Credit

Cash Spreads Tighten Slightly But Rates Remain In The Driver's Seat Today

The avalanche of IG deals keeps going, has now broken the three-day record for number of deals; BMO's US$ 3.7bn in 4 tranches was the largest IG offering priced today

Published ET

Rising Stars A Good Source Of Alpha For Credit Managers This Year | Source: Credit Suisse

QUICK SUMMARY

- S&P 500 Bond Index was up 0.40% today, with investment grade up 0.43% and high yield up 0.15% (YTD total return: +0.24%)

- The iBoxx USD Liquid Investment Grade Total Return Index was up 0.637% today (Month-to-date: 0.32%; Year-to-date: -0.16%)

- The iBoxx USD Liquid High Yield Total Return Index was up 0.082% today (Month-to-date: 0.17%; Year-to-date: 4.07%)

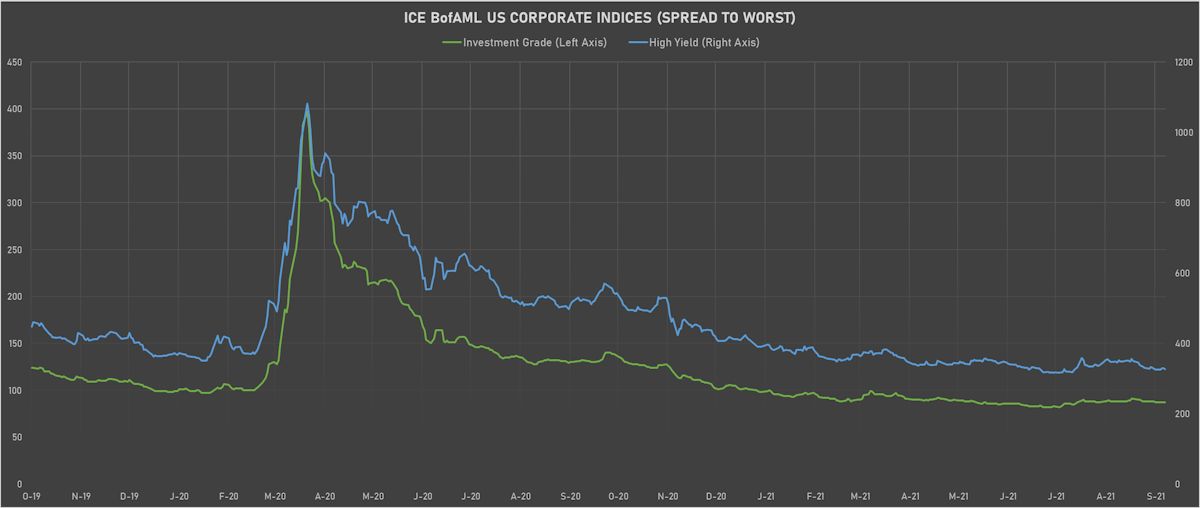

- ICE BofA US Corporate Index (Investment Grade) spread to worst unchanged at 87.0 bp (YTD change: -11.0 bp)

- ICE BofA US High Yield Index spread to worst down -2.0 bp, now at 327.0 bp (YTD change: -63.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index up 0.03% today (YTD total return: +2.8%)

