Credit

IG Cash Spreads Unchanged, Up 2bp For HY On Quiet Start To The Week

Not much activity in the primary market, with Pfizer and Southwestern Energy the only 2 prints over US$ 1bn today

Published ET

Vedanta Resources (USG9T27HAD620), which carries a 8.95% coupon and expires in Nov. 2025, is up close to 5% so far this month | Source: Refinitiv

QUICK SUMMARY

- S&P 500 Bond Index was up 0.22% today, with investment grade up 0.23% and high yield up 0.07% (YTD total return: -0.07%)

- The iBoxx USD Liquid Investment Grade Total Return Index was up 0.146% today (Month-to-date: -0.44%; Year-to-date: -0.59%)

- The iBoxx USD Liquid High Yield Total Return Index was up 0.010% today (Month-to-date: -0.30%; Year-to-date: 2.93%)

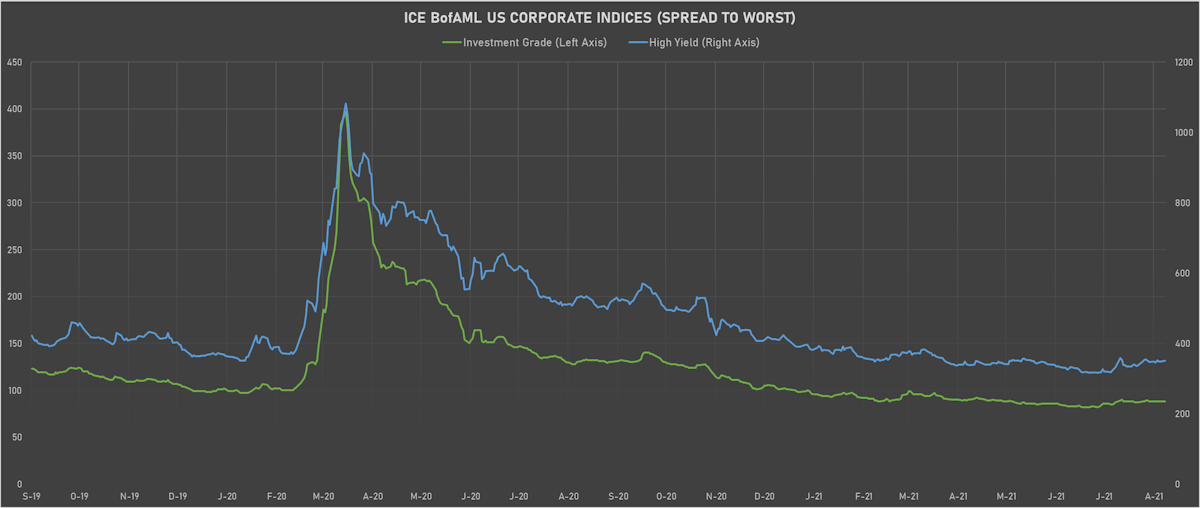

- ICE BofA US Corporate Index (Investment Grade) spread to worst unchanged, now at 88.0 bp (YTD change: -10.0 bp)

- ICE BofA US High Yield Index spread to worst up 2.0 bp, now at 351.0 bp (YTD change: -39.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index up 0.04% today (YTD total return: +2.1%)

