Credit

USD Bonds Rise On Lower Rates, Stable Spreads

Very little action in the primary market as this week should be extremely slow, with Labor Day just around the corner

Published ET

Secondary trading volumes for US IG & HY Bonds | Source: Credit Suisse

QUICK SUMMARY

- S&P 500 Bond Index was up 0.49% today, with investment grade up 0.50% and high yield up 0.41% (YTD total return: +0.20%)

- The iBoxx USD Liquid Investment Grade Total Return Index was up 0.266% today (Month-to-date: -0.09%; Year-to-date: -0.23%)

- The iBoxx USD Liquid High Yield Total Return Index was up 0.200% today (Month-to-date: 0.57%; Year-to-date: 3.82%)

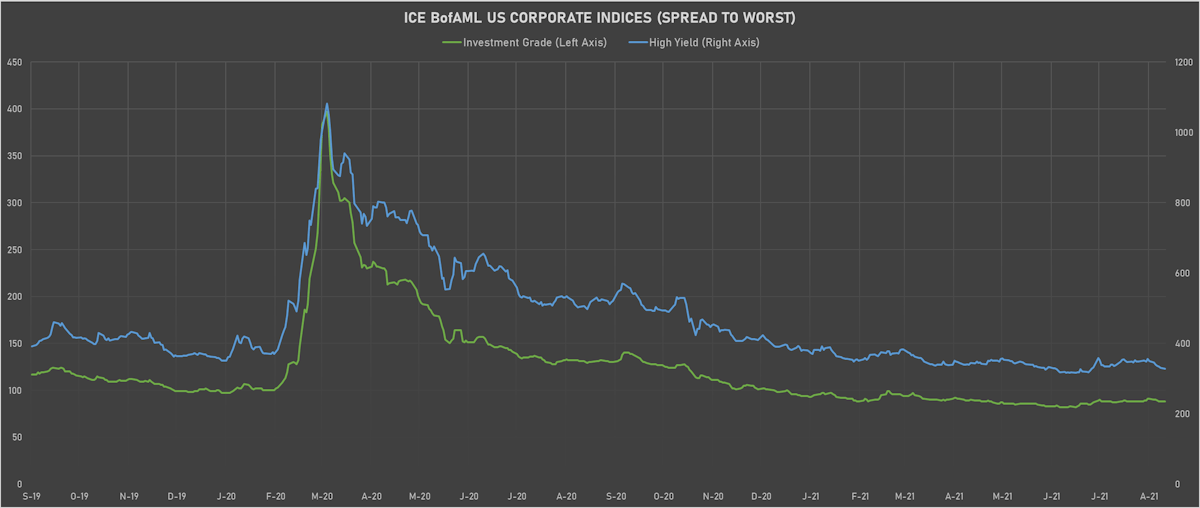

- ICE BofA US Corporate Index (Investment Grade) spread to worst unchanged 0.0 bp, now at 88.0 bp (YTD change: -10.0 bp)

- ICE BofA US High Yield Index spread to worst down -2.0 bp, now at 328.0 bp (YTD change: -62.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index up 0.14% today (YTD total return: +2.5%)

