Credit

US Corporate Bonds Fall Despite Lower Rates And Rally In Equities

High yield cash spreads widened again today, with virus concerns and primary activity impacting the market

Published ET

American Airlines 5Y USD CDS Spread Widening Again On Delta Virus Spread | Source: Refinitiv

QUICK SUMMARY

- S&P 500 Bond Index was down -0.04% today, with investment grade down -0.03% and high yield down -0.14% (YTD total return: +0.61%)

- The iBoxx USD Liquid Investment Grade Total Return Index was down -0.048% today (Month-to-date: 0.28%; Year-to-date: 0.13%)

- The iBoxx USD Liquid High Yield Total Return Index was down -0.15% today (Month-to-date: -0.12%; Year-to-date: 3.11%)

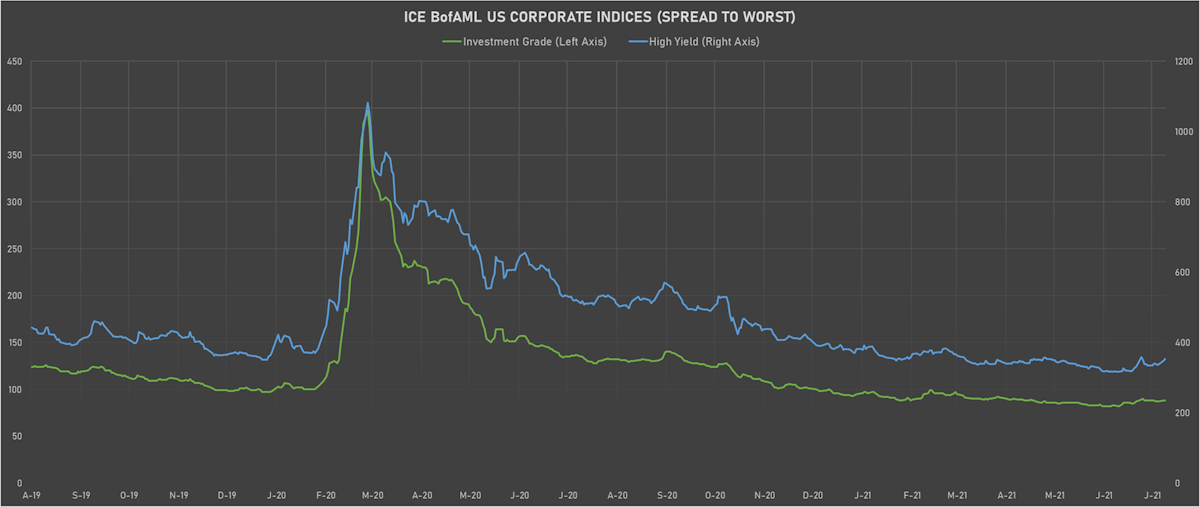

- ICE BofA US Corporate Index (Investment Grade) spread to worst unchanged at 88.0 bp (YTD change: -10.0 bp)

- ICE BofA US High Yield Index spread to worst up 6.0 bp, now at 354.0 bp (YTD change: -36.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index down -0.02% today (YTD total return: +1.9%)

