Credit

HY Bonds Close To Unchanged, IG Down With Higher Rates

With the major bounce in oil prices, energy companies have seen their credit spreads compress significantly in the past week

Published ET

Apache and NRG Energy 5Y USD CDS Spreads | Source: Refinitiv

QUICK SUMMARY

- S&P 500 Bond Index was down -0.09% today, with investment grade down -0.11% and high yield up 0.04% (YTD total return: +0.11%)

- The iBoxx USD Liquid Investment Grade Total Return Index was down -0.25% today (Month-to-date: -0.34%; Year-to-date: -0.49%)

- The iBoxx USD Liquid High Yield Total Return Index was up 0.07% today (Month-to-date: 0.64%; Year-to-date: 3.89%)

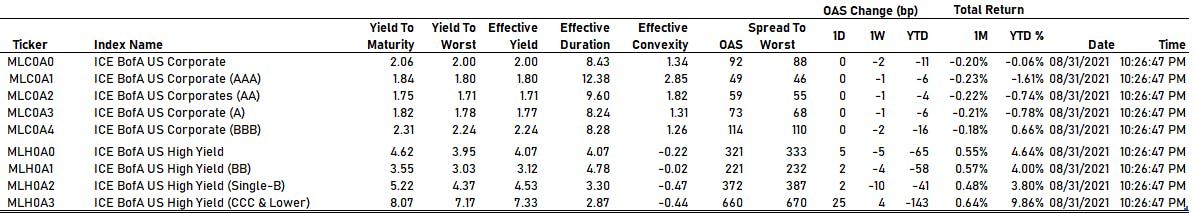

- ICE BofA US Corporate Index (Investment Grade) spread to worst unchanged at 88.0 bp (YTD change: -10.0 bp)

- ICE BofA US High Yield Index spread to worst up 5.0 bp, now at 333.0 bp (YTD change: -57.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index up 0.03% today (YTD total return: +2.5%)

