Credit

Credit Spreads Edge Down, US Corporate Bonds Rise Despite Equities Fall

Very little bond issuance today, with a just handful of deals priced in the US and Europe

Published ET

Palmer Square CLO Indices | Sources: ϕpost, Refinitiv data

QUICK SUMMARY

- The iBoxx USD Liquid Investment Grade Total Return Index was up 0.088% today (Month-to-date: -0.77%; Year-to-date: -0.91%)

- The iBoxx USD Liquid High Yield Total Return Index was up 0.030% today (Month-to-date: 0.16%; Year-to-date: 3.39%)

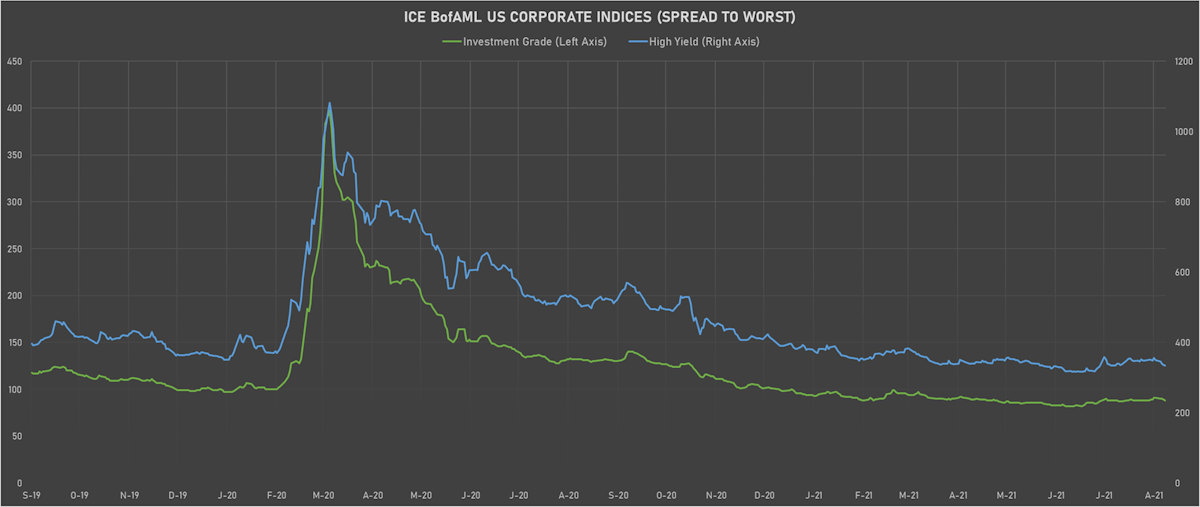

- ICE BofA US Corporate Index (Investment Grade) spread to worst down -1.0 bp, now at 88.0 bp (YTD change: -10.0 bp)

- ICE BofA US High Yield Index spread to worst down -2.0 bp, now at 334.0 bp (YTD change: -56.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index up 0.03% today (YTD total return: +2.3%)

