Credit

Spreads Widen Slightly In US Credit, Investment Grade Overperforms

In a daily note, Credit Suisse points out that recent underperformance of high-yield credit derivatives (relative to equities and IG) can be attributed to cyclical and high-beta single-names

Published ET

Recent Widening of the CDX HY Spread By Type Of Constituents | Source: Credit Suisse

QUICK SUMMARY

- S&P 500 Bond Index was down -0.01% today, with investment grade unchanged and high yield down -0.09% (YTD total return: +0.60%)

- The iBoxx USD Liquid Investment Grade Total Return Index was up 0.038% today (Month-to-date: 0.31%; Year-to-date: 0.16%)

- The iBoxx USD Liquid High Yield Total Return Index was down -0.089% today (Month-to-date: -0.21%; Year-to-date: 3.02%)

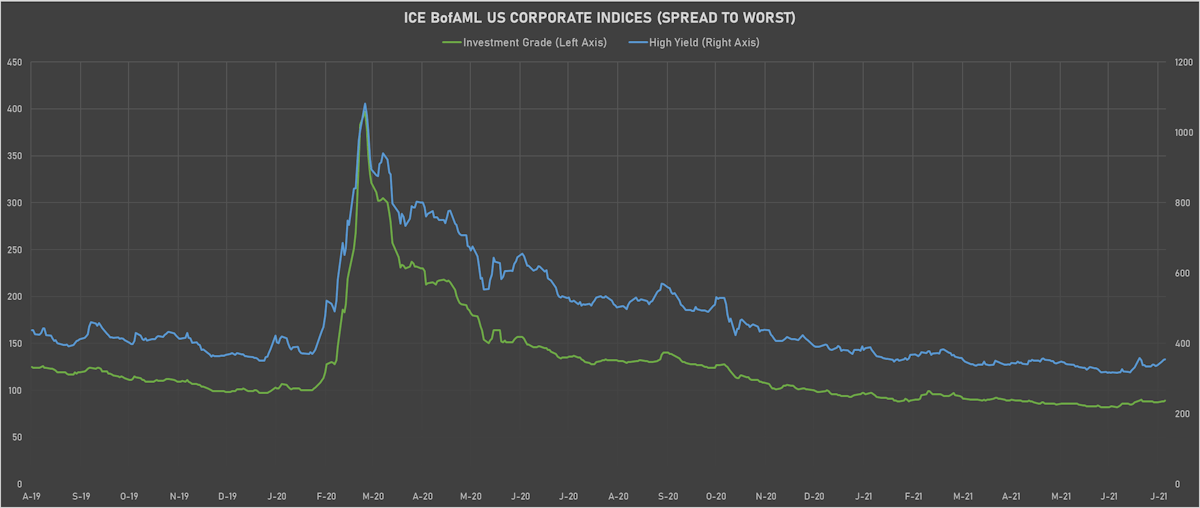

- ICE BofA US Corporate Index (Investment Grade) spread to worst up 1.0 bp, now at 89.0 bp (YTD change: -9.0 bp)

- ICE BofA US High Yield Index spread to worst up 1.0 bp, now at 355.0 bp (YTD change: -35.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index unchanged today (YTD total return: +1.9%)