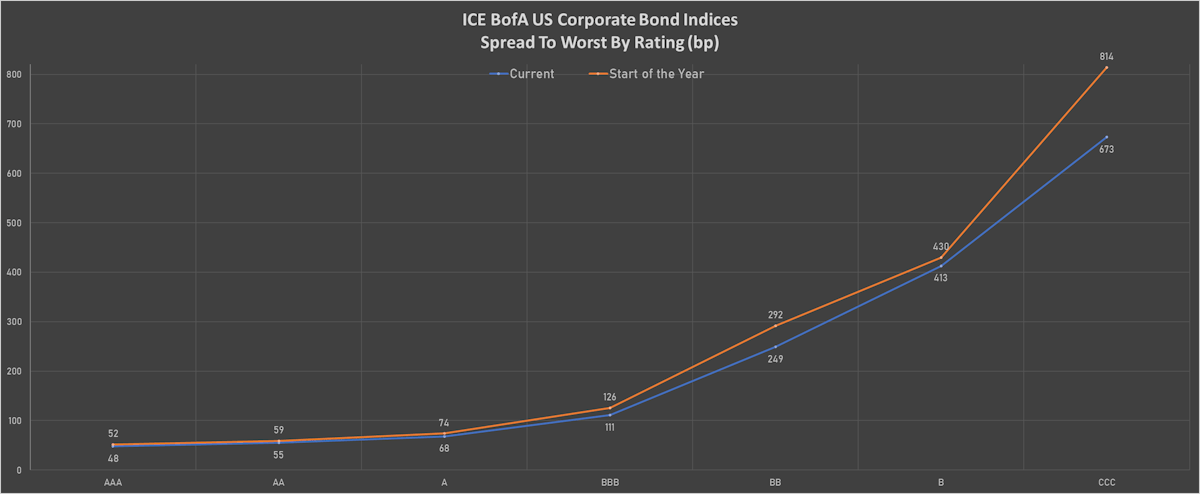

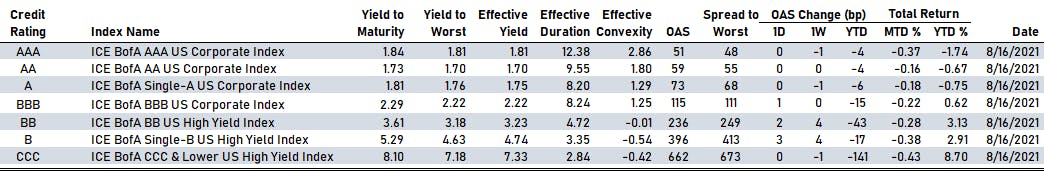

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

- AAA unchanged at 51 bp

- AA unchanged at 59 bp

- A unchanged at 73 bp

- BBB up by 1 bp at 115 bp

- BB up by 2 bp at 236 bp

- B up by 3 bp at 396 bp

- CCC unchanged at 662 bp

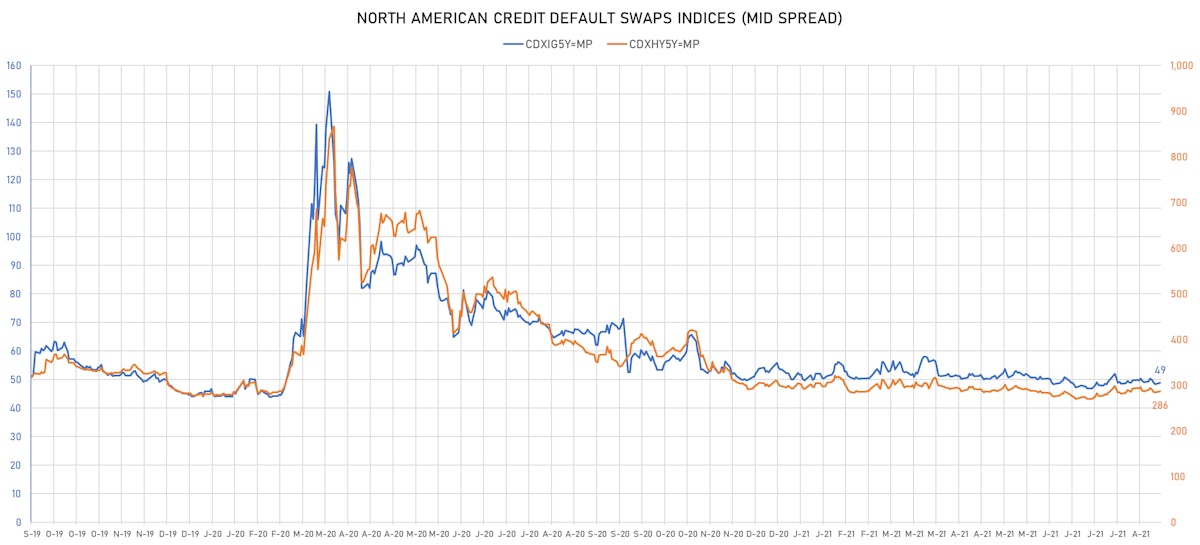

CDS INDICES (mid-spreads)

- Markit CDX.NA.IG 5Y up 0.4 bp, now at 49bp (YTD change: -1.2bp)

- Markit CDX.NA.HY 5Y up 2.2 bp, now at 286bp (YTD change: -6.8bp)

