Credit

Stable Spreads To Kick Off The Month, With Little Movement In Cash IG & HY Indices

A decent debut for September bond issuance, with a few deals both in the US and Europe, including a 20-year US$ 1bn 2.85% coupon issue from Verizon priced below par

Published ET

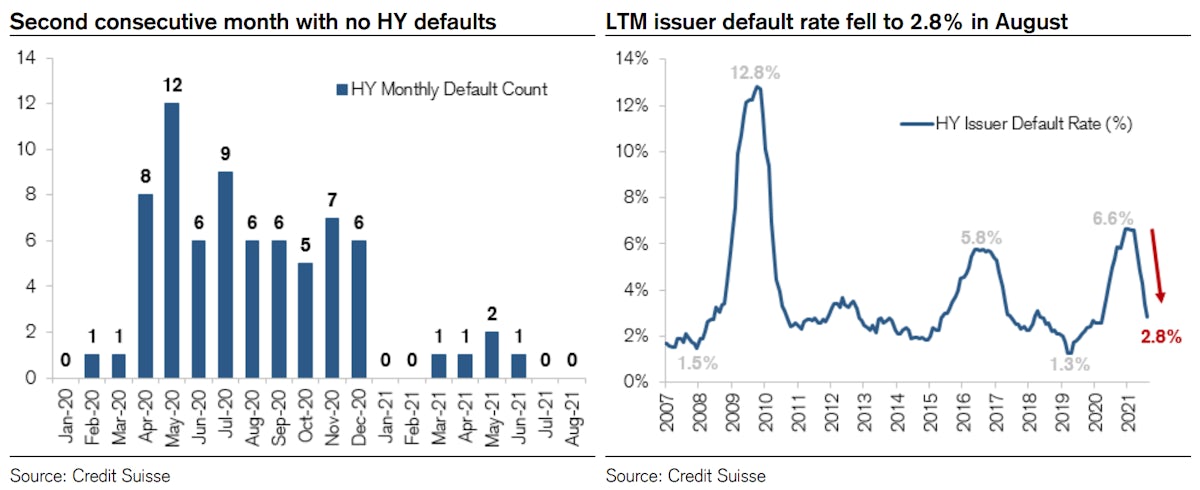

No high-yield defaults in August for the second consecutive month | Source: Credit Suisse

QUICK SUMMARY

- S&P 500 Bond Index was down -0.03% today, with investment grade down -0.04% and high yield up 0.04% (YTD total return: +0.08%)

- The iBoxx USD Liquid Investment Grade Total Return Index was up 0.006% today (Month-to-date: 0.01%; Year-to-date: -0.48%)

- The iBoxx USD Liquid High Yield Total Return Index was up 0.039% today (Month-to-date: 0.04%; Year-to-date: 3.93%)