- New issues: US$ 19.7bn in dollars and € 4.0bn in euros

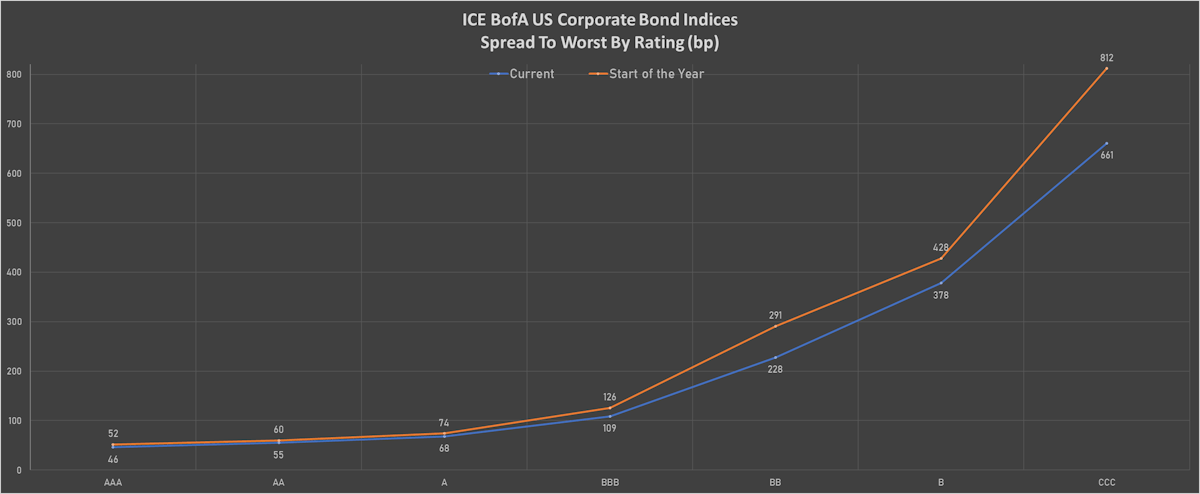

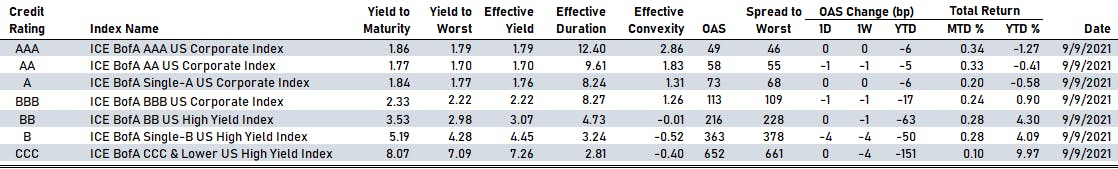

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

- AAA unchanged at 49 bp

- AA down by -1 bp at 58 bp

- A unchanged at 73 bp

- BBB down by -1 bp at 113 bp

- BB unchanged at 216 bp

- B down by -4 bp at 363 bp

- CCC unchanged at 652 bp

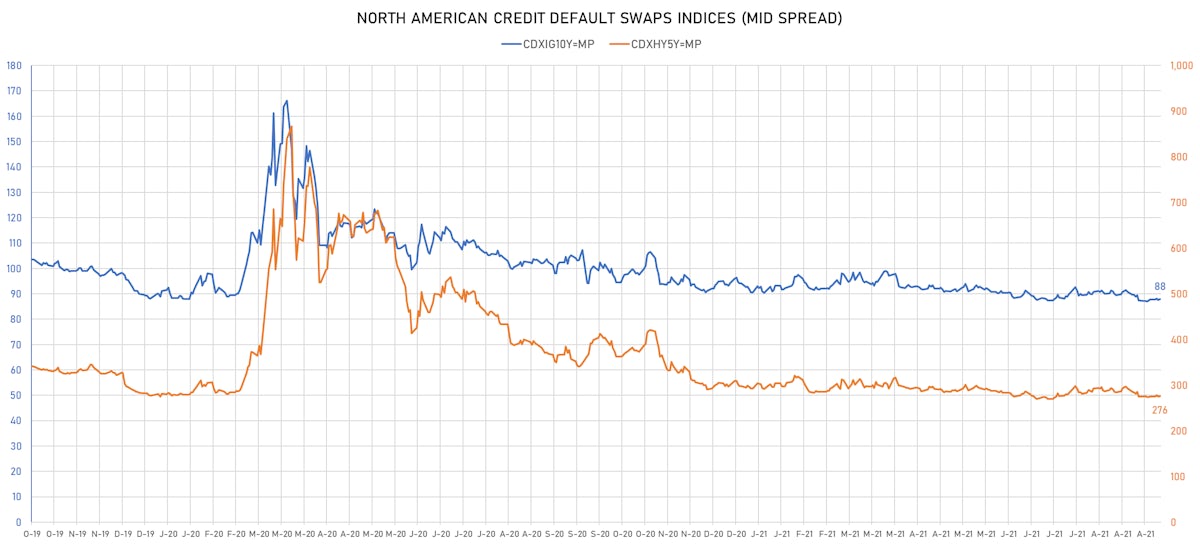

CDS INDICES (mid-spreads)

