Credit

HY Spreads Widen, IG Mostly Unchanged, Though IG Bonds Fall With Higher Rates

A huge amount of new corporate bonds priced to kick off the week, with US$ 5bn issued by Nestle and $4.5bn by Toronto-Dominion Bank

Published ET

Dealer Inventories Are Way Down, Most Notably in IG | Source: Credit Suisse

QUICK SUMMARY

- S&P 500 Bond Index was down -0.32% today, with investment grade down -0.34% and high yield down -0.13% (YTD total return: -0.32%)

- The iBoxx USD Liquid Investment Grade Total Return Index was down -0.45% today (Month-to-date: -0.57%; Year-to-date: -1.05%)

- The iBoxx USD Liquid High Yield Total Return Index was down -0.11% today (Month-to-date: 0.09%; Year-to-date: 3.98%)

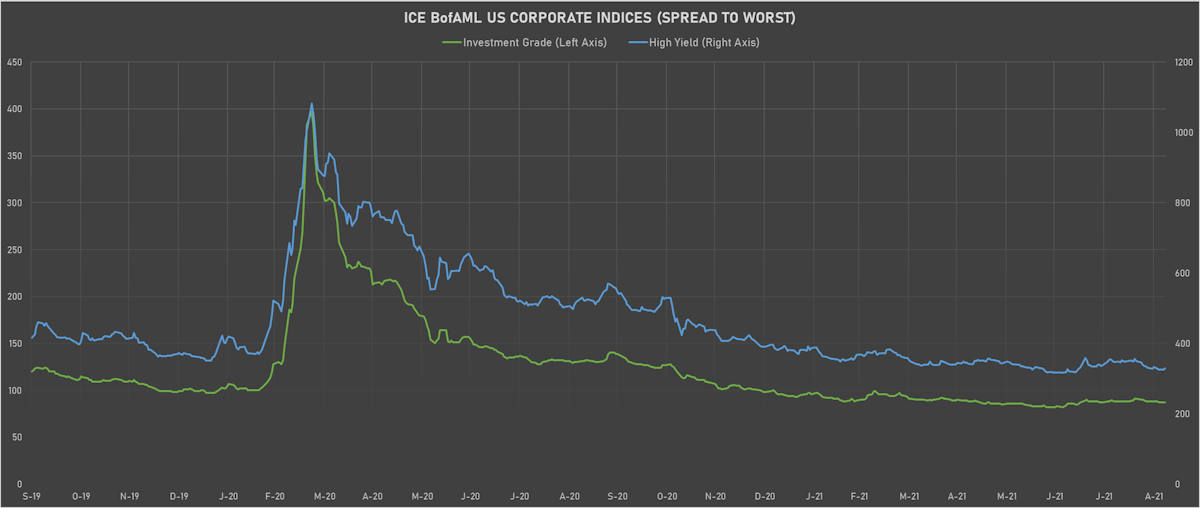

- ICE BofA US Corporate Index (Investment Grade) spread to worst unchanged at 87.0 bp (YTD change: -11.0 bp)

- ICE BofA US High Yield Index spread to worst up 4.0 bp, now at 329.0 bp (YTD change: -61.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index up 0.08% today (YTD total return: +2.7%)

