Credit

USD Corporate Bonds Rise, Helped By Lower Rates And Tighter HY Cash Spreads

Another decent day of issuance in Europe, where we're seeing more deals priced this week, including €2bn in 3 tranches from Mondelez International Holdings

Published ET

Bonds from Rockies Express Pipeline LLC and Southeast Supply Header LLC Have Seen Their Spreads Fall Recently With The Surge In Nat Gas Prices | Source: Refinitiv

QUICK SUMMARY

- S&P 500 Bond Index was up 0.18% today, with investment grade up 0.18% and high yield up 0.14% (YTD total return: +0.26%)

- The iBoxx USD Liquid Investment Grade Total Return Index was up 0.20% today (Month-to-date: 0.21%; Year-to-date: -0.28%)

- The iBoxx USD Liquid High Yield Total Return Index was up 0.11% today (Month-to-date: 0.15%; Year-to-date: 4.05%)

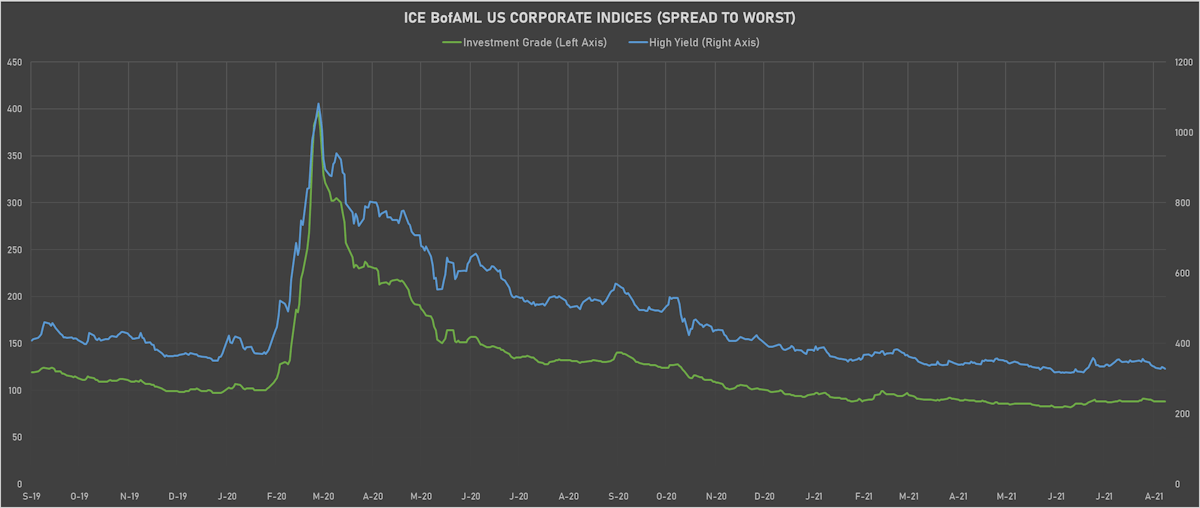

- ICE BofA US Corporate Index (Investment Grade) spread to worst unchanged at 88.0 bp (YTD change: -10.0 bp)

- ICE BofA US High Yield Index spread to worst down -3.0 bp, now at 328.0 bp (YTD change: -62.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index up 0.04% today (YTD total return: +2.6%)

