Credit

US Investment Grade Corporate Bonds Rose Today Thanks To Lower Rates, While High Yield Cash Spreads Widened By 19bp

Although the Evergrande meme had its day thanks to the FT, we doubt it is that meaningful for global markets: the start of a large but well-telegraphed default / debt restructuring, a risk that has been known / priced for months, is not the typical stuff that leads to market contagion and meltdowns

Published ET

Seasonality Is Favorable To USD Investment Grade Bonds | Source: Credit Suisse

QUICK SUMMARY

- S&P 500 Bond Index was up 0.35% today, with investment grade up 0.40% and high yield down -0.15% (YTD total return: +0.48%)

- The iBoxx USD Liquid Investment Grade Total Return Index was up 0.335% today (Month-to-date: 0.42%; Year-to-date: -0.07%)

- The iBoxx USD Liquid High Yield Total Return Index was down -0.368% today (Month-to-date: -0.08%; Year-to-date: 3.81%)

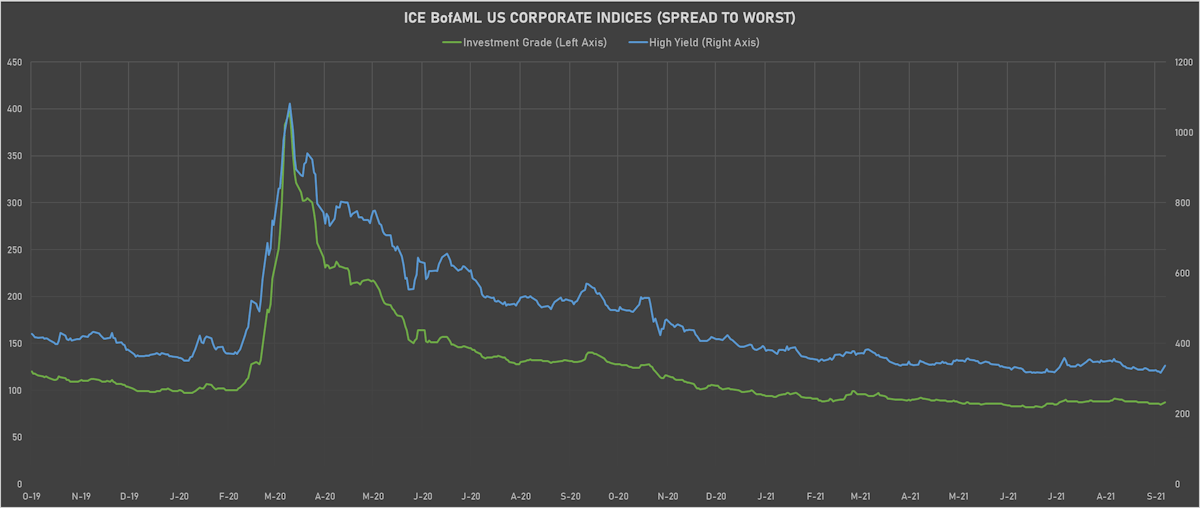

- ICE BofA US Corporate Index (Investment Grade) spread to worst up 2.0 bp, now at 87.0 bp (YTD change: -11.0 bp)

- ICE BofA US High Yield Index spread to worst up 20.0 bp, now at 337.0 bp (YTD change: -53.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index down -0.06% today (YTD total return: +3.0%)