- New issues: US$ .6bn in dollars and € 4.0bn in euros

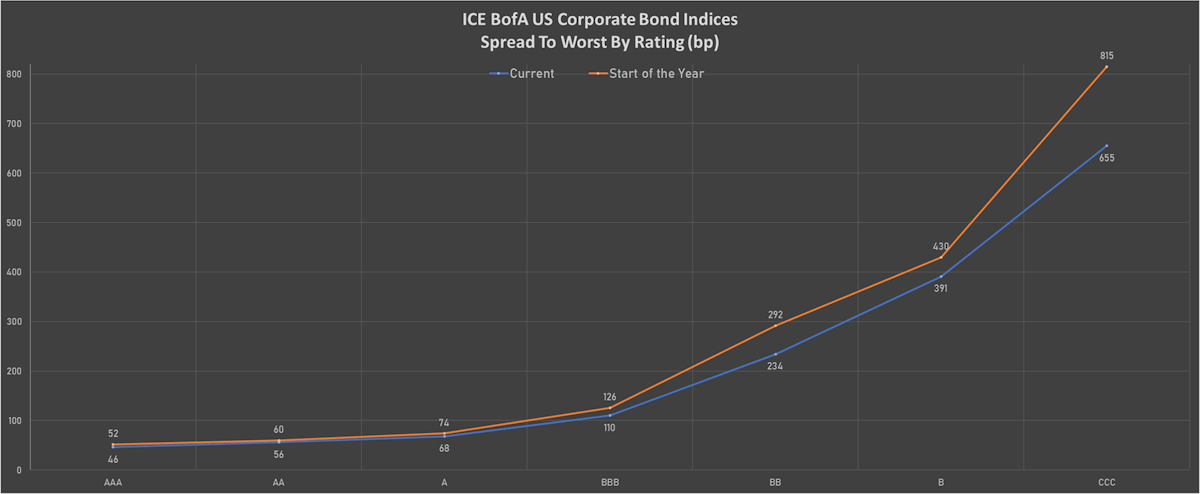

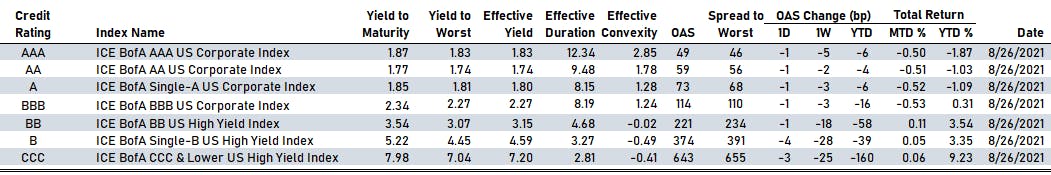

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

- AAA down by -1 bp at 49 bp

- AA down by -1 bp at 59 bp

- A down by -1 bp at 73 bp

- BBB down by -1 bp at 114 bp

- BB down by -1 bp at 221 bp

- B down by -4 bp at 374 bp

- CCC down by -3 bp at 643 bp

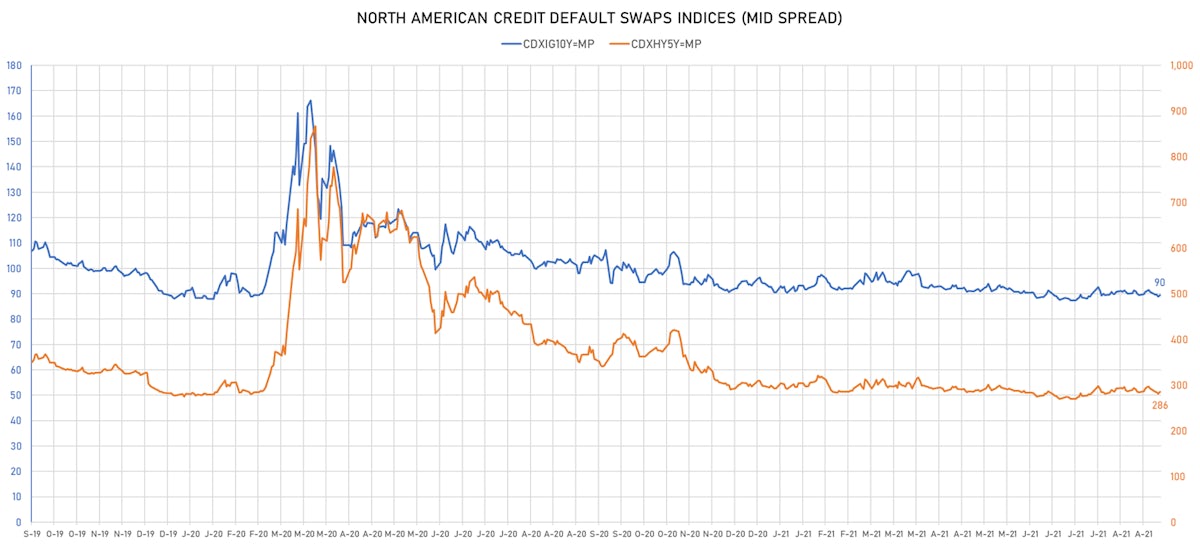

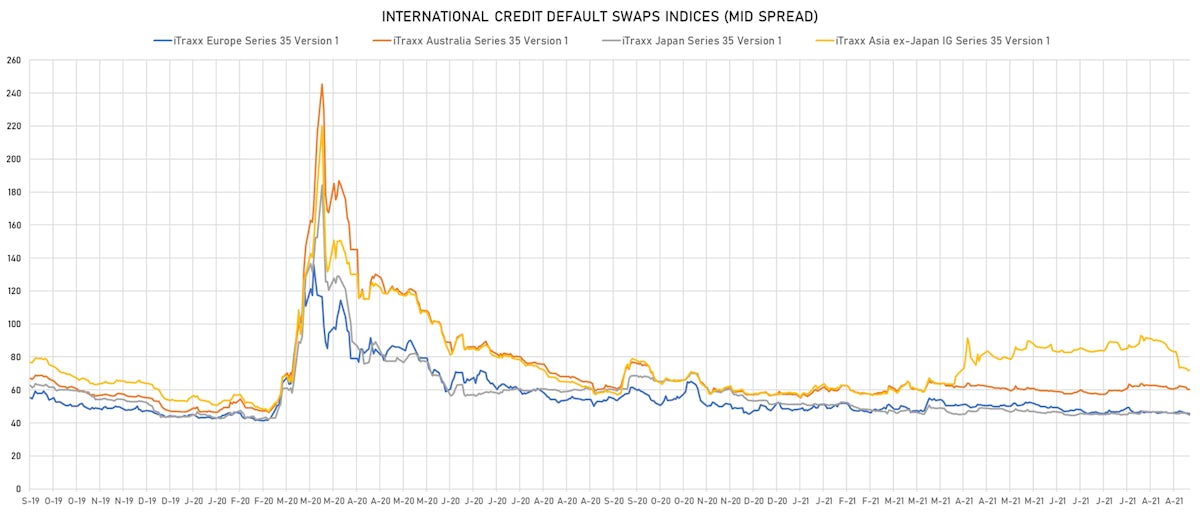

CDS INDICES (mid-spreads)

- Markit CDX.NA.IG 5Y up 0.7 bp, now at 90bp (YTD change: -1.0bp)

- Markit CDX.NA.HY 5Y up 3.9 bp, now at 286bp (YTD change: -7.6bp)

- Markit iTRAXX Europe up 0.4 bp, now at 46bp (YTD change: -2.0bp)

- Markit iTRAXX Japan down 0.3 bp, now at 45bp (YTD change: -6.8bp)

- Markit iTRAXX Asia Ex-Japan down 0.7 bp, now at 71bp (YTD change: +13.1bp)

USD BOND ISSUES

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$190m Bond (US3133EM4H22), fixed rate (2.20% coupon) maturing on 2 September 2036, priced at 100.00 (original spread of 213 bp), callable (15nc1)

- Huainan Construction Development Holding Group Co Ltd (Leasing | Huainan, China (Mainland) | Rating: NR): US$200m Senior Note (XS2366190366), fixed rate (2.80% coupon) maturing on 2 September 2024, priced at 100.00, non callable

- Singapore Exchange Ltd (Securities | Singapore | Rating: AA): US$250m Senior Note (XS2380226659), fixed rate (1.23% coupon) maturing on 3 September 2026, priced at 100.00 (original spread of 40 bp), callable (5nc5)

EUR BOND ISSUES

- Deutsche Bank AG (Banking | Frankfurt, Germany | Rating: BBB): €500m Inhaberschuldverschreibung (DE000DB9U4V1), floating rate maturing on 16 September 2031, priced at 100.00, non callable