- Markit CDX.NA.IG 5Y up 0.3 bp, now at 88bp (YTD change: -2.6bp)

- Markit CDX.NA.HY 5Y up 1.3 bp, now at 276bp (YTD change: -17.1bp)

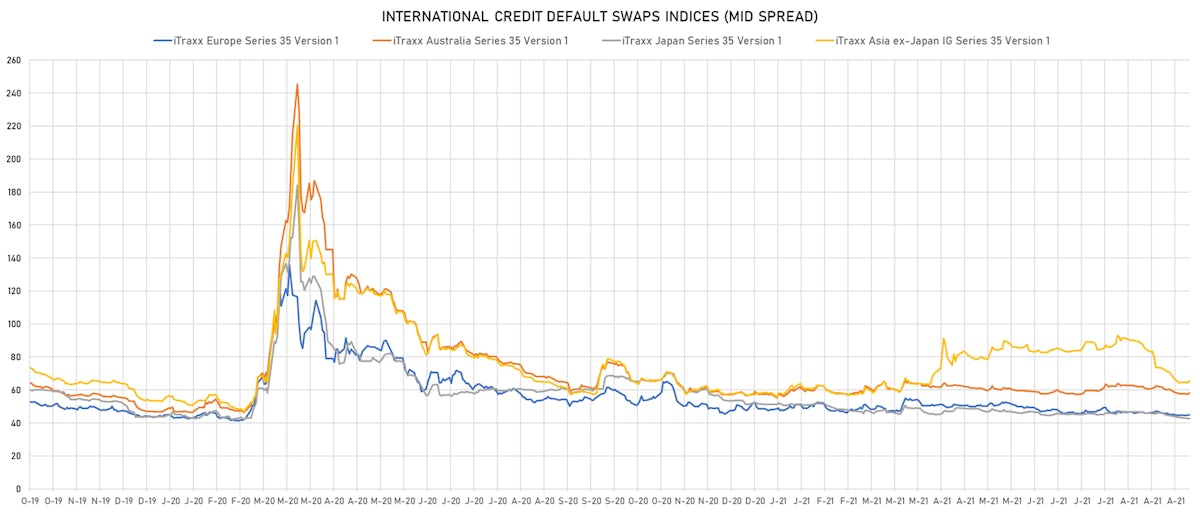

- Markit iTRAXX Europe down 0.3 bp, now at 45bp (YTD change: -3.4bp)

- Markit iTRAXX Japan unchanged at 43bp (YTD change: -8.7bp)

- Markit iTRAXX Asia Ex-Japan up 0.8 bp, now at 66bp (YTD change: +8.0bp)

USD BOND ISSUES

- Allegheny Technologies Inc (Metals/Mining | Pittsburgh, United States | Rating: B-): US$350m Senior Note (US01741RAM43), fixed rate (5.13% coupon) maturing on 1 October 2031, priced at 100.00, callable (10nc5)

- Allegheny Technologies Inc (Metals/Mining | Pittsburgh, United States | Rating: B-): US$325m Senior Note (US01741RAL69), fixed rate (4.88% coupon) maturing on 1 October 2029, priced at 100.00, callable (8nc3)

- Ashton Woods USA LLC (Home Builders | Roswell, United States | Rating: B): US$300m Senior Note (USU04537AH65), fixed rate (4.63% coupon) maturing on 1 April 2030, priced at 100.00 (original spread of 337 bp), callable (9nc4)

