Credit

USD Corporate Bonds Rise On Tighter Spreads, Lower Rates

Very few new corporate issues today in USD or Euros, a modest start to what should be one of the slowest weeks of the year

Published ET

iBOXX USD Liquid IG & HY Bonds Total Return Indices | Sources: ϕpost, Refinitiv data

QUICK SUMMARY

- The iBoxx USD Liquid Investment Grade Total Return Index was up 0.16% today (Month-to-date: -0.29%; Year-to-date: -0.44%)

- The iBoxx USD Liquid High Yield Total Return Index was up 0.22% today (Month-to-date: -0.12%; Year-to-date: 3.11%)

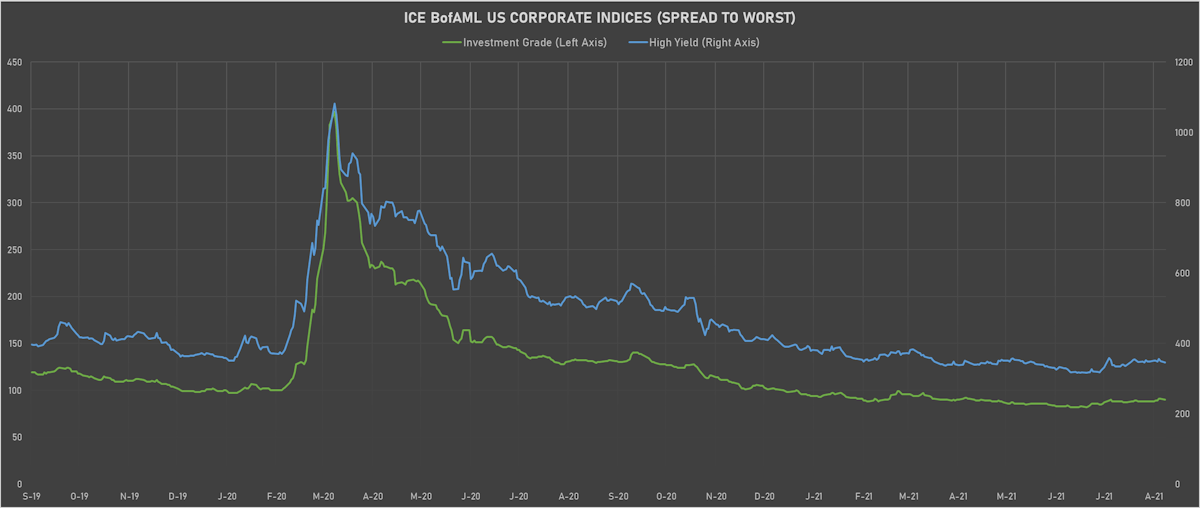

- ICE BofA US Corporate Index (Investment Grade) spread to worst down -1.0 bp, now at 90.0 bp (YTD change: -8.0 bp)

- ICE BofA US High Yield Index spread to worst down -4.0 bp, now at 346.0 bp (YTD change: -44.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index up 0.06% today (YTD total return: +2.2%)