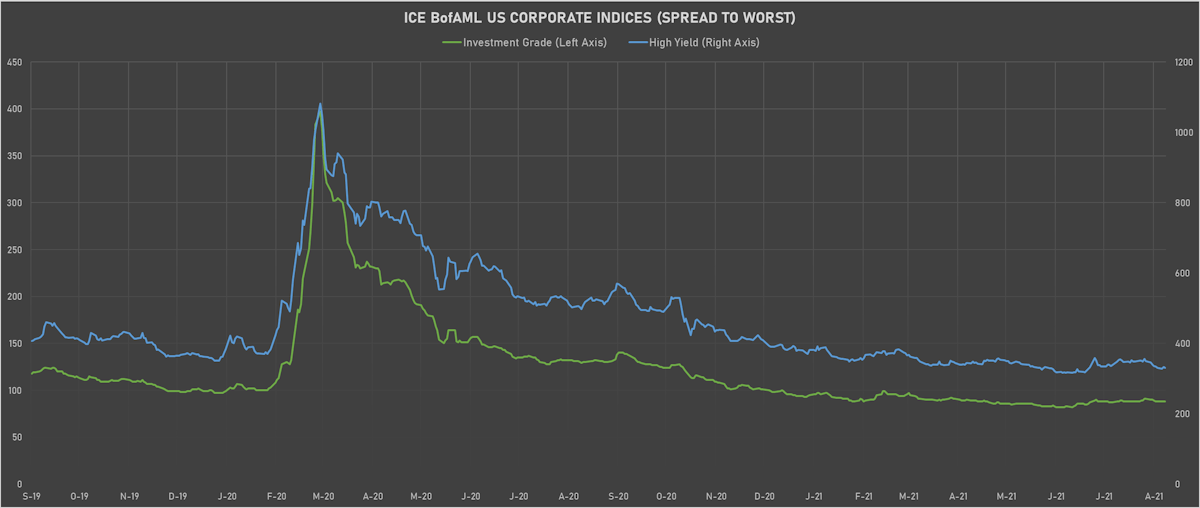

- ICE BofA US Corporate Index (Investment Grade) spread to worst unchanged 0.0 bp, now at 88.0 bp (YTD change: -10.0 bp)

- ICE BofA US High Yield Index spread to worst down -2.0 bp, now at 331.0 bp (YTD change: -59.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index up 0.04% today (YTD total return: +2.6%)