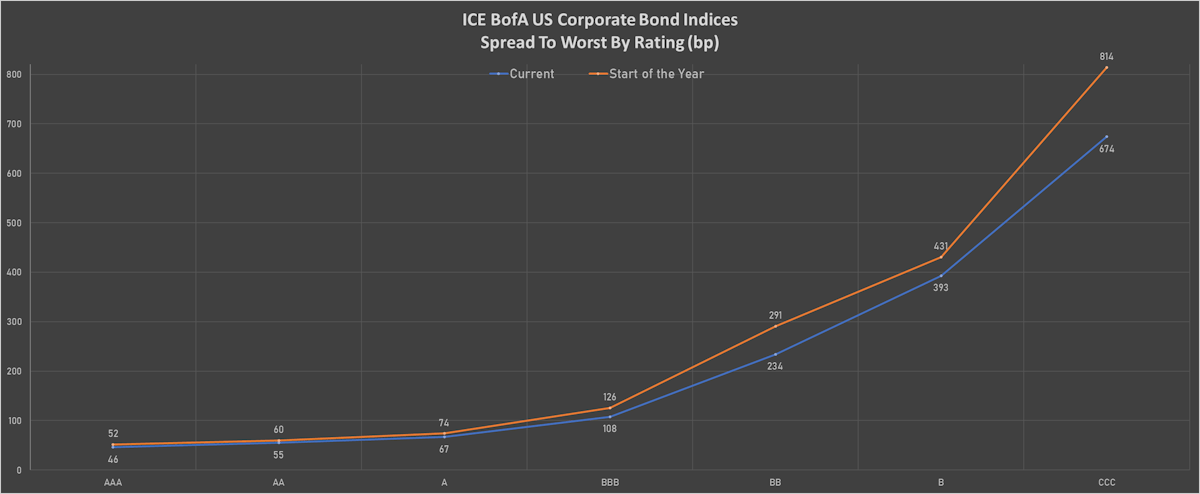

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

- AAA up by 1 bp at 49 bp

- AA up by 1 bp at 58 bp

- A up by 1 bp at 72 bp

- BBB up by 2 bp at 112 bp

- BB up by 15 bp at 222 bp

- B up by 23 bp at 375 bp

- CCC up by 29 bp at 663 bp

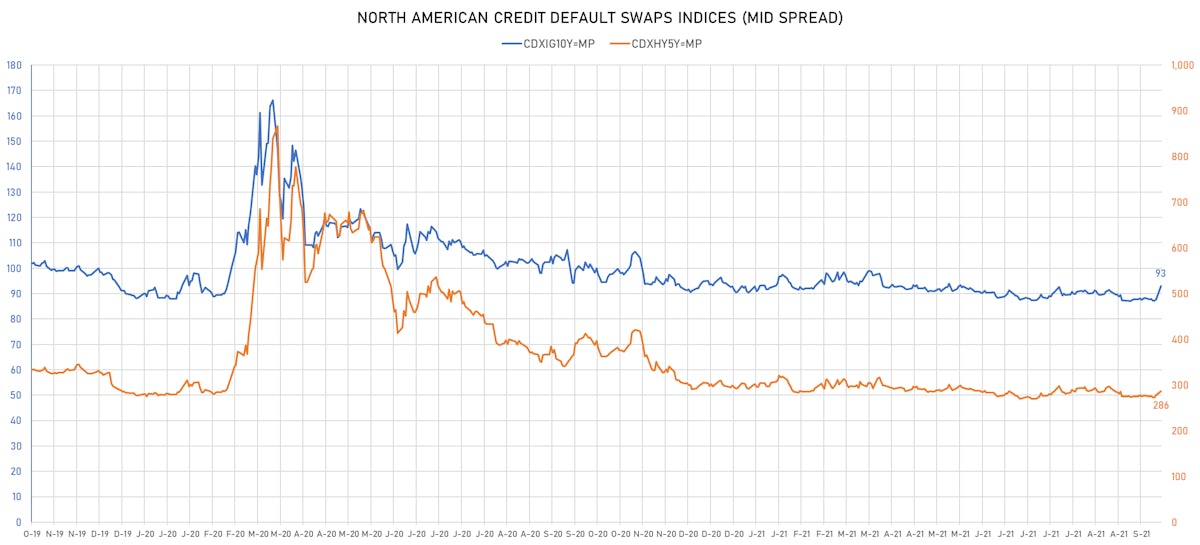

CDS INDICES (mid-spreads)

- Markit CDX.NA.IG 5Y up 5.3 bp, now at 93bp (YTD change: +2.6bp)

- Markit CDX.NA.HY 5Y up 8.3 bp, now at 286bp (YTD change: -6.9bp)

