Credit

High Yield Cash Rises On Tighter Spreads, IG Largely Unchanged

As the Evergrande meme grew bigger than we thought possible, we will just say that it will be an interesting stress test of how the Chinese system handles a large corporate default, which (if managed successfully) should be a long-term positive for investors

Published ET

Bonds Issued By Seazen Group, Another Chinese Real Estate Company, Have Dropped Significantly In The Past Week (XS2215175634 ) | Source: Refinitiv

QUICK SUMMARY

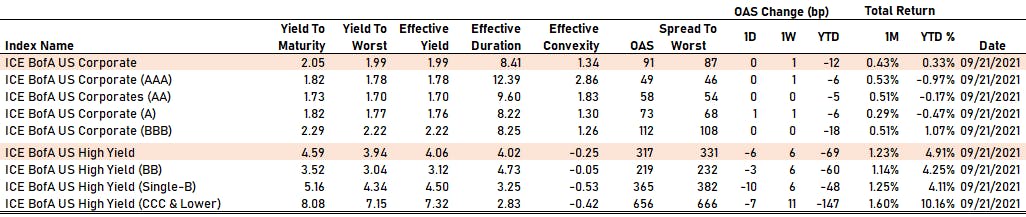

- S&P 500 Bond Index was down -0.03% today, with investment grade down -0.04% and high yield up 0.07% (YTD total return: +0.46%)

- The iBoxx USD Liquid Investment Grade Total Return Index was up 0.088% today (Month-to-date: 0.51%; Year-to-date: 0.02%)

- The iBoxx USD Liquid High Yield Total Return Index was up 0.178% today (Month-to-date: 0.09%; Year-to-date: 3.99%)

- ICE BofA US Corporate Index (Investment Grade) spread to worst unchanged at 87.0 bp (YTD change: -11.0 bp)

- ICE BofA US High Yield Index spread to worst down -6.0 bp, now at 331.0 bp (YTD change: -59.0 bp)

- S&P/LSTA U.S. Leveraged Loan 100 Index up 0.06% today (YTD total return: +3.0%)