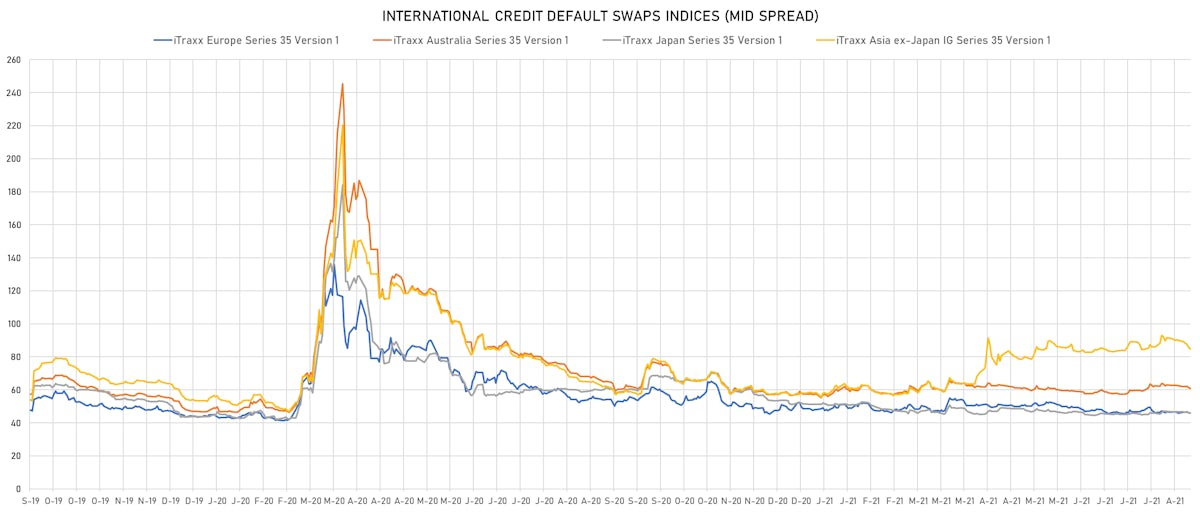

- Markit iTRAXX Europe up 0.3 bp, now at 46bp (YTD change: -1.8bp)

- Markit iTRAXX Japan down 0.1 bp, now at 46bp (YTD change: -5.5bp)

- Markit iTRAXX Asia Ex-Japan down 1.6 bp, now at 83bp (YTD change: +25.0bp)

TOP BONDS MOVES IN THE PAST WEEK - USD HY

- Issuer: Bonitron DAC (DUBLIN, Ireland) | Coupon: 9.00% | Maturity: 22/10/2025 | Rating: B- | ISIN: XS2243344434 | Z-spread up by 34.3 bp to 703.4 bp, with the yield to worst at 7.3% and the bond now trading down to 105.0 cents on the dollar (1Y price range: 104.0-109.9).

- Issuer: Pakistan Water and Power Development Authority (Lahore, Pakistan) | Coupon: 7.50% | Maturity: 4/6/2031 | Rating: B- | ISIN: XS2348591707 | Z-spread up by 32.0 bp to 670.2 bp, with the yield to worst at 7.6% and the bond now trading down to 98.5 cents on the dollar (1Y price range: 98.5-101.9).

- Issuer: Banco Safra SA (Cayman Islands Branch) (George Town, Cayman Islands) | Coupon: 4.13% | Maturity: 8/2/2023 | Rating: BB- | ISIN: US05964TAQ22 | Z-spread up by 31.6 bp to 143.5 bp, with the yield to worst at 1.4% and the bond now trading down to 103.6 cents on the dollar (1Y price range: 102.3-104.8).

- Issuer: Bank of Bahrain and Kuwait BSC (Manama, Bahrain) | Coupon: 5.50% | Maturity: 9/7/2024 | Rating: B | ISIN: XS2017807301 | Z-spread up by 30.5 bp to 322.1 bp, with the yield to worst at 3.5% and the bond now trading down to 105.0 cents on the dollar (1Y price range: 101.2-106.6).

- Issuer: American Airlines Group Inc (Fort Worth, Texas (US)) | Coupon: 3.75% | Maturity: 1/3/2025 | Rating: CCC | ISIN: USU0242AAD47 | Z-spread up by 30.2 bp to 699.5 bp (CDS basis: 18.6bp), with the yield to worst at 7.3% and the bond now trading down to 88.6 cents on the dollar (1Y price range: 71.0-93.1).

- Issuer: EnLink Midstream LLC (Dallas, Texas (US)) | Coupon: 5.63% | Maturity: 15/1/2028 | Rating: BB | ISIN: USU26790AB82 | Z-spread up by 24.8 bp to 391.2 bp, with the yield to worst at 4.7% and the bond now trading down to 103.9 cents on the dollar (1Y price range: 96.8-107.4).

- Issuer: EQM Midstream Partners LP (Canonsburg, Pennsylvania (US)) | Coupon: 6.50% | Maturity: 1/7/2027 | Rating: BB- | ISIN: USU26886AB46 | Z-spread up by 22.3 bp to 358.4 bp, with the yield to worst at 4.2% and the bond now trading down to 109.8 cents on the dollar (1Y price range: 106.5-113.5).

