Credit

Credit Spreads Tighten Slightly But Bonds Fall On Higher Rates

Weekly US Corporate Bonds Issuance (IFR data): US$ 35.8bn in 51 Tranches for IG, US$ 13.3bn in 16 Tranches for HY

Published ET

iBOXX USD Liquid Bonds IG & HY Total Return Indices | Sources: ϕpost, Refinitiv data

QUICK SUMMARY

- S&P 500 Bond Index was down -0.78% today, with investment grade down -0.85% and high yield down -0.15% (YTD total return: -0.19%)

- The iBoxx USD Liquid Investment Grade Total Return Index was down -0.809% today (Month-to-date: -0.86%; Year-to-date: -1.01%)

- The iBoxx USD Liquid High Yield Total Return Index was down -0.006% today (Month-to-date: -0.18%; Year-to-date: 3.05%)

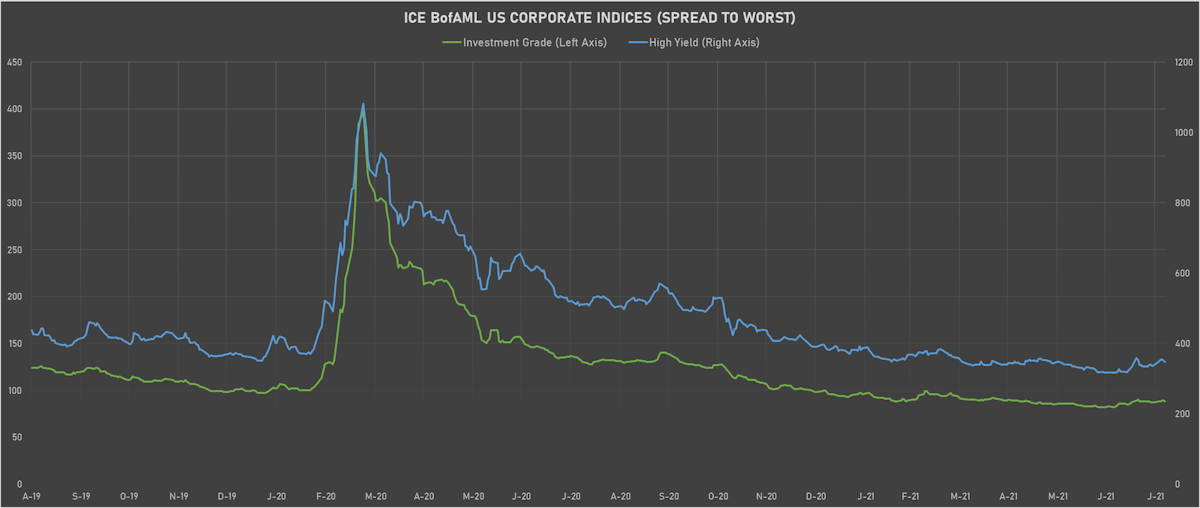

- ICE BofA US Corporate Index (Investment Grade) spread to worst down -1.0 bp, now at 88.0 bp (YTD change: -10.0 bp)

- ICE BofA US High Yield Index spread to worst down -4.0 bp, now at 347.0 bp (YTD change: -43.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index up 0.03% today (YTD total return: +1.9%)

