Credit

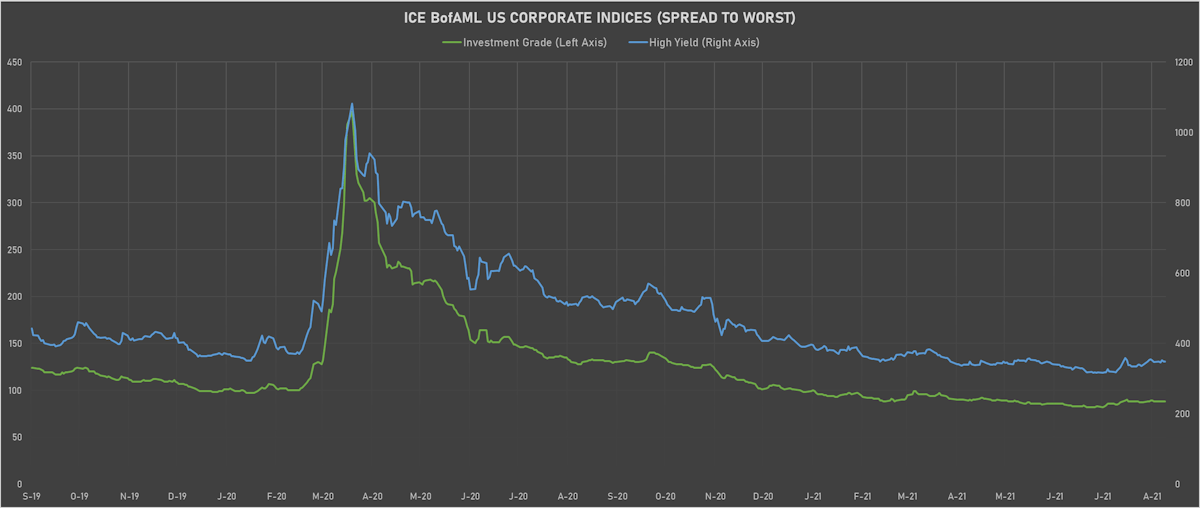

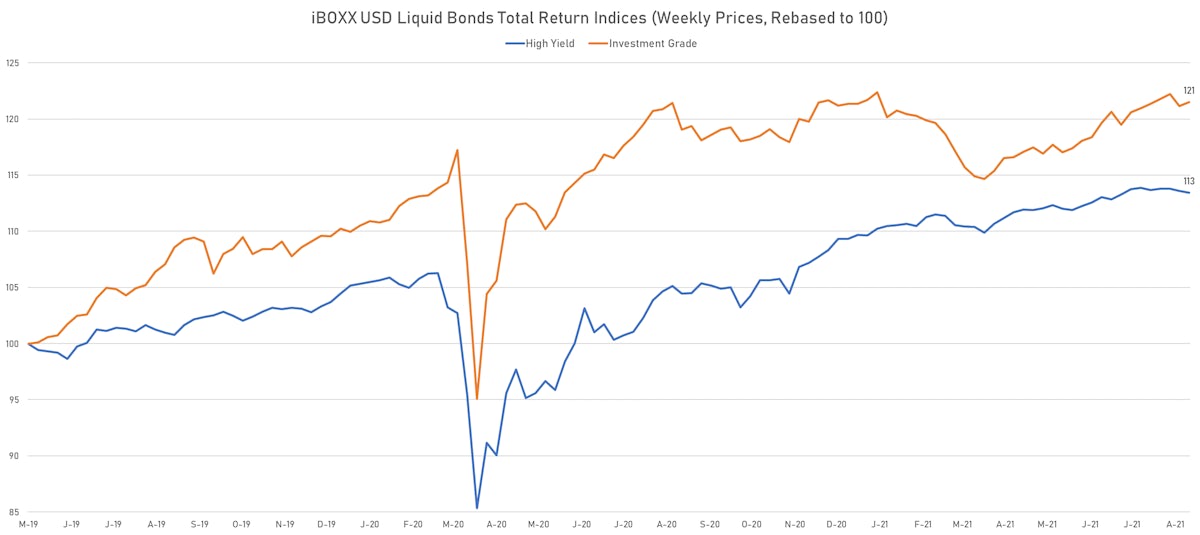

Lower Rates Push IG Bonds Higher, While HY Cash Spreads Widened To Close The Week

Total issuance of USD bond this week (IFR data): US$42.1bn in 62 Tranches for IG, US$14.5bn in 14 Tranches for HY

