Credit

Another Day Of Spreads Tightening, But IG Bonds Fall On Higher Rates

Fifth highest week ever in terms of number of investment grade deals priced (IFR data): US$ 81.1 bn in 108 tranches for IG, $ 5.25 bn in 10 tranches for HY

Published ET

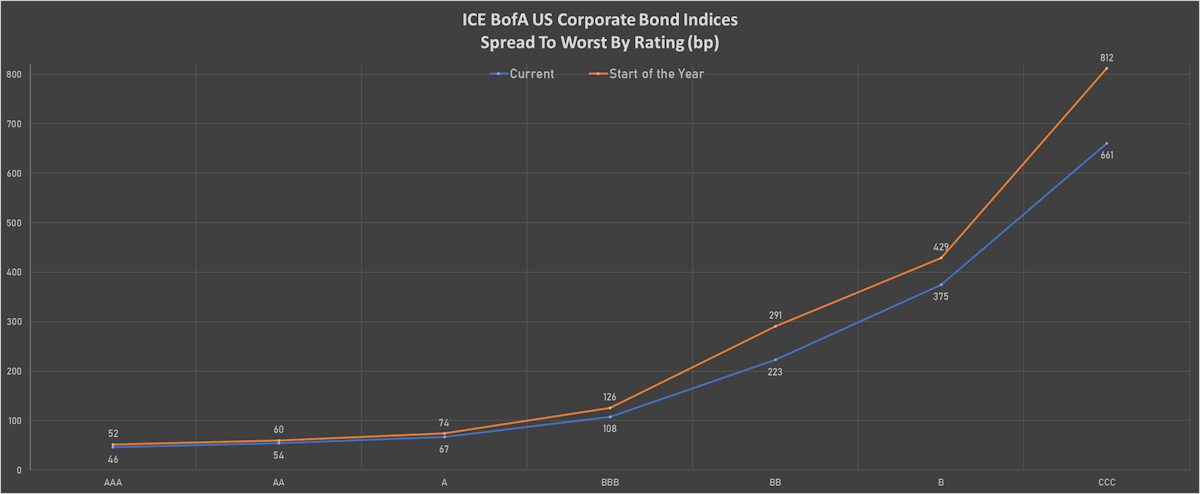

ICE BofAML US Corporate Spreads By Rating | Sources: ϕpost, FactSet data

QUICK SUMMARY

- S&P 500 Bond Index was down -0.20% today, with investment grade down -0.22% and high yield down -0.03% (YTD total return: +0.04%)

- The iBoxx USD Liquid Investment Grade Total Return Index was down -0.237% today (Month-to-date: 0.09%; Year-to-date: -0.40%)

- The iBoxx USD Liquid High Yield Total Return Index was up 0.074% today (Month-to-date: 0.24%; Year-to-date: 4.15%)

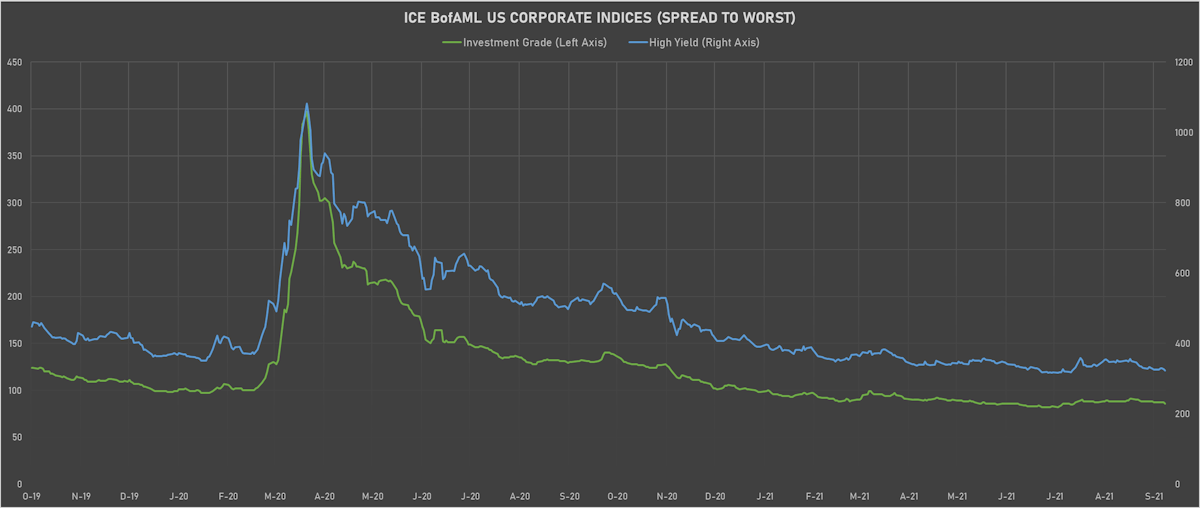

- ICE BofA US Corporate Index (Investment Grade) spread to worst down -1.0 bp, now at 86.0 bp (YTD change: -12.0 bp)