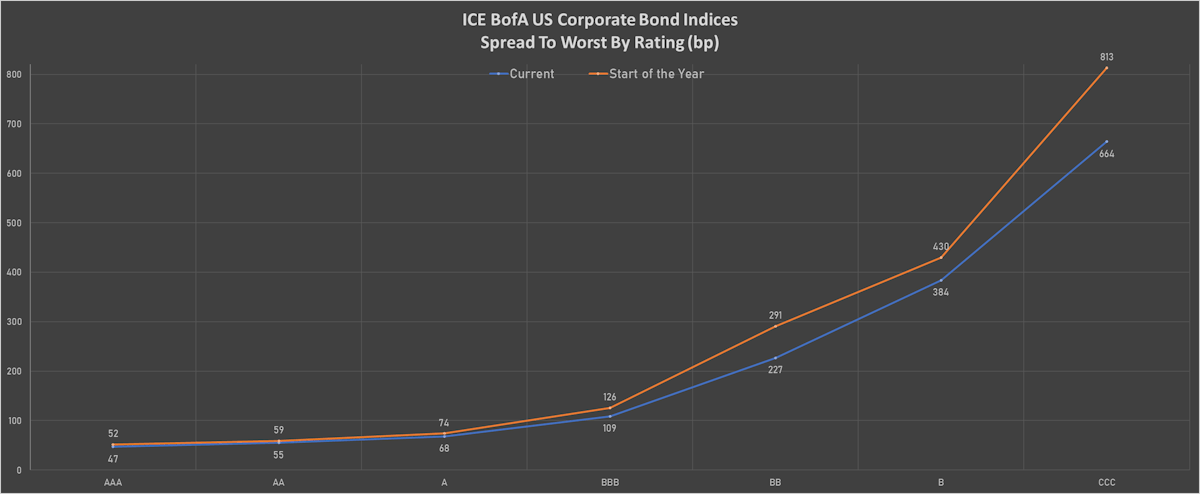

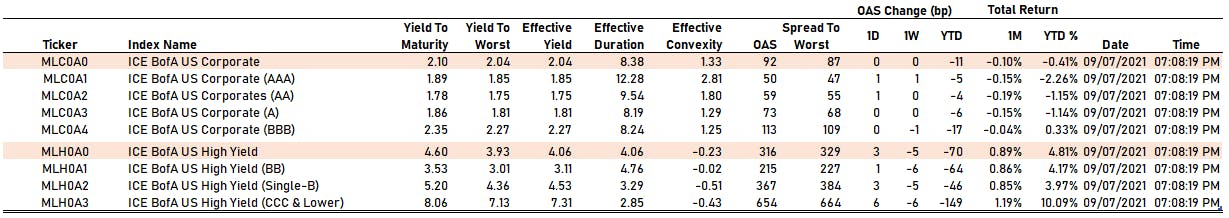

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

- AAA up by 1 bp at 50 bp

- AA up by 1 bp at 59 bp

- A unchanged at 73 bp

- BBB unchanged at 113 bp

- BB up by 1 bp at 215 bp

- B up by 3 bp at 367 bp

- CCC up by 6 bp at 654 bp

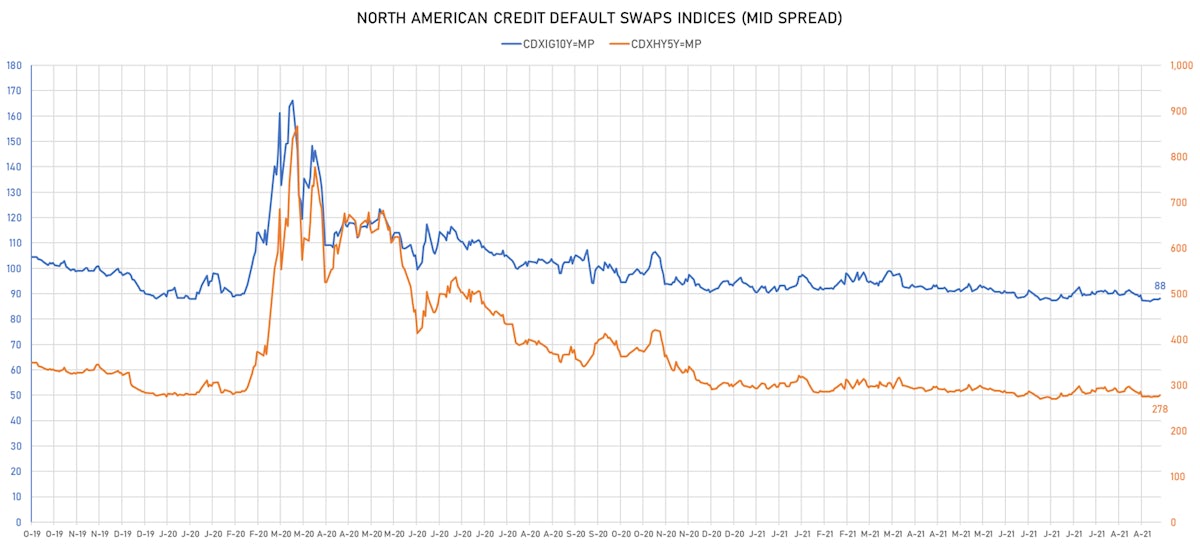

CDS INDICES (mid-spreads)

- Markit CDX.NA.IG 5Y up 0.5 bp, now at 88bp (YTD change: -2.3bp)

- Markit CDX.NA.HY 5Y up 3.1 bp, now at 278bp (YTD change: -15.5bp)