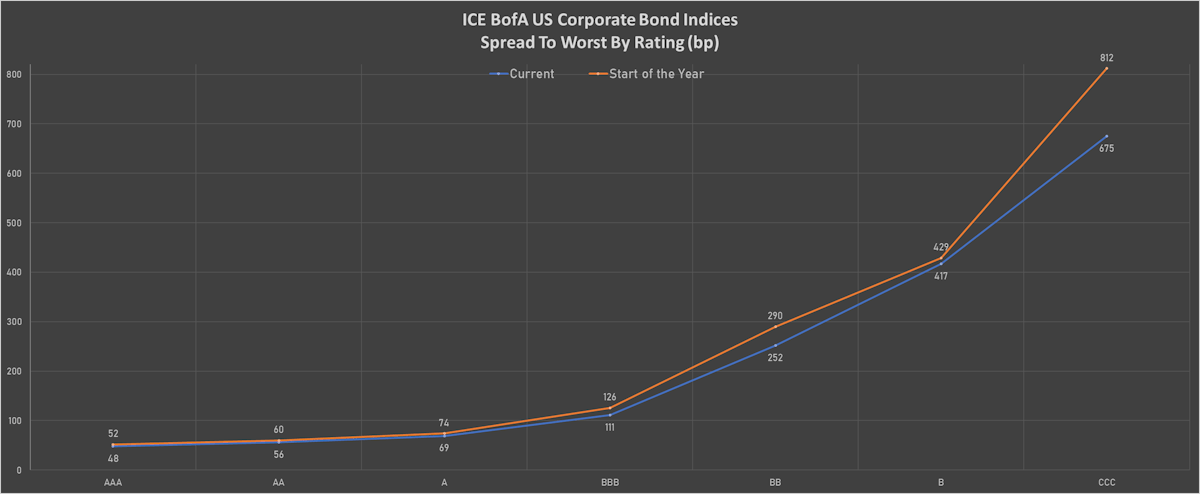

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

- AAA unchanged at 51 bp

- AA unchanged at 59 bp

- A unchanged at 74 bp

- BBB unchanged at 115 bp

- BB down by -1 bp at 241 bp

- B up by 3 bp at 401 bp

- CCC up by 7 bp at 666 bp

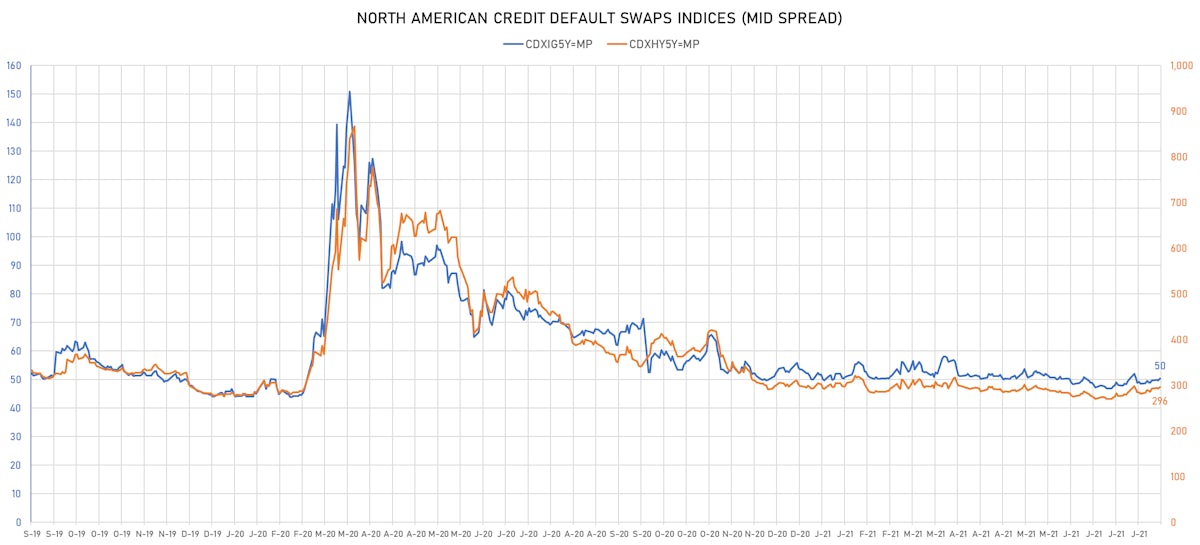

CDS INDICES (mid-spreads)

- Markit CDX.NA.IG 5Y up 0.6 bp, now at 50bp (YTD change: +0.3bp)

- Markit CDX.NA.HY 5Y up 3.0 bp, now at 296bp (YTD change: +2.7bp)