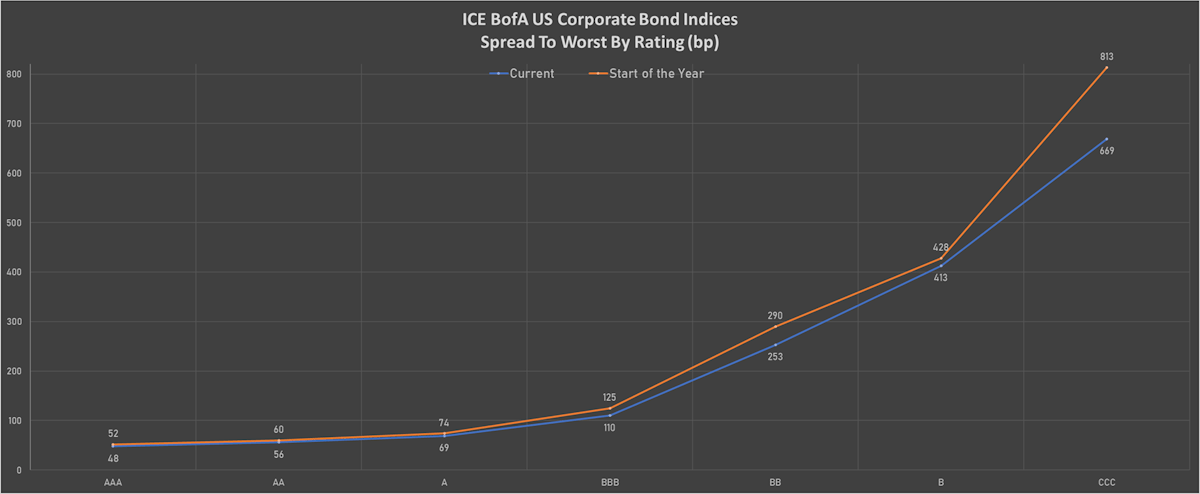

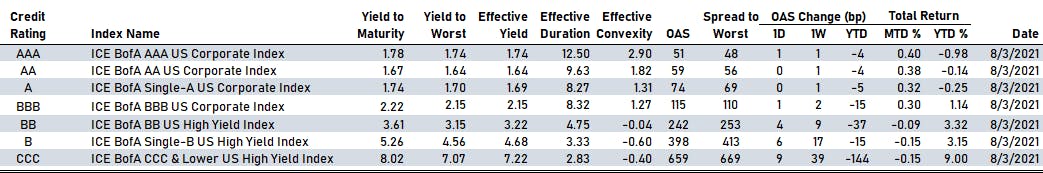

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

- AAA up by 1 bp at 51 bp

- AA unchanged at 59 bp

- A unchanged at 74 bp

- BBB up by 1 bp at 115 bp

- BB up by 4 bp at 242 bp

- B up by 6 bp at 398 bp

- CCC up by 9 bp at 659 bp

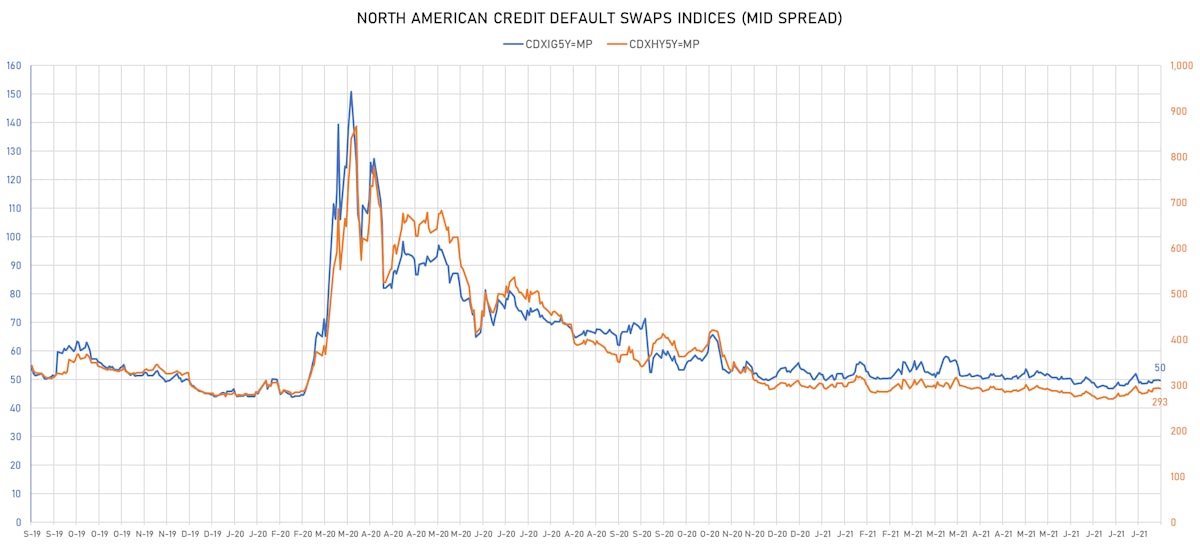

CDS INDICES (mid-spreads)