- ICE BofA US High Yield Index spread to worst down -4.0 bp, now at 323.0 bp (YTD change: -67.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index up 0.05% today (YTD total return: +2.8%)

- New issues: US$ 4.6bn in dollars and € 1.5bn in euros

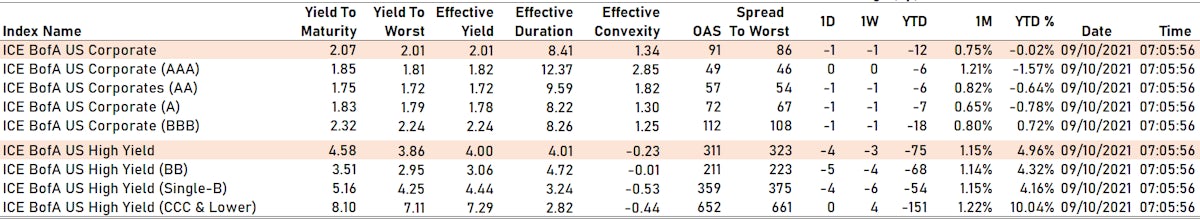

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

- AAA unchanged at 49 bp

- AA down by -1 bp at 57 bp

- A down by -1 bp at 72 bp

- BBB down by -1 bp at 112 bp

- BB down by -5 bp at 211 bp

- B down by -4 bp at 359 bp

- CCC unchanged at 652 bp

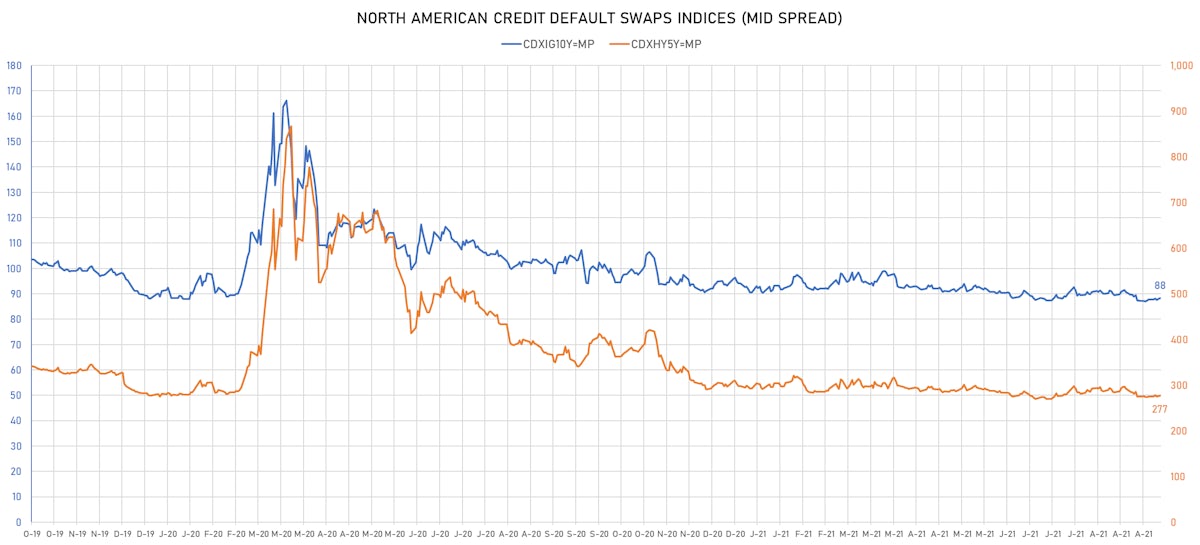

CDS INDICES (mid-spreads)

- Markit CDX.NA.IG 5Y up 0.4 bp, now at 88bp (YTD change: -2.2bp)

- Markit CDX.NA.HY 5Y up 1.1 bp, now at 277bp (YTD change: -16.0bp)