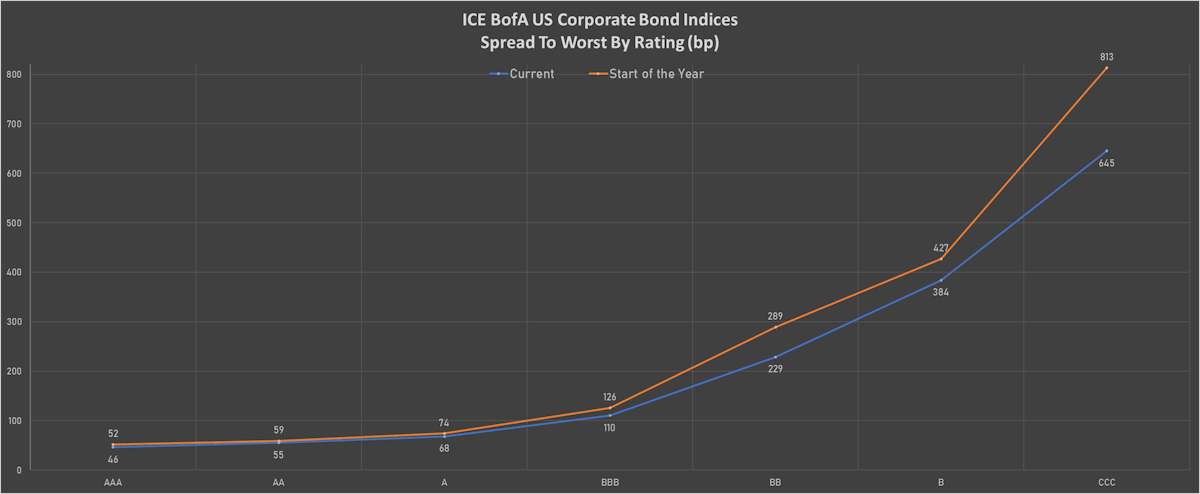

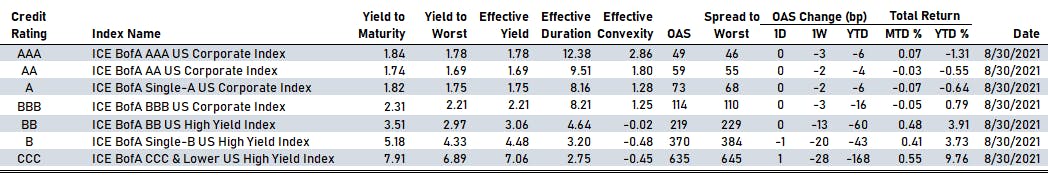

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

- AAA unchanged at 49 bp

- AA unchanged at 59 bp

- A unchanged at 73 bp

- BBB unchanged at 114 bp

- BB unchanged at 219 bp

- B down by -1 bp at 370 bp

- CCC up by 1 bp at 635 bp

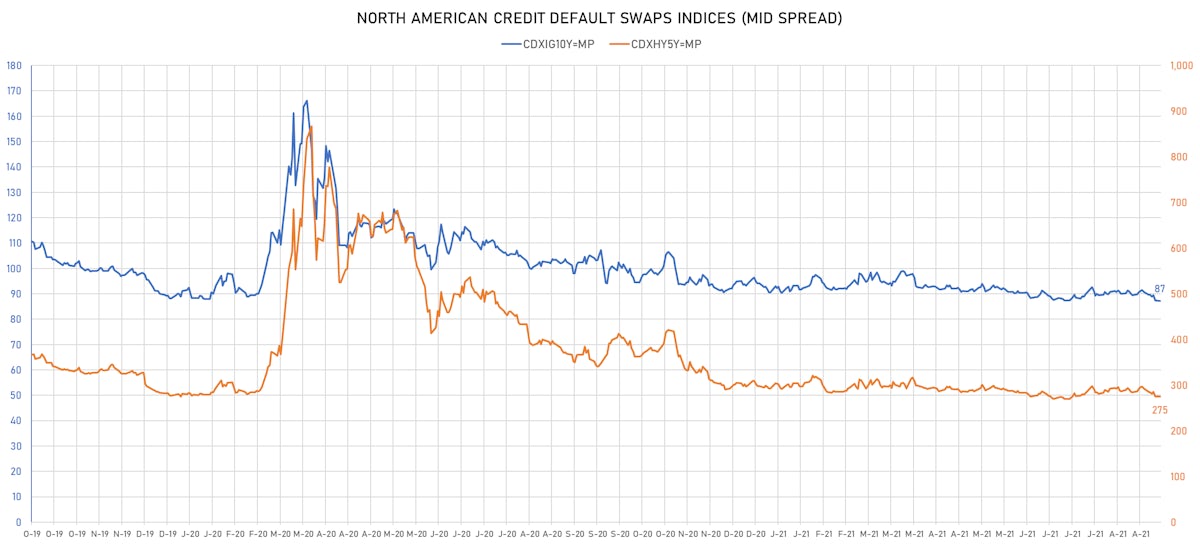

CDS INDICES (mid-spreads)

- Markit CDX.NA.IG 5Y down 0.3 bp, now at 87bp (YTD change: -3.4bp)

- Markit CDX.NA.HY 5Y down 0.3 bp, now at 275bp (YTD change: -18.1bp)

