Credit

Significant Drops In CDX And HY Cash Spreads Today As Fed Boosts Risk Appetite

Very little action in the US primary corporate bond market this week, with total issuance (IFR data) of just US$ 3.15 bn in 4 tranches for IG and US$100m in 1 tranche for HY

Published ET

CDX.NA.HY 5Y Spread Intraday | Source: Refinitiv

QUICK SUMMARY

- S&P 500 Bond Index was up 0.28% today, with investment grade up 0.29% and high yield up 0.20% (YTD total return: -0.01%)

- The iBoxx USD Liquid Investment Grade Total Return Index was up 0.42% today (Month-to-date: -0.35%; Year-to-date: -0.50%)

- The iBoxx USD Liquid High Yield Total Return Index was up 0.21% today (Month-to-date: 0.37%; Year-to-date: 3.61%)

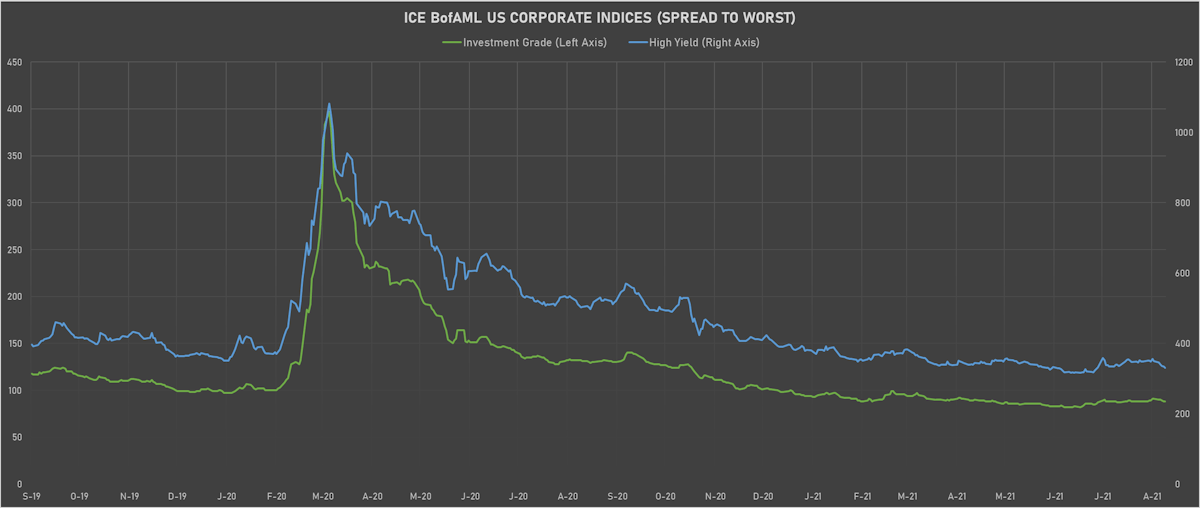

- ICE BofA US Corporate Index (Investment Grade) spread to worst unchanged at 88.0 bp (YTD change: -10.0 bp)

- ICE BofA US High Yield Index spread to worst down -4.0 bp, now at 330.0 bp (YTD change: -60.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index up 0.05% today (YTD total return: +2.4%)

