Credit

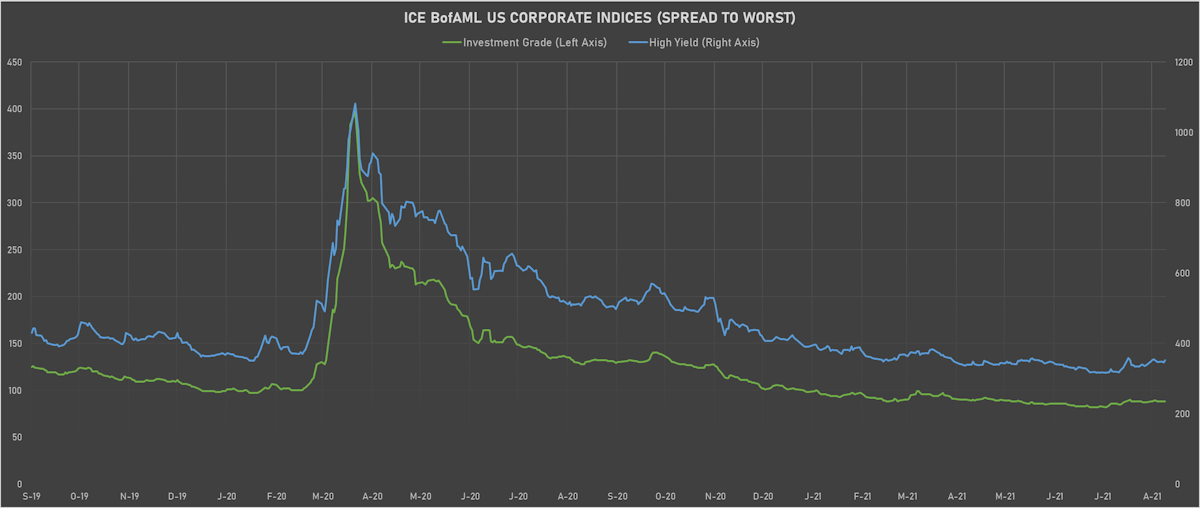

US High Yield Cash Spreads Widen Against A Backdrop Of Lower Rates, Lower CDS Spreads

Another decent day of corporate bond issuance, with the largest prints being US$ 1.1bn for Air Lease in 2 tranches and US$ 1bn for Royal Caribbean Cruises in a single tranche

Published ET

Royal Caribbean Cruises 5-Year USD Credit Default Swap Spread | Source: Refinitiv

QUICK SUMMARY

- S&P 500 Bond Index was down -0.05% today, with investment grade down -0.04% and high yield down -0.06% (YTD total return: -0.69%)

- The iBoxx USD Liquid Investment Grade Total Return Index was up 0.014% today (Month-to-date: -1.37%; Year-to-date: -1.51%)

- The iBoxx USD Liquid High Yield Total Return Index was down -0.081% today (Month-to-date: -0.43%; Year-to-date: 2.79%)

- ICE BofA US Corporate Index (Investment Grade) spread to worst unchanged, now at 88.0 bp (YTD change: -10.0 bp)

- ICE BofA US High Yield Index spread to worst up 6.0 bp, now at 352.0 bp (YTD change: -38.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index up 0.01% today (YTD total return: +2.0%)