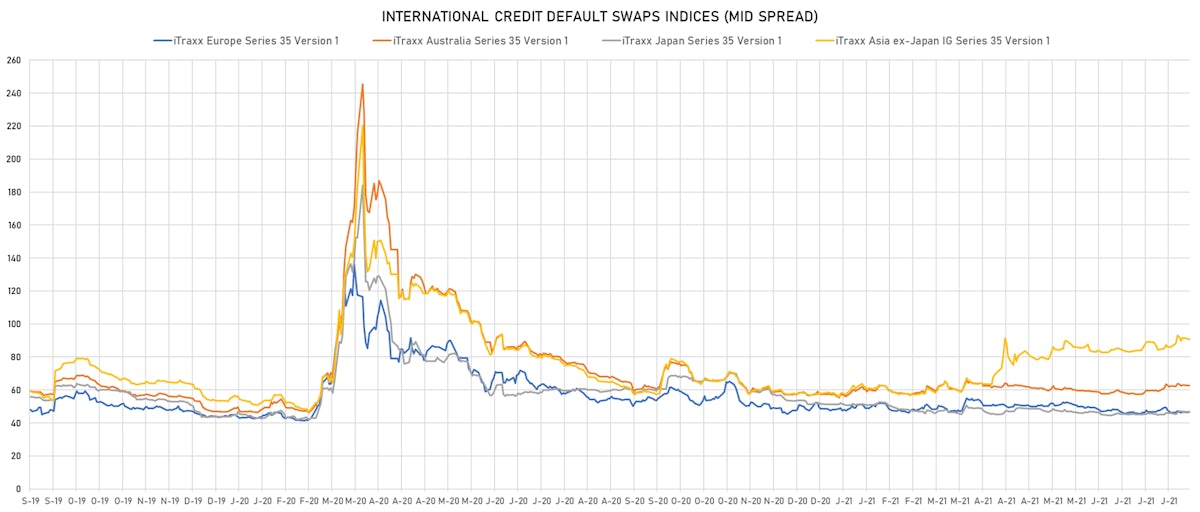

- Markit iTRAXX Europe up 0.1 bp, now at 47bp (YTD change: -1.2bp)

- Markit iTRAXX Japan unchanged at 47bp (YTD change: -4.7bp)

- Markit iTRAXX Asia Ex-Japan down 0.7 bp, now at 90bp (YTD change: +31.8bp)

TOP BONDS MOVES IN THE PAST WEEK - USD HY

- Issuer: American Airlines Group Inc (Fort Worth, Texas (US)) | Coupon: 3.75% | Maturity: 1/3/2025 | Rating: CCC | ISIN: USU0242AAD47 | Z-spread up by 118.6 bp to 775.9 bp (CDS basis: -72.5bp), with the yield to worst at 8.0% and the bond now trading down to 86.6 cents on the dollar (1Y price range: 71.0-93.1).

- Issuer: Royal Caribbean Cruises Ltd (Miami, Liberia) | Coupon: 4.25% | Maturity: 1/7/2026 | Rating: B | ISIN: USV7780TAF04 | Z-spread up by 83.5 bp to 485.3 bp (CDS basis: -74.3bp), with the yield to worst at 5.2% and the bond now trading down to 94.4 cents on the dollar (1Y price range: 94.4-100.9).

- Issuer: Wynn Las Vegas LLC (Las Vegas, Nevada (US)) | Coupon: 5.25% | Maturity: 15/5/2027 | Rating: B+ | ISIN: USU98347AL87 | Z-spread up by 78.5 bp to 405.3 bp, with the yield to worst at 4.7% and the bond now trading down to 101.8 cents on the dollar (1Y price range: 101.5-108.1).

- Issuer: NCL Corporation Ltd (Miami, Bermuda) | Coupon: 5.88% | Maturity: 15/3/2026 | Rating: CCC+ | ISIN: USG6436QAL08 | Z-spread up by 73.1 bp to 562.3 bp, with the yield to worst at 6.2% and the bond now trading down to 98.3 cents on the dollar (1Y price range: 98.3-105.3).