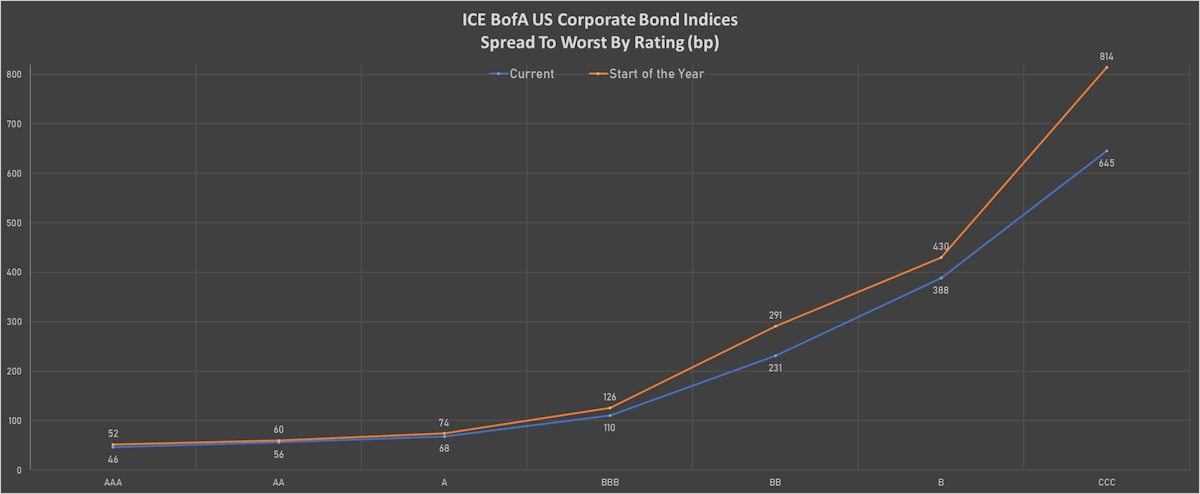

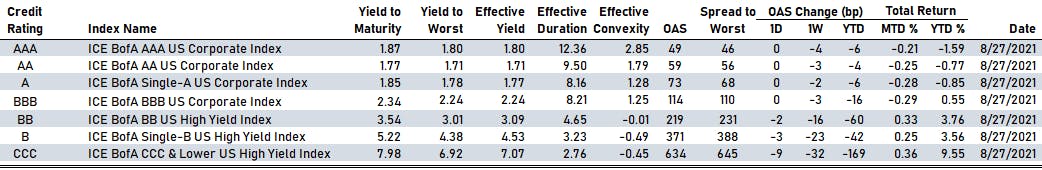

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

- AAA unchanged at 49 bp

- AA unchanged at 59 bp

- A unchanged at 73 bp

- BBB unchanged at 114 bp

- BB down by -2 bp at 219 bp

- B down by -3 bp at 371 bp

- CCC down by -9 bp at 634 bp

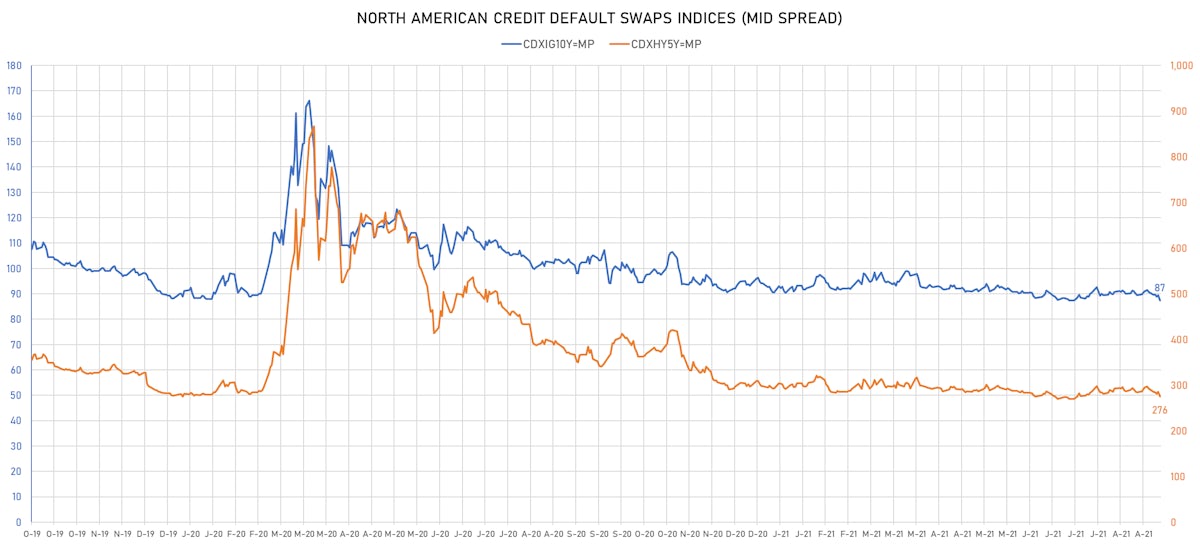

CDS INDICES (mid-spreads)

