Credit

HY Cash Rises As Spreads Tighten Significantly, IG Falls With Higher Rates

Decent volumes of bond issuance today as European agencies and corporates have woken up from their summer slumber

Published ET

Royal Caribbean & Carnival Corp 5Y USD CDS Spreads | Source: Refinitiv

QUICK SUMMARY

- S&P 500 Bond Index was down -0.18% today, with investment grade down -0.22% and high yield up 0.10% (YTD total return: -0.14%)

- The iBoxx USD Liquid Investment Grade Total Return Index was down -0.248% today (Month-to-date: -0.54%; Year-to-date: -0.69%)

- The iBoxx USD Liquid High Yield Total Return Index was up 0.162% today (Month-to-date: 0.04%; Year-to-date: 3.28%)

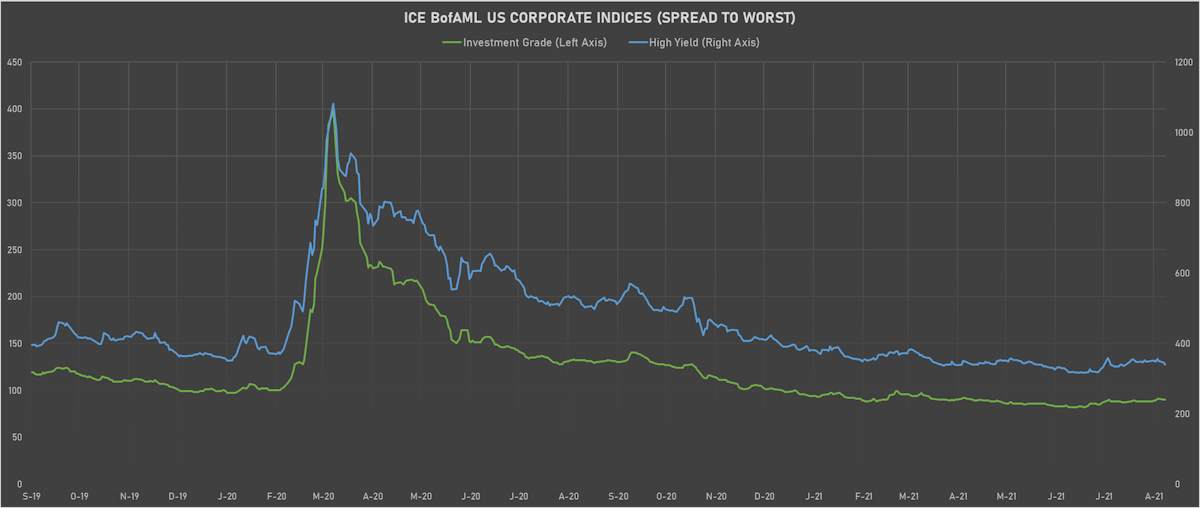

- ICE BofA US Corporate Index (Investment Grade) spread to worst unchanged, now at 90.0 bp (YTD change: -8.0 bp)

- ICE BofA US High Yield Index spread to worst down -6.0 bp, now at 340.0 bp (YTD change: -50.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index up 0.05% today (YTD total return: +2.3%)