- New issues: US$ 17.4bn in dollars and € 8.7bn in euros

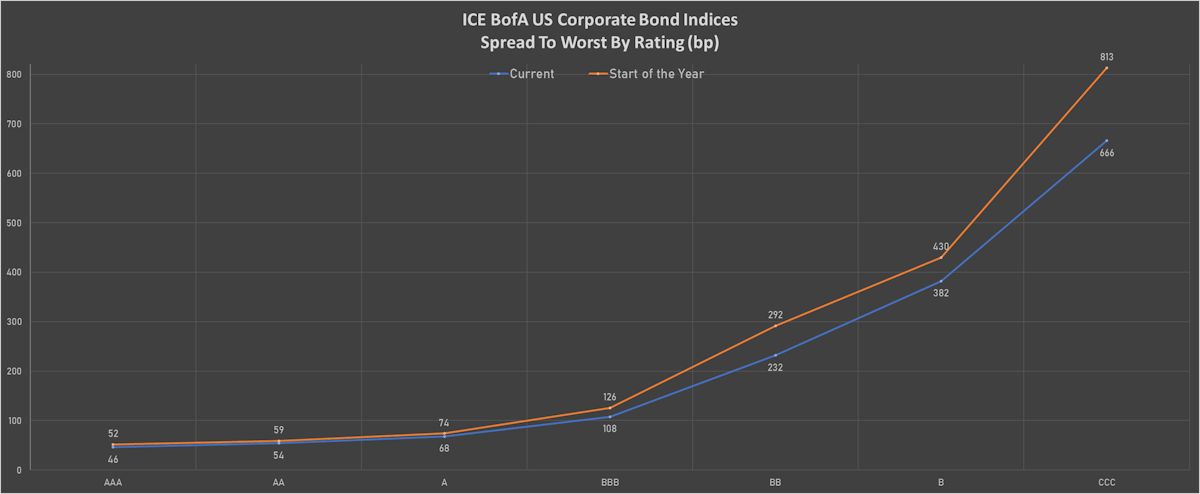

US CORPORATE OPTION-ADJUSTED SPREAD (OAS) BY RATING

- AAA unchanged at 49 bp

- AA unchanged at 58 bp

- A up by 1 bp at 73 bp

- BBB unchanged at 112 bp

- BB down by -3 bp at 219 bp

- B down by -10 bp at 365 bp

- CCC down by -7 bp at 656 bp

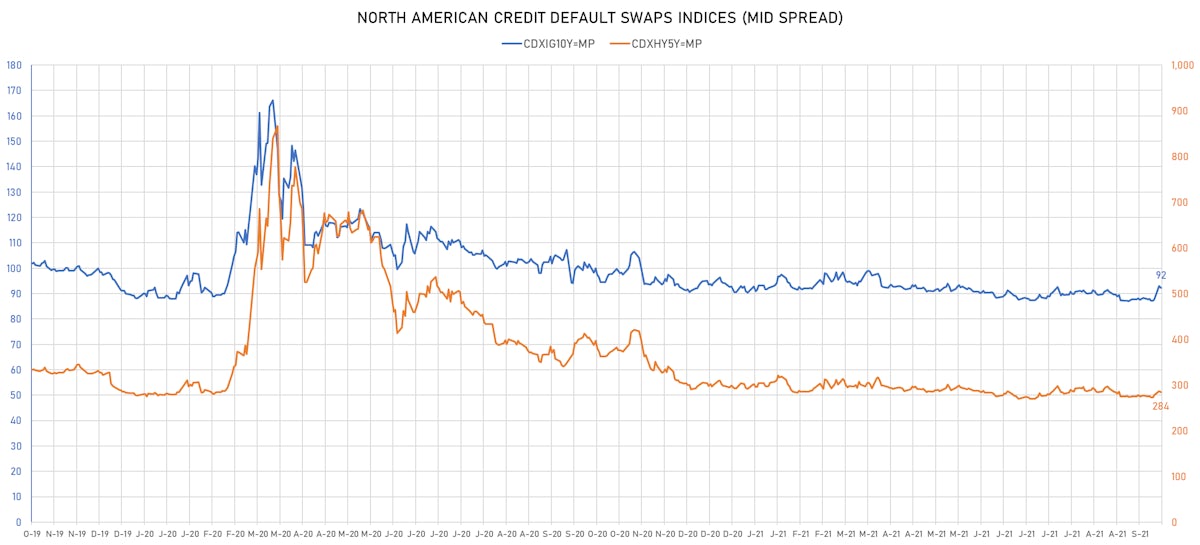

CDS INDICES (mid-spreads)

- Markit CDX.NA.IG 5Y down 0.8 bp, now at 92bp (YTD change: +1.8bp)

- Markit CDX.NA.HY 5Y down 2.2 bp, now at 284bp (YTD change: -9.1bp)

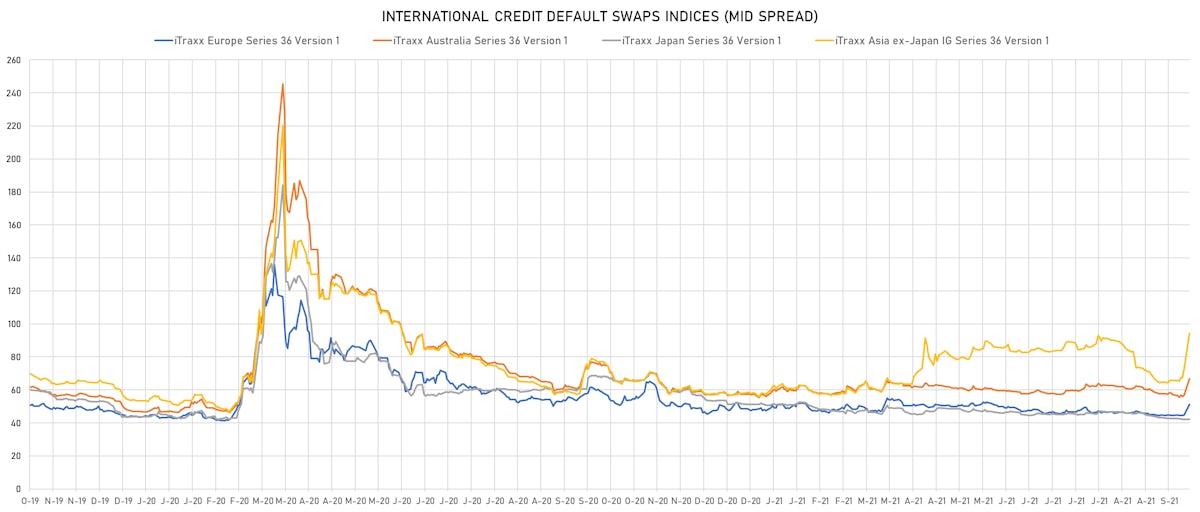

- Markit iTRAXX Europe down 0.5 bp, now at 51bp (YTD change: +2.8bp)