- Markit CDX.NA.IG 5Y down 2.1 bp, now at 87bp (YTD change: -3.1bp)

- Markit CDX.NA.HY 5Y down 10.1 bp, now at 276bp (YTD change: -17.7bp)

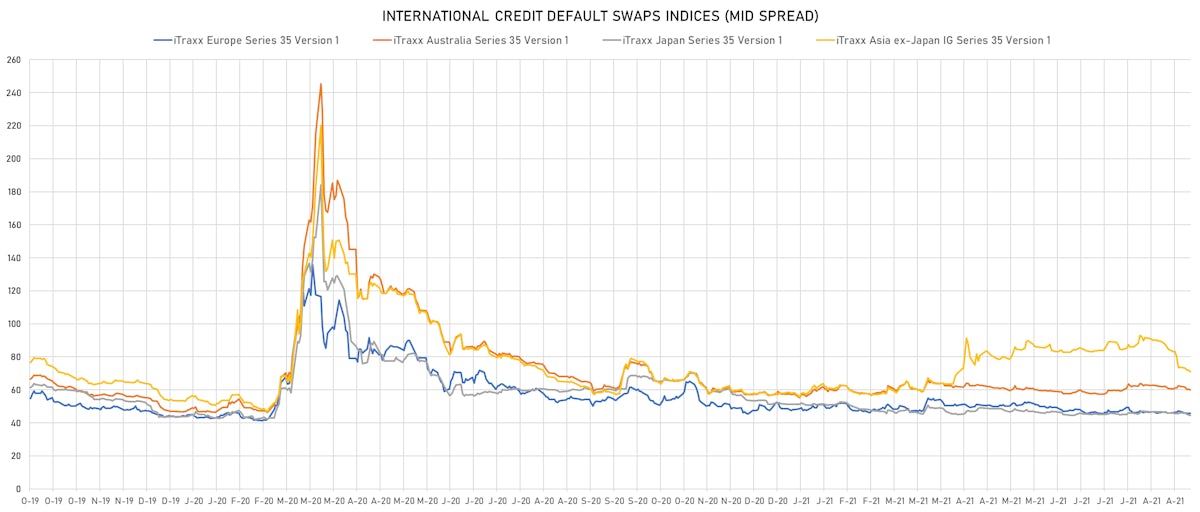

- Markit iTRAXX Europe down 0.8 bp, now at 45bp (YTD change: -2.7bp)

- Markit iTRAXX Japan unchanged at 44bp (YTD change: -6.8bp)

- Markit iTRAXX Asia Ex-Japan down 0.1 bp, now at 71bp (YTD change: +12.9bp)

LARGEST USD CORPORATE CDS MOVES IN THE PAST WEEK

- Macy's Inc (Country: US; rated: Ba2): down 55.6 bp to 222.1bp (1Y range: 203-1,253bp)

- Kohls Corp (Country: US; rated: BBB): down 16.9 bp to 115.0bp (1Y range: 107-332bp)

- American Axle & Manufacturing Inc (Country: US; rated: Ba1): down 16.8 bp to 383.7bp (1Y range: 336-581bp)

- Petroleo Brasileiro SA Petrobras (Country: BR; rated: B): up 13.5 bp to 216.4bp (1Y range: 175-315bp)

- NOVA Chemicals Corp (Country: CA; rated: Discontinued): up 13.8 bp to 252.5bp (1Y range: 243-394bp)

- MBIA Inc (Country: US; rated: Ba3): up 14.4 bp to 376.7bp (1Y range: 365-757bp)

- Sabre Holdings Corp (Country: US; rated: Ba3): up 19.5 bp to 398.5bp (1Y range: 337-611bp)

- Genworth Holdings Inc (Country: US; rated: Caa1): up 24.8 bp to 578.0bp (1Y range: 447-737bp)