- Issuer: WeWork Companies Inc (New York City, New York (US)) | Coupon: 7.88% | Maturity: 1/5/2025 | Rating: CC | ISIN: USU96217AA99 | Z-spread up by 60.3 bp to 746.7 bp, with the yield to worst at 7.6% and the bond now trading down to 100.0 cents on the dollar (1Y price range: 67.5-104.8).

- Issuer: NCL Finance Ltd (#N/A, United Kingdom) | Coupon: 6.13% | Maturity: 15/3/2028 | Rating: CCC+ | ISIN: USG6437FAA78 | Z-spread up by 50.8 bp to 550.2 bp, with the yield to worst at 6.2% and the bond now trading down to 98.5 cents on the dollar (1Y price range: 98.5-105.9).

- Issuer: Seagate HDD Cayman (GEORGE TOWN, Cayman Islands) | Coupon: 4.09% | Maturity: 1/6/2029 | Rating: BB+ | ISIN: USG79456AM41 | Z-spread up by 49.7 bp to 272.0 bp, with the yield to worst at 3.6% and the bond now trading down to 102.3 cents on the dollar (1Y price range: 100.5-106.8).

- Issuer: Carnival Corp (Miami, Panama) | Coupon: 5.75% | Maturity: 1/3/2027 | Rating: B | ISIN: USP2121VAL82 | Z-spread up by 47.8 bp to 504.8 bp (CDS basis: -47.2bp), with the yield to worst at 5.6% and the bond now trading down to 99.5 cents on the dollar (1Y price range: 99.1-106.5).

- Issuer: Nexa Resources SA (Luxembourg, Luxembourg) | Coupon: 5.38% | Maturity: 4/5/2027 | Rating: BB | ISIN: USP98118AA38 | Z-spread up by 43.8 bp to 348.0 bp, with the yield to worst at 4.1% and the bond now trading down to 105.3 cents on the dollar (1Y price range: 103.1-111.4).

- Issuer: Grupo de Inversiones Suramericana SA (Medellin, Colombia) | Coupon: 5.50% | Maturity: 29/4/2026 | Rating: BB+ | ISIN: USG42036AB25 | Z-spread up by 35.8 bp to 287.7 bp, with the yield to worst at 3.4% and the bond now trading down to 108.0 cents on the dollar (1Y price range: 107.0-114.6).

- Issuer: Jersey Central Power & Light Co (Akron, Ohio (US)) | Coupon: 4.30% | Maturity: 15/1/2026 | Rating: BB+ | ISIN: USU04536AD78 | Z-spread up by 34.2 bp to 109.8 bp (CDS basis: -56.4bp), with the yield to worst at 1.7% and the bond now trading down to 110.3 cents on the dollar (1Y price range: 109.1-112.2).

- Issuer: Pennsylvania Electric Co (Akron, Ohio (US)) | Coupon: 4.15% | Maturity: 15/4/2025 | Rating: BB+ | ISIN: USU70842AB21 | Z-spread down by 35.8 bp to 73.0 bp (CDS basis: -25.5bp), with the yield to worst at 1.2% and the bond now trading up to 109.7 cents on the dollar (1Y price range: 106.4-110.0).

- Issuer: ZF North America Capital Inc (Northville, Michigan (US)) | Coupon: 4.75% | Maturity: 29/4/2025 | Rating: BB+ | ISIN: USU98737AC03 | Z-spread down by 40.2 bp to 136.5 bp, with the yield to worst at 1.7% and the bond now trading up to 110.1 cents on the dollar (1Y price range: 106.3-110.1).