- New issues: US$ 7.8bn in dollars and € 6.5bn in euros

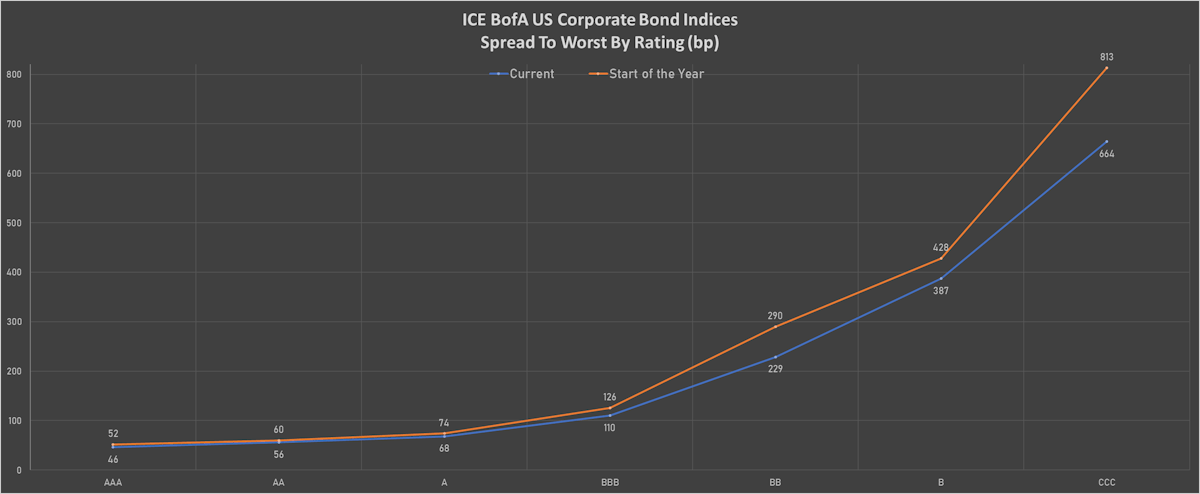

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

- AAA unchanged at 49 bp

- AA unchanged at 59 bp

- A unchanged at 73 bp

- BBB unchanged at 114 bp

- BB down by -3 bp at 218 bp

- B unchanged at 372 bp

- CCC down by -6 bp at 654 bp

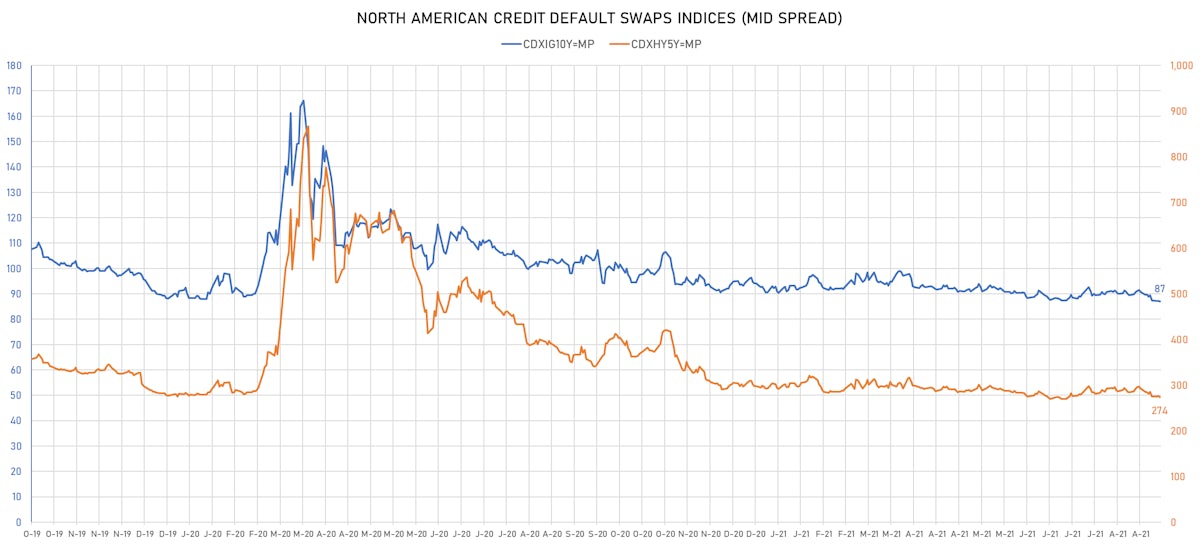

CDS INDICES (mid-spreads)

- Markit CDX.NA.IG 5Y down 0.1 bp, now at 87bp (YTD change: -3.5bp)

- Markit CDX.NA.HY 5Y down 1.2 bp, now at 274bp (YTD change: -18.8bp)

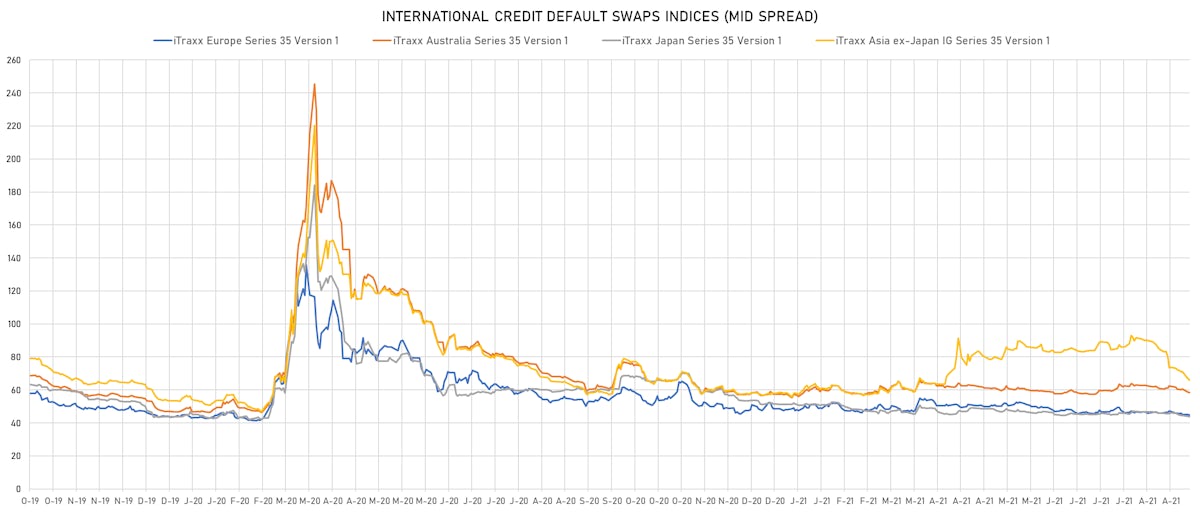

- Markit iTRAXX Europe down 0.4 bp, now at 44bp (YTD change: -3.5bp)