- Markit CDX.NA.IG 5Y down 0.2 bp, now at 50bp (YTD change: -0.3bp)

- Markit CDX.NA.HY 5Y down 1.4 bp, now at 293bp (YTD change: -0.3bp)

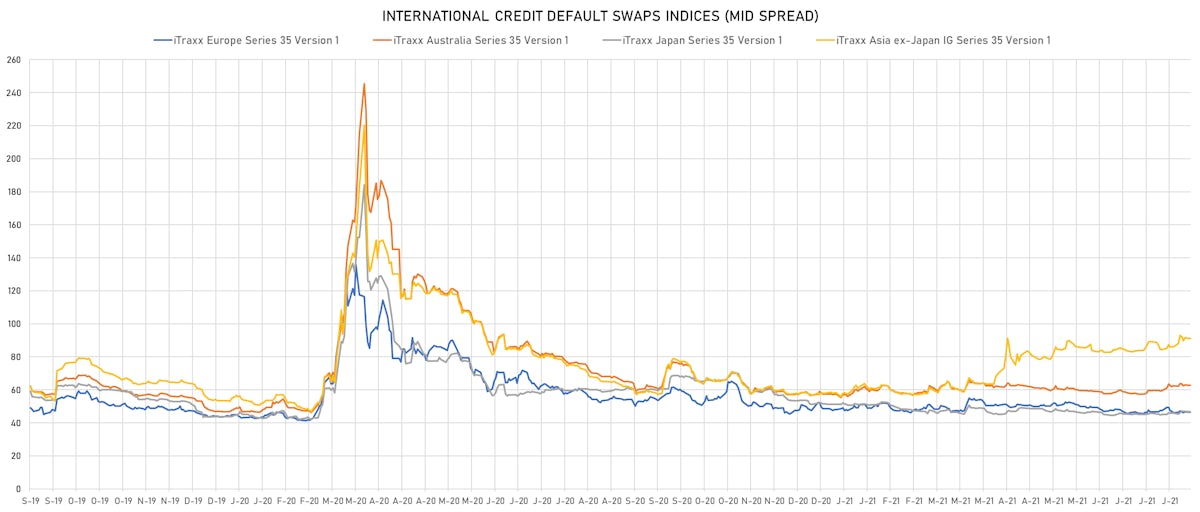

- Markit iTRAXX Europe up 0.2 bp, now at 47bp (YTD change: -1.3bp)

- Markit iTRAXX Japan down 0.1 bp, now at 47bp (YTD change: -4.7bp)

- Markit iTRAXX Asia Ex-Japan down 0.4 bp, now at 91bp (YTD change: +32.5bp)

LARGEST USD CORPORATE CDS MOVES IN THE PAST WEEK

- Talen Energy Supply LLC (Country: US; rated: BB-): down 149.8 bp to 3,031.5bp (1Y range: 875-2,714bp)

- Avis Budget Group Inc (Country: US; rated: CCC): down 26.6 bp to 267.9bp (1Y range: 236-665bp)

- Domtar Corp (Country: US; rated: Baa3): down 17.4 bp to 237.2bp (1Y range: 64-262bp)

- Murphy Oil Corp (Country: US; rated: Ba3): down 16.4 bp to 340.2bp (1Y range: 280-763bp)

- DISH DBS Corp (Country: US; rated: B2): down 14.8 bp to 329.8bp (1Y range: 323-545bp)

- Petroleos Mexicanos (Country: MX; rated: Ba3): down 14.8 bp to 388.8bp (1Y range: 364-589bp)

- Bombardier Inc (Country: CA; rated: Caa2): down 13.0 bp to 436.5bp (1Y range: 436-1,912bp)

- Avon Products Inc (Country: GB; rated: WR): down 12.5 bp to 203.1bp (1Y range: 160-463bp)

- Realogy Group LLC (Country: US; rated: B3): down 11.8 bp to 300.1bp (1Y range: 294-538bp)

- Carnival Corp (Country: US; rated: LGD5 - 72%): up 28.4 bp to 461.2bp (1Y range: 291-1,214bp)

