Credit

Heavy Supply And Higher Rates Weighed Down US Investment Grade Bonds Today

Issuers are rushing to print ahead of possibly higher rates later this year: there were another 15 new IG corporate bonds priced today, resulting in 30+ IG deals over the last couple of days

Published ET

iBOXX USD Liquid Bonds IG & HY Total Returns | Sources: ϕpost, Refinitiv data

QUICK SUMMARY

- S&P 500 Bond Index was down -0.23% today, with investment grade down -0.26% and high yield down -0.05% (YTD total return: -0.42%)

- The iBoxx USD Liquid Investment Grade Total Return Index was down -0.24% today (Month-to-date: -1.38%; Year-to-date: -1.53%)

- The iBoxx USD Liquid High Yield Total Return Index was down -0.086% today (Month-to-date: -0.35%; Year-to-date: 2.87%)

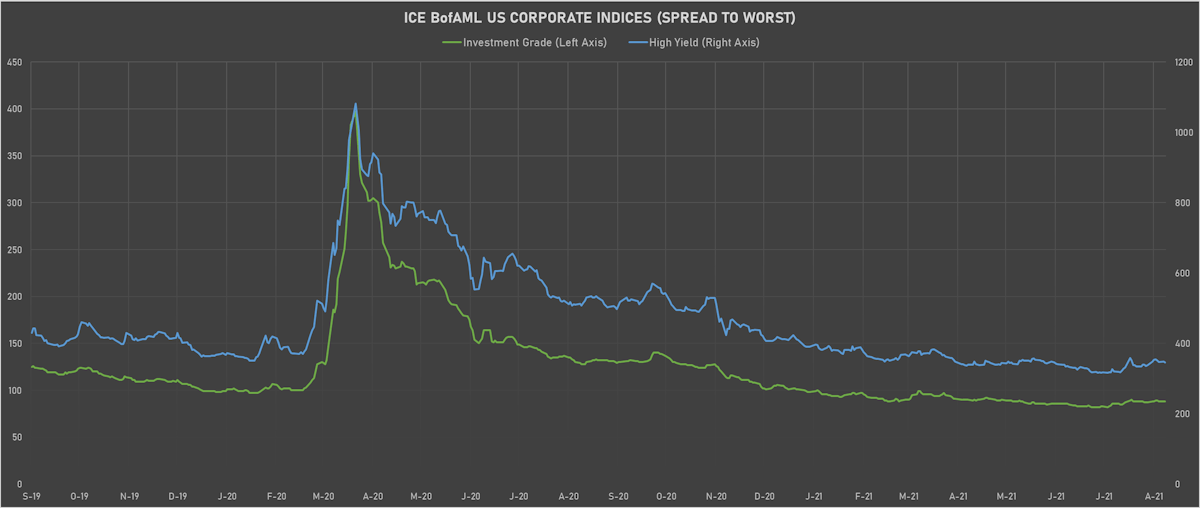

- ICE BofA US Corporate Index (Investment Grade) spread to worst unchanged at 88.0 bp (YTD change: -10.0 bp)

- ICE BofA US High Yield Index spread to worst down -3.0 bp, now at 346.0 bp (YTD change: -44.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index unchanged today (YTD total return: +1.9%)