Published ET

iBOXX USD Liquid Bonds Total Returns IG & HY Indices | Sources: ϕpost, Refinitiv data

QUICK SUMMARY

- S&P 500 Bond Index was up 0.41% today, with investment grade up 0.44% and high yield up 0.14% (YTD total return: -0.28%)

- ICE BofA US Corporate Index (Investment Grade) spread to worst unchanged, now at 88.0 bp (YTD change: -10.0 bp)

- ICE BofA US High Yield Index spread to worst up 1.0 bp, now at 349.0 bp (YTD change: -41.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index up 0.10% today (YTD total return: +2.1%)

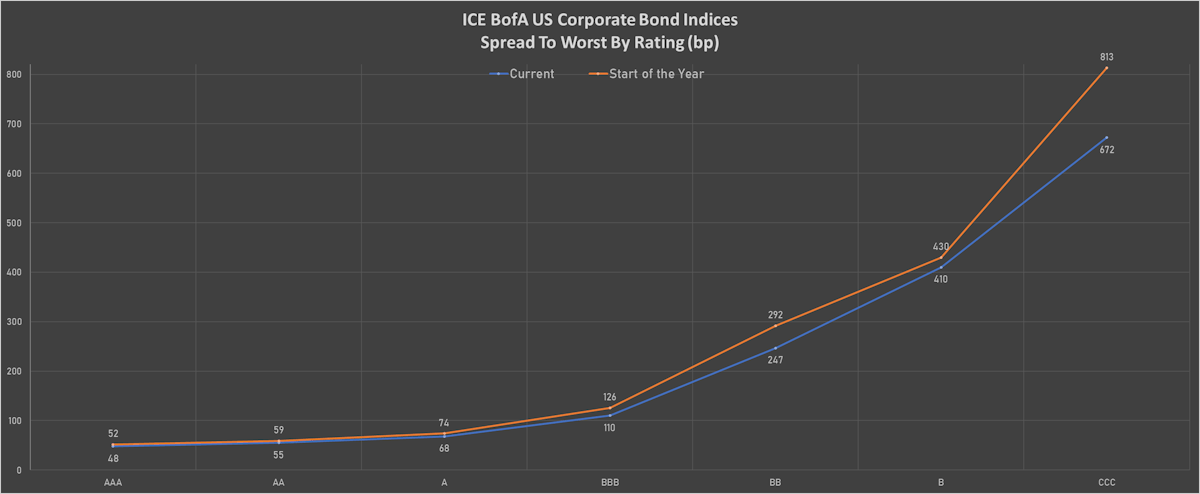

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

- AAA unchanged at 51 bp

- AA unchanged at 59 bp

- A down by -1 bp at 73 bp

- BBB down by -1 bp at 114 bp

- BB up by 2 bp at 234 bp

- B up by 3 bp at 393 bp

- CCC unchanged at 662 bp

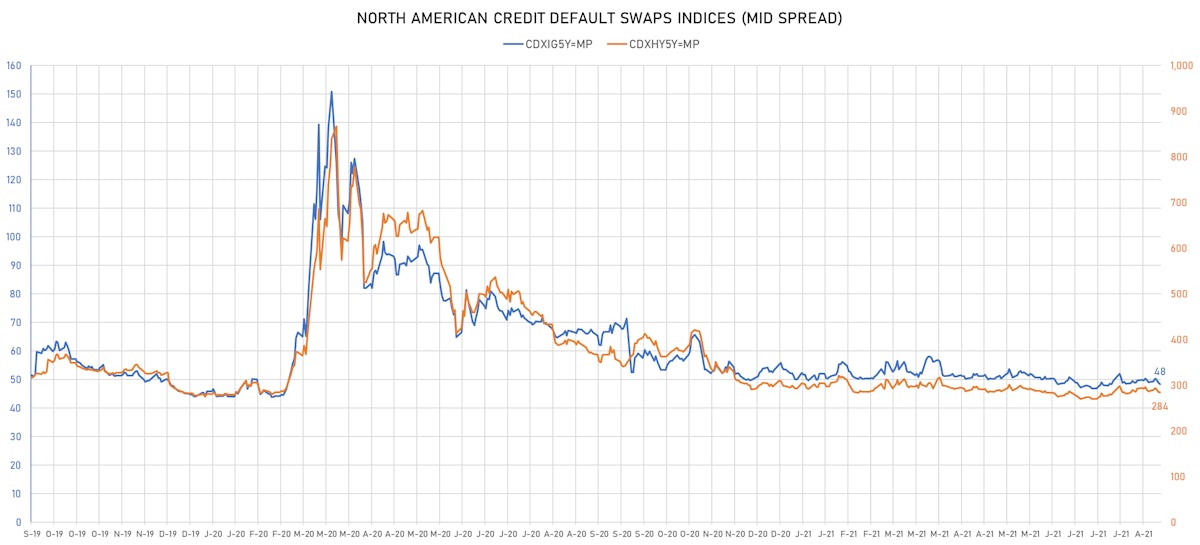

CDS INDICES (mid-spreads)