- Markit iTRAXX Japan up 7.4 bp, now at 50bp (YTD change: -1.7bp)

- Markit iTRAXX Asia Ex-Japan down 6.4 bp, now at 88bp (YTD change: +30.0bp)

TOP BONDS MOVES IN THE PAST WEEK - USD HY

- Issuer: Seazen Group Ltd (Shanghai, Cayman Islands) | Coupon: 6.00% | Maturity: 12/8/2024 | Rating: BB+ | ISIN: XS2215175634 | Z-spread up by 186.2 bp to 666.0 bp, with the yield to worst at 6.7% and the bond now trading down to 97.3 cents on the dollar (1Y price range: 97.3-105.8).

- Issuer: Vedanta Resources Finance II PLC (London, United Kingdom) | Coupon: 8.95% | Maturity: 11/3/2025 | Rating: B- | ISIN: USG9T27HAD62 | Z-spread up by 154.0 bp to 880.7 bp, with the yield to worst at 8.9% and the bond now trading down to 98.5 cents on the dollar (1Y price range: 93.5-102.4).

- Issuer: NOVA Chemicals Corp (Calgary, Canada) | Coupon: 5.25% | Maturity: 1/6/2027 | Rating: BB- | ISIN: USC67111AJ05 | Z-spread up by 127.3 bp to 412.7 bp (CDS basis: -123.3bp), with the yield to worst at 4.9% and the bond now trading down to 100.6 cents on the dollar (1Y price range: 100.6-108.3).

- Issuer: Gemdale Ever Prosperity Investment Ltd (Hong Kong) | Coupon: 4.95% | Maturity: 12/8/2024 | Rating: BB- | ISIN: XS2357443410 | Z-spread up by 49.0 bp to 437.8 bp, with the yield to worst at 4.5% and the bond now trading down to 100.3 cents on the dollar (1Y price range: 100.6-102.0).

- Issuer: Banco Bradesco SA (Cayman Islands Branch) (George Town, Cayman Islands) | Coupon: 3.20% | Maturity: 27/1/2025 | Rating: BB- | ISIN: US05947LAZ13 | Z-spread up by 36.1 bp to 211.3 bp (CDS basis: -37.0bp), with the yield to worst at 2.6% and the bond now trading down to 101.5 cents on the dollar (1Y price range: 101.5-105.0).

- Issuer: Kuwait Projects Company SPC Ltd (Dubai, United Arab Emirates) | Coupon: 4.23% | Maturity: 29/10/2026 | Rating: BB- | ISIN: XS2071383397 | Z-spread up by 35.1 bp to 451.7 bp, with the yield to worst at 5.1% and the bond now trading down to 95.0 cents on the dollar (1Y price range: 95.0-104.7).

- Issuer: FMG Resources (August 2006) Pty Ltd (Australia) | Coupon: 4.50% | Maturity: 15/9/2027 | Rating: BB+ | ISIN: USQ3919KAM38 | Z-spread up by 34.0 bp to 234.8 bp, with the yield to worst at 3.2% and the bond now trading down to 105.9 cents on the dollar (1Y price range: 105.5-111.4).

- Issuer: Metinvest BV (S-GRAVENHAGE, Netherlands) | Coupon: 7.75% | Maturity: 17/10/2029 | Rating: B | ISIN: XS2056723468 | Z-spread up by 33.4 bp to 464.6 bp, with the yield to worst at 5.6% and the bond now trading down to 112.1 cents on the dollar (1Y price range: 99.6-114.5).

- Issuer: CBOM Finance PLC (DUBLIN, Ireland) | Coupon: 4.70% | Maturity: 29/1/2025 | Rating: BB | ISIN: XS2099763075 | Z-spread up by 32.6 bp to 281.7 bp, with the yield to worst at 3.1% and the bond now trading down to 104.0 cents on the dollar (1Y price range: 99.6-105.3).