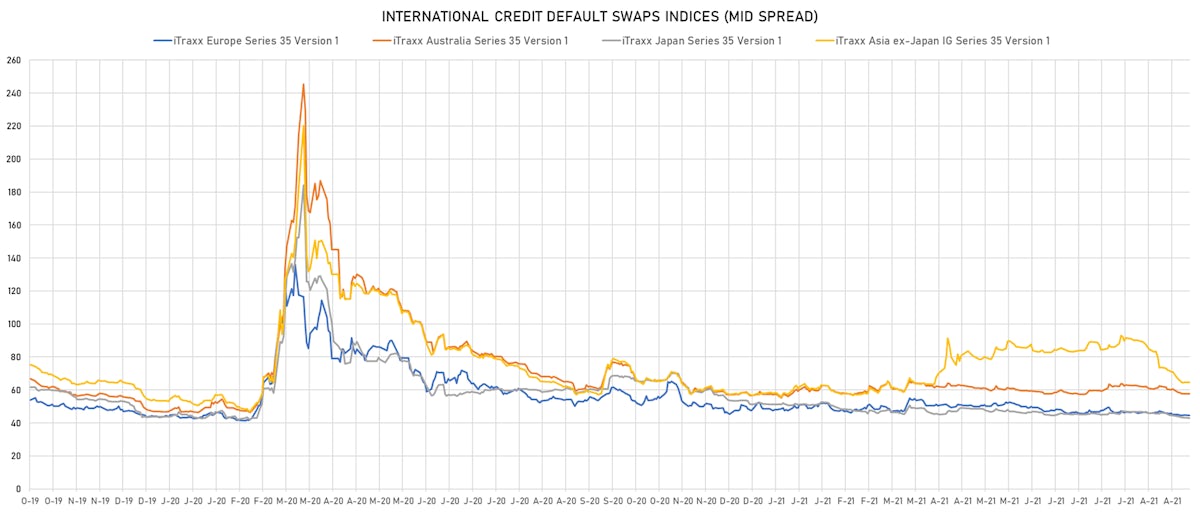

- Markit iTRAXX Europe up 0.5 bp, now at 45bp (YTD change: -3.0bp)

- Markit iTRAXX Japan down 0.3 bp, now at 43bp (YTD change: -8.6bp)

- Markit iTRAXX Asia Ex-Japan down 0.2 bp, now at 64bp (YTD change: +6.3bp)

USD BOND ISSUES

- DXC Technology Co (Service - Other | Tysons Corner, United States | Rating: BBB): US$650m Senior Note (US23355LAM81), fixed rate (2.38% coupon) maturing on 15 September 2028, priced at 99.91 (original spread of 125 bp), callable (7nc7)

- DXC Technology Co (Service - Other | Tysons Corner, United States | Rating: BBB): US$700m Senior Note (US23355LAL09), fixed rate (1.80% coupon) maturing on 15 September 2026, priced at 99.90 (original spread of 100 bp), callable (5nc5)

- Ga Global Funding Trust (Financial - Other | Wilmington, United States | Rating: NR): US$500m Note (US36143L2D64), fixed rate (1.95% coupon) maturing on 15 September 2028, priced at 99.79 (original spread of 85 bp), non callable

- American Honda Finance Corp (Leasing | Torrance, Japan | Rating: A-): US$1,000m Senior Note (US02665WDY49), fixed rate (0.75% coupon) maturing on 9 August 2024, priced at 99.93 (original spread of 35 bp), with a make whole call

- Aries Capital DAC (Financial - Other | Dublin, Dublin, Ireland | Rating: NR): US$300m Unsecured Note (XS2384186073) zero coupon maturing on 9 September 2026, priced at 100.00, non callable

- Banco Santander SA (Banking | Boadilla Del Monte, Spain | Rating: A-): US$1,500m Note (US05964HAN52), floating rate maturing on 14 September 2027, priced at 100.00 (original spread of 90 bp), callable (6nc5)

- China Everbright Bank Company Ltd (Luxembourg Branch) (Banking | Luxembourg, China (Mainland) | Rating: NR): US$500m Senior Note (XS2378772417), fixed rate (0.83% coupon) maturing on 14 September 2024, priced at 100.00 (original spread of 40 bp), non callable

- DBS Group Holdings Ltd (Banking | Singapore | Rating: AA-): US$800m Senior Note (US24023LAF31), fixed rate (1.19% coupon) maturing on 15 March 2027, priced at 100.00 (original spread of 37 bp), non callable

- Danske Bank A/S (Banking | Koebenhavn K, Denmark | Rating: A-): US$1,000m Senior Note (US23636ABB61), fixed rate (1.55% coupon) maturing on 10 September 2027, priced at 100.00 (original spread of 73 bp), callable (6nc5)

