Credit

High Yield Cash OAS 3bp Tighter, IG Unchanged For The Week

Weekly USD corporate bond issuance volume (IFR data): just US$ 3.75bn in 4 tranches for IG, and US$ 100m in a single tranche for HY

Published ET

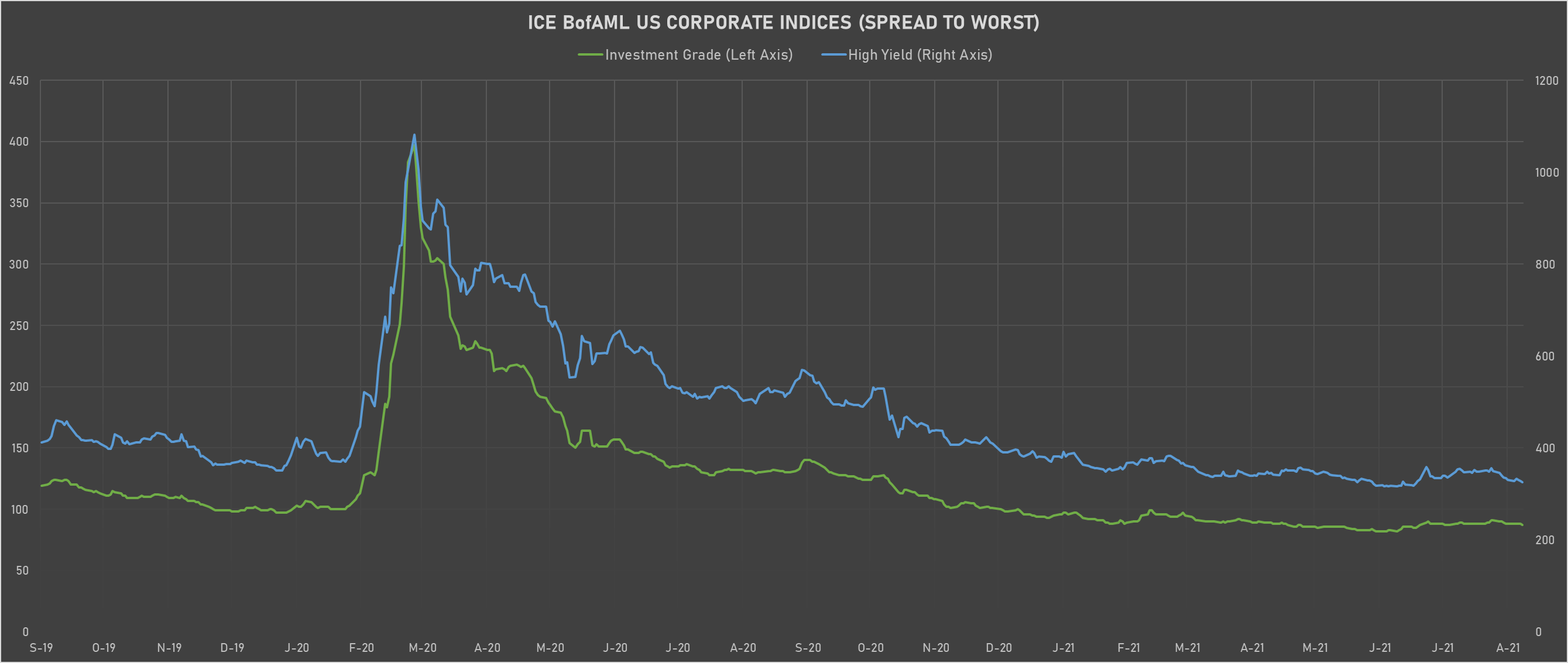

ICE BofAML US Corporate Spreads To Worst By Rating | Sources: ϕpost, Refinitiv data

QUICK SUMMARY

- The iBoxx USD Liquid Investment Grade Total Return Index was down -0.344% today (Month-to-date: -0.14%; Year-to-date: -0.63%)