- Issuer: Turkiye Vakiflar Bankasi TAO (Turkey) | Coupon: 5.50% | Maturity: 1/10/2026 | Rating: B+ | ISIN: XS2386558113 | Z-spread up by 31.4 bp to 511.3 bp, with the yield to worst at 5.8% and the bond now trading down to 98.2 cents on the dollar (1Y price range: 97.9-99.9).

- Issuer: Buckeye Partners LP (Houston, Texas (US)) | Coupon: 4.13% | Maturity: 1/3/2025 | Rating: B+ | ISIN: USU05638AB41 | Z-spread up by 28.5 bp to 240.8 bp, with the yield to worst at 2.8% and the bond now trading down to 103.4 cents on the dollar (1Y price range: 102.4-104.4).

- Issuer: MHP Lux SA (Luxembourg, Luxembourg) | Coupon: 6.25% | Maturity: 19/9/2029 | Rating: B | ISIN: XS2010044894 | Z-spread down by 28.4 bp to 455.3 bp, with the yield to worst at 5.6% and the bond now trading up to 103.1 cents on the dollar (1Y price range: 93.0-103.3).

- Issuer: TBC bank'i SS (Tbilisi, Georgia) | Coupon: 5.75% | Maturity: 19/6/2024 | Rating: BB- | ISIN: XS1843434363 | Z-spread down by 30.7 bp to 235.9 bp, with the yield to worst at 2.5% and the bond now trading up to 107.6 cents on the dollar (1Y price range: 104.0-110.0).

- Issuer: Bank razvitiya Respubliki Belarus' OAO (MINSK, Belarus) | Coupon: 6.75% | Maturity: 2/5/2024 | Rating: B | ISIN: XS1904731129 | Z-spread down by 40.7 bp to 910.7 bp, with the yield to worst at 9.2% and the bond now trading up to 94.1 cents on the dollar (1Y price range: 91.3-102.5).

- Issuer: Southeast Supply Header LLC (Houston, Texas (US)) | Coupon: 4.25% | Maturity: 15/6/2024 | Rating: BB- | ISIN: USU83854AB29 | Z-spread down by 51.3 bp to 247.5 bp, with the yield to worst at 2.5% and the bond now trading up to 103.1 cents on the dollar (1Y price range: 98.4-103.2).

TOP BONDS MOVES IN THE PAST WEEK - EUR HY

- Issuer: Adler Group SA (Senningerberg, Luxembourg) | Coupon: 3.25% | Maturity: 5/8/2025 | Rating: BB+ | ISIN: XS2010029663 | Z-spread up by 180.0 bp to 539.9 bp, with the yield to worst at 4.9% and the bond now trading down to 93.8 cents on the dollar (1Y price range: 93.3-105.4).

- Issuer: Fortune Star (BVI) Ltd (British Virgin Islands) | Coupon: 3.95% | Maturity: 2/10/2026 | Rating: BB- | ISIN: XS2357132849 | Z-spread up by 16.4 bp to 505.7 bp, with the yield to worst at 4.7% and the bond now trading down to 96.5 cents on the dollar (1Y price range: 95.5-102.1).

- Issuer: CBOM Finance PLC (Dublin, Ireland) | Coupon: 3.10% | Maturity: 21/1/2026 | Rating: BB | ISIN: XS2281299763 | Z-spread up by 12.6 bp to 344.6 bp, with the yield to worst at 3.0% and the bond now trading down to 99.8 cents on the dollar (1Y price range: 96.0-100.3).

- Issuer: SoftBank Group Corp (Minato-Ku, Japan) | Coupon: 3.38% | Maturity: 6/7/2029 | Rating: BB+ | ISIN: XS2361255057 | Z-spread up by 11.2 bp to 399.3 bp, with the yield to worst at 3.7% and the bond now trading down to 96.8 cents on the dollar (1Y price range: 95.3-99.9).

- Issuer: Akropolis Group UAB (Vilnius, Lithuania) | Coupon: 2.88% | Maturity: 2/6/2026 | Rating: BB+ | ISIN: XS2346869097 | Z-spread up by 10.2 bp to 391.9 bp, with the yield to worst at 3.5% and the bond now trading down to 96.8 cents on the dollar (1Y price range: 96.4-99.4).