- Issuer: Banistmo SA (PANAMA CITY, Panama) | Coupon: 3.65% | Maturity: 19/9/2022 | Rating: BB+ | ISIN: USP15383AC95 | Z-spread down by 46.4 bp to 179.9 bp, with the yield to worst at 1.8% and the bond now trading up to 101.9 cents on the dollar (1Y price range: 101.2-103.5).

- Issuer: Vedanta Resources Finance II PLC (London, United Kingdom) | Coupon: 8.95% | Maturity: 11/3/2025 | Rating: B- | ISIN: USG9T27HAD62 | Z-spread down by 92.4 bp to 946.4 bp, with the yield to worst at 9.7% and the bond now trading up to 96.9 cents on the dollar (1Y price range: 93.5-99.8).

TOP BONDS MOVES IN THE PAST WEEK - EUR HY

- Issuer: Adler Group SA (Senningerberg, Luxembourg) | Coupon: 2.25% | Maturity: 14/1/2029 | Rating: BB+ | ISIN: XS2283225477 | Z-spread up by 19.9 bp to 350.7 bp, with the yield to worst at 3.1% and the bond now trading down to 93.5 cents on the dollar (1Y price range: 92.8-98.9).

- Issuer: SoftBank Group Corp (Minato-Ku, Japan) | Coupon: 3.38% | Maturity: 6/7/2029 | Rating: BB+ | ISIN: XS2361255057 | Z-spread up by 9.3 bp to 397.7 bp, with the yield to worst at 3.6% and the bond now trading down to 97.7 cents on the dollar (1Y price range: 95.7-99.9).

- Issuer: Saipem Finance International BV (Amsterdam, Netherlands) | Coupon: 3.13% | Maturity: 31/3/2028 | Rating: BB | ISIN: XS2325696628 | Z-spread up by 8.3 bp to 326.7 bp (CDS basis: 81.9bp), with the yield to worst at 2.8% and the bond now trading down to 100.9 cents on the dollar (1Y price range: 98.5-102.9).

- Issuer: Telecom Italia SpA (Rome, Italy) | Coupon: 5.25% | Maturity: 17/3/2055 | Rating: BB | ISIN: XS0214965963 | Z-spread up by 7.9 bp to 383.9 bp (CDS basis: -92.2bp), with the yield to worst at 3.7% and the bond now trading down to 123.6 cents on the dollar (1Y price range: 114.2-126.9).

- Issuer: Atlantia SpA (Rome, Italy) | Coupon: 1.88% | Maturity: 12/2/2028 | Rating: BB- | ISIN: XS2301390089 | Z-spread up by 6.0 bp to 159.0 bp (CDS basis: -36.3bp), with the yield to worst at 1.1% and the bond now trading down to 103.5 cents on the dollar (1Y price range: 97.5-103.6).

- Issuer: Telecom Italia SpA (Rome, Italy) | Coupon: 1.63% | Maturity: 18/1/2029 | Rating: BB | ISIN: XS2288109676 | Z-spread up by 5.9 bp to 208.8 bp (CDS basis: 5.1bp), with the yield to worst at 1.8% and the bond now trading down to 98.5 cents on the dollar (1Y price range: 96.8-100.1).

- Issuer: Nexi SpA (Milan, Italy) | Coupon: 2.13% | Maturity: 30/4/2029 | Rating: BB- | ISIN: XS2332590475 | Z-spread down by 4.9 bp to 231.1 bp, with the yield to worst at 1.9% and the bond now trading up to 100.4 cents on the dollar (1Y price range: 98.0-100.3).

- Issuer: Petroleos Mexicanos (Miguel Hidalgo, Mexico) | Coupon: 4.75% | Maturity: 26/2/2029 | Rating: BB- | ISIN: XS1824424706 | Z-spread down by 5.0 bp to 531.1 bp (CDS basis: -116.6bp), with the yield to worst at 4.9% and the bond now trading up to 98.2 cents on the dollar (1Y price range: 95.6-102.0).

