Credit

Investment Grade Cash Spreads Unchanged Today, High Yield 3bp Tighter

Issuance of HY corporate debt has been slower than expected this month, but IG had another good day, with JPM pricing 2 tranches for a total offering of US$ 3.25bn

Published ET

Kohl's & GAP 5Y USD CDS Spreads Have Widened Slightly This Month | Source: Refinitiv

QUICK SUMMARY

- The iBoxx USD Liquid Investment Grade Total Return Index was down -0.154% today (Month-to-date: 0.54%; Year-to-date: 0.05%)

- The iBoxx USD Liquid High Yield Total Return Index was up 0.092% today (Month-to-date: 0.37%; Year-to-date: 4.28%)

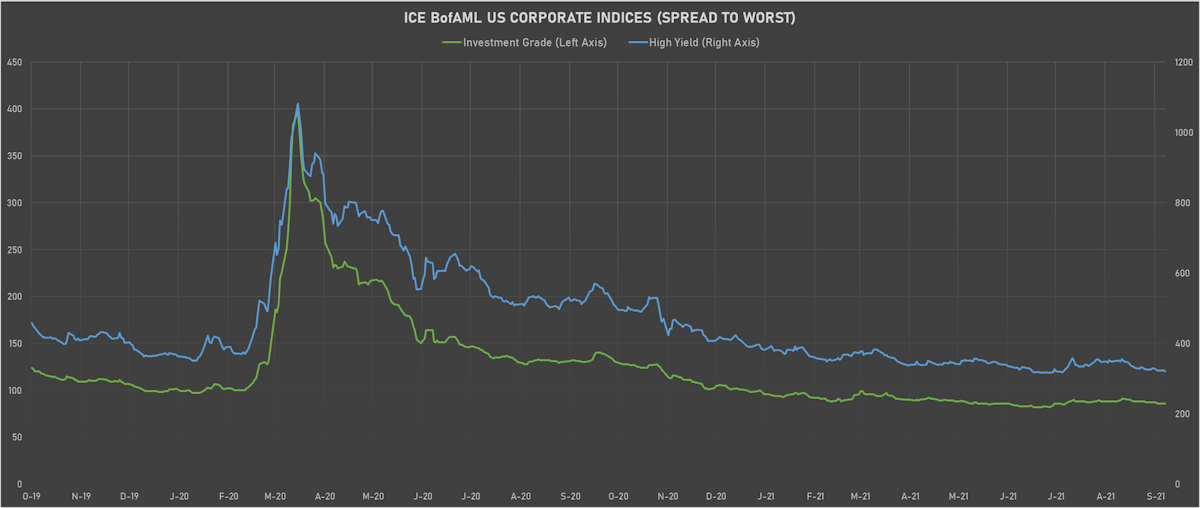

- ICE BofA US Corporate Index (Investment Grade) spread to worst unchanged at 86.0 bp (YTD change: -12.0 bp)

- ICE BofA US High Yield Index spread to worst down -3.0 bp, now at 321.0 bp (YTD change: -69.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index up 0.02% today (YTD total return: +3.0%)