- New issues: US$ 6.6bn in dollars and € 11.9bn in euros

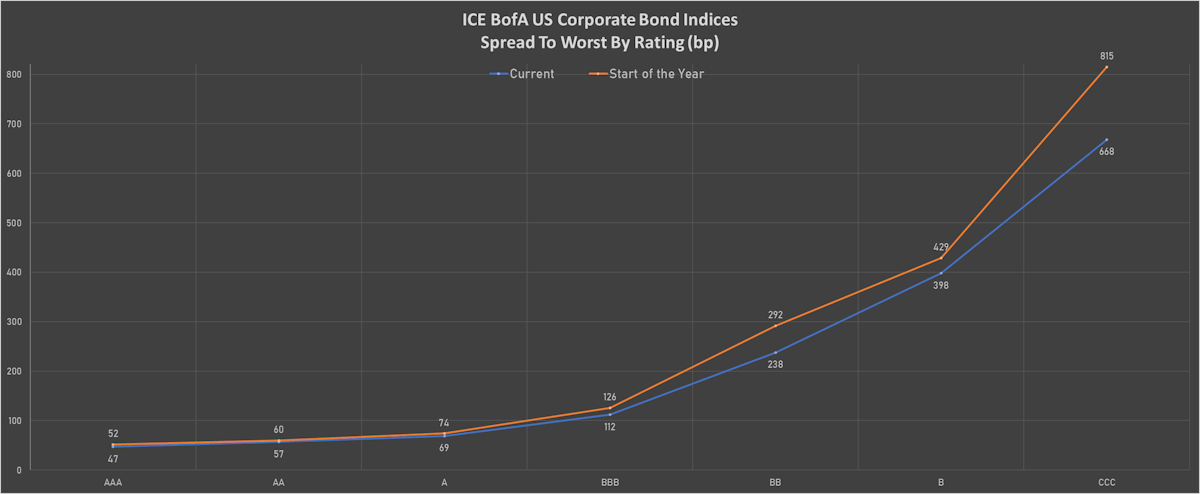

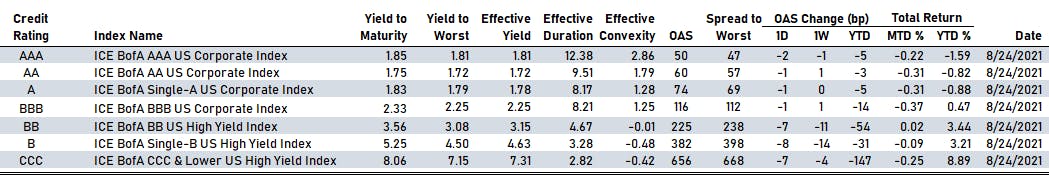

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

- AAA down by -2 bp at 50 bp

- AA down by -1 bp at 60 bp

- A down by -1 bp at 74 bp

- BBB down by -1 bp at 116 bp

- BB down by -7 bp at 225 bp

- B down by -8 bp at 382 bp

- CCC down by -7 bp at 656 bp

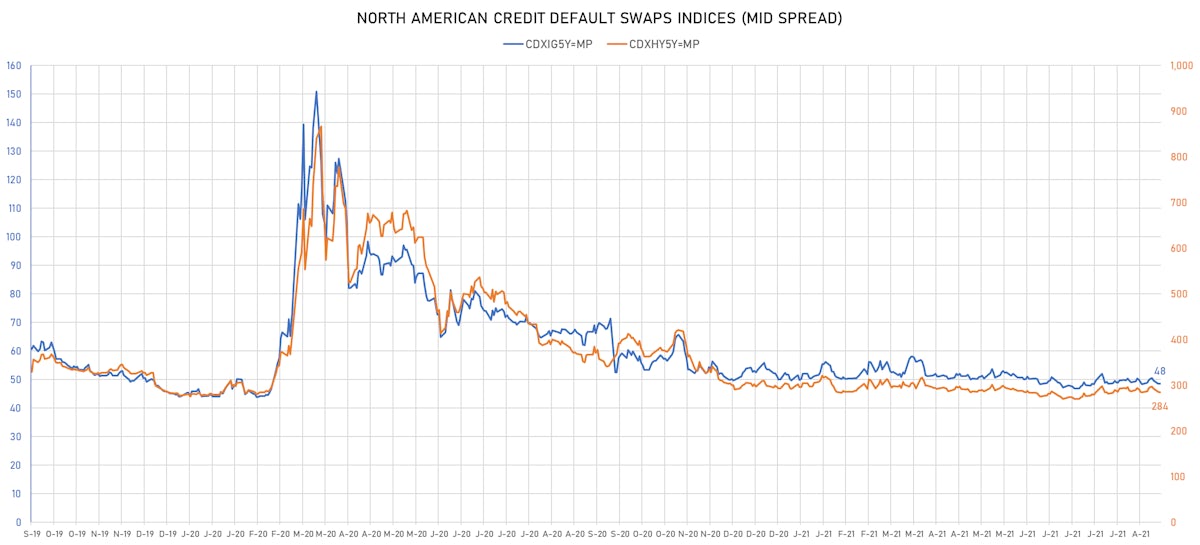

CDS INDICES (mid-spreads)

