Credit

US Corporate Bonds Fall, Driven By Slight Widening In HY Spreads And Rise In Rates

Big day for USD corporate bond issuance, led by US$ 3.1 bn from Thermo Fisher, US$ 2.5bn from BMW, and US$ 1.5 bn from Uber

Published ET

MGM Growth Properties (USU5930BAD83) Has Seen Further Compression In Its Credit Spreads Despite Delta Variant | Source: Refinitiv

QUICK SUMMARY

- S&P 500 Bond Index was down -0.23% today, with investment grade down -0.26% and high yield down -0.05% (YTD total return: -0.42%)

- The iBoxx USD Liquid Investment Grade Total Return Index was down -0.286% today (Month-to-date: -1.14%; Year-to-date: -1.29%)

- The iBoxx USD Liquid High Yield Total Return Index was down -0.085% today (Month-to-date: -0.26%; Year-to-date: 2.96%)

- ICE BofA US Corporate Index (Investment Grade) spread to worst unchanged at 88.0 bp (YTD change: -10.0 bp)

- ICE BofA US High Yield Index spread to worst up 2.0 bp, now at 349.0 bp (YTD change: -41.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index unchanged (YTD total return: +1.9%)

- New bond issues: US$ 18.8bn in dollars

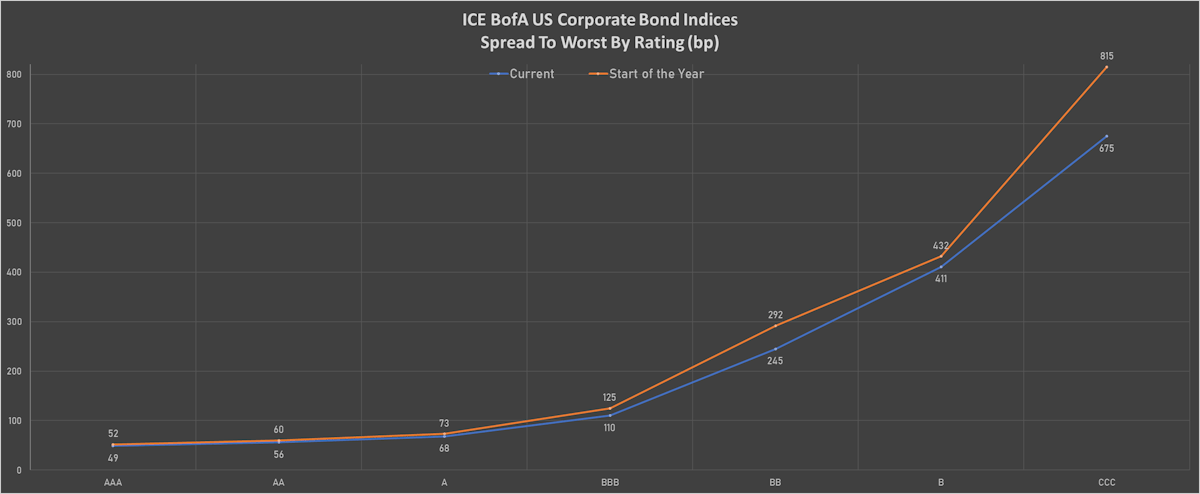

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

- AAA unchanged at 52 bp

- AA unchanged at 59 bp

- A unchanged at 74 bp

- BBB unchanged at 115 bp

- BB up by 1 bp at 232 bp

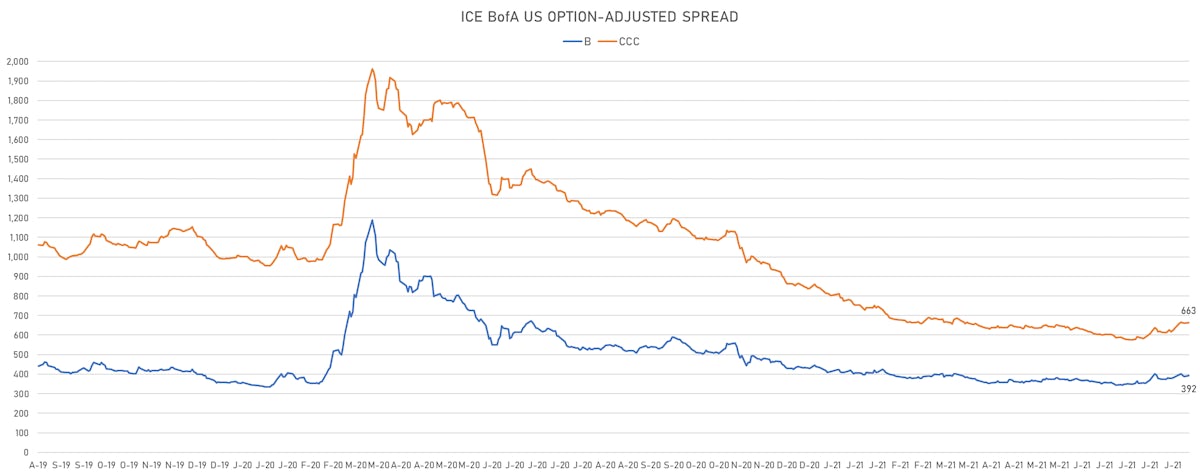

- B up by 4 bp at 392 bp

- CCC up by 1 bp at 663 bp

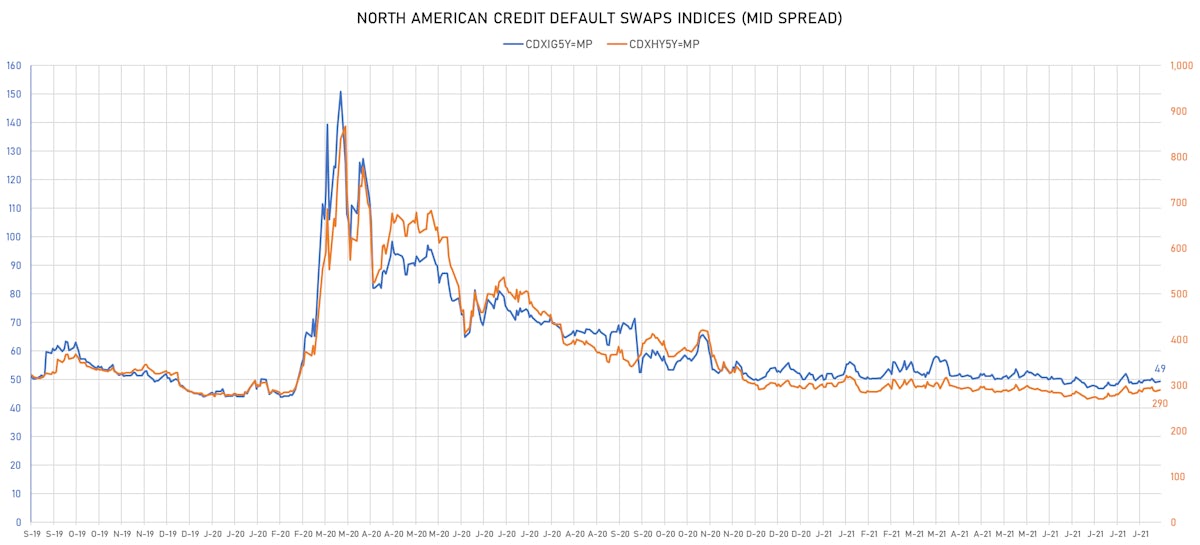

CDS INDICES (mid-spreads)

- Markit CDX.NA.IG 5Y up 0.4 bp, now at 49bp (YTD change: -0.6bp)

- Markit CDX.NA.HY 5Y up 3.6 bp, now at 290bp (YTD change: -3.5bp)