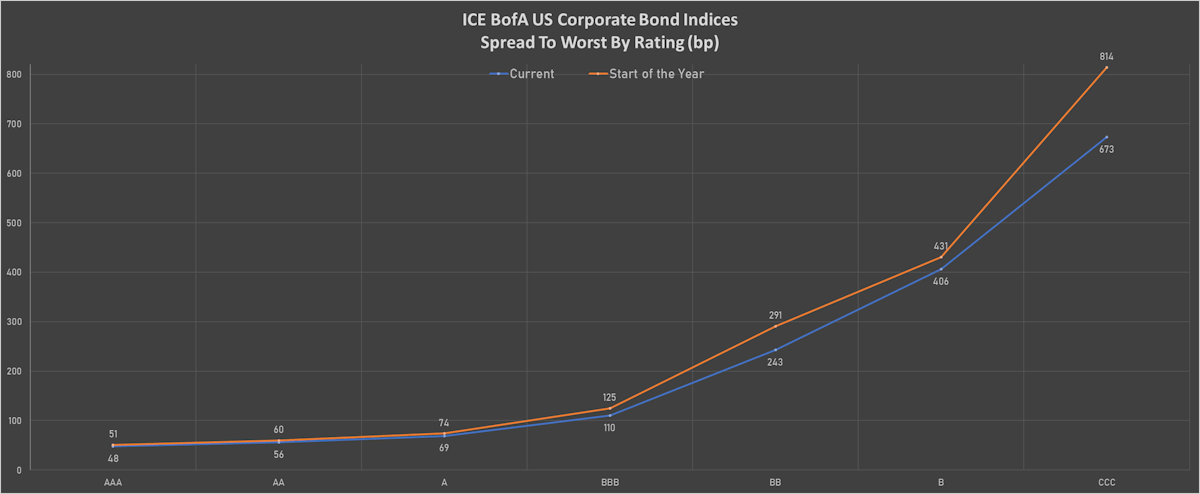

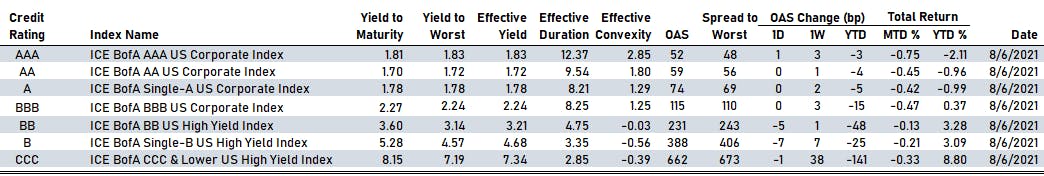

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

- AAA up by 1 bp at 52 bp

- AA unchanged at 59 bp

- A unchanged at 74 bp

- BBB unchanged at 115 bp

- BB down by -5 bp at 231 bp

- B down by -7 bp at 388 bp

- CCC down by -1 bp at 662 bp

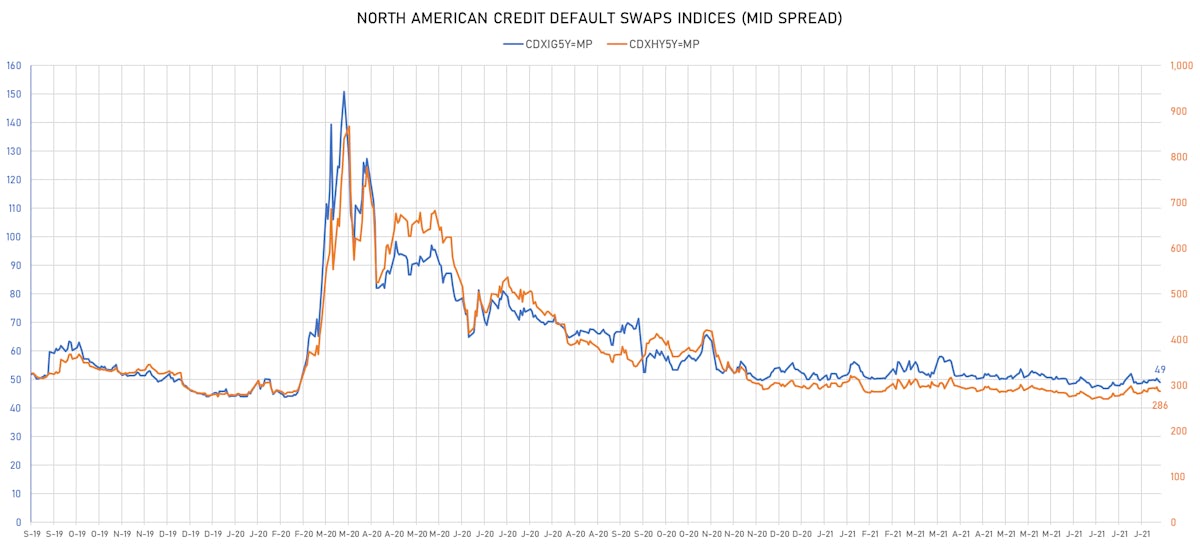

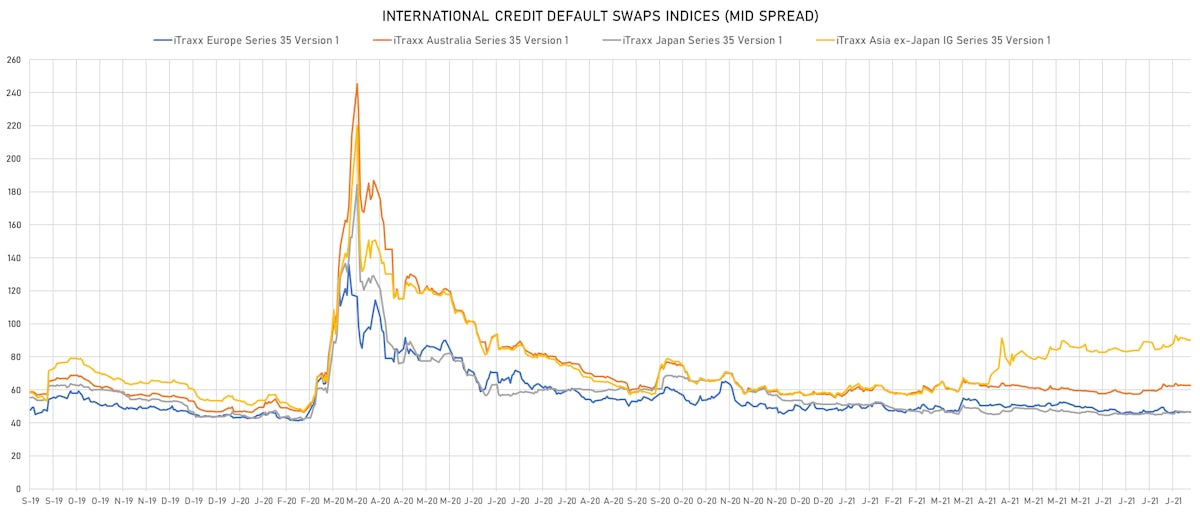

CDS INDICES (mid-spreads)

- Markit CDX.NA.IG 5Y down 0.6 bp, now at 49bp (YTD change: -1.0bp)

- Markit CDX.NA.HY 5Y down 2.5 bp, now at 286bp (YTD change: -7.1bp)

- Markit iTRAXX Europe down 0.3 bp, now at 46bp (YTD change: -2.0bp)

- Markit iTRAXX Japan unchanged 0.0 bp, now at 47bp (YTD change: -4.7bp)

- Markit iTRAXX Asia Ex-Japan down 0.3 bp, now at 90bp (YTD change: +32.0bp)

TOP BONDS MOVES IN THE PAST WEEK - USD HY

- Issuer: NCL Corporation Ltd (Miami) | Coupon: 5.88% | Maturity: 15/3/2026 | Rating: CCC+ | ISIN: USG6436QAL08 | Z-spread up by 41.3 bp to 553.6 bp, with the yield to worst at 6.2% and the bond now trading down to 98.3 cents on the dollar (1Y price range: 98.0-105.3).

- Issuer: WeWork Companies Inc (New York City, New York (US)) | Coupon: 7.88% | Maturity: 1/5/2025 | Rating: CC | ISIN: USU96217AA99 | Z-spread up by 38.1 bp to 730.1 bp, with the yield to worst at 7.5% and the bond now trading down to 100.3 cents on the dollar (1Y price range: 67.5-104.8).

- Issuer: Royal Caribbean Cruises Ltd (Miami) | Coupon: 5.50% | Maturity: 1/4/2028 | Rating: B | ISIN: USV7780TAE39 | Z-spread up by 31.1 bp to 456.6 bp (CDS basis: -29.2bp), with the yield to worst at 5.4% and the bond now trading down to 99.5 cents on the dollar (1Y price range: 98.3-105.9).

