Credit

Spreads Compress Across The Credit Complex, Though IG Bonds Fall With Higher Rates

After widening markedly since the start of the third quarter, spreads on Single-Bs and CCCs have tightened significantly in the last couple of days

Published ET

Option-adjusted spreads on US Corporate Single Bs and CCCs | Source: Refinitiv

QUICK SUMMARY

- S&P 500 Bond Index was down -0.24% today, with investment grade down -0.27% and high yield up 0.05% (YTD total return: -0.38%)

- The iBoxx USD Liquid Investment Grade Total Return Index was down -0.32% today (Month-to-date: -0.85%; Year-to-date: -1.00%)

- The iBoxx USD Liquid High Yield Total Return Index was up 0.08% today (Month-to-date: 0.13%; Year-to-date: 3.36%)

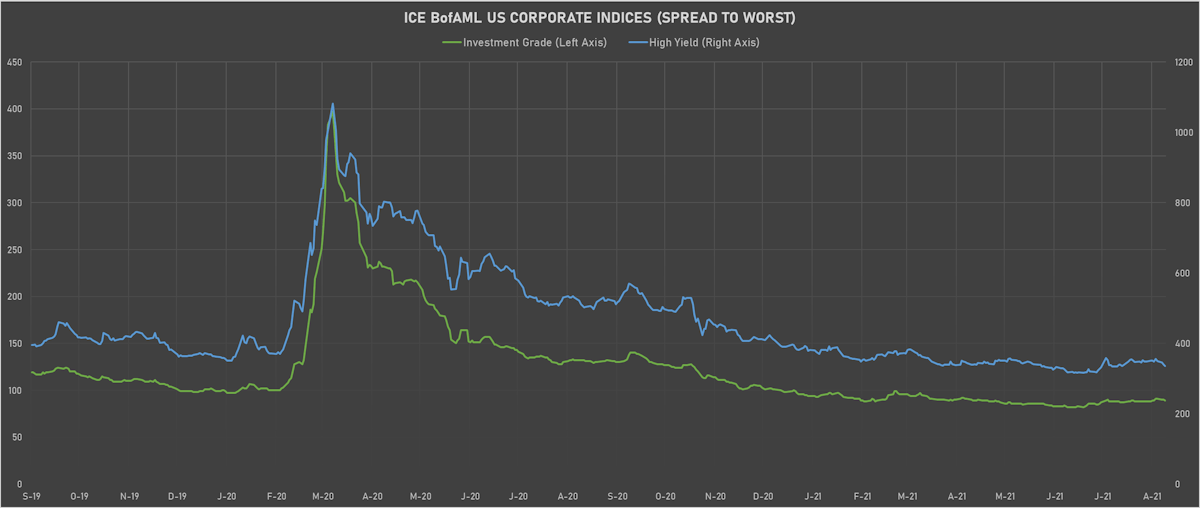

- ICE BofA US Corporate Index (Investment Grade) spread to worst down -1.0 bp, now at 89.0 bp (YTD change: -9.0 bp)

- ICE BofA US High Yield Index spread to worst down -4.0 bp, now at 336.0 bp (YTD change: -54.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index up 0.06% today (YTD total return: +2.3%)