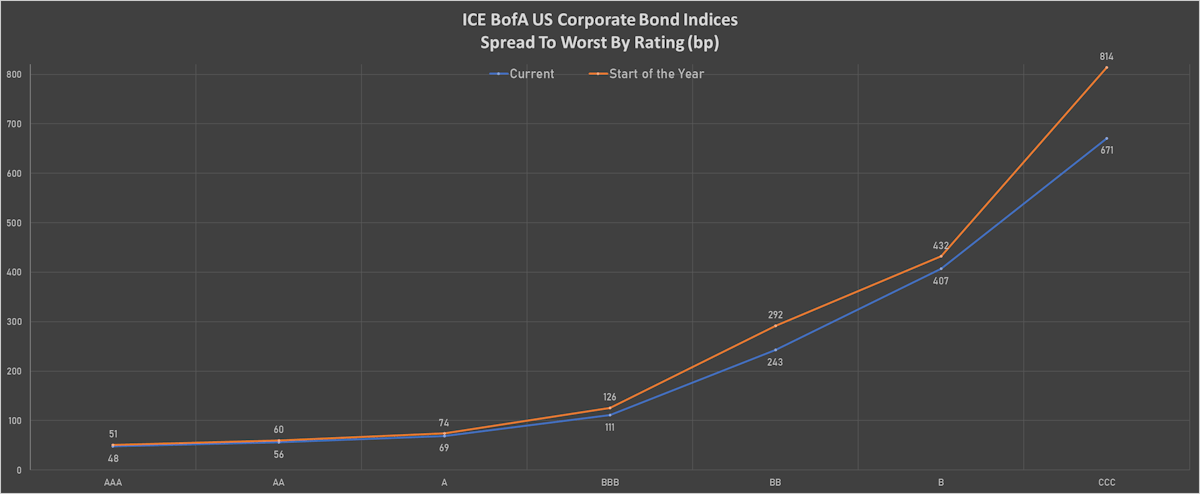

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

- AAA unchanged at 52 bp

- AA unchanged at 59 bp

- A unchanged at 74 bp

- BBB unchanged at 115 bp

- BB down by -2 bp at 230 bp

- B down by -4 bp at 388 bp

- CCC down by -3 bp at 660 bp

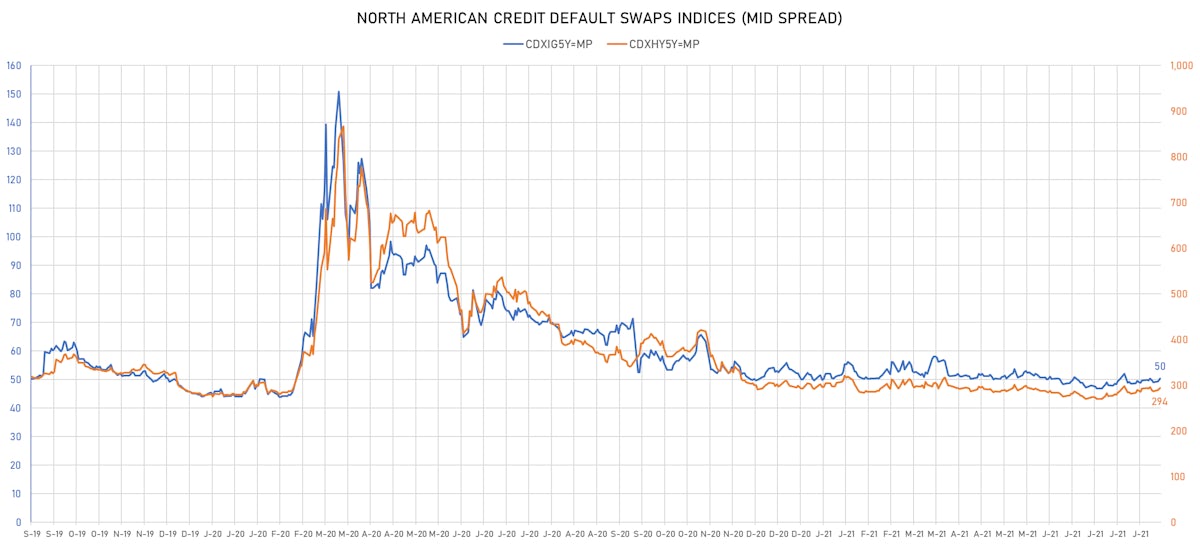

CDS INDICES (mid-spreads)

- Markit CDX.NA.IG 5Y up 0.9 bp, now at 50bp (YTD change: +0.3bp)

- Markit CDX.NA.HY 5Y up 4.4 bp, now at 294bp (YTD change: +0.9bp)