- Issuer: Wynn Las Vegas LLC (Las Vegas, Nevada (US)) | Coupon: 5.25% | Maturity: 15/5/2027 | Rating: B+ | ISIN: USU98347AL87 | Z-spread up by 29.3 bp to 380.4 bp, with the yield to worst at 4.5% and the bond now trading down to 102.5 cents on the dollar (1Y price range: 101.5-108.1).

- Issuer: Nexa Resources SA (Luxembourg, Luxembourg) | Coupon: 5.38% | Maturity: 4/5/2027 | Rating: BB | ISIN: USP98118AA38 | Z-spread down by 27.5 bp to 320.9 bp, with the yield to worst at 3.9% and the bond now trading up to 106.1 cents on the dollar (1Y price range: 103.1-111.4).

- Issuer: Rockies Express Pipeline LLC (Leawood, Kansas (US)) | Coupon: 6.88% | Maturity: 15/4/2040 | Rating: BB | ISIN: USU75111AG60 | Z-spread down by 28.9 bp to 484.0 bp, with the yield to worst at 6.1% and the bond now trading up to 107.0 cents on the dollar (1Y price range: 104.0-112.0).

- Issuer: LGI Homes Inc (The Woodlands, Texas (US)) | Coupon: 4.00% | Maturity: 15/7/2029 | Rating: BB- | ISIN: USU5286JAB53 | Z-spread down by 30.2 bp to 260.5 bp, with the yield to worst at 3.7% and the bond now trading up to 101.5 cents on the dollar (1Y price range: 100.3-101.5).

- Issuer: Pakistan Water and Power Development Authority (Lahore, Pakistan) | Coupon: 7.50% | Maturity: 4/6/2031 | Rating: B- | ISIN: XS2348591707 | Z-spread down by 31.0 bp to 636.4 bp, with the yield to worst at 7.3% and the bond now trading up to 100.4 cents on the dollar (1Y price range: 98.6-101.9).

- Issuer: Seazen Group Ltd (Shanghai, Cayman Islands) | Coupon: 6.00% | Maturity: 12/8/2024 | Rating: BB+ | ISIN: XS2215175634 | Z-spread down by 32.2 bp to 514.8 bp, with the yield to worst at 5.2% and the bond now trading up to 101.1 cents on the dollar (1Y price range: 100.5-105.8).

- Issuer: Banistmo SA (PANAMA CITY, Panama) | Coupon: 3.65% | Maturity: 19/9/2022 | Rating: BB+ | ISIN: USP15383AC95 | Z-spread down by 34.9 bp to 179.8 bp, with the yield to worst at 1.9% and the bond now trading up to 101.9 cents on the dollar (1Y price range: 101.2-103.5).

- Issuer: Periama Holdings LLC (Baytown, Texas (US)) | Coupon: 5.95% | Maturity: 19/4/2026 | Rating: BB- | ISIN: XS2224065289 | Z-spread down by 38.1 bp to 348.2 bp, with the yield to worst at 4.0% and the bond now trading up to 107.3 cents on the dollar (1Y price range: 104.1-109.3).

- Issuer: MGM Growth Properties Operating Partnership LP (Las Vegas, Nevada (US)) | Coupon: 3.88% | Maturity: 15/2/2029 | Rating: B+ | ISIN: USU5930BAE66 | Z-spread down by 39.8 bp to 213.7 bp, with the yield to worst at 3.1% and the bond now trading up to 104.0 cents on the dollar (1Y price range: 97.5-104.0).

- Issuer: China Hongqiao Group Ltd (Binzhou, Cayman Islands) | Coupon: 6.25% | Maturity: 8/6/2024 | Rating: B+ | ISIN: XS2348238259 | Z-spread down by 83.3 bp to 536.4 bp, with the yield to worst at 5.4% and the bond now trading up to 101.3 cents on the dollar (1Y price range: 99.4-102.9).