- Issuer: Petroleos Mexicanos (Miguel Hidalgo, Mexico) | Coupon: 4.88% | Maturity: 21/2/2028 | Rating: BB- | ISIN: XS1568888777 | Z-spread up by 9.8 bp to 470.6 bp (CDS basis: -97.1bp), with the yield to worst at 4.4% and the bond now trading down to 101.9 cents on the dollar (1Y price range: 97.7-103.3).

- Issuer: Jaguar Land Rover Automotive PLC (Coventry, United Kingdom) | Coupon: 6.88% | Maturity: 15/11/2026 | Rating: B | ISIN: XS2010037682 | Z-spread up by 9.2 bp to 406.6 bp (CDS basis: -10.4bp), with the yield to worst at 3.6% and the bond now trading down to 113.9 cents on the dollar (1Y price range: 102.3-116.4).

- Issuer: Louis Dreyfus Co BV (Rotterdam, Netherlands) | Coupon: 2.38% | Maturity: 27/11/2025 | Rating: BB+ | ISIN: XS2264074647 | Z-spread down by 12.0 bp to 101.4 bp (CDS basis: -17.1bp), with the yield to worst at 0.5% and the bond now trading up to 106.5 cents on the dollar (1Y price range: 102.8-106.8).

- Issuer: Deutsche Lufthansa AG (Cologne, Germany) | Coupon: 3.75% | Maturity: 11/2/2028 | Rating: BB- | ISIN: XS2296203123 | Z-spread down by 16.5 bp to 305.7 bp (CDS basis: -47.2bp), with the yield to worst at 2.7% and the bond now trading up to 104.9 cents on the dollar (1Y price range: 97.6-105.3).

- Issuer: International Consolidated Airlines Group SA (London, Spain) | Coupon: 1.50% | Maturity: 4/7/2027 | Rating: B+ | ISIN: XS2020581752 | Z-spread down by 25.7 bp to 325.1 bp, with the yield to worst at 2.9% and the bond now trading up to 92.0 cents on the dollar (1Y price range: 84.0-92.1).

USD BOND ISSUES

- Atmos Energy Corp (Oil and Gas | Dallas, United States | Rating: A-): US$600m Senior Note (US049560AW50), fixed rate (2.85% coupon) maturing on 15 February 2052, priced at 99.36 (original spread of 103 bp), callable (30nc30)

- Bill.com Holdings Inc (Information/Data Technology | San Jose, United States | Rating: NR): US$500m Bond (US090054AA53), fixed rate (0.13% coupon) maturing on 1 April 2027, priced at 100.00, non callable, convertible

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$125m Bond (US3133EM6J69), fixed rate (2.00% coupon) maturing on 27 September 2033, priced at 100.00, callable (12nc6m)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$110m Bond (US3133EM6H04), fixed rate (1.90% coupon) maturing on 27 September 2033, priced at 100.00, callable (12nc1)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$115m Bond (US3133EM6L16), fixed rate (2.23% coupon) maturing on 29 September 2036, priced at 100.00, callable (15nc3m)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$110m Bond (US3133EM6K33), fixed rate (2.15% coupon) maturing on 29 September 2036, priced at 100.00, callable (15nc6m)

- Federal Farm Credit Banks Funding Corp (Agency | Jersey City, United States | Rating: AA+): US$250m Bond (US3133EM6N71), fixed rate (0.17% coupon) maturing on 27 September 2023, priced at 100.00, non callable

- J M Smucker Co (Food Processors | Orrville, United States | Rating: BBB): US$300m Senior Note (US832696AV08), fixed rate (2.75% coupon) maturing on 15 September 2041, priced at 99.97 (original spread of 95 bp), callable (20nc19)

- J M Smucker Co (Food Processors | Orrville, United States | Rating: BBB): US$500m Senior Note (US832696AU25), fixed rate (2.13% coupon) maturing on 15 March 2032, priced at 99.54 (original spread of 85 bp), callable (10nc10)

- Metropolitan Life Global Funding I (Financial - Other | Wilmington, United States | Rating: NR): US$500m Note (US59217GEP00), fixed rate (0.70% coupon) maturing on 27 September 2024, priced at 99.99 (original spread of 25 bp), non callable

- Metropolitan Life Global Funding I (Financial - Other | Wilmington, United States | Rating: NR): US$500m Note (US59217GEQ82), floating rate (SOFR + 30.0 bp) maturing on 27 September 2024, priced at 100.00, non callable