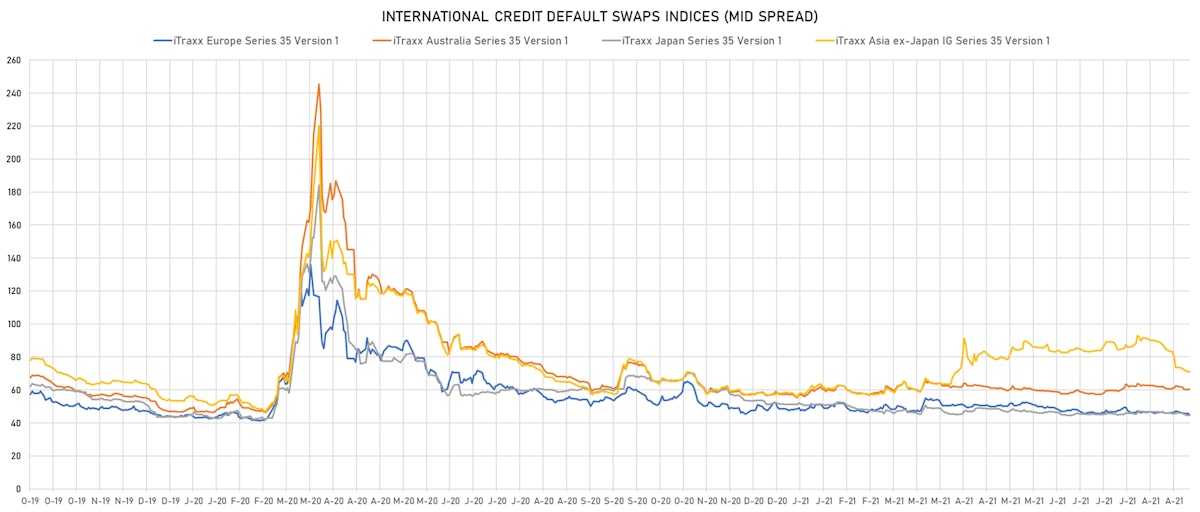

- Markit iTRAXX Europe unchanged at 45bp (YTD change: -2.7bp)

- Markit iTRAXX Japan down 0.5 bp, now at 44bp (YTD change: -7.4bp)

- Markit iTRAXX Asia Ex-Japan down 4.0 bp, now at 67bp (YTD change: +8.9bp)

TOP BONDS MOVES IN THE PAST WEEK - USD HY

- Issuer: Bonitron DAC (DUBLIN, Ireland) | Coupon: 9.00% | Maturity: 22/10/2025 | Rating: B- | ISIN: XS2243344434 | Z-spread up by 57.4 bp to 735.2 bp, with the yield to worst at 7.6% and the bond now trading down to 103.9 cents on the dollar (1Y price range: 103.9-109.9).

- Issuer: WeWork Companies Inc (New York City, New York (US)) | Coupon: 7.88% | Maturity: 1/5/2025 | Rating: CC | ISIN: USU96217AA99 | Z-spread up by 54.2 bp to 791.1 bp, with the yield to worst at 8.0% and the bond now trading down to 98.5 cents on the dollar (1Y price range: 67.5-104.8).

- Issuer: EnLink Midstream LLC (Dallas, Texas (US)) | Coupon: 5.63% | Maturity: 15/1/2028 | Rating: BB | ISIN: USU26790AB82 | Z-spread up by 42.8 bp to 430.5 bp, with the yield to worst at 5.1% and the bond now trading down to 101.6 cents on the dollar (1Y price range: 96.8-107.4).

- Issuer: Oi SA em Recuperacao Judicial (Rio de Janeiro, Brazil) | Coupon: 10.00% | Maturity: 27/7/2025 | Rating: CCC+ | ISIN: USP7354PAA23 | Z-spread up by 38.0 bp to 1,032.3 bp, with the yield to worst at 10.4% and the bond now trading down to 97.9 cents on the dollar (1Y price range: 97.8-107.0).

- Issuer: NCL Finance Ltd (#N/A, United Kingdom) | Coupon: 6.13% | Maturity: 15/3/2028 | Rating: CCC+ | ISIN: USG6437FAA78 | Z-spread down by 34.4 bp to 493.8 bp, with the yield to worst at 5.7% and the bond now trading up to 101.0 cents on the dollar (1Y price range: 98.3-105.9).