- New issues: US$ 6.4bn in dollars and € 10.2bn in euros

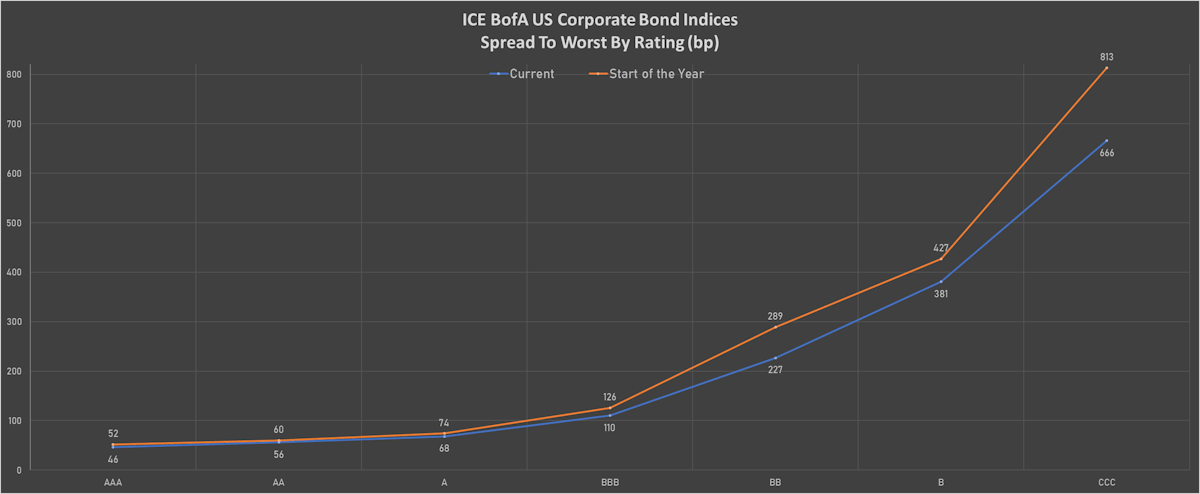

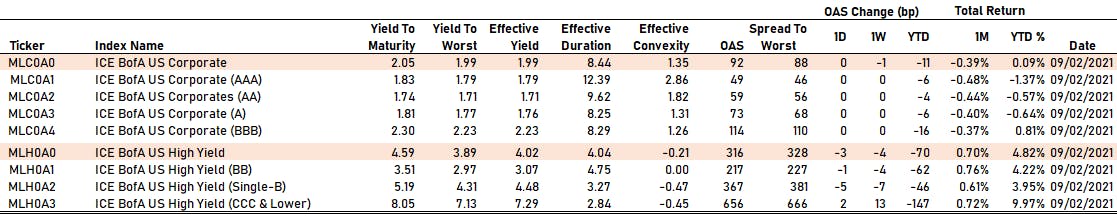

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

- AAA unchanged at 49 bp

- AA unchanged at 59 bp

- A unchanged at 73 bp

- BBB unchanged at 114 bp

- BB down by -1 bp at 217 bp

- B down by -5 bp at 367 bp

- CCC up by 2 bp at 656 bp

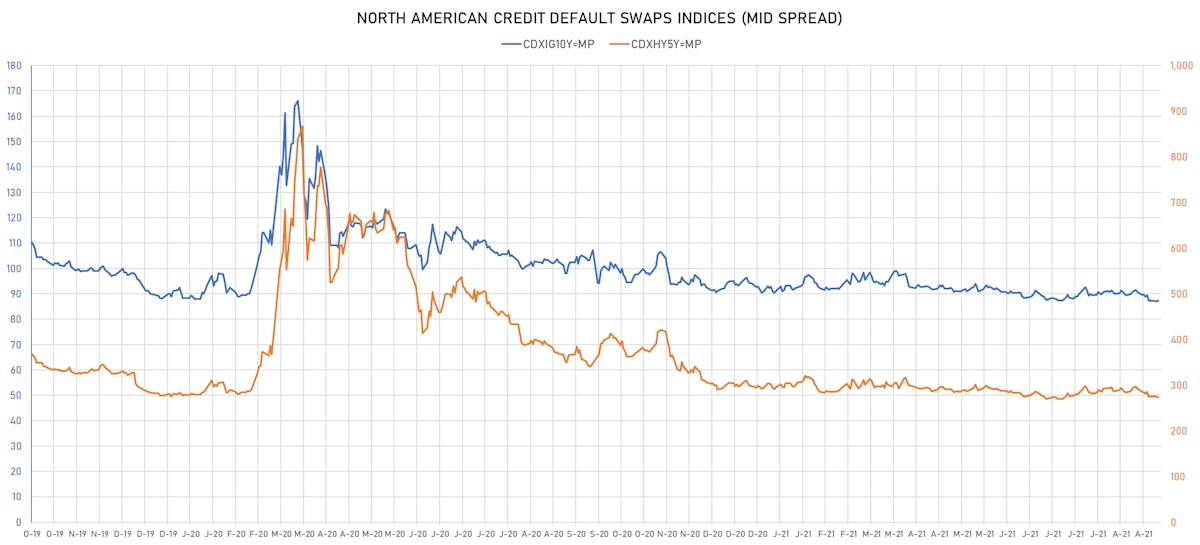

CDS INDICES (mid-spreads)