- The iBoxx USD Liquid High Yield Total Return Index was up 0.006% today (Month-to-date: 0.15%; Year-to-date: 4.05%)

- ICE BofA US Corporate Index (Investment Grade) spread to worst down -1.0 bp, now at 87.0 bp (YTD change: -11.0 bp)

- ICE BofA US High Yield Index spread to worst down -2.0 bp, now at 326.0 bp (YTD change: -64.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index up 0.02% today (YTD total return: +2.6%)

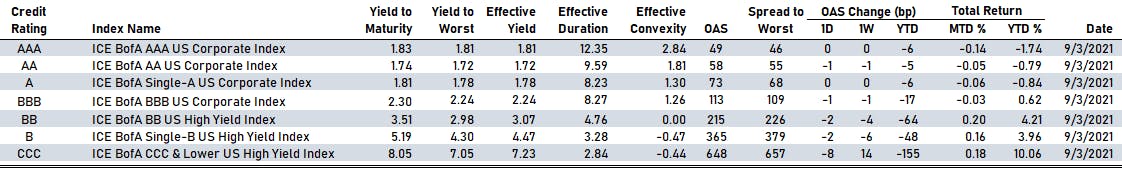

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

- AAA unchanged at 49 bp

- AA down by -1 bp at 58 bp

- A unchanged at 73 bp

- BBB down by -1 bp at 113 bp

- BB down by -2 bp at 215 bp

- B down by -2 bp at 365 bp

- CCC down by -8 bp at 648 bp

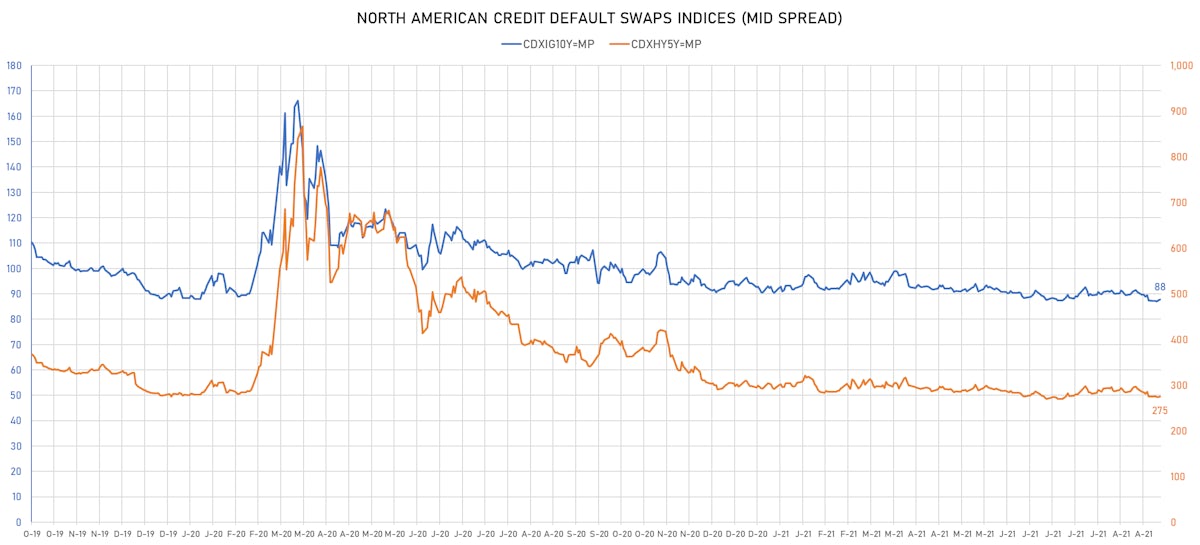

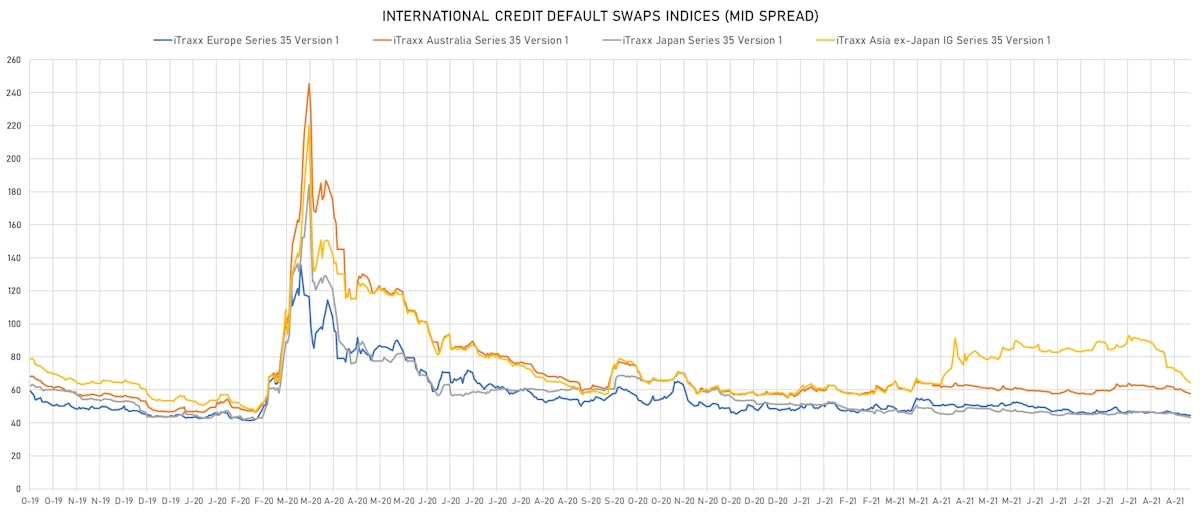

CDS INDICES (mid-spreads)

- Markit CDX.NA.IG 5Y up 0.4 bp, now at 88bp (YTD change: -2.8bp)

- Markit CDX.NA.HY 5Y up 0.7 bp, now at 275bp (YTD change: -18.6bp)

- Markit iTRAXX Europe up 0.3 bp, now at 45bp (YTD change: -3.0bp)

- Markit iTRAXX Japan down 0.1 bp, now at 43bp (YTD change: -8.2bp)