- Issuer: Verallia SAS (Courbevoie, France) | Coupon: 1.63% | Maturity: 14/5/2028 | Rating: BB+ | ISIN: FR0014003G27 | Z-spread down by 6.5 bp to 153.5 bp, with the yield to worst at 1.1% and the bond now trading up to 102.4 cents on the dollar (1Y price range: 99.0-102.3).

- Issuer: Teva Pharmaceutical Finance Netherlands II BV (Amsterdam, Netherlands) | Coupon: 1.63% | Maturity: 15/10/2028 | Rating: BB- | ISIN: XS1439749364 | Z-spread down by 13.5 bp to 329.4 bp, with the yield to worst at 2.9% and the bond now trading up to 91.1 cents on the dollar (1Y price range: 87.1-92.6).

- Issuer: Schaeffler AG (Herzogenaurach, Germany) | Coupon: 3.38% | Maturity: 12/10/2028 | Rating: BB+ | ISIN: DE000A3H2TA0 | Z-spread down by 15.0 bp to 189.3 bp, with the yield to worst at 1.4% and the bond now trading up to 111.5 cents on the dollar (1Y price range: 108.0-111.8).

- Issuer: Rolls-Royce PLC (Birmingham, United Kingdom) | Coupon: 1.63% | Maturity: 9/5/2028 | Rating: BB- | ISIN: XS1819574929 | Z-spread down by 16.8 bp to 290.8 bp (CDS basis: -13.0bp), with the yield to worst at 2.5% and the bond now trading up to 93.9 cents on the dollar (1Y price range: 90.4-94.1).

- Issuer: Renault SA (Boulogne-Billancourt, France) | Coupon: 2.50% | Maturity: 1/4/2028 | Rating: BB | ISIN: FR0014002OL8 | Z-spread down by 26.0 bp to 244.2 bp (CDS basis: -40.8bp), with the yield to worst at 2.0% and the bond now trading up to 102.1 cents on the dollar (1Y price range: 98.4-102.3).

- Issuer: ZF Europe Finance BV (Amsterdam, Netherlands) | Coupon: 2.50% | Maturity: 23/10/2027 | Rating: BB+ | ISIN: XS2010039977 | Z-spread down by 33.1 bp to 185.4 bp, with the yield to worst at 1.4% and the bond now trading up to 105.5 cents on the dollar (1Y price range: 99.0-105.6).

USD BOND ISSUES

- B Riley Financial Inc (Service - Other | Los Angeles, California, United States | Rating: NR): US$275m Senior Note (US05580M8192), fixed rate (5.25% coupon) maturing on 31 August 2028, priced at 100.00 (original spread of 441 bp), callable (7nc2)

- Brunswick Corp (Transportation - Other | Mettawa, United States | Rating: BBB-): US$550m Senior Note (US117043AT65), fixed rate (2.40% coupon) maturing on 18 August 2031, priced at 99.74 (original spread of 125 bp), with a make whole call

- Brunswick Corp (Transportation - Other | Mettawa, United States | Rating: BBB-): US$450m Senior Note (US117043AS82), fixed rate (0.85% coupon) maturing on 18 August 2024, priced at 99.88 (original spread of 55 bp), callable (3nc1)

- Chemours Co (Chemicals | Wilmington, Delaware, United States | Rating: B): US$650m Senior Note (US163851AH15), fixed rate (4.63% coupon) maturing on 15 November 2029, priced at 100.00 (original spread of 367 bp), callable (8nc3)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$475m Bond (US3133EM2E19), fixed rate (0.16% coupon) maturing on 10 August 2023, priced at 100.00 (original spread of 1 bp), non callable

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$110m Bond (US3133EM2H40), fixed rate (2.22% coupon) maturing on 12 August 2036, priced at 100.00 (original spread of 215 bp), callable (15nc1)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$155m Bond (US3133EM2G66), fixed rate (1.18% coupon) maturing on 10 May 2028, priced at 100.00 (original spread of 24 bp), callable (7nc6m)