- New issues: US$ 2.5bn in dollars and € 4.1bn in euros

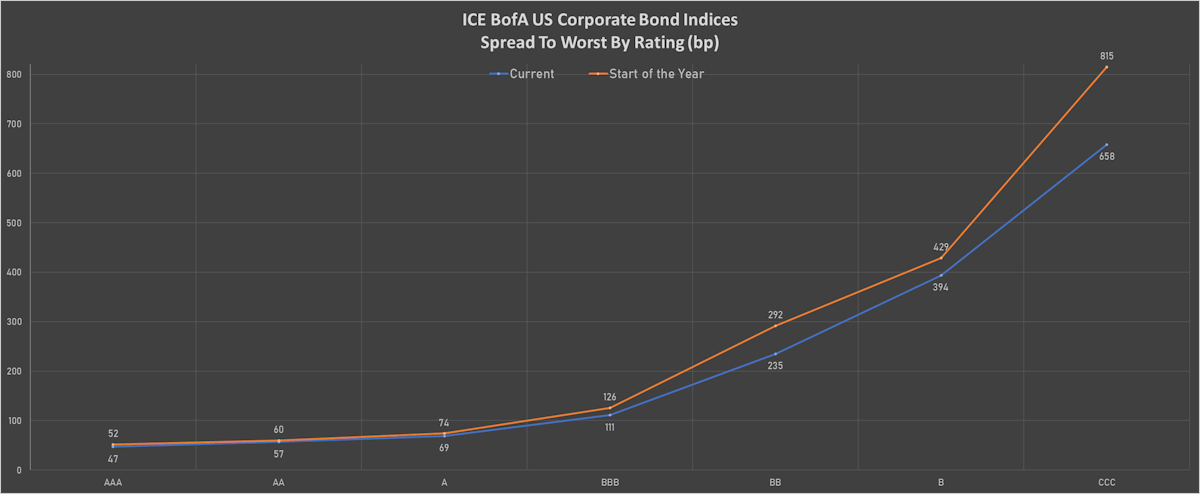

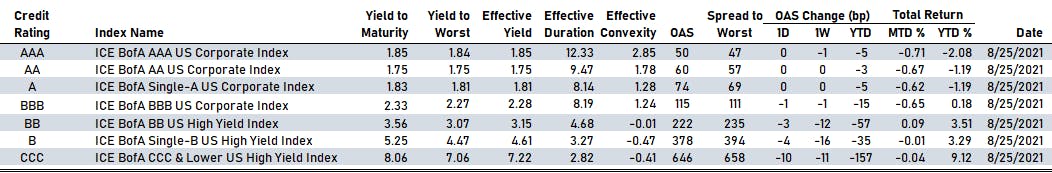

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

- AAA unchanged at 50 bp

- AA unchanged at 60 bp

- A unchanged at 74 bp

- BBB down by -1 bp at 115 bp

- BB down by -3 bp at 222 bp

- B down by -4 bp at 378 bp

- CCC down by -10 bp at 646 bp

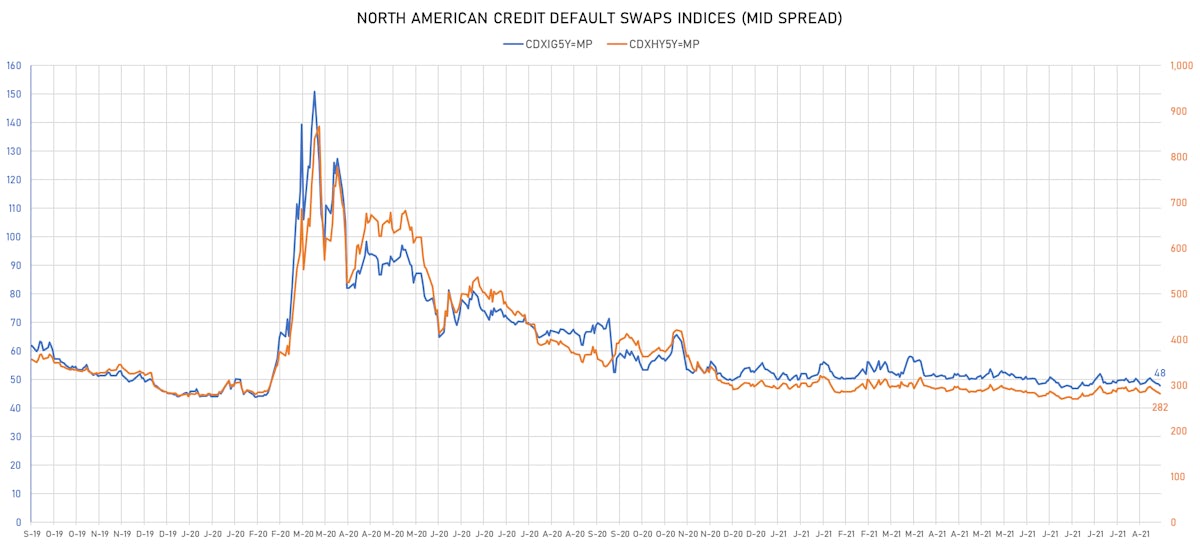

CDS INDICES (mid-spreads)