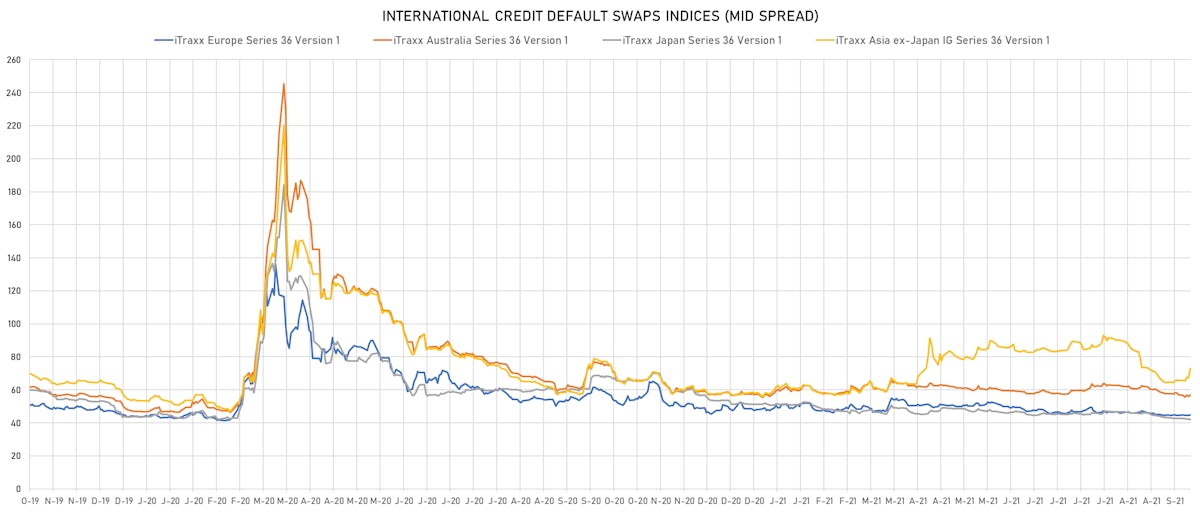

- Markit iTRAXX Europe up 6.5 bp, now at 51bp (YTD change: +3.3bp)

- Markit iTRAXX Japan unchanged at 42bp (YTD change: -9.1bp)

- Markit iTRAXX Asia Ex-Japan up 21.5 bp, now at 94bp (YTD change: +36.3bp)

LARGEST USD CORPORATE CDS MOVES IN THE PAST WEEK

- Transocean Inc (Country: KY; rated: Caa3): down 65.3 bp to 1,702.5bp (1Y range: 941-7,695bp)

- Genworth Holdings Inc (Country: US; rated: Caa1): down 43.6 bp to 506.8bp (1Y range: 447-681bp)

- K Hovnanian Enterprises Inc (Country: US; rated: Caa3): down 43.2 bp to 718.0bp (1Y range: 606-1,208bp)

- Petroleos Mexicanos (Country: MX; rated: BBB+): down 28.4 bp to 333.8bp (1Y range: 323-589bp)

- Office Depot Inc (Country: US; rated: WR): down 20.8 bp to 541.2bp (1Y range: 549-583bp)

- Macy's Inc (Country: US; rated: Ba2): down 17.8 bp to 193.6bp (1Y range: 190-1,253bp)

- Nordstrom Inc (Country: US; rated: Ba1): down 17.7 bp to 222.8bp (1Y range: 211-684bp)

- Teck Resources Ltd (Country: CA; rated: BBB): down 14.0 bp to 100.6bp (1Y range: 105-165bp)

- Gap Inc (Country: US; rated: Ba2): down 11.7 bp to 136.9bp (1Y range: 132-294bp)

- Pactiv LLC (Country: US; rated: Caa1): up 12.2 bp to 367.8bp (1Y range: 231-418bp)

- American Axle & Manufacturing Inc (Country: US; rated: Ba1): up 13.6 bp to 362.9bp (1Y range: 336-581bp)

- Tegna Inc (Country: US; rated: Ba3): up 25.9 bp to 202.0bp (1Y range: 148-252bp)

- RR Donnelley & Sons Co (Country: US; rated: B2): up 30.6 bp to 480.8bp (1Y range: 447-802bp)

LARGEST EURO CORPORATE CDS MOVES IN THE PAST WEEK

- Lagardere SA (Country: FR; rated: B): down 101.7 bp to 104.8bp (1Y range: 117-350bp)

- Novafives SAS (Country: FR; rated: Caa1): down 93.5 bp to 674.4bp (1Y range: 673-1,205bp)

- Deutsche Lufthansa AG (Country: DE; rated: Ba2): down 38.9 bp to 235.5bp (1Y range: 231-421bp)

- Thyssenkrupp AG (Country: DE; rated: B1): down 20.3 bp to 216.1bp (1Y range: 206-479bp)

- Boparan Finance PLC (Country: GB; rated: WR): down 20.2 bp to 1,018.6bp (1Y range: 478-1,062bp)