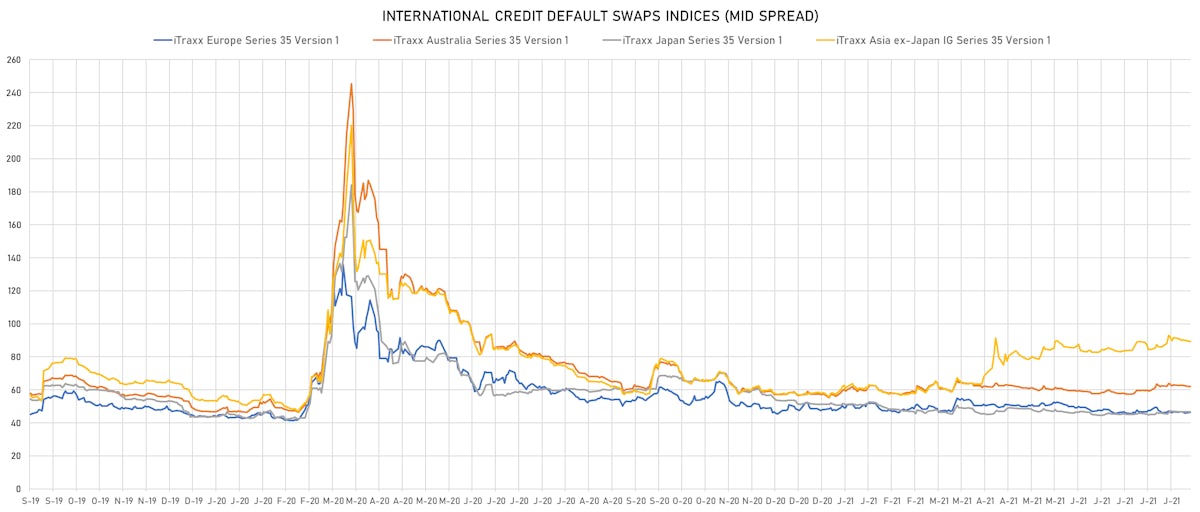

- Markit iTRAXX Europe up 0.2 bp, now at 47bp (YTD change: -1.4bp)

- Markit iTRAXX Japan down 0.1 bp, now at 47bp (YTD change: -4.8bp)

- Markit iTRAXX Asia Ex-Japan down 0.8 bp, now at 88bp (YTD change: +30.4bp)

LARGEST USD CORPORATE CDS MOVES IN THE PAST WEEK

- Talen Energy Supply LLC (Country: US; rated: BB-): down 430.4 bp to 2,601.1bp (1Y range: 875-2,688bp)

- Carnival Corp (Country: US; rated: LGD5 - 72%): down 26.7 bp to 434.5bp (1Y range: 291-1,214bp)

- Navient Corp (Country: US; rated: Ba3): down 11.5 bp to 280.5bp (1Y range: -281bp)

- Bombardier Inc (Country: CA; rated: Caa1): down 10.4 bp to 426.2bp (1Y range: 405-1,912bp)

- NRG Energy Inc (Country: US; rated: Ba1): down 9.7 bp to 164.0bp (1Y range: 108-219bp)

- Sabre Holdings Corp (Country: US; rated: Ba3): up 9.3 bp to 369.3bp (1Y range: 337-611bp)

- Murphy Oil Corp (Country: US; rated: Ba3): up 10.6 bp to 350.8bp (1Y range: 280-763bp)

- Vale SA (Country: BR; rated: WR): up 11.9 bp to 153.9bp (1Y range: 126-258bp)

- RR Donnelley & Sons Co (Country: US; rated: B2): up 15.4 bp to 527.6bp (1Y range: 447-986bp)

- Genworth Holdings Inc (Country: US; rated: Caa1): up 20.2 bp to 535.1bp (1Y range: 447-805bp)

- Apache Corp (Country: US; rated: WD): up 26.3 bp to 238.4bp (1Y range: 168-453bp)

- Lumen Technologies Inc (Country: US; rated: Ba3): up 31.7 bp to 316.8bp (1Y range: 195-533bp)

- Staples Inc (Country: US; rated: B2): up 91.4 bp to 1,073.5bp (1Y range: 652-1,801bp)

- Transocean Inc (Country: KY; rated: Caa3): up 317.0 bp to 2,185.1bp (1Y range: 941-7,695bp)

LARGEST EURO CORPORATE CDS MOVES IN THE PAST WEEK

- CMA CGM SA (Country: FR; rated: B1): down 18.5 bp to 323.0bp (1Y range: 321-734bp)