- Markit CDX.NA.IG 5Y down 0.7 bp, now at 48bp (YTD change: -2.2bp)

- Markit CDX.NA.HY 5Y down 2.3 bp, now at 282bp (YTD change: -11.5bp)

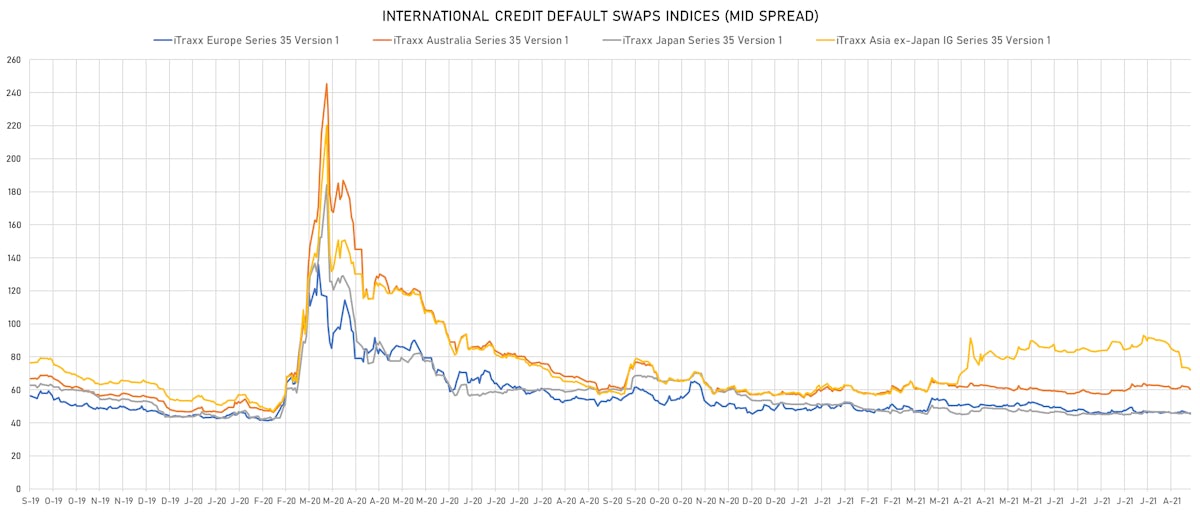

- Markit iTRAXX Europe down 0.2 bp, now at 46bp (YTD change: -2.4bp)

- Markit iTRAXX Japan down 0.5 bp, now at 45bp (YTD change: -6.5bp)

- Markit iTRAXX Asia Ex-Japan down 0.4 bp, now at 72bp (YTD change: +13.7bp)

TOP BONDS MOVES IN THE PAST WEEK - USD HY

- Issuer: Resorts World Las Vegas LLC (Las Vegas, Nevada (US)) | Coupon: 4.63% | Maturity: 16/4/2029 | Rating: BB | ISIN: USU76198AA52 | Z-spread up by 59.0 bp to 343.3 bp, with the yield to worst at 4.6% and the bond now trading down to 100.1 cents on the dollar (1Y price range: 98.1-105.8).

- Issuer: EnLink Midstream LLC (Dallas, Texas (US)) | Coupon: 5.63% | Maturity: 15/1/2028 | Rating: BB | ISIN: USU26790AB82 | Z-spread down by 32.3 bp to 375.5 bp, with the yield to worst at 4.6% and the bond now trading up to 104.3 cents on the dollar (1Y price range: 96.8-107.4).

