Credit

Slight Underperformance Of IG, As Credit Markets Calm Compared To Equities

Not a lot of activity in the primary market: MPH issued US$ 1.05bn and Cheniere Corpus Christi US$ 750m

Published ET

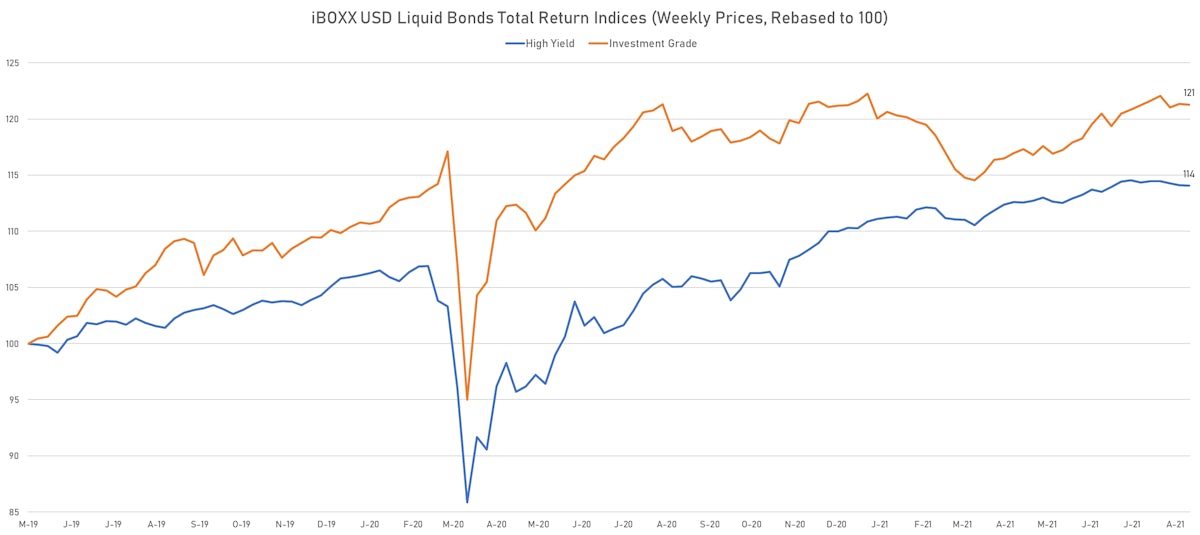

iBOXX USD Liquid IG & HY Total Return Indices | Sources: ϕpost, Refinitiv data

QUICK SUMMARY

- S&P 500 Bond Index was down -0.07% today, with investment grade down -0.08% and high yield down -0.04% (YTD total return: -0.14%)

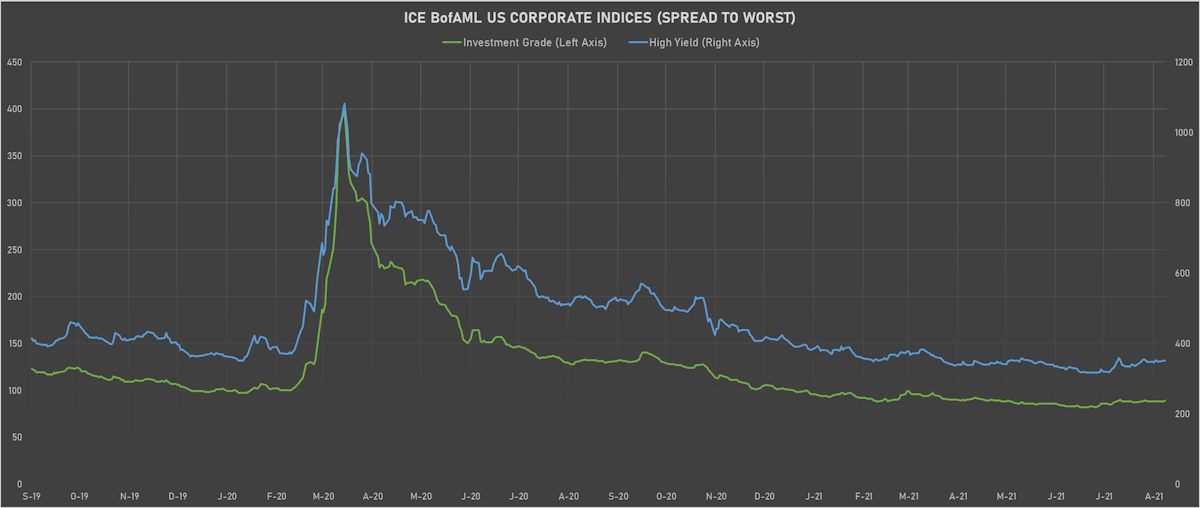

- ICE BofA US Corporate Index (Investment Grade) spread to worst up 1.0 bp, now at 89.0 bp (YTD change: -9.0 bp)