- American Airlines Group Inc (Country: US; rated: B2): up 29.2 bp to 725.4bp (1Y range: 596-3,280bp)

- Genworth Holdings Inc (Country: US; rated: Caa1): up 39.2 bp to 514.8bp (1Y range: 447-830bp)

- Staples Inc (Country: US; rated: B2): up 77.1 bp to 982.2bp (1Y range: 652-1,965bp)

- Transocean Inc (Country: KY; rated: Caa3): up 177.9 bp to 1,868.1bp (1Y range: 941-7,695bp)

LARGEST EURO CORPORATE CDS MOVES IN THE PAST WEEK

- TUI AG (Country: DE; rated: LGD4 - 50%): down 63.2 bp to 745.3bp (1Y range: 590-1,799bp)

- Banca Monte dei Paschi di Siena SpA (Country: IT; rated: NP): down 29.0 bp to 195.0bp (1Y range: 188-272bp)

- Premier Foods Finance PLC (Country: ; rated: B1): down 20.1 bp to 183.9bp (1Y range: 141-273bp)

- Lagardere SA (Country: FR; rated: B): down 20.0 bp to 215.3bp (1Y range: 213-350bp)

- Thyssenkrupp AG (Country: DE; rated: B1): down 15.9 bp to 265.1bp (1Y range: 206-479bp)

- Deutsche Lufthansa AG (Country: DE; rated: Ba2): down 12.6 bp to 262.4bp (1Y range: 236-421bp)

- Ineos Group Holdings SA (Country: LU; rated: LGD5 - 88%): down 9.6 bp to 203.9bp (1Y range: 199-447bp)

- ArcelorMittal SA (Country: LU; rated: Ba1): down 6.8 bp to 120.0bp (1Y range: 119-248bp)

- Cable & Wireless Ltd (Country: GB; rated: WR): down 6.6 bp to 79.5bp (1Y range: 74-143bp)

- UPC Holding BV (Country: NL; rated: LGD6 - 93%): down 6.6 bp to 219.0bp (1Y range: 211-315bp)

- Louis Dreyfus Co BV (Country: NL; rated: ): down 5.9 bp to 108.9bp (1Y range: -104bp)

- Glencore International AG (Country: CH; rated: WR): down 5.9 bp to 110.1bp (1Y range: 104-194bp)

- Altice Finco SA (Country: LU; rated: Caa1): up 5.8 bp to 349.2bp (1Y range: 317-477bp)

- Novafives SAS (Country: FR; rated: Caa1): up 31.3 bp to 877.1bp (1Y range: 716-1,205bp)

- Boparan Finance PLC (Country: GB; rated: WR): up 41.7 bp to 984.4bp (1Y range: 478-994bp)

USD BOND ISSUES

- Ashland LLC (Chemicals | Covington, Kentucky, United States | Rating: BB+): US$450m Senior Note (US04433LAA08), fixed rate (3.38% coupon) maturing on 1 September 2031, priced at 100.00 (original spread of 220 bp), callable (10nc10)

- Century Communities Inc (Building Products | Greenwood Village, Colorado, United States | Rating: BB-): US$500m Senior Note (US156504AM47), fixed rate (3.88% coupon) maturing on 15 August 2029, priced at 100.00, callable (8nc7)

- ERP Operating LP (Real Estate Investment Trust | Chicago, Illinois, United States | Rating: A-): US$500m Unsecured Note (US26884ABN28), fixed rate (1.85% coupon) maturing on 1 August 2031, priced at 99.49 (original spread of 73 bp), callable (10nc10)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$200m Bond (US3133EMZ542), floating rate (SOFR + 2.5 bp) maturing on 10 August 2023, priced at 100.00, non callable

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$215m Bond (US3133EMZ708), fixed rate (0.48% coupon) maturing on 10 February 2025, priced at 100.00 (original spread of 42 bp), callable (4nc3m)

- Invitation Homes Operating Partnership LP (Financial - Other | Dallas, Texas, United States | Rating: BBB-): US$650m Senior Note (US46188BAA08), fixed rate (2.00% coupon) maturing on 15 August 2031, priced at 98.40 (original spread of 100 bp), callable (10nc10)