- New issues: US$ 8.9bn in dollars and € 9.3bn in euros

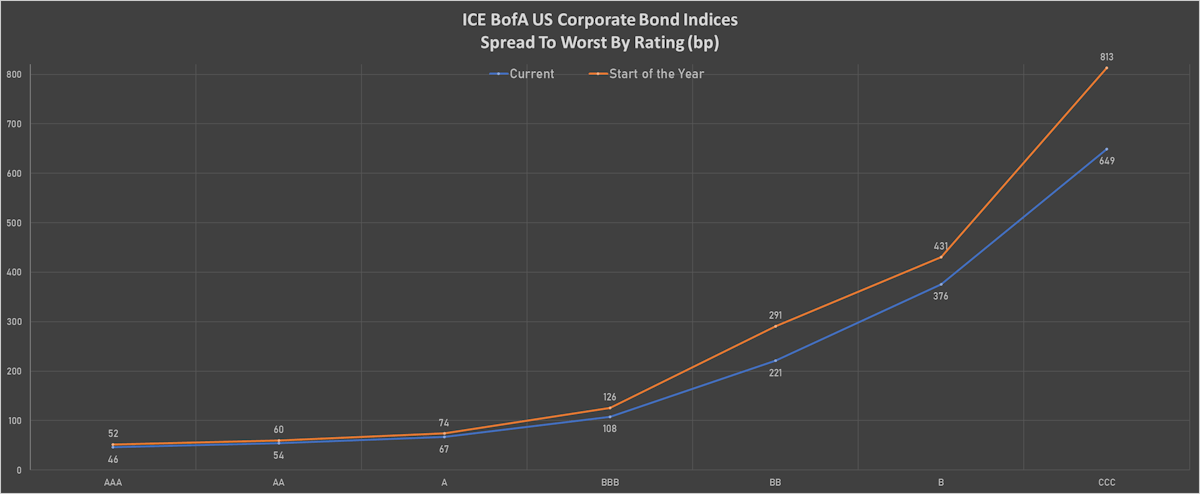

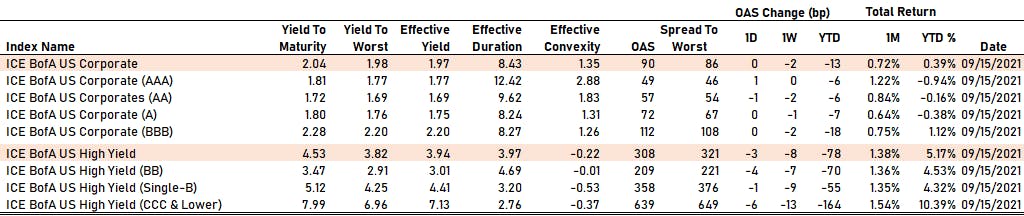

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

- AAA up by 1 bp at 49 bp

- AA down by -1 bp at 57 bp

- A unchanged at 72 bp

- BBB unchanged at 112 bp

- BB down by -4 bp at 209 bp

- B down by -1 bp at 358 bp

- CCC down by -6 bp at 639 bp

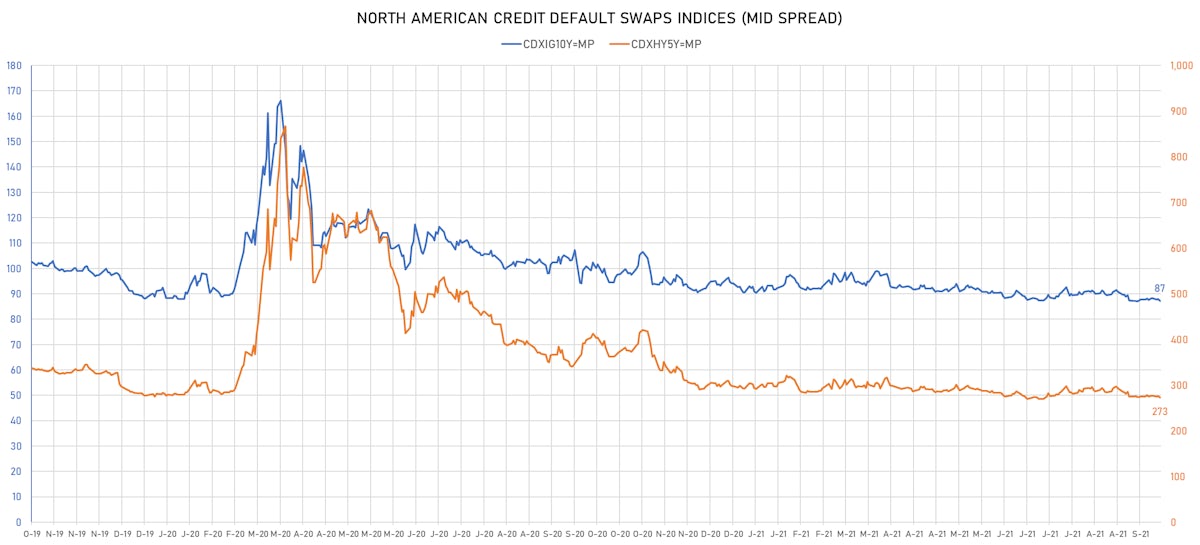

CDS INDICES (mid-spreads)

- Markit CDX.NA.IG 5Y down 0.7 bp, now at 87bp (YTD change: -3.3bp)