- Issuer: Banistmo SA (PANAMA CITY, Panama) | Coupon: 3.65% | Maturity: 19/9/2022 | Rating: BB+ | ISIN: USP15383AC95 | Z-spread down by 35.3 bp to 186.3 bp, with the yield to worst at 1.9% and the bond now trading up to 101.7 cents on the dollar (1Y price range: 101.2-103.5).

- Issuer: Rockies Express Pipeline LLC (Leawood, Kansas (US)) | Coupon: 4.95% | Maturity: 15/7/2029 | Rating: BB | ISIN: USU75111AJ00 | Z-spread down by 37.7 bp to 321.2 bp, with the yield to worst at 4.2% and the bond now trading up to 104.0 cents on the dollar (1Y price range: 101.3-107.8).

- Issuer: Resorts World Las Vegas LLC (Las Vegas, Nevada (US)) | Coupon: 4.63% | Maturity: 16/4/2029 | Rating: BB | ISIN: USU76198AA52 | Z-spread down by 38.7 bp to 305.6 bp, with the yield to worst at 4.1% and the bond now trading up to 102.9 cents on the dollar (1Y price range: 98.1-105.8).

- Issuer: Wynn Las Vegas LLC (Las Vegas, Nevada (US)) | Coupon: 5.50% | Maturity: 1/3/2025 | Rating: B+ | ISIN: USU98347AK05 | Z-spread down by 41.6 bp to 285.1 bp, with the yield to worst at 3.1% and the bond now trading up to 106.4 cents on the dollar (1Y price range: 102.5-108.3).

- Issuer: American Airlines Group Inc (Fort Worth, Texas (US)) | Coupon: 3.75% | Maturity: 1/3/2025 | Rating: CCC | ISIN: USU0242AAD47 | Z-spread down by 44.8 bp to 653.9 bp (CDS basis: 58.7bp), with the yield to worst at 6.9% and the bond now trading up to 90.0 cents on the dollar (1Y price range: 71.0-93.1).

- Issuer: Dilijan Finance BV (Amsterdam, Netherlands) | Coupon: 6.50% | Maturity: 28/1/2025 | Rating: B+ | ISIN: XS2080321198 | Z-spread down by 47.9 bp to 598.6 bp, with the yield to worst at 6.1% and the bond now trading up to 100.1 cents on the dollar (1Y price range: 93.6-101.0).

- Issuer: Royal Caribbean Cruises Ltd (Miami) | Coupon: 4.25% | Maturity: 1/7/2026 | Rating: B | ISIN: USV7780TAF04 | Z-spread down by 48.8 bp to 395.0 bp (CDS basis: -22.5bp), with the yield to worst at 4.5% and the bond now trading up to 97.8 cents on the dollar (1Y price range: 94.1-100.9).

- Issuer: YPF SA (Buenos Aires, Argentina) | Coupon: 6.95% | Maturity: 21/7/2027 | Rating: CCC | ISIN: USP989MJBL47 | Z-spread down by 75.7 bp to 1,240.4 bp, with the yield to worst at 12.7% and the bond now trading up to 76.0 cents on the dollar (1Y price range: 56.6-76.0).

Option-adjusted spreads on Lufthansa and International Consolidated Airlines Group 2029 Bonds (XS2322423539 & XS2363235107)

TOP BONDS MOVES IN THE PAST WEEK - EUR HY

- Issuer: Teva Pharmaceutical Finance Netherlands II BV (Amsterdam, Netherlands) | Coupon: 1.88% | Maturity: 31/3/2027 | Rating: BB- | ISIN: XS1211044075 | Z-spread up by 9.2 bp to 357.8 bp, with the yield to worst at 3.1% and the bond now trading down to 93.1 cents on the dollar (1Y price range: 90.5-95.4).

- Issuer: Adler Group SA (Senningerberg, Luxembourg) | Coupon: 2.25% | Maturity: 27/4/2027 | Rating: BB+ | ISIN: XS2336188029 | Z-spread down by 8.4 bp to 330.0 bp, with the yield to worst at 2.8% and the bond now trading up to 96.2 cents on the dollar (1Y price range: 94.3-100.2).

- Issuer: Autostrade per l'Italia SpA (Rome, Italy) | Coupon: 1.88% | Maturity: 26/9/2029 | Rating: BB- | ISIN: XS1688199949 | Z-spread down by 9.2 bp to 141.9 bp (CDS basis: -11.9bp), with the yield to worst at 1.1% and the bond now trading up to 104.7 cents on the dollar (1Y price range: 98.5-104.7).