- ICE BofA US High Yield Index spread to worst unchanged, now at 351.0 bp (YTD change: -39.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index up 0.02% today (YTD total return: +2.1%)

- New issues: US$ 3.1bn in dollars and € 1.0bn in euros

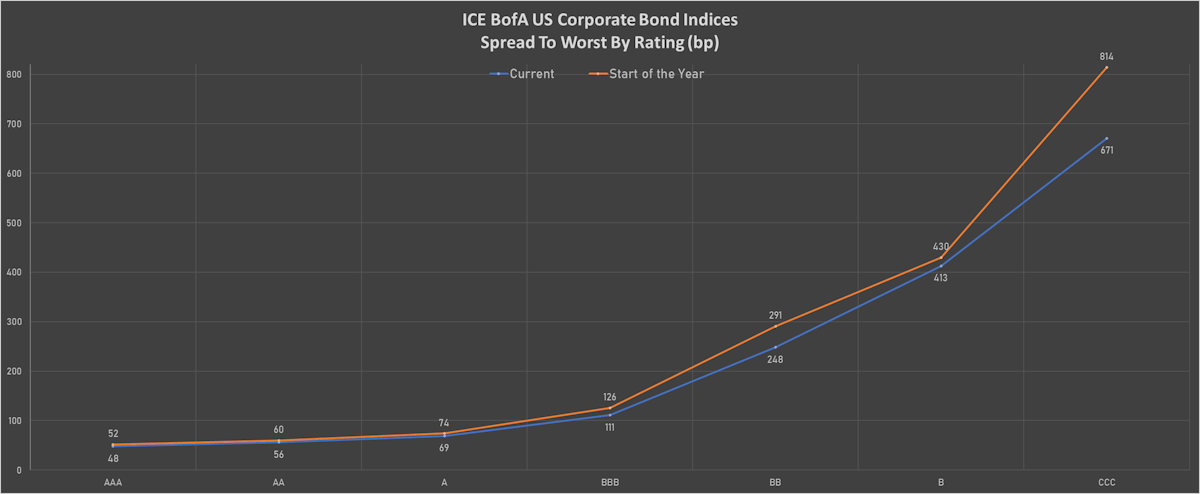

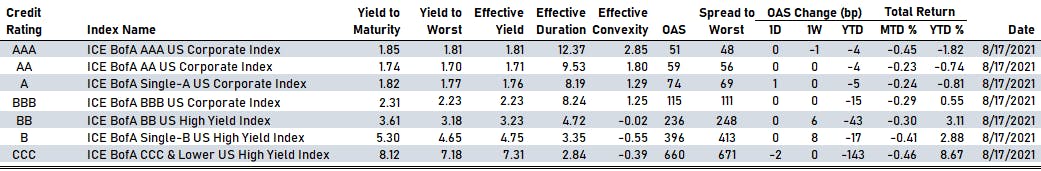

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

- AAA unchanged at 51 bp

- AA unchanged at 59 bp

- A up by 1 bp at 74 bp

- BBB unchanged at 115 bp

- BB unchanged at 236 bp