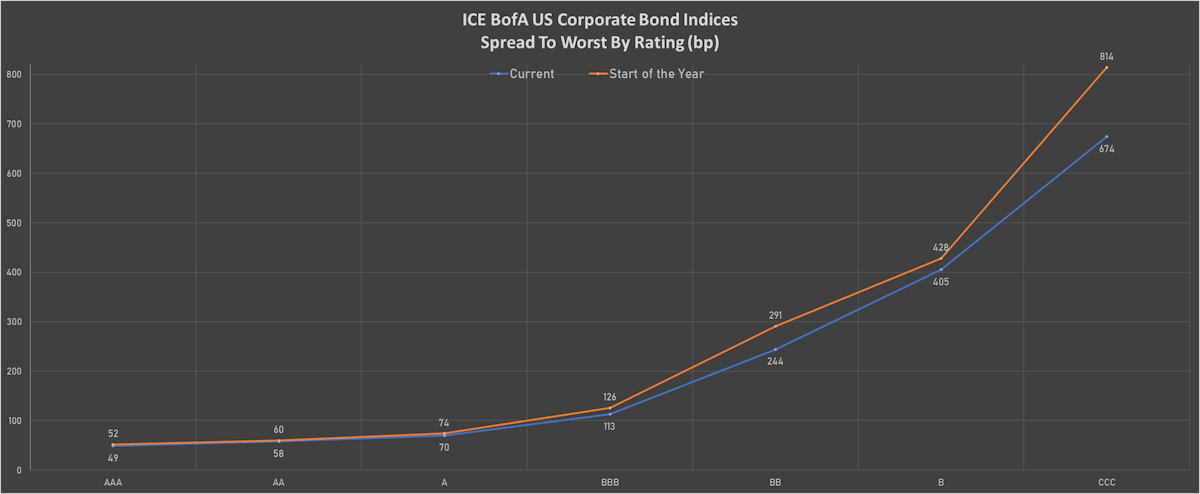

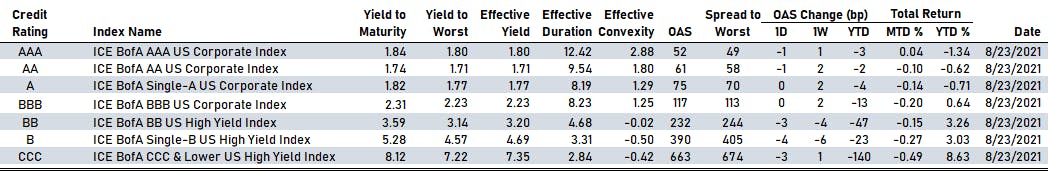

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

- AAA down by -1 bp at 52 bp

- AA down by -1 bp at 61 bp

- A unchanged at 75 bp

- BBB unchanged at 117 bp

- BB down by -3 bp at 232 bp

- B down by -4 bp at 390 bp

- CCC down by -3 bp at 663 bp

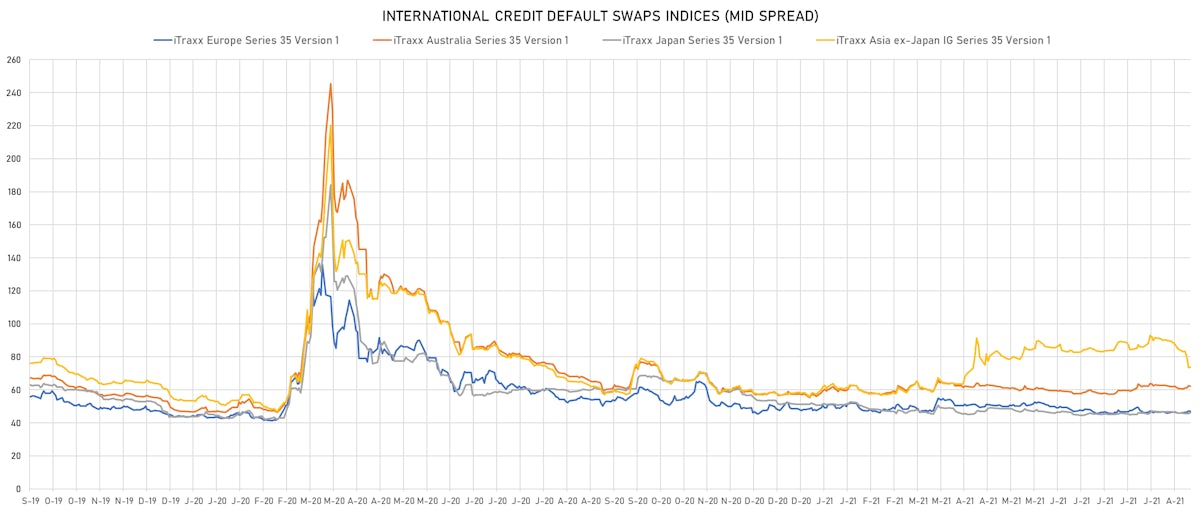

CDS INDICES (mid-spreads)

- Markit CDX.NA.IG 5Y down 1.1 bp, now at 49bp (YTD change: -1.4bp)

- Markit CDX.NA.HY 5Y down 7.1 bp, now at 285bp (YTD change: -8.1bp)

- Markit iTRAXX Europe down 1.1 bp, now at 46bp (YTD change: -1.9bp)

- Markit iTRAXX Japan down 0.1 bp, now at 46bp (YTD change: -5.4bp)

- Markit iTRAXX Asia Ex-Japan down 0.6 bp, now at 73bp (YTD change: +15.0bp)

TOP BONDS MOVES IN THE PAST WEEK - USD HY

- Issuer: Resorts World Las Vegas LLC (Las Vegas, Nevada (US)) | Coupon: 4.63% | Maturity: 16/4/2029 | Rating: BB | ISIN: USU76198AA52 | Z-spread up by 58.8 bp to 345.6 bp, with the yield to worst at 4.5% and the bond now trading down to 100.5 cents on the dollar (1Y price range: 98.1-105.8).