- Markit CDX.NA.IG 5Y down 0.1 bp, now at 48bp (YTD change: -1.5bp)

- Markit CDX.NA.HY 5Y down 1.1 bp, now at 284bp (YTD change: -9.1bp)

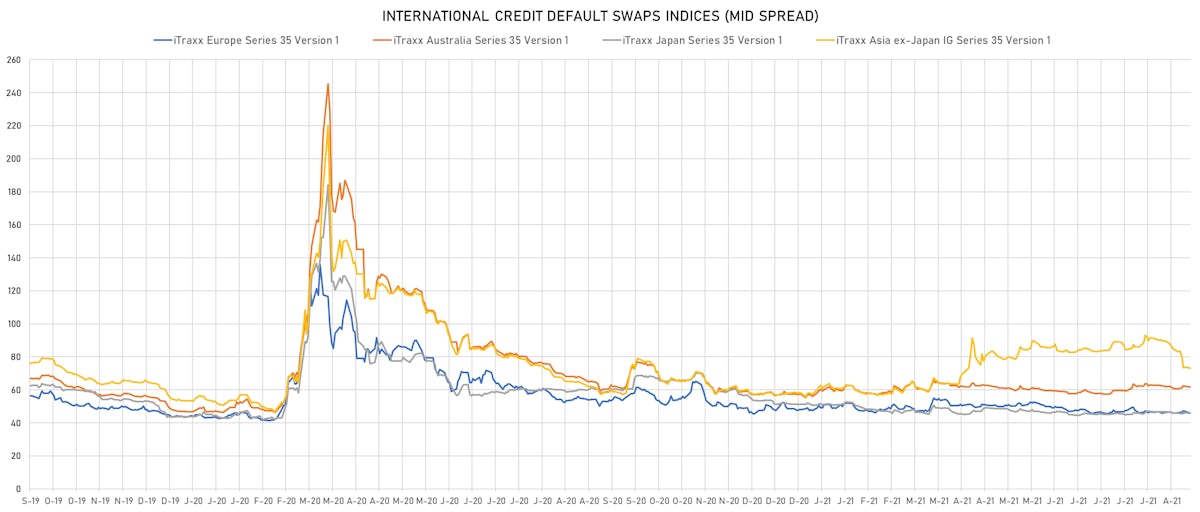

- Markit iTRAXX Europe down 0.2 bp, now at 46bp (YTD change: -2.1bp)

- Markit iTRAXX Japan down 0.7 bp, now at 45bp (YTD change: -6.0bp)

- Markit iTRAXX Asia Ex-Japan down 1.0 bp, now at 72bp (YTD change: +14.1bp)

LARGEST USD CORPORATE CDS MOVES IN THE PAST WEEK

- Macy's Inc (Country: US; rated: WD): down 55.6 bp to 222.1bp (1Y range: 206-1,253bp)

- Kohls Corp (Country: US; rated: BBB): down 16.9 bp to 115.0bp (1Y range: 109-332bp)

- American Axle & Manufacturing Inc (Country: US; rated: Ba1): down 16.8 bp to 383.7bp (1Y range: 336-581bp)

- Petroleo Brasileiro SA Petrobras (Country: BR; rated: B): up 13.5 bp to 216.4bp (1Y range: 175-315bp)

- NOVA Chemicals Corp (Country: CA; rated: Discontinued): up 13.8 bp to 252.5bp (1Y range: 243-394bp)

- MBIA Inc (Country: US; rated: Ba3): up 14.4 bp to 376.7bp (1Y range: 365-757bp)

- Sabre Holdings Corp (Country: US; rated: Ba3): up 19.5 bp to 398.5bp (1Y range: 337-611bp)

- Genworth Holdings Inc (Country: US; rated: Caa1): up 24.8 bp to 578.0bp (1Y range: 447-737bp)

- Royal Caribbean Cruises Ltd (Country: US; rated: LGD4 - 59%): up 25.4 bp to 423.6bp (1Y range: 318-1,291bp)