- Markit CDX.NA.HY 5Y down 2.9 bp, now at 273bp (YTD change: -20.3bp)

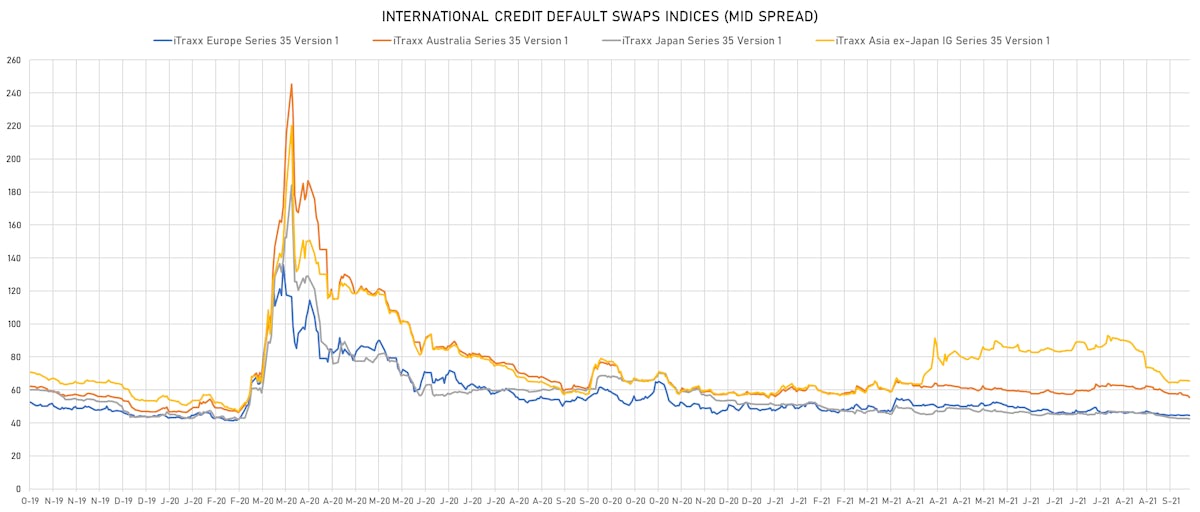

- Markit iTRAXX Europe up 0.1 bp, now at 45bp (YTD change: -3.4bp)

- Markit iTRAXX Japan down 0.1 bp, now at 42bp (YTD change: -9.0bp)

- Markit iTRAXX Asia Ex-Japan up 2.0 bp, now at 67bp (YTD change: +9.4bp)

LARGEST USD CORPORATE CDS MOVES IN THE PAST WEEK

- RR Donnelley & Sons Co (Country: US; rated: B2): down 26.1 bp to 450.1bp (1Y range: 447-802bp)

- Petroleos Mexicanos (Country: MX; rated: BBB+): down 21.7 bp to 362.1bp (1Y range: 326-589bp)

- Lumen Technologies Inc (Country: US; rated: Ba3): down 13.6 bp to 275.2bp (1Y range: 195-533bp)

- Navient Corp (Country: US; rated: Ba3): down 12.5 bp to 244.0bp (1Y range: -240bp)

- Avon Products Inc (Country: GB; rated: WR): down 11.6 bp to 182.3bp (1Y range: 160-365bp)

- Goodyear Tire & Rubber Co (Country: US; rated: LGD2 - 22%): down 10.2 bp to 191.3bp (1Y range: 187-429bp)

- Bombardier Inc (Country: CA; rated: Caa1): down 8.8 bp to 342.8bp (1Y range: 341-1,912bp)

- Kohls Corp (Country: US; rated: BBB): up 9.1 bp to 114.8bp (1Y range: 101-332bp)

- Gap Inc (Country: US; rated: Ba2): up 9.6 bp to 148.7bp (1Y range: 132-294bp)

- Sabre Holdings Corp (Country: US; rated: Ba3): up 9.7 bp to 398.0bp (1Y range: 337-611bp)

- Carnival Corp (Country: US; rated: LGD5 - 72%): up 19.1 bp to 414.0bp (1Y range: 291-1,214bp)

- Transocean Inc (Country: KY; rated: Caa3): up 21.4 bp to 1,767.8bp (1Y range: 941-7,695bp)