- Markit iTRAXX Japan down 0.4 bp, now at 43bp (YTD change: -8.1bp)

- Markit iTRAXX Asia Ex-Japan down 0.8 bp, now at 65bp (YTD change: +6.9bp)

TOP BONDS MOVES IN THE PAST WEEK - USD HY

- Issuer: StoneCo Ltd (George Town, Cayman Islands) | Coupon: 3.95% | Maturity: 16/6/2028 | Rating: BB- | ISIN: USG85158AA43 | Z-spread up by 69.1 bp to 363.9 bp, with the yield to worst at 4.5% and the bond now trading down to 95.8 cents on the dollar (1Y price range: 98.5-100.0).

- Issuer: Oi SA em Recuperacao Judicial (Rio de Janeiro, Brazil) | Coupon: 10.00% | Maturity: 27/7/2025 | Rating: CCC+ | ISIN: USP7354PAA23 | Z-spread up by 53.5 bp to 1,044.5 bp, with the yield to worst at 10.5% and the bond now trading down to 97.5 cents on the dollar (1Y price range: 97.5-107.0).

- Issuer: EnLink Midstream LLC (Dallas, Texas (US)) | Coupon: 5.63% | Maturity: 15/1/2028 | Rating: BB | ISIN: USU26790AB82 | Z-spread up by 41.7 bp to 412.7 bp, with the yield to worst at 4.9% and the bond now trading down to 102.5 cents on the dollar (1Y price range: 96.8-107.4).

- Issuer: Vedanta Resources Finance II PLC (London, United Kingdom) | Coupon: 8.95% | Maturity: 11/3/2025 | Rating: B- | ISIN: USG9T27HAD62 | Z-spread down by 29.1 bp to 784.4 bp, with the yield to worst at 8.0% and the bond now trading up to 101.4 cents on the dollar (1Y price range: 93.5-101.6).

- Issuer: NCL Corporation Ltd (Miami, Bermuda) | Coupon: 5.88% | Maturity: 15/3/2026 | Rating: CCC+ | ISIN: USG6436QAL08 | Z-spread down by 29.3 bp to 496.4 bp, with the yield to worst at 5.6% and the bond now trading up to 100.5 cents on the dollar (1Y price range: 98.0-105.3).

- Issuer: American Airlines Group Inc (Fort Worth, Texas (US)) | Coupon: 3.75% | Maturity: 1/3/2025 | Rating: CCC | ISIN: USU0242AAD47 | Z-spread down by 29.3 bp to 644.7 bp (CDS basis: 66.0bp), with the yield to worst at 6.8% and the bond now trading up to 90.3 cents on the dollar (1Y price range: 71.0-93.1).

- Issuer: Azarbayjan Beynalkhalg Banki ASJ (BAKU, Azerbaijan) | Coupon: 3.50% | Maturity: 1/9/2024 | Rating: B | ISIN: XS1678466027 | Z-spread down by 30.2 bp to 283.5 bp, with the yield to worst at 3.2% and the bond now trading up to 100.5 cents on the dollar (1Y price range: 92.8-100.6).

- Issuer: Rockies Express Pipeline LLC (Leawood, Kansas (US)) | Coupon: 4.80% | Maturity: 15/5/2030 | Rating: BB | ISIN: USU75111AL55 | Z-spread down by 30.5 bp to 317.8 bp, with the yield to worst at 4.2% and the bond now trading up to 103.0 cents on the dollar (1Y price range: 97.8-105.6).

- Issuer: Turkiye Vakiflar Bankasi TAO (#N/A, Turkey) | Coupon: 5.25% | Maturity: 5/2/2025 | Rating: B | ISIN: XS2112797290 | Z-spread down by 31.2 bp to 439.2 bp, with the yield to worst at 4.6% and the bond now trading up to 101.0 cents on the dollar (1Y price range: 94.0-101.0).