- RR Donnelley & Sons Co (Country: US; rated: B2): up 28.2 bp to 547.8bp (1Y range: 447-962bp)

- Carnival Corp (Country: US; rated: LGD5 - 72%): up 41.9 bp to 458.9bp (1Y range: 291-1,214bp)

- Apache Corp (Country: US; rated: WD): up 42.0 bp to 258.8bp (1Y range: 168-453bp)

- American Airlines Group Inc (Country: US; rated: B2): up 45.5 bp to 817.6bp (1Y range: 596-2,968bp)

- Domtar Corp (Country: US; rated: Baa3): up 75.0 bp to 313.0bp (1Y range: 64-331bp)

- Transocean Inc (Country: KY; rated: Caa3): up 478.0 bp to 2,780.5bp (1Y range: 941-7,695bp)

LARGEST EURO CORPORATE CDS MOVES IN THE PAST WEEK

- Casino Guichard Perrachon SA (Country: FR; rated: WR): down 23.2 bp to 519.6bp (1Y range: 494-1,210bp)

- Marks and Spencer PLC (Country: GB; rated: Ba1): down 9.0 bp to 175.3bp (1Y range: 162-349bp)

- Premier Foods Finance PLC (Country: ; rated: B1): down 7.0 bp to 165.9bp (1Y range: 141-273bp)

- Altice Finco SA (Country: LU; rated: Caa1): down 6.6 bp to 362.6bp (1Y range: 317-477bp)

- CMA CGM SA (Country: FR; rated: B1): down 4.9 bp to 314.2bp (1Y range: 309-734bp)

- Ardagh Packaging Finance PLC (Country: IE; rated: B1): up 5.3 bp to 215.2bp (1Y range: 188-272bp)

- Louis Dreyfus Co BV (Country: NL; rated: ): up 5.8 bp to 105.4bp (1Y range: -102bp)

- Rexel SA (Country: FR; rated: WR): up 6.8 bp to 105.6bp (1Y range: -104bp)

- Ladbrokes Coral Group Ltd (Country: GB; rated: WR): up 6.9 bp to 178.9bp (1Y range: 164-227bp)

- Air France KLM SA (Country: FR; rated: B-): up 7.8 bp to 420.0bp (1Y range: 392-1,211bp)

- Virgin Media Finance PLC (Country: GB; rated: WR): up 8.8 bp to 247.5bp (1Y range: 222-325bp)

- ArcelorMittal SA (Country: LU; rated: WR): up 9.8 bp to 126.7bp (1Y range: 123-248bp)

- Deutsche Lufthansa AG (Country: DE; rated: Ba2): up 14.6 bp to 271.0bp (1Y range: 236-421bp)

- Novafives SAS (Country: FR; rated: Caa1): up 15.7 bp to 895.0bp (1Y range: 716-1,205bp)

- TUI AG (Country: DE; rated: LGD4 - 50%): up 20.0 bp to 744.7bp (1Y range: 590-1,799bp)

USD BOND ISSUES

- Charles Schwab Corp (Securities | Westlake, United States | Rating: A): US$850m Senior Note (US808513BT10), fixed rate (1.95% coupon) maturing on 1 December 2031, priced at 99.83 (original spread of 68 bp), callable (10nc10)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$400m Bond (US3133EM3V25), floating rate (SOFR + 2.5 bp) maturing on 28 August 2023, priced at 100.00, non callable

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$310m Bond (US3133EM3T78), fixed rate (0.87% coupon) maturing on 1 September 2026, priced at 100.00 (original spread of 80 bp), callable (5nc1)

- Pricoa Global Funding I (Financial - Other | Wilmington, United States | Rating: NR): US$700m Note (US74153WCP23), fixed rate (1.20% coupon) maturing on 1 September 2026, priced at 99.77 (original spread of 45 bp), non callable

- European Investment Bank (Supranational | Luxembourg, Luxembourg | Rating: AAA): US$3,000m Senior Note (US298785JP29), fixed rate (0.75% coupon) maturing on 26 October 2026, priced at 99.40 (original spread of 10 bp), non callable