- Murphy Oil Corp (Country: US; rated: Ba3): up 24.1 bp to 337.7bp (1Y range: 280-763bp)

- Apache Corp (Country: US; rated: Ba1): up 24.6 bp to 188.6bp (1Y range: 165-453bp)

- Staples Inc (Country: US; rated: B2): up 28.7 bp to 954.2bp (1Y range: 652-1,320bp)

LARGEST EURO CORPORATE CDS MOVES IN THE PAST WEEK

- Novafives SAS (Country: FR; rated: Caa1): down 63.1 bp to 767.9bp (1Y range: 690-1,205bp)

- Monitchem Holdco 3 SA (Country: LU; rated: B2): down 13.8 bp to 206.9bp (1Y range: 197-393bp)

- Valeo SE (Country: FR; rated: P-3): down 6.5 bp to 111.5bp (1Y range: 109-189bp)

- Premier Foods Finance PLC (Country: GB; rated: B1): down 6.4 bp to 146.5bp (1Y range: 141-273bp)

- GKN Holdings Ltd (Country: GB; rated: Ba1): down 4.6 bp to 113.7bp (1Y range: 114-296bp)

- Lagardere SA (Country: FR; rated: B): up 3.8 bp to 206.5bp (1Y range: 210-350bp)

- Jaguar Land Rover Automotive PLC (Country: GB; rated: WD): up 4.4 bp to 362.0bp (1Y range: 339-891bp)

- Tdc A/S (Country: DK; rated: ): up 5.4 bp to 150.4bp (1Y range: 138-201bp)

- Air France KLM SA (Country: FR; rated: B-): up 5.9 bp to 429.1bp (1Y range: 392-1,211bp)

- Ineos Group Holdings SA (Country: LU; rated: LGD5 - 88%): up 12.0 bp to 204.5bp (1Y range: 199-447bp)

- Unilabs SubHolding AB (Country: SE; rated: B2): up 13.5 bp to 182.5bp (1Y range: -176bp)

- Deutsche Lufthansa AG (Country: DE; rated: Ba2): up 13.7 bp to 274.4bp (1Y range: 236-421bp)

- TUI AG (Country: DE; rated: LGD4 - 50%): up 13.7 bp to 742.5bp (1Y range: 590-1,799bp)

- Boparan Finance PLC (Country: GB; rated: WR): up 37.6 bp to 1,038.8bp (1Y range: 478-1,046bp)

- Iceland Bondco PLC (Country: GB; rated: LGD3 - 46%): up 49.5 bp to 486.9bp (1Y range: 358-655bp)

USD BOND ISSUES

- Boston Properties LP (Leisure | Boston, Massachusetts, United States | Rating: BBB+): US$850m Senior Note (US10112RBF01), fixed rate (2.45% coupon) maturing on 1 October 2033, priced at 99.96 (original spread of 115 bp), callable (12nc12)

- CNX Midstream Partners LP (Gas Utility - Pipelines | Canonsburg, United States | Rating: BB-): US$400m Senior Note (US12654AAA97), fixed rate (4.75% coupon) maturing on 15 April 2030, priced at 100.00 (original spread of 352 bp), callable (9nc4)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$170m Bond (US3133EM5V07), fixed rate (0.56% coupon) maturing on 21 March 2025, priced at 99.93 (original spread of 14 bp), callable (3nc3m)

- Federal Home Loan Banks (Agency | Washington, United States | Rating: NR): US$113m Bond (US3130AP4H52), fixed rate (1.15% coupon) maturing on 26 October 2026, priced at 100.00, callable (5nc1m)

- Florida Gas Transmission Company LLC (Gas Utility - Pipelines | Dallas, United States | Rating: BBB): US$600m Senior Note (USU33966AN90), fixed rate (2.30% coupon) maturing on 1 October 2031, priced at 99.92 (original spread of 100 bp), callable (10nc10)

- Florida Gas Transmission Company LLC (Gas Utility - Pipelines | Dallas, United States | Rating: BBB+): US$600m Senior Note (US340711BA72), fixed rate (2.30% coupon) maturing on 1 October 2031, priced at 99.92 (original spread of 100 bp), callable (10nc10)