- Monitchem Holdco 3 SA (Country: LU; rated: B2): down 18.6 bp to 188.3bp (1Y range: 194-393bp)

- Air France KLM SA (Country: FR; rated: B-): down 14.7 bp to 414.4bp (1Y range: 392-1,211bp)

- Ladbrokes Coral Group Ltd (Country: GB; rated: WR): down 12.1 bp to 156.2bp (1Y range: 149-227bp)

- Virgin Media Finance PLC (Country: GB; rated: WR): down 10.2 bp to 217.1bp (1Y range: 222-325bp)

- CMA CGM SA (Country: FR; rated: Ba3): down 10.0 bp to 247.6bp (1Y range: 259-734bp)

- Louis Dreyfus Co BV (Country: NL; rated: ): down 9.8 bp to 95.0bp (1Y range: -109bp)

- Vivendi SE (Country: FR; rated: BBB-): up 9.2 bp to 67.8bp (1Y range: 34-96bp)

- Tui AG (Country: DE; rated: LGD4 - 50%): up 12.7 bp to 755.1bp (1Y range: 609-1,799bp)

- Premier Foods Finance PLC (Country: GB; rated: B1): up 18.4 bp to 164.9bp (1Y range: 154-273bp)

- Banca Monte dei Paschi di Siena SpA (Country: IT; rated: NP): up 29.1 bp to 192.2bp (1Y range: 145-272bp)

USD BOND ISSUES

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: NR): US$385m Bond (US3133EM6E72), fixed rate (0.94% coupon) maturing on 28 September 2026, priced at 100.00, callable (5nc1)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, New Jersey, United States | Rating: NR): US$675m Bond (US3133EM6F48), floating rate (SOFR + 2.5 bp) maturing on 27 September 2023, priced at 100.00, non callable

- Amipeace Ltd (Financial - Other | Tortola, China (Mainland) | Rating: NR): US$300m Unsecured Note (XS2390145006), fixed rate (1.45% coupon) maturing on 18 October 2026, priced at 100.00, non callable

- Amipeace Ltd (Financial - Other | Tortola, China (Mainland) | Rating: NR): US$300m Unsecured Note (XS2390144702), fixed rate (2.25% coupon) maturing on 18 October 2031, priced at 100.00, non callable

- Industrial and Commercial Bank of China Ltd (Hong Kong Branch) (Banking | China (Mainland) | Rating: NR): US$500m Unsecured Note (XS2381043350), fixed rate (1.25% coupon) maturing on 20 September 2026, priced at 100.00, non callable

- Korea Development Bank (Agency | Seoul, South Korea | Rating: AA-): US$200m Unsecured Note (XS2389120598), fixed rate (1.62% coupon) maturing on 29 September 2031, priced at 100.00, non callable

- Macquarie Group Ltd (Financial - Other | Sydney, New South Wales, Australia | Rating: BBB+): US$150m Unsecured Note (XS2390147804) zero coupon maturing on 13 October 2056, priced at 100.00, non callable

- Malayan Banking Bhd (Banking | Kuala Lumpur, Wilayah Persekutuan, Malaysia | Rating: BBB+): US$255m Unsecured Note (XS2389792776) zero coupon maturing on 7 October 2061, priced at 100.00, non callable

- Municipality Finance Plc (Agency | Helsinki, Etela-Suomen, Finland | Rating: AA+): US$10,000m Unsecured Note (XS2388188851), fixed rate (1.50% coupon) maturing on 24 September 2026, priced at 100.00, non callable

- Single Platform Investment Repackaging Entity SA (Financial - Other | Luxembourg, Netherlands | Rating: NR): US$192m Unsecured Note (XS2388479664) zero coupon maturing on 20 June 2051, priced at 52.14, non callable

- State Elite Global Ltd (Financial - Other | China (Mainland) | Rating: NR): US$400m Unsecured Note (XS2388908969), fixed rate (1.00% coupon) maturing on 30 September 2024, priced at 100.00, non callable

- State Elite Global Ltd (Financial - Other | China (Mainland) | Rating: NR): US$300m Unsecured Note (XS2388909181), fixed rate (1.00% coupon) maturing on 30 September 2026, priced at 100.00, non callable

- UBS AG (London Branch) (Banking | London, Switzerland | Rating: A+): US$250m Unsecured Note (XS2388448941), floating rate maturing on 28 September 2026, priced at 100.00, non callable