- Japan Finance Organization for Municipalities (Agency | Chiyoda-Ku, Tokyo-To, Japan | Rating: A+): €1,000m Senior Note (XS2377379461), fixed rate (0.10% coupon) maturing on 3 September 2031, priced at 99.80 (original spread of 54 bp), non callable

- Jyske Bank A/S (Banking | Silkeborg, Denmark | Rating: A): €500m Note (XS2382849888), fixed rate (0.05% coupon) maturing on 2 September 2026, priced at 99.79 (original spread of 86 bp), callable (5nc4)

- Schleswig-Holstein, State of (Official and Muni | Kiel, Germany | Rating: AAA): €1,000m Jumbo Landesschatzanweisung (DE000SHFM816), fixed rate (0.01% coupon) maturing on 2 September 2025, priced at 101.99 (original spread of 28 bp), non callable

- Svenska Handelsbanken AB (Banking | Stockholm, Stockholm, Sweden | Rating: AA-): €1,000m Note (XS2345317510), fixed rate (0.05% coupon) maturing on 6 September 2028, priced at 99.71 (original spread of 72 bp), non callable

NEW LOANS

- LendingTree Inc (BB-), signed a US$ 250m Term Loan B, to be used for refinancing. It matures on 08/24/28 and initial pricing is set at LIBOR +400bps

- Faurecia SA (BB), signed a € 5,500m Bridge Loan, to be used for acquisition financing. It matures on 08/24/22.

- Axcel Management A/S, signed a € 800m Term Loan, to be used for general corporate purposes

- Livanova PLC, signed a US$ 125m Revolving Credit Facility, to be used for general corporate purposes. It matures on 08/24/26 and initial pricing is set at LIBOR +300bps

- Lanxess AG (BBB-), signed a US$ 1,300m Term Loan, to be used for acquisition financing.