- Inventive Global Investments Ltd (Financial - Other | Tortola, British Virgin Islands | Rating: NR): US$300m Senior Note (XS2379487189), fixed rate (1.60% coupon) maturing on 1 September 2026, priced at 99.87 (original spread of 85 bp), non callable

- Inventive Global Investments Ltd (Financial - Other | Tortola, British Virgin Islands | Rating: NR): US$500m Senior Note (XS2379486884), fixed rate (1.10% coupon) maturing on 1 September 2024, priced at 99.87 (original spread of 70 bp), non callable

- Nomura International Funding Pte Ltd (Financial - Other | Singapore | Rating: NR): US$500m Unsecured Note (XS2218299134), floating rate maturing on 20 June 2026, priced at 100.00, non callable

EUR BOND ISSUES

- Aareal Bank AG (Banking | Wiesbaden, Germany | Rating: A-): €500m Inhaberschuldverschreibung (DE000AAR0298), fixed rate (0.05% coupon) maturing on 2 September 2026, priced at 99.90 (original spread of 80 bp), non callable

- BAWAG PSK Bank fuer Arbeit und Wirtschaft und Oesterreichische Postsparkasse AG (Banking | Wien, Austria | Rating: AAA): €500m Covered Bond (Other) (XS2380748439), fixed rate (0.01% coupon) maturing on 3 September 2029, priced at 101.91 (original spread of 41 bp), non callable

- Bewi ASA (Industrials - Other | Norway | Rating: NR): €160m Bond (SE0016276398), floating rate (EU03MLIB + 315.0 bp) maturing on 2 September 2026, callable (5nc1m)

- Bng Bank NV (Agency | S-Gravenhage, Netherlands | Rating: AAA): €1,750m Senior Note (XS2381566616) zero coupon maturing on 31 August 2028, priced at 102.25 (original spread of 33 bp), non callable

- Credit Suisse Ag London Branch (Banking | London, Switzerland | Rating: NR): €1,750m Senior Note (XS2381633150), floating rate (EU03MLIB + 100.0 bp) maturing on 1 September 2023, priced at 101.42, non callable

- Credit Suisse Ag London Branch (Banking | London, Switzerland | Rating: NR): €1,250m Senior Note (XS2381671671), fixed rate (0.25% coupon) maturing on 1 September 2028, priced at 99.18 (original spread of 101 bp), non callable

- EnBW Energie Baden Wuerttemberg AG (Utility - Other | Karlsruhe, Germany | Rating: BBB+): €500m Subordinated Note (XS2381272207), fixed rate (1.38% coupon) maturing on 31 August 2081, priced at 100.00 (original spread of 205 bp), callable (60nc7)

- EnBW Energie Baden Wuerttemberg AG (Utility - Other | Karlsruhe, Germany | Rating: BBB+): €500m Subordinated Note (XS2381277008), fixed rate (2.13% coupon) maturing on 31 August 2081, priced at 100.00 (original spread of 260 bp), callable (60nc11)

- Finland, Republic of (Government) (Sovereign | Helsinki, Finland | Rating: AA+): €3,000m Bond (FI4000511449) zero coupon maturing on 15 September 2026, priced at 103.22 (original spread of 11 bp), non callable

- Investitionsbank Berlin (Banking | Berlin, Germany | Rating: AAA): €500m Inhaberschuldverschreibung (DE000A289KG5), fixed rate (0.01% coupon) maturing on 15 July 2027, priced at 102.24 (original spread of 36 bp), non callable

- Societe du Grand Paris (Agency | Saint-Denis, France | Rating: AA): €1,500m Bond (FR00140058G6), fixed rate (0.30% coupon) maturing on 2 September 2036, priced at 99.23, non callable

NEW LOANS

- Fairbanks Morse LLC, signed a US$ 203m Term Loan B, to be used for acquisition financing. It matures on 06/23/28 and initial pricing is set at LIBOR +475bps

- ONGC Videsh Ltd (BBB-), signed a US$ 500m Revolving Credit / Term Loan maturing on 8/24/26, to be used for refinancing / returning bank debt