Credit

Cash Spreads Roughly Unchanged Today, Bond Indices Performance Driven By Duration

Another huge day of issuance in the primary market, as USD IG breaks the two-day record for number of deals; Walmart's US$ 7bn in 5 tranches was the largest offering today

Published ET

iBOXX USD Liquid Bonds Total Returns IG & HY Indices | Sources: ϕpost, Refinitiv data

QUICK SUMMARY

- S&P 500 Bond Index was up 0.16% today, with investment grade up 0.18% and high yield up 0.02% (YTD total return: -0.16%)

- The iBoxx USD Liquid Investment Grade Total Return Index was up 0.258% today (Month-to-date: -0.31%; Year-to-date: -0.80%)

- The iBoxx USD Liquid High Yield Total Return Index was unchanged today (Month-to-date: 0.09%; Year-to-date: 3.98%)

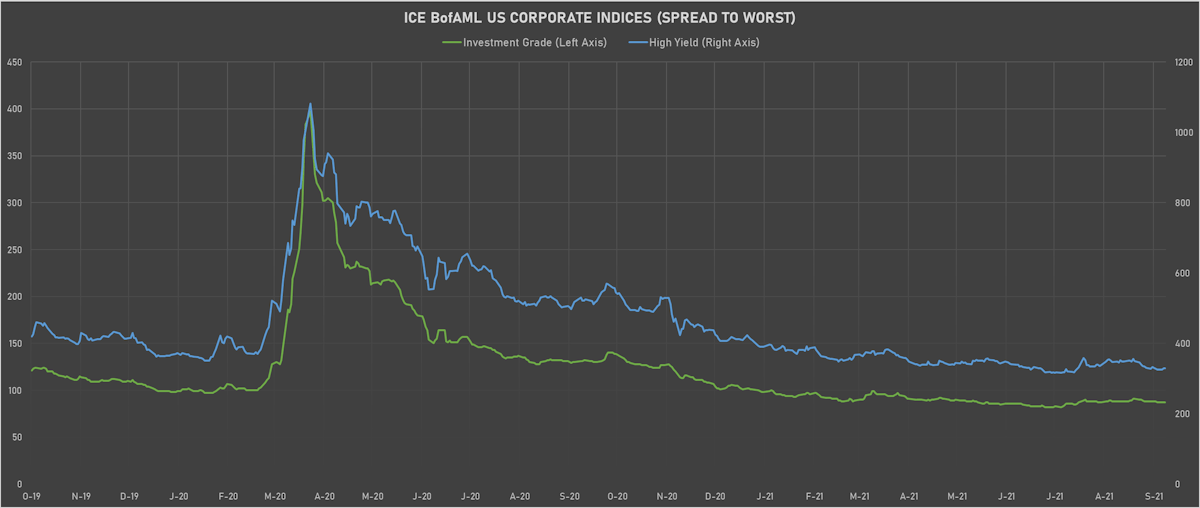

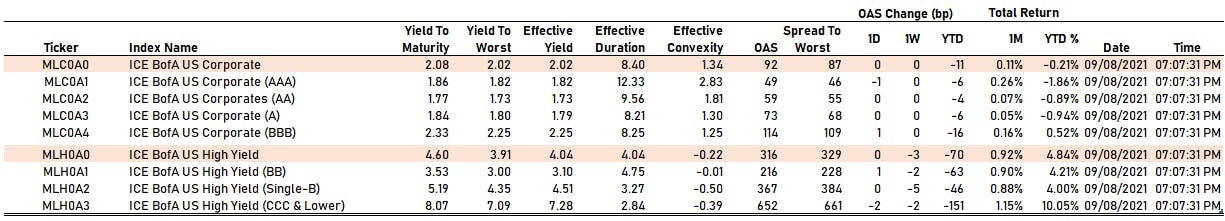

- ICE BofA US Corporate Index (Investment Grade) spread to worst unchanged at 87.0 bp (YTD change: -11.0 bp)