- Renault SA (Country: FR; rated: A-): down 17.9 bp to 177.5bp (1Y range: 168-277bp)

- Deutsche Lufthansa AG (Country: DE; rated: Ba2): down 15.5 bp to 246.9bp (1Y range: 236-421bp)

- Thyssenkrupp AG (Country: DE; rated: B1): down 10.9 bp to 254.2bp (1Y range: 206-479bp)

- Virgin Media Finance PLC (Country: GB; rated: WR): down 9.8 bp to 233.7bp (1Y range: 220-325bp)

- UPC Holding BV (Country: NL; rated: LGD6 - 93%): down 9.7 bp to 209.2bp (1Y range: 200-315bp)

- Stellantis NV (Country: NL; rated: BBB): down 9.1 bp to 88.5bp (1Y range: 89-569bp)

- Louis Dreyfus Co BV (Country: NL; rated: ): down 8.7 bp to 100.1bp (1Y range: -100bp)

- TUI AG (Country: DE; rated: LGD4 - 50%): down 8.4 bp to 736.9bp (1Y range: 590-1,799bp)

- Jaguar Land Rover Automotive PLC (Country: GB; rated: WD): down 8.3 bp to 355.8bp (1Y range: 339-891bp)

- Lagardere SA (Country: FR; rated: B): down 7.5 bp to 207.8bp (1Y range: 212-350bp)

- Marks and Spencer PLC (Country: GB; rated: Ba1): down 7.5 bp to 188.8bp (1Y range: 174-349bp)

- Novafives SAS (Country: FR; rated: Caa1): up 9.8 bp to 887.0bp (1Y range: 716-1,205bp)

- Altice Finco SA (Country: LU; rated: Caa1): up 10.7 bp to 359.9bp (1Y range: 317-477bp)

- Boparan Finance PLC (Country: GB; rated: WR): up 25.4 bp to 1,009.8bp (1Y range: 478-1,011bp)

USD BOND ISSUES

- Alleghany Corp (Property and Casualty Insurance | New York City, New York, United States | Rating: BBB+): US$500m Senior Note (US017175AF71), fixed rate (3.25% coupon) maturing on 15 August 2051, priced at 98.64 (original spread of 132 bp), callable (30nc30)

- Avery Dennison Corp (Conglomerate/Diversified Mfg | Glendale, California, United States | Rating: BBB): US$300m Senior Note (US053611AL39), fixed rate (0.85% coupon) maturing on 15 August 2024, priced at 99.99 (original spread of 40 bp), callable (3nc1)

- Avery Dennison Corp (Conglomerate/Diversified Mfg | Glendale, California, United States | Rating: BBB): US$500m Senior Note (US053611AM12), fixed rate (2.25% coupon) maturing on 15 February 2032, priced at 99.59 (original spread of 95 bp), callable (11nc10)

- Dominion Energy Inc (Utility - Other | Richmond, Virginia, United States | Rating: BBB+): US$1,000m Senior Note (US25746UDL08), fixed rate (2.25% coupon) maturing on 15 August 2031, priced at 99.86 (original spread of 92 bp), callable (10nc10)

- Eversource Energy (Utility - Other | Springfield, Massachusetts, United States | Rating: BBB+): US$300m Senior Note (US30040WAN83), fixed rate (1.40% coupon) maturing on 15 August 2026, priced at 99.89 (original spread of 60 bp), callable (5nc5)

- Eversource Energy (Utility - Other | Springfield, Massachusetts, United States | Rating: BBB+): US$350m Senior Note (US30040WAM01), floating rate (SOFR + 25.0 bp) maturing on 15 August 2023, priced at 100.00, non callable

- Federal Home Loan Banks (Agency | Washington, Washington Dc, United States | Rating: NR): US$300m Bond (US3130ANP610), fixed rate (0.68% coupon) maturing on 26 February 2025, priced at 100.00, callable (4nc3m)

- Federal Home Loan Banks (Agency | Washington, Washington Dc, United States | Rating: NR): US$125m Bond (US3130ANNV89), fixed rate (1.20% coupon) maturing on 15 September 2026, priced at 100.00, callable (5nc1m)