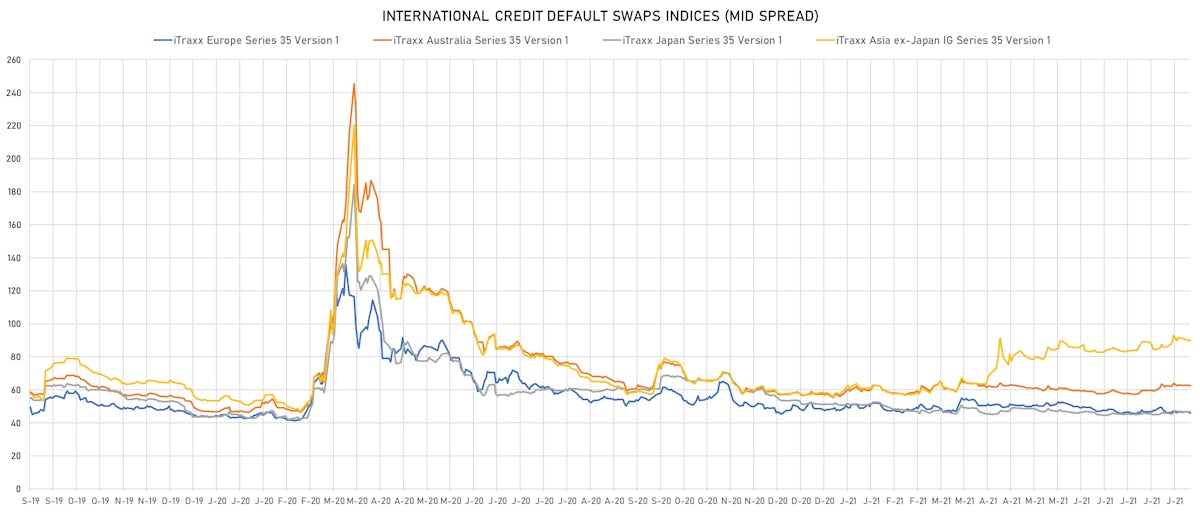

- Markit iTRAXX Europe up 0.3 bp, now at 46bp (YTD change: -1.6bp)

- Markit iTRAXX Japan unchanged at 47bp (YTD change: -4.7bp)

- Markit iTRAXX Asia Ex-Japan down 0.8 bp, now at 89bp (YTD change: +31.2bp)

TOP BONDS MOVES IN THE PAST WEEK - USD HY

- Issuer: Southeast Supply Header LLC (Houston, Texas (US)) | Coupon: 4.25% | Maturity: 15/6/2024 | Rating: BB- | ISIN: USU83854AB29 | Z-spread up by 36.0 bp to 384.4 bp, with the yield to worst at 4.0% and the bond now trading down to 99.7 cents on the dollar (1Y price range: 99.0-101.2).

- Issuer: Gtlk Europe Capital DAC (Ireland) | Coupon: 4.80% | Maturity: 26/2/2028 | Rating: BB | ISIN: XS2249778247 | Z-spread down by 30.8 bp to 279.9 bp, with the yield to worst at 3.6% and the bond now trading up to 105.8 cents on the dollar (1Y price range: 100.8-105.9).

- Issuer: Banco Bradesco SA (Cayman Islands Branch) (George Town, Cayman Islands) | Coupon: 3.20% | Maturity: 27/1/2025 | Rating: BB- | ISIN: US05947LAZ13 | Z-spread down by 31.4 bp to 179.1 bp (CDS basis: -2.1bp), with the yield to worst at 2.2% and the bond now trading up to 102.6 cents on the dollar (1Y price range: 101.8-105.0).

- Issuer: Banistmo SA (PANAMA CITY, Panama) | Coupon: 3.65% | Maturity: 19/9/2022 | Rating: BB+ | ISIN: USP15383AC95 | Z-spread down by 34.5 bp to 180.0 bp, with the yield to worst at 1.9% and the bond now trading up to 101.8 cents on the dollar (1Y price range: 101.2-103.5).