- New issues: US$ 9.8bn in dollars and € 2.7bn in euros

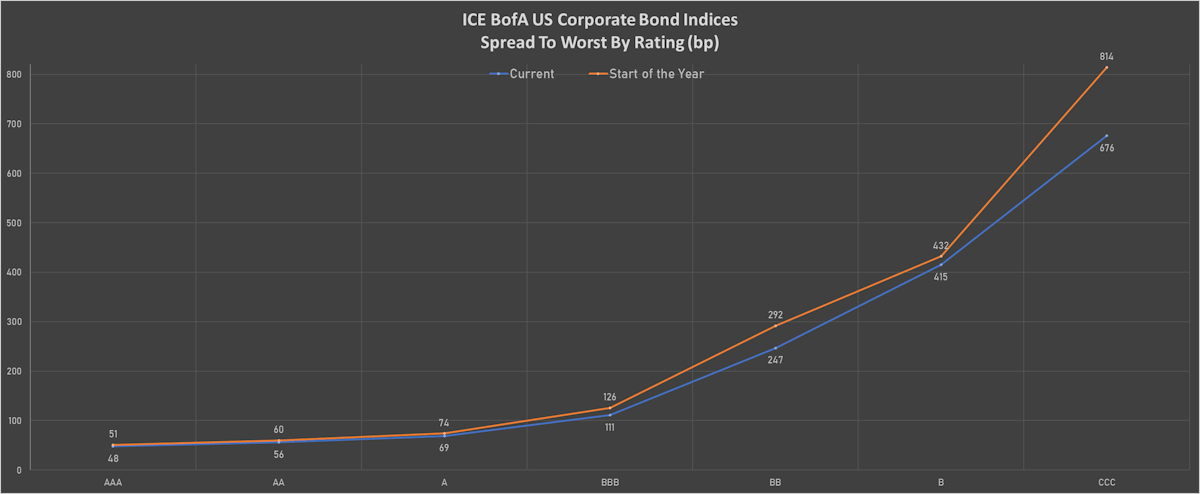

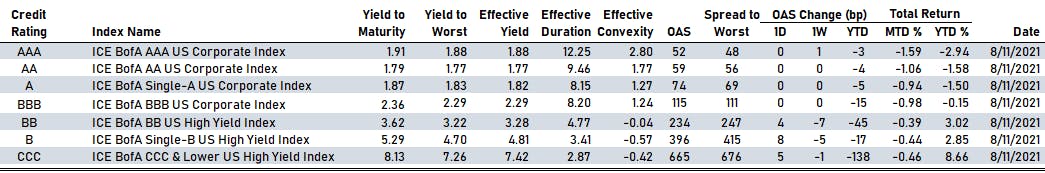

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

- AAA unchanged at 52 bp

- AA unchanged at 59 bp

- A unchanged at 74 bp

- BBB unchanged at 115 bp

- BB up by 4 bp at 234 bp

- B up by 8 bp at 396 bp

- CCC up by 5 bp at 665 bp

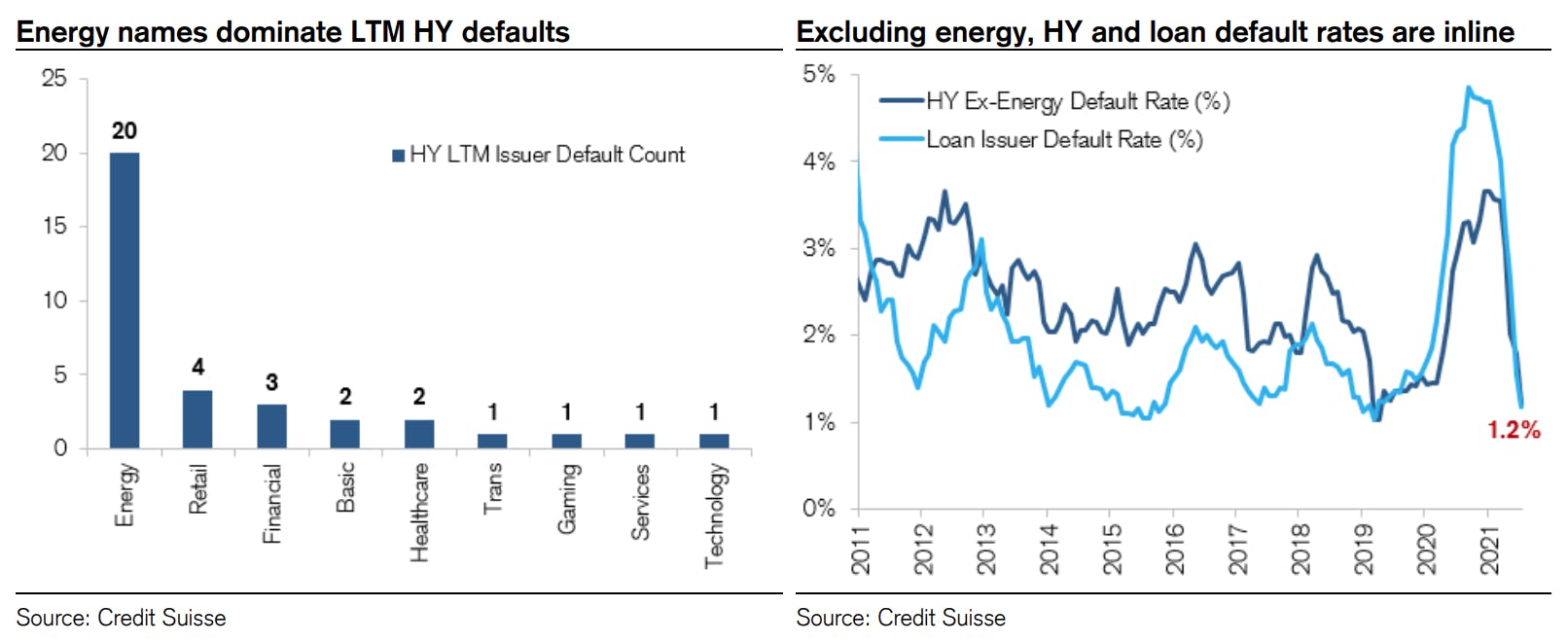

HIGH YIELD DEFAULT RATES