- New issues: US$ 4.0bn in dollars and € 1.1bn in euros

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

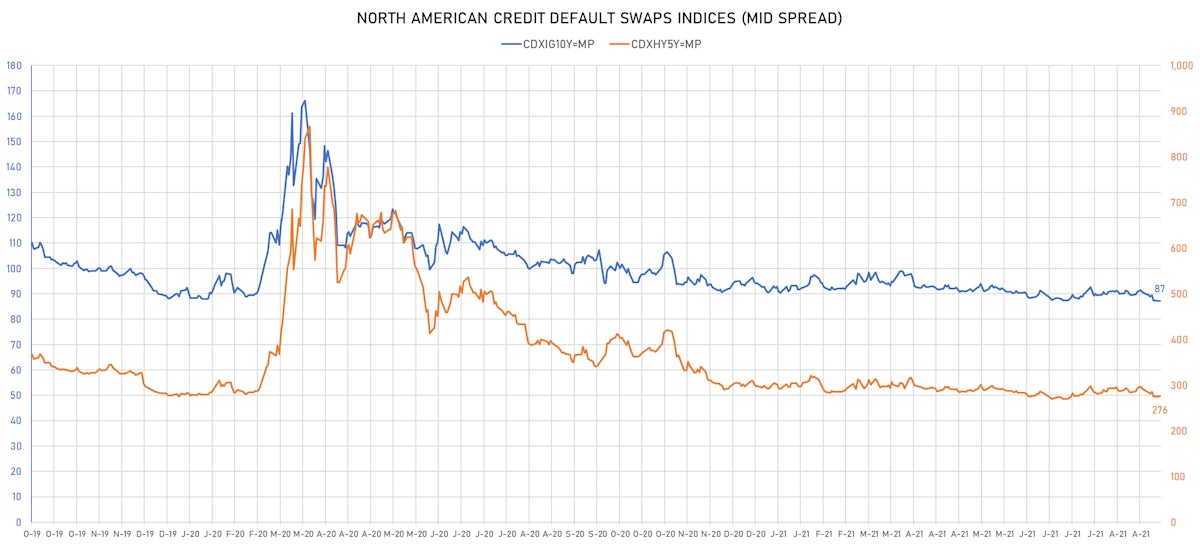

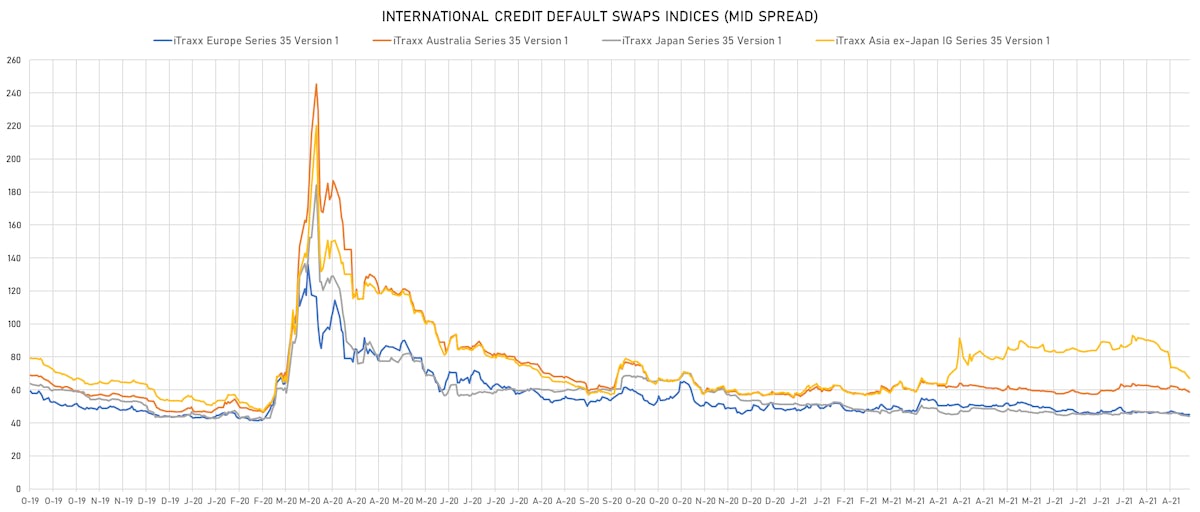

CDS INDICES (mid-spreads)

- Markit CDX.NA.IG 5Y unchanged at 87bp (YTD change: -3.4bp)

- Markit CDX.NA.HY 5Y up 0.4 bp, now at 276bp (YTD change: -17.7bp)

- Markit iTRAXX Europe down 0.3 bp, now at 45bp (YTD change: -3.1bp)

- Markit iTRAXX Japan down 0.3 bp, now at 44bp (YTD change: -7.7bp)

- Markit iTRAXX Asia Ex-Japan down 1.2 bp, now at 66bp (YTD change: +7.8bp)

LARGEST USD CORPORATE CDS MOVES IN THE PAST WEEK

- Transocean Inc (Country: KY; rated: Caa3): down 655.6 bp to 2,124.9bp (1Y range: 941-7,695bp)

- Apache Corp (Country: US; rated: Ba1): down 73.9 bp to 185.0bp (1Y range: 168-453bp)

- Carnival Corp (Country: US; rated: LGD5 - 72%): down 60.0 bp to 398.9bp (1Y range: 291-1,214bp)

- American Airlines Group Inc (Country: US; rated: B2): down 49.3 bp to 768.4bp (1Y range: 596-2,968bp)

- Royal Caribbean Cruises Ltd (Country: US; rated: LGD4 - 59%): down 44.2 bp to 379.4bp (1Y range: 318-1,291bp)

- Pitney Bowes Inc (Country: US; rated: LGD2 - 16%): down 37.5 bp to 385.6bp (1Y range: 363-546bp)

- Murphy Oil Corp (Country: US; rated: Ba3): down 35.9 bp to 324.1bp (1Y range: 280-763bp)

- Beazer Homes USA Inc (Country: US; rated: B2): down 33.2 bp to 297.8bp (1Y range: 231-363bp)

- Avis Budget Group Inc (Country: US; rated: CCC): down 27.8 bp to 234.3bp (1Y range: 230-665bp)

- Evraz Group SA (Country: LU; rated: WR): down 26.7 bp to 183.4bp (1Y range: -194bp)

- Akbank TAS (Country: TR; rated: Ba3): down 26.2 bp to 480.5bp (1Y range: 397-597bp)

- American Axle & Manufacturing Inc (Country: US; rated: Ba1): down 25.4 bp to 358.3bp (1Y range: 336-581bp)

- Gap Inc (Country: US; rated: Ba2): down 23.7 bp to 130.1bp (1Y range: 134-294bp)

- NRG Energy Inc (Country: US; rated: Ba1): down 21.0 bp to 122.0bp (1Y range: 108-219bp)