- ICE BofA US High Yield Index spread to worst unchanged at 329.0 bp (YTD change: -61.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index up 0.04% today (YTD total return: +2.7%)

- New issues: US$ 44.8bn in dollars and € 12.6bn in euros

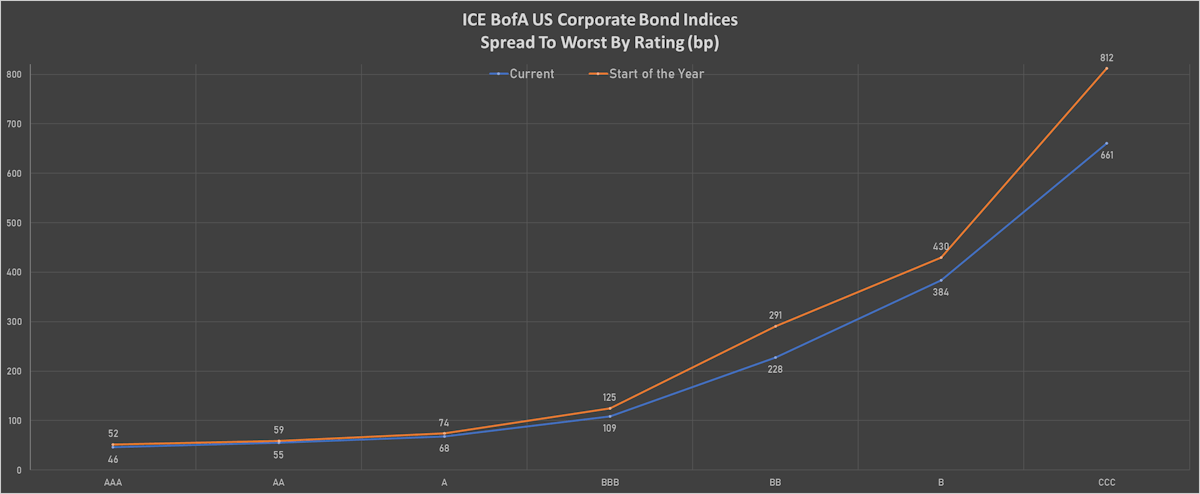

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

- AAA down by -1 bp at 49 bp

- AA unchanged at 59 bp

- A unchanged at 73 bp

- BBB up by 1 bp at 114 bp

- BB up by 1 bp at 216 bp

- B unchanged at 367 bp

- CCC down by -2 bp at 652 bp

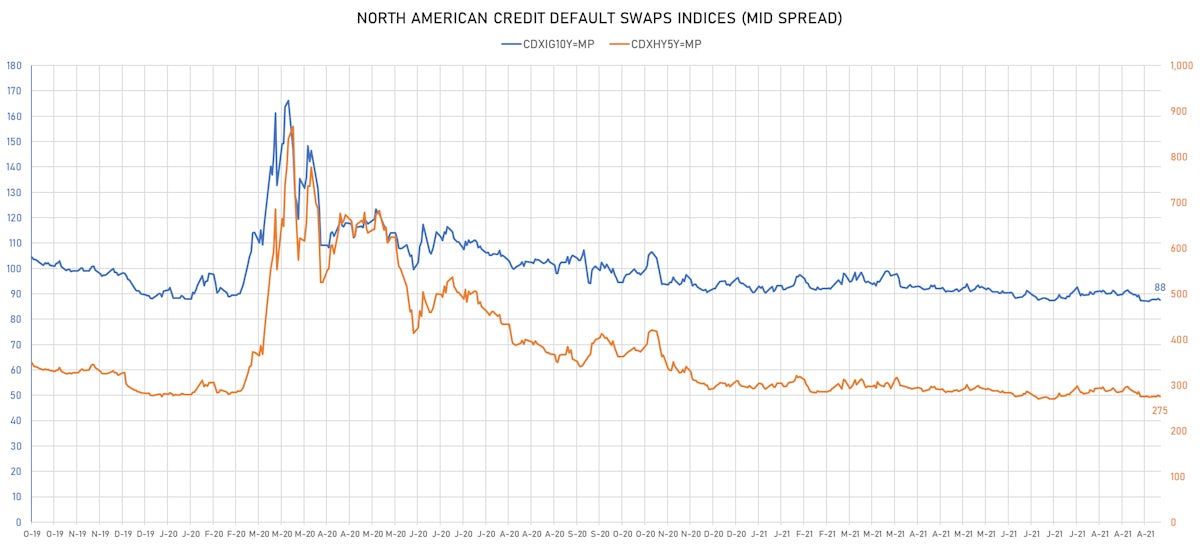

CDS INDICES (mid-spreads)

- Markit CDX.NA.IG 5Y down 0.6 bp, now at 88bp (YTD change: -2.9bp)

- Markit CDX.NA.HY 5Y down 2.9 bp, now at 275bp (YTD change: -18.4bp)

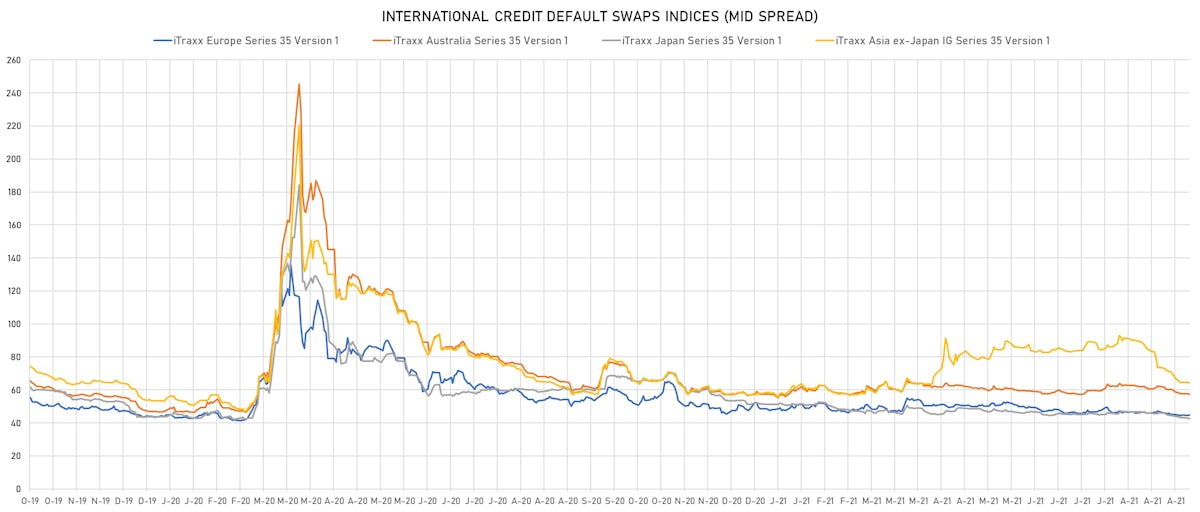

- Markit iTRAXX Europe unchanged at 45bp (YTD change: -3.1bp)

- Markit iTRAXX Japan down 0.1 bp, now at 43bp (YTD change: -8.7bp)

- Markit iTRAXX Asia Ex-Japan up 1.0 bp, now at 65bp (YTD change: +7.2bp)

USD BOND ISSUES

- Avalonbay Communities Inc (Real Estate Investment Trust | Arlington, United States | Rating: A-): US$700m Senior Note (US053484AB76), fixed rate (2.05% coupon) maturing on 15 January 2032, priced at 99.88 (original spread of 73 bp), callable (10nc10)

- DXC Technology Co (Service - Other | Tysons Corner, United States | Rating: BBB): US$650m Senior Note (US23355LAM81), fixed rate (2.38% coupon) maturing on 15 September 2028, priced at 99.91 (original spread of 125 bp), callable (7nc7)

- DXC Technology Co (Service - Other | Tysons Corner, United States | Rating: BBB): US$700m Senior Note (US23355LAL09), fixed rate (1.80% coupon) maturing on 15 September 2026, priced at 99.90 (original spread of 100 bp), callable (5nc5)