- Royal Caribbean Cruises Ltd (Country: US; rated: LGD4 - 59%): up 25.4 bp to 423.6bp (1Y range: 318-1,291bp)

- RR Donnelley & Sons Co (Country: US; rated: B2): up 28.2 bp to 547.8bp (1Y range: 447-962bp)

- Carnival Corp (Country: US; rated: LGD5 - 72%): up 41.9 bp to 458.9bp (1Y range: 291-1,214bp)

- Apache Corp (Country: US; rated: Ba1): up 42.0 bp to 258.8bp (1Y range: 168-453bp)

- American Airlines Group Inc (Country: US; rated: B2): up 45.5 bp to 817.6bp (1Y range: 596-2,968bp)

- Domtar Corp (Country: US; rated: Baa3): up 75.0 bp to 313.0bp (1Y range: 64-324bp)

- Transocean Inc (Country: KY; rated: Caa3): up 478.0 bp to 2,780.5bp (1Y range: 941-7,695bp)

LARGEST EURO CORPORATE CDS MOVES IN THE PAST WEEK

- Casino Guichard Perrachon SA (Country: FR; rated: WR): down 23.2 bp to 519.6bp (1Y range: 494-1,210bp)

- Marks and Spencer PLC (Country: GB; rated: Ba1): down 9.0 bp to 175.3bp (1Y range: 157-349bp)

- Premier Foods Finance PLC (Country: ; rated: B1): down 7.0 bp to 165.9bp (1Y range: 141-273bp)

- Altice Finco SA (Country: LU; rated: Caa1): down 6.6 bp to 362.6bp (1Y range: 317-477bp)

- CMA CGM SA (Country: FR; rated: B1): down 4.9 bp to 314.2bp (1Y range: 309-734bp)

- Ardagh Packaging Finance PLC (Country: IE; rated: B1): up 5.3 bp to 215.2bp (1Y range: 188-272bp)

- Louis Dreyfus Co BV (Country: NL; rated: ): up 5.8 bp to 105.4bp (1Y range: -101bp)

- Rexel SA (Country: FR; rated: WR): up 6.8 bp to 105.6bp (1Y range: -104bp)

- Ladbrokes Coral Group Ltd (Country: GB; rated: WR): up 6.9 bp to 178.9bp (1Y range: 164-227bp)

- Air France KLM SA (Country: FR; rated: B-): up 7.8 bp to 420.0bp (1Y range: 392-1,211bp)

- Virgin Media Finance PLC (Country: GB; rated: WR): up 8.8 bp to 247.5bp (1Y range: 222-325bp)

- ArcelorMittal SA (Country: LU; rated: WR): up 9.8 bp to 126.7bp (1Y range: 121-248bp)

- Deutsche Lufthansa AG (Country: DE; rated: Ba2): up 14.6 bp to 271.0bp (1Y range: 236-421bp)

- Novafives SAS (Country: FR; rated: Caa1): up 15.7 bp to 895.0bp (1Y range: 716-1,205bp)

- TUI AG (Country: DE; rated: LGD4 - 50%): up 20.0 bp to 744.7bp (1Y range: 590-1,799bp)

USD BOND ISSUES

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: AA+): US$190m Bond (US3133EM4H22), fixed rate (2.20% coupon) maturing on 2 September 2036, priced at 100.00, callable (15nc1)

- Huafa 2020 I Company Ltd (Financial - Other | China (Mainland) | Rating: BBB): US$200m Bond (XS2379456895), fixed rate (2.95% coupon) maturing on 28 February 2025, priced at 100.00, non callable

EUR BOND ISSUES

- Deutsche Apotheker und Aerztebank eG (Banking | Dusseldorf, Germany | Rating: A+): €250m Hypothekenpfandbrief (Covered Bond) (XS2381584940), floating rate (EU03MLIB + 60.0 bp) maturing on 9 February 2026, priced at 102.27, non callable

NEW LOANS

- Niigata E Port Biomass Power, signed a US$ 282m Revolving Credit / Term Loan, to be used for project finance.