- Issuer: SoftBank Group Corp (Minato-ku, Japan) | Coupon: 3.13% | Maturity: 6/1/2025 | Rating: BB+ | ISIN: XS2362416294 | Z-spread down by 31.3 bp to 292.5 bp, with the yield to worst at 3.2% and the bond now trading up to 98.8 cents on the dollar (1Y price range: 97.4-100.1).

- Issuer: NCL Finance Ltd (#N/A, United Kingdom) | Coupon: 6.13% | Maturity: 15/3/2028 | Rating: CCC+ | ISIN: USG6437FAA78 | Z-spread down by 42.4 bp to 480.8 bp, with the yield to worst at 5.6% and the bond now trading up to 101.6 cents on the dollar (1Y price range: 98.3-105.9).

- Issuer: YPF SA (Buenos Aires, Argentina) | Coupon: 8.50% | Maturity: 27/6/2029 | Rating: CCC- | ISIN: USP989MJBP50 | Z-spread down by 43.4 bp to 1,210.6 bp, with the yield to worst at 12.9% and the bond now trading up to 77.6 cents on the dollar (1Y price range: 59.9-77.6).

- Issuer: Resorts World Las Vegas LLC (Las Vegas, Nevada (US)) | Coupon: 4.63% | Maturity: 6/4/2031 | Rating: BB | ISIN: USU76198AB36 | Z-spread down by 44.4 bp to 298.2 bp, with the yield to worst at 4.1% and the bond now trading up to 103.0 cents on the dollar (1Y price range: 99.4-105.6).

- Issuer: Rolls-Royce PLC (BIRMINGHAM, United Kingdom) | Coupon: 3.63% | Maturity: 14/10/2025 | Rating: BB- | ISIN: USG76237AB53 | Z-spread down by 46.7 bp to 248.9 bp (CDS basis: -84.3bp), with the yield to worst at 2.9% and the bond now trading up to 101.5 cents on the dollar (1Y price range: 98.4-102.6).

TOP BONDS MOVES IN THE PAST WEEK - EUR HY

- Issuer: Autostrade per l'Italia SpA (Rome, Italy) | Coupon: 2.00% | Maturity: 15/1/2030 | Rating: BB- | ISIN: XS2278566299 | Z-spread down by 5.3 bp to 144.7 bp (CDS basis: -13.6bp), with the yield to worst at 1.2% and the bond now trading up to 105.2 cents on the dollar (1Y price range: 98.1-105.4).

- Issuer: Deutsche Lufthansa AG (Cologne, Germany) | Coupon: 3.75% | Maturity: 11/2/2028 | Rating: BB- | ISIN: XS2296203123 | Z-spread down by 6.0 bp to 352.1 bp (CDS basis: -67.4bp), with the yield to worst at 3.1% and the bond now trading up to 102.7 cents on the dollar (1Y price range: 97.6-105.3).

- Issuer: Orano SA (Chatillon, France) | Coupon: 2.75% | Maturity: 8/3/2028 | Rating: BB+ | ISIN: FR0013533031 | Z-spread down by 6.0 bp to 209.9 bp, with the yield to worst at 1.7% and the bond now trading up to 105.3 cents on the dollar (1Y price range: 103.2-105.5).

- Issuer: Bulgarian Energy Holding EAD (Sofia, Bulgaria) | Coupon: 2.45% | Maturity: 22/7/2028 | Rating: BB | ISIN: XS2367164576 | Z-spread down by 6.1 bp to 271.3 bp (CDS basis: -202.2bp), with the yield to worst at 2.3% and the bond now trading up to 99.7 cents on the dollar (1Y price range: 98.5-100.0).

- Issuer: Renault SA (Boulogne-Billancourt, France) | Coupon: 2.38% | Maturity: 25/5/2026 | Rating: BB | ISIN: FR0014000NZ4 | Z-spread down by 6.6 bp to 216.3 bp (CDS basis: -63.6bp), with the yield to worst at 1.7% and the bond now trading up to 102.4 cents on the dollar (1Y price range: 99.5-102.9).