- Ga Global Funding Trust (Financial - Other | Wilmington, United States | Rating: NR): US$500m Note (US36143L2D64), fixed rate (1.95% coupon) maturing on 15 September 2028, priced at 99.79 (original spread of 85 bp), non callable

- Lakeland Bancorp Inc (Banking | Oak Ridge, New Jersey, United States | Rating: NR): US$150m Subordinated Note (US511637AB61), floating rate maturing on 15 September 2031, priced at 100.00, callable (10nc5)

- Marriott International Inc (Lodging | Bethesda, United States | Rating: BBB-): US$700m Senior Note (US571903BH57), fixed rate (2.75% coupon) maturing on 15 October 2033, priced at 99.91 (original spread of 143 bp), callable (12nc12)

- PerkinElmer Inc (Health Care Supply | Boston, United States | Rating: BBB): US$500m Senior Note (US714046AN96), fixed rate (2.25% coupon) maturing on 8 September 2031, priced at 99.70 (original spread of 95 bp), callable (10nc10)

- PerkinElmer Inc (Health Care Supply | Boston, United States | Rating: BBB): US$800m Senior Note (US714046AL31), fixed rate (0.85% coupon) maturing on 8 September 2024, priced at 99.94 (original spread of 45 bp), callable (3nc1)

- PerkinElmer Inc (Health Care Supply | Boston, United States | Rating: BBB): US$500m Senior Note (US714046AM14), fixed rate (1.90% coupon) maturing on 15 September 2028, priced at 99.93 (original spread of 80 bp), callable (7nc7)

- Puget Sound Energy Inc (Utility - Other | Bellevue, United States | Rating: A-): US$450m First Mortgage Note (US745332CK03), fixed rate (2.89% coupon) maturing on 15 September 2051, priced at 100.00 (original spread of 95 bp), callable (30nc30)

- Truist Bank (Banking | Charlotte, United States | Rating: A): US$1,250m Senior Note (US89788JAD19), floating rate (SOFR + 20.0 bp) maturing on 17 January 2024, priced at 100.00, callable (2nc1)

- W R Berkley Corp (Property and Casualty Insurance | Greenwich, United States | Rating: BBB+): US$350m Senior Note (US084423AW21), fixed rate (3.15% coupon) maturing on 30 September 2061, priced at 99.05 (original spread of 156 bp), callable (40nc40)

- Walmart Inc (Retail Stores - Other | Bentonville, United States | Rating: AA): US$1,000m Senior Note (US931142EU39), fixed rate (2.50% coupon) maturing on 22 September 2041, priced at 100.00 (original spread of 62 bp), callable (20nc20)

- Walmart Inc (Retail Stores - Other | Bentonville, United States | Rating: AA): US$1,500m Senior Note (US931142EV12), fixed rate (2.65% coupon) maturing on 22 September 2051, priced at 99.63 (original spread of 72 bp), callable (30nc30)

- Walmart Inc (Retail Stores - Other | Bentonville, United States | Rating: AA): US$1,250m Senior Note (US931142ES82), fixed rate (1.05% coupon) maturing on 17 September 2026, priced at 99.81 (original spread of 28 bp), callable (5nc5)

- Walmart Inc (Retail Stores - Other | Bentonville, United States | Rating: AA): US$2,000m Senior Note (US931142ET65), fixed rate (1.80% coupon) maturing on 22 September 2031, priced at 99.65, callable (10nc10)

- BNP Paribas SA (Banking | Paris, France | Rating: A+): US$1,500m Note (US09659W2R48), floating rate maturing on 15 September 2029, priced at 100.00, callable (8nc7)

- CCBL (Cayman) 1 Corporation Ltd (Financial - Other | Beijing, China (Mainland) | Rating: NR): US$400m Senior Note (XS2384580051), fixed rate (1.60% coupon) maturing on 15 September 2026, priced at 99.43 (original spread of 90 bp), callable (5nc5)