- JPMorgan Chase & Co (Banking | New York City, New York, United States | Rating: A-): US$1,250m Senior Note (US46647PCM68), floating rate maturing on 9 August 2025, priced at 100.00 (original spread of 32 bp), callable (4nc3)

- MDC Holdings Inc (Home Builders | Denver, Colorado, United States | Rating: BB+): US$350m Senior Note (US552676AV06), fixed rate (3.97% coupon) maturing on 6 August 2061, priced at 100.00 (original spread of 210 bp), callable (40nc40)

- MSCI Inc (Financial - Other | New York City, New York, United States | Rating: BB+): US$700m Senior Note (US55354GAQ38), fixed rate (3.25% coupon) maturing on 15 August 2033, priced at 100.00 (original spread of 208 bp), callable (12nc6)

- PACCAR Financial Corp (Financial - Other | Bellevue, Washington, United States | Rating: A+): US$300m Senior Note (US69371RR407), fixed rate (0.50% coupon) maturing on 9 August 2024, priced at 99.95 (original spread of 20 bp), non callable

- Rockwell Automation Inc (Conglomerate/Diversified Mfg | Milwaukee, Wisconsin, United States | Rating: A): US$450m Senior Note (US773903AL39), fixed rate (1.75% coupon) maturing on 15 August 2031, priced at 99.78 (original spread of 60 bp), callable (10nc10)

- Rockwell Automation Inc (Conglomerate/Diversified Mfg | Milwaukee, Wisconsin, United States | Rating: A): US$450m Senior Note (US773903AM12), fixed rate (2.80% coupon) maturing on 15 August 2061, priced at 99.76 (original spread of 95 bp), callable (40nc40)

- Rockwell Automation Inc (Conglomerate/Diversified Mfg | Milwaukee, Wisconsin, United States | Rating: A): US$600m Senior Note (US773903AK55), fixed rate (0.35% coupon) maturing on 15 August 2023, priced at 99.95 (original spread of 20 bp), callable (2nc1)

- Altice Financing SA (Financial - Other | Luxembourg, Luxembourg | Rating: B): US$1,925m Note (US02154CAH60), fixed rate (5.75% coupon) maturing on 15 August 2029, priced at 100.00 (original spread of 472 bp), callable (8nc3)

- Ashtead Capital Inc (Leasing | Fort Mill, South Carolina, United Kingdom | Rating: NR): US$750m Senior Note (US045054AP84), fixed rate (2.45% coupon) maturing on 12 August 2031, priced at 99.75 (original spread of 130 bp), callable (10nc10)

- Ashtead Capital Inc (Leasing | Fort Mill, South Carolina, United Kingdom | Rating: NR): US$550m Senior Note (USU04503AH81), fixed rate (1.50% coupon) maturing on 12 August 2026, priced at 99.74 (original spread of 90 bp), callable (5nc5)

- Bank of China Ltd (Hong Kong Branch) (Banking | China (Mainland) | Rating: A+): US$500m Senior Note (XS2369293886), floating rate (SOFR + 48.0 bp) maturing on 10 August 2024, priced at 100.00, non callable

- Bng Bank NV (Agency | S-Gravenhage, Zuid-Holland, Netherlands | Rating: AAA): US$500m Unsecured Note (XS2373155295), floating rate maturing on 5 August 2026, priced at 103.93 (original spread of 3 bp), non callable

- Deutsche Bank Luxembourg SA (Banking | Luxembourg, Germany | Rating: BBB+): US$667m Unsecured Note (XS2374420839) zero coupon maturing on 2 December 2026, priced at 100.00, non callable

- GFL Environmental Inc (Service - Other | Vaughan, Ontario, Canada | Rating: B-): US$550m Senior Note (US36168QAP90), fixed rate (4.38% coupon) maturing on 15 August 2029, priced at 100.00 (original spread of 334 bp), callable (8nc3)

- National Bank of Canada (Banking | Montreal, Quebec, Canada | Rating: A-): US$500m Senior Note (US63307A2P94), fixed rate (0.75% coupon) maturing on 6 August 2024, priced at 99.95 (original spread of 45 bp), non callable