- Issuer: Nexi SpA (Milan, Italy) | Coupon: 2.13% | Maturity: 30/4/2029 | Rating: BB- | ISIN: XS2332590475 | Z-spread down by 6.9 bp to 229.4 bp, with the yield to worst at 2.0% and the bond now trading up to 100.1 cents on the dollar (1Y price range: 98.0-100.5).

- Issuer: Saipem Finance International BV (Amsterdam, Netherlands) | Coupon: 3.13% | Maturity: 31/3/2028 | Rating: BB | ISIN: XS2325696628 | Z-spread down by 7.3 bp to 318.7 bp (CDS basis: 38.8bp), with the yield to worst at 2.8% and the bond now trading up to 101.0 cents on the dollar (1Y price range: 98.5-102.9).

- Issuer: Petroleos Mexicanos (Miguel Hidalgo, Mexico) | Coupon: 4.88% | Maturity: 21/2/2028 | Rating: BB- | ISIN: XS1568888777 | Z-spread down by 7.3 bp to 497.7 bp (CDS basis: -102.3bp), with the yield to worst at 4.6% and the bond now trading up to 100.8 cents on the dollar (1Y price range: 97.7-103.3).

- Issuer: Fortune Star (BVI) Ltd (British Virgin Islands) | Coupon: 3.95% | Maturity: 2/10/2026 | Rating: BB- | ISIN: XS2357132849 | Z-spread down by 10.2 bp to 486.1 bp, with the yield to worst at 4.5% and the bond now trading up to 97.6 cents on the dollar (1Y price range: 96.5-102.1).

- Issuer: Teva Pharmaceutical Finance Netherlands II BV (Amsterdam, Netherlands) | Coupon: 1.63% | Maturity: 15/10/2028 | Rating: BB- | ISIN: XS1439749364 | Z-spread down by 11.4 bp to 335.6 bp, with the yield to worst at 3.0% and the bond now trading up to 90.4 cents on the dollar (1Y price range: 87.1-92.6).

- Issuer: SoftBank Group Corp (Minato-Ku, Japan) | Coupon: 3.38% | Maturity: 6/7/2029 | Rating: BB+ | ISIN: XS2361255057 | Z-spread down by 15.2 bp to 409.1 bp, with the yield to worst at 3.8% and the bond now trading up to 96.6 cents on the dollar (1Y price range: 95.3-99.9).

- Issuer: Ashland Services BV (Zwijndrecht, Netherlands) | Coupon: 2.00% | Maturity: 30/1/2028 | Rating: BB+ | ISIN: XS2103218538 | Z-spread down by 18.9 bp to 181.8 bp, with the yield to worst at 1.5% and the bond now trading up to 102.6 cents on the dollar (1Y price range: 98.4-102.6).

- Issuer: Adler Group SA (Senningerberg, Luxembourg) | Coupon: 2.75% | Maturity: 13/11/2026 | Rating: BB+ | ISIN: XS2248826294 | Z-spread down by 37.9 bp to 295.3 bp, with the yield to worst at 2.5% and the bond now trading up to 100.5 cents on the dollar (1Y price range: 97.5-103.2).

USD BOND ISSUES

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$267m Bond (US3133EM4N99), fixed rate (0.35% coupon) maturing on 1 May 2024, priced at 100.00, non callable

- Heartland Financial USA Inc (Banking | Dubuque, United States | Rating: NR): US$150m Subordinated Note (US42234QAE26), floating rate maturing on 15 September 2031, priced at 100.00, callable (10nc5)

- Verizon Communications Inc (Telecommunications | New York City, United States | Rating: BBB+): US$1,000m Senior Note (US92343VGL27), fixed rate (2.85% coupon) maturing on 3 September 2041, priced at 99.76 (original spread of 102 bp), callable (20nc20)

- Adani Green Energy Ltd (Financial - Other | Ahmedabad, Gujarat, India | Rating: NR): US$750m Note (XS2383328932), fixed rate (4.38% coupon) maturing on 8 September 2024, priced at 100.00, non callable