- Commonwealth Bank of Australia (Banking | Sydney, Australia | Rating: A+): US$500m Senior Note (US2027A1KE64), floating rate (SOFR + 52.0 bp) maturing on 15 June 2026, priced at 100.00, non callable

- Commonwealth Bank of Australia (Banking | Sydney, Australia | Rating: A+): US$1,200m Senior Note (US2027A1KD81), fixed rate (1.13% coupon) maturing on 15 June 2026, priced at 99.74 (original spread of 38 bp), non callable

- Commonwealth Bank of Australia (Banking | Sydney, Australia | Rating: A+): US$800m Senior Note (US2027A1KF30), fixed rate (1.88% coupon) maturing on 15 September 2031, priced at 99.04 (original spread of 65 bp), non callable

- Cooperativa Nacional de Productores de Leche (Consumer Products | Montevideo, Uruguay | Rating: NR): US$5,000m Bond (UYONCO158US1), fixed rate (2.00% coupon) maturing on 20 December 2024, priced at 100.00, callable (3nc1m)

- Emirate of Abu Dhabi (Official and Muni | Abu Dhabi, United Arab Emirates | Rating: AA): US$1,250m Senior Note (XS2386638816), fixed rate (3.00% coupon) maturing on 15 September 2051, priced at 100.00 (original spread of 106 bp), non callable

- Emirate of Abu Dhabi (Official and Muni | Abu Dhabi, United Arab Emirates | Rating: AA): US$1,750m Senior Note (XS2386638733), fixed rate (1.88% coupon) maturing on 15 September 2031, priced at 99.18 (original spread of 63 bp), non callable

- Empresa de Transporte de Pasajeros Metro SA (Agency | Santiago, Chile | Rating: A): US$650m Senior Note (USP37466AT90), fixed rate (3.69% coupon) maturing on 13 September 2061, priced at 100.00 (original spread of 208 bp), callable (40nc40)

- Kommuninvest i Sverige AB (Agency | Orebro, Sweden | Rating: AAA): US$1,000m Unsecured Note (US50046PBU84), fixed rate (0.63% coupon) maturing on 15 September 2025, priced at 99.54, non callable

- Mizuho Financial Group Inc (Banking | Chiyoda-Ku, Japan | Rating: BBB+): US$1,000m Subordinated Note (US60687YBU29), fixed rate (2.56% coupon) maturing on 13 September 2031, priced at 100.00 (original spread of 123 bp), non callable

- Movida Europe SA (Financial - Other | Luxembourg, Brazil | Rating: NR): US$300m Senior Note (USL65266AB19), fixed rate (5.25% coupon) maturing on 8 February 2031, priced at 100.00, callable (9nc4)

- Nigeria, Federal Republic of (Government) (Sovereign | Abuja, Federal Capital Territory, Nigeria | Rating: B-): US$3,000m Senior Note (XS2384704800), fixed rate (1.00% coupon) maturing on 18 October 2051, priced at 100.00, non callable

- Oesterreichische Kontrollbank AG (Agency | Wien, Austria | Rating: AA+): US$1,750m Senior Note (US676167CD90), fixed rate (0.50% coupon) maturing on 16 September 2024, priced at 99.88 (original spread of 10 bp), non callable

- Sea Ltd (Information/Data Technology | Singapore | Rating: NR): US$2,500m Bond (US81141RAG56), fixed rate (0.25% coupon) maturing on 15 September 2026, priced at 100.00, non callable, convertible

- Smithfield Foods Inc (Food Processors | Smithfield, British Virgin Islands | Rating: BBB): US$500m Senior Note (US832248BD93), fixed rate (2.63% coupon) maturing on 13 September 2031, priced at 98.68 (original spread of 145 bp), callable (10nc10)

- Stellantis Finance US Inc (Financial - Other | Rating: NR): US$1,000m Senior Note (US85855CAA80), fixed rate (1.71% coupon) maturing on 29 January 2027, priced at 100.00 (original spread of 90 bp), callable (5nc5)