- Markit CDX.NA.IG 5Y down 0.6 bp, now at 48bp (YTD change: -1.6bp)

- Markit CDX.NA.HY 5Y down 1.4 bp, now at 284bp (YTD change: -9.0bp)

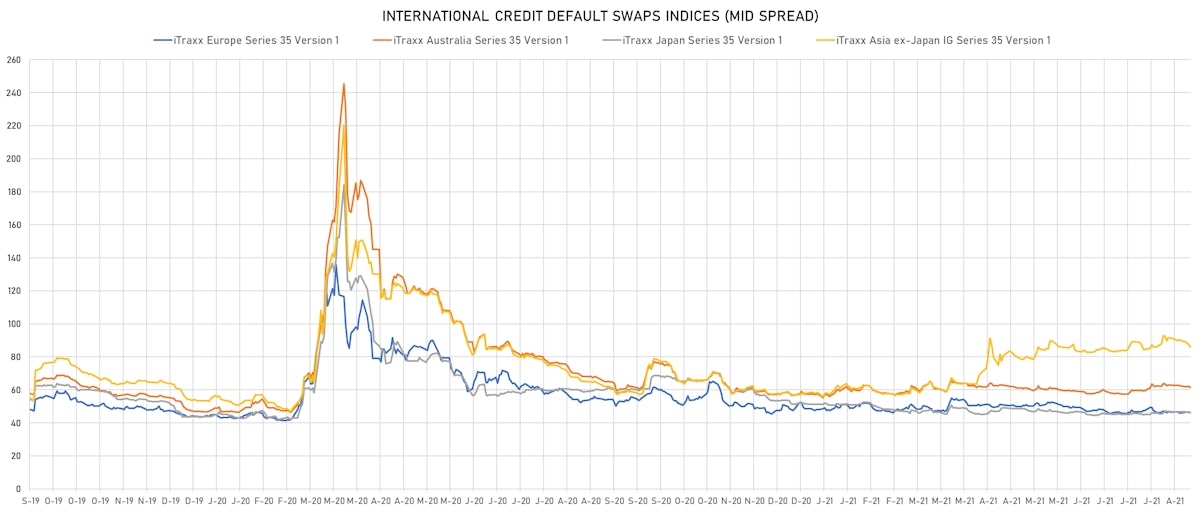

- Markit iTRAXX Europe down 0.2 bp, now at 46bp (YTD change: -2.0bp)

- Markit iTRAXX Japan down 0.3 bp, now at 46bp (YTD change: -5.4bp)

- Markit iTRAXX Asia Ex-Japan down 1.4 bp, now at 85bp (YTD change: +26.5bp)

LARGEST USD CORPORATE CDS MOVES IN THE PAST WEEK

- Talen Energy Supply LLC (Country: US; rated: BB-): down 430.4 bp to 2,601.1bp (1Y range: 875-4,791bp)

- Carnival Corp (Country: US; rated: LGD5 - 72%): down 26.7 bp to 434.5bp (1Y range: 291-1,214bp)

- Navient Corp (Country: US; rated: Ba3): down 11.5 bp to 280.5bp (1Y range: -278bp)

- Bombardier Inc (Country: CA; rated: Caa1): down 10.4 bp to 426.2bp (1Y range: 388-1,912bp)

- NRG Energy Inc (Country: US; rated: Ba1): down 9.7 bp to 164.0bp (1Y range: 108-219bp)

- Peru, Republic of (Government) (Country: PE; rated: A3): down 9.1 bp to 93.3bp (1Y range: 54-103bp)

- Sabre Holdings Corp (Country: US; rated: Ba3): up 9.3 bp to 369.3bp (1Y range: 337-611bp)

- Murphy Oil Corp (Country: US; rated: Ba3): up 10.6 bp to 350.8bp (1Y range: 280-763bp)

- Vale SA (Country: BR; rated: WR): up 11.9 bp to 153.9bp (1Y range: 126-258bp)

- RR Donnelley & Sons Co (Country: US; rated: B2): up 15.4 bp to 527.6bp (1Y range: 447-982bp)

