Credit

USD Bonds Fall With Higher Rates, Cash Spreads Largely Unchanged

Issuance activity slowed drastically on Thursday, with the most notable deal being a US$ 800m offering from South African company Bidvest

Published ET

The spread on the Wynn Las Vegas 2025 bond (USU98347AK05) widened significantly this week but should ease after a $1.5bn refi | Source: Refinitiv

QUICK SUMMARY

- S&P 500 Bond Index was down -0.35% today, with investment grade down -0.37% and high yield down -0.14% (YTD total return: +0.31%)

- The iBoxx USD Liquid Investment Grade Total Return Index was down -0.23% today (Month-to-date: 0.31%; Year-to-date: -0.18%)

- The iBoxx USD Liquid High Yield Total Return Index was down -0.06% today (Month-to-date: 0.32%; Year-to-date: 4.22%)

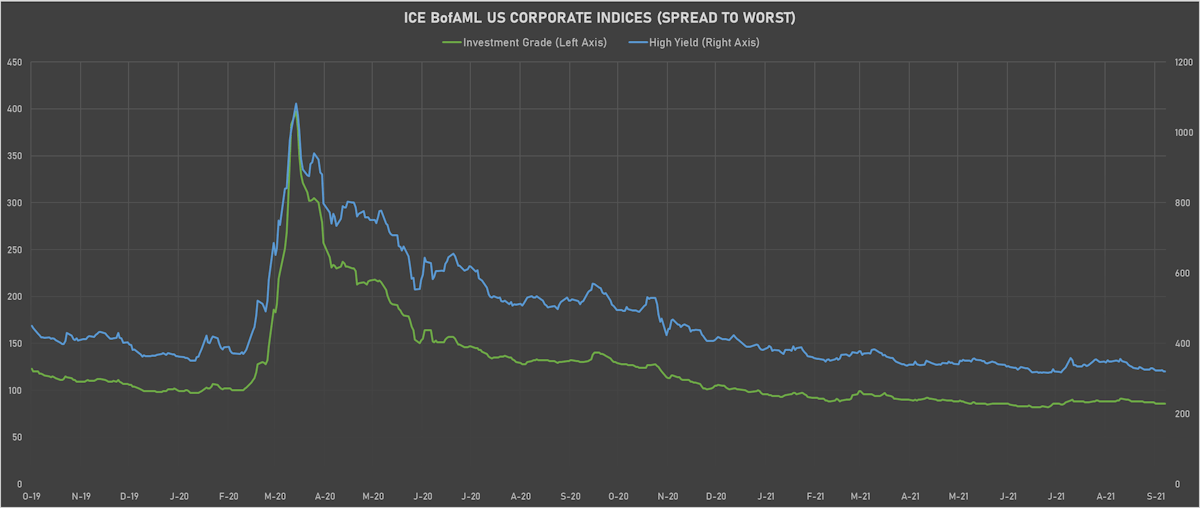

- ICE BofA US Corporate Index (Investment Grade) spread to worst unchanged at 86.0 bp (YTD change: -12.0 bp)

- ICE BofA US High Yield Index spread to worst down -1.0 bp, now at 320.0 bp (YTD change: -70.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index up 0.05% today (YTD total return: +3.0%)