- Stellantis Finance US Inc (Financial - Other | Rating: NR): US$1,000m Senior Note (US85855CAB63), fixed rate (2.69% coupon) maturing on 15 September 2031, priced at 100.00 (original spread of 135 bp), callable (10nc10)

- Sumitomo Mitsui Trust Bank (USA) Ltd (Banking | Hoboken, Japan | Rating: A): US$750m Senior Note (US86563VAX73), floating rate (SOFR + 44.0 bp) maturing on 16 September 2024, priced at 100.00, non callable

- Sumitomo Mitsui Trust Bank (USA) Ltd (Banking | Hoboken, Japan | Rating: A+): US$750m Senior Note (USJ7771YLH82), floating rate (SOFR + 44.0 bp) maturing on 16 September 2024, priced at 100.00, non callable

- Sumitomo Mitsui Trust Bank Ltd (Banking | Chiyoda-Ku, Japan | Rating: A+): US$750m Senior Note (USJ7771YLJ49), fixed rate (1.35% coupon) maturing on 16 September 2026, priced at 100.00 (original spread of 55 bp), non callable

- Sumitomo Mitsui Trust Bank Ltd (Banking | Chiyoda-Ku, Tokyo-To, Japan | Rating: A): US$750m Senior Note (US86563VAY56), fixed rate (1.35% coupon) maturing on 16 September 2026, priced at 100.00 (original spread of 55 bp), non callable

- Sumitomo Mitsui Trust Bank Ltd (Banking | Chiyoda-Ku, Japan | Rating: A+): US$750m Senior Note (USJ7771YLG00), fixed rate (0.80% coupon) maturing on 16 September 2024, priced at 99.95 (original spread of 40 bp), non callable

- Sumitomo Mitsui Trust Bank Ltd (Banking | Chiyoda-Ku, Tokyo-To, Japan | Rating: A): US$750m Senior Note (US86563VAW90), fixed rate (0.80% coupon) maturing on 16 September 2024, priced at 99.95 (original spread of 40 bp), non callable

- Toyota Motor Credit Corp (Financial - Other | Plano, Japan | Rating: A+): US$600m Senior Note (US89236TJP12), floating rate (SOFR + 29.0 bp) maturing on 13 September 2024, priced at 100.00, non callable

- Toyota Motor Credit Corp (Financial - Other | Plano, Japan | Rating: A+): US$1,000m Senior Note (US89236TJN63), fixed rate (0.63% coupon) maturing on 13 September 2024, priced at 99.95 (original spread of 22 bp), non callable

- Toyota Motor Credit Corp (Financial - Other | Plano, Japan | Rating: A+): US$500m Senior Note (US89236TJQ94), fixed rate (1.90% coupon) maturing on 12 September 2031, priced at 99.69 (original spread of 60 bp), non callable

- Zensun Enterprises Ltd (Financial - Other | British Virgin Islands | Rating: NR): US$142m Senior Note (XS2382158207), fixed rate (12.50% coupon) maturing on 13 September 2023, priced at 100.00, non callable

EUR BOND ISSUES

- Bank of Nova Scotia (Banking | Toronto, Canada | Rating: A): €1,500m Covered Bond (Other) (XS2386592138), fixed rate (0.01% coupon) maturing on 14 September 2029, priced at 100.30 (original spread of 46 bp), non callable

- Caisse Amortissement de la Dette Sociale (Agency | Paris, Ile-De-France, France | Rating: AA): €5,000m Bond (FR0014005FC8), fixed rate (0.13% coupon) maturing on 15 September 2031, priced at 99.98 (original spread of 13 bp), non callable

- de Volksbank NV (Banking | Utrecht, Netherlands | Rating: A-): €600m Covered Bond (Other) (XS2386592302), fixed rate (0.38% coupon) maturing on 16 September 2041, priced at 99.06 (original spread of 54 bp), non callable

- Eli Lilly and Co (Pharmaceuticals | Indianapolis, United States | Rating: A): €700m Senior Note (XS2386220698), fixed rate (1.38% coupon) maturing on 14 September 2061, priced at 97.83 (original spread of 128 bp), callable (40nc40)