- Tenet Healthcare Corp (Country: US; rated: LGD3 - 41%): down 20.9 bp to 244.8bp (1Y range: 239-542bp)

LARGEST EURO CORPORATE CDS MOVES IN THE PAST WEEK

- Novafives SAS (Country: FR; rated: Caa1): down 37.8 bp to 857.3bp (1Y range: 716-1,205bp)

- Casino Guichard Perrachon SA (Country: FR; rated: WR): down 22.9 bp to 496.7bp (1Y range: 491-1,210bp)

- Virgin Media Finance PLC (Country: GB; rated: WR): down 18.6 bp to 229.0bp (1Y range: 222-325bp)

- Marks and Spencer PLC (Country: GB; rated: Ba1): down 17.5 bp to 157.9bp (1Y range: 151-349bp)

- Altice Finco SA (Country: LU; rated: Caa1): down 15.3 bp to 347.3bp (1Y range: 317-477bp)

- UPC Holding BV (Country: NL; rated: LGD6 - 93%): down 14.7 bp to 186.1bp (1Y range: 184-315bp)

- TUI AG (Country: DE; rated: LGD4 - 50%): down 13.3 bp to 731.4bp (1Y range: 590-1,799bp)

- Iceland Bondco PLC (Country: GB; rated: LGD3 - 46%): down 9.1 bp to 446.6bp (1Y range: 358-689bp)

- Telecom Italia SpA (Country: IT; rated: Ba2): down 7.2 bp to 159.0bp (1Y range: 142-219bp)

- ArcelorMittal SA (Country: LU; rated: WR): down 5.8 bp to 120.9bp (1Y range: 119-248bp)

- Thyssenkrupp AG (Country: DE; rated: B1): down 5.8 bp to 252.9bp (1Y range: 206-479bp)

- Unilabs SubHolding AB (publ) (Country: SE; rated: B2): down 5.0 bp to 178.2bp (1Y range: -173bp)

- CMA CGM SA (Country: FR; rated: B1): down 4.9 bp to 309.3bp (1Y range: 264-734bp)

- Air France KLM SA (Country: FR; rated: B-): up 8.1 bp to 428.1bp (1Y range: 392-1,211bp)

- J Sainsbury PLC (Country: GB; rated: WR): up 26.2 bp to 109.3bp (1Y range: 52-111bp)

USD BOND ISSUES

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$265m Bond (US3133EM4L34), floating rate (SOFR + 6.0 bp) maturing on 9 September 2024, priced at 100.00, non callable

- International Finance Corporation IFC Ltd (Financial - Other | London, United Kingdom | Rating: NR): US$2,000m Senior Note (US45950KCX63), fixed rate (0.75% coupon) maturing on 8 October 2026, priced at 99.44 (original spread of 9 bp), non callable

- Quan Cheng Financial Holdings (BVI) Ltd (Financial - Other | Rating: NR): US$278m Senior Note (XS2380533740), fixed rate (3.80% coupon) maturing on 7 September 2024, priced at 100.00, non callable

- Skandinaviska Enskilda Banken AB (Banking | Stockholm, Sweden | Rating: A+): US$750m Note (US83051GAS75), fixed rate (0.65% coupon) maturing on 9 September 2024, priced at 99.86 (original spread of 30 bp), non callable

- Skandinaviska Enskilda Banken AB (Banking | Stockholm, Sweden | Rating: A+): US$750m Note (US83051GAT58), fixed rate (1.20% coupon) maturing on 9 September 2026, priced at 99.91 (original spread of 45 bp), non callable

EUR BOND ISSUES

- KBC Groep NV (Banking | Brussels, Bruxelles-Capitale, Belgium | Rating: A-): €750m Bond (BE0002819002), fixed rate (0.63% coupon) maturing on 7 December 2031, priced at 99.98 (original spread of 132 bp), callable (10nc5)

- RRE 8 Loan Management DAC (Financial - Other | Dublin, Ireland | Rating: NR): €303m Bond (XS2379452639), floating rate maturing on 15 October 2036, priced at 100.00, non callable

NEW LOANS

- ION Trading Technologies Ltd (B), signed a € 1,680m Term Loan, to be used for general corporate purposes. It matures on 11/26/21 and initial pricing is set at EURIBOR +400bps

- Parker Hannifin Corp (BBB+), signed a US$ 2,000m Delayed Draw Term Loan, to be used for acquisition financing. It matures on 08/27/24 and initial pricing is set at LIBOR +100bps