- Markit iTRAXX Asia Ex-Japan up 0.2 bp, now at 65bp (YTD change: +6.4bp)

LARGEST USD CORPORATE CDS MOVES IN THE PAST WEEK

- Transocean Inc (Country: KY; rated: Caa3): down 655.6 bp to 2,124.9bp (1Y range: 941-7,695bp)

- Apache Corp (Country: US; rated: Ba1): down 73.9 bp to 185.0bp (1Y range: 164-453bp)

- Carnival Corp (Country: US; rated: LGD5 - 72%): down 60.0 bp to 398.9bp (1Y range: 291-1,214bp)

- American Airlines Group Inc (Country: US; rated: B2): down 49.3 bp to 768.4bp (1Y range: 596-2,968bp)

- Royal Caribbean Cruises Ltd (Country: US; rated: LGD4 - 59%): down 44.2 bp to 379.4bp (1Y range: 318-1,291bp)

- Pitney Bowes Inc (Country: US; rated: LGD2 - 16%): down 37.5 bp to 385.6bp (1Y range: 363-546bp)

- Murphy Oil Corp (Country: US; rated: Ba3): down 35.9 bp to 324.1bp (1Y range: 280-763bp)

- Beazer Homes USA Inc (Country: US; rated: B2): down 33.2 bp to 297.8bp (1Y range: 231-363bp)

- Avis Budget Group Inc (Country: US; rated: CCC): down 27.8 bp to 234.3bp (1Y range: 226-665bp)

- American Axle & Manufacturing Inc (Country: US; rated: Ba1): down 25.4 bp to 358.3bp (1Y range: 336-581bp)