- Mondelez International Holdings Netherlands BV (Food Processors | Oosterhout, United States | Rating: NR): US$500m Senior Note (US60920LAQ77), fixed rate (0.75% coupon) maturing on 24 September 2024, priced at 99.85 (original spread of 35 bp), with a make whole call

- Office Properties Income Trust (Real Estate Investment Trust | Newton, United States | Rating: BBB-): US$400m Senior Note (US67623CAF68), fixed rate (3.45% coupon) maturing on 15 October 2031, priced at 99.81 (original spread of 215 bp), callable (10nc10)

- Owl Rock Core Income Corp (Financial - Other | New York City, United States | Rating: NR): US$350m Senior Note (US69120VAA98), fixed rate (3.13% coupon) maturing on 23 September 2026, priced at 99.74 (original spread of 235 bp), callable (5nc5)

- Reliance Standard Life Global Funding II (Financial - Other | United States | Rating: NR): US$350m Note (US75951AAQ13), fixed rate (1.51% coupon) maturing on 28 September 2026, priced at 100.00 (original spread of 68 bp), with a make whole call

- Rocket Mortgage LLC (Mortgage Banking | Detroit, United States | Rating: BB+): US$1,150m Senior Note (USU7507LAA18), fixed rate (2.88% coupon) maturing on 15 October 2026, priced at 100.00 (original spread of 204 bp), callable (5nc2)

- Rocket Mortgage LLC (Mortgage Banking | Detroit, United States | Rating: BB+): US$850m Senior Note (USU7507LAB90), fixed rate (4.00% coupon) maturing on 15 October 2033, priced at 100.00 (original spread of 279 bp), callable (12nc6)

- Sabra Health Care LP (Real Estate Investment Trust | Irvine, United States | Rating: BBB-): US$800m Senior Note (US78574MAA18), fixed rate (3.20% coupon) maturing on 1 December 2031, priced at 98.94 (original spread of 200 bp), callable (10nc10)

- Tempur Sealy International Inc (Industrials - Other | Lexington, United States | Rating: BB+): US$800m Senior Note (USU8801TAE74), fixed rate (3.88% coupon) maturing on 15 October 2031, priced at 100.00 (original spread of 255 bp), callable (10nc5)

- Weatherford International Ltd (Oilfield Machinery and Services | Houston, United States | Rating: B): US$5,000m Note (US947075AT41), fixed rate (6.50% coupon) maturing on 15 September 2028, priced at 100.00 (original spread of 538 bp), callable (7nc3)

- GFL Environmental Inc (Service - Other | Vaughan, Canada | Rating: B+): US$250m Senior Note (USC39217AP66), fixed rate (4.00% coupon) maturing on 1 August 2028, priced at 100.00 (original spread of 292 bp), callable (7nc2)

- JDE Peets NV (Service - Other | Amsterdam, Luxembourg | Rating: BBB-): US$500m Senior Note (US47216QAA13), fixed rate (0.80% coupon) maturing on 24 September 2024, priced at 99.78 (original spread of 42 bp), callable (3nc1)

- JDE Peets NV (Service - Other | Amsterdam, Luxembourg | Rating: BBB-): US$500m Senior Note (US47216QAC78), fixed rate (2.25% coupon) maturing on 24 September 2031, priced at 99.59 (original spread of 97 bp), callable (10nc10)

- JDE Peets NV (Service - Other | Amsterdam, Luxembourg | Rating: BBB-): US$750m Senior Note (US47216QAB95), fixed rate (1.38% coupon) maturing on 15 January 2027, priced at 99.36 (original spread of 67 bp), callable (5nc5)

- New York State Electric & Gas Corp (Utility - Other | Rochester, Spain | Rating: BBB+): US$350m Senior Note (US649840CT03), fixed rate (2.15% coupon) maturing on 1 October 2031, priced at 99.79 (original spread of 85 bp), callable (10nc10)

- Olympus Water US Holding Corp (Financial - Other | Beverly Hills | Rating: NR): US$400m Senior Note (USU68195AB93), fixed rate (6.25% coupon) maturing on 1 October 2029, priced at 100.00 (original spread of 508 bp), callable (8nc3)

- Olympus Water US Holding Corp (Financial - Other | Beverly Hills | Rating: NR): US$815m Note (USU68195AA11), fixed rate (4.25% coupon) maturing on 1 October 2028, priced at 100.00 (original spread of 314 bp), callable (7nc3)