- Ball Corp (Containers | Westminster, United States | Rating: BB+): US$850m Senior Note (US058498AX40), fixed rate (3.13% coupon) maturing on 15 September 2031, priced at 100.00 (original spread of 183 bp), callable (10nc10)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: NR): US$110m Bond (US3133EM5H13), fixed rate (2.15% coupon) maturing on 15 September 2036, priced at 100.00 (original spread of 64 bp), callable (15nc1)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: NR): US$125m Bond (US3133EM5L25), fixed rate (1.47% coupon) maturing on 17 December 2029, priced at 100.00 (original spread of 147 bp), callable (8nc3m)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: NR): US$130m Bond (US3133EM5G30), fixed rate (1.91% coupon) maturing on 15 September 2033, priced at 100.00 (original spread of 63 bp), callable (12nc1)

- Flowserve Corp (Machinery | Irving, United States | Rating: BBB-): US$500m Senior Note (US34355JAB44), fixed rate (2.80% coupon) maturing on 15 January 2032, priced at 99.66 (original spread of 155 bp), callable (10nc10)

- Inter-American Development Bank (Supranational | Washington, United States | Rating: AAA): US$600m Senior Note (US4581X0DY17), floating rate (SOFR + 17.0 bp) maturing on 16 September 2026, priced at 100.00, non callable

- JP Morgan Structured Products BV (Financial - Other | Amsterdam, Noord-Holland, United States | Rating: NR): US$250m Unsecured Note (XS2168731573) zero coupon maturing on 10 September 2024, priced at 100.00, non callable

- Ohio Power Co (Utility - Other | Columbus, United States | Rating: A-): US$600m Senior Note (US677415CU30), fixed rate (2.90% coupon) maturing on 1 October 2051, priced at 99.52 (original spread of 133 bp), callable (30nc30)

- Quanta Services Inc (Building Products | Houston, United States | Rating: BBB-): US$500m Senior Note (US74762EAG70), fixed rate (0.95% coupon) maturing on 1 October 2024, priced at 99.55 (original spread of 55 bp), callable (3nc1)

- Quanta Services Inc (Building Products | Houston, United States | Rating: BBB-): US$500m Senior Note (US74762EAJ10), fixed rate (3.05% coupon) maturing on 1 October 2041, priced at 99.39 (original spread of 125 bp), callable (20nc20)

- Quanta Services Inc (Building Products | Houston, United States | Rating: BBB-): US$500m Senior Note (US74762EAH53), fixed rate (2.35% coupon) maturing on 15 January 2032, priced at 99.94 (original spread of 105 bp), callable (10nc10)

- Rlj Lodging Trust LP (Financial - Other | Dover, United States | Rating: BB-): US$500m Note (US74965LAB71), fixed rate (4.00% coupon) maturing on 15 September 2029, priced at 100.00 (original spread of 285 bp), callable (8nc3)

- Sands China Ltd (Gaming | United States | Rating: BBB-): US$600m Senior Note (US80007RAR66), fixed rate (3.25% coupon) maturing on 8 August 2031, priced at 99.93 (original spread of 195 bp), callable (10nc10)

- Sands China Ltd (Gaming | United States | Rating: BBB-): US$700m Senior Note (USG7801RAF67), fixed rate (2.30% coupon) maturing on 8 March 2027, priced at 99.78 (original spread of 155 bp), callable (5nc5)

- Sands China Ltd (Gaming | United States | Rating: BBB-): US$650m Senior Note (USG7801RAG41), fixed rate (2.85% coupon) maturing on 8 March 2029, priced at 99.75 (original spread of 180 bp), callable (7nc7)

- Alfa Desarrollo SpA (Financial - Other | Santiago | Rating: NR): US$1,099m Bond (USP0R60QAA15), fixed rate (4.55% coupon) maturing on 27 September 2051, priced at 100.00, with a make whole call

- Asian Infrastructure Investment Bank (Supranational | Beijing, Beijing, China (Mainland) | Rating: AAA): US$2,500m Senior Note (US04522KAE64), fixed rate (0.50% coupon) maturing on 30 October 2024, priced at 99.85 (original spread of 12 bp), non callable

- Bank of Montreal (Banking | Montreal, Canada | Rating: A+): US$1,350m Senior Note (US06368FAA75), fixed rate (0.40% coupon) maturing on 15 September 2023, priced at 99.92 (original spread of 23 bp), with a make whole call