- Markit CDX.NA.IG 5Y up 0.3 bp, now at 87bp (YTD change: +bp)

- Markit CDX.NA.HY 5Y down 0.5 bp, now at 274bp (YTD change: +bp)

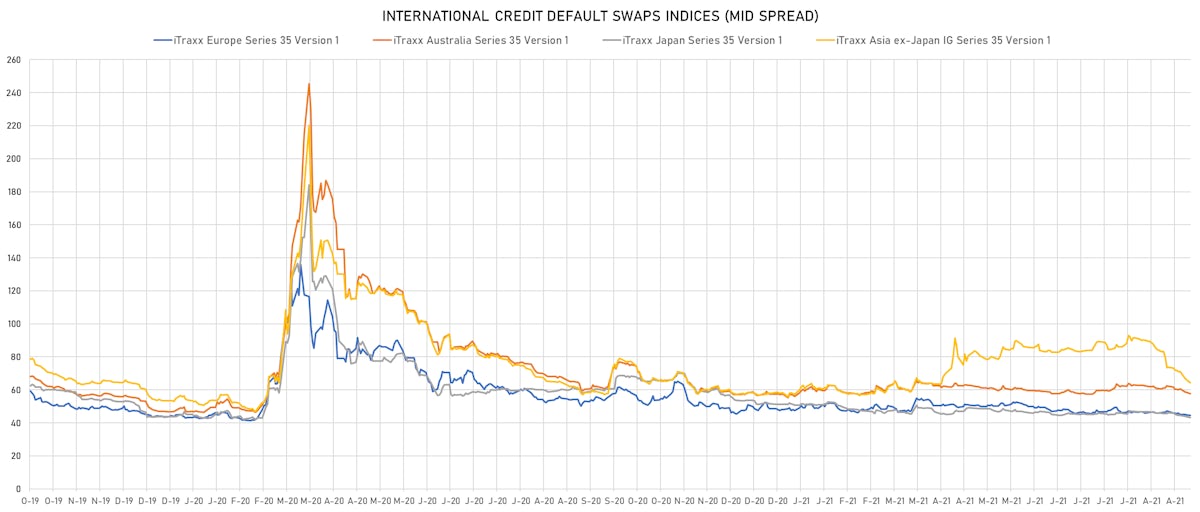

- Markit iTRAXX Europe unchanged at 45bp (YTD change: -3.3bp)

- Markit iTRAXX Japan down 0.1 bp, now at 43bp (YTD change: -8.2bp)

- Markit iTRAXX Asia Ex-Japan up 0.2 bp, now at 65bp (YTD change: +6.4bp)

TOP BONDS MOVES IN THE PAST WEEK - USD HY

- Issuer: StoneCo Ltd (George Town, Cayman Islands) | Coupon: 3.95% | Maturity: 16/6/2028 | Rating: BB- | ISIN: USG85158AA43 | Z-spread up by 65.3 bp to 365.0 bp, with the yield to worst at 4.5% and the bond now trading down to 95.8 cents on the dollar (1Y price range: 98.5-100.0).

- Issuer: Oi SA em Recuperacao Judicial (Rio de Janeiro, Brazil) | Coupon: 10.00% | Maturity: 27/7/2025 | Rating: CCC+ | ISIN: USP7354PAA23 | Z-spread up by 63.0 bp to 1,071.4 bp, with the yield to worst at 10.7% and the bond now trading down to 96.8 cents on the dollar (1Y price range: 96.8-107.0).

- Issuer: Aag FH LP (Canada) | Coupon: 9.75% | Maturity: 15/7/2024 | Rating: B- | ISIN: USC33027AA82 | Z-spread up by 46.5 bp to 978.9 bp, with the yield to worst at 9.8% and the bond now trading down to 98.8 cents on the dollar (1Y price range: 96.0-99.8).

- Issuer: Grupo de Inversiones Suramericana SA (Medellin, Colombia) | Coupon: 5.50% | Maturity: 29/4/2026 | Rating: BB+ | ISIN: USG42036AB25 | Z-spread up by 39.8 bp to 282.2 bp, with the yield to worst at 3.4% and the bond now trading down to 107.7 cents on the dollar (1Y price range: 107.0-114.6).