- New issues: US$ 2.2bn in dollars and € 4.3bn in euros

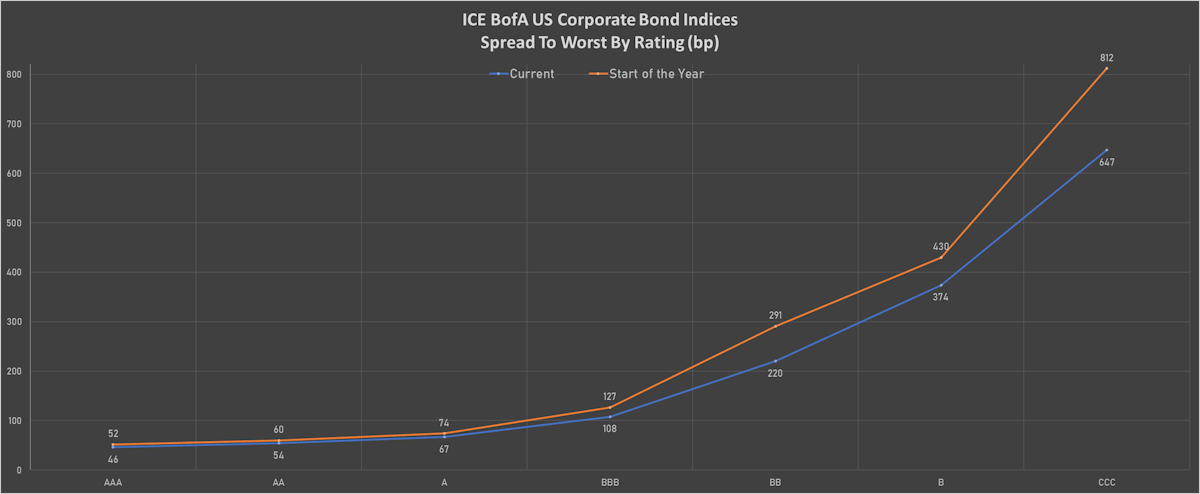

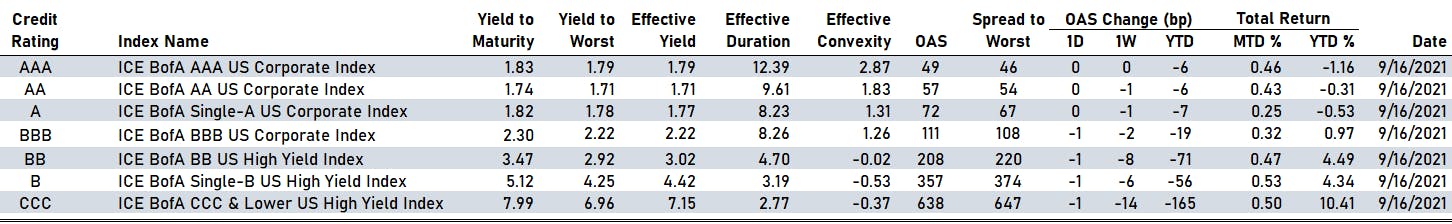

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

- AAA unchanged at 49 bp

- AA unchanged at 57 bp

- A unchanged at 72 bp

- BBB down by -1 bp at 111 bp

- BB down by -1 bp at 208 bp

- B down by -1 bp at 357 bp

- CCC down by -1 bp at 638 bp

CDS INDICES (mid-spreads)

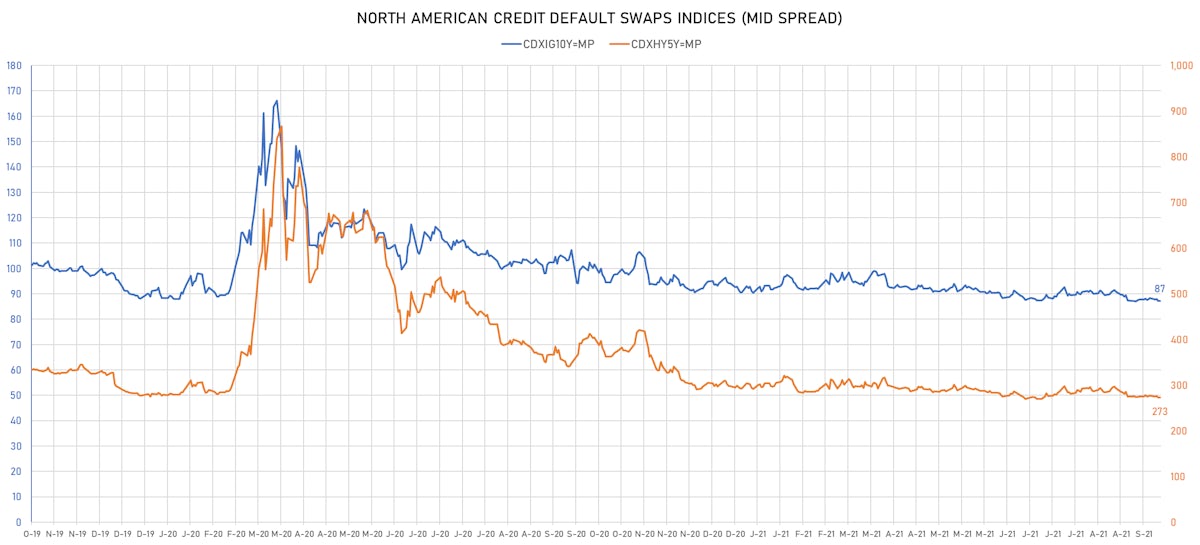

- Markit CDX.NA.IG 5Y at 87bp (YTD change: -3.4bp)

- Markit CDX.NA.HY 5Y at 273bp (YTD change: -20.5bp)