- Bank of Montreal (Banking | Montreal, Canada | Rating: A+): US$1,300m Senior Note (US06368FAC32), fixed rate (1.25% coupon) maturing on 15 September 2026, priced at 99.83 (original spread of 50 bp), non callable

- Bank of Montreal (Banking | Montreal, Canada | Rating: A+): US$650m Senior Note (US06368FAB58), floating rate (SOFR + 26.5 bp) maturing on 15 September 2023, priced at 100.00, non callable

- CGI Inc (Service - Other | Montreal, Canada | Rating: BBB+): US$600m Senior Note (US12532HAA23), fixed rate (1.45% coupon) maturing on 14 September 2026, priced at 99.82 (original spread of 70 bp), callable (5nc5)

- CGI Inc (Service - Other | Montreal, Canada | Rating: BBB+): US$400m Senior Note (US12532HAD61), fixed rate (2.30% coupon) maturing on 14 September 2031, priced at 99.58 (original spread of 105 bp), callable (10nc10)

- CMB International Leasing Management Ltd (Financial - Other | China (Mainland) | Rating: BBB+): US$300m Senior Note (XS2373796593), fixed rate (1.75% coupon) maturing on 16 September 2026, priced at 99.57 (original spread of 130 bp), callable (5nc5)

- CMB International Leasing Management Ltd (Financial - Other | China (Mainland) | Rating: BBB+): US$600m Senior Note (XS2373796320), fixed rate (1.25% coupon) maturing on 16 September 2024, priced at 99.82 (original spread of 88 bp), callable (3nc3)

- CMS International Gemstone Ltd (Financial - Other | China (Mainland) | Rating: NR): US$500m Senior Note (XS2385065656), fixed rate (1.30% coupon) maturing on 16 September 2024, priced at 100.00, non callable

- Cenovus Energy Inc (Oil and Gas | Calgary, Canada | Rating: BBB-): US$500m Senior Note (US15135UAW99), fixed rate (2.65% coupon) maturing on 15 January 2032, priced at 99.56 (original spread of 140 bp), callable (10nc10)

- Cenovus Energy Inc (Oil and Gas | Calgary, Canada | Rating: BBB-): US$750m Senior Note (US15135UAX72), fixed rate (3.75% coupon) maturing on 15 February 2052, priced at 99.28 (original spread of 220 bp), callable (30nc30)

- Denso Corp (Vehicle Parts | Kariya-Shi, Japan | Rating: A): US$500m Senior Note (USJ12075AZ00), fixed rate (1.24% coupon) maturing on 16 September 2026, priced at 100.00 (original spread of 45 bp), non callable

- Empresa Nacional de Telecomunicaciones SA (Telecommunications | Las Condes, Santiago, Chile | Rating: BBB-): US$800m Bond (US29245VAE56), fixed rate (3.05% coupon) maturing on 14 September 2032, priced at 99.98 (original spread of 175 bp), with a make whole call

- Empresa Nacional del Petroleo (Oil and Gas | Las Condes, Chile | Rating: BB+): US$560m Senior Note (US29245JAM45), fixed rate (3.45% coupon) maturing on 16 September 2031, priced at 99.65 (original spread of 220 bp), with a make whole call

- KT21 T2 Co Ltd (Financial - Other | Rating: NR): US$350m Islamic Sukuk (Hybrid) (XS2384355520), fixed rate (6.13% coupon) maturing on 16 December 2031, priced at 100.00 (original spread of 533 bp), callable (10nc5)

- National Bank of Kuwait SAKP (Banking | Kuwait City, Kuwait | Rating: A): US$1,000m Senior Note (US62877PAB04), floating rate maturing on 15 September 2027, priced at 99.52, callable (6nc5)

- Nippon Life Insurance Co (Life Insurance | Osaka, Japan | Rating: A-): US$900m Subordinated Note (USJ54675BB86), fixed rate (2.90% coupon) maturing on 16 September 2051, priced at 100.00 (original spread of 260 bp), callable (30nc10)