- In a market update today, Credit Suisse shows that high-yield default rates have come down a lot but are still higher than defaults on loans

- When taking out the energy sector, default rates in the two asset classes align:

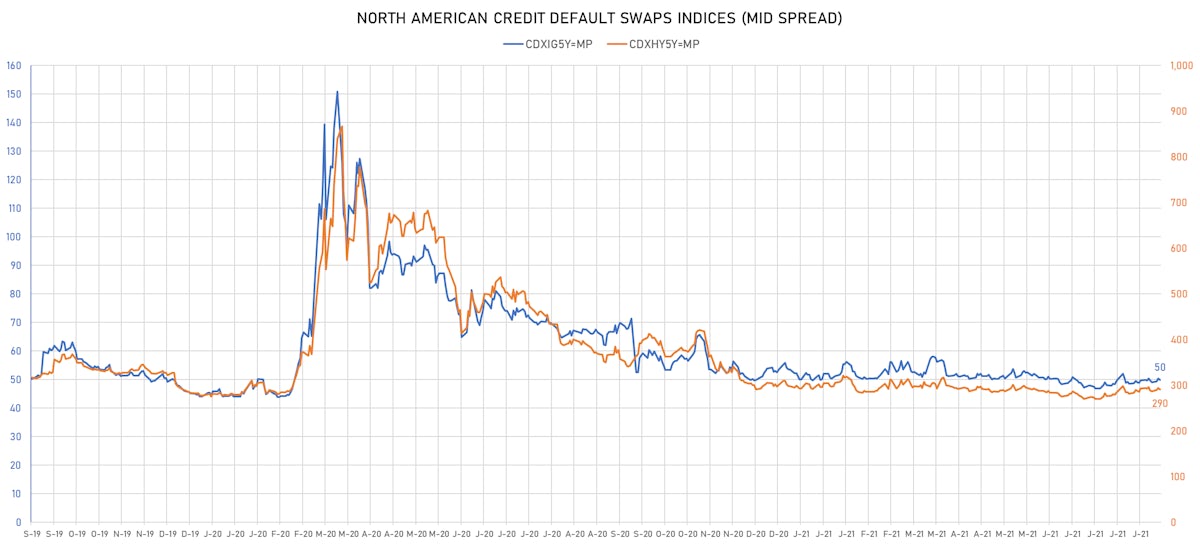

CDS INDICES (mid-spreads)

- Markit CDX.NA.IG 5Y down 0.4 bp, now at 50bp (YTD change: -0.1bp)

- Markit CDX.NA.HY 5Y down 4.0 bp, now at 290bp (YTD change: -3.1bp)