- Issuer: Petroleos Mexicanos (MIGUEL HIDALGO, Mexico) | Coupon: 6.88% | Maturity: 16/10/2025 | Rating: BB- | ISIN: USP7S08VBZ31 | Z-spread down by 38.1 bp to 362.1 bp (CDS basis: -16.0bp), with the yield to worst at 4.3% and the bond now trading up to 109.2 cents on the dollar (1Y price range: 107.8-111.8).

- Issuer: Royal Caribbean Cruises Ltd (Miami, Liberia) | Coupon: 5.50% | Maturity: 1/4/2028 | Rating: B | ISIN: USV7780TAE39 | Z-spread down by 38.7 bp to 446.1 bp (CDS basis: -54.3bp), with the yield to worst at 5.4% and the bond now trading up to 99.8 cents on the dollar (1Y price range: 97.7-105.9).

- Issuer: American Airlines Group Inc (Fort Worth, Texas (US)) | Coupon: 3.75% | Maturity: 1/3/2025 | Rating: CCC | ISIN: USU0242AAD47 | Z-spread down by 39.4 bp to 687.7 bp (CDS basis: 37.2bp), with the yield to worst at 7.3% and the bond now trading up to 88.9 cents on the dollar (1Y price range: 71.0-93.1).

- Issuer: Grupo de Inversiones Suramericana SA (Medellin, Colombia) | Coupon: 5.50% | Maturity: 29/4/2026 | Rating: BB+ | ISIN: USG42036AB25 | Z-spread down by 39.7 bp to 242.4 bp, with the yield to worst at 3.1% and the bond now trading up to 109.3 cents on the dollar (1Y price range: 107.0-114.6).

- Issuer: Carnival Corp (Miami, Panama) | Coupon: 5.75% | Maturity: 1/3/2027 | Rating: B | ISIN: USP2121VAL82 | Z-spread down by 40.8 bp to 436.9 bp (CDS basis: -41.0bp), with the yield to worst at 5.1% and the bond now trading up to 102.0 cents on the dollar (1Y price range: 99.1-106.5).

- Issuer: EQM Midstream Partners LP (Canonsburg, Pennsylvania (US)) | Coupon: 6.50% | Maturity: 1/7/2027 | Rating: BB- | ISIN: USU26886AB46 | Z-spread down by 42.7 bp to 325.2 bp, with the yield to worst at 4.0% and the bond now trading up to 111.0 cents on the dollar (1Y price range: 106.5-113.5).

- Issuer: YPF SA (Buenos Aires, Argentina) | Coupon: 6.95% | Maturity: 21/7/2027 | Rating: CCC | ISIN: USP989MJBL47 | Z-spread down by 59.7 bp to 1,300.2 bp, with the yield to worst at 13.4% and the bond now trading up to 73.9 cents on the dollar (1Y price range: 56.6-73.9).

- Issuer: Vedanta Resources Finance II PLC (London, United Kingdom) | Coupon: 8.95% | Maturity: 11/3/2025 | Rating: B- | ISIN: USG9T27HAD62 | Z-spread down by 86.1 bp to 833.1 bp, with the yield to worst at 8.5% and the bond now trading up to 99.8 cents on the dollar (1Y price range: 93.5-100.4).

TOP BONDS MOVES IN THE PAST WEEK - EUR HY

- Issuer: Fortune Star (BVI) Ltd (British Virgin Islands) | Coupon: 3.95% | Maturity: 2/10/2026 | Rating: BB- | ISIN: XS2357132849 | Z-spread up by 15.8 bp to 492.2 bp, with the yield to worst at 4.5% and the bond now trading down to 97.5 cents on the dollar (1Y price range: 96.5-102.1).

- Issuer: Teva Pharmaceutical Finance Netherlands II BV (Amsterdam, Netherlands) | Coupon: 1.88% | Maturity: 31/3/2027 | Rating: BB- | ISIN: XS1211044075 | Z-spread up by 7.7 bp to 358.6 bp, with the yield to worst at 3.1% and the bond now trading down to 93.0 cents on the dollar (1Y price range: 90.5-95.4).