- Danske Bank A/S (Banking | Koebenhavn K, Denmark | Rating: A-): US$1,000m Senior Note (US23636ABA88), fixed rate (0.98% coupon) maturing on 10 September 2025, priced at 100.00 (original spread of 55 bp), callable (4nc3)

- Empresa Nacional de Telecomunicaciones SA (Agency | Las Condes, Chile | Rating: A): US$500m Senior Note (USP3742RAX81), fixed rate (3.83% coupon) maturing on 14 September 2061, priced at 100.00 (original spread of 185 bp), non callable

- Kommunalbanken AS (Agency | Oslo, Oslo, Norway | Rating: AAA): US$500m Unsecured Note (XS2384477126), fixed rate (1.00% coupon) maturing on 27 October 2023, priced at 100.00 (original spread of 10 bp), non callable

- Nestle Holdings Inc (Consumer Products | Arlington, Switzerland | Rating: AA-): US$500m Senior Note (US641062AY06), fixed rate (2.50% coupon) maturing on 14 September 2041, priced at 99.77 (original spread of 60 bp), callable (20nc20)

- Nestle Holdings Inc (Consumer Products | Arlington, Switzerland | Rating: AA-): US$500m Senior Note (US641062AZ70), fixed rate (2.88% coupon) maturing on 14 September 2051, priced at 99.24 (original spread of 68 bp), callable (30nc30)

- Nestle Holdings Inc (Consumer Products | Arlington, Switzerland | Rating: AA-): US$500m Senior Note (US641062AV66), fixed rate (1.15% coupon) maturing on 14 January 2027, priced at 99.89 (original spread of 35 bp), callable (5nc5)

- Nestle Holdings Inc (Consumer Products | Arlington, Switzerland | Rating: AA-): US$1,000m Senior Note (US641062AW40), fixed rate (1.50% coupon) maturing on 14 September 2028, priced at 99.73 (original spread of 40 bp), callable (7nc7)

- Nestle Holdings Inc (Consumer Products | Arlington, Switzerland | Rating: AA-): US$1,000m Senior Note (US641062AX23), fixed rate (1.88% coupon) maturing on 14 September 2031, priced at 100.00 (original spread of 50 bp), callable (10nc10)

- Nestle Holdings Inc (Consumer Products | Arlington, Switzerland | Rating: AA-): US$1,500m Senior Note (US641062AU83), fixed rate (0.61% coupon) maturing on 14 September 2024, priced at 100.00 (original spread of 18 bp), callable (3nc3)

- Toronto-Dominion Bank (Banking | Toronto, Canada | Rating: A+): US$900m Senior Note (US89114TZJ41), fixed rate (2.00% coupon) maturing on 10 September 2031, priced at 99.60 (original spread of 67 bp), with a make whole call

- Toronto-Dominion Bank (Banking | Toronto, Canada | Rating: A+): US$1,000m Senior Note (US89114TZE53), fixed rate (0.70% coupon) maturing on 10 September 2024, priced at 99.92 (original spread of 30 bp), with a make whole call

- Waste Connections Inc (Service - Other | Woodbridge, Canada | Rating: BBB): US$650m Senior Note (US94106BAC54), fixed rate (2.20% coupon) maturing on 15 January 2032, priced at 99.84 (original spread of 85 bp), callable (10nc10)

- Waste Connections Inc (Service - Other | Woodbridge, Canada | Rating: BBB+): US$850m Senior Note (US94106BAD38), fixed rate (2.95% coupon) maturing on 15 January 2052, priced at 98.05 (original spread of 105 bp), callable (30nc30)

- Xingcheng (BVI) Ltd (Financial - Other | Road Town, British Virgin Islands | Rating: NR): US$300m Unsecured Note (XS2384258245), fixed rate (1.00% coupon) maturing on 13 September 2024, priced at 100.00, non callable

EUR BOND ISSUES

- Aareal Bank AG (Banking | Wiesbaden, Germany | Rating: A-): €500m Hypothekenpfandbrief (Covered Bond) (DE000AAR0306), fixed rate (0.01% coupon) maturing on 15 September 2028, priced at 101.28 (original spread of 38 bp), non callable

- BAWAG PSK Bank fuer Arbeit und Wirtschaft und Oesterreichische Postsparkasse AG (Banking | Wien, Austria | Rating: A): €150m Fundierte Schuldverschreibungen (Covered Bond) (AT0000A2SUK5) zero coupon maturing on 15 September 2026, priced at 101.50, non callable