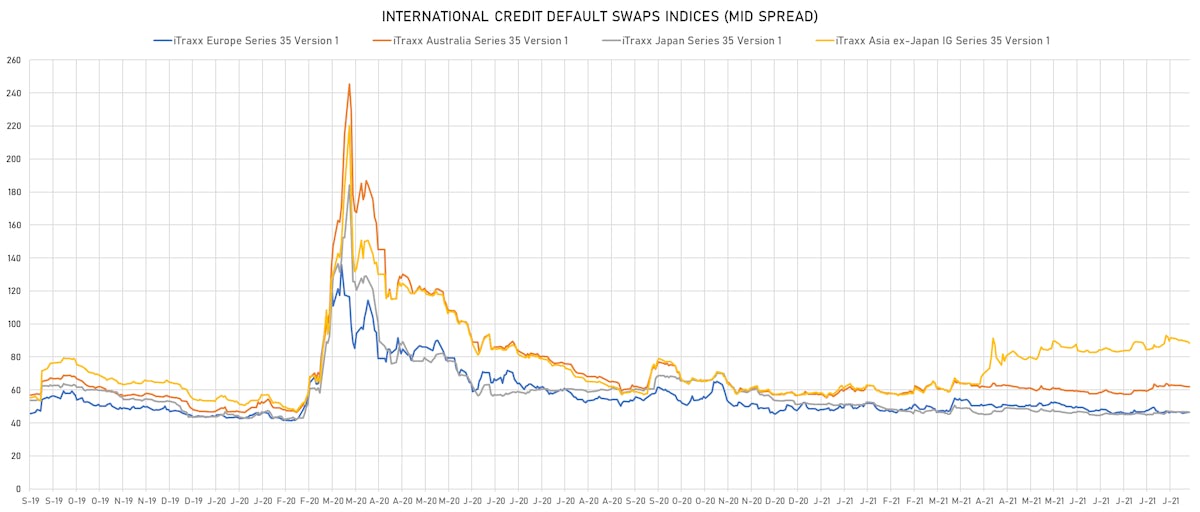

- Markit iTRAXX Europe up 0.2 bp, now at 47bp (YTD change: -1.2bp)

- Markit iTRAXX Japan down 0.2 bp, now at 46bp (YTD change: -5.0bp)

- Markit iTRAXX Asia Ex-Japan down 0.7 bp, now at 88bp (YTD change: +29.7bp)

TOP BONDS MOVES IN THE PAST WEEK - USD HY

- Issuer: Pennsylvania Electric Co (Akron, Ohio (US)) | Coupon: 4.15% | Maturity: 15/4/2025 | Rating: BB+ | ISIN: USU70842AB21 | Z-spread up by 49.3 bp to 121.1 bp (CDS basis: -75.6bp), with the yield to worst at 1.7% and the bond now trading down to 107.6 cents on the dollar (1Y price range: 106.4-110.0).

- Issuer: Banistmo SA (PANAMA CITY, Panama) | Coupon: 3.65% | Maturity: 19/9/2022 | Rating: BB+ | ISIN: USP15383AC95 | Z-spread up by 40.8 bp to 220.6 bp, with the yield to worst at 2.3% and the bond now trading down to 101.4 cents on the dollar (1Y price range: 101.2-103.5).

- Issuer: Jersey Central Power & Light Co (Akron, Ohio (US)) | Coupon: 4.70% | Maturity: 1/4/2024 | Rating: BB+ | ISIN: USU04536AC95 | Z-spread up by 40.0 bp to 93.3 bp (CDS basis: -53.7bp), with the yield to worst at 1.3% and the bond now trading down to 107.9 cents on the dollar (1Y price range: 107.8-109.8).

- Issuer: Dilijan Finance BV (Amsterdam, Netherlands) | Coupon: 6.50% | Maturity: 28/1/2025 | Rating: B+ | ISIN: XS2080321198 | Z-spread up by 38.4 bp to 659.5 bp, with the yield to worst at 6.7% and the bond now trading down to 98.3 cents on the dollar (1Y price range: 93.6-101.0).

- Issuer: WeWork Companies Inc (New York City, New York (US)) | Coupon: 7.88% | Maturity: 1/5/2025 | Rating: CC | ISIN: USU96217AA99 | Z-spread down by 33.6 bp to 708.6 bp, with the yield to worst at 7.3% and the bond now trading up to 100.9 cents on the dollar (1Y price range: 67.5-104.8).