- Federal Home Loan Banks (Agency | Washington, Washington Dc, United States | Rating: NR): US$250m Bond (US3130ANKD19), fixed rate (0.65% coupon) maturing on 23 May 2025, priced at 100.00 (original spread of 60 bp), callable (4nc3m)

- Federal Home Loan Banks (Agency | Washington, Washington Dc, United States | Rating: NR): US$300m Bond (US3130ANK587), fixed rate (0.45% coupon) maturing on 26 August 2024, priced at 100.00 (original spread of 11 bp), callable (3nc3m)

- Federal Home Loan Banks (Agency | Washington, Washington Dc, United States | Rating: NR): US$250m Bond (US3130ANKC36), fixed rate (0.60% coupon) maturing on 24 February 2025, priced at 100.00 (original spread of 54 bp), callable (4nc3m)

- Goldman Sachs Finance Corp International Ltd (Financial - Other | Saint Helier, United States | Rating: NR): US$14,000m Unsecured Note (XS2093998735), fixed rate (7.00% coupon) maturing on 9 August 2024, priced at 100.00, non callable

- Gps Hospitality Holding Company LLC (Financial - Other | Atlanta, Georgia, United States | Rating: B-): US$400m Note (US36262BAA08), fixed rate (7.00% coupon) maturing on 15 August 2028, priced at 100.00 (original spread of 621 bp), callable (7nc3)

- Onemain Finance Corp (Financial - Other | Evansville, Indiana, United States | Rating: BB-): US$600m Senior Note (US682691AC47), fixed rate (3.88% coupon) maturing on 15 September 2028, priced at 100.00 (original spread of 290 bp), callable (7nc3)

- Raytheon Technologies Corp (Aerospace | Waltham, United States | Rating: BBB+): US$1,000m Senior Note (US75513ECL39), fixed rate (2.82% coupon) maturing on 1 September 2051, priced at 99.90 (original spread of 98 bp), callable (30nc30)

- Raytheon Technologies Corp (Aerospace | Waltham, United States | Rating: A-): US$1,000m Senior Note (US75513ECM12), fixed rate (1.90% coupon) maturing on 1 September 2031, priced at 99.96 (original spread of 73 bp), callable (10nc10)

- Rexford Industrial Realty LP (Financial - Other | Los Angeles, United States | Rating: BBB): US$400m Senior Note (US76169XAB01), fixed rate (2.15% coupon) maturing on 1 September 2031, priced at 99.01 (original spread of 112 bp), callable (10nc10)

- Ningbo Yincheng Group Co Ltd (Financial - Other | Ningbo, China (Mainland) | Rating: BBB-): US$200m Senior Note (XS2360792449), fixed rate (2.15% coupon) maturing on 11 August 2024, priced at 100.00, non callable

- Yamana Gold Inc (Metals/Mining | Toronto, Canada | Rating: BB+): US$500m Senior Note (US98462YAE05), fixed rate (2.63% coupon) maturing on 15 August 2031, priced at 100.00 (original spread of 147 bp), callable (10nc10)

EUR BOND ISSUES

- SC Germany SA (Financial - Other | Luxembourg, Netherlands | Rating: NR): €1,670m Unsecured Note (XS2375000325) zero coupon maturing on 14 September 2036, non callable

- SC Germany SA (Financial - Other | Luxembourg, Netherlands | Rating: NR): €131m Unsecured Note (XS2375000754), fixed rate (1.00% coupon) maturing on 14 September 2036, priced at 100.00, non callable

- Volkswagen International Finance NV (Financial - Other | Amsterdam, Noord-Holland, Germany | Rating: NR): €750m Unsecured Note (XS2374594401), fixed rate (0.12% coupon) maturing on 12 February 2027, priced at 100.00, non callable

NEW LOANS

- Mavenir Systems Inc (B-), signed a US$ 560m Term Loan B, to be used for general corporate purposes. It matures on 08/12/28 and initial pricing is set at LIBOR +500bps