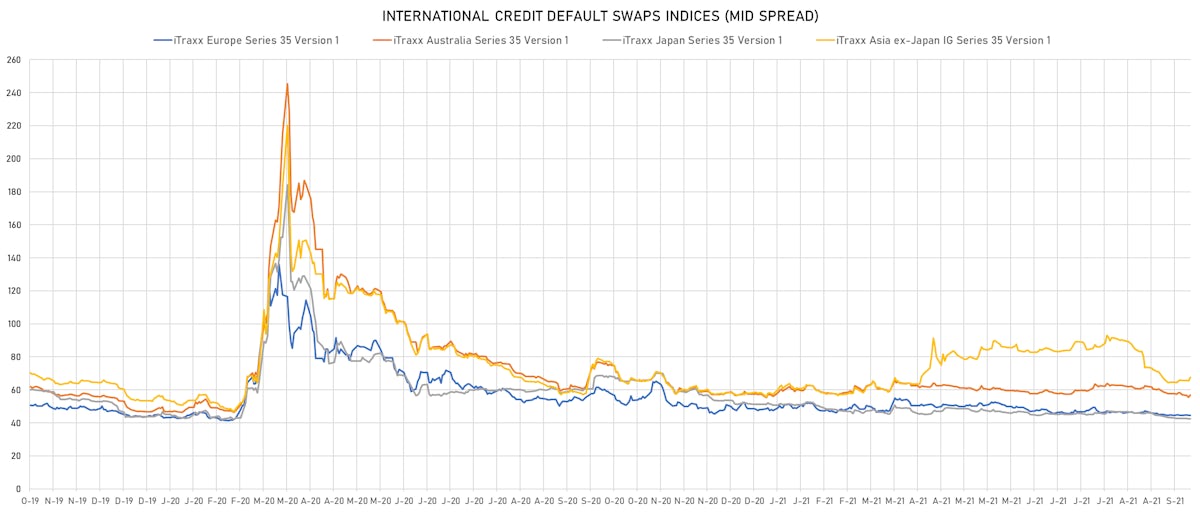

- Markit iTRAXX Europe at 44bp (YTD change: -3.5bp)

- Markit iTRAXX Japan at 42bp (YTD change: -9.1bp)

- Markit iTRAXX Asia Ex-Japan at 67bp (YTD change: +9.3bp)

USD BOND ISSUES

- Athene Global Funding (Financial - Other | Wilmington, United States | Rating: NR): US$275m Senior Note (US04686E3J92), fixed rate (2.08% coupon) maturing on 19 August 2028, priced at 99.39 (original spread of 95 bp), non callable

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$185m Bond (US3133EM6A50), fixed rate (1.57% coupon) maturing on 23 September 2030, priced at 100.00 (original spread of 150 bp), callable (9nc1)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$125m Bond (US3133EM6C17), fixed rate (1.73% coupon) maturing on 22 September 2031, priced at 100.00 (original spread of 167 bp), callable (10nc3m)

- Federal Home Loan Banks (Agency | Washington, United States | Rating: NR): US$131m Bond (US3130AP5J00), fixed rate (1.17% coupon) maturing on 22 October 2026, priced at 100.00, callable (5nc1m)

- Waldorf Production Uk Ltd (Oil and Gas | London, United States | Rating: NR): US$270m Bond (NO0011100935), fixed rate (9.75% coupon) maturing on 1 October 2024, callable (3nc1)

- Bidvest Group (UK) PLC (Financial - Other | Banbury, South Africa | Rating: NR): US$800m Senior Note (XS2388496247), fixed rate (3.63% coupon) maturing on 23 September 2026, callable (5nc2)

- Indiabulls Housing Finance Ltd (Mortgage Banking | New Delhi, Delhi, India | Rating: NR): US$150m Bond (XS2377720839), fixed rate (4.50% coupon) maturing on 28 September 2026, priced at 100.00, non callable, convertible

- Jinan Urban Construction International Investment Co Ltd (Financial - Other | China (Mainland) | Rating: BBB): US$305m Senior Note (XS2384202292), fixed rate (2.40% coupon) maturing on 23 September 2026, priced at 100.00, non callable

EUR BOND ISSUES

- ANZ New Zealand (Int'l) Ltd (Securities | Wellington, Wellington, Australia | Rating: NR): €750m Senior Note (XS2389757944), fixed rate (0.20% coupon) maturing on 23 September 2027, priced at 99.74 (original spread of 107 bp), non callable