- Issuer: Seazen Group Ltd (Shanghai, Cayman Islands) | Coupon: 6.00% | Maturity: 12/8/2024 | Rating: BB+ | ISIN: XS2215175634 | Z-spread down by 36.1 bp to 468.1 bp, with the yield to worst at 4.8% and the bond now trading up to 102.4 cents on the dollar (1Y price range: 100.5-105.8).

- Issuer: Banco Do Brasil SA (Cayman Islands Branch) (GEORGE TOWN, Cayman Islands) | Coupon: 4.75% | Maturity: 20/3/2024 | Rating: BB- | ISIN: USP1R027AA25 | Z-spread down by 37.3 bp to 155.5 bp (CDS basis: -35.8bp), with the yield to worst at 1.6% and the bond now trading up to 107.0 cents on the dollar (1Y price range: 104.6-108.5).

- Issuer: NCL Corporation Ltd (Miami, Bermuda) | Coupon: 5.88% | Maturity: 15/3/2026 | Rating: CCC+ | ISIN: USG6436QAL08 | Z-spread down by 39.7 bp to 525.1 bp, with the yield to worst at 5.9% and the bond now trading up to 99.3 cents on the dollar (1Y price range: 98.0-105.3).

- Issuer: Empresa Nacional del Petroleo (LAS CONDES, Chile) | Coupon: 3.75% | Maturity: 5/8/2026 | Rating: BB+ | ISIN: USP37110AK24 | Z-spread down by 44.4 bp to 167.7 bp (CDS basis: -105.7bp), with the yield to worst at 2.5% and the bond now trading up to 105.4 cents on the dollar (1Y price range: 103.4-109.9).

- Issuer: Carnival Corp (Miami, Panama) | Coupon: 5.75% | Maturity: 1/3/2027 | Rating: B | ISIN: USP2121VAL82 | Z-spread down by 46.9 bp to 446.4 bp (CDS basis: -61.6bp), with the yield to worst at 5.2% and the bond now trading up to 101.6 cents on the dollar (1Y price range: 99.1-106.5).

- Issuer: Wynn Las Vegas LLC (Las Vegas, Nevada (US)) | Coupon: 5.25% | Maturity: 15/5/2027 | Rating: B+ | ISIN: USU98347AL87 | Z-spread down by 52.2 bp to 339.7 bp, with the yield to worst at 4.1% and the bond now trading up to 104.4 cents on the dollar (1Y price range: 101.5-108.1).

- Issuer: China Hongqiao Group Ltd (Binzhou, Cayman Islands) | Coupon: 6.25% | Maturity: 8/6/2024 | Rating: B+ | ISIN: XS2348238259 | Z-spread down by 52.6 bp to 491.9 bp, with the yield to worst at 4.9% and the bond now trading up to 102.4 cents on the dollar (1Y price range: 99.4-102.9).

- Issuer: YPF SA (Buenos Aires, Argentina) | Coupon: 8.50% | Maturity: 27/6/2029 | Rating: CCC- | ISIN: USP989MJBP50 | Z-spread down by 58.7 bp to 1,317.3 bp, with the yield to worst at 14.0% and the bond now trading up to 73.3 cents on the dollar (1Y price range: 59.9-73.8).

- Issuer: Guacolda Energia SA (LAS CONDES, Chile) | Coupon: 4.56% | Maturity: 30/4/2025 | Rating: B+ | ISIN: USP3711HAF66 | Z-spread down by 295.6 bp to 1,871.4 bp, with the yield to worst at 18.9% and the bond now trading up to 62.0 cents on the dollar (1Y price range: 53.5-92.1).

TOP BONDS MOVES IN THE PAST WEEK - EUR HY

- Issuer: Bulgarian Energy Holding EAD (Sofia, Bulgaria) | Coupon: 2.45% | Maturity: 22/7/2028 | Rating: BB | ISIN: XS2367164576 | Z-spread up by 303.2 bp to 281.7 bp (CDS basis: -212.1bp), with the yield to worst at 2.4% and the bond now trading down to 99.4 cents on the dollar (1Y price range: 98.5-100.0).