- Issuer: Guacolda Energia SA (LAS CONDES, Chile) | Coupon: 4.56% | Maturity: 30/4/2025 | Rating: B+ | ISIN: USP3711HAF66 | Z-spread up by 37.8 bp to 1,831.8 bp, with the yield to worst at 18.4% and the bond now trading down to 63.0 cents on the dollar (1Y price range: 53.5-92.1).

- Issuer: Jersey Central Power & Light Co (Akron, Ohio (US)) | Coupon: 4.70% | Maturity: 1/4/2024 | Rating: BB+ | ISIN: USU04536AC95 | Z-spread up by 32.8 bp to 101.6 bp (CDS basis: -64.1bp), with the yield to worst at 1.3% and the bond now trading down to 107.6 cents on the dollar (1Y price range: 107.6-109.8).

- Issuer: YPF SA (Buenos Aires, Argentina) | Coupon: 6.95% | Maturity: 21/7/2027 | Rating: CCC | ISIN: USP989MJBL47 | Z-spread up by 31.3 bp to 1,373.2 bp, with the yield to worst at 14.0% and the bond now trading down to 71.9 cents on the dollar (1Y price range: 56.6-72.8).

- Issuer: TBC bank'i SS (Tbilisi, Georgia) | Coupon: 5.75% | Maturity: 19/6/2024 | Rating: BB- | ISIN: XS1843434363 | Z-spread up by 29.8 bp to 294.2 bp, with the yield to worst at 3.0% and the bond now trading down to 106.3 cents on the dollar (1Y price range: 104.0-110.0).

- Issuer: Wynn Las Vegas LLC (Las Vegas, Nevada (US)) | Coupon: 5.25% | Maturity: 15/5/2027 | Rating: B+ | ISIN: USU98347AL87 | Z-spread up by 26.4 bp to 376.7 bp, with the yield to worst at 4.5% and the bond now trading down to 102.8 cents on the dollar (1Y price range: 101.5-108.1).

- Issuer: Petroleos Mexicanos (MIGUEL HIDALGO, Mexico) | Coupon: 6.88% | Maturity: 16/10/2025 | Rating: BB- | ISIN: USP7S08VBZ31 | Z-spread up by 26.4 bp to 376.6 bp (CDS basis: -31.2bp), with the yield to worst at 4.4% and the bond now trading down to 108.9 cents on the dollar (1Y price range: 107.8-111.8).

- Issuer: Vedanta Resources Finance II PLC (London, United Kingdom) | Coupon: 8.95% | Maturity: 11/3/2025 | Rating: B- | ISIN: USG9T27HAD62 | Z-spread up by 25.7 bp to 909.7 bp, with the yield to worst at 9.4% and the bond now trading down to 97.8 cents on the dollar (1Y price range: 93.5-99.8).

- Issuer: Royal Caribbean Cruises Ltd (Miami, Liberia) | Coupon: 4.25% | Maturity: 1/7/2026 | Rating: B | ISIN: USV7780TAF04 | Z-spread up by 23.9 bp to 472.3 bp (CDS basis: -64.7bp), with the yield to worst at 5.3% and the bond now trading down to 94.6 cents on the dollar (1Y price range: 94.1-100.9).

- Issuer: Syngenta Finance NV (Enkhuizen, Netherlands) | Coupon: 4.89% | Maturity: 24/4/2025 | Rating: BB | ISIN: USN84413CL06 | Z-spread up by 23.4 bp to 150.3 bp, with the yield to worst at 2.0% and the bond now trading down to 109.3 cents on the dollar (1Y price range: 100.0-110.9).

- Issuer: National Bank of Oman SAOG (Muscat, Oman) | Coupon: 5.63% | Maturity: 25/9/2023 | Rating: BB- | ISIN: XS1884006559 | Z-spread up by 22.1 bp to 276.5 bp, with the yield to worst at 2.9% and the bond now trading down to 105.1 cents on the dollar (1Y price range: 101.3-105.6).