- Issuer: TBC bank'i SS (Tbilisi, Georgia) | Coupon: 5.75% | Maturity: 19/6/2024 | Rating: BB- | ISIN: XS1843434363 | Z-spread up by 31.9 bp to 266.7 bp, with the yield to worst at 2.7% and the bond now trading down to 107.0 cents on the dollar (1Y price range: 104.0-110.0).

- Issuer: YPF SA (Buenos Aires, Argentina) | Coupon: 8.50% | Maturity: 27/6/2029 | Rating: CCC- | ISIN: USP989MJBP50 | Z-spread down by 32.8 bp to 1,221.4 bp, with the yield to worst at 13.0% and the bond now trading up to 77.3 cents on the dollar (1Y price range: 59.9-77.6).

- Issuer: EQM Midstream Partners LP (Canonsburg, Pennsylvania (US)) | Coupon: 6.50% | Maturity: 1/7/2027 | Rating: BB- | ISIN: USU26886AB46 | Z-spread down by 33.8 bp to 290.4 bp, with the yield to worst at 3.6% and the bond now trading up to 113.0 cents on the dollar (1Y price range: 106.5-113.5).

- Issuer: Turkiye Vakiflar Bankasi TAO (Turkey) | Coupon: 5.25% | Maturity: 5/2/2025 | Rating: B | ISIN: XS2112797290 | Z-spread down by 34.6 bp to 440.0 bp, with the yield to worst at 4.6% and the bond now trading up to 101.0 cents on the dollar (1Y price range: 94.0-101.0).

- Issuer: SoftBank Group Corp (Minato-ku, Japan) | Coupon: 3.13% | Maturity: 6/1/2025 | Rating: BB+ | ISIN: XS2362416294 | Z-spread down by 38.3 bp to 297.2 bp, with the yield to worst at 3.2% and the bond now trading up to 98.6 cents on the dollar (1Y price range: 97.4-100.1).

- Issuer: NCL Corporation Ltd (Miami, Bermuda) | Coupon: 5.88% | Maturity: 15/3/2026 | Rating: CCC+ | ISIN: USG6436QAL08 | Z-spread down by 39.5 bp to 490.6 bp, with the yield to worst at 5.5% and the bond now trading up to 100.8 cents on the dollar (1Y price range: 98.0-105.3).

- Issuer: Rockies Express Pipeline LLC (Leawood, Kansas (US)) | Coupon: 4.95% | Maturity: 15/7/2029 | Rating: BB | ISIN: USU75111AJ00 | Z-spread down by 40.1 bp to 309.2 bp, with the yield to worst at 4.1% and the bond now trading up to 104.8 cents on the dollar (1Y price range: 101.3-107.8).

- Issuer: Vedanta Resources Finance II PLC (London, United Kingdom) | Coupon: 8.95% | Maturity: 11/3/2025 | Rating: B- | ISIN: USG9T27HAD62 | Z-spread down by 43.1 bp to 762.3 bp, with the yield to worst at 7.9% and the bond now trading up to 102.0 cents on the dollar (1Y price range: 93.5-101.9).

- Issuer: Southeast Supply Header LLC (Houston, Texas (US)) | Coupon: 4.25% | Maturity: 15/6/2024 | Rating: BB- | ISIN: USU83854AB29 | Z-spread down by 64.7 bp to 283.9 bp, with the yield to worst at 2.9% and the bond now trading up to 102.3 cents on the dollar (1Y price range: 98.4-102.4).

TOP BONDS MOVES IN THE PAST WEEK - EUR HY

- Issuer: Telecom Italia SpA (Rome, Italy) | Coupon: 5.25% | Maturity: 17/3/2055 | Rating: BB | ISIN: XS0214965963 | Z-spread down by 5.5 bp to 375.6 bp (CDS basis: -122.4bp), with the yield to worst at 3.7% and the bond now trading up to 122.9 cents on the dollar (1Y price range: 114.2-126.9).

- Issuer: ZF Finance GmbH (Friedrichshafen, Germany) | Coupon: 3.75% | Maturity: 21/9/2028 | Rating: BB+ | ISIN: XS2231331260 | Z-spread down by 5.7 bp to 224.4 bp, with the yield to worst at 1.9% and the bond now trading up to 111.0 cents on the dollar (1Y price range: 105.4-112.7).