- Issuer: Standard Industries Inc (Parsippany, New Jersey (US)) | Coupon: 2.25% | Maturity: 21/11/2026 | Rating: BB- | ISIN: XS2080766475 | Z-spread up by 10.7 bp to 280.7 bp, with the yield to worst at 2.3% and the bond now trading down to 99.0 cents on the dollar (1Y price range: 96.7-102.9).

- Issuer: ZF Europe Finance BV (Amsterdam, Netherlands) | Coupon: 2.50% | Maturity: 23/10/2027 | Rating: BB+ | ISIN: XS2010039977 | Z-spread up by 10.6 bp to 192.8 bp, with the yield to worst at 1.5% and the bond now trading down to 105.0 cents on the dollar (1Y price range: 99.0-105.7).

- Issuer: Syngenta Finance NV (Enkhuizen, Netherlands) | Coupon: 3.38% | Maturity: 16/4/2026 | Rating: BB | ISIN: XS2154325489 | Z-spread up by 6.8 bp to 118.7 bp, with the yield to worst at 0.7% and the bond now trading down to 111.2 cents on the dollar (1Y price range: 102.3-112.0).

- Issuer: SoftBank Group Corp (Minato-Ku, Japan) | Coupon: 3.38% | Maturity: 6/7/2029 | Rating: BB+ | ISIN: XS2361255057 | Z-spread up by 5.4 bp to 398.2 bp, with the yield to worst at 3.6% and the bond now trading down to 97.6 cents on the dollar (1Y price range: 95.7-99.9).

- Issuer: Cellnex Telecom SA (Barcelona, Spain) | Coupon: 1.75% | Maturity: 23/10/2030 | Rating: BB+ | ISIN: XS2247549731 | Z-spread up by 5.1 bp to 179.6 bp, with the yield to worst at 1.6% and the bond now trading down to 100.8 cents on the dollar (1Y price range: 96.7-101.5).

- Issuer: Cellnex Finance Company SA (Madrid, Spain) | Coupon: 2.00% | Maturity: 15/2/2033 | Rating: BB+ | ISIN: XS2300293003 | Z-spread up by 4.4 bp to 195.9 bp, with the yield to worst at 1.9% and the bond now trading down to 100.7 cents on the dollar (1Y price range: 96.0-101.4).

- Issuer: International Consolidated Airlines Group SA (London, Spain) | Coupon: 3.75% | Maturity: 25/3/2029 | Rating: B+ | ISIN: XS2322423539 | Z-spread up by 4.1 bp to 388.5 bp, with the yield to worst at 3.5% and the bond now trading down to 100.6 cents on the dollar (1Y price range: 97.5-102.0).

- Issuer: Mahle GmbH (Stuttgart, Germany) | Coupon: 2.38% | Maturity: 14/5/2028 | Rating: BB+ | ISIN: XS2341724172 | Z-spread up by 4.0 bp to 273.9 bp, with the yield to worst at 2.3% and the bond now trading down to 99.5 cents on the dollar (1Y price range: 99.1-100.9).

- Issuer: Elis SA (Saint-Cloud, France) | Coupon: 1.63% | Maturity: 3/4/2028 | Rating: BB | ISIN: FR0013449998 | Z-spread down by 4.2 bp to 175.3 bp, with the yield to worst at 1.3% and the bond now trading up to 100.9 cents on the dollar (1Y price range: 95.8-101.0).

- Issuer: Dometic Group AB (Solna, Sweden) | Coupon: 3.00% | Maturity: 8/5/2026 | Rating: BB- | ISIN: XS1991114858 | Z-spread down by 4.9 bp to 193.7 bp, with the yield to worst at 1.4% and the bond now trading up to 106.5 cents on the dollar (1Y price range: 102.7-106.7).

- Issuer: Saipem Finance International BV (Amsterdam, Netherlands) | Coupon: 3.13% | Maturity: 31/3/2028 | Rating: BB | ISIN: XS2325696628 | Z-spread down by 4.9 bp to 323.7 bp (CDS basis: 65.0bp), with the yield to worst at 2.8% and the bond now trading up to 101.0 cents on the dollar (1Y price range: 98.5-102.9).