- JPMorgan Chase & Co (Banking | New York City, United States | Rating: A-): US$500m Senior Note (US46647PCQ72), floating rate (SOFR + 76.5 bp) maturing on 22 September 2027, priced at 100.00, callable (6nc5)

- JPMorgan Chase & Co (Banking | New York City, United States | Rating: A-): US$2,750m Senior Note (US46647PCP99), fixed rate (1.47% coupon) maturing on 22 September 2027, priced at 100.00 (original spread of 67 bp), callable (6nc5)

- National Retail Properties Inc (Real Estate Investment Trust | Orlando, United States | Rating: BBB+): US$450m Senior Note (US637417AR70), fixed rate (3.00% coupon) maturing on 15 April 2052, priced at 97.68 (original spread of 151 bp), callable (31nc30)

- Access Bank Plc (Banking | Victoria Island, Nigeria | Rating: B): US$500m Senior Note (US00434G2B53), fixed rate (6.13% coupon) maturing on 21 September 2026, priced at 100.00, non callable

- B3 SA Brasil Bolsa Balcao (Financial - Other | Sao Paulo, Brazil | Rating: BB-): US$700m Senior Note (US11778EAA47), fixed rate (4.13% coupon) maturing on 20 September 2031, priced at 100.00, non callable

- Council of Europe Development Bank (Supranational | Paris, France | Rating: AA+): US$1,000m Senior Note (US222213AY60), fixed rate (0.88% coupon) maturing on 22 September 2026, priced at 99.93 (original spread of 10 bp), non callable

- Glencore Funding LLC (Financial - Other | Stamford, Switzerland | Rating: NR): US$750m Senior Note (USU37818BC10), fixed rate (2.63% coupon) maturing on 23 September 2031, priced at 99.77 (original spread of 135 bp), callable (10nc10)

- Glencore Funding LLC (Financial - Other | Stamford, Switzerland | Rating: NR): US$500m Senior Note (US378272BH01), fixed rate (3.38% coupon) maturing on 23 September 2051, priced at 98.51 (original spread of 160 bp), callable (30nc30)

- JSW Steel Ltd (Metals/Mining | Mumbai, India | Rating: BB-): US$500m Bond (USY44680RW11), fixed rate (5.05% coupon) maturing on 5 April 2032, priced at 100.00, non callable

- JSW Steel Ltd (Metals/Mining | Mumbai, India | Rating: BB-): US$500m Bond (USY44680RV38), fixed rate (3.95% coupon) maturing on 5 April 2027, priced at 100.00, non callable

- Jinan Urban Construction International Investment Co Ltd (Financial - Other | China (Mainland) | Rating: NR): US$305m Senior Note (XS2384202292), fixed rate (2.40% coupon) maturing on 23 September 2026, priced at 100.00, non callable

- Korea Electric Power Corp (Utility - Other | Naju, Jeollanam-Do, South Korea | Rating: AA): US$300m Bond (XS2385061820), fixed rate (1.13% coupon) maturing on 24 September 2026, priced at 99.63 (original spread of 40 bp), non callable

- Natixis SA (Banking | Paris, Ile-De-France, France | Rating: A): US$180m Unsecured Note (XS2303548635) zero coupon maturing on 8 October 2051, non callable

- Rumo Luxembourg SARL (Financial - Other | Luxembourg, Brazil | Rating: BB): US$500m Senior Note (US781467AE54), fixed rate (4.20% coupon) maturing on 18 January 2032, priced at 99.59 (original spread of 297 bp), callable (10nc5)

- Unifrax Escrow Issuer Corp (Financial - Other | Rating: BB): US$800m Note (USU9044LAA71), fixed rate (5.25% coupon) maturing on 30 September 2028, priced at 100.00 (original spread of 421 bp), callable (7nc3)

- Unifrax Escrow Issuer Corp (Financial - Other | Rating: CCC+): US$400m Senior Note (US90473LAC63), fixed rate (7.50% coupon) maturing on 30 September 2029, priced at 100.00 (original spread of 637 bp), callable (8nc3)

- Vinpearl JSC (Leisure | Hanoi, Vietnam | Rating: NR): US$425m Bond (XS2387598209), fixed rate (3.25% coupon) maturing on 21 September 2026, priced at 100.00, non callable, convertible