- Issuer: Telecom Italia Finance SA (Luxembourg, Luxembourg) | Coupon: 7.75% | Maturity: 24/1/2033 | Rating: BB | ISIN: XS0161100515 | Z-spread down by 6.1 bp to 293.1 bp (CDS basis: -56.2bp), with the yield to worst at 2.5% and the bond now trading up to 146.9 cents on the dollar (1Y price range: 141.9-149.5).

- Issuer: ZF Finance GmbH (Friedrichshafen, Germany) | Coupon: 3.75% | Maturity: 21/9/2028 | Rating: BB+ | ISIN: XS2231331260 | Z-spread down by 6.4 bp to 232.8 bp, with the yield to worst at 1.8% and the bond now trading up to 110.6 cents on the dollar (1Y price range: 105.4-112.7).

- Issuer: Bulgarian Energy Holding EAD (Sofia, Bulgaria) | Coupon: 2.45% | Maturity: 22/7/2028 | Rating: BB | ISIN: XS2367164576 | Z-spread down by 6.6 bp to 281.3 bp (CDS basis: -212.3bp), with the yield to worst at 2.4% and the bond now trading up to 99.3 cents on the dollar (1Y price range: 98.5-100.0).

- Issuer: Verallia SAS (Courbevoie, France) | Coupon: 1.63% | Maturity: 14/5/2028 | Rating: BB+ | ISIN: FR0014003G27 | Z-spread down by 6.8 bp to 146.5 bp, with the yield to worst at 1.1% and the bond now trading up to 102.6 cents on the dollar (1Y price range: 99.0-102.9).

- Issuer: Mahle GmbH (Stuttgart, Germany) | Coupon: 2.38% | Maturity: 14/5/2028 | Rating: BB+ | ISIN: XS2341724172 | Z-spread down by 6.9 bp to 277.4 bp, with the yield to worst at 2.4% and the bond now trading up to 99.1 cents on the dollar (1Y price range: 97.7-100.9).

- Issuer: Elis SA (Saint-Cloud, France) | Coupon: 1.63% | Maturity: 3/4/2028 | Rating: BB | ISIN: FR0013449998 | Z-spread down by 7.6 bp to 176.5 bp, with the yield to worst at 1.4% and the bond now trading up to 100.7 cents on the dollar (1Y price range: 95.8-101.0).

- Issuer: Nemak SAB de CV (San Pedro Garza Garcia, Mexico) | Coupon: 2.25% | Maturity: 20/7/2028 | Rating: BB+ | ISIN: XS2362994068 | Z-spread down by 9.7 bp to 247.1 bp, with the yield to worst at 2.1% and the bond now trading up to 100.1 cents on the dollar (1Y price range: 99.2-100.8).

- Issuer: Autostrade per l'Italia SpA (Rome, Italy) | Coupon: 2.00% | Maturity: 15/1/2030 | Rating: BB- | ISIN: XS2278566299 | Z-spread down by 11.9 bp to 151.0 bp (CDS basis: -18.3bp), with the yield to worst at 1.2% and the bond now trading up to 105.0 cents on the dollar (1Y price range: 98.1-105.3).

- Issuer: Schaeffler AG (Herzogenaurach, Germany) | Coupon: 3.38% | Maturity: 12/10/2028 | Rating: BB+ | ISIN: DE000A3H2TA0 | Z-spread down by 14.7 bp to 154.2 bp, with the yield to worst at 1.1% and the bond now trading up to 113.7 cents on the dollar (1Y price range: 108.0-114.1).

- Issuer: Adler Group SA (Senningerberg, Luxembourg) | Coupon: 2.25% | Maturity: 27/4/2027 | Rating: BB+ | ISIN: XS2336188029 | Z-spread down by 15.4 bp to 335.8 bp, with the yield to worst at 2.9% and the bond now trading up to 96.0 cents on the dollar (1Y price range: 94.3-100.2).