- Credit Suisse Ag London Branch (Banking | London, Switzerland | Rating: NR): €300m Inhaberschuldverschreibung (DE000CS8DCN1) zero coupon maturing on 27 September 2023, priced at 100.00, non callable

- Daa Finance PLC (Financial - Other | Dublin, Ireland | Rating: NR): €150m Senior Note (XS2384714783), fixed rate (1.55% coupon) maturing on 7 June 2028, priced at 106.94 (original spread of 118 bp), callable (7nc6)

- East Japan Railway Co (Railroads | Shibuya-Ku, Tokyo-To, Japan | Rating: A+): €700m Senior Note (XS2385121749), fixed rate (1.10% coupon) maturing on 15 September 2039, priced at 100.00 (original spread of 121 bp), non callable

- East Japan Railway Co (Railroads | Shibuya-Ku, Tokyo-To, Japan | Rating: A+): €500m Senior Note (XS2385121582), fixed rate (0.77% coupon) maturing on 15 September 2034, priced at 100.00 (original spread of 109 bp), non callable

- Erste Group Bank AG (Banking | Wien, Austria | Rating: A): €500m Inhaberschuldverschreibung (AT0000A2SUH1), fixed rate (0.25% coupon) maturing on 14 September 2029, priced at 99.21 (original spread of 83 bp), non callable

- Eurobank SA (ATHINA) (Banking | Athina, Greece | Rating: B+): €500m Senior Note (XS2385386029), fixed rate (2.25% coupon) maturing on 14 March 2028, priced at 99.37 (original spread of 301 bp), callable (7nc5)

- Hsbc Bank Canada (Banking | Vancouver, United Kingdom | Rating: A+): €750m Covered Bond (Other) (XS2386287762), fixed rate (0.01% coupon) maturing on 14 September 2026, priced at 101.22 (original spread of 40 bp), non callable

- International Bank for Reconstruction and Development (Supranational | Washington, Washington Dc, United States | Rating: AAA): €200m Unsecured Note (XS2384460585), fixed rate (1.16% coupon) maturing on 9 September 2051, priced at 100.00, non callable

- Investitions Und Strukturbank Rheinland Pfalz Isb (Financial - Other | Mainz, Germany | Rating: NR): €250m Inhaberschuldverschreibung (DE000A3E5W46), fixed rate (0.01% coupon) maturing on 14 September 2028, priced at 101.26 (original spread of 39 bp), non callable

- Nationwide Building Society (Financial - Other | Swindon, United Kingdom | Rating: A): €750m Senior Note (XS2385790667), fixed rate (0.25% coupon) maturing on 14 September 2028, priced at 99.56 (original spread of 87 bp), non callable

- Natwest Group PLC (Banking | Edinburgh, United Kingdom | Rating: BBB): €750m Subordinated Note (XS2382950330), fixed rate (1.04% coupon) maturing on 14 September 2032, priced at 100.00 (original spread of 165 bp), callable (11nc6)

NEW LOANS

- Peraton Corp (B+), signed a US$ 240m Term Loan B, to be used for acquisition financing. It matures on 02/01/28 and initial pricing is set at LIBOR +375bps

- Baxter International Inc (A-), signed a US$ 11,400m Bridge Loan, to be used for general corporate purposes and acquisition financing. It matures on 09/15/22.

- Mattress Firm Inc (B+), signed a US$ 1,100m Term Loan, to be used for general corporate purposes and dividends to shareholders. It matures on 09/23/28.

- Sanderson Farms Inc, signed a US$ 750m Term Loan B, to be used for leveraged buyout. It matures on 09/22/28.

- Tnt Crane & Rigging Inc, signed a US$ 119m Term Loan, to be used for general corporate purposes.

- Tnt Crane & Rigging Inc, signed a US$ 385m Revolving Credit Facility, to be used for general corporate purposes.

- Clean Harbors Inc (BB+), signed a US$ 1,000m Term Loan B, to be used for acquisition financing

- Enterprise Products Operating (BBB+), signed a US$ 3,000m Revolving Credit Facility, to be used for general corporate purposes. It matures on 09/07/26 and initial pricing is set at LIBOR +80bps

- Enterprise Products Operating (BBB+), signed a US$ 1,500m 364d Revolver, to be used for general corporate purposes. It matures on 09/06/22 and initial pricing is set at LIBOR +81.5bps