- B unchanged at 396 bp

- CCC down by -2 bp at 660 bp

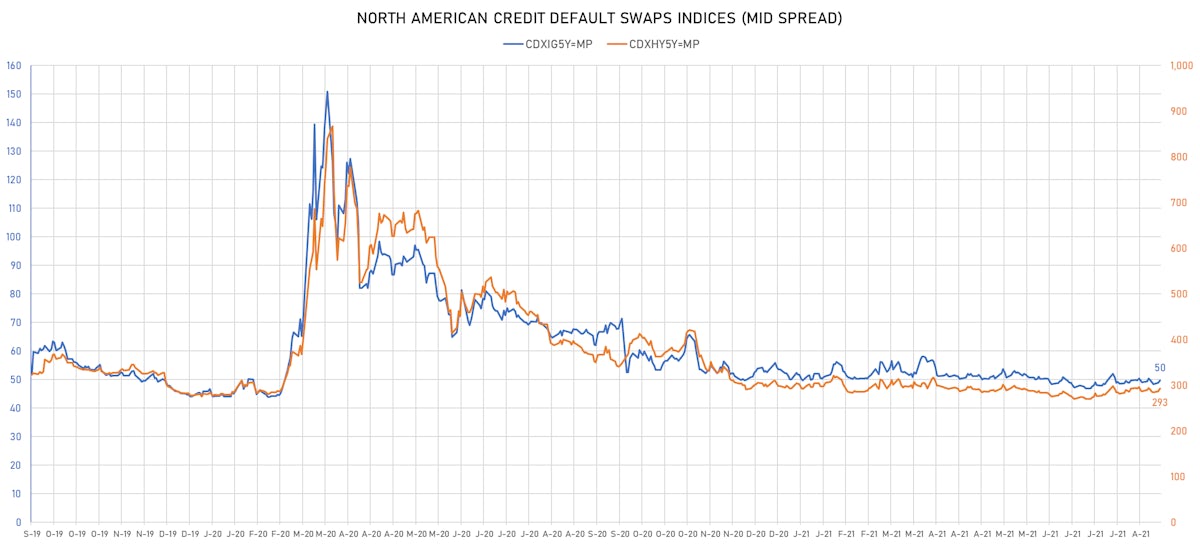

CDS INDICES (mid-spreads)

- Markit CDX.NA.IG 5Y up 0.9 bp, now at 50bp (YTD change: -0.3bp)

- Markit CDX.NA.HY 5Y up 6.4 bp, now at 293bp (YTD change: -0.4bp)

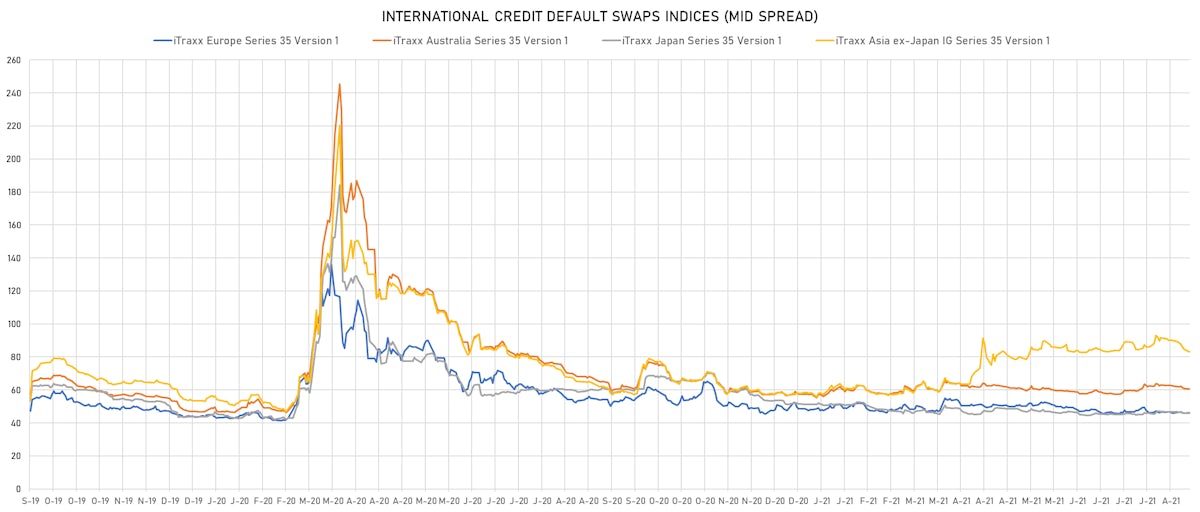

- Markit iTRAXX Europe up 0.3 bp, now at 46bp (YTD change: -1.5bp)

- Markit iTRAXX Japan down 0.3 bp, now at 46bp (YTD change: -5.8bp)

- Markit iTRAXX Asia Ex-Japan up 0.4 bp, now at 83bp (YTD change: +25.4bp)