- Lansforsakringar Hypotek AB (publ) (Mortgage Banking | Stockholm, Sweden | Rating: NR): €500m Sakerstallda Obligation (Covered Bond) (XS2389315768), fixed rate (0.01% coupon) maturing on 27 September 2028, priced at 100.70 (original spread of 44 bp), non callable

- Leather 2 SpA (Financial - Other | Milan, Milano, France | Rating: NR): €340m Note (XS2389335287), floating rate (EU03MLIB + 450.0 bp) maturing on 30 September 2028, priced at 100.00, callable (7nc1)

- NRW Bank (Agency | Dusseldorf, Nordrhein-Westfalen, Germany | Rating: AA): €1,000m Inhaberschuldverschreibung (DE000NWB0AP2) zero coupon maturing on 22 September 2028, priced at 101.18 (original spread of 37 bp), non callable

- Serbia, Republic of (Government) (Sovereign | Beograd, Serbia | Rating: BB): €1,000m Senior Note (XS2388561677), fixed rate (1.00% coupon) maturing on 23 September 2028, priced at 98.26 (original spread of 179 bp), non callable

- Serbia, Republic of (Government) (Sovereign | Beograd, Serbia | Rating: BB): €750m Senior Note (XS2388562139), fixed rate (2.05% coupon) maturing on 23 September 2036, priced at 96.80 (original spread of 235 bp), non callable

NEW LOANS

- Diamond BC BV, signed a US$ 1,500m Term Loan B, to be used for general corporate purposes. It matures on 09/22/28 and initial pricing is set at LIBOR +300bps

- Audia Plastics, signed a US$ 175m Revolving Credit Facility, to be used for general corporate purposes. It matures on 09/30/26 and initial pricing is set at LIBOR +95bps

- Campbell Soup Co (BBB-), signed a US$ 1,850m Revolving Credit Facility, to be used for general corporate purposes and working capital. It matures on 09/27/26 and initial pricing is set at LIBOR +120bps

- American Tire Distributors Inc (B-), signed a US$ 1,100m Revolving Credit Facility, to be used for general corporate purposes. It matures on 09/30/26 and initial pricing is set at LIBOR +150bps

- Carlyle Partners VI LP, signed a US$ 2,400m Revolving Credit Facility, to be used for general corporate purposes. It matures on 01/24/23 and initial pricing is set at LIBOR +195bps

- STADA Arzneimittel AG, signed a € 175m Term Loan B, to be used for refin/ret bank debt. It matures on 08/21/26 and initial pricing is set at EURIBOR +350bps

- Caleres Inc (B+), signed a US$ 500m Revolving Credit Facility, to be used for general corporate purposes, working capital and capital expenditures. It matures on 09/28/25 and initial pricing is set at LIBOR +225bps

NEW ISSUES IN SECURITIZED CREDIT

- Wells Fargo Mortgage Backed Securities 2021-2 Trust issued a fixed-rate RMBS in 5 tranches, for a total of US$ 622 m. Bookrunners: Wells Fargo Securities LLC

- Barclays Dryrock Issuance Trust 2021-1 issued a fixed-rate ABS backed by receivables in 1 trancheoffering a yield to maturity of 0.63%, for a total of US$ 1,000 m. Bookrunners: Barclays Capital Group

- Mercedes-Benz Auto Receivables Trust 2021-1 issued a fixed-rate ABS backed by auto receivables in 3 tranches, for a total of US$ 1,250 m. Highest-rated tranche offering a yield to maturity of 0.21%, and the lowest-rated tranche a yield to maturity of 0.74%. Bookrunners: Santander Investment Securities Inc, Mizuho Securities USA Inc, TD Securities (USA) LLC

- Fresb 2021-Sb90 Mortgage Trust issued a floating-rate Agency CMBS in 4 tranches, for a total of US$ 406 m. Bookrunners: Credit Suisse, Wells Fargo Securities LLC

- BX Commercial Mortgage Trust 2021-Volt issued a floating-rate CMBS in 8 tranches, for a total of US$ 3,200 m. Highest-rated tranche offering a spread over the floating rate of 70bp, and the lowest-rated tranche a spread of 525bp. Bookrunners: Goldman Sachs & Co, Barclays Capital Group, Deutsche Bank Securities Inc, Citigroup Global Markets Inc

- Verus Securitization Trust 2021-5 issued a floating-rate RMBS in 6 tranches, for a total of US$ 627 m. Highest-rated tranche offering a spread over the floating rate of 65bp, and the lowest-rated tranche a spread of 315bp. Bookrunners: Credit Suisse, Barclays Capital Group, Deutsche Bank Securities Inc