B, to be used for general corporate purposes

NEW ISSUES IN SECURITIZED CREDIT

- PRPM 2021-6 issued a fixed-rate RMBS in 2 tranches, for a total of US$ 416 m. Highest-rated tranche offering a yield to maturity of 1.79%, and the lowest-rated tranche a yield to maturity of 3.47%. Bookrunners: Nomura Securities Co Ltd, Goldman Sachs & Co