- Gap Inc (Country: US; rated: Ba2): down 23.7 bp to 130.1bp (1Y range: 134-294bp)

- NRG Energy Inc (Country: US; rated: Ba1): down 21.0 bp to 122.0bp (1Y range: 108-219bp)

- Tenet Healthcare Corp (Country: US; rated: B2): down 20.9 bp to 244.8bp (1Y range: 237-542bp)

- Genworth Holdings Inc (Country: US; rated: Caa1): down 20.7 bp to 557.3bp (1Y range: 447-681bp)

- Hess Corp (Country: US; rated: A3): down 18.4 bp to 109.7bp (1Y range: 102-236bp)

LARGEST EURO CORPORATE CDS MOVES IN THE PAST WEEK

- Novafives SAS (Country: FR; rated: Caa1): down 37.8 bp to 857.3bp (1Y range: 716-1,205bp)

- Casino Guichard Perrachon SA (Country: FR; rated: WR): down 22.9 bp to 496.7bp (1Y range: 482-1,210bp)

- Virgin Media Finance PLC (Country: GB; rated: WR): down 18.6 bp to 229.0bp (1Y range: 222-325bp)

- Marks and Spencer PLC (Country: GB; rated: Ba1): down 17.5 bp to 157.9bp (1Y range: 144-349bp)

- Altice Finco SA (Country: LU; rated: Caa1): down 15.3 bp to 347.3bp (1Y range: 317-477bp)

- UPC Holding BV (Country: NL; rated: LGD6 - 93%): down 14.7 bp to 186.1bp (1Y range: 183-315bp)

- Tui AG (Country: DE; rated: LGD4 - 50%): down 13.3 bp to 731.4bp (1Y range: 590-1,799bp)

- Iceland Bondco PLC (Country: GB; rated: LGD3 - 46%): down 9.1 bp to 446.6bp (1Y range: 358-686bp)

- Telecom Italia SpA (Country: IT; rated: Ba2): down 7.2 bp to 159.0bp (1Y range: 144-219bp)

- ArcelorMittal SA (Country: LU; rated: WR): down 5.8 bp to 120.9bp (1Y range: 115-248bp)

- Thyssenkrupp AG (Country: DE; rated: B1): down 5.8 bp to 252.9bp (1Y range: 206-479bp)

- Unilabs SubHolding AB (publ) (Country: SE; rated: B2): down 5.0 bp to 178.2bp (1Y range: -169bp)

- CMA CGM SA (Country: FR; rated: B1): down 4.9 bp to 309.3bp (1Y range: 256-734bp)

- Air France KLM SA (Country: FR; rated: B-): up 8.1 bp to 428.1bp (1Y range: 392-1,211bp)

- J Sainsbury PLC (Country: GB; rated: WR): up 26.2 bp to 109.3bp (1Y range: 52-111bp)

EUR BOND ISSUES

- Credit Suisse Ag London Branch (Banking | London, Switzerland | Rating: NR): €110m Unsecured Note (XS2152297003) zero coupon maturing on 27 September 2023, priced at 100.00, non callable

- DekaBank Deutsche Girozentrale (Financial - Other | Frankfurt, Hessen, Germany | Rating: AAA): €250m Oeffenlicher Pfandbrief (Covered Bond) (DE000DK0YUK9), fixed rate (0.01% coupon) maturing on 30 December 2024, priced at 101.42, non callable

- DXC Capital Funding DAC (Financial - Other | Dublin, Dublin, United States | Rating: BBB): €600m Senior Note (XS2384716721), fixed rate (0.95% coupon) maturing on 15 September 2031, priced at 99.72 (original spread of 137 bp), callable (10nc10)

NEW LOANS

- Yingde Gases Investment Ltd (BB-), signed a US$ 500m Revolving Credit / Term Loan, to be used for refinancing and returning bank debt.

- Roompot Service BV, signed a € 1,050m Term Loan B, to be used for acquisition financing.