- Issuer: Renault SA (Boulogne-Billancourt, France) | Coupon: 2.50% | Maturity: 1/4/2028 | Rating: BB | ISIN: FR0014002OL8 | Z-spread down by 11.3 bp to 234.8 bp (CDS basis: -40.6bp), with the yield to worst at 1.9% and the bond now trading up to 102.6 cents on the dollar (1Y price range: 98.4-102.9).

- Issuer: Rolls-Royce PLC (Birmingham, United Kingdom) | Coupon: 1.63% | Maturity: 9/5/2028 | Rating: BB- | ISIN: XS1819574929 | Z-spread down by 13.9 bp to 267.2 bp (CDS basis: -15.2bp), with the yield to worst at 2.2% and the bond now trading up to 95.3 cents on the dollar (1Y price range: 90.4-95.5).

USD BOND ISSUES

- Air Lease Corp (Leasing | Los Angeles, United States | Rating: BBB): US$500m Senior Note (US00914AAQ58), fixed rate (2.10% coupon) maturing on 1 September 2028, priced at 98.32 (original spread of 125 bp), callable (7nc7)

- Air Lease Corp (Leasing | Los Angeles, United States | Rating: BBB): US$600m Unsecured Note (US00914AAP75), fixed rate (0.80% coupon) maturing on 18 August 2024, priced at 99.33 (original spread of 60 bp), callable (3nc3)

- Arizona Public Service Co (Utility - Other | Phoenix, United States | Rating: A-): US$450m Senior Note (US040555DD31), fixed rate (2.20% coupon) maturing on 15 December 2031, priced at 99.98 (original spread of 88 bp), callable (10nc10)

- Brixmor Operating Partnership LP (Real Estate Investment Trust | New York City, United States | Rating: BBB-): US$500m Senior Note (US11120VAL71), fixed rate (2.50% coupon) maturing on 16 August 2031, priced at 99.68 (original spread of 120 bp), callable (10nc10)

- CommScope Inc (Cable/Media | Hickory, United States | Rating: B): US$1,250m Note (US203372AX50), fixed rate (4.75% coupon) maturing on 1 September 2029, priced at 100.00 (original spread of 355 bp), callable (8nc3)

- Entergy Texas Inc (Utility - Other | The Woodlands, United States | Rating: BBB-): US$130m First Mortgage Bond (US29365TAL89), fixed rate (1.50% coupon) maturing on 1 September 2026, priced at 99.76 (original spread of 75 bp), callable (5nc5)

- Equifax Inc (Service - Other | Atlanta, United States | Rating: BBB): US$1,000m Senior Note (US294429AT25), fixed rate (2.35% coupon) maturing on 15 September 2031, priced at 99.73 (original spread of 105 bp), callable (10nc10)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$105m Bond (US3133EM2V34), fixed rate (0.91% coupon) maturing on 17 August 2026, priced at 100.00 (original spread of 83 bp), callable (5nc1)

- Liberty Mutual Group Inc (Property and Casualty Insurance | Boston, United States | Rating: BBB): US$500m Junior Subordinated Note (USU52932BP15), fixed rate (4.13% coupon) maturing on 15 December 2051, priced at 100.00 (original spread of 332 bp), callable (30nc5)

- Morgan Stanley Finance LLC (Financial - Other | New York City, New York, United States | Rating: BBB+): US$110m Unsecured Note (XS2175204523) zero coupon maturing on 24 August 2061, priced at 100.00, non callable

- NexBank Capital Inc (Banking | Dallas, United States | Rating: NR): US$150m Subordinated Note (US65341TAE73), floating rate maturing on 15 August 2031, priced at 100.00, non callable

- Royal Caribbean Cruises Ltd (Leisure | Miami, United States | Rating: B): US$1,000m Senior Note (US780153BJ00), fixed rate (5.50% coupon) maturing on 31 August 2026, priced at 100.00 (original spread of 470 bp), callable (5nc5)