- Eli Lilly and Co (Pharmaceuticals | Indianapolis, United States | Rating: A): €600m Senior Note (XS2386186063), fixed rate (0.50% coupon) maturing on 14 September 2033, priced at 99.83 (original spread of 84 bp), callable (12nc12)

- Eli Lilly and Co (Pharmaceuticals | Indianapolis, United States | Rating: A): €500m Senior Note (XS2386186576), fixed rate (1.13% coupon) maturing on 14 September 2051, priced at 97.77 (original spread of 105 bp), callable (30nc30)

- Equitable Bank (Banking | Toronto, Canada | Rating: BBB-): €350m Covered Bond (Other) (XS2386885581), fixed rate (0.01% coupon) maturing on 16 September 2024, priced at 100.82 (original spread of 47 bp), non callable

- ERG SpA (Service - Other | Genoa, Italy | Rating: NR): €500m Senior Note (XS2386650274), fixed rate (0.88% coupon) maturing on 15 September 2031, priced at 99.75 (original spread of 123 bp), callable (10nc10)

- Essity Capital BV (Financial - Other | Zeist, Netherlands | Rating: NR): €600m Senior Note (XS2386877133), fixed rate (0.25% coupon) maturing on 15 September 2029, priced at 99.37 (original spread of 81 bp), callable (8nc8)

- Grenke Finance PLC (Financial - Other | Dublin, Germany | Rating: NR): €125m Senior Note (XS2386650191), fixed rate (3.95% coupon) maturing on 9 July 2025, priced at 105.21 (original spread of 323 bp), non callable

- Hessen, State of (Official and Muni | Wiesbaden, Germany | Rating: AA+): €300m Landesschatzanweisung (DE000A1RQD84) zero coupon maturing on 16 September 2024 (original spread of -3 bp), non callable

- Hsbc Bank Canada (Banking | Vancouver, British Columbia, United Kingdom | Rating: A+): €750m Covered Bond (Other) (XS2386287762), fixed rate (0.01% coupon) maturing on 14 September 2026, priced at 101.22 (original spread of 40 bp), non callable

- International Bank for Reconstruction and Development (Supranational | Washington, Washington Dc, United States | Rating: AAA): €200m Unsecured Note (XS2384460585), fixed rate (1.16% coupon) maturing on 9 September 2051, priced at 100.00, non callable

- Oberoesterreichische Landesbank AG (Banking | Linz, Austria | Rating: A+): €250m Hypothekenpfandbrief (Covered Bond) (AT0000A2SUL3), fixed rate (0.01% coupon) maturing on 15 September 2028, priced at 101.00 (original spread of 42 bp), non callable

- Swiss Life Finance I Ltd (Financial - Other | Ruggell, Switzerland | Rating: NR): €600m Bond (CH1130818847), fixed rate (0.50% coupon) maturing on 15 September 2031, priced at 99.49 (original spread of 88 bp), callable (10nc10)

NEW LOANS

- Quest Software Inc, signed a US$ 330m Term Loan B, to be used for acquisition financing.

- Pretium Packaging LLC, signed a US$ 365m Term Loan, to be used for general corporate purposes and acquisition financing. It matures on 09/21/29 and initial pricing is set at LIBOR +725bps

- Pretium Packaging LLC, signed a US$ 1,215m Term Loan B, to be used for general corporate purposes and acquisition financing. It matures on 09/21/28 and initial pricing is set at LIBOR +400bps

- Bracco SpA, signed a € 450m Term Loan, to be used for general corporate purposes. It matures on 09/30/26.

- Comer Industries SpA, signed a € 120m Term Loan, to be used for general corporate purposes. It matures on 03/31/27.

- Virtus Investment Partners Inc (BB+), signed a US$ 275m Term Loan B, to be used for general corporate purposes.

- Zurn Water Solutions, signed a US$ 550m Term Loan B, to be used for general corporate purposes. It matures on 09/21/28 and initial pricing is set at LIBOR +275bps