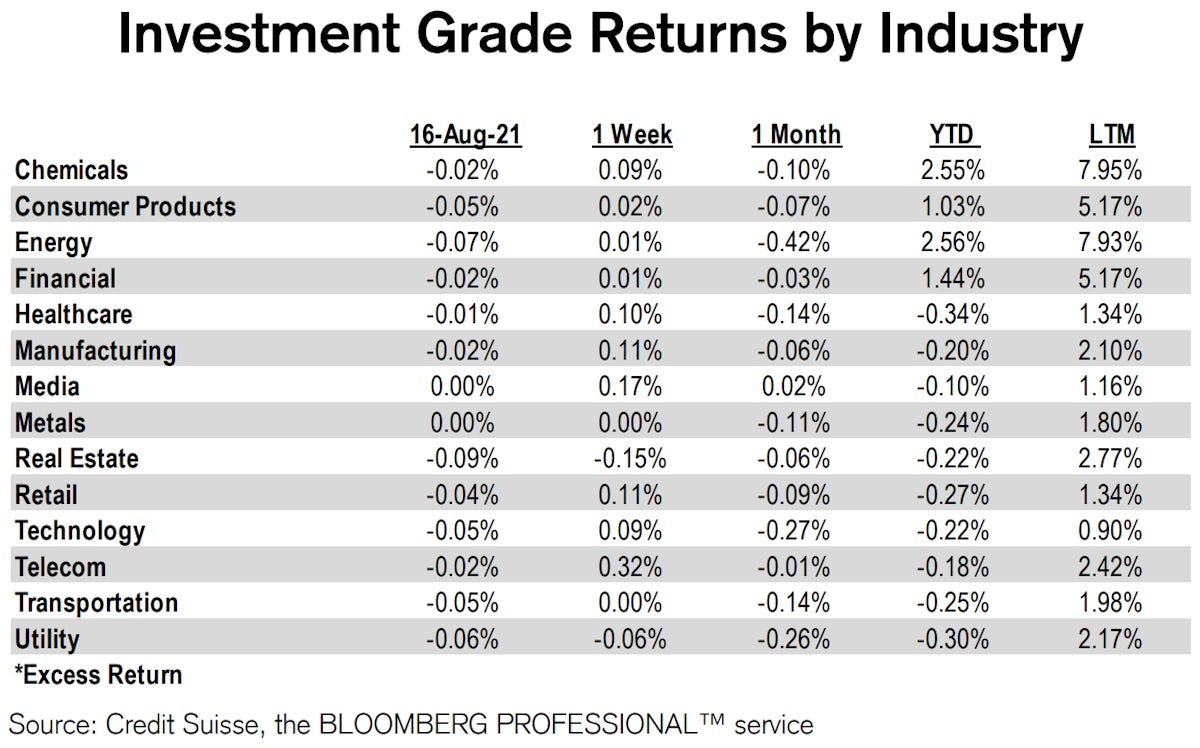

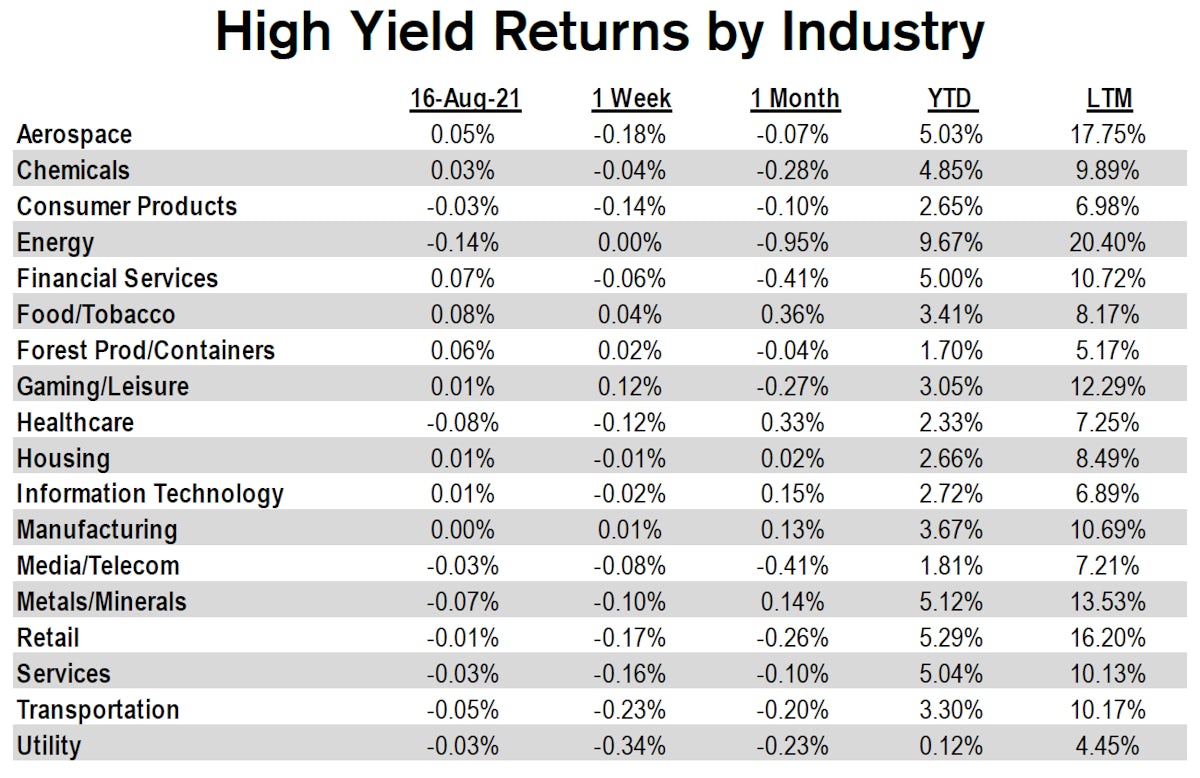

PERFORMANCE OF US IG & HY BONDS BY INDUSTRY

USD BOND ISSUES

- Cheniere Corpus Christi Holdings LLC (Oil and Gas | Houston, Texas, United States | Rating: NR): US$750m Note (US16412XAK19), fixed rate (2.74% coupon) maturing on 31 December 2039, priced at 100.00 (original spread of 150 bp), with a make whole call

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: NR): US$185m Bond (US3133EM3E00), fixed rate (0.61% coupon) maturing on 23 May 2025, priced at 100.00, callable (4nc3m)

- MPH Acquisition Holdings LLC (Industrials - Other | New York City, United States | Rating: B+): US$1,050m Note (US553283AD43), fixed rate (5.50% coupon) maturing on 1 September 2028, priced at 100.00 (original spread of 446 bp), callable (7nc3)

- Public Service Electric And Gas Co (Utility - Other | Newark, New Jersey, United States | Rating: A): US$425m Note (US74456QCH74), fixed rate (1.90% coupon) maturing on 15 August 2031, priced at 99.76 (original spread of 68 bp), callable (10nc10)

- Assured Guaranty US Holdings Inc (Financial - Other | New York City, Bermuda | Rating: A): US$400m Senior Note (US04621WAE03), fixed rate (3.60% coupon) maturing on 15 September 2051, priced at 99.82 (original spread of 170 bp), callable (30nc30)