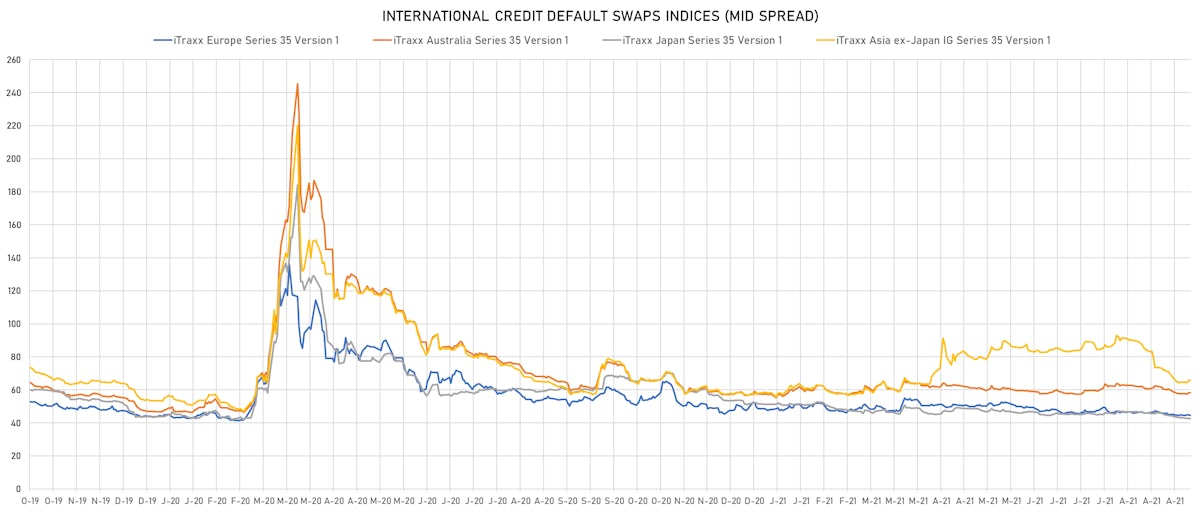

- Markit iTRAXX Europe unchanged at 45bp (YTD change: -3.3bp)

- Markit iTRAXX Japan unchanged at 43bp (YTD change: -8.7bp)

- Markit iTRAXX Asia Ex-Japan down 0.3 bp, now at 66bp (YTD change: +7.7bp)

LARGEST USD CORPORATE CDS MOVES IN THE PAST WEEK

- Transocean Inc (Country: KY; rated: Caa3): down 378.5 bp to 1,746.4bp (1Y range: 941-7,695bp)

- RR Donnelley & Sons Co (Country: US; rated: B2): down 68.3 bp to 476.3bp (1Y range: 447-946bp)

- Staples Inc (Country: US; rated: B2): down 65.1 bp to 925.5bp (1Y range: 652-1,320bp)

- Bombardier Inc (Country: CA; rated: Caa1): down 32.5 bp to 351.6bp (1Y range: 343-1,912bp)

- Meritor Inc (Country: US; rated: Ba3): down 24.9 bp to 193.6bp (1Y range: 164-266bp)

- Apache Corp (Country: US; rated: Ba1): down 20.9 bp to 164.1bp (1Y range: 165-453bp)

- Aramark Services Inc (Country: US; rated: Ba3): down 19.5 bp to 169.3bp (1Y range: 169-304bp)

- Beazer Homes USA Inc (Country: US; rated: B2): down 17.0 bp to 280.8bp (1Y range: 231-363bp)

- Realogy Group LLC (Country: US; rated: B3): down 16.2 bp to 281.7bp (1Y range: 274-538bp)

- Navient Corp (Country: US; rated: Ba3): down 16.0 bp to 256.5bp (1Y range: -245bp)

- Royal Caribbean Cruises Ltd (Country: US; rated: LGD4 - 59%): down 15.9 bp to 363.5bp (1Y range: 318-1,291bp)

- Goodyear Tire & Rubber Co (Country: US; rated: LGD2 - 22%): down 14.7 bp to 201.4bp (1Y range: 192-429bp)

- KB Home (Country: US; rated: Ba2): down 13.5 bp to 136.3bp (1Y range: 129-211bp)

- MBIA Insurance Corp (Country: US; rated: Caa1): up 13.2 bp to 571.0bp (1Y range: 515-635bp)

- MBIA Inc (Country: US; rated: Ba3): up 15.5 bp to 383.8bp (1Y range: 365-757bp)

LARGEST EURO CORPORATE CDS MOVES IN THE PAST WEEK

- CMA CGM SA (Country: FR; rated: B1): down 53.3 bp to 256.0bp (1Y range: 258-734bp)

- Novafives SAS (Country: FR; rated: Caa1): down 26.2 bp to 831.0bp (1Y range: 716-1,205bp)

- Altice Finco SA (Country: LU; rated: Caa1): down 14.9 bp to 332.5bp (1Y range: 322-477bp)

- Casino Guichard Perrachon SA (Country: FR; rated: WR): down 14.0 bp to 482.7bp (1Y range: 467-1,210bp)

- Marks and Spencer PLC (Country: GB; rated: Ba1): down 13.6 bp to 144.3bp (1Y range: 142-349bp)

- Thyssenkrupp AG (Country: DE; rated: B1): down 13.1 bp to 239.8bp (1Y range: 206-479bp)

- Unilabs SubHolding AB (Country: SE; rated: B2): down 9.2 bp to 169.0bp (1Y range: -183bp)