- Tallgrass Energy Partners LP (Gas Utility - Pipelines | Leawood, United States | Rating: B+): US$500m Senior Note (US87470LAK70), fixed rate (6.00% coupon) maturing on 1 September 2031, priced at 100.00 (original spread of 467 bp), callable (10nc5)

- Ventas Realty LP (Securities | Louisville, United States | Rating: BBB+): US$500m Senior Note (US92277GAW78), fixed rate (2.50% coupon) maturing on 1 September 2031, priced at 99.74 (original spread of 120 bp), callable (10nc10)

- Azure Power Energy Ltd (Financial - Other | Ebene, Canada | Rating: NR): US$414m Senior Note (USV0002UAA52), fixed rate (3.58% coupon) maturing on 19 August 2026, priced at 100.00, callable (5nc2)

- W R Grace Holdings LLC (Financial - Other | Rating: CCC+): US$1,155m Senior Note (USU38406AA92), fixed rate (5.63% coupon) maturing on 15 August 2029, priced at 100.00 (original spread of 441 bp), callable (8nc3)

- Yieldking Investment Ltd (Financial - Other | Chengdu, Sichuan, China (Mainland) | Rating: NR): US$400m Senior Note (XS2266935993), fixed rate (2.80% coupon) maturing on 18 August 2026, priced at 100.00 (original spread of 181 bp), non callable

EUR BOND ISSUES

- Becton Dickinson and Co (Health Care Supply | Franklin Lakes, New Jersey, United States | Rating: BBB-): €900m Senior Note (XS2375844144), fixed rate (0.33% coupon) maturing on 13 August 2028, priced at 100.00 (original spread of 102 bp), callable (7nc7)

- Becton Dickinson and Co (Health Care Supply | Franklin Lakes, New Jersey, United States | Rating: BBB-): €900m Senior Note (XS2375844656), fixed rate (1.34% coupon) maturing on 13 August 2041, priced at 100.00 (original spread of 159 bp), callable (20nc20)

- Becton Dickinson and Co (Health Care Supply | Franklin Lakes, New Jersey, United States | Rating: BBB-): €500m Senior Note (XS2375836553), fixed rate (0.03% coupon) maturing on 13 August 2025, priced at 100.00 (original spread of 83 bp), callable (4nc4)

- Becton Dickinson and Co (Health Care Supply | Franklin Lakes, New Jersey, United States | Rating: BBB-): €400m Senior Note (XS2375836470) zero coupon maturing on 13 August 2023, priced at 100.29 (original spread of 61 bp), with a make whole call

NEW LOANS

- Canadian Pacific Railway Ltd (BBB+), signed a US$ 9,500m Term Loan, to be used for acquisition financing.

- Ocean Partners UK Ltd, signed a US$ 300m Revolving Credit Facility maturing on 08/11/22, to be used for general corporate purposes.

NEW ISSUES IN SECURITIZED CREDIT

- Flagship Credit Auto Trust 2021-3 issued a fixed-rate ABS backed by auto receivables in 5 tranches, for a total of US$ 359 m. Highest-rated tranche offering a yield to maturity of 0.36%, and the lowest-rated tranche a yield to maturity of 3.32%. Bookrunners: Deutsche Bank Securities Inc, Citigroup Global Markets Inc

- Freddie Mac Spc K-F118 issued a floating-rate Agency CMBS in 1 tranche offering a spread over the floating rate of 20bp, for a total of US$ 859 m. Bookrunners: Morgan Stanley International Ltd, Bank of America Merrill Lynch

- Freddie Mac Spc K-744 issued a fixed-rate Agency CMBS in 3 tranches, for a total of US$ 759 m. Highest-rated tranche offering a yield to maturity of 0.86%, and the lowest-rated tranche a yield to maturity of 1.26%. Bookrunners: Barclays Capital Group, Wells Fargo Securities LLC

- SMB Private Education Loan Trust 2021-D issued a floating-rate ABS backed by student loans in 3 tranches, for a total of US$ 527 m. Bookrunners: Goldman Sachs & Co, JP Morgan & Co Inc, Barclays Capital Group, RBC Capital Markets