- Genworth Holdings Inc (Country: US; rated: Caa1): up 20.2 bp to 535.1bp (1Y range: 447-786bp)

- Apache Corp (Country: US; rated: WD): up 26.3 bp to 238.4bp (1Y range: 168-453bp)

- Lumen Technologies Inc (Country: US; rated: Ba3): up 31.7 bp to 316.8bp (1Y range: 195-533bp)

- Staples Inc (Country: US; rated: B2): up 91.4 bp to 1,073.5bp (1Y range: 652-1,680bp)

- Transocean Inc (Country: KY; rated: Caa3): up 317.0 bp to 2,185.1bp (1Y range: 941-7,695bp)

LARGEST EURO CORPORATE CDS MOVES IN THE PAST WEEK

- CMA CGM SA (Country: FR; rated: B1): down 18.5 bp to 323.0bp (1Y range: 319-734bp)

- Renault SA (Country: FR; rated: A-): down 17.9 bp to 177.5bp (1Y range: 168-277bp)

- Deutsche Lufthansa AG (Country: DE; rated: Ba2): down 15.5 bp to 246.9bp (1Y range: 236-421bp)

- Thyssenkrupp AG (Country: DE; rated: B1): down 10.9 bp to 254.2bp (1Y range: 206-479bp)

- Virgin Media Finance PLC (Country: GB; rated: WR): down 9.8 bp to 233.7bp (1Y range: 220-325bp)

- UPC Holding BV (Country: NL; rated: LGD6 - 93%): down 9.7 bp to 209.2bp (1Y range: 199-315bp)

- Stellantis NV (Country: NL; rated: BBB): down 9.1 bp to 88.5bp (1Y range: 87-569bp)

- Louis Dreyfus Co BV (Country: NL; rated: ): down 8.7 bp to 100.1bp (1Y range: -100bp)

- Tui AG (Country: DE; rated: LGD4 - 50%): down 8.4 bp to 736.9bp (1Y range: 590-1,799bp)

- Jaguar Land Rover Automotive PLC (Country: GB; rated: WD): down 8.3 bp to 355.8bp (1Y range: 339-891bp)

- Lagardere SA (Country: FR; rated: B): down 7.5 bp to 207.8bp (1Y range: 208-350bp)

- Marks and Spencer PLC (Country: GB; rated: Ba1): down 7.5 bp to 188.8bp (1Y range: 174-349bp)

- Novafives SAS (Country: FR; rated: Caa1): up 9.8 bp to 887.0bp (1Y range: 716-1,205bp)

- Altice Finco SA (Country: LU; rated: Caa1): up 10.7 bp to 359.9bp (1Y range: 317-477bp)

- Boparan Finance PLC (Country: GB; rated: WR): up 25.4 bp to 1,009.8bp (1Y range: 478-1,006bp)

USD BOND ISSUES

- Chongqing International Logistics Hub Park Construction Co Ltd (Service - Other | Chongqing, China (Mainland) | Rating: BBB-): US$160m Senior Note (XS2361085975), fixed rate (5.30% coupon) maturing on 20 August 2024, priced at 100.00, non callable

- Shinsun Holdings Group Co Ltd (Service - Other | Shanghai | Rating: B-): US$200m Senior Note (XS2369849745), fixed rate (12.00% coupon) maturing on 18 August 2023, priced at 99.14, non callable

EUR BOND ISSUES

- Posco (Metals/Mining | Pohang, South Korea | Rating: BBB+): €1,029m Bond (XS2376482423) zero coupon maturing on 1 September 2026, priced at 105.00, non callable, convertible

NEW LOANS

- Tempo Acquisition LLC (BB-), signed a US$ 450m Term Loan B, to be used for acquisition financing. It matures on 10/31/26 and initial pricing is set at LIBOR +325bps

- Trip.com Group Ltd, signed a US$ 1,000m Revolving Credit / Term Loan, to be used for general corporate purposes. It matures on 08/12/24 and initial pricing is set at LIBOR +115bps

NEW ISSUES IN SECURITIZED CREDIT

- Eaton CLO 2020-1 issued a fixed-rate CLO in 5 tranches, for a total of US$ 414 m. Bookrunners: Wells Fargo Securities LLC

- Goldman Home Improvement Trust 2021-GRN2 Issuer Trust issued a fixed-rate ABS backed by consumer loan in 4 tranches, for a total of US$ 264 m. Highest-rated tranche offering a yield to maturity of 1.17%, and the lowest-rated tranche a yield to maturity of 4.08%. Bookrunners: Goldman Sachs & Co