- Issuer: Saipem Finance International BV (Amsterdam, Netherlands) | Coupon: 3.13% | Maturity: 31/3/2028 | Rating: BB | ISIN: XS2325696628 | Z-spread down by 9.3 bp to 317.4 bp (CDS basis: 49.2bp), with the yield to worst at 2.8% and the bond now trading up to 101.2 cents on the dollar (1Y price range: 98.5-102.9).

- Issuer: Fortune Star (BVI) Ltd (British Virgin Islands) | Coupon: 3.95% | Maturity: 2/10/2026 | Rating: BB- | ISIN: XS2357132849 | Z-spread down by 10.5 bp to 492.7 bp, with the yield to worst at 4.5% and the bond now trading up to 97.5 cents on the dollar (1Y price range: 96.5-102.1).

- Issuer: Deutsche Lufthansa AG (Cologne, Germany) | Coupon: 3.50% | Maturity: 14/7/2029 | Rating: BB- | ISIN: XS2363235107 | Z-spread down by 11.3 bp to 354.8 bp (CDS basis: -51.5bp), with the yield to worst at 3.2% and the bond now trading up to 101.0 cents on the dollar (1Y price range: 97.7-102.1).

- Issuer: International Consolidated Airlines Group SA (London) | Coupon: 3.75% | Maturity: 25/3/2029 | Rating: B+ | ISIN: XS2322423539 | Z-spread down by 12.2 bp to 395.7 bp, with the yield to worst at 3.6% and the bond now trading up to 100.0 cents on the dollar (1Y price range: 97.5-102.0).

- Issuer: SoftBank Group Corp (Minato-Ku, Japan) | Coupon: 3.38% | Maturity: 6/7/2029 | Rating: BB+ | ISIN: XS2361255057 | Z-spread down by 14.1 bp to 405.6 bp, with the yield to worst at 3.7% and the bond now trading up to 97.0 cents on the dollar (1Y price range: 95.3-99.9).

- Issuer: Petroleos Mexicanos (Miguel Hidalgo, Mexico) | Coupon: 4.88% | Maturity: 21/2/2028 | Rating: BB- | ISIN: XS1568888777 | Z-spread down by 16.7 bp to 502.1 bp (CDS basis: -97.4bp), with the yield to worst at 4.6% and the bond now trading up to 100.8 cents on the dollar (1Y price range: 97.7-103.3).

USD BOND ISSUES

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$225m Bond (US3133EM4J87), fixed rate (2.15% coupon) maturing on 7 March 2036, priced at 100.00 (original spread of 88 bp), callable (15nc3m)

- Bank of Montreal (Toronto Branch) (Banking | Toronto, Canada | Rating: NR): US$250m Unsecured Note (XS2383659377) zero coupon maturing on 23 September 2061, priced at 100.00, non callable

- Guangzhou Metro Investment Finance BVI Ltd (Financial - Other | Rating: NR): US$200m Unsecured Note (XS2382853997), fixed rate (1.00% coupon) maturing on 21 September 2026, priced at 100.00, non callable

- Industrial and Commercial Bank of China Ltd (Hong Kong Branch) (Banking | China (Mainland) | Rating: NR): US$500m Unsecured Note (XS2381043350), fixed rate (1.25% coupon) maturing on 20 September 2026, priced at 100.00, non callable

- Lai Sun MTN Ltd (Financial - Other | Hong Kong | Rating: NR): US$400m Unsecured Note (XS2382904063), fixed rate (5.00% coupon) maturing on 28 July 2026, priced at 100.00, non callable

- Single Platform Investment Repackaging Entity SA (Financial - Other | Luxembourg, Netherlands | Rating: NR): US$193m Unsecured Note (XS2378758267) zero coupon maturing on 20 June 2051, priced at 51.82, non callable

- Toyota Finance Australia Ltd (Financial - Other | New South Wales, Japan | Rating: A+): US$112m Unsecured Note (XS2378501576), fixed rate (1.00% coupon) maturing on 28 August 2026, priced at 100.00, non callable

NEW LOANS

- CMOC Ltd, signed a US$ 504m Term Loan maturing on 05/27/22, to be used for refinancing and returning bank debt