- Central Nippon Expressway Co Ltd (Transportation - Other | Nagoya, Aichi-Ken, Japan | Rating: AA+): US$300m Senior Note (XS2378544543), fixed rate (1.17% coupon) maturing on 21 August 2026, priced at 100.00 (original spread of 43 bp), non callable

EUR BOND ISSUES

- Berlin Hyp AG (Banking | Berlin, Berlin, Germany | Rating: AA): €500m Hypothekenpfandbrief (Covered Bond) (DE000BHY0HZ2), fixed rate (0.01% coupon) maturing on 24 August 2026, priced at 102.08 (original spread of 34 bp), non callable

- Hessen, State of (Official and Muni | Wiesbaden, Hessen, Germany | Rating: AA+): €500m Jumbo Landesschatzanweisung (DE000A1RQD68) zero coupon maturing on 11 August 2025, priced at 102.06 (original spread of 28 bp), non callable

NEW LOANS

- Haza Foods of Louisiana LLC, signed a US$ 268m Term Loan A maturing on 08/13/26, to be used for general corporate purposes.

- Encina Equip Fin SPV LLC, signed a US$ 375m Revolving Credit Facility maturing on 10/16/23, to be used for general corporate purposes.

- Asklepios Kliniken GmbH & Co K, signed a € 550m Revolving Credit Facility maturing on 08/13/26, to be used for general corporate purposes.

- OCM System One Buyer CTB LLC (B-), signed a US$ 320m Term Loan B, to be used for general corporate purposes. It matures on 03/02/28 and initial pricing is set at LIBOR +400bps

- SoftBank Group Corp (BB+), signed a US$ 3,730m 364d Revolver maturing on 08/12/22, to be used for general corporate purposes