- Iceland Bondco PLC (Country: GB; rated: LGD3 - 46%): down 9.2 bp to 437.4bp (1Y range: 358-655bp)

- Leonardo SpA (Country: IT; rated: BBB-): down 8.9 bp to 130.6bp (1Y range: 127-298bp)

- Premier Foods Finance PLC (Country: GB; rated: B1): down 8.3 bp to 152.9bp (1Y range: 141-273bp)

- Valeo SE (Country: FR; rated: P-3): down 7.8 bp to 118.0bp (1Y range: 112-189bp)

- Ineos Group Holdings SA (Country: LU; rated: LGD5 - 88%): down 6.7 bp to 192.5bp (1Y range: 199-447bp)

- J Sainsbury PLC (Country: GB; rated: WR): down 6.6 bp to 102.6bp (1Y range: 54-111bp)

- Telecom Italia SpA (Country: IT; rated: Ba2): down 6.5 bp to 152.5bp (1Y range: 149-219bp)

- GKN Holdings Ltd (Country: GB; rated: BB+): down 6.4 bp to 118.3bp (1Y range: 114-296bp)

USD BOND ISSUES

- Blackstone Private Credit Fund (Financial - Other | New York City, United States | Rating: NR): US$900m Senior Note (US09261HAC16), fixed rate (2.63% coupon) maturing on 15 December 2026, priced at 99.30 (original spread of 195 bp), callable (5nc5)

- Blackstone Private Credit Fund (Financial - Other | New York City, United States | Rating: NR): US$365m Senior Note (US09261HAA59), fixed rate (1.75% coupon) maturing on 15 September 2024, priced at 99.78 (original spread of 140 bp), with a make whole call

- Broadstone Net Lease Inc (Real Estate Investment Trust | Rochester, United States | Rating: BBB): US$375m Senior Note (US11135EAA29), fixed rate (2.60% coupon) maturing on 15 September 2031, priced at 99.82 (original spread of 128 bp), callable (10nc10)

- Caesars Entertainment Inc (Financial - Other | Reno, United States | Rating: CCC+): US$1,200m Senior Note (USU1230PAA94), fixed rate (4.63% coupon) maturing on 15 October 2029, priced at 100.00 (original spread of 342 bp), callable (8nc3)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$175m Bond (US3133EM5M08), fixed rate (1.63% coupon) maturing on 17 March 2031, priced at 100.00 (original spread of 156 bp), callable (10nc3m)

- PGT Innovations Inc (Building Products | North Venice, United States | Rating: B+): US$575m Senior Note (US69336VAB71), fixed rate (4.38% coupon) maturing on 1 August 2029, priced at 100.00, callable (8nc3)

- Nbk Spc Ltd (Financial - Other | Dubai, Kuwait | Rating: NR): US$1,000m Senior Note (XS2386563469), floating rate maturing on 15 September 2027, priced at 99.52 (original spread of 68 bp), callable (6nc5)

EUR BOND ISSUES

- ABN Amro Bank NV (Banking | Amsterdam, Netherlands | Rating: A): €1,500m Covered Bond (Other) (XS2387713238), fixed rate (0.40% coupon) maturing on 17 September 2041, priced at 99.64 (original spread of 54 bp), non callable

NEW LOANS

- Solenis International, signed a US$ 700m Term Loan B, to be used for a leveraged buyout. It matures on 09/21/28 and initial pricing is set at LIBOR +400bps

- Solenis International, signed a € 591m Term Loan B, to be used for a leveraged buyout. It matures on 09/21/28 and initial pricing is set at EURIBOR +425bps

- CCC Information Services Inc (B), signed a US$ 800m Term Loan B, to be used for general corporate purposes. It matures on 09/16/28 and initial pricing is set at LIBOR +275bps

- ConnectWise Inc, signed a US$ 1,050m Term Loan B, to be used for general corporate purposes. It matures on 09/27/28.

- Autokiniton Us Hldg Inc. (B), signed a US$ 300m Term Loan B. It matures on 04/06/28 and initial pricing is set at LIBOR +450bps

- Orion Engineered Carbons GmbH (BB), signed a € 275m Term Loan, to be used for general corporate purposes. It matures on 09/07/28.

- Orion Engineered Carbons GmbH (BB), signed a US$ 325m Term Loan, to be used for general corporate purposes. It matures on 09/07/28.

- Corcentric LLC, signed a US$ 225m Revolving Credit Facility, to be used for general corporate purposes. It matures on 11/15/23 and initial pricing is set at LIBOR +150bps

- Macquarie Group Ltd (BBB+), signed a US$ 1,445m Term Loan, to be used for refinancing and returning bank debt. It matures on 03/01/28 and initial pricing is set at Other +145bps