- Lockheed Martin Corp (A-), signed a US$ 3,000m Revolving Credit Facility, to be used for general corporate purposes. It matures on 08/24/26 and initial pricing is set at LIBOR +69bps

- VPower Holdings Ltd, signed a US$ 172m Term Loan, to be used for general corporate purposes. It matures on 01/00/00 and initial pricing is set at LIBOR +275bps

- China Aviation Intl Hldg Co, signed a US$ 150m Term Loan, to be used for general corporate purposes, and capital expenditures. It matures on 08/24/24 and initial pricing is set at LIBOR +140bps

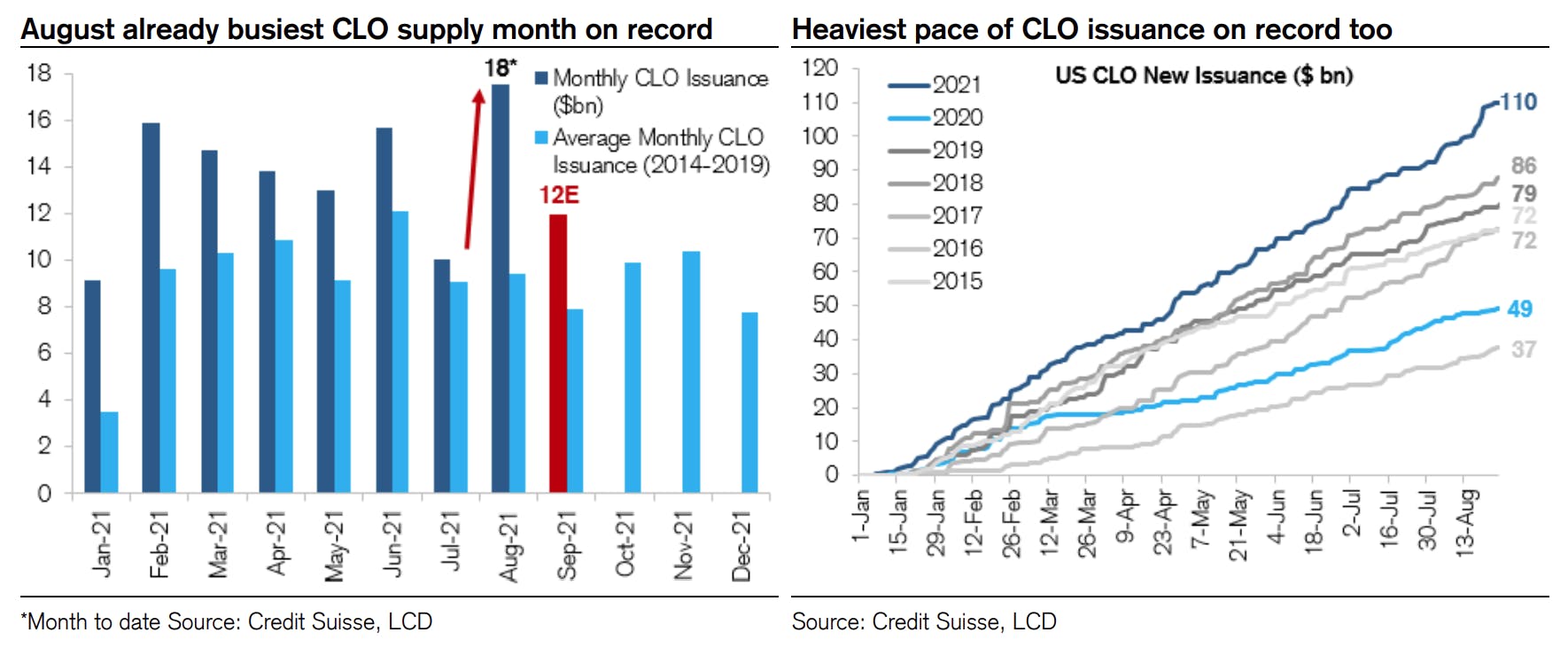

NEW ISSUES IN SECURITIZED CREDIT

- Oaktree CLO 2019-3 Ltd. issued a fixed-rate CLO in 7 tranches, for a total of US$ 601 m. Highest-rated tranche offering a coupon of 5.75%, and the lowest-rated tranche a yield to maturity of 5.75%. Bookrunners: Wells Fargo Securities LLC

- Golden Credit Card Trust 2021-1 issued a fixed-rate ABS backed by receivables in 3 tranches, for a total of US$ 1,069 m. Highest-rated tranche offering a yield to maturity of 1.15%, and the lowest-rated tranche a yield to maturity of 1.74%. Bookrunners: RBC Capital Markets

- Nelnet Student Loan Trust 2021-2 issued a floating-rate ABS backed by student loans in 2 tranches, for a total of US$ 531 m. Highest-rated tranche offering a spread over the floating rate of 50bp, and the lowest-rated tranche a spread of 120bp. Bookrunners: RBC Capital Markets, Citigroup Global Markets Inc, BMO Capital Markets

- VCAT 2021-Npl4 issued a fixed-rate RMBS in 2 tranches, for a total of US$ 333 m. Highest-rated tranche offering a yield to maturity of 1.87%, and the lowest-rated tranche a yield to maturity of 3.84%. Bookrunners: Credit Suisse