- Issuer: DTEK Finance PLC (London, United Kingdom) | Coupon: 5.00% | Maturity: 31/12/2027 | Rating: CCC | ISIN: XS2342930521 | Z-spread down by 303.6 bp to 1,295.9 bp, with the yield to worst at 13.0% and the bond now trading up to 64.8 cents on the dollar (1Y price range: 63.6-65.4).

TOP BONDS MOVES IN THE PAST WEEK - EUR HY

- Issuer: Louis Dreyfus Co BV (Rotterdam, Netherlands) | Coupon: 1.63% | Maturity: 28/4/2028 | Rating: BB+ | ISIN: XS2332552541 | Z-spread down by 11.6 bp to 154.5 bp (CDS basis: -27.0bp), with the yield to worst at 1.1% and the bond now trading up to 102.1 cents on the dollar (1Y price range: 98.5-102.6).

- Issuer: Dometic Group AB (Solna, Sweden) | Coupon: 3.00% | Maturity: 8/5/2026 | Rating: BB- | ISIN: XS1991114858 | Z-spread down by 11.9 bp to 196.1 bp, with the yield to worst at 1.5% and the bond now trading up to 106.3 cents on the dollar (1Y price range: 102.7-106.7).

- Issuer: Verallia SAS (Courbevoie, France) | Coupon: 1.63% | Maturity: 14/5/2028 | Rating: BB+ | ISIN: FR0014003G27 | Z-spread down by 13.2 bp to 148.4 bp, with the yield to worst at 1.1% and the bond now trading up to 102.5 cents on the dollar (1Y price range: 99.0-102.6).

- Issuer: Petroleos Mexicanos (Miguel Hidalgo, Mexico) | Coupon: 2.75% | Maturity: 21/4/2027 | Rating: BB- | ISIN: XS1172951508 | Z-spread down by 13.4 bp to 454.6 bp (CDS basis: -76.8bp), with the yield to worst at 4.1% and the bond now trading up to 92.7 cents on the dollar (1Y price range: 89.3-94.8).

- Issuer: Standard Industries Inc (Parsippany, New Jersey (US)) | Coupon: 2.25% | Maturity: 21/11/2026 | Rating: BB- | ISIN: XS2080766475 | Z-spread down by 14.4 bp to 278.4 bp, with the yield to worst at 2.3% and the bond now trading up to 99.0 cents on the dollar (1Y price range: 96.7-102.9).

- Issuer: International Consolidated Airlines Group SA (London, Spain) | Coupon: 3.75% | Maturity: 25/3/2029 | Rating: B+ | ISIN: XS2322423539 | Z-spread down by 14.9 bp to 385.9 bp, with the yield to worst at 3.5% and the bond now trading up to 100.7 cents on the dollar (1Y price range: 97.5-102.0).

- Issuer: Renault SA (Boulogne-Billancourt, France) | Coupon: 2.50% | Maturity: 1/4/2028 | Rating: BB | ISIN: FR0014002OL8 | Z-spread down by 15.2 bp to 239.9 bp (CDS basis: -41.0bp), with the yield to worst at 2.0% and the bond now trading up to 102.2 cents on the dollar (1Y price range: 98.4-102.5).

- Issuer: Adler Group SA (Senningerberg, Luxembourg) | Coupon: 2.75% | Maturity: 13/11/2026 | Rating: BB+ | ISIN: XS2248826294 | Z-spread down by 17.5 bp to 330.1 bp, with the yield to worst at 2.8% and the bond now trading up to 99.0 cents on the dollar (1Y price range: 97.5-103.2).

- Issuer: Schaeffler AG (Herzogenaurach, Germany) | Coupon: 3.38% | Maturity: 12/10/2028 | Rating: BB+ | ISIN: DE000A3H2TA0 | Z-spread down by 21.5 bp to 182.2 bp, with the yield to worst at 1.4% and the bond now trading up to 111.8 cents on the dollar (1Y price range: 108.0-112.1).

- Issuer: ZF Europe Finance BV (Amsterdam, Netherlands) | Coupon: 2.50% | Maturity: 23/10/2027 | Rating: BB+ | ISIN: XS2010039977 | Z-spread down by 30.6 bp to 183.9 bp, with the yield to worst at 1.4% and the bond now trading up to 105.5 cents on the dollar (1Y price range: 99.0-105.6).

- Issuer: Rolls-Royce PLC (Birmingham, United Kingdom) | Coupon: 1.63% | Maturity: 9/5/2028 | Rating: BB- | ISIN: XS1819574929 | Z-spread down by 41.5 bp to 270.2 bp (CDS basis: -11.4bp), with the yield to worst at 2.3% and the bond now trading up to 95.0 cents on the dollar (1Y price range: 90.4-95.3).

- Issuer: CyrusOne LP (Dallas, Texas (US)) | Coupon: 1.45% | Maturity: 22/1/2027 | Rating: BB+ | ISIN: XS2089972629 | Z-spread down by 531.8 bp to 123.8 bp, with the yield to worst at 0.8% and the bond now trading up to 102.8 cents on the dollar (1Y price range: 100.4-103.1).

USD BOND ISSUES

- Federal Home Loan Banks (Agency | Washington, Washington Dc, United States | Rating: NR): US$110m Bond (US3130ANMC18), fixed rate (1.15% coupon) maturing on 14 September 2026, priced at 100.00, callable (5nc1m)

- Federal Home Loan Banks (Agency | Washington, Washington Dc, United States | Rating: NR): US$800m Bond (US3130ANMH05), fixed rate (1.10% coupon) maturing on 20 August 2026, priced at 100.00, callable (5nc1m)

- Federal Home Loan Banks (Agency | Washington, Washington Dc, United States | Rating: NR): US$300m Bond (US3130ANMM99), fixed rate (0.54% coupon) maturing on 26 August 2024, priced at 100.00, callable (3nc3m)

- Federal Home Loan Banks (Agency | Washington, Washington Dc, United States | Rating: NR): US$150m Bond (US3130ANLY47), floating rate (SOFR + 4.0 bp) maturing on 10 August 2023, priced at 100.00, callable (2nc3m)

- Korea Land & Housing Corp (Agency | Jinju, Gyeongsangnam-Do, South Korea | Rating: AA): US$130m Senior Note (HK0000757572), fixed rate (0.77% coupon) maturing on 5 August 2024, non callable

- Premier Entertainment SUB LLC (Financial - Other | Rating: NR): US$750m Senior Note (US74052HAB06), fixed rate (5.88% coupon) maturing on 1 September 2031, priced at 99.07 (original spread of 478 bp), callable (10nc5)

- Premier Entertainment SUB LLC (Financial - Other | Rating: NR): US$750m Unsecured Note (US74052HAA23), fixed rate (5.63% coupon) maturing on 1 September 2029, priced at 99.20 (original spread of 466 bp), callable (8nc3)

NEW LOANS

- Auramet Trading LLC, signed a US$ 300m 364d Revolver, to be used for general corporate purposes

- Astek SA, signed a € 200m Other, to be used for general corporate purposes

NEW ISSUES IN SECURITIZED CREDIT

- PHEAA Student Loan Trust 2021-1 issued a floating-rate ABS backed by student loans in 2 tranches, for a total of US$ 665 m. Highest-rated tranche offering a spread over the floating rate of 53bp, and the lowest-rated tranche a spread of 115bp. Bookrunners: BMO Capital Markets, Credit Suisse Securities (USA) LLC, Bank of America Merrill Lynch

- HOA Funding LLC issued a fixed-rate ABS backed by business cashflow in 2 tranches, for a total of US$ 315 m. Highest-rated tranche offering a yield to maturity of 4.72%, and the lowest-rated tranche a yield to maturity of 7.43%. Bookrunners: Guggenheim Securities LLC

- Ready Capital Mortgage Financing 2021-Fl6 LLC issued a floating-rate CMBS in 6 tranches, for a total of US$ 543 m. Highest-rated tranche offering a spread over the floating rate of 95bp, and the lowest-rated tranche a spread of 290bp. Bookrunners: Credit Suisse, JP Morgan & Co Inc, Deutsche Bank Securities Inc