- Issuer: Pennsylvania Electric Co (Akron, Ohio (US)) | Coupon: 3.25% | Maturity: 15/3/2028 | Rating: BB+ | ISIN: USU70842AC04 | Z-spread down by 23.8 bp to 97.5 bp (CDS basis: -28.0bp), with the yield to worst at 1.9% and the bond now trading up to 107.6 cents on the dollar (1Y price range: 102.0-108.5).

- Issuer: QNB Finansbank AS (#N/A, Turkey) | Coupon: 6.88% | Maturity: 7/9/2024 | Rating: B | ISIN: XS1959391019 | Z-spread down by 44.4 bp to 291.7 bp (CDS basis: -249.9bp), with the yield to worst at 3.3% and the bond now trading up to 109.9 cents on the dollar (1Y price range: 103.3-110.5).

- Issuer: Southeast Supply Header LLC (Houston, Texas (US)) | Coupon: 4.25% | Maturity: 15/6/2024 | Rating: BB- | ISIN: USU83854AB29 | Z-spread down by 61.3 bp to 335.5 bp, with the yield to worst at 3.4% and the bond now trading up to 101.0 cents on the dollar (1Y price range: 98.4-101.2).

TOP BONDS MOVES IN THE PAST WEEK - EUR HY

- Issuer: SoftBank Group Corp (Minato-Ku, Japan) | Coupon: 3.38% | Maturity: 6/7/2029 | Rating: BB+ | ISIN: XS2361255057 | Z-spread up by 31.2 bp to 433.2 bp, with the yield to worst at 4.0% and the bond now trading down to 95.5 cents on the dollar (1Y price range: 95.3-99.9).

- Issuer: Teva Pharmaceutical Finance Netherlands II BV (Amsterdam, Netherlands) | Coupon: 1.63% | Maturity: 15/10/2028 | Rating: BB- | ISIN: XS1439749364 | Z-spread up by 12.8 bp to 344.3 bp, with the yield to worst at 3.0% and the bond now trading down to 90.3 cents on the dollar (1Y price range: 87.1-92.6).

- Issuer: Renault SA (Boulogne-Billancourt, France) | Coupon: 2.38% | Maturity: 25/5/2026 | Rating: BB | ISIN: FR0014000NZ4 | Z-spread up by 12.3 bp to 216.6 bp (CDS basis: -62.2bp), with the yield to worst at 1.7% and the bond now trading down to 102.6 cents on the dollar (1Y price range: 99.5-102.9).

- Issuer: International Consolidated Airlines Group SA (London, Spain) | Coupon: 3.75% | Maturity: 25/3/2029 | Rating: B+ | ISIN: XS2322423539 | Z-spread up by 7.9 bp to 400.0 bp, with the yield to worst at 3.6% and the bond now trading down to 100.0 cents on the dollar (1Y price range: 97.5-102.0).

- Issuer: Rolls-Royce PLC (Birmingham, United Kingdom) | Coupon: 1.63% | Maturity: 9/5/2028 | Rating: BB- | ISIN: XS1819574929 | Z-spread up by 7.7 bp to 272.2 bp (CDS basis: -20.7bp), with the yield to worst at 2.3% and the bond now trading down to 95.1 cents on the dollar (1Y price range: 90.4-95.5).

- Issuer: Telecom Italia SpA (Rome, Italy) | Coupon: 5.25% | Maturity: 17/3/2055 | Rating: BB | ISIN: XS0214965963 | Z-spread up by 7.4 bp to 385.3 bp (CDS basis: -96.3bp), with the yield to worst at 3.7% and the bond now trading down to 123.2 cents on the dollar (1Y price range: 114.2-126.9).

- Issuer: Deutsche Lufthansa AG (Cologne, Germany) | Coupon: 3.50% | Maturity: 14/7/2029 | Rating: BB- | ISIN: XS2363235107 | Z-spread up by 6.8 bp to 360.3 bp (CDS basis: -52.7bp), with the yield to worst at 3.2% and the bond now trading down to 100.9 cents on the dollar (1Y price range: 97.7-102.1).

- Issuer: Fortune Star (BVI) Ltd (British Virgin Islands) | Coupon: 3.95% | Maturity: 2/10/2026 | Rating: BB- | ISIN: XS2357132849 | Z-spread up by 6.6 bp to 489.0 bp, with the yield to worst at 4.5% and the bond now trading down to 97.7 cents on the dollar (1Y price range: 96.7-102.1).