EUR BOND ISSUES

- Bausparkasse Wuestenrot AG (Banking | Salzburg, Austria | Rating: BBB+): €300m Hypothekenpfandbrief (Covered Bond) (AT0000A2T4M8), fixed rate (0.01% coupon) maturing on 28 September 2028, priced at 100.65 (original spread of 46 bp), non callable

- Commerzbank AG (Banking | Frankfurt, Germany | Rating: BBB+): €500m Inhaberschuldverschreibung (DE000CZ45WP5), fixed rate (1.38% coupon) maturing on 29 December 2031, priced at 99.50 (original spread of 212 bp), callable (10nc5)

- Deutsche Bahn Finance GmbH (Financial - Other | Berlin, Germany | Rating: NR): €750m Senior Note (XS2391406530), fixed rate (0.35% coupon) maturing on 29 September 2031, priced at 99.85 (original spread of 70 bp), non callable

- ENEL Finance International NV (Financial - Other | Amsterdam, Italy | Rating: NR): €1,250m Senior Note (XS2390400807), fixed rate (0.88% coupon) maturing on 28 September 2034, priced at 99.51 (original spread of 123 bp), callable (13nc13)

- ENEL Finance International NV (Financial - Other | Amsterdam, Italy | Rating: NR): €1,250m Senior Note (XS2390400633) zero coupon maturing on 28 May 2026, priced at 99.70 (original spread of 74 bp), callable (5nc5)

- ENEL Finance International NV (Financial - Other | Amsterdam, Italy | Rating: NR): €1,000m Senior Note (XS2390400716), fixed rate (0.38% coupon) maturing on 28 May 2029, priced at 99.90 (original spread of 90 bp), callable (8nc7)

- Goodyear Europe BV (Vehicle Parts | Vianen, United States | Rating: NR): €400m Senior Note (XS2390510142), fixed rate (2.75% coupon) maturing on 15 August 2028, priced at 100.00 (original spread of 330 bp), callable (7nc3)

- Investitionsbank des Landes Brandenburg (Banking | Potsdam, Germany | Rating: AAA): €500m Inhaberschuldverschreibung (DE000A3E5RF9), fixed rate (0.05% coupon) maturing on 29 September 2031, priced at 99.89 (original spread of 38 bp), non callable

- Landwirtschaftliche Rentenbank (Agency | Frankfurt, Germany | Rating: AAA): €1,500m Senior Note (XS2390861362) zero coupon maturing on 28 September 2026, priced at 102.01 (original spread of 27 bp), non callable

- Olympus Water US Holding Corp (Financial - Other | Beverly Hills | Rating: NR): €500m Note (XS2391351454), fixed rate (3.88% coupon) maturing on 1 October 2028, priced at 100.00, callable (7nc3)

- Olympus Water US Holding Corp (Financial - Other | Beverly Hills | Rating: NR): €265m Senior Note (XS2391353070), fixed rate (5.38% coupon) maturing on 1 October 2029, priced at 100.00, callable (8nc3)

- Sp Kiinnitysluottopankki Oyj (Financial - Other | Helsinki, Finland | Rating: NR): €500m Covered Bond (Other) (XS2391343196), fixed rate (0.01% coupon) maturing on 28 September 2028, priced at 100.88 (original spread of 44 bp), non callable

NEW LOANS

- Quality Tech (BB+), signed a US$ 2,840m Term Loan, to be used for general corporate purposes. It matures on 08/31/26 and initial pricing is set at LIBOR +225bps

- Becton Dickinson & Co (BBB), signed a US$ 2,750m Revolving Credit Facility, to be used for general corporate purposes. It matures on 09/24/26 and initial pricing is set at LIBOR +112.5bps

NEW ISSUES IN SECURITIZED CREDIT

- Discover Card Execution Note Trust 2021-A1a2 issued a fixed-rate ABS backed by receivables in 2 tranches, for a total of US$ 1,749 m. Highest-rated tranche offering a yield to maturity of 0.58%, and the lowest-rated tranche a yield to maturity of 1.04%. Bookrunners: Barclays Capital Group, RBC Capital Markets, Citigroup Global Markets Inc, Wells Fargo Securities LLC, Bank of America Merrill Lynch