- Issuer: TBC bank'i SS (Tbilisi, Georgia) | Coupon: 5.75% | Maturity: 19/6/2024 | Rating: BB- | ISIN: XS1843434363 | Z-spread up by 21.1 bp to 261.2 bp, with the yield to worst at 2.7% and the bond now trading down to 107.3 cents on the dollar (1Y price range: 104.0-110.0).

- Issuer: Sensata Technologies Inc (Attleboro, Massachusetts (US)) | Coupon: 4.38% | Maturity: 15/2/2030 | Rating: BB- | ISIN: USU81700AA12 | Z-spread up by 20.8 bp to 233.4 bp, with the yield to worst at 3.3% and the bond now trading down to 106.5 cents on the dollar (1Y price range: 102.9-108.9).

- Issuer: W R Grace & Co (Hartford, Conn (US)) | Coupon: 5.63% | Maturity: 1/10/2024 | Rating: B+ | ISIN: USU38246AB79 | Z-spread up by 19.4 bp to 180.7 bp, with the yield to worst at 2.0% and the bond now trading down to 109.9 cents on the dollar (1Y price range: 108.0-111.6).

- Issuer: MHP Lux SA (Luxembourg, Luxembourg) | Coupon: 6.25% | Maturity: 19/9/2029 | Rating: B | ISIN: XS2010044894 | Z-spread down by 21.7 bp to 522.7 bp, with the yield to worst at 6.2% and the bond now trading up to 99.5 cents on the dollar (1Y price range: 93.0-103.3).

- Issuer: Itau Unibanco Holding SA (Cayman Islands Branch) (GEORGE TOWN, Cayman Islands) | Coupon: 3.25% | Maturity: 24/1/2025 | Rating: BB- | ISIN: US46556KAB26 | Z-spread down by 21.8 bp to 179.2 bp, with the yield to worst at 2.1% and the bond now trading up to 102.9 cents on the dollar (1Y price range: 101.6-104.9).

- Issuer: China Hongqiao Group Ltd (Binzhou, Cayman Islands) | Coupon: 6.25% | Maturity: 8/6/2024 | Rating: B+ | ISIN: XS2348238259 | Z-spread down by 30.4 bp to 493.0 bp, with the yield to worst at 4.9% and the bond now trading up to 102.4 cents on the dollar (1Y price range: 99.4-102.9).

- Issuer: Southeast Supply Header LLC (Houston, Texas (US)) | Coupon: 4.25% | Maturity: 15/6/2024 | Rating: BB- | ISIN: USU83854AB29 | Z-spread down by 65.9 bp to 346.9 bp, with the yield to worst at 3.5% and the bond now trading up to 100.8 cents on the dollar (1Y price range: 98.4-101.2).

- Issuer: Vedanta Resources Finance II PLC (London, United Kingdom) | Coupon: 8.95% | Maturity: 11/3/2025 | Rating: B- | ISIN: USG9T27HAD62 | Z-spread down by 68.9 bp to 868.6 bp, with the yield to worst at 9.0% and the bond now trading up to 99.0 cents on the dollar (1Y price range: 93.5-99.8).

TOP BONDS MOVES IN THE PAST WEEK - EUR HY

- Issuer: Mahle GmbH (Stuttgart, Germany) | Coupon: 2.38% | Maturity: 14/5/2028 | Rating: BB+ | ISIN: XS2341724172 | Z-spread up by 17.2 bp to 282.3 bp, with the yield to worst at 2.4% and the bond now trading down to 99.0 cents on the dollar (1Y price range: 97.7-100.9).

- Issuer: ZF Europe Finance BV (Amsterdam, Netherlands) | Coupon: 2.50% | Maturity: 23/10/2027 | Rating: BB+ | ISIN: XS2010039977 | Z-spread up by 12.2 bp to 203.8 bp, with the yield to worst at 1.6% and the bond now trading down to 104.4 cents on the dollar (1Y price range: 99.0-105.7).

- Issuer: Deutsche Lufthansa AG (Cologne, Germany) | Coupon: 3.75% | Maturity: 11/2/2028 | Rating: BB- | ISIN: XS2296203123 | Z-spread up by 8.8 bp to 349.2 bp (CDS basis: -83.3bp), with the yield to worst at 3.0% and the bond now trading down to 103.2 cents on the dollar (1Y price range: 97.6-105.3).