- CPPIB Capital Inc (Financial - Other | Toronto, Canada | Rating: NR): US$2,500m Senior Note (US22411VAU26), fixed rate (0.88% coupon) maturing on 9 September 2026, priced at 99.84 (original spread of 14 bp), non callable

- Chang Development International Ltd (Financial - Other | Tortola, China (Mainland) | Rating: NR): US$230m Bond (XS2374510407), fixed rate (4.30% coupon) maturing on 9 September 2024, priced at 100.00, non callable

- Chiba Bank Ltd (Banking | Chiba, Japan | Rating: A-): US$300m Bond (XS2382296858), fixed rate (1.35% coupon) maturing on 8 September 2026, priced at 99.81, non callable

- European Stability Mechanism (Supranational | Luxembourg, Luxembourg | Rating: AA+): US$2,000m Senior Note (US29881WAE21), fixed rate (0.25% coupon) maturing on 8 September 2023 (original spread of 9 bp), non callable

- State Grid Overseas Investment BVI Ltd (Financial - Other | Tortola, China (Mainland) | Rating: NR): US$600m Senior Note (XS2358735830), fixed rate (1.13% coupon) maturing on 8 September 2026, priced at 99.48, callable (5nc5)

EUR BOND ISSUES

- ASB Finance Ltd (Financial - Other | Auckland, Australia | Rating: AA-): €750m Senior Note (XS2381560411), fixed rate (0.25% coupon) maturing on 8 September 2028, priced at 99.70 (original spread of 88 bp), non callable

- Banco Bilbao Vizcaya Argentaria SA (Banking | Bilbao, Spain | Rating: A-): €1,000m Note (XS2384578824), floating rate (EU03MLIB + 100.0 bp) maturing on 9 September 2023, priced at 101.73, non callable

- Czech Gas Networks Investments SARL (Financial - Other | Luxembourg, Guernsey | Rating: BBB+): €500m Senior Note (XS2382953789), fixed rate (0.45% coupon) maturing on 8 September 2029, priced at 99.95 (original spread of 98 bp), callable (8nc8)

- Development Bank of Japan Inc (Agency | Chiyoda-Ku, Japan | Rating: A): €600m Senior Note (XS2382951148), fixed rate (0.01% coupon) maturing on 9 September 2025, priced at 101.14 (original spread of 47 bp), non callable

- European Energy A/S (Utility - Other | Soborg, Denmark | Rating: NR): €300m Bond (DK0030494505), floating rate (EU03MLIB + 375.0 bp) maturing on 16 September 2025, priced at 100.00, callable (4nc2)

- Lanxess AG (Chemicals | Cologne, Germany | Rating: BBB): €500m Senior Note (XS2383886947) zero coupon maturing on 8 September 2027, priced at 99.36 (original spread of 76 bp), callable (6nc6)

- Mizuho Financial Group Inc (Banking | Chiyoda-Ku, Japan | Rating: A-): €1,000m Senior Note (XS2383901761), floating rate maturing on 6 September 2029, priced at 100.00 (original spread of 107 bp), callable (8nc7)

- OP Yrityspankki Oyj (Banking | Helsinki, Finland | Rating: AA-): €500m Note (XS2384473992), fixed rate (0.38% coupon) maturing on 8 December 2028, priced at 99.79 (original spread of 97 bp), non callable

- SR Boligkreditt AS (Financial - Other | Stavanger, Norway | Rating: NR): €500m Covered Bond (Other) (XS2384580218), fixed rate (0.01% coupon) maturing on 8 September 2028, priced at 101.35 (original spread of 42 bp), non callable

- State Grid Overseas Investment BVI Ltd (Financial - Other | Tortola, China (Mainland) | Rating: NR): €800m Senior Note (XS2358736051), fixed rate (0.42% coupon) maturing on 8 September 2028, priced at 100.00 (original spread of 97 bp), callable (7nc7)

NEW LOANS

- Greenbrier Cos Inc (BB-), signed a US$ 600m Revolving Credit Facility, a US$ 200m Term Loan, and a US$ 292m Term Loan A, to be used for general corporate purposes