- Issuer: Ashland Services BV (Zwijndrecht, Netherlands) | Coupon: 2.00% | Maturity: 30/1/2028 | Rating: BB+ | ISIN: XS2103218538 | Z-spread up by 6.5 bp to 203.8 bp, with the yield to worst at 1.6% and the bond now trading down to 101.6 cents on the dollar (1Y price range: 98.4-102.2).

- Issuer: ZF Finance GmbH (Friedrichshafen, Germany) | Coupon: 3.75% | Maturity: 21/9/2028 | Rating: BB+ | ISIN: XS2231331260 | Z-spread up by 5.4 bp to 231.7 bp, with the yield to worst at 1.9% and the bond now trading down to 110.9 cents on the dollar (1Y price range: 105.4-112.7).

- Issuer: Nokia Oyj (Espoo, Finland) | Coupon: 3.13% | Maturity: 15/5/2028 | Rating: BB | ISIN: XS2171872570 | Z-spread up by 5.2 bp to 133.1 bp (CDS basis: -21.4bp), with the yield to worst at 0.9% and the bond now trading down to 113.2 cents on the dollar (1Y price range: 108.4-113.4).

- Issuer: Bulgarian Energy Holding EAD (Sofia, Bulgaria) | Coupon: 2.45% | Maturity: 22/7/2028 | Rating: BB | ISIN: XS2367164576 | Z-spread up by 5.1 bp to 281.6 bp (CDS basis: -212.2bp), with the yield to worst at 2.4% and the bond now trading down to 99.5 cents on the dollar (1Y price range: 98.5-100.0).

- Issuer: Adler Group SA (Senningerberg, Luxembourg) | Coupon: 2.25% | Maturity: 14/1/2029 | Rating: BB+ | ISIN: XS2283225477 | Z-spread up by 4.9 bp to 341.5 bp, with the yield to worst at 3.0% and the bond now trading down to 94.1 cents on the dollar (1Y price range: 92.8-98.9).

- Issuer: Netflix Inc (Los Gatos, California (US)) | Coupon: 3.63% | Maturity: 15/6/2030 | Rating: BB+ | ISIN: XS2072829794 | Z-spread up by 4.6 bp to 136.0 bp, with the yield to worst at 1.0% and the bond now trading down to 120.2 cents on the dollar (1Y price range: 112.9-121.8).

- Issuer: Schaeffler AG (Herzogenaurach, Germany) | Coupon: 3.38% | Maturity: 12/10/2028 | Rating: BB+ | ISIN: DE000A3H2TA0 | Z-spread down by 28.4 bp to 158.5 bp, with the yield to worst at 1.1% and the bond now trading up to 113.7 cents on the dollar (1Y price range: 108.0-113.9).

USD BOND ISSUES

- Black Hills Corp (Utility - Other | Rapid City, United States | Rating: BBB): US$600m Senior Note (US092113AU39), fixed rate (1.04% coupon) maturing on 23 August 2024, priced at 100.00 (original spread of 92 bp), callable (3nc6m)

- Charah Solutions Inc (Service - Other | Louisville, Kentucky, United States | Rating: NR): US$135m Senior Note (US15957P2048), fixed rate (8.50% coupon) maturing on 31 August 2026, priced at 100.00 (original spread of 782 bp), callable (5nc2)

- Bank of Nova Scotia (Banking | Toronto, Ontario, Canada | Rating: A): US$250m Unsecured Note (XS2377129353) zero coupon maturing on 8 September 2061, priced at 100.00, non callable

EUR BOND ISSUES

- Mediobanca International Luxembourg SA (Banking | Luxembourg, Italy | Rating: NR): €200m Unsecured Note (XS2377391912), floating rate maturing on 10 February 2027, priced at 100.00, non callable

NEW LOANS

- Safariland LLC, signed a US$ 141m Term Loan A, maturing on 08/31/26, with initial pricing set at LIBOR +200bps

- South Jersey Industries Inc (BBB), signed a US$ 1,000m Term Loan, to be used for general corporate purposes.

- Hub Truck Rental Corp, signed a US$ 110m Term Loan, to be used for acquisition financing. It matures on 06/26/26 and initial pricing is set at LIBOR +200bps