- Issuer: Petroleos Mexicanos (Miguel Hidalgo, Mexico) | Coupon: 2.75% | Maturity: 21/4/2027 | Rating: BB- | ISIN: XS1172951508 | Z-spread down by 15.6 bp to 445.4 bp (CDS basis: -59.6bp), with the yield to worst at 4.0% and the bond now trading up to 93.2 cents on the dollar (1Y price range: 89.3-94.8).

USD BOND ISSUES

- Federal Home Loan Banks (Agency | Washington, United States | Rating: AA+): US$210m Bond (US3133EM4B51), fixed rate (1.87% coupon) maturing on 1 September 2033, priced at 100.00 (original spread of 180 bp), callable (12nc1)

- Federal Home Loan Banks (Agency | Washington, United States | Rating: NR): US$150m Bond (US3130ANV980), fixed rate (1.12% coupon) maturing on 22 September 2026, priced at 100.00 (original spread of 104 bp), callable (5nc1m)

- China Merchants Bank Co Ltd (Luxembourg Branch) (Banking | Luxembourg, China (Mainland) | Rating: A-): US$300m Bond (XS2379392397), fixed rate (1.25% coupon) maturing on 1 September 2026, priced at 99.54 (original spread of 55 bp), non callable

- China Merchants Bank Co Ltd (Luxembourg Branch) (Banking | Luxembourg, China (Mainland) | Rating: A-): US$300m Bond (XS2379392124), floating rate (SOFR + 50.0 bp) maturing on 1 September 2023, priced at 100.00, non callable

- Municipality Finance Plc (Agency | Helsinki, Finland | Rating: AA+): US$1,000m Senior Note (US62630CEF41), fixed rate (0.88% coupon) maturing on 2 September 2026, priced at 99.79 (original spread of 11 bp), non callable

- Nomura International Funding Pte Ltd (Financial - Other | Singapore | Rating: NR): US$500m Unsecured Note (XS2218299134), floating rate maturing on 20 June 2026, priced at 100.00, non callable

EUR BOND ISSUES

- Bank of Nova Scotia (Banking | Toronto, Ontario, Canada | Rating: A): €750m Senior Note (XS2381362966), fixed rate (0.25% coupon) maturing on 1 November 2028, priced at 99.96 (original spread of 86 bp), non callable

- Muenchener Rueckversicherungs Gesellschaft AG in Muenchen (Financial - Other | Muenchen, Bayern, Germany | Rating: A): €1,000m Bond (XS2381261424), floating rate maturing on 26 May 2042, priced at 99.36 (original spread of 150 bp), callable (21nc10)

- National Grid PLC (Service - Other | London, United Kingdom | Rating: BBB-): €650m Senior Note (XS2381853436), fixed rate (0.75% coupon) maturing on 1 September 2033, priced at 98.67 (original spread of 129 bp), callable (12nc12)

- Nederlandse Waterschapsbank NV (Agency | S-Gravenhage, Netherlands | Rating: AAA): €1,000m Bond (XS2382267750) zero coupon maturing on 8 September 2031, priced at 101.16 (original spread of 33 bp), non callable

- Raiffeisen Bank International AG (Banking | Wien, Austria | Rating: A-): €500m Note (XS2381599898), fixed rate (0.05% coupon) maturing on 1 September 2027, priced at 99.76 (original spread of 78 bp), non callable

- Sagax EURO MTN NL BV (Financial - Other | Rotterdam, Sweden | Rating: NR): €200m Senior Note (XS2381873384), fixed rate (1.00% coupon) maturing on 17 May 2029, priced at 101.02 (original spread of 149 bp), callable (8nc7)

NEW LOANS

- VPower Holdings Ltd, signed a US$ 172m Term Loan, to be used for general corporate purposes, initial pricing is set at LIBOR +275bps

NEW ISSUES IN SECURITIZED CREDIT

- Golden Creek Asset Trust 2021-Nqm4 issued a fixed-rate RMBS in 5 tranches, for a total of US$ 260 m. Highest-rated tranche offering a yield to maturity of 1.09%, and the lowest-rated tranche a yield to maturity of 3.37%. Bookrunners: Credit Suisse