- Issuer: Autostrade per l'Italia SpA (Rome, Italy) | Coupon: 2.00% | Maturity: 15/1/2030 | Rating: BB- | ISIN: XS2278566299 | Z-spread down by 6.4 bp to 144.8 bp (CDS basis: -16.0bp), with the yield to worst at 1.1% and the bond now trading up to 105.3 cents on the dollar (1Y price range: 98.1-105.4).

- Issuer: Renault SA (Boulogne-Billancourt, France) | Coupon: 2.38% | Maturity: 25/5/2026 | Rating: BB | ISIN: FR0014000NZ4 | Z-spread down by 6.5 bp to 213.7 bp (CDS basis: -61.4bp), with the yield to worst at 1.7% and the bond now trading up to 102.5 cents on the dollar (1Y price range: 99.5-102.9).

- Issuer: Amplifon SpA (Milan, Italy) | Coupon: 1.13% | Maturity: 13/2/2027 | Rating: BB+ | ISIN: XS2116503546 | Z-spread down by 6.9 bp to 110.3 bp, with the yield to worst at 0.6% and the bond now trading up to 101.7 cents on the dollar (1Y price range: 98.8-101.6).

- Issuer: Orano SA (Chatillon, France) | Coupon: 2.75% | Maturity: 8/3/2028 | Rating: BB+ | ISIN: FR0013533031 | Z-spread down by 7.2 bp to 209.2 bp, with the yield to worst at 1.7% and the bond now trading up to 105.3 cents on the dollar (1Y price range: 103.2-105.5).

- Issuer: Atlantia SpA (Rome, Italy) | Coupon: 1.88% | Maturity: 12/2/2028 | Rating: BB- | ISIN: XS2301390089 | Z-spread down by 7.9 bp to 141.0 bp (CDS basis: -25.6bp), with the yield to worst at 1.0% and the bond now trading up to 104.3 cents on the dollar (1Y price range: 97.5-104.5).

- Issuer: Saipem Finance International BV (Amsterdam, Netherlands) | Coupon: 3.13% | Maturity: 31/3/2028 | Rating: BB | ISIN: XS2325696628 | Z-spread down by 8.0 bp to 315.1 bp (CDS basis: 40.0bp), with the yield to worst at 2.8% and the bond now trading up to 101.2 cents on the dollar (1Y price range: 98.5-102.9).

- Issuer: Verallia SAS (Courbevoie, France) | Coupon: 1.63% | Maturity: 14/5/2028 | Rating: BB+ | ISIN: FR0014003G27 | Z-spread down by 9.1 bp to 135.7 bp, with the yield to worst at 1.0% and the bond now trading up to 103.1 cents on the dollar (1Y price range: 99.0-103.1).

- Issuer: Teva Pharmaceutical Finance Netherlands II BV (Amsterdam, Netherlands) | Coupon: 1.63% | Maturity: 15/10/2028 | Rating: BB- | ISIN: XS1439749364 | Z-spread down by 10.0 bp to 334.0 bp, with the yield to worst at 3.0% and the bond now trading up to 90.6 cents on the dollar (1Y price range: 87.1-92.6).

- Issuer: SoftBank Group Corp (Minato-Ku, Japan) | Coupon: 3.38% | Maturity: 6/7/2029 | Rating: BB+ | ISIN: XS2361255057 | Z-spread down by 15.5 bp to 396.6 bp, with the yield to worst at 3.6% and the bond now trading up to 97.4 cents on the dollar (1Y price range: 95.3-99.9).

- Issuer: Ashland Services BV (Zwijndrecht, Netherlands) | Coupon: 2.00% | Maturity: 30/1/2028 | Rating: BB+ | ISIN: XS2103218538 | Z-spread down by 22.7 bp to 180.5 bp, with the yield to worst at 1.4% and the bond now trading up to 102.7 cents on the dollar (1Y price range: 98.4-102.8).

- Issuer: Adler Group SA (Senningerberg, Luxembourg) | Coupon: 2.25% | Maturity: 14/1/2029 | Rating: BB+ | ISIN: XS2283225477 | Z-spread down by 40.9 bp to 295.5 bp, with the yield to worst at 2.6% and the bond now trading up to 96.6 cents on the dollar (1Y price range: 92.8-98.9).