- National Bank of Canada (Banking | Montreal, Quebec, Canada | Rating: A-): US$300m Senior Note (US63307A2Q77), floating rate (SOFR + 49.0 bp) maturing on 6 August 2024, priced at 100.00, non callable

- UBS AG (Banking | Zurich, Zuerich, Switzerland | Rating: A+): US$2,000m Senior Note (USH42097CM73), fixed rate (1.49% coupon) maturing on 10 August 2027, priced at 100.00 (original spread of 85 bp), callable (6nc5)

- UBS AG (Banking | Zurich, Zuerich, Switzerland | Rating: A-): US$2,000m Senior Note (US902613AH15), fixed rate (1.49% coupon) maturing on 10 August 2027, priced at 100.00 (original spread of 85 bp), callable (6nc5)

- UBS AG (London Branch) (Banking | London, Switzerland | Rating: A+): US$1,000m Senior Note (US902674YL82), floating rate (SOFR + 45.0 bp) maturing on 9 August 2024, non callable

- UBS AG (London Branch) (Banking | London, Switzerland | Rating: A+): US$1,000m Senior Note (US902674YK00), fixed rate (0.70% coupon) maturing on 9 August 2024, priced at 99.60 (original spread of 40 bp), non callable

- Value Success International Ltd (Financial - Other | Tortola, China (Mainland) | Rating: NR): US$500m Unsecured Note (XS2372974746), fixed rate (2.50% coupon) maturing on 10 August 2026, priced at 100.00, non callable

- Value Success International Ltd (Financial - Other | Tortola, China (Mainland) | Rating: BBB): US$550m Senior Note (XS2372975040), fixed rate (2.85% coupon) maturing on 12 August 2031, priced at 99.92 (original spread of 186 bp), non callable

EUR BOND ISSUES

- Altice Financing SA (Financial - Other | Luxembourg, Luxembourg | Rating: NR): €700m Note (XS2373430854), fixed rate (4.25% coupon) maturing on 15 August 2029, priced at 100.00 (original spread of 488 bp), callable (8nc3)

- Barclays Bank PLC (Banking | London, United Kingdom | Rating: A+): €250m Senior Note (XS2372741137) zero coupon maturing on 14 August 2023, priced at 100.00, callable (2nc1m)

NEW LOANS

- Herschend Family Ent Corp, signed a US$ 475m Term Loan B, to be used for general corporate purposes.

- Ecopetrol SA (BB+), signed a US$ 1,200m Delayed Draw Term Loan, to be used for general corporate purposes. It matures on 08/03/24 and initial pricing is set at LIBOR +125bps

- Unified Women's Healthcare LLC (B-), signed a US$ 130m Term Loan B, to be used for acquisition financing. It matures on 12/18/27 and initial pricing is set at LIBOR +425bps

- Ancestry.com, signed a US$ 350m Term Loan B, maturing on 12/04/27. Initial pricing is set at LIBOR +325bps

NEW ISSUES IN SECURITIZED CREDIT

- U.S. Auto Funding Trust 2021-1 issued a fixed-rate ABS backed by auto receivables in 5 tranches, for a total of US$ 331 m. Highest-rated tranche offering a yield to maturity of 0.79%, and the lowest-rated tranche a yield to maturity of 6.23%. Bookrunners: Credit Suisse

- ZH Trust 2021-1 issued a fixed-rate RMBS in 2 tranches, for a total of US$ 450 m. Highest-rated tranche offering a yield to maturity of 2.25%, and the lowest-rated tranche a yield to maturity of 3.26%. Bookrunners: Credit Suisse, Goldman Sachs & Co, Citigroup Global Markets Inc

- Textainer Marine Containers Vii Ltd Series 2021-3 issued a fixed-rate ABS backed by certificates in 2 tranches, for a total of US$ 599 m. Highest-rated tranche offering a yield to maturity of 1.94%, and the lowest-rated tranche a yield to maturity of 2.43%. Bookrunners: PNC Capital Markets, RBC Capital Markets, Wells Fargo Securities LLC, Bank of America Merrill Lynch