- Issuer: Seazen Group Ltd (Shanghai, Cayman Islands) | Coupon: 6.00% | Maturity: 12/8/2024 | Rating: BB+ | ISIN: XS2215175634 | Z-spread down by 34.5 bp to 499.7 bp, with the yield to worst at 5.1% and the bond now trading up to 101.5 cents on the dollar (1Y price range: 100.5-105.8).

- Issuer: Carnival Corp (Miami, Panama) | Coupon: 5.75% | Maturity: 1/3/2027 | Rating: B | ISIN: USP2121VAL82 | Z-spread down by 40.2 bp to 465.5 bp (CDS basis: -60.0bp), with the yield to worst at 5.4% and the bond now trading up to 100.8 cents on the dollar (1Y price range: 99.1-106.5).

- Issuer: Wynn Las Vegas LLC (Las Vegas, Nevada (US)) | Coupon: 5.25% | Maturity: 15/5/2027 | Rating: B+ | ISIN: USU98347AL87 | Z-spread down by 41.4 bp to 342.7 bp, with the yield to worst at 4.2% and the bond now trading up to 104.3 cents on the dollar (1Y price range: 101.5-108.1).

- Issuer: Rockies Express Pipeline LLC (Leawood, Kansas (US)) | Coupon: 6.88% | Maturity: 15/4/2040 | Rating: BB | ISIN: USU75111AG60 | Z-spread down by 42.6 bp to 472.0 bp, with the yield to worst at 6.0% and the bond now trading up to 108.3 cents on the dollar (1Y price range: 104.0-112.0).

- Issuer: YPF SA (Buenos Aires, Argentina) | Coupon: 6.95% | Maturity: 21/7/2027 | Rating: CCC | ISIN: USP989MJBL47 | Z-spread down by 43.9 bp to 1,420.5 bp, with the yield to worst at 14.4% and the bond now trading up to 70.3 cents on the dollar (1Y price range: 56.6-72.0).

- Issuer: Vedanta Resources Finance II PLC (London, United Kingdom) | Coupon: 8.95% | Maturity: 11/3/2025 | Rating: B- | ISIN: USG9T27HAD62 | Z-spread down by 44.6 bp to 963.5 bp, with the yield to worst at 9.8% and the bond now trading up to 96.2 cents on the dollar (1Y price range: 93.5-99.8).

- Issuer: MGM Growth Properties Operating Partnership LP (Las Vegas, Nevada (US)) | Coupon: 4.63% | Maturity: 15/6/2025 | Rating: B+ | ISIN: USU5930BAD83 | Z-spread down by 46.0 bp to 198.8 bp, with the yield to worst at 2.4% and the bond now trading up to 106.8 cents on the dollar (1Y price range: 103.6-107.4).

- Issuer: Oi SA em Recuperacao Judicial (Rio de Janeiro, Brazil) | Coupon: 10.00% | Maturity: 27/7/2025 | Rating: CCC+ | ISIN: USP7354PAA23 | Z-spread down by 58.8 bp to 957.1 bp, with the yield to worst at 9.7% and the bond now trading up to 100.0 cents on the dollar (1Y price range: 98.3-107.0).

- Issuer: China Hongqiao Group Ltd (Binzhou, Cayman Islands) | Coupon: 6.25% | Maturity: 8/6/2024 | Rating: B+ | ISIN: XS2348238259 | Z-spread down by 60.4 bp to 540.3 bp, with the yield to worst at 5.4% and the bond now trading up to 101.1 cents on the dollar (1Y price range: 99.4-102.9).

- Issuer: Guacolda Energia SA (LAS CONDES, Chile) | Coupon: 4.56% | Maturity: 30/4/2025 | Rating: B+ | ISIN: USP3711HAF66 | Z-spread down by 238.3 bp to 1,975.1 bp, with the yield to worst at 19.9% and the bond now trading up to 60.0 cents on the dollar (1Y price range: 53.5-92.1).