- Xingcheng (BVI) Ltd (Financial - Other | Road Town, British Virgin Islands | Rating: NR): US$300m Unsecured Note (XS2384258245), fixed rate (1.00% coupon) maturing on 13 September 2024, priced at 100.00, non callable

- Zensun Enterprises Ltd (Financial - Other | British Virgin Islands | Rating: NR): US$160m Bond (XS2385313064), fixed rate (12.50% coupon) maturing on 23 April 2024, priced at 99.97, non callable

EUR BOND ISSUES

- Azores, Autonomous Region of (Official and Muni | Ponta Delgada, Portugal | Rating: BB+): €435m Bond (PTRAAHOM0000), fixed rate (1.10% coupon) maturing on 27 September 2036, priced at 100.00 (original spread of 52 bp), non callable

- CTP NV (Financial - Other | Utrecht, Netherlands | Rating: BBB-): €500m Senior Note (XS2390530330), fixed rate (0.63% coupon) maturing on 27 September 2026, priced at 99.93 (original spread of 130 bp), callable (5nc5)

- CTP NV (Financial - Other | Utrecht, Utrecht, Netherlands | Rating: BBB-): €500m Senior Note (XS2390546849), fixed rate (1.50% coupon) maturing on 27 September 2031, priced at 99.39 (original spread of 188 bp), callable (10nc10)

- UniCredit Bank AG (Banking | Muenchen, Bayern, Italy | Rating: BBB+): €500m Pfandbrief Anleihe (Covered Bond) (DE000HV2AYN4), fixed rate (0.01% coupon) maturing on 28 September 2026, priced at 101.48 (original spread of 38 bp), non callable

NEW LOANS

- Seaport Np Title Holder Llc, signed a US$ 575m Term Loan, to be used for real estate/ppty acq. It matures on 09/30/24 and initial pricing is set at LIBOR +300bps

- Otter Tail Corp (BBB), signed a US$ 170m Revolving Credit Facility, to be used for general corporate purposes, working capital and capital expenditures. It matures on 09/30/26 and initial pricing is set at LIBOR +150bps

NEW ISSUES IN SECURITIZED CREDIT

- Cairn CLO XIV Designated Activity Co issued a floating-rate CLO in 7 tranches, for a total of € 436 m. Highest-rated tranche offering a spread over the floating rate of 100bp, and the lowest-rated tranche a spread of 910bp. Bookrunners: Goldman Sachs & Co

- BMARK 2021-B29 issued a fixed-rate CMBS in 11 tranches, for a total of US$ 997 m. Highest-rated tranche offering a yield to maturity of 0.71%, and the lowest-rated tranche a yield to maturity of 2.75%. Bookrunners: Goldman Sachs & Co, JP Morgan & Co Inc, Deutsche Bank Securities Inc, Citigroup Global Markets Inc

- Mosaic Solar Loan Trust 2021-3 issued a fixed-rate ABS backed by certificates in 4 tranches, for a total of US$ 208 m. Highest-rated tranche offering a yield to maturity of 1.50%, and the lowest-rated tranche a yield to maturity of 3.29%. Bookrunners: Deutsche Bank Securities Inc, RBC Capital Markets, BNP Paribas Securities Corp

- HGI CRE CLO 2021-Fl2 Ltd issued a floating-rate CLO in 5 tranches, for a total of US$ 463 m. Highest-rated tranche offering a spread over the floating rate of 100bp, and the lowest-rated tranche a spread of 245bp. Bookrunners: Goldman Sachs & Co, JP Morgan & Co Inc, Pierpont Securities Holdings LLC

- CATLK 2013-1 issued a floating-rate CLO in 2 tranches, for a total of US$ 334 m. Highest-rated tranche offering a spread over the floating rate of 102bp, and the lowest-rated tranche a spread of 170bp. Bookrunners: Jefferies & Co Inc

- Upstart Securitization Trust 2021-4 issued a fixed-rate ABS backed by consumer loan in 3 tranches, for a total of US$ 671 m. Highest-rated tranche offering a yield to maturity of 0.84%, and the lowest-rated tranche a yield to maturity of 3.19%. Bookrunners: Goldman Sachs & Co

- Dillons Park CLO DAC issued a floating-rate CLO in 8 tranches, for a total of € 439 m. Highest-rated tranche offering a spread over the floating rate of 50bp, and the lowest-rated tranche a spread of 910bp. Bookrunners: Deutsche Bank