- Phosagro Bond Funding DAC (Financial - Other | Dublin, Dublin, Ireland | Rating: NR): US$500m Senior Note (XS2384719402), fixed rate (2.60% coupon) maturing on 16 September 2028, priced at 100.00 (original spread of 153 bp), non callable

- SPCM SA (Chemicals | Andrezieux-Boutheon, France | Rating: BB+): US$350m Senior Note (US7846ELAE71), fixed rate (3.38% coupon) maturing on 15 March 2030, priced at 100.00 (original spread of 231 bp), callable (8nc3)

- SPCM SA (Chemicals | Andrezieux-Boutheon, France | Rating: BB+): US$350m Senior Note (US7846ELAD98), fixed rate (3.13% coupon) maturing on 15 March 2027, priced at 100.00 (original spread of 210 bp), callable (5nc2)

- Turkiye Vakiflar Bankasi TAO (Banking | Turkey | Rating: B+): US$500m Senior Note (XS2386558113), fixed rate (5.50% coupon) maturing on 1 October 2026, priced at 99.45 (original spread of 485 bp), non callable

EUR BOND ISSUES

- Castellum Helsinki Finance Holding Abp (Financial - Other | Helsinki, Sweden | Rating: NR): €650m Senior Note (XS2387052744), fixed rate (0.88% coupon) maturing on 17 September 2029, priced at 99.54 (original spread of 143 bp), callable (8nc8)

- Deutsche Bank AG (Banking | Frankfurt, Germany | Rating: BBB): €500m Inhaberschuldverschreibung (DE000DB9U4X7), floating rate maturing on 4 October 2028, priced at 100.00, non callable

- Holding d'infrastructures Des Metiers De l'environnement SAS (Financial - Other | Issy-Les-Moulineaux, Netherlands | Rating: NR): €500m Senior Note (XS2385390724), fixed rate (0.63% coupon) maturing on 16 September 2028, priced at 99.77 (original spread of 124 bp), callable (7nc7)

- Holding d'infrastructures Des Metiers De l'environnement SAS (Financial - Other | Issy-Les-Moulineaux, Netherlands | Rating: NR): €450m Senior Note (XS2385389551), fixed rate (0.13% coupon) maturing on 16 September 2025, priced at 99.77 (original spread of 90 bp), callable (4nc4)

- Natwest Group PLC (Banking | Edinburgh, United Kingdom | Rating: BBB): €1,000m Senior Note (XS2387060259), floating rate maturing on 14 September 2029, priced at 100.00 (original spread of 124 bp), callable (8nc7)

- State of Rhineland Palatinate (Official and Muni | Mainz, Germany | Rating: AAA): €350m Landesschatzanweisung (DE000RLP1338), fixed rate (0.01% coupon) maturing on 18 September 2023, non callable

- Woolworths Group Ltd (Retail Stores - Food/Drug | Sydney, Australia | Rating: BBB): €550m Senior Note (XS2384274440), fixed rate (0.38% coupon) maturing on 15 November 2028, priced at 99.68 (original spread of 95 bp), callable (7nc7)

NEW LOANS

- CCC Information Services Inc (B), signed a US$ 800m Term Loan B, to be used for general corporate purposes. It matures on 09/16/28 and initial pricing is set at LIBOR +275bps

- ConnectWise Inc, signed a US$ 1,050m Term Loan B, to be used for general corporate purposes. It matures on 09/27/28.

- Autokiniton Us Hldg Inc. (B), signed a US$ 300m Term Loan B. It matures on 04/06/28 and initial pricing is set at LIBOR +450bps

- Corcentric LLC, signed a US$ 225m Revolving Credit Facility, to be used for general corporate purposes. It matures on 11/15/23 and initial pricing is set at LIBOR +150bps

- Macquarie Group Ltd (BBB+), signed a US$ 1,445m Term Loan, to be used for refinancing and returning bank debt. It matures on 03/01/28 and initial pricing is set at Other +145bps

- Oil Search Ltd, signed a US$ 565m Revolving Credit Facility, to be used for refinancing and returning bank debt. It matures on 12/31/26.