USD BOND ISSUES

- Federal Agricultural Mortgage Corp (Agency | Washington, Washington Dc, United States | Rating: NR): US$150m Unsecured Note (US31422XML37), fixed rate (0.60% coupon) maturing on 8 September 2025, priced at 100.00, non callable

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$220m Bond (US3133EM4S86), fixed rate (0.87% coupon) maturing on 8 September 2026, priced at 100.00 (original spread of 80 bp), callable (5nc1)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$665m Bond (US3133EM4T69), floating rate (SOFR + 2.5 bp) maturing on 8 September 2023, priced at 100.00, non callable

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$325m Bond (US3133EM4U33), floating rate (PRQ -315.5 bp) maturing on 8 September 2023, priced at 100.00, non callable

- AUB Sukuk Ltd (Financial - Other | Cayman Islands | Rating: NR): US$600m Islamic Sukuk (Hybrid) (XS2384698051), fixed rate (2.62% coupon) maturing on 9 September 2026, priced at 100.00, non callable

- Aozora Bank Ltd (Banking | Chiyoda-Ku, Japan | Rating: BBB+): US$300m Senior Note (XS2383887598), fixed rate (1.05% coupon) maturing on 9 September 2024, priced at 99.93 (original spread of 68 bp), non callable

- Aries Capital DAC (Financial - Other | Dublin, Ireland | Rating: NR): US$125m Unsecured Note (XS2384185851) zero coupon maturing on 9 September 2026, priced at 100.00, non callable

- Aries Capital DAC (Financial - Other | Dublin, Ireland | Rating: NR): US$300m Unsecured Note (XS2384186073) zero coupon maturing on 9 September 2026, priced at 100.00, non callable

- Bank of Montreal (Toronto Branch) (Banking | Toronto, Canada | Rating: NR): US$250m Unsecured Note (XS2383659377) zero coupon maturing on 23 September 2061, priced at 100.00, non callable

- China Development Bank (Hong Kong Branch) (Banking | China (Mainland) | Rating: NR): US$500m Senior Note (XS2380541685), fixed rate (0.63% coupon) maturing on 9 September 2024, priced at 99.96 (original spread of 23 bp), non callable

- Contemporary Ruiding Development Ltd (Financial - Other | Road Town, China (Mainland) | Rating: BBB+): US$500m Bond (XS2369276014), fixed rate (1.50% coupon) maturing on 9 September 2026, priced at 99.45 (original spread of 85 bp), non callable

- Dno ASA (Oil and Gas | Oslo, Oslo, Norway | Rating: NR): US$400m Bond (NO0011088593), fixed rate (7.88% coupon) maturing on 9 September 2026, callable (5nc3)

- Euronav Luxembourg SA (Service - Other | Luxembourg, Belgium | Rating: NR): US$200m Bond (NO0011091290), fixed rate (6.25% coupon) maturing on 14 September 2026, non callable

- Guangzhou Metro Investment Finance BVI Ltd (Financial - Other | Rating: NR): US$200m Unsecured Note (XS2382853997), fixed rate (1.00% coupon) maturing on 21 September 2026, priced at 100.00, non callable

- Industrial and Commercial Bank of China Ltd (Hong Kong Branch) (Banking | China (Mainland) | Rating: NR): US$500m Unsecured Note (XS2381043350), fixed rate (1.25% coupon) maturing on 20 September 2026, priced at 100.00, non callable

- JT International Financial Services BV (Financial - Other | Amstelveen, Noord-Holland, Japan | Rating: NR): US$625m Senior Note (XS2383503013), fixed rate (2.25% coupon) maturing on 14 September 2031, priced at 99.80, callable (10nc10)

- Maldives Sukuk Issuance Ltd (Financial - Other | Cayman Islands | Rating: NR): US$200m Islamic Sukuk (Hybrid) (USG5852MAC67), fixed rate (9.88% coupon) maturing on 8 April 2026, priced at 97.76, non callable

- Xingcheng (BVI) Ltd (Financial - Other | Road Town, British Virgin Islands | Rating: NR): US$300m Unsecured Note (XS2384258245), fixed rate (1.00% coupon) maturing on 13 September 2024, priced at 100.00, non callable

EUR BOND ISSUES

- Aedifica SA (Real Estate Investment Trust | Brussels, Bruxelles-Capitale, Belgium | Rating: BBB): €500m Bond (BE6330288687), fixed rate (0.75% coupon) maturing on 9 September 2031, priced at 99.88 (original spread of 114 bp), callable (10nc10)