- Intel Corp (Electronics | Santa Clara, California, United States | Rating: A+): US$1,250m Senior Note (US458140BW93), fixed rate (3.05% coupon) maturing on 12 August 2051, priced at 99.67 (original spread of 105 bp), callable (30nc30)

- Intel Corp (Electronics | Santa Clara, California, United States | Rating: A+): US$1,000m Senior Note (US458140BT64), fixed rate (1.60% coupon) maturing on 12 August 2028, priced at 99.80 (original spread of 50 bp), callable (7nc7)

- Intel Corp (Electronics | Santa Clara, California, United States | Rating: A+): US$750m Senior Note (US458140BX76), fixed rate (3.20% coupon) maturing on 12 August 2061, priced at 99.62 (original spread of 120 bp), callable (40nc40)

- Intel Corp (Electronics | Santa Clara, California, United States | Rating: A+): US$750m Senior Note (US458140BV11), fixed rate (2.80% coupon) maturing on 12 August 2041, priced at 99.91 (original spread of 90 bp), callable (20nc20)

- Intel Corp (Electronics | Santa Clara, California, United States | Rating: A+): US$1,250m Senior Note (US458140BU38), fixed rate (2.00% coupon) maturing on 12 August 2031, priced at 99.96 (original spread of 65 bp), callable (10nc10)

- NSTAR Electric Co (Utility - Other | Boston, Massachusetts, United States | Rating: A+): US$300m Senior Note (US67021CAR88), fixed rate (1.95% coupon) maturing on 15 August 2031, priced at 99.42 (original spread of 67 bp), callable (10nc10)

- Office Properties Income Trust (Real Estate Investment Trust | Newton, Massachusetts, United States | Rating: BBB-): US$350m Senior Note (US67623CAE93), fixed rate (2.40% coupon) maturing on 1 February 2027, priced at 99.88 (original spread of 160 bp), callable (5nc5)

- PNC Financial Services Group Inc (Banking | Pittsburgh, Pennsylvania, United States | Rating: A-): US$700m Senior Note (US693475BB04), fixed rate (1.15% coupon) maturing on 13 August 2026, priced at 99.81 (original spread of 37 bp), callable (5nc5)

- Resideo Funding Inc (Financial - Other | United States | Rating: BB): US$300m Senior Note (US76119LAB71), fixed rate (4.00% coupon) maturing on 1 September 2029, priced at 100.00 (original spread of 280 bp), callable (8nc3)

- Scotts Miracle-Gro Co (Chemicals | Marysville, Ohio, United States | Rating: B+): US$400m Senior Note (US810186AV84), fixed rate (4.38% coupon) maturing on 1 February 2032, priced at 100.00 (original spread of 303 bp), callable (10nc5)

- Universal Health Services Inc (Health Care Facilities | King Of Prussia, Pennsylvania, United States | Rating: BBB-): US$500m Senior Note (US913903AY69), fixed rate (2.65% coupon) maturing on 15 January 2032, priced at 99.74 (original spread of 133 bp), callable (10nc10)

- Universal Health Services Inc (Health Care Facilities | King Of Prussia, Pennsylvania, United States | Rating: BBB-): US$700m Senior Note (US913903AX86), fixed rate (1.65% coupon) maturing on 1 September 2026, priced at 99.88 (original spread of 85 bp), callable (5nc5)

- Modivcare Escrow Issuer Inc (Financial - Other | Rating: B+): US$500m Senior Note (US60783XAA28), fixed rate (5.00% coupon) maturing on 1 October 2029, priced at 100.00, callable (8nc3)

- T-Mobile USA Inc (Telecommunications | Bellevue, Washington | Rating: BBB-): US$700m Note (US87264ACN37), fixed rate (3.60% coupon) maturing on 15 November 2060, priced at 100.94 (original spread of 155 bp), callable (39nc39)

- T-Mobile USA Inc (Telecommunications | Bellevue, Washington | Rating: BBB-): US$1,300m Note (US87264ACM53), fixed rate (3.40% coupon) maturing on 15 October 2052, priced at 99.90 (original spread of 140 bp), callable (31nc31)