- Issuer: Teva Pharmaceutical Finance Netherlands II BV (Amsterdam, Netherlands) | Coupon: 1.63% | Maturity: 15/10/2028 | Rating: BB- | ISIN: XS1439749364 | Z-spread up by 5.3 bp to 333.6 bp, with the yield to worst at 2.9% and the bond now trading down to 90.9 cents on the dollar (1Y price range: 87.1-92.6).

- Issuer: Nemak SAB de CV (San Pedro Garza Garcia, Mexico) | Coupon: 2.25% | Maturity: 20/7/2028 | Rating: BB+ | ISIN: XS2362994068 | Z-spread up by 5.0 bp to 245.2 bp, with the yield to worst at 2.0% and the bond now trading down to 100.4 cents on the dollar (1Y price range: 99.2-100.8).

- Issuer: Ashland Services BV (Zwijndrecht, Netherlands) | Coupon: 2.00% | Maturity: 30/1/2028 | Rating: BB+ | ISIN: XS2103218538 | Z-spread up by 4.6 bp to 198.7 bp, with the yield to worst at 1.5% and the bond now trading down to 101.9 cents on the dollar (1Y price range: 98.4-102.2).

- Issuer: Cellnex Finance Company SA (Madrid, Spain) | Coupon: 2.00% | Maturity: 15/2/2033 | Rating: BB+ | ISIN: XS2300293003 | Z-spread up by 3.7 bp to 199.2 bp, with the yield to worst at 1.9% and the bond now trading down to 100.4 cents on the dollar (1Y price range: 96.0-101.4).

- Issuer: Cellnex Telecom SA (Barcelona, Spain) | Coupon: 1.75% | Maturity: 23/10/2030 | Rating: BB+ | ISIN: XS2247549731 | Z-spread up by 3.4 bp to 182.9 bp, with the yield to worst at 1.6% and the bond now trading down to 100.6 cents on the dollar (1Y price range: 96.7-101.5).

- Issuer: Telecom Italia Finance SA (Luxembourg, Luxembourg) | Coupon: 7.75% | Maturity: 24/1/2033 | Rating: BB | ISIN: XS0161100515 | Z-spread up by 3.4 bp to 295.4 bp (CDS basis: -52.9bp), with the yield to worst at 2.5% and the bond now trading down to 147.1 cents on the dollar (1Y price range: 141.9-149.5).

- Issuer: Nokia Oyj (Espoo, Finland) | Coupon: 3.13% | Maturity: 15/5/2028 | Rating: BB | ISIN: XS2171872570 | Z-spread up by 3.0 bp to 135.3 bp (CDS basis: -22.9bp), with the yield to worst at 0.9% and the bond now trading down to 113.0 cents on the dollar (1Y price range: 108.4-113.2).

- Issuer: Netflix Inc (Los Gatos, California (US)) | Coupon: 4.63% | Maturity: 15/5/2029 | Rating: BB+ | ISIN: XS2076099865 | Z-spread up by 2.9 bp to 132.9 bp, with the yield to worst at 1.0% and the bond now trading down to 126.3 cents on the dollar (1Y price range: 120.0-128.0).

- Issuer: TechnipFMC PLC (London, United Kingdom) | Coupon: 4.50% | Maturity: 30/6/2025 | Rating: BB | ISIN: XS2197326437 | Z-spread down by 2.7 bp to 250.5 bp (CDS basis: -23.2bp), with the yield to worst at 2.1% and the bond now trading up to 108.9 cents on the dollar (1Y price range: 103.4-109.0).

- Issuer: Renault SA (Boulogne-Billancourt, France) | Coupon: 2.50% | Maturity: 1/4/2028 | Rating: BB | ISIN: FR0014002OL8 | Z-spread down by 4.2 bp to 233.7 bp (CDS basis: -47.1bp), with the yield to worst at 1.9% and the bond now trading up to 102.7 cents on the dollar (1Y price range: 98.4-102.9).

- Issuer: Adler Group SA (Senningerberg, Luxembourg) | Coupon: 2.25% | Maturity: 27/4/2027 | Rating: BB+ | ISIN: XS2336188029 | Z-spread down by 6.3 bp to 329.5 bp, with the yield to worst at 2.8% and the bond now trading up to 96.4 cents on the dollar (1Y price range: 94.3-100.2).

- Issuer: Banca IFIS SpA (Venice, Italy) | Coupon: 1.75% | Maturity: 25/6/2024 | Rating: BB+ | ISIN: XS2124192654 | Z-spread down by 19.8 bp to 177.9 bp, with the yield to worst at 1.3% and the bond now trading up to 101.2 cents on the dollar (1Y price range: 97.1-101.2).