- Athene Global Funding (Financial - Other | Wilmington, Delaware, United States | Rating: NR): €600m Senior Note (XS2384413311), fixed rate (0.37% coupon) maturing on 10 September 2026, priced at 100.00 (original spread of 109 bp), non callable

- Banco de Credito Social Cooperativo SA (Banking | Madrid, Madrid, Spain | Rating: BB): €500m Note (XS2383811424), fixed rate (1.75% coupon) maturing on 9 March 2028, priced at 99.50 (original spread of 254 bp), callable (7nc5)

- Celanese US Holdings LLC (Chemicals | Irving, United States | Rating: BBB): €500m Senior Note (XS2385114298), fixed rate (0.63% coupon) maturing on 10 September 2028, priced at 99.90 (original spread of 124 bp), non callable

- Delivery Hero SE (Service - Other | Berlin, Germany | Rating: NR): €750m Bond (DE000A3MP429), fixed rate (1.00% coupon) maturing on 30 April 2026, priced at 100.00, non callable, convertible

- Delivery Hero SE (Service - Other | Berlin, Germany | Rating: NR): €500m Bond (DE000A3MP437), fixed rate (2.13% coupon) maturing on 10 March 2029, priced at 100.00, non callable, convertible

- Hessen, State of (Official and Muni | Wiesbaden, Hessen, Germany | Rating: AA+): €500m Jumbo Landesschatzanweisung (DE000A1RQD76) zero coupon maturing on 10 September 2026, priced at 102.23 (original spread of 26 bp), non callable

- HYPO NOE Landesbank fuer Niederoesterreich und Wien AG (Banking | Sankt Poelten, Niederoesterreich, Austria | Rating: A): €500m Hypothekenpfandbrief Jumbo (Covered Bond) (AT0000A2STT8), fixed rate (0.01% coupon) maturing on 8 September 2028, priced at 101.40 (original spread of 42 bp), non callable

- Landesbank Hessen Thueringen Girozentrale (Banking | Frankfurt, Hessen, Germany | Rating: A-): €750m Oeffenlicher Pfandbrief (Covered Bond) (DE000HLB41M4), floating rate (EU06MLIB + 100.0 bp) maturing on 6 September 2024, priced at 103.07, non callable

- Mondelez International Holdings Netherlands BV (Food Processors | Oosterhout, Noord-Brabant | Rating: NR): €700m Senior Note (XS2384726795), fixed rate (1.25% coupon) maturing on 9 September 2041, priced at 98.02 (original spread of 151 bp), callable (20nc20)

- Mondelez International Holdings Netherlands BV (Food Processors | Oosterhout, Noord-Brabant | Rating: NR): €650m Senior Note (XS2384726282), fixed rate (0.63% coupon) maturing on 9 September 2032, priced at 99.54 (original spread of 105 bp), callable (11nc11)

- Mondelez International Holdings Netherlands BV (Food Processors | Oosterhout | Rating: NR): €650m Senior Note (XS2384725045), fixed rate (0.25% coupon) maturing on 9 September 2029, priced at 99.57 (original spread of 84 bp), callable (8nc8)

- NIBC Bank NV (Banking | S-Gravenhage, Zuid-Holland, United States | Rating: BBB+): €750m Note (XS2384734542), fixed rate (0.25% coupon) maturing on 9 September 2026, priced at 99.93 (original spread of 98 bp), non callable

- Public Storage (Real Estate Investment Trust | Glendale, California, United States | Rating: A): €700m Senior Note (XS2384697830), fixed rate (0.50% coupon) maturing on 9 September 2030, priced at 99.39 (original spread of 104 bp), callable (9nc9)

- RRE 8 Loan Management DAC (Financial - Other | Dublin, Ireland | Rating: NR): €303m Bond (XS2379452639), floating rate maturing on 15 October 2036, priced at 100.00, non callable

- Wuestenrot & Wuerttembergische AG (Financial - Other | Stuttgart, Baden-Wuerttemberg, Germany | Rating: BBB+): €300m Subordinated Note (XS2378468420), floating rate maturing on 10 September 2041, priced at 99.10, callable (20nc10)

NEW LOANS

- Oriental Energy (Singapore), signed a US$ 120m 364d Revolver, to be used for refinancing and returning bank debt. It matures on 09/01/22 and initial pricing is set at LIBOR +200bps