EUR BOND ISSUES

- Almirall SA (Pharmaceuticals | Barcelona, Barcelona, Spain | Rating: BB-): €300m Senior Note (XS2388162385), fixed rate (2.13% coupon) maturing on 30 September 2026, priced at 100.00 (original spread of 276 bp), callable (5nc2)

- Bank of America Corp (Banking | Charlotte, United States | Rating: A-): €2,000m Senior Note (XS2387929834), floating rate (EU03MLIB + 100.0 bp) maturing on 22 September 2026, priced at 102.03, callable (5nc4)

- European Investment Bank (Supranational | Luxembourg, Luxembourg | Rating: AAA): €3,000m Senior Note (XS2388495942) zero coupon maturing on 22 December 2026, priced at 102.25 (original spread of 22 bp), non callable

- Hungary (Government) (Sovereign | Budapest, Hungary | Rating: BBB-): €1,000m Senior Note (XS2386583145), fixed rate (0.13% coupon) maturing on 21 September 2028, priced at 98.61 (original spread of 87 bp), non callable

- Mondelez International Holdings Netherlands BV (Food Processors | Oosterhout, United States | Rating: NR): €300m Bond (XS2388456456) zero coupon maturing on 20 September 2024, priced at 102.00, non callable, convertible

- Norddeutsche Landesbank Girozentrale (Banking | Hannover, Germany | Rating: NR): €500m Hypotheken-Namenspfandbrief (covered bond) (DE000NLB3UX1), fixed rate (0.01% coupon) maturing on 23 September 2026, priced at 101.59 (original spread of 34 bp), non callable

- Verde Bidco SpA (Financial - Other | Milan | Rating: B): €450m Note (XS2389120325), fixed rate (4.63% coupon) maturing on 1 October 2026, priced at 100.00 (original spread of 529 bp), callable (5nc2)

- Westpac Banking Corp (Banking | Sydney, Australia | Rating: A+): €1,250m Covered Bond (Other) (XS2388390507), fixed rate (0.01% coupon) maturing on 22 September 2028, priced at 100.54 (original spread of 48 bp), non callable

- Westpac Banking Corp (Banking | Sydney, Australia | Rating: A+): €500m Covered Bond (Other) (XS2388390689), fixed rate (0.38% coupon) maturing on 22 September 2036, priced at 99.06 (original spread of 50 bp), non callable

NEW LOANS

- American Bath Group LLC, signed a US$ 150m Term Loan B, to be used for general corporate purposes. It matures on 11/23/27 and initial pricing is set at LIBOR +375bps

NEW ISSUES IN SECURITIZED CREDIT

- US Small Business Administration 2021-10 B issued a fixed-rate ABS backed by small business loan in 1 tranche offering a yield to maturity of 1.30%, for a total of US$ 1,360 m. Bookrunners: Credit Suisse, Goldman Sachs & Co, JP Morgan & Co Inc

- Fat Brands Twin Peaks I LLC issued a fixed-rate ABS backed by certificates in 3 tranches, for a total of US$ 250 m. Highest-rated tranche offering a yield to maturity of 7.00%, and the lowest-rated tranche a yield to maturity of 10.00%. Bookrunners: Jefferies & Co Inc

- GM Financial Revolving Receivables Trust 2021-1 issued a floating-rate ABS backed by auto receivables in 1 tranche offering a spread over the floating rate of 30bp, for a total of US$ 702 m. Bookrunners: JP Morgan & Co Inc, Barclays Capital Group, Deutsche Bank Securities Inc, Credit Agricole Corporate & Investment Bank

- Freddie Mac Spc Series K-745 issued a fixed-rate Agency CMBS in 3 tranches, for a total of US$ 929 m. Highest-rated tranche offering a yield to maturity of 0.84%, and the lowest-rated tranche a yield to maturity of 1.53%. Bookrunners: Morgan Stanley International Ltd, Bank of America Merrill Lynch

- Tesla Auto Lease Trust 2021-B issued a fixed-rate ABS backed by auto receivables in 7 tranches, for a total of US$ 904 m. Highest-rated tranche offering a yield to maturity of 0.12%, and the lowest-rated tranche a yield to maturity of 1.33%. Bookrunners: Credit Suisse, Barclays Capital Group, Deutsche Bank Securities Inc, Citigroup Global Markets Inc, Wells Fargo Securities LLC