TOP BONDS MOVES IN THE PAST WEEK - EUR HY

- Issuer: Syngenta Finance NV (Enkhuizen, Netherlands) | Coupon: 1.25% | Maturity: 10/9/2027 | Rating: BB | ISIN: XS1199954691 | Z-spread up by 6.0 bp to 110.6 bp, with the yield to worst at 0.7% and the bond now trading down to 102.6 cents on the dollar (1Y price range: 93.2-103.7).

- Issuer: Orano SA (Chatillon, France) | Coupon: 2.75% | Maturity: 8/3/2028 | Rating: BB+ | ISIN: FR0013533031 | Z-spread down by 5.9 bp to 224.0 bp, with the yield to worst at 1.8% and the bond now trading up to 104.8 cents on the dollar (1Y price range: 103.2-105.5).

- Issuer: Nexi SpA (Milan, Italy) | Coupon: 2.13% | Maturity: 30/4/2029 | Rating: BB- | ISIN: XS2332590475 | Z-spread down by 6.8 bp to 233.1 bp, with the yield to worst at 2.0% and the bond now trading up to 100.2 cents on the dollar (1Y price range: 98.0-100.5).

- Issuer: International Consolidated Airlines Group SA (London, Spain) | Coupon: 1.50% | Maturity: 4/7/2027 | Rating: B+ | ISIN: XS2020581752 | Z-spread down by 8.0 bp to 359.3 bp, with the yield to worst at 3.1% and the bond now trading up to 90.7 cents on the dollar (1Y price range: 84.0-92.1).

- Issuer: Atlantia SpA (Rome, Italy) | Coupon: 1.88% | Maturity: 12/2/2028 | Rating: BB- | ISIN: XS2301390089 | Z-spread down by 8.5 bp to 155.7 bp (CDS basis: -35.1bp), with the yield to worst at 1.1% and the bond now trading up to 103.7 cents on the dollar (1Y price range: 97.5-103.7).

- Issuer: Elis SA (Saint-Cloud, France) | Coupon: 1.63% | Maturity: 3/4/2028 | Rating: BB | ISIN: FR0013449998 | Z-spread down by 9.0 bp to 179.4 bp, with the yield to worst at 1.4% and the bond now trading up to 100.7 cents on the dollar (1Y price range: 95.8-100.6).

- Issuer: Louis Dreyfus Co BV (Rotterdam, Netherlands) | Coupon: 1.63% | Maturity: 28/4/2028 | Rating: BB+ | ISIN: XS2332552541 | Z-spread down by 10.7 bp to 155.3 bp (CDS basis: -27.2bp), with the yield to worst at 1.1% and the bond now trading up to 102.2 cents on the dollar (1Y price range: 98.5-102.6).

- Issuer: Amplifon SpA (Milan, Italy) | Coupon: 1.13% | Maturity: 13/2/2027 | Rating: BB+ | ISIN: XS2116503546 | Z-spread down by 11.2 bp to 124.9 bp, with the yield to worst at 0.8% and the bond now trading up to 101.1 cents on the dollar (1Y price range: 98.8-101.2).

- Issuer: ZF Europe Finance BV (Amsterdam, Netherlands) | Coupon: 2.50% | Maturity: 23/10/2027 | Rating: BB+ | ISIN: XS2010039977 | Z-spread down by 12.4 bp to 186.7 bp, with the yield to worst at 1.4% and the bond now trading up to 105.4 cents on the dollar (1Y price range: 99.0-105.6).

- Issuer: ZF Finance GmbH (Friedrichshafen, Germany) | Coupon: 3.75% | Maturity: 21/9/2028 | Rating: BB+ | ISIN: XS2231331260 | Z-spread down by 13.2 bp to 213.0 bp, with the yield to worst at 1.7% and the bond now trading up to 112.1 cents on the dollar (1Y price range: 105.4-112.7).

- Issuer: Verallia SAS (Courbevoie, France) | Coupon: 1.63% | Maturity: 14/5/2028 | Rating: BB+ | ISIN: FR0014003G27 | Z-spread down by 13.3 bp to 150.5 bp, with the yield to worst at 1.1% and the bond now trading up to 102.5 cents on the dollar (1Y price range: 99.0-102.6).

- Issuer: Schaeffler AG (Herzogenaurach, Germany) | Coupon: 3.38% | Maturity: 12/10/2028 | Rating: BB+ | ISIN: DE000A3H2TA0 | Z-spread down by 18.0 bp to 183.7 bp, with the yield to worst at 1.4% and the bond now trading up to 111.8 cents on the dollar (1Y price range: 108.0-112.1).

- Issuer: Renault SA (Boulogne-Billancourt, France) | Coupon: 2.50% | Maturity: 1/4/2028 | Rating: BB | ISIN: FR0014002OL8 | Z-spread down by 21.1 bp to 239.2 bp (CDS basis: -42.6bp), with the yield to worst at 1.9% and the bond now trading up to 102.3 cents on the dollar (1Y price range: 98.4-102.5).

- Issuer: Adler Group SA (Senningerberg, Luxembourg) | Coupon: 2.25% | Maturity: 27/4/2027 | Rating: BB+ | ISIN: XS2336188029 | Z-spread down by 26.1 bp to 326.8 bp, with the yield to worst at 2.8% and the bond now trading up to 96.4 cents on the dollar (1Y price range: 94.3-100.2).

- Issuer: Rolls-Royce PLC (Birmingham, United Kingdom) | Coupon: 1.63% | Maturity: 9/5/2028 | Rating: BB- | ISIN: XS1819574929 | Z-spread down by 35.3 bp to 267.3 bp (CDS basis: -14.7bp), with the yield to worst at 2.2% and the bond now trading up to 95.3 cents on the dollar (1Y price range: 90.4-95.4).

USD BOND ISSUES

- Avalara Inc (Information/Data Technology | Seattle, United States | Rating: NR): US$850m Bond (US05338GAA40), fixed rate (0.25% coupon) maturing on 1 August 2026, priced at 100.00, non callable, convertible

- CVS Health Corp (Health Care Facilities | Woonsocket, Rhode Island, United States | Rating: BBB): US$1,000m Senior Note (US126650DR85), fixed rate (2.13% coupon) maturing on 15 September 2031, priced at 99.37 (original spread of 88 bp), callable (10nc10)

- Cloudflare Inc (Publishing | San Francisco, United States | Rating: NR): US$1,000m Bond (US18915MAD92), fixed rate (0.25% coupon) maturing on 15 August 2026, priced at 100.00, non callable, convertible

- Conagra Brands Inc (Food Processors | Chicago, United States | Rating: BBB-): US$500m Senior Note (US205887CG52), fixed rate (0.50% coupon) maturing on 11 August 2023, priced at 99.81 (original spread of 38 bp), callable (2nc1)

- Duke Energy Progress LLC (Utility - Other | Raleigh, North Carolina, United States | Rating: BBB+): US$650m First Mortgage Bond (US26442UAL89), fixed rate (2.00% coupon) maturing on 15 August 2031, priced at 99.83 (original spread of 70 bp), callable (10nc10)

- Duke Energy Progress LLC (Utility - Other | Raleigh, North Carolina, United States | Rating: BBB+): US$450m First Mortgage Bond (US26442UAM62), fixed rate (2.90% coupon) maturing on 15 August 2051, priced at 99.82 (original spread of 93 bp), callable (30nc30)

- Ecolab Inc (Chemicals | Saint Paul, Minnesota, United States | Rating: A-): US$300m Senior Note (US278865BH22), fixed rate (2.75% coupon) maturing on 18 August 2055, priced at 98.78 (original spread of 83 bp), callable (34nc34)

- Huntington Bancshares Inc (Banking | Columbus, Ohio, United States | Rating: BBB+): US$500m Subordinated Note (US446150AW47), fixed rate (2.49% coupon) maturing on 15 August 2036, priced at 100.00 (original spread of 117 bp), callable (15nc10)

- Huntington Ingalls Industries Inc (Conglomerate/Diversified Mfg | Newport News, Virginia, United States | Rating: BBB-): US$400m Senior Note (US446413AU00), fixed rate (0.67% coupon) maturing on 16 August 2023, priced at 100.00 (original spread of 45 bp), callable (2nc1)

- Huntington Ingalls Industries Inc (Conglomerate/Diversified Mfg | Newport News, Virginia, United States | Rating: BBB-): US$600m Senior Note (US446413AX49), fixed rate (2.04% coupon) maturing on 16 August 2028, priced at 100.00 (original spread of 95 bp), with a special call

- Kennedy Wilson Inc (Service - Other | Beverly Hills, California, United States | Rating: BB): US$600m Senior Note (US489399AN56), fixed rate (4.75% coupon) maturing on 1 February 2030, priced at 100.00, callable (8nc3)

- M/I Homes Inc (Home Builders | Columbus, Ohio, United States | Rating: BB-): US$300m Senior Note (USU6006PAJ13), fixed rate (3.95% coupon) maturing on 15 February 2030, priced at 100.00 (original spread of 272 bp), callable (8nc8)

- Mckesson Corp (Pharmaceuticals | Irving, Texas, United States | Rating: BBB+): US$500m Senior Note (US581557BR53), fixed rate (1.30% coupon) maturing on 15 August 2026, priced at 99.55 (original spread of 60 bp), callable (5nc5)

- NRG Energy Inc (Utility - Other | Princeton, New Jersey, United States | Rating: BB+): US$1,100m Senior Note (US629377CS98), fixed rate (3.88% coupon) maturing on 15 February 2032, priced at 100.00, callable (10nc5)

- San Diego Gas & Electric Co (Utility - Other | San Diego, California, United States | Rating: A): US$750m First Mortgage Bond (US797440CA05), fixed rate (2.95% coupon) maturing on 15 August 2051, priced at 99.37 (original spread of 100 bp), callable (30nc30)

- Simon Property Group LP (Real Estate Investment Trust | Indianapolis, Indiana, United States | Rating: A-): US$700m Senior Note (US828807DQ71), fixed rate (2.25% coupon) maturing on 15 January 2032, priced at 99.28 (original spread of 100 bp), callable (10nc10)

- Simon Property Group LP (Real Estate Investment Trust | Indianapolis, Indiana, United States | Rating: A-): US$550m Senior Note (US828807DP98), fixed rate (1.38% coupon) maturing on 15 January 2027, priced at 99.87 (original spread of 60 bp), callable (5nc5)

- Thermo Fisher Scientific Inc (Electronics | Waltham, Massachusetts, United States | Rating: BBB+): US$1,200m Senior Note (US883556CL42), fixed rate (2.00% coupon) maturing on 15 October 2031, priced at 98.83 (original spread of 80 bp), callable (10nc10)

- Thermo Fisher Scientific Inc (Electronics | Waltham, Massachusetts, United States | Rating: BBB+): US$700m Senior Note (US883556CK68), fixed rate (1.75% coupon) maturing on 15 October 2028, priced at 99.95 (original spread of 65 bp), callable (7nc7)

- Thermo Fisher Scientific Inc (Electronics | Waltham, Massachusetts, United States | Rating: BBB+): US$1,200m Senior Note (US883556CM25), fixed rate (2.80% coupon) maturing on 15 October 2041, priced at 99.51 (original spread of 95 bp), callable (20nc20)

- Uber Technologies Inc (Information/Data Technology | San Francisco, California, United States | Rating: B-): US$1,500m Senior Note (USU9029YAG53), fixed rate (4.50% coupon) maturing on 15 August 2029, priced at 100.00 (original spread of 332 bp), callable (8nc3)

- BMW US Capital LLC (Financial - Other | Woodcliff Lake, New Jersey, Germany | Rating: NR): US$750m Senior Note (USU09513JE09), floating rate (SOFR + 38.0 bp) maturing on 12 August 2024, priced at 100.00, non callable

- Bell Telephone Company of Canada or Bell Canada (Quebec,CA) (Financial - Other | Verdun, Quebec, Canada | Rating: BBB+): US$600m Senior Note (US0778FPAG48), fixed rate (2.15% coupon) maturing on 15 February 2032, priced at 99.56 (original spread of 88 bp), callable (11nc10)

- Bell Telephone Company of Canada or Bell Canada (Quebec,CA) (Financial - Other | Verdun, Quebec, Canada | Rating: BBB+): US$650m Senior Note (US0778FPAH21), fixed rate (3.20% coupon) maturing on 15 February 2052, priced at 99.96 (original spread of 123 bp), callable (31nc30)

- Bombardier Inc (Aerospace | Montreal, Quebec, Canada | Rating: CCC+): US$750m Senior Note (USC10602BK23), fixed rate (6.00% coupon) maturing on 15 February 2028, priced at 100.00 (original spread of 498 bp), callable (7nc3)

- Equitable Financial Life Global Funding (Financial - Other | Delaware | Rating: NR): US$500m Note (US29450LAK35), fixed rate (0.80% coupon) maturing on 12 August 2024, priced at 99.99 (original spread of 38 bp), non callable

- Unilever Capital Corp (Financial - Other | Englewood Cliffs, New Jersey, United Kingdom | Rating: NR): US$500m Senior Note (US904764BN68), fixed rate (0.63% coupon) maturing on 12 August 2024, priced at 100.00 (original spread of 20 bp), callable (3nc1)

- Unilever Capital Corp (Financial - Other | Englewood Cliffs, New Jersey, United Kingdom | Rating: NR): US$650m Senior Note (US904764BR72), fixed rate (2.63% coupon) maturing on 12 August 2051, priced at 98.71 (original spread of 70 bp), callable (30nc30)

- Unilever Capital Corp (Financial - Other | Englewood Cliffs, New Jersey, United Kingdom | Rating: NR): US$850m Senior Note (US904764BQ99), fixed rate (1.75% coupon) maturing on 12 August 2031, priced at 99.35 (original spread of 50 bp), callable (10nc10)

- Vericast Merger Sub Inc (Financial - Other | Rating: B-): US$540m Senior Note (USU9T23TAA41), fixed rate (11.00% coupon) maturing on 15 September 2026, priced at 100.00 (original spread of 1,019 bp), callable (5nc2)

EUR BOND ISSUES

- CMB International Leasing Management Ltd (Financial - Other | China (Mainland) | Rating: BBB+): €300m Unsecured Note (XS2373796676), fixed rate (0.50% coupon) maturing on 9 September 2024, priced at 100.00, non callable

NEW LOANS

- PetVet Care Centers Inc, signed a US$ 250m Term Loan B, to be used for acquisition financing. It matures on 02/15/25 and initial pricing is set at LIBOR +350bps

- MultiPlan Inc, signed a US$ 1,600m Term Loan B maturing on 08/23/28 and to be used for general corporate purposes

- SIT SpA, signed a € 90m Term Loan, to be used for general corporate purposes. It matures on 08/09/26.

- Pakistan (B-), signed a US$ 500m Revolving Credit / Term Loan, to be used for general budget purposes.

NEW ISSUES IN SECURITIZED CREDIT

- TCW CLO 2019-1 issued a floating-rate CLO in 11 tranches, for a total of US$ 406 m. Highest-rated tranche offering a spread over the floating rate of 100bp, and the lowest-rated tranche a spread of 845bp. Bookrunners: Jefferies & Co Inc, MUFG Securities Americas Inc

- Golub Capital Partners CLO 49(M)-R issued a fixed-rate CLO in 5 tranches, for a total of US$ 613 m. Bookrunners: Wells Fargo Securities LLC

- Theorem Funding Trust 2021-1 issued a fixed-rate ABS backed by consumer loan in 2 tranches, for a total of US$ 462 m. Highest-rated tranche offering a yield to maturity of 1.21%, and the lowest-rated tranche a yield to maturity of 1.84%. Bookrunners: Goldman